Economy & Markets #3 - What will happen to the dollar? Applying for jobs again thanks to AI?

This week's topics:

What will the dollar do in 2026?

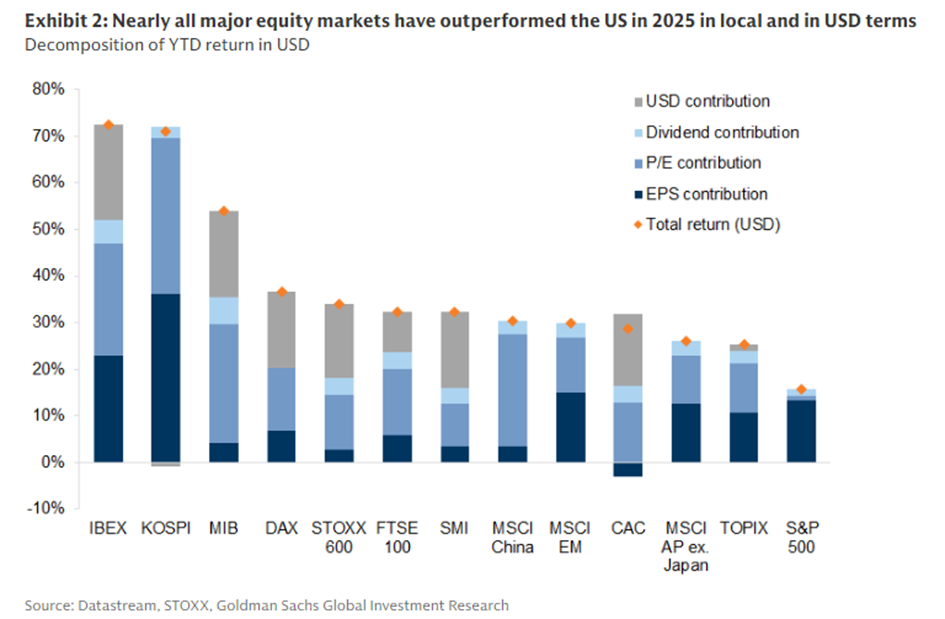

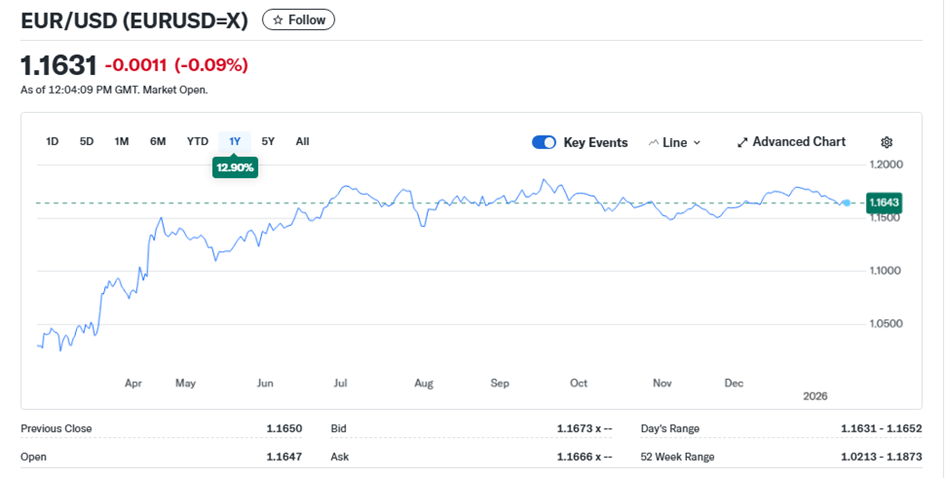

For many international investors, returns in 2025 were lower than expected. Despite strong performances in sectors such as technology and defense, there was one dominant factor that depressed total returns (in euros): the sharp depreciation of the US dollar by approximately 12% against the euro. While an ETF on the S&P 500 achieved a return of approximately +17% from a US perspective, this investment only yielded approximately +5% on a euro account. For similar reasons, the MSCI World stock index (approximately 8% in euros) also lagged significantly behind the European stock indices.

Most investors do not hedge currency risk on equities, particularly when companies operate globally. The idea is that currency losses can eventually be offset by higher profits from international activities. Currency risk is always hedged for bonds and other defensive investments, because exchange rate volatility is often many times greater than the volatility of the bonds themselves. In other cases, bond exposure is even completely phased out (when the foreign yield curve is clearly above the European curve and is flat or inverted). An important exception is bonds from emerging markets, which are often deliberately held in local currency because of the extra return and diversification potential.

With 2026 in mind, the question arises once again as to which direction the US dollar will take. When the Trump administration took office, it was clear from the outset that it would pursue a policy of dollar weakening, with the aim of reducing the twin deficits: the trade and budget deficits. A weaker dollar strengthens the international competitive position of American companies and thus contributes to an improvement in the trade balance. At the same time, it supports the budget balance by making the US more attractive as a production location, partly through (enforced) onshoring.

The United States is in a strong starting position in this regard. The country is a net energy exporter, while energy is traded globally in dollars, which limits the risk of inflation shocks. In addition, the US has a dominant position in semiconductors, which are largely priced in USD, and is very strong in the export of services. The structural deficit on the goods balance is thus more than offset by a surplus on the services balance.

This allows the US to afford to let the dollar weaken in order to support its competitive position and domestic economy. Some even suggest that proponents of a weaker dollar, such as J.D. Vance and Stephen Miran, are using the trade war partly as a diversionary tactic, while the actual adjustment is primarily taking place via the exchange rate. Have you seen the headlines where European or Asian central bankers, economists, or politicians complain about the weakness of the dollar?

As long as imported inflation caused by the weakening dollar remains manageable, there is scope to further lower real interest rates and thereby improve the financing of US government debt. It is therefore logical that the US government has an interest in lower real interest rates and, by extension, a weaker dollar exchange rate. US core inflation came in at +2.6% this week, confirming the ongoing disinflationary trend. As expected, the Trump administration will increase pressure on the Federal Reserve to accelerate interest rate cuts. In this context, criticism of Fed Chairman Jerome Powell is also increasing. In the run-up to his retirement in May this year, he is being held responsible, among other things, for the persistently high (construction) costs of the new Fed office. The implicit message here is that he should abandon his ambition to remain as chairman.

Trump and Powell are arguing about renovation costs.

Following the temporary reduction of US assets by foreign investors during the market turmoil surrounding Liberation Day in April 2025, there has now been a return to normal and renewed inflows into US government bonds and equities. This inflow is mainly driven by the structural appeal of the US economic system and the continuing interest rate and yield advantage compared to other developed markets.

Outlook for 2026: what will happen to the USD (versus the euro)?

Looking ahead to 2026, the question of which direction the US dollar will take is once again central. Below, we weigh up the most important factors for further USD weakening and the arguments for a possible revaluation.

Factors arguing for further USD weakening

- The cycle of interest rate cuts in the US does not appear to be over yet; the policy rate is expected to fall from around 3.75% to 3.25% towards the end of the year.

- The Trump administration is explicitly pushing for maximum economic support through a weaker dollar.

- Persistent concerns about the US budget deficit continue to exert structural downward pressure on the USD.

- The visible power struggle within the Federal Reserve evokes parallels among some investors with previous political interference in Turkey, which at the time led to a sharp weakening of the lira.

- Increasing domestic political tensions ahead of the midterm elections in November are heightening uncertainty and may temporarily increase the risk premium on US assets.

- Historically, an incumbent US administration often loses seats in midterm elections, which, in the event of a political stalemate, limits its policy mandate and scope for action during the remainder of its term in office.

Arguments why the USD may still recover (versus the euro):

- There is little confidence that the eurozone will be able to sustainably raise its structural growth above 0%. Demographic decline and low productivity growth are weighing on growth potential, while the US continues to grow at around 2% on a structural basis.

- The European energy transition is costly and contributes to inflation, while at the same time putting pressure on the competitiveness of industrial sectors such as automotive, chemicals, and construction.

- European businesses are poorly positioned for the new economy (AI, digitization), which supports structural capital flows toward US capital markets.

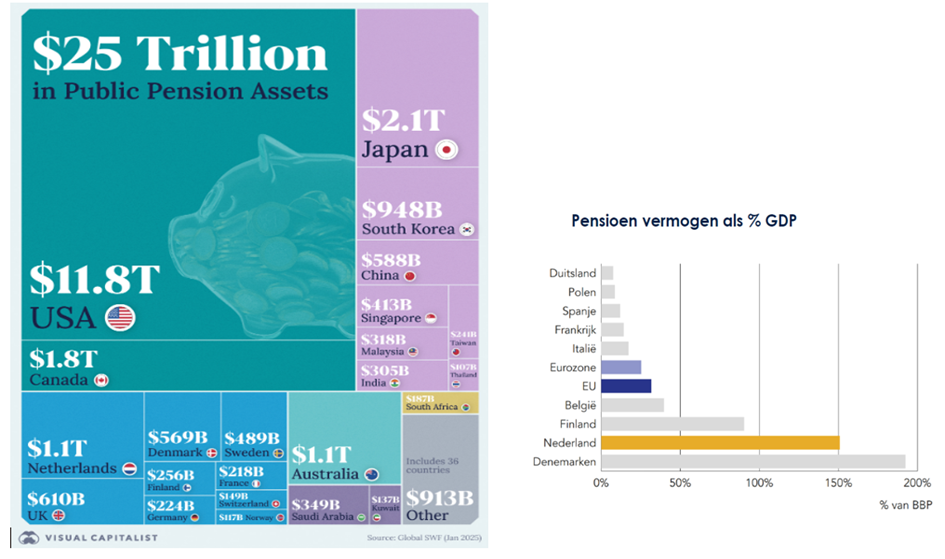

- Demographics are working in favor of the US: American baby boomers are retiring with considerable wealth, which supports consumption. In Europe, however, aging populations and substantial unfunded pension liabilities are putting increasing pressure on public finances and the social welfare state. Unfunded pension liabilities in Europe are estimated to exceed 200% of GDP.

- The introduction of Eurobonds, including in the context of financing Ukraine, could eventually lead to further joint debt issuance, which could put the euro under structural pressure.

- The recent formation of a new cabinet in The Hague is being followed with interest in Europe. For countries such as France, Spain, and to a certain extent Germany, joint decision-making is attractive because it offers the possibility of indirectly drawing on the relatively strong pension and capital positions of countries such as the Netherlands and Finland through solidarity mechanisms (see figure below).

conclusion Although the market consensus, including major banks such as Goldman Sachs and Citigroup as well as asset managers such as State Street and PIMCO, assumes a further appreciation of the euro against the dollar, we believe there is a good chance that the USD will make a clear comeback after the midterms. In the run-up to the elections, policy is expected to remain focused on a weaker dollar, without any visible macroeconomic disruption for the time being. After the midterms, however, it will become increasingly clear that the long-term fundamentals of the United States are stronger than those of Europe, which could accelerate capital flows to the US and provide renewed structural support for the dollar.

Receive weekly insights in your inbox

Exclusive analyses and updates on family holdings and global market developments.

Artificial Intelligence: in which sector will our children still be able to work in the future?

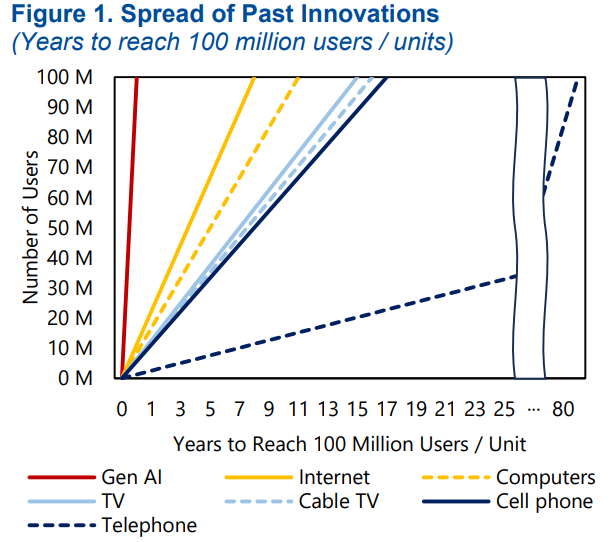

Artificial intelligence (AI) is advancing at an unprecedented rate, making it difficult to predict its final stage and consequences. Whereas previous technological innovations, such as the internet, computers, and mobile phones, spread gradually, we are now seeing exceptionally rapid adoption of a new technology. In 2022, generative AI, with applications such as ChatGPT, made its definitive breakthrough. Just three years later, more than 900 million people worldwide are already using AI tools on a regular basis.

What is becoming clear, however, is the impact on the economy and the labor market. Companies can increase their productivity and profits with the help of AI, without this automatically leading to more jobs. Tasks such as analyzing, writing, coding, and customer contact have suddenly become scalable. Or, as it is often summarized: "We are growing, but with fewer people." This makes economic growth without proportional job growth, also known as jobless growth, increasingly realistic.

What's more, the benefits of this growth are unevenly distributed. AI functions economically like capital: it increases returns for companies and shareholders, while wages and employment lag behind. Large players with the best technology and data benefit the most, without needing to hire many additional staff.

This is creating a clear divide in the labor market. Highly educated, AI-complementary skills are becoming scarcer and better paid, while many middle-level jobs (white-collar jobs) are under pressure. Average wages are barely growing, even though corporate profits are increasing. It is no coincidence that this is already becoming increasingly visible in the US market. AI is shifting from experimentation to everyday use in sectors such as finance, software, and business services, where growth is accelerating but no longer automatically trickling down to jobs and wages.

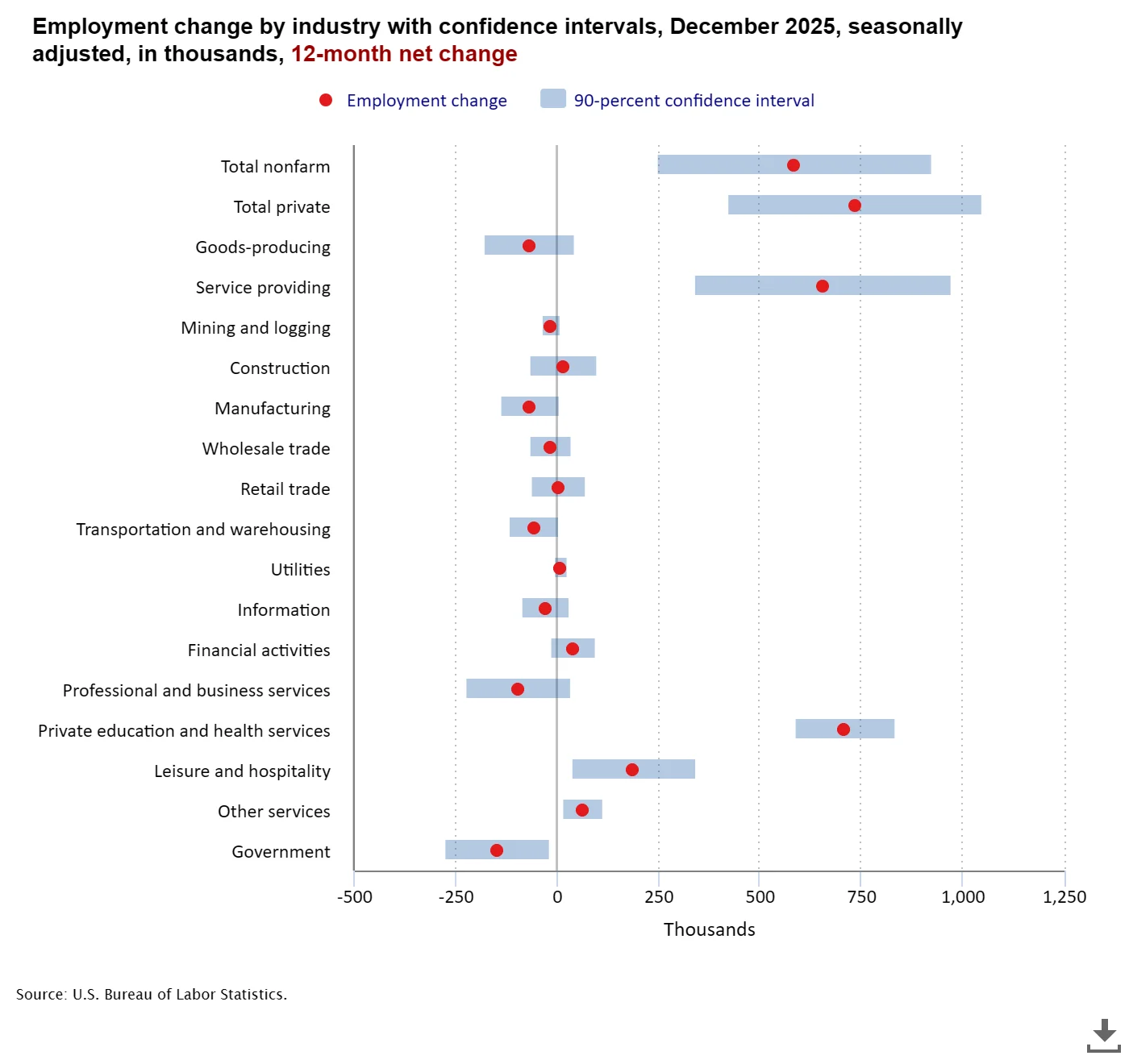

American labor market statistics show that many sectors are barely creating any jobs. Exceptions to this are education and healthcare. Positions involving highly repetitive, digital, and cognitive tasks, such as administration, customer support, simple analysis, and junior knowledge-based roles, are particularly under pressure. As a result, graduates will have to search for jobs more often and for longer periods of time, and increasingly focus on sectors where the labor market is tight and automation remains more limited, such as healthcare, technology, infrastructure, and education.

Effect of AI on productivity and profitability

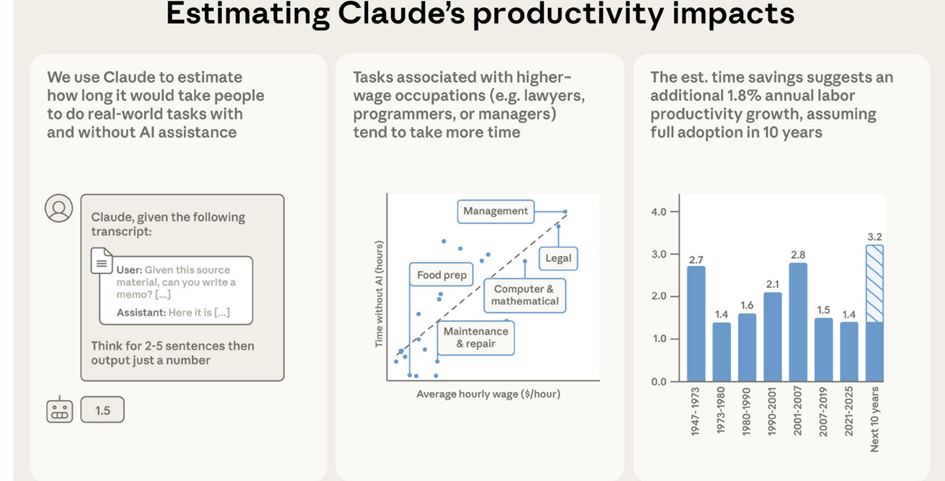

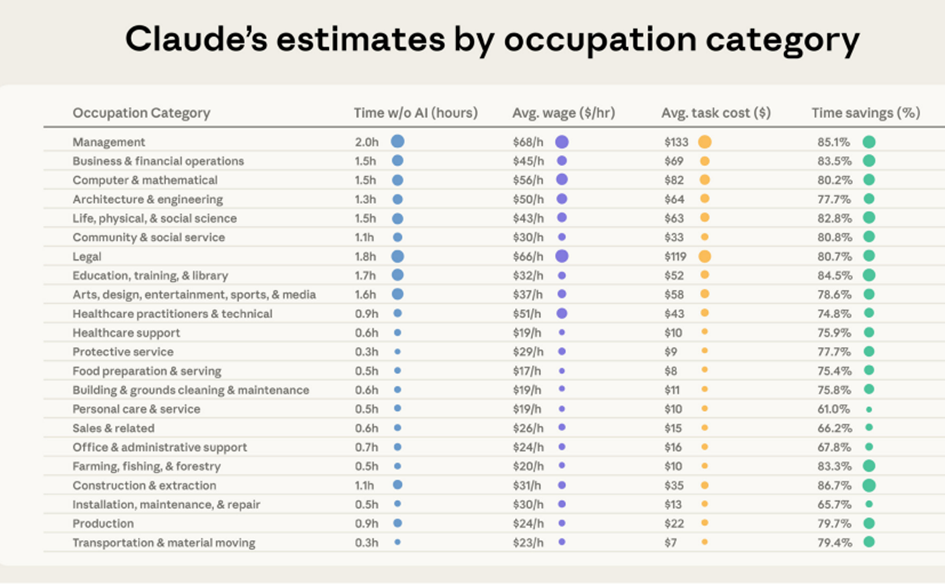

AI is having an increasingly direct and measurable impact on productivity and profitability. A recent, comprehensive study by Anthropic, a leading AI company, offers valuable insight into which sectors are benefiting, where productivity gains are occurring, and how investors can view this.

The study shows that AI drastically speeds up the performance of many tasks, saving up to 80% of the time on average, across a wide range of professions. The greatest efficiency gains are achieved in complex cognitive tasks, such as analysis, planning, writing, and problem solving. It is precisely in areas where human time is traditionally scarce and expensive that AI appears to add the most economic value. If these effects continue to spread widely, AI could significantly accelerate labor productivity growth in the coming years, possibly to about twice the pace of the past decade.

For companies, this means higher output at lower marginal costs and thus a structural boost to profit margins. For investors, the focus is shifting to sectors and companies that effectively integrate AI into their core processes and achieve economies of scale without a proportional increase in personnel costs.

And in which sectors should we apply for jobs?

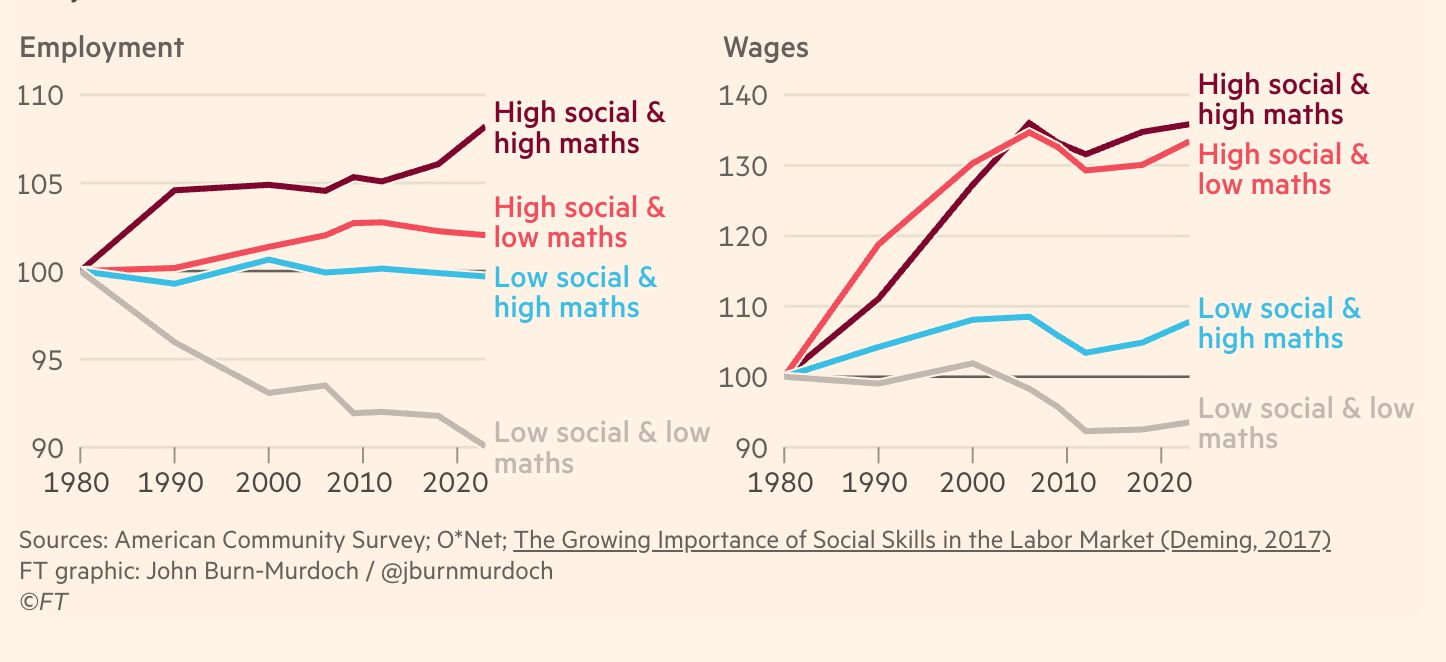

For a long time, people who were good with people and good with numbers had a clear advantage in the job market. At least, that is what can be concluded from the image below, which shows that being good with numbers (maths) is a required skill alongside good social skills.

The rapid development of large language models is making traditional programming languages such as Python or C++ increasingly less decisive. Whereas technical knowledge used to be the key to impact, the value is now shifting to the ability to clearly instruct AI systems, provide context, and give direction. In that sense, English, or more broadly, clear language, is becoming the new programming language.

The ability to formulate clearly, ask relevant questions, and think conceptually outweighs the ability to write code yourself. This democratizes productivity: a much larger group of professionals gains access to advanced technology. At the same time, the importance of judgment, communication skills, and analytical thinking is only increasing.

Nevertheless, one truth remains: anyone looking for a job would be wise to continue applying for positions themselves in the future, without relying on AI.

Receive weekly insights in your inbox

Exclusive analyses and updates on family holdings and global market developments.

AI made possible by acceleration in computing power (chips)

The explosive growth of AI is not only reflected in the automation of work, but also in massive investments in the core infrastructure that enables AI: chips and data centers. Lisa Su, CEO of AMD and one of the key players in the semiconductor industry, introduced the concept of the "YottaScale era." This is a phase in which AI infrastructure is measured in yottaflops, computing power with 24 zeros after the one. According to Su, by the end of this decade, the world will need up to 10 yottaflops of AI computing power, approximately 10,000 times more than in 2022. To enable this scale-up, AMD expects the global market for AI data center chips to grow to an annual market of approximately $1 trillion by 2030.

This underscores that AI is not just about software and algorithms, but above all requires a fundamental upscaling of the hardware infrastructure, with substantial investments in advanced chips, data centers, and energy supply. A crucial link in this is the production of semiconductors. Taiwan Semiconductor Manufacturing Company confirmed this picture this week with strong figures. The company reported record sales and saw demand for AI hardware accelerate further. In the fourth quarter of 2025, TSMC achieved a net profit of approximately NT$505.7 billion, equivalent to approximately US$16 billion, an increase of 35 percent compared to a year earlier, with revenue growth of more than 20 percent on an annual basis.

In addition, TSMC announced that it would increase its capital expenditure for 2026 to approximately US$52 to 56 billion, almost 30 percent more than the previous year. As ASML's largest customer, these investments are an important indicator of future demand for advanced lithography machines. TSMC's strong figures are therefore an encouraging sign for ASML, which will publish its quarterly update on January 28.

Both ASML and TSMC are part of Scottish Mortgage Trust's investment portfolio and are therefore indirectly included in the Tresor Family Holding strategy.

Recommended for tech enthusiasts: short video about Moore's Law

How do increasingly smaller chips provide exponentially more computing power and higher energy efficiency? And why is that crucial for the further development of AI? In this clear mini-documentary, ASML shows why Moore's Law still determines the pace of technological progress.

Receive weekly insights in your inbox

Exclusive analyses and updates on family holdings and global market developments.

Would you like more information about our services?

Contact us

Disclaimer:

No rights can be derived from this publication. This is a publication by Tresor Capital. Reproduction of this document, or parts thereof, by third parties is only permitted with written permission and with reference to the source, Tresor Capital.

This publication has been compiled with the utmost care by Tresor Capital. The information is intended in a general sense and is not tailored to your individual situation. The information should therefore expressly not be regarded as advice, an offer or a proposal to purchase or trade investment products and/or purchase investment services, nor as investment advice. The authors, Tresor Capital and/or its employees may hold positions in the securities discussed, either for their own account or for their clients.

You should carefully consider the risks before you start investing. The value of your investments may fluctuate. Past performance is no guarantee of future results. You may lose (part of) your investment. Tresor Capital accepts no liability for any inaccuracies or omissions. This information is for indicative purposes only and is subject to change.

Read the full disclaimer at tresorcapitalnieuws.nl/disclaimer .