Economy & Markets #47 - How Asian turmoil and AI doubts are testing market sentiment

This week's topics:

Meanwhile, enthusiasm around AI stocks cooled due to concerns about financing, higher capital costs and critical market commentary. Still, the underlying AI trend remains robust. Investment in data centers, computing power and automation is on the rise globally, with NVIDIA a measure of the strength of this structural growth cycle.

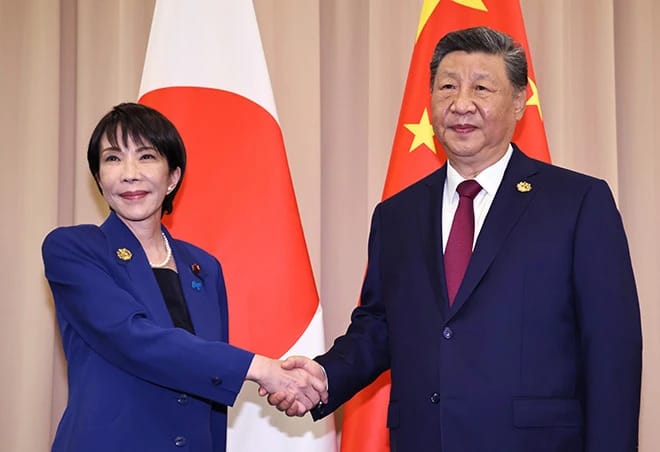

New wave of tension between China and Japan

The relationship between China and Japan has come under further strain this week following firm statements about Taiwan by new Japanese Prime Minister Sanae Takaichi. Takaichi, in many ways labeled as a new Thatcher, stated that a Chinese attack on Taiwan could create a situation that "threatens Japan's survival," which in Japan's security law could serve as grounds for military involvement. Beijing responded immediately and sharply. China called the statements irresponsible and initiated a series of countermeasures, including a negative travel advisory for Japan and the suspension of cultural exchanges. The effect was quickly seen on Japan's tourism industry, where Chinese visitors traditionally make up a large part of the influx.

An important geographical element in this cycle of tension is again the Senkaku archipelago, called Diaoyu by China and Diaoyutai by Taiwan. Located about 220 kilometers northeast of Taiwan, these uninhabited islands have both symbolic and strategic value. Japan has governed the islands for decades, but China and Taiwan also claim sovereignty. In recent days, several Chinese coast guard ships have been seen in Japanese-controlled waters, increasing China's pressure and, in turn, intensifying Japan's patrols.

The recent developments are not isolated. Sino-Japanese relations around the islands previously experienced a sharp escalation, most notably in 2010, when a Chinese fishing vessel rammed two Japanese coast guard vessels in the same area. At the time, the arrest of the Chinese captain led to a diplomatic crisis, economic pressure from Beijing and a noticeable cooling of mutual relations. That incident has since been a benchmark for how quickly friction can turn into crisis.

Even now, the likelihood of a deliberate military confrontation seems low, but the risk of incident-driven escalation has clearly increased. A maritime or air blunder can quickly gain momentum of its own, especially at a time when diplomacy between the two countries is virtually at a standstill. Economically, the consequences seem limited for now, although the canceled trips and rhetorical acuity show that both sides are willing to apply pressure when politically convenient. Meanwhile, Japan stresses that there is no indication that China is using strategic raw materials as a means of pressure, but markets are watching this segment closely.

For investors and markets, this represents a phase of heightened geopolitical uncertainty in Northeast Asia. The combination of diplomatic rigidity, symbolic territorial issues and sensitivity around Taiwan creates an environment in which sentiment can turn quickly. In the coming weeks, maritime activities around the Senkaku Islands and the tone toward regional summits in particular will determine the risk picture.

Receive weekly insights in your inbox

Exclusive analyses and updates on family holdings and global market developments.

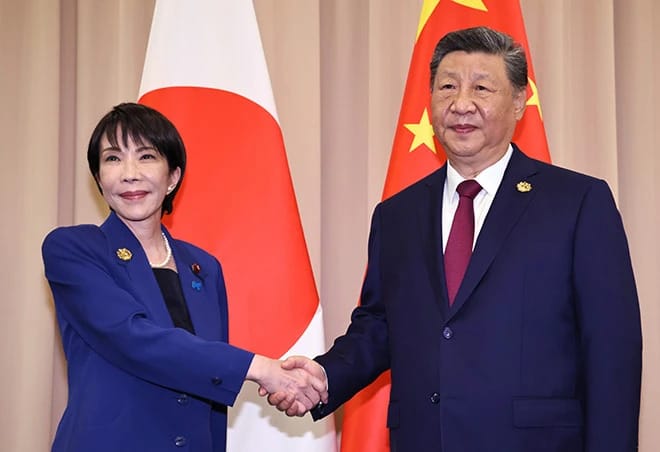

Takaichi puts pressure on bond and currency markets

In addition to the geopolitical tension with China this week, turmoil simultaneously emerged in Japanese financial markets. Government bond yields shot up to levels not seen by Japan since the 2008 financial crisis. The 10-year JGB ticked up 1.78%, while the 30-year rate rose to 3.35%

That rise in interest rates is mainly a reaction to Prime Minister Sanae Takaichi's new fiscal stance. Markets are factoring in a much larger stimulus package than previously anticipated; an additional budget of around ¥25 trillion now seems to be the base case. That would lead to a sharp increase in government bond issuance, causing investors to demand higher fees to absorb the growing supply.

On top of this, Japan has been struggling with structural problems for many years: a public debt of about 260% of GDP (the highest in the world). aging population, low productivity growth and a chronic budget deficit. By comparison, in Europe, Italy is among the most indebted countries at about 140% of GDP. Decades of fiscal stimulus have helped the economy, but have also led to a situation where the government structurally spends more than it brings in. Those deficits are expected to climb toward 4% of GDP in 2025 and 2026.

Against this backdrop, the role of the Bank of Japan once again takes center stage. For years, the central bank kept the market in check through massive bond purchases and yield curve control, tools that helped keep sky-high debt sustainable. Meanwhile, the government directly and indirectly owns about half of all outstanding JGBs, a situation that was only possible during a period of extremely low inflation. Now that inflation has reached 2.9%, this policy is coming under increasing pressure. The BoJ has tentatively begun normalizing, while the market tests how far the central bank is willing to go. That uncertainty is contributing to the recent rate hikes.

Interestingly, despite rising interest rates, the yen actually continued to weaken and fell through the ¥155 per dollar mark. The currency remains relatively stable given the underlying problems, partly because Japanese investors hold large foreign positions and the yen has traditionally had a reputation as a safe haven. Yet one risk is pointing ever more emphatically: the possible unwind of the yen carry trade. For years, investors could borrow yen cheaply to invest in assets with higher yields. If Japanese interest rates normalize or the yen appreciates, this strategy could come under pressure, potentially resulting in global selling pressure.

For investors, this means that the risk picture is determined not only by geopolitical tensions with China, but also by a Japanese domestic market moving toward a new, uncertain equilibrium after decades of artificially low interest rates. In the coming weeks, Takaichi's budget proposals and the Bank of Japan's tone in particular will determine sentiment.

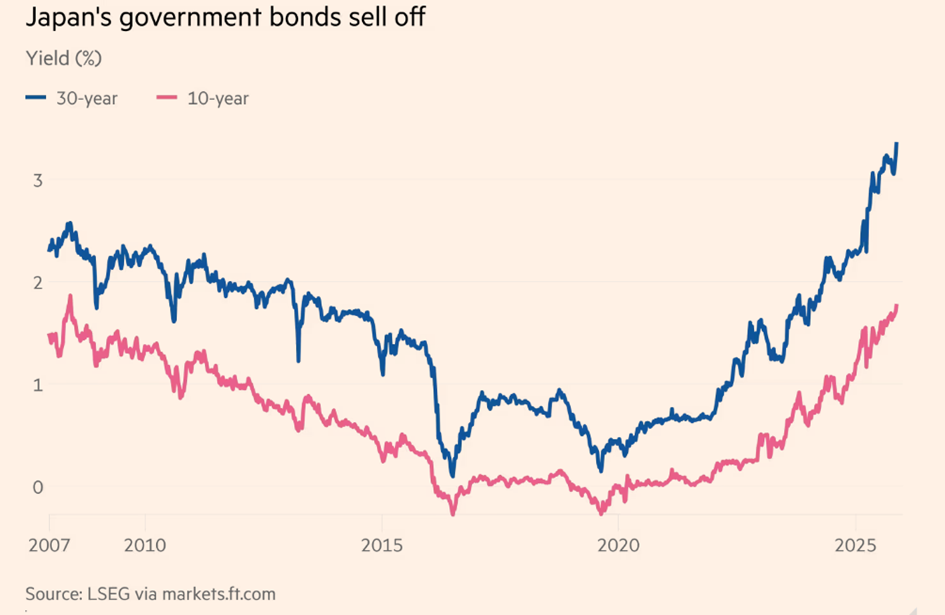

NVIDIA keeps sentiment upright

Recent weeks have seen growing caution in global equity markets and in particular the artificial intelligence, data centers and chips sector. Well-known market figures publicly expressed doubts about the valuation of data centers and chips, while rising financing costs among companies fueled fears that parts of the AI infrastructure chain may no longer be able to sustain their investment rhythm.

Michael Burry, known for his successful short position against the U.S. mortgage market during the 2008 financial crisis (see the movie: The Big Short), even suggested that data centers remain on the balance sheet too long and should be depreciated faster. In essence, that amounts to lower underlying profitability for the entire industry. At the same time, credit markets continued to exude nervousness. Rising CDS spreads at Oracle and CoreWeave, among others, were seen by the market as a warning that financing for large AI projects was becoming more expensive. This fueled questions about the feasibility of announced investments by companies such as OpenAI, AMD and NVIDIA itself.

Yet the underlying trend appears remarkably robust. Capital flows toward data centers, training clusters and inference capacity continue to increase globally. In that context, NVIDIA serves as one of the key barometers of the strength of the AI investment cycle. The company represents a substantial part of the global hardware supply chain, and shifts in demand for computing power are reflected almost immediately in its revenue mix. That NVIDIA is now larger in terms of market capitalization than entire national stock markets (including Germany) underscores how central AI infrastructure is in the global capital picture. With a weight of over 5% in the MSCI ACWI, AI is no longer a thematic niche, but a structural pillar of global markets.

On the demand side, OpenAI remains a key metric. The growth in business applications, internal automation and generative AI integration shows that adoption is no longer limited to experimental use cases, but is increasingly becoming part of core business processes. As a result, the demand for computing power is once again increasing, forcing hyperscalers to further expand their investment plans. This dynamic extends directly to the hardware chain and thus to NVIDIA.

The tension between temporarily weaker sentiment and structurally growing AI demand makes the sector more complex, but at the same time more mature. Whereas the rally in 2023 and 2024 was mainly driven by expectations, it is now increasingly clear that the economic value of AI is actually being realized. The strong concentration of capital in a limited number of companies means that movements in these names have immediate knock-on effects on the broader AI ecosystem, requiring careful risk assessment. But it changes little about the underlying direction: the investment wave behind AI remains powerful.

Receive weekly insights in your inbox

Exclusive analyses and updates on family holdings and global market developments.

Would you like more information about our services? Please feel free to contact us.

Contact us

Disclaimer:

No rights can be derived from this publication. This is a publication of Tresor Capital. Reproduction of this document, or parts thereof, by third parties is only permitted after written permission and with reference to the source, Tresor Capital.

This publication has been prepared by Tresor Capital with the utmost care. The information is intended to be general in nature and does not focus on your individual situation. The information should therefore expressly not be regarded as advice, an offer or proposal to purchase or trade investment products and/or purchase investment services nor as investment advice. The authors, Tresor Capital and/or its employees may hold position in the securities discussed, for their own account or for their clients.

You should carefully consider the risks before you begin investing. The value of your investments may fluctuate. Past performance is no guarantee of future results. You may lose all or part of your investment. Tresor Capital disclaims any liability for any imperfections or inaccuracies. This information is solely indicative and subject to change.

Read the full disclaimer at tresorcapitalnieuws.nl/disclaimer .