Economy & Markets #49 - Europe is becoming divided in terms of pace and vision

This week's topics:

Swiss population chooses different route than the British

The Swiss vote four times a year in binding referendums on national, regional, and local political proposals. Last weekend, one of the proposals on the agenda was to tax inheritances over 50 million Swiss francs at a rate of 50% and use the proceeds for sustainability. The result raised eyebrows across Europe, as the proposal was rejected by an overwhelming majority. At first glance, this seems to defy all logic: only a fraction of the Swiss population has assets of that magnitude. If every voter had followed their personal interests, this proposal should have won by a huge majority, mathematically speaking. Yet eight out of ten Swiss voters voted against it. That choice says a lot about how differently Europe views taxation, growth, and prosperity, and whether limits should be set on the costs of the energy transition.

In countries such as Belgium, Norway, and the United Kingdom, the political debate quickly shifts to new wealth taxes as soon as the affordability of the social welfare state and the energy transition come under discussion. The Swiss population has opted for a clearly different and less ideological approach. Taxes are largely levied at the municipal level, which means that Swiss municipalities compete with each other to remain fiscally attractive. As a result, the local population quickly realizes that a higher tax rate yields less revenue above a certain point. The Laffer curve is therefore not an academic or theoretical discussion in Switzerland; local, regional, and national politicians are well aware that tax revenues decline as soon as the tax burden becomes too high.

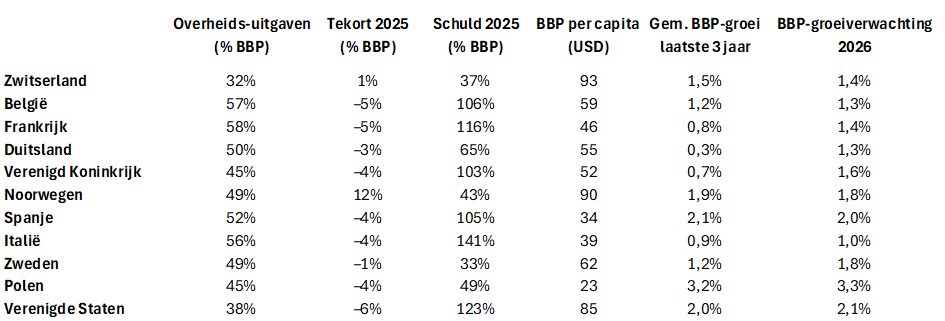

Whereas American economist Arthur Laffer worked as an advisor to President Reagan in the 1970s and 1980s to determine the optimal tax level for maximum revenue, American economist Richard Rahn is considered an important reference point for classical liberals. Rahn argues that once total government spending exceeds 25% of GDP, it begins to slow down a country's economic development. The Rahn curve is, however, a more theoretical model. Many economists warn that "optimal" spending depends heavily on how the money is spent (infrastructure, education, social security, etc.), but looking at how government debt is structurally increasing, it is fair to say that Swiss citizens are (un)consciously applying the theories of Rahn and Laffer to maintain prosperity for future generations.

The table below provides a rough picture of how different countries are doing. We realize that there is little completely consistent data available, but a trend can certainly be observed. With the rising costs of aging populations and the social welfare state in the coming decades, the table gives a clear indication of where we as investors can expect economic dynamics (but also rising debt and an ever-increasing tax burden for businesses and consumers).

This dynamic was once again evident in practice this week. Lakshmi Mittal, founder of ArcelorMittal and one of Europe's richest industrialists, announced last weekend that he was leaving the United Kingdom. According to the Sunday Times Rich List 2025, Mittal (75) has an estimated fortune of £15.4 billion and has been a fixture in British business life since 1995. He is also known for his substantial donations to the Labour Party during the Blair and Brown years.

The news follows the Labour government's controversial tax reforms, including restrictions on the 'non-dom' regime and possible tightening of inheritance and wealth rules. In 2024, an estimated 11,000 wealthy entrepreneurs and high-net-worth individuals left the UK, and in 2025, the number is already around 17,000.

The fact that entrepreneurs with this scale, this capacity, and such international influence are leaving emphasizes how sensitive wealthy families and investors are to deteriorating tax conditions and how quickly capital can flee when a country loses its competitive edge structurally.

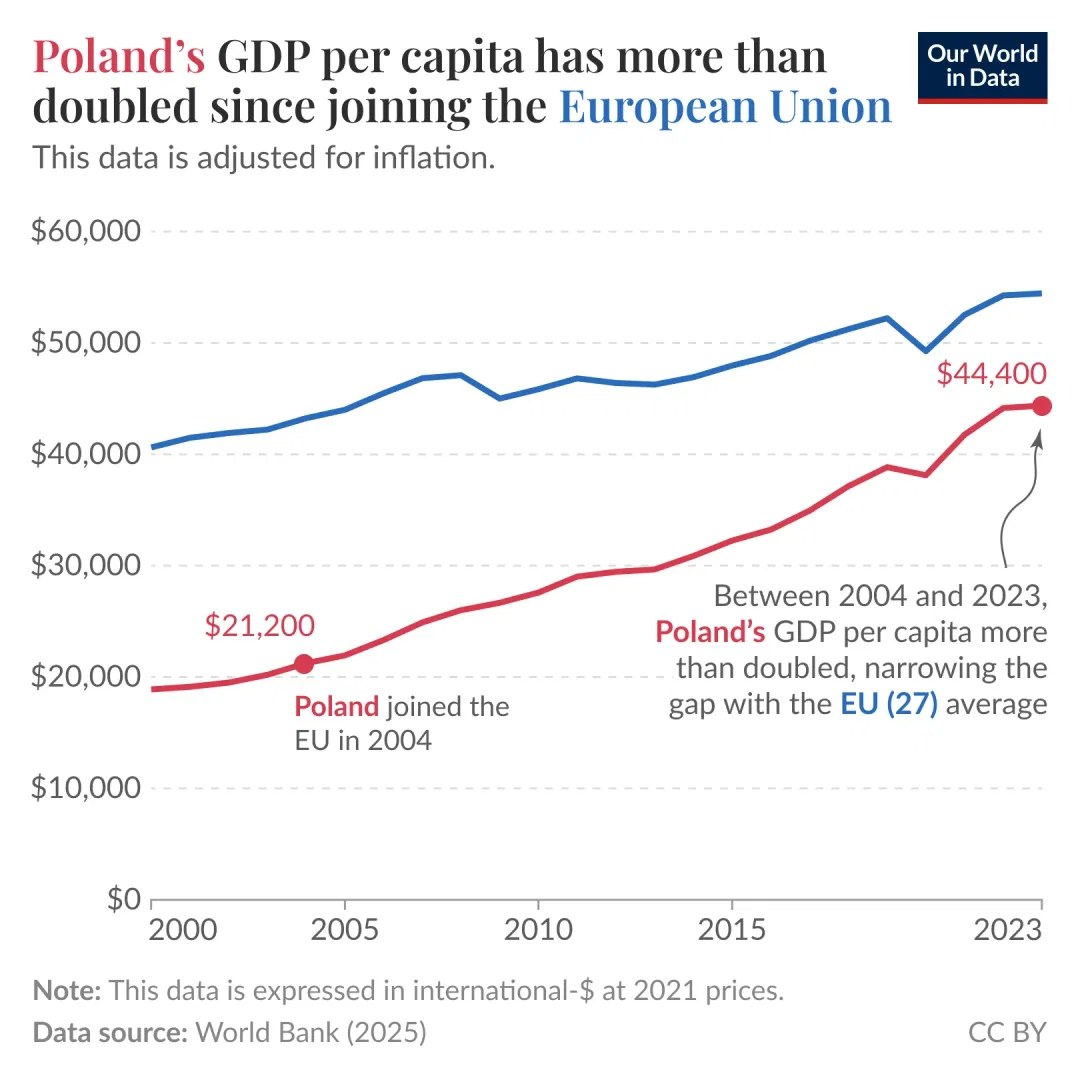

Polish economy continues to impress

It is not only ultra-high-net-worth entrepreneurs who are leaving the United Kingdom; more and more Poles who emigrated to the UK in the past as cheap labor are now returning as the economic outlook in Poland begins to look more attractive. In this respect, the Polish economy continues to impress. In the third quarter of 2025, the country grew by 3.7 percent, well above the EU average of 1.5 percent. This makes Poland one of the fastest growing economies in Europe. The country also clearly stands out from its neighbors in Central and Eastern Europe: the Czech Republic recorded 2.7 percent growth, Hungary only 0.6 percent. The main driver behind this lead is strong domestic consumption; Polish households continue to spend a lot.

Although investment is lagging behind due to the slow implementation of European funds, this is hardly slowing down the economy. Sectorally, Poland is showing broad resilience: industry is slowly climbing out of a dip, retail continues to grow, and the service sector is once again the main driver. Only construction is under pressure, as is the case in many other European countries.

Compared to the major economies of Europe, the contrast is becoming increasingly clear. Germany is showing hardly any growth, France remains below one percent, and Italy rarely exceeds that level. Even Spain, which is performing relatively well, is growing significantly slower than Poland. The Polish economy is therefore not only growing faster, but also structurally faster than most Western European countries.

Macroeconomically, Poland is also in a solid position, as the current account deficit is limited, inflation is close to target, and economic fundamentals appear stronger than in many EU member states. The outlook remains positive. Growth of around 3.5 percent is expected for 2025 and over 3 percent for 2026, which means that Poland is expected to be one of the fastest growing economies in Europe once again. Once the investment funds from European funds are fully activated, this could provide an additional boost on top of the already strong domestic consumption.

It is therefore not surprising that this macroeconomic strength is finding its way to the stock market. In 2025, the broad WIG index (the Warsaw Stock Exchange) recorded an increase of approximately 28.6 percent, while the twelve-month return was around 36.8 percent. These performances reflect strong investor sentiment, supported by solid growth, robust consumption, and high business confidence.

Europe's Green Transition: Climate Gains with an Economic Downside

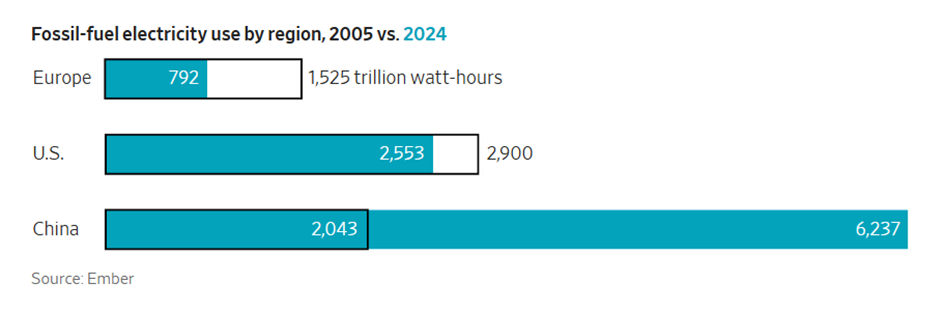

This week, The Wall Street Journal published a scathing article about the costs of the European energy transition. Over the past twenty years, Europe has implemented one of the most ambitious climate programs in the world. Since 2005, CO₂ emissions have fallen by around 30%. In the United States, the figure is 17%. Europe therefore remains the global leader in climate policy.

However, the WSJ points out that the US has continued to grow economically during the same period and is actively engaged in reindustrialization. Europe, on the other hand, has seen a significant portion of its industry shift to Asia and the US. The energy transition appears to be accompanied by high economic costs that are felt by both households and businesses.

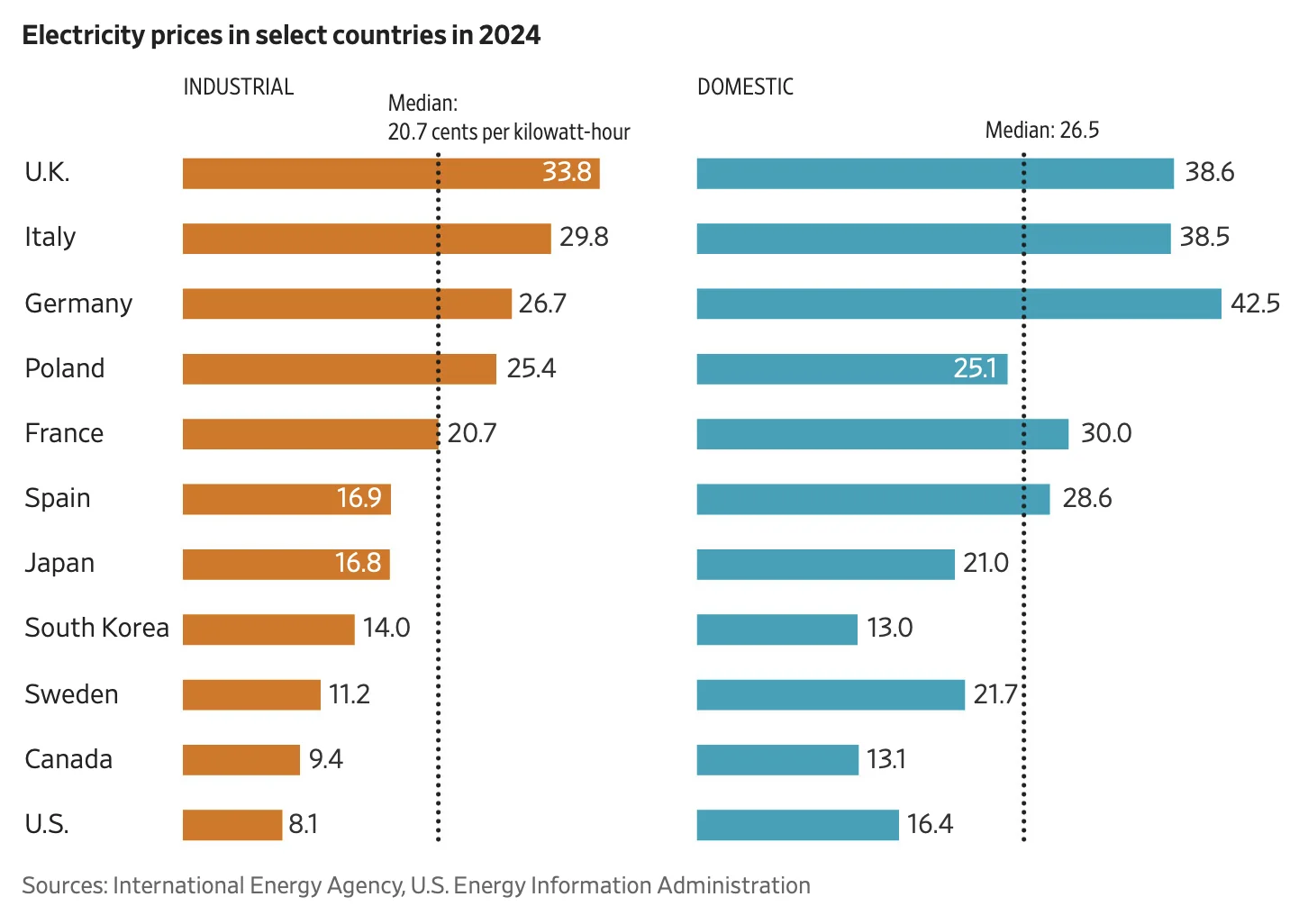

Energy prices are a major part of the problem. Industrial electricity in Europe now costs about twice as much as in the US and is about 50% higher than in China. This difference is structural. It is not only generation, but also the additional system costs (such as grid reinforcement, storage, congestion management, and balancing) that are pushing prices up.

The consequences do not only affect existing industry. According to the WSJ, the current energy infrastructure even hinders the growth of strategic sectors such as artificial intelligence, where cheap and reliable electricity is essential. Higher energy costs also increase pressure on households, which undermines public support for climate policy. More and more anti-establishment parties are presenting the energy transition as an elitist project that mainly affects workers, consumers, and peripheral regions.

Several examples illustrate the urgency. Jerome Evans, CEO of a German data center operator, wanted to expand in Frankfurt, the digital heart of Germany. However, the local network operator reported that additional capacity would not be available until 2035. Aurora Energy Research calculated that a completely clean energy system in the United Kingdom will only become more cost-effective for households from 2044 onwards. Similar expectations apply to Germany. By that time, the economic damage could already be considerable.

The Swedish Deputy Prime Minister and Minister of Energy, Ebba Busch, also strongly criticizes Germany's course:

“In global competition, you cannot afford to pursue ideologically driven energy policies.”

She points out that Germany has become too dependent on wind and solar power and, on windless or cloudy days, imports large amounts of electricity from neighboring countries, which drives up prices there.

The broader economic effects are becoming increasingly apparent. Energy-intensive companies are losing competitiveness, production is being relocated, and new investment projects, including data centers, are stalling due to a lack of grid capacity. In Ireland, data centers now consume more than 20 percent of all electricity. As a result, new applications are rarely approved.

For households and businesses, all this results in structurally high costs and increasing uncertainty. As a result, political resistance to additional climate policy is growing. The essence of the WSJ story is that Europe is making impressive climate gains, but that the current model is imposing increasingly heavy economic and infrastructural burdens.

This development is crucial for investors and entrepreneurs. Energy prices, infrastructure, and industrial competitiveness are closely intertwined. The coming years will reveal whether Europe can combine its green ambitions with a sustainable economic foundation or whether a change of course will become inevitable.

What happened on the capital markets last week?

- The likelihood of the Federal Reserve cutting interest rates next week has increased further; the market is now pricing in a probability of over 80%. This expectation is fueled by deteriorating economic sentiment in the US. Consumer confidence declined, the Chicago Business Barometer weakened, and the labor market is clearly cooling: ADP reported a contraction in private sector employment, while new unemployment claims fell slightly. Producer prices (PPI) were neutral, giving the Fed additional room to ease policy.

- Diplomatically, the situation surrounding Ukraine remained largely unchanged. New talks in Switzerland yielded little progress due to ongoing disagreements over security guarantees and territorial concessions. On the Polymarket trading platform, the probability of a ceasefire before the end of the first quarter of 2026 is estimated at around 20%.

- Capital market interest rates continued to fall worldwide. Inflation in the eurozone fell again in November, from 0.9 percent in France to 3.1 percent in Spain. In the United Kingdom, ten-year interest rates fell because the government's financing plans turned out to be less extensive than feared. Japan was the exception: higher core inflation and stronger industrial production led to rising interest rates there.

- Stock markets recovered across the board. During the shortened Thanksgiving week, global stocks rose by 3.3 percent. Precious metals performed remarkably well, particularly silver, which rose by 13 percent thanks to lower interest rates and strong industrial demand. The price of oil fell slightly, leading to the lowest US gasoline prices since 2021, among other things.

- The K-shaped dynamic remains visible on the stock markets. Cyclical companies are suffering from weaker macro data, while technology stocks are benefiting from falling interest rates. In the US, the Magnificent Seven continue to drive the market, with Broadcom as one of the standout winners of the year (+66 percent YTD) thanks to continued demand for AI infrastructure. The company, like Nvidia a fabless chip manufacturer, recently passed the $1.9 trillion mark in market value. This has led to new names being coined for the group of largest US tech companies.

- Concentration in the global stock market continues to increase. The effective number of shares in the MSCI World Index is at an all-time low, driven by the dominance of US megacaps. Among the twenty largest listed companies in the world, only three are not from the US; BP is the only remaining European company.

Receive weekly insights in your inbox

Exclusive analyses and updates on family holdings and global market developments.

Would you like more information about our services? Please feel free to contact us.

Contact us

Disclaimer:

No rights can be derived from this publication. This is a publication of Tresor Capital. Reproduction of this document, or parts thereof, by third parties is only permitted after written permission and with reference to the source, Tresor Capital.

This publication has been prepared by Tresor Capital with the utmost care. The information is intended to be general in nature and does not focus on your individual situation. The information should therefore expressly not be regarded as advice, an offer or proposal to purchase or trade investment products and/or purchase investment services nor as investment advice. The authors, Tresor Capital and/or its employees may hold position in the securities discussed, for their own account or for their clients.

You should carefully consider the risks before you begin investing. The value of your investments may fluctuate. Past performance is no guarantee of future results. You may lose all or part of your investment. Tresor Capital disclaims any liability for any imperfections or inaccuracies. This information is solely indicative and subject to change.

Read the full disclaimer at tresorcapitalnieuws.nl/disclaimer .