Economy & Markets #48 - How a butterfly in Japan can cause a whirlwind in Brussels

This week's topics:

Calm returns cautiously on Wall Street

Over the past two weeks, the S&P 500 and the Nasdaq regained support after the sharp correction earlier in November. The main driver of the recovery has been sharply increased expectations that the Federal Reserve will implement an interest rate cut as early as December. Both John Williams, president of the New York Fed, and Governor Christopher Waller emphasized that the labor market is cooling and that inflation is moving toward target, which they believe leaves room for a 25 basis point rate cut. The market price for such a cut has now risen to around 85%, a remarkably quick turnaround from the previous week. Volatility fell sharply as a result: the VIX fell from a peak around 26% to around 17%, indicating calmer market conditions and more willingness among investors to take risk.

Asia's butterfly effect

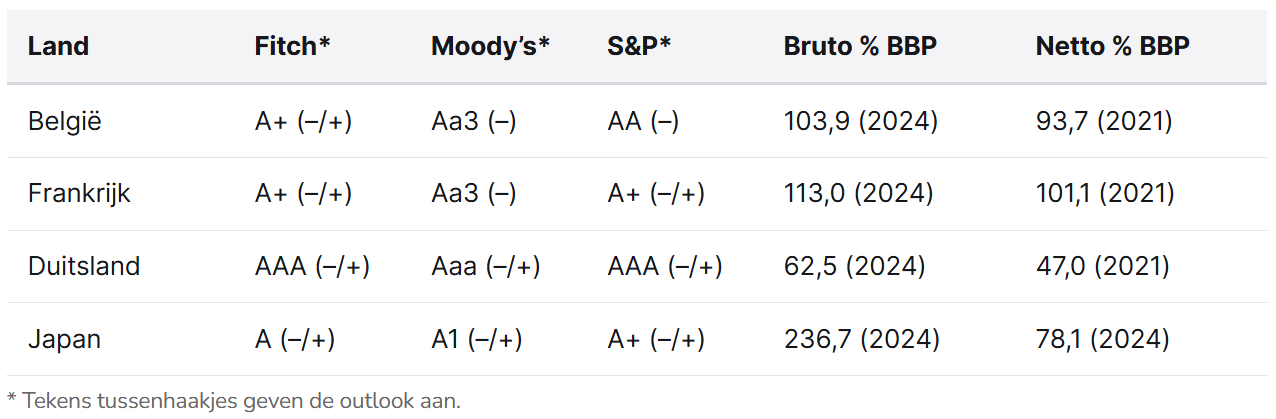

Last week we wrote about the rapidly deteriorating financial position of the Japanese government. Interest rates are rising sharply and the Japanese yen is weakening rapidly. Gross public debt is now more than 240% of GDP. However, when looking at the net position, which corrects for the state's substantial financial holdings, it comes out at a much lower level of about 76% of GDP. This difference is partly explained by the fact that the Japanese Ministry of Finance itself has bought up a large portion of government bonds. In addition, Japan's pension funds and substantial domestic savings are among the largest in the world.

If we look at other countries facing similar structural challenges (demographic contraction, rising social spending and the risk of higher interest rates), it is not inconceivable that the dynamics we are now seeing in Japan could eventually spread to countries such as Belgium, France or even Germany. This is a striking example of the so-called butterfly effect: a seemingly local disturbance in Asia may end up turning into a much bigger shock in Europe.

Belgium's gross public debt is about 104% of GDP in 2024. An official calculation of net public debt is lacking, except for an estimate from 2021, which makes it difficult to make a nuanced assessment of the actual debt position. At the same time, budget deficits remain stubbornly high, with deficits of around 5.5% of GDP projected in both 2025 and 2026. Not surprisingly, the De Wever government is coming under increasing pressure from capital markets to implement structural reforms.

Reform Agenda Bart de Wever

This week, Prime Minister Bart De Wever presented a new agreement to reduce the budget deficit in 2026 and 2027. The package consists of a combination of tax increases and targeted savings. For example, taxes on share transactions, airline tickets and natural gas will rise, there will be an additional bank tax and various government expenditures will be more strictly curtailed.

In addition, the socio-economic measures from the summer 2025 agreement will be accelerated. These include labor market reforms, tax adjustments, and a review of the unemployment system that reduces the duration of benefits to increase labor force participation.

Remarkably, unlike Germany and France, Belgium is also taking steps to control future pension costs. As of 2027, anyone who wants to retire early at 63 must be able to present at least 42 career years, with each year counting 156 days worked or equivalent. Those who do not meet this requirement and still retire earlier will receive a lower benefit, in proportion to the number of years of earlier retirement.

Table - New taxes and tax measures for investors (private & business)

According to the government, the total savings of €9.2 billion should cover a substantial portion of the deficit. Yet it remains uncertain whether this will be enough to once again fall below the European budget norm of 3%. After all, part of the planned revenue depends on behavioral responses from citizens and businesses. For example, there is a risk that private individuals will trade less on the stock market, as a result of which the revenue from the stock exchange tax (TOB) may be lower than estimated. For other measures, too, it is still uncertain whether the expected revenues will be fully realized.

Receive weekly insights in your inbox

Exclusive analyses and updates on family holdings and global market developments.

Is political crisis looming in Germany?

Remember how European stock markets rebounded early this year when Germany announced extensive investments and reforms? Meanwhile, however, Chancellor Friedrich Merz finds himself in a political crisis: his own youth wing within the CDU is blocking the pension plan that was supposed to secure benefits until 2031.

It is little surprise that the pension issue is becoming a structural risk for the European project. The German system, like that of France, operates on the pay-as-you-go principle: current pensions are financed from the tax revenues of working people, without the support of accumulated reserves. An aging population is putting increasing pressure on this model. Within the CDU/CSU, young people accuse Merz of opting mainly for postponement rather than real reform, and of continuing to avoid necessary structural interventions. His reputation as a "great reformer" is thus crumbling further; the risk is growing that, like former Chancellor Angela Merkel, he will go down in history as someone who put off major economic problems for too long. This puts the political stability of the government under pressure.

It also delays investment plans for more than 500 billion euros in infrastructure and defense, accounting for about 15% of Germany's GDP. Combined with the fact that the German economy has been in recession for three years, it becomes clear how quickly the political and economic climate in Germany can tilt, and not in a positive direction.

Bitcoin correction and the self-reinforcing effect around MicroStrategy

Bitcoin has corrected solidly over the past two months, from around US$126,000 to a range of US$80,000-90,000. This decline coincided with outflows from spot ETFs, broader risk reduction in financial markets and hefty liquidations in the derivatives market. The combination of these weakened intraday liquidity and accelerated downward pricing.

An additional source of pressure comes from companies with large Bitcoin positions, especially when those positions are built with borrowed money and Bitcoin itself serves as collateral. MicroStrategy is the best-known example. The company issued multiple tranches of debt securities in recent years and used Bitcoin as a strategic balance sheet tool within its financing structure. CEO Michael Saylor summed it up pithily earlier, "We are a leveraged long Bitcoin operating company."

This model works very well during times of rising rates, but when there are sharp declines, vulnerability increases rapidly. When the value of collateral (Bitcoin) falls, lenders may demand additional collateral. If these are not available, there is a risk of forced sales, which can intensify price pressures precisely during down markets. This dynamic applies more broadly to companies that combine leverage with digital assets and acts as an accelerator of downward movements during volatile periods.

MicroStrategy shares have fallen about 41% this year and are at risk of losing their place in certain stock indexes due to recent price movements. Such an index removal could lead to mandatory selling by ETFs and index funds, which would again put additional pressure on the stock price. A lower share price also reduces MicroStrategy's ability to raise new capital through equity issuances, making the company even more dependent on Bitcoin-related collateral.

This creates a self-reinforcing mechanism:

A lower Bitcoin price depresses the value of collateral → this increases financing pressure → leading to possible forced sales → which further depresses the Bitcoin price → causing MicroStrategy's share price to fall again.

A fragile balance, especially in an environment where both market risks and liquidity shocks can turn quickly.

Receive weekly insights in your inbox

Exclusive analyses and updates on family holdings and global market developments.

Would you like more information about our services? Please feel free to contact us.

Contact us

Disclaimer:

No rights can be derived from this publication. This is a publication of Tresor Capital. Reproduction of this document, or parts thereof, by third parties is only permitted after written permission and with reference to the source, Tresor Capital.

This publication has been prepared by Tresor Capital with the utmost care. The information is intended to be general in nature and does not focus on your individual situation. The information should therefore expressly not be regarded as advice, an offer or proposal to purchase or trade investment products and/or purchase investment services nor as investment advice. The authors, Tresor Capital and/or its employees may hold position in the securities discussed, for their own account or for their clients.

You should carefully consider the risks before you begin investing. The value of your investments may fluctuate. Past performance is no guarantee of future results. You may lose all or part of your investment. Tresor Capital disclaims any liability for any imperfections or inaccuracies. This information is solely indicative and subject to change.

Read the full disclaimer at tresorcapitalnieuws.nl/disclaimer .