Economy & Markets #2 - Trump plays real-life Risk

This week's topics:

Whoever controls energy controls continents

In our newsletters at the beginning of December, we pointed out that the Trump administration has major strategic plans on the geopolitical chessboard. The United States National Security Strategy views Europe as a 'weakened' and 'dysfunctional' power bloc, which will eventually lose its geopolitical relevance and harm American interests. As a result, the US government is shifting its focus to China and the US's strategic backyard, namely Latin America. Global energy flows play a significant role in this.

President Trump has repeatedly stated that he is striving for structurally lower oil prices, with a level of around USD 50 per barrel being considered economically desirable. Lower energy prices help to curb inflation, increase the scope for lower interest rates, and thus indirectly ease the financing burden of the US national debt. In this context, the policy of increasing global oil and gas production, both through domestic production and through geopolitical reorientation of supply flows, is appropriate.

Venezuela: a first strategic move on the chessboard

In this light, the arrest of Venezuelan President Maduro did not come as a complete surprise. Although there has not (yet) been a formal change of regime, the long-term strategic benefits for the tightened US security strategy are considerable. Ultimately, the US will want to achieve the following in Venezuela, through soft or hard power:

- Control over the world's largest proven oil reserves.

- Cutting off oil supplies to China (in the event of escalation around Taiwan). China consumes approximately 16 million barrels per day, a large proportion of which is sanctioned oil from Venezuela (~0.5-1 million), Iran (~2 million), and Russia (~3 million) that is traded at a discount.

- Eliminating Venezuela as a springboard for Chinese geopolitical influence in Latin America.

- Cutting off funding to allies such as Cuba and Iran, and indirect cash flows to Hamas and Hezbollah.

- Building goodwill among the Venezuelan population. More than 25% live as refugees and are predominantly pro-American (similar to the Cuban diaspora).

- Inspiring other oppressed populations to rise up against authoritarian regimes.

- Ending the dispute over exploration rights, which stimulates investment in oil and gas fields in French Guiana and Trinidad and Tobago.

Although Maduro's arrest has created a power vacuum in Venezuela and it is unclear who (on behalf of the US) will determine policy, the financial markets are anticipating de-escalation. Geopolitical risk premiums fell, leading to a 'risk-on' sentiment last Monday:

- Bonds issued by Venezuela and state oil company PDVSA rose by 20%.

- American oil companies also rebounded strongly: Chevron (+11%), Valero (+11%), ConocoPhillips (+10%), Marathon (+10%), ExxonMobil (+7%), Phillips 66 (+6%), Occidental (+4%), EOG (+4%), Devon (+4%), and Kinder Morgan (+3%).

- Technology stocks gained ground on the prospect of lower inflation.

- Gold and silver rose in value, also driven by expectations of declining inflation.

Declining effect on oil prices? A decade of deflation ahead

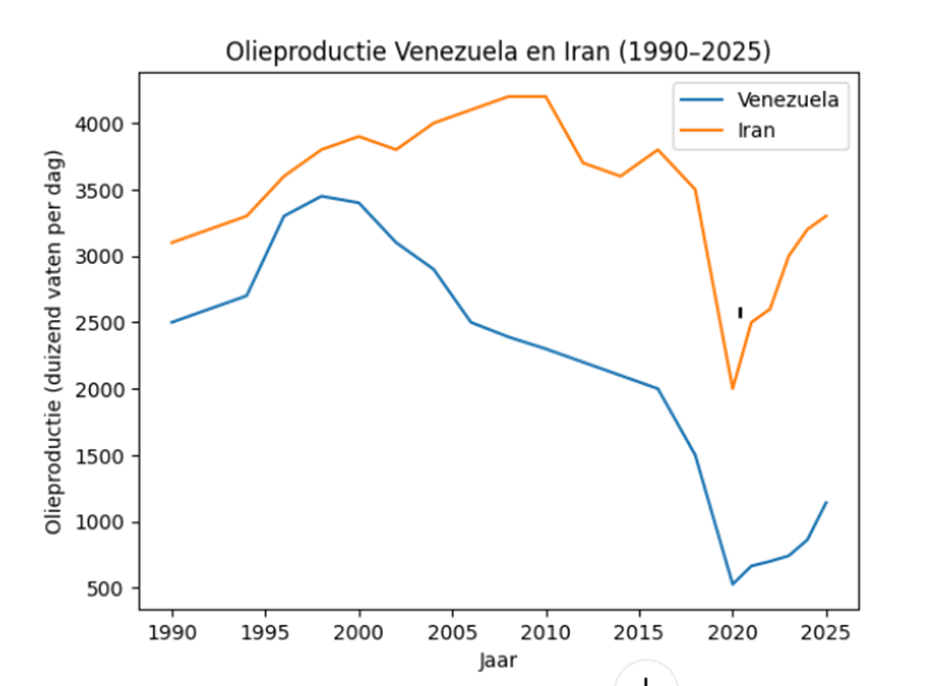

Capital markets are already anticipating the scenario in which the US gains access to the world's largest oil reserves. Venezuela is estimated to have at least 303 billion barrels. This is approximately 20% of global reserves and represents roughly eight years of global consumption. However, a direct increase in Venezuelan supply is not a foregone conclusion. The oil is very heavy, which makes extraction and refining technically complex and capital-intensive. A structural increase in production to 3 million barrels per day (the level in 1998 before the nationalizations under Chávez) will require years and substantial investment. In the short term, an additional supply of approximately 0.4 million barrels per day is more realistic. In a market with oversupply and a fall in oil prices (from USD 85 to USD 55), this prospect could be an incentive for OPEC+ to increase production. This would further depress prices and could lead to the postponement of capital-intensive US investments in Venezuela.

In addition, the US will actively push the new oil supply away from China and Russia towards refineries on the US Gulf Coast, creating an attractive alternative to the relatively expensive Canadian tar sand oil. This oil is of comparable quality, but costly due to transport via pipelines from Canada to the Gulf of Mexico.

Venezuela has very substantial natural gas reserves and is internationally known as one of the largest gas flaring countries. Due to insufficient incentives and investments in gas processing and transport infrastructure, a large part of the gas released during oil production is flared instead of being utilized. With Western technical expertise and investments, this waste can be reduced, allowing significantly more gas to be used effectively or exported.

Iran as the next strategic move?

Since the Islamic Revolution of 1979, the Iranian clerical regime has pursued a distinctly anti-Western and geopolitically destabilizing policy. This stands in sharp contrast to the demographic and social reality. Iran has a population of approximately 80 million, a young population, and is culturally and economically strongly Western-oriented. It is estimated that approximately 40% of the population is not actively religious, and among young people this percentage is even higher than 80%.

This reality contrasts with foreign policy that provides structural support to armed groups such as Hezbollah, Hamas, and the Houthis, and active involvement in Syria and Iraq. This tension has been a source of instability in the Middle East for decades.

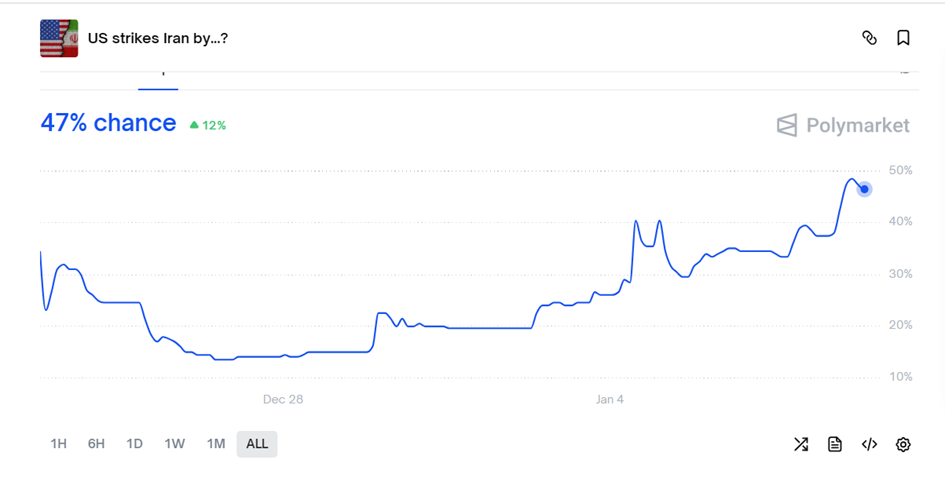

Whereas the Obama and Biden administrations primarily focused on diplomacy and sanctions (soft power), President Trump opted for a tougher security approach. In 2020, General Qassem Soleimani, the key architect of Iran's military strategy, was targeted and killed. The confrontation escalated in 2024 when the US, in collaboration with Israel, attacked critical nuclear infrastructure. According to sources, this destroyed a large part of the military command structure and technological expertise.

Iran has paid a heavy economic price for its nuclear ambitions: approximately USD 50 billion in direct costs and more than USD 300 billion in indirect damage due to sanctions. At the same time, the missile program proved ineffective for credible retaliation, which significantly weakened its military capabilities.

Since the summer of 2025, tougher sanctions, combined with extreme drought, have put further pressure on the economy. This has deepened social discontent. According to the Foundation for Defense of Democracies (FDD), protests have increased significantly in both spread and intensity since early 2026. Given the growing internal instability and Trump's confrontational doctrine, it is obvious that Iran is the next target for regime change.

Strategic implications of a possible regime change (from a US/Israel perspective)

- Iran currently produces approximately 3.5 million barrels of oil per day, largely for domestic use and sanctioned exports (smuggling) to (primarily) China.

- With foreign investment, technology, and sanctions relief, production can be ramped up relatively quickly to around 5 million barrels per day.

- Iran possesses approximately 9% of the world's proven oil reserves and approximately 17% of the world's gas reserves.

- There will be a structural end to the hostile relationship with Israel, but also with Saudi Arabia.

- The financing, training, and arming of Hamas, Hezbollah, and other proxy actors will be stopped.

- Sunni-Shia tensions are easing, particularly in Iraq and Yemen.

- The structural risk surrounding the Strait of Hormuz is decreasing. This strategic bottleneck is currently causing high geopolitical risk premiums, which may now decline as a result.

- Greater geopolitical predictability offers markets scope for lower volatility, lower risk premiums for the Middle East, and more stable capital flows.

- Iran is an important supplier of weapons and technology to Russia. A change of power in Tehran would put additional pressure on Moscow and weaken Russia's negotiating position in Ukraine.

Receive weekly insights in your inbox

Exclusive analyses and updates on family holdings and global market developments.

China and Russia in a tight spot: “The ends justify the means” (Machiavelli, Il Principe, 1532)

Many European debates focus on the legal and ethical issues surrounding the Trump administration's actions and pressure tactics in the Middle East and Venezuela. At the same time, relatively little attention is being paid to the far-reaching geopolitical consequences that may unfold in the coming days, weeks, and months. The possible shift of Iran and Venezuela toward a more pro-Western political and economic profile represents one of the most significant geopolitical scenarios of this decade. Such a transition would have far-reaching implications for energy, security, and market dynamics worldwide.

Positive scenarios (US perspective)

- Renewed energy security: If Iran and Venezuela open their energy sectors to Western investment and governance, oil and gas production could increase substantially in the long term. This would put pressure on global energy prices and reduce risks. It would reduce energy-driven inflationary pressure and could increase the policy space for monetary stability (recycling of petrodollars).

- Regional stabilization: An end to structural hostility with Israel and reduced support for armed proxy groups could lead to lower regional tensions and risk premiums in the Middle East.

- Strategic reorientation: China and other rivals will have less unhindered access to cheap oil. This could lead to geopolitical reconsiderations and financial pressure on Beijing and Moscow.

Negative or risk scenarios

- Instability during transition: If a regime change is not orderly or widely supported, it can lead to a power vacuum, domestic unrest, and even violence. This increases the risks for international investments. The US is successful in regime change, but less successful in nation-building.

- Regional backlashes: Changes in Iran and Venezuela may prompt rival states or groups to intensify their own strategies, putting pressure on stability on other fronts.

- Mobilization of counterforces: China and Russia will attempt to mobilize counterforces, as they benefit from destabilization in Iran and Venezuela. The uncertain factor is which allies they will deploy in this endeavor.

- Overplaying its hand: The Trump administration is threatening to alienate its allies. For example, President Trump is once again talking about American interests in Greenland, which is immediately causing tensions with NATO. There is a political risk that allies will view the United States as unpredictable because of this solo action.

The direction these developments will take and the timeframe involved remain highly unclear. Given the potential geopolitical shifts, we believe the following statement applies: “There are decades where nothing happens; and there are weeks where decades happen” (Vladimir I. Lenin). In our view, the movement appears to be potentially very positive for global capital markets.

Tresor Capital does not comment on the moral or legal justification of US policy choices. We observe geopolitical and macroeconomic developments and adjust our investment portfolios solely on the basis of the dominant macro-strategic scenario that we identify, with constant attention to risk and return profiles. This is not done out of a blind belief that a radical shift is inevitable, but on the basis of scenario analysis and probabilistic thinking.

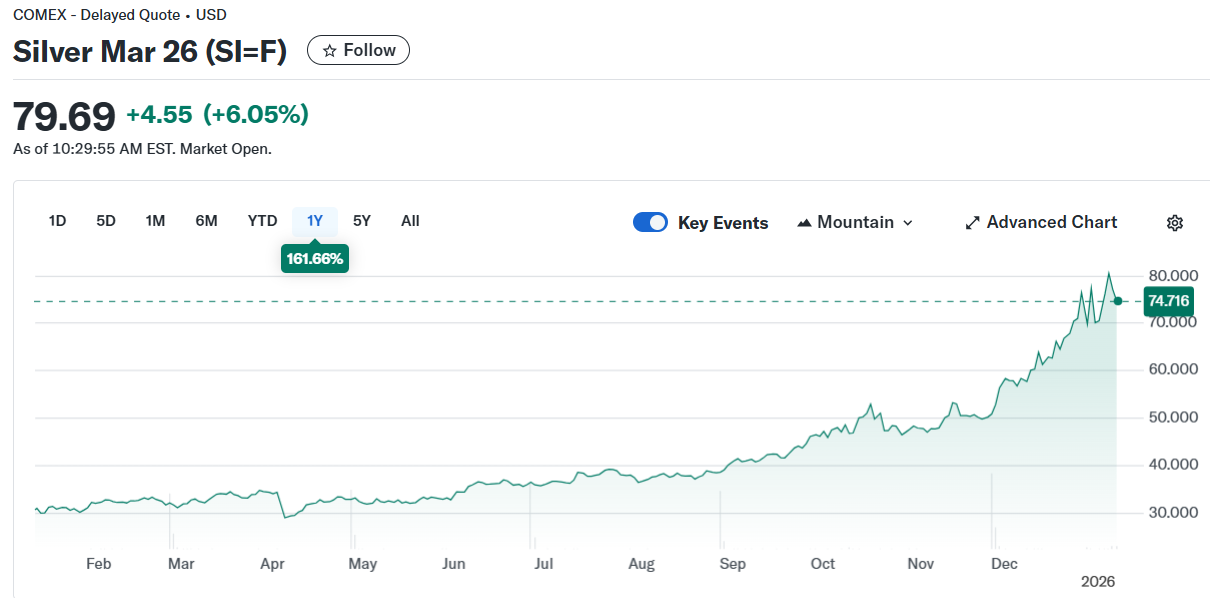

Poor man's gold (silver) rises faster than gold

The precious metals market continues to perform exceptionally well this year. In 2025, gold had one of its best years since 1979, with prices rising by around 60–70%, breaking records and trading well above USD 4,500 per troy ounce. Silver experienced an even more spectacular rally: prices rose by more than 140–150% and reached levels above USD 80 per ounce, one of the sharpest increases in decades.

The sharp rise in silver is also driven by increased geopolitical uncertainty and expectations of lower interest rates. Investors are seeking protection in safe havens, while a weaker dollar is providing additional support for precious metals. Silver is also benefiting from strong industrial demand for solar panels, relatively tight supplies, and the freeze on Chinese silver exports, which is amplifying the price movement. The rise in silver prices is unlikely to lead to higher production, as approximately three-quarters of the supply comes from by-products of copper, lead, zinc, and gold mining.

2026: AI boom or bubble? What do the major banks say?

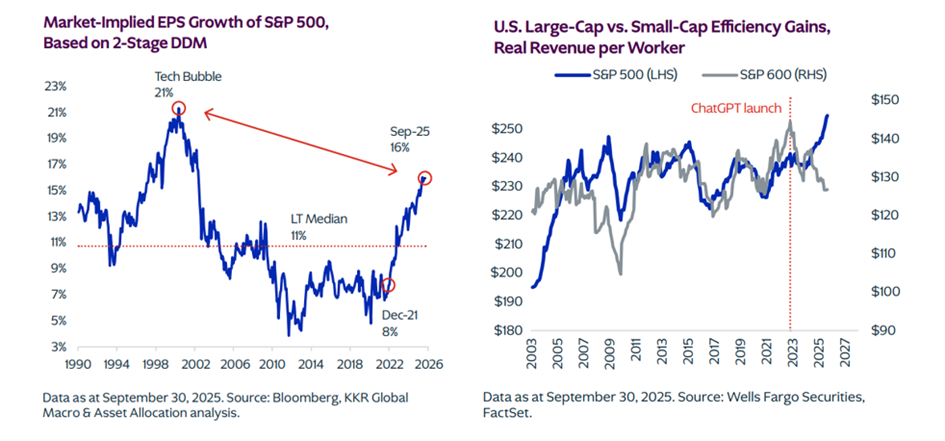

Around the turn of the year, the major banks traditionally publish their outlooks. This year, they are again positive about stock markets heading into 2026, with an emphasis on structural profit growth at large US companies. Artificial intelligence plays an important role in this, not as hype, but as an accelerator of productivity and profitability. According to banks such as Goldman Sachs, JPMorgan, and Morgan Stanley, there is no widespread AI bubble. Investments are being made by wealthy market leaders, including Meta, Google, Microsoft, and Amazon, which are investing heavily in AI infrastructure and where productivity gains and high EPS growth are now visible.

So far, investments in artificial intelligence have hardly been financed with debt, compared to the IT and telecom bubble in 2000. And even when debt financing is used, data centers and chips retain their value and therefore offer solid collateral against bankruptcy risk. In its outlook for 2026, KKR points to a clear acceleration in profit growth, which, thanks to AI, is mainly being achieved by large companies in the service sector.

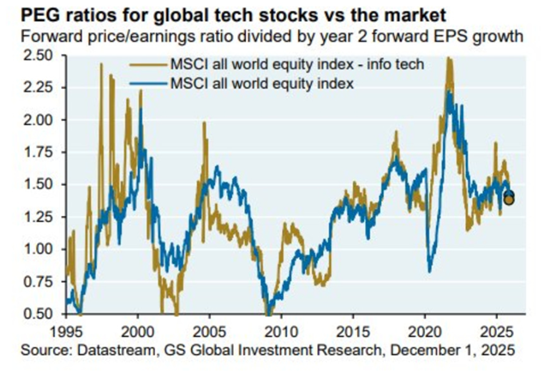

At first glance, current price-to-earnings ratios (P/E ratios) suggest that stocks are expensive, especially when compared to historical averages. However, this picture changes when valuations are adjusted for expected earnings growth using the PEG ratio (Price/Earnings Growth). During the IT bubble of 1995–2000, share prices far outstripped earnings, most of which had yet to be realized. As a result, PEG ratios were often well above 2, a sign of overvaluation.

Today, PEG ratios are significantly lower, despite higher P/E levels. This indicates that valuations are now in many cases supported by actual and visible earnings growth, as shown in KKR's illustrations. Particularly in large, profitable technology companies, AI is rapidly translating into productivity improvements, margin expansion, and EPS growth. Whereas the P/E ratio on its own may indicate overvaluation, the PEG ratio shows that, unlike in the late 1990s, the current market is more strongly supported by fundamental earnings growth.

Receive weekly insights in your inbox

Exclusive analyses and updates on family holdings and global market developments.

Inflation is falling rapidly worldwide, except in the Netherlands.

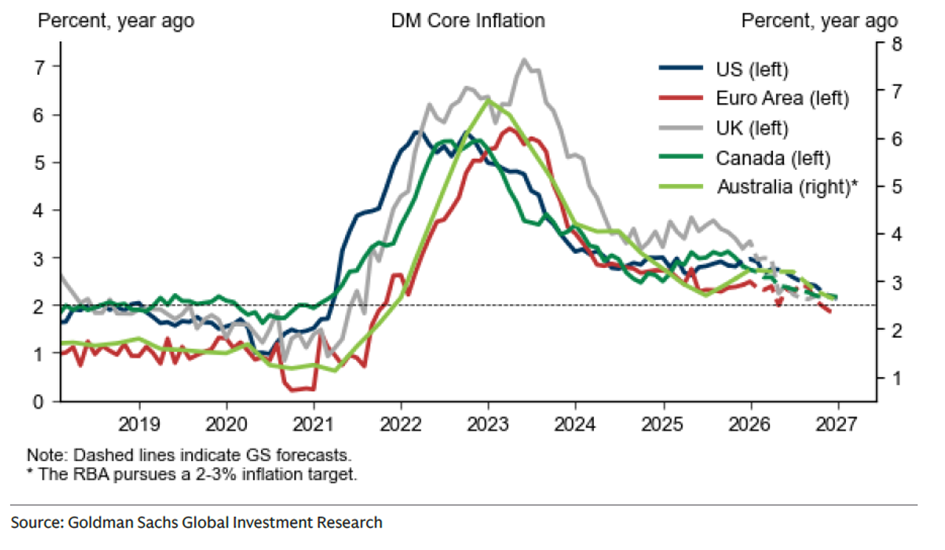

Inflation in the United States was significantly lower than expected in November: the consumer price index came in at around 2.7% (both headline and core), which was below analysts' expectations and the lag. This increases the scope for the Federal Reserve to implement earlier and possibly multiple interest rate cuts in 2026, as price pressures are moving toward the target level of around 2% faster than previously thought.

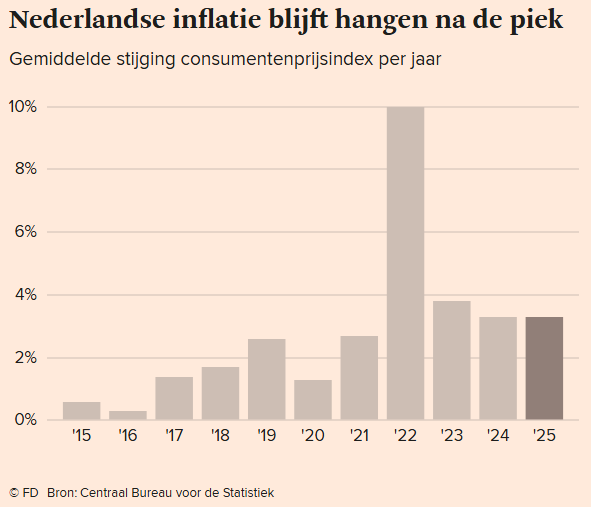

However, inflation in the Netherlands remains structurally higher than in many other European countries. According to De Nederlandsche Bank, Dutch inflation will continue to fluctuate around 3% in 2025–2026, well above the eurozone average. This difference is mainly caused by domestic factors: higher wage growth due to a skewed labor market, sharply rising prices in the service sector, and indirect tax increases (such as excise duties) have kept price pressure higher than elsewhere in Europe.

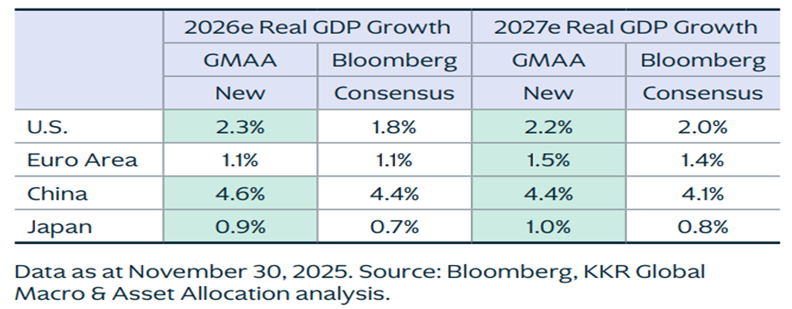

The new government in the Netherlands will have to work hard to prevent the Dutch competitive position from deteriorating further. This is all the more important given that high inflation in the Netherlands is not a sign of an overheating economy or high economic growth. Declining inflation gives central banks around the world room to lower interest rates. According to KKR, a stimulative monetary policy combined with high productivity due to artificial intelligence will continue to translate into strong economic growth in the US and China in 2026 and 2027, while growth expectations for Europe will lag behind despite Germany's efforts.

Ontvang wekelijks inzichten in uw inbox

Exclusive analyses and updates on family holdings and global market developments.

Would you like more information about our services?

Contact us

Disclaimer:

No rights can be derived from this publication. This is a publication by Tresor Capital. Reproduction of this document, or parts thereof, by third parties is only permitted with written permission and with reference to the source, Tresor Capital.

This publication has been compiled with the utmost care by Tresor Capital. The information is intended in a general sense and is not tailored to your individual situation. The information should therefore expressly not be regarded as advice, an offer or a proposal to purchase or trade investment products and/or purchase investment services, nor as investment advice. The authors, Tresor Capital and/or its employees may hold positions in the securities discussed, either for their own account or for their clients.

You should carefully consider the risks before you start investing. The value of your investments may fluctuate. Past performance is no guarantee of future results. You may lose (part of) your investment. Tresor Capital accepts no liability for any inaccuracies or omissions. This information is for indicative purposes only and is subject to change.

Read the full disclaimer at tresorcapitalnieuws.nl/disclaimer .