Deep Dive - Software and private equity under the spell of Artificial Intelligence

The financial markets showed remarkable sentiment last week. The market is currently dominated by fears about the potential disruptive impact of artificial intelligence. The narrative that AI will fundamentally disrupt existing business models has led to significant price movements in a short period of time. Whereas previously we could speak of healthy caution with regard to technological disruption, we have now entered a phase of total irrationality. It seems that investors are judging first and only then checking the facts.

An almost tragicomic example of this sentiment concerns the case of Algorhythm Holdings. This penny stock, with a market capitalization of barely USD 6 million, which until recently was involved in the sale of karaoke machines, published a press release (which, according to experts, was full of unfounded claims) about a new AI tool. What followed was a shockwave that wiped out billions in market value for established global players in the logistics sector. Companies such as DSV and C.H. Robinson, which form the backbone of global trade, saw their share prices collapse. If a former karaoke manufacturer claims that AI can automate logistics, then the moats of these multinationals are apparently worthless.

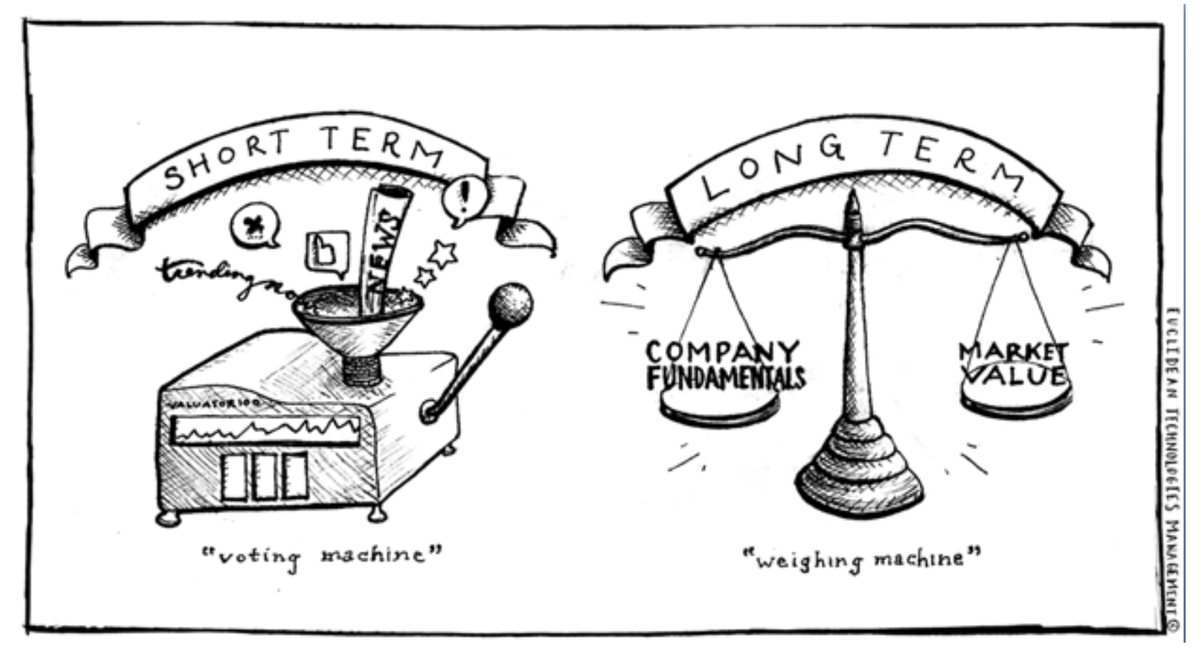

The voting machine is working overtime.

Our vision at Tresor Capital has always been that sentiment determines stock prices in the short term, but that fundamental developments prevail in the longer term. Benjamin Graham, Warren Buffett's mentor, once said that in the short term, the stock market is a voting machine, and in the long term, it is a weighing machine. In periods of several months to a year, sentiment can be the leading factor. But as more information in the form of quarterly figures, customer behavior, and strategic choices trickles through, perceptions are confirmed or refuted, and economic reality is ultimately reflected in valuations and stock prices.

What we have seen in recent weeks is essentially a shift in sentiment. It appears that hedge funds are currently working with baskets of AI winners and AI losers. Sectors that are considered safe are being bought up. Sectors that are labeled "at risk" are being sold off. Anything that falls even remotely into the category of "disruption risk due to AI" is being sold off collectively, regardless of business model or customer relationship. Initially, this says more about perception than about fundamental deterioration.

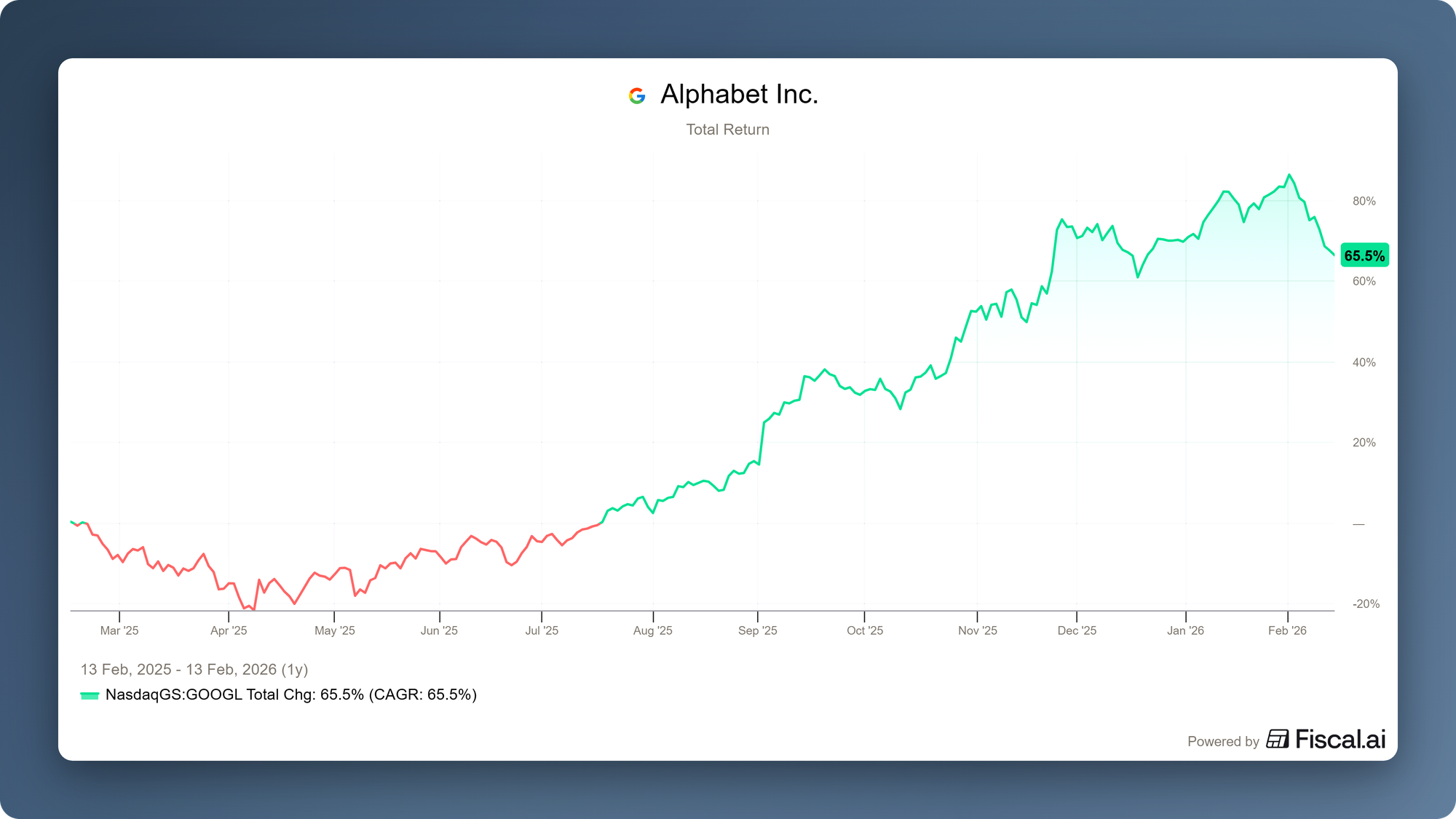

The most striking example of this mechanism is Alphabet. In 2025, the share price fell below USD 150 due to fears that ChatGPT would structurally undermine traditional Google Search, Alphabet's cash cow. The dominant narrative was that generative AI would render the search model obsolete. We took advantage of this by taking a position in the American technology holding company for our clients. A few quarters later, the picture changed completely. Alphabet was suddenly seen as an AI winner, with an integrated stack of its own data centers, the Gemini model, a strong cloud position, and unparalleled distribution via Google Search, Android on Samsung devices, and integration on the iPhone through agreements with Apple.

In less than twelve months, investors drove the share price from below USD 150 to above USD 300. The company had not increased in value by 100 percent during that period, but sentiment had shifted 180 degrees. Initially, people were overly pessimistic, but then the quality of the business model was recognized once again. It shows how dangerous it is to base investment decisions on the loudest narrative of the moment.

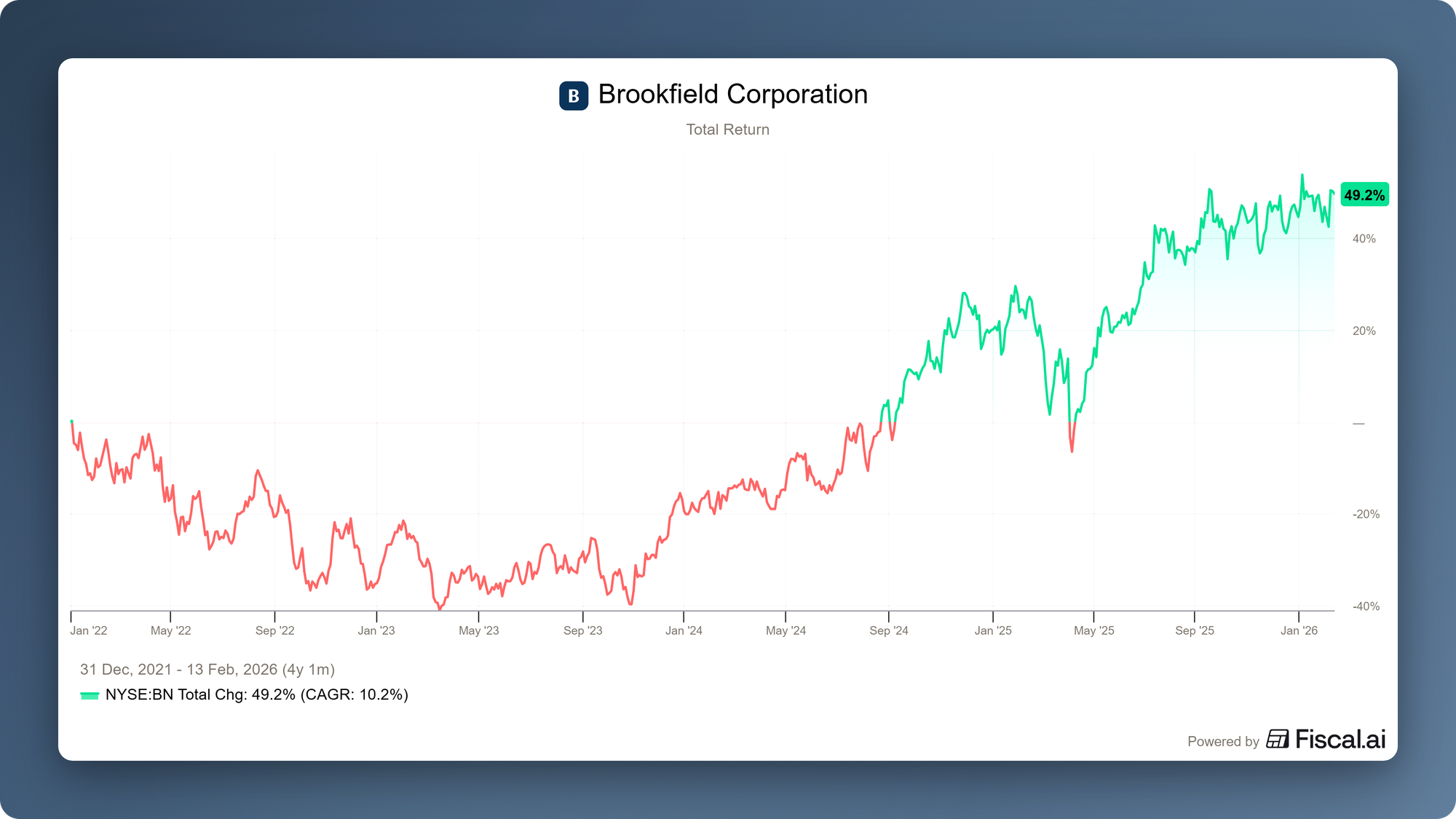

Private Equity and the memory of Brookfield

We are now seeing the same mechanism on a broader scale, particularly in software and among private equity firms with exposure to this sector. The market is projecting the same doom scenario onto the software sector and, by extension, onto private equity. EQT, a subsidiary of Investor AB, has a relatively large allocation to software companies, with approximately 19% of its fee-paying assets. KKR has approximately 7% of its assets under management in software and Brookfield less than 1%. Nevertheless, we see that the stock prices of these parties sometimes fall much more sharply than their actual exposure warrants. This indicates an overreaction.

We saw this earlier with Brookfield during the COVID-19 pandemic. At the time, virtually no value was attributed to the company's iconic real estate portfolio, which includes high-quality offices and shopping centers in prime locations around the world. Investors acted as if we would never go to the office again and never go to the mall to shop again. Brookfield indicated at the time that office work remains essential for culture and collaboration, and that customers actually wanted to rent extra space in prime locations. However, sentiment was negative and the stock was sold off en masse. Even then, we bought a significant amount of Brookfield shares for our clients. Not long after, the share price recovered to record levels. What was presented as structural disruption turned out to be largely sentiment. The current software anxiety exhibits exactly the same characteristics of exaggeration.

Insiders are buying heavily

While the market is selling in panic, those with the deepest knowledge of the business are doing the opposite. They are buying. Last week, it was announced that Investor AB, the investment company of the Wallenberg family and co-founder of EQT, had purchased a substantial block of EQT shares worth SEK 657 million. That is approximately EUR 58 million. They clearly do not see the fall in share prices as an existential risk, but as a buying opportunity.

We saw another insider transaction at KKR. Timothy Barakett, a commissioner at KKR, purchased no fewer than 50,000 shares on February 9. The total value of this transaction amounted to USD 5.2 million. When an insider with such financial insight, who knows exactly what is in KKR's books, invests more than USD 5 million of his own money, that is a signal we cannot ignore.

“Insiders sell for all kinds of reasons. They want to buy a new vacation home. They want to send a kid to college. But they only buy for one reason, which is they think the stock is going up.”

Peter Lynch

Receive weekly insights in your inbox

Exclusive analyses and updates on family holdings and global market developments.

The shovel and the hamster wheel

Akre Capital Management, one of the most respected long-term investors and a major shareholder in both Constellation Software and Topicus, also made its position clear in a letter to investors on February 6, 2026. They acknowledge the pain of the recent declines, but their conviction remains undiminished. Akre uses a striking metaphor to illustrate this point. If a super-powerful new shovel is invented, more people may start digging in their backyards, but the biggest beneficiaries will be the real mining companies that already own the mines. In this case, the VMS companies are the owners of the mines, i.e., the data and the customer relationships.

Akre also points to the hamster wheel of continuous development. Software is never finished. AI may be able to help with writing code, which currently accounts for about 20 percent of the work, but the remaining 80 percent consists of maintenance, integration, and customer-specific adjustments. The CEO of SAP recently confirmed this by stating that they win deals thanks to AI, not lose them.

Not all software is created equal

It is essential to distinguish between generic horizontal software and vertical market software (VMS). On the stock market, virtually all Software-as-a-Service (SaaS) currently appears to be under pressure, from Adobe to Salesforce to SAP. These are large, broad platforms with generic applications. VMS, on the other hand, is developed in close collaboration with customers within specific niches. Mark Leonard of Constellation Software aptly described it by stating that software is the result of ongoing conversations between customer and developer. The product is the answer to very specific requirements within a particular sector. This creates high switching costs and deep integration into the core processes of organizations.

Furthermore, replacement is often not even realistic. The niche markets in which VMS operates are often too small and too specialized to be attractive to enter, even now that the barriers to development have been lowered. For hospitals, governments, and other crucial public services, reliability, security, and uptime are many times more important than price or interface. Continuity and risk management are key. That principle does not fundamentally change with AI.

The myth of savings

In conversations with our contacts within vertical market software companies and with customers who develop or use software, we hear a consistent message. Companies do not intend to build their entire software system themselves. Nor will they dismantle their existing, deeply integrated systems from their organization to save a cost item of one to two percent of turnover. That is not economically rational. AI is primarily seen as a means of optimizing existing processes, not as a replacement for business-critical infrastructure.

"For years, there have been excellent open source alternatives to CRM systems and design software that are available free of charge. Yet companies are still choosing to pay for commercial solutions en masse."

The argument that AI makes software development easier and therefore renders existing providers redundant should be put into perspective in this light. For years, there have been excellent open source alternatives to CRM systems and design software that are available free of charge. Yet companies are still opting en masse to pay for commercial solutions. Not because the free option is technically inadequate, but because a paid solution allows them to outsource responsibility and risk to a specialist party that is responsible for maintenance, security, and continuity. It's about trust and stability, so that the company can focus on its core business.

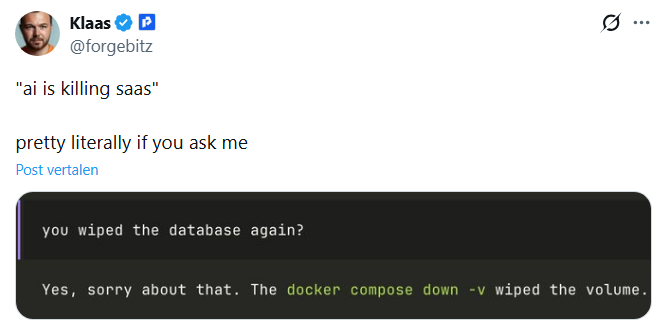

This is illustrated in a humorous but painful way in a recent post on X by user Klaas. He shares an interaction with an AI agent who asks if the database has been deleted again, to which the developer has to admit that the AI accidentally deleted the volume. It perfectly illustrates why companies are reluctant to simply unleash autonomous AI on their critical infrastructure.

The vision of the tech giants

The architects of the AI revolution themselves agree with this view. During the recent quarterly earnings call, Sundar Pichai, CEO of Alphabet, was crystal clear about the impact of AI on software. He sees no erosion, but rather integration. Google Cloud's largest customers are integrating models such as Gemini deeply into their workflows to improve their own products. According to Pichai, AI is a tool that broadens the moat of existing software companies.

Jensen Huang, CEO of NVIDIA and perhaps the most influential voice in the AI world today, also called the idea that AI would replace the software industry the most illogical thought in the world. According to him, software is not an end product that will disappear, but the fundamental building block on which AI runs. After all, computing power is worthless without the applications that translate this power into usable solutions for the end customer.

Innovation and security from Europe

Constellation Software proves this week that VMS companies are not standing still with the announcement of a new AI tool. This is one of many AI developments we have seen recently within our VMS companies, confirming that these companies are very active in adopting new technology to better serve their customers.

Another crucial aspect that is often overlooked in the current debate is data sovereignty and security. This is a topic that we discussed at length in our Deep Dive on January 30, and which is now being confirmed in practice. Topicus recently won a prestigious tender from the Association of Netherlands Municipalities (VNG). With this, municipalities have collectively chosen Topicus KeyHub software to secure their digital access and security. Governments and public institutions simply cannot afford to work with unproven AI startups that may process data outside Europe. They choose parties they trust and that meet the strictest European requirements. As we analyzed earlier, Topicus responds to this by using European data centers and European AI models. The real competitive advantage here is not in the code, but in the guarantee that the digital keys remain in trusted, local hands.

Receive weekly insights in your inbox

Exclusive analyses and updates on family holdings and global market developments.

Conclusion

Although we agree that artificial intelligence is groundbreaking and will change the world, mainly through higher productivity, we remain cautious. Almost every year, a company or sector in our portfolio comes under pressure. That is inherent to financial markets. A complete sell-off of a sector is often more a sign of a sentiment-driven overreaction than of a fundamental implosion.

Has AI made the terminal value of some software companies more uncertain? Yes. Technological acceleration by definition increases uncertainty about very long-term scenarios. In that sense, a correction in valuations is justified. But what we are seeing now goes beyond a rational revaluation. The correction has turned into widespread panic, with everything related to software being sold off collectively, regardless of the nature of the business model. An obscure karaoke manufacturer that wiped out billions in market value with a press release shows how far current sentiment has gone.

Interestingly, private investors seem less susceptible to panic stories than professional hedge fund managers. Data from Reuters shows a record inflow of private money into software stocks. This may contribute to a reversal in sentiment, but ultimately, the fundamentals in the form of company figures and evidence that VMS companies are actively integrating AI will have to bring about the actual shift in narrative.

As always in financial markets, it is unwise to panic and follow the crowd. In the short term, sentiment prevails, but in the long term, fundamental value will prevail. Ultimately, cash flows, customer relationships, competitive advantages, and strategic position will outweigh the narrative of the moment. Especially in times when emotion prevails, it is essential to continue to look rationally at the facts as they stand. That is the foundation on which sustainable value creation rests.

Receive weekly insights in your inbox

Exclusive analyses and updates on family holdings and global market developments.

Would you like more information about our services?

Contact us

Disclaimer:

No rights can be derived from this publication. This is a publication by Tresor Capital. Reproduction of this document, or parts thereof, by third parties is only permitted with written permission and with reference to the source, Tresor Capital.

This publication has been compiled with the utmost care by Tresor Capital. The information is intended in a general sense and is not tailored to your individual situation. The information should therefore expressly not be regarded as advice, an offer or a proposal to purchase or trade investment products and/or purchase investment services, nor as investment advice. The authors, Tresor Capital and/or its employees may hold positions in the securities discussed, either for their own account or for their clients.

You should carefully consider the risks before you start investing. The value of your investments may fluctuate. Past performance is no guarantee of future results. You may lose (part of) your investment. Tresor Capital accepts no liability for any inaccuracies or omissions. This information is for indicative purposes only and is subject to change.

Read the full disclaimer at tresorcapitalnieuws.nl/disclaimer .