Family Holdings #1 - Buffett steps down, Investor AB has been outperforming the stock market for 15 years

This week's topics:

Investor AB beat the index for the 15th consecutive year with a return of over 15% thanks to a strong finish in the fourth quarter of 2025. Growth was driven by outliers such as Saab and a recovery at AstraZeneca, pushing market capitalization past the SEK 1,000 billion mark. With a focus on intrinsic value creation, the Wallenberg family's holding company once again demonstrates the power of a diversified and disciplined long-term portfolio.

Despite structural pressure on the German economy, MBB achieved record results in 2025 thanks to a strong focus on long-term value and financial solidity. The performance confirms that the quality of management and the underlying portfolio are more important for value creation than the general economic climate.

On December 31, 2025, Warren Buffett stepped down as CEO of Berkshire Hathaway, with an investment of USD 100 since 1964 having grown to USD 5.5 million. His successor, Greg Abel, has been given full confidence and day-to-day management of a group that has been built with USD 380 billion in cash to continue for at least another 100 years. Although Buffett is stepping back as chairman, the unique corporate culture and focus on integrity and long-term value remain the unchanged foundation of the holding company.

Alphabet is focusing on vertical integration with the acquisition of Intersect for USD 4.75 billion, giving the company control over scarce power supply and data center capacity. This strategic move prevents delays in the AI stack and offers speed and certainty in a market where the cost of "no capacity" outweighs the price of ownership. At the same time, AI chatbot Gemini is gaining ground with market share rising from 5.4% to 18.2% in one year, strengthening Alphabet's monetization potential and intrinsic value.

In Brief:

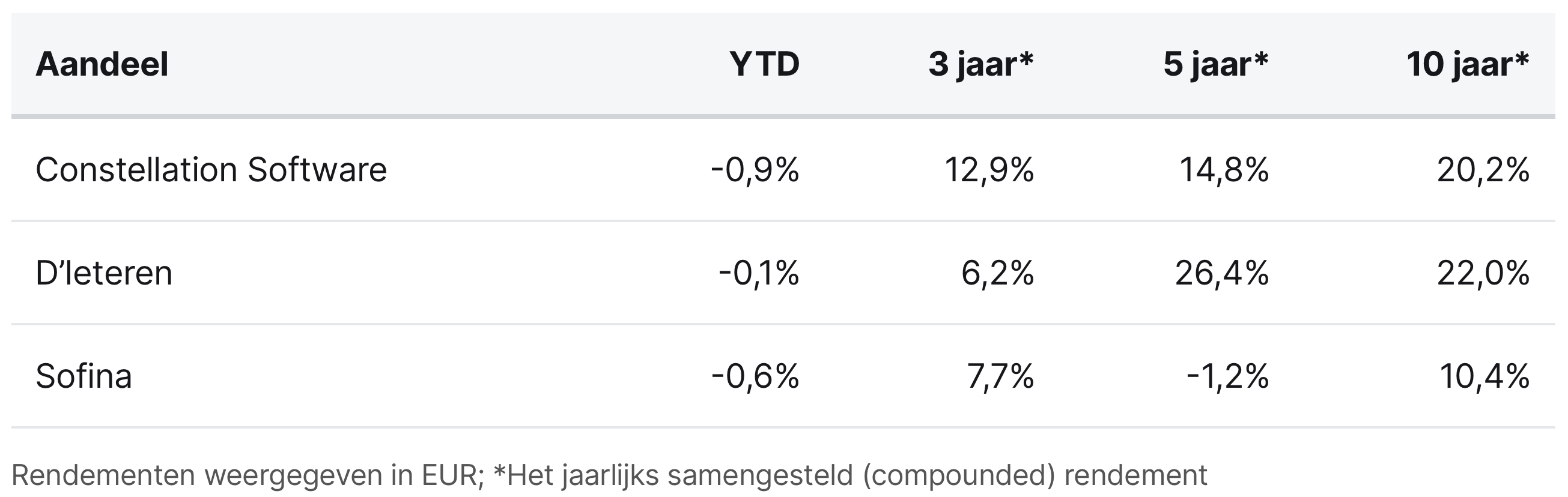

Constellation Software (Toronto: CSU) acquired Site Service Software, a US-based specialist in workflow and field service solutions for the elevator industry, within the Jonas division. The company, which has approximately 10 employees, will be merged with Total Service, another market leader in this vertical niche. This was one of the last deals of 2025. This brings the total number of acquisitions completed in 2025 to more than 111 for the entire group, of which 83 were acquired by Constellation and 24 by Topicus.

D’Ieteren (Brussels: DIE) announced the relaunch of a share buyback program worth up to EUR 100 million, resuming the program that started in 2023 after the extraordinary dividend payment at the end of 2024. At the current share price, approximately 670,000 shares can be repurchased, representing approximately 1.2% of the total number of outstanding shares. The repurchased shares will be cancelled or used for long-term incentive plans.

Sofina ( Brussels: SOF) has seen a lot of activity in its portfolio in recent weeks. Battery manufacturer GEO raised USD 110 million and immediately acquired two factories from Mitsubishi Chemical. Sofina was one of the founders of this company, which focuses on electrolytes for the battery industry. In addition, the Team.blue investment continues to maintain its high growth rate with the acquisition of Czech AI player Macaly. Finally, Sofina led a new USD 33 million investment round in Qargo. This logistics platform uses smart software to plan transport more efficiently and automate administration.

Constellation Software, D'ieteren, and Sofina are currently trading on the Toronto and Brussels stock exchanges at prices of CAD 3,260, EUR 154.80, and EUR 247.20 per share, respectively.

Michael Gielkens speaks at VFB Trefpunt Hasselt

On Thursday, January 15, 2026, Michael Gielkens, partner and co-owner of Tresor Capital, will give a lecture at VFB Trefpunt Hasselt.

During this session, Michael discusses why holding companies are one of the most effective structures for diversified and sustainable wealth accumulation across generations, and why it is crucial that entrepreneurs and families themselves invest substantially in the same vehicles as their investors. This skin-in-the-game dynamic ensures discipline, careful decision-making, and a natural long-term focus.

"Not skin in the game is like a chef who doesn't taste his own food."

Michael also discusses an element that is often overlooked: internal diversification. While many investors assess diversification based on the number of stocks in their portfolio, Michael shows how holdings such as Berkshire Hathaway and Constellation Software actually consist of dozens to hundreds of underlying companies, sectors, and geographic markets.

As a result, an investor with a handful of well-chosen holdings can, in practice, be much more broadly and robustly diversified than someone with dozens of separate single-product stocks.

We would like to invite you to attend. You can register using the button below. For non-VFB members, the admission fee is €10.

Investor AB has been outperforming the stock market for 15 years

The Swedish investment holding company Investor AB (Stockholm: INVE-B), owned by the Wallenberg family, has outperformed the stock market for the 15th consecutive year. Its track record is based on fundamental growth, as over the past fifteen years more than 80% of its total return can be attributed to growth in net asset value, with the remainder comprising dividends and the reduction in undervaluation.

We have previously written about the unique qualities Sweden has to offer:

With a total return of over 15% compared to 12.5% for the SIX Return Index, Investor AB also outperformed in 2025. This result is remarkable, given that at the end of September the share was still facing a loss of 1.7%, while the index was already recording a gain of over 4% at that time. The turnaround in the fourth quarter was driven by a combination of factors, including a decrease in the discount to net asset value and a strong recovery of heavyweights such as EQT and AstraZeneca.

Within the listed portfolio, defense company Saab was the absolute standout with an annual gain of 126%, while ABB also contributed substantially to the result with an increase of almost 16%. Atlas Copco initially acted as a brake on performance, but recovered with a gain of more than 8% in the last three months, ultimately making a positive contribution. This demonstrates once again that a holding company such as Investor AB benefits from a diversified portfolio.

A similar pattern was visible in the unlisted portfolio under Patricia Industries, where negative returns in the first two quarters were followed by a 4% gain in the third quarter thanks to rising valuation multiples. This strong finish saw Investor pass the SEK 1,000 billion mark in market capitalization, making the holding company the largest company on the Stockholm stock exchange behind AstraZeneca.

Chief Information Officer Jacob Lund emphasizes that Investor has never been concerned. "We know that the companies have worked hard, even though the market has been somewhat challenging." The focus is primarily on future value creation and not on celebrating past results. That is exactly what we want to see in the holdings in our portfolio.

Investor AB is currently trading on the Stockholm Stock Exchange at a price of SEK 325.50 per B share.

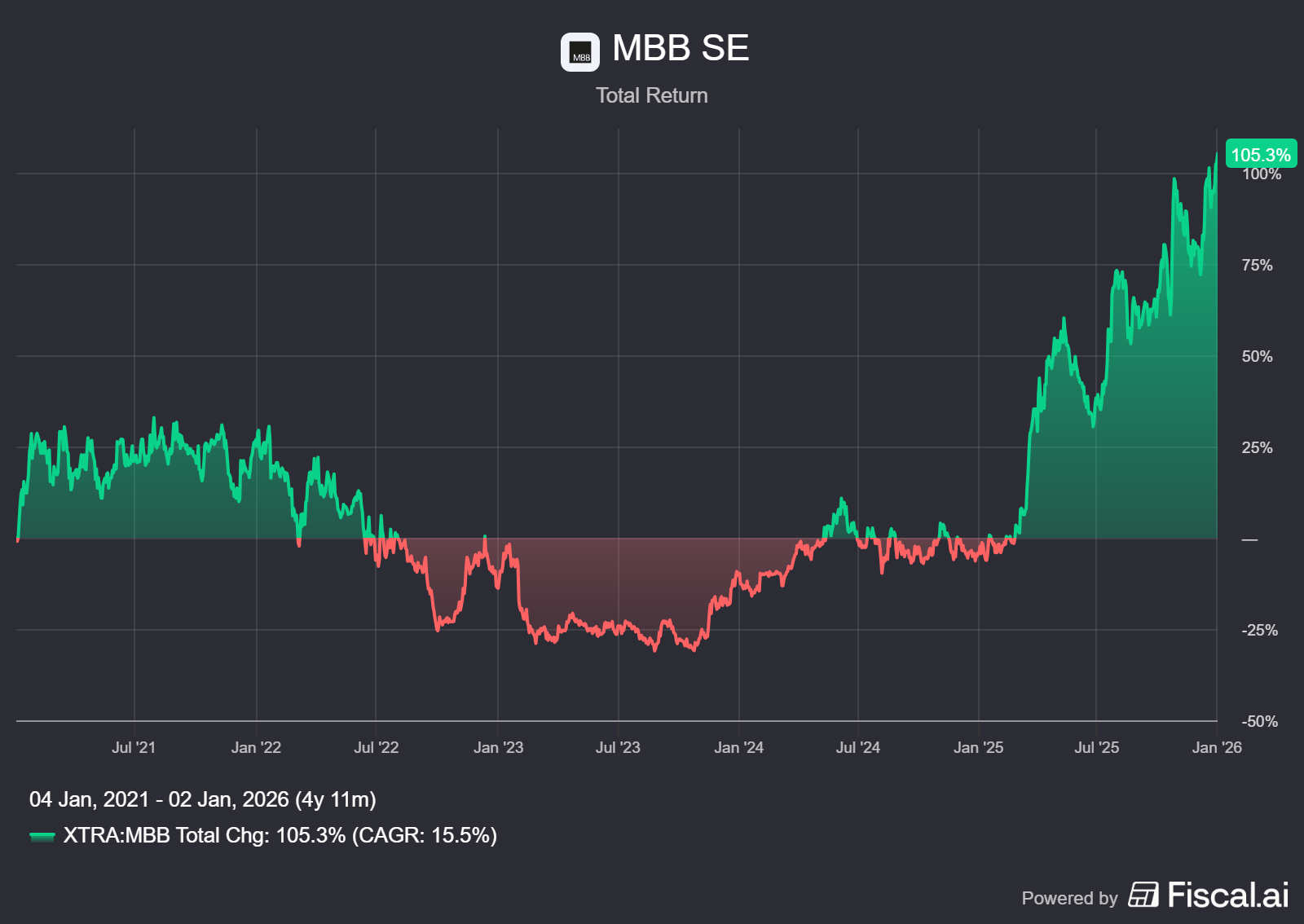

MBB flourishes despite disappointing German economy

The German investment holding company MBB SE (Frankfurt: MBB) had an exceptionally successful 2025 and shared a brief review of its performance. While the German economy as a whole is facing considerable structural pressure and geopolitical uncertainties, MBB posted record figures.

The performance underscores the strength of the business model. Particularly in the current economic climate, MBB's core principles of long-term thinking, financial solidity, and entrepreneurial spirit are proving to be of crucial value.

Management is demonstrating that, despite headwinds in Germany, it is capable of consistently creating value. This is an important lesson for investors: the economic situation in a country does not necessarily always translate into the stock price of a company operating there.

With Vorwerk, MBB is perfectly positioned for the extensive investments in Germany's energy infrastructure, while DTS is the wild card in the field of cybersecurity.

For us as investors, all this confirms the quality of the management and the underlying portfolio. We therefore look forward with confidence to developments in 2026.

MBB is currently trading on the Frankfurt Stock Exchange at a price of EUR 210 per share.

Receive weekly insights in your inbox

Exclusive analyses and updates on family holdings and global market developments.

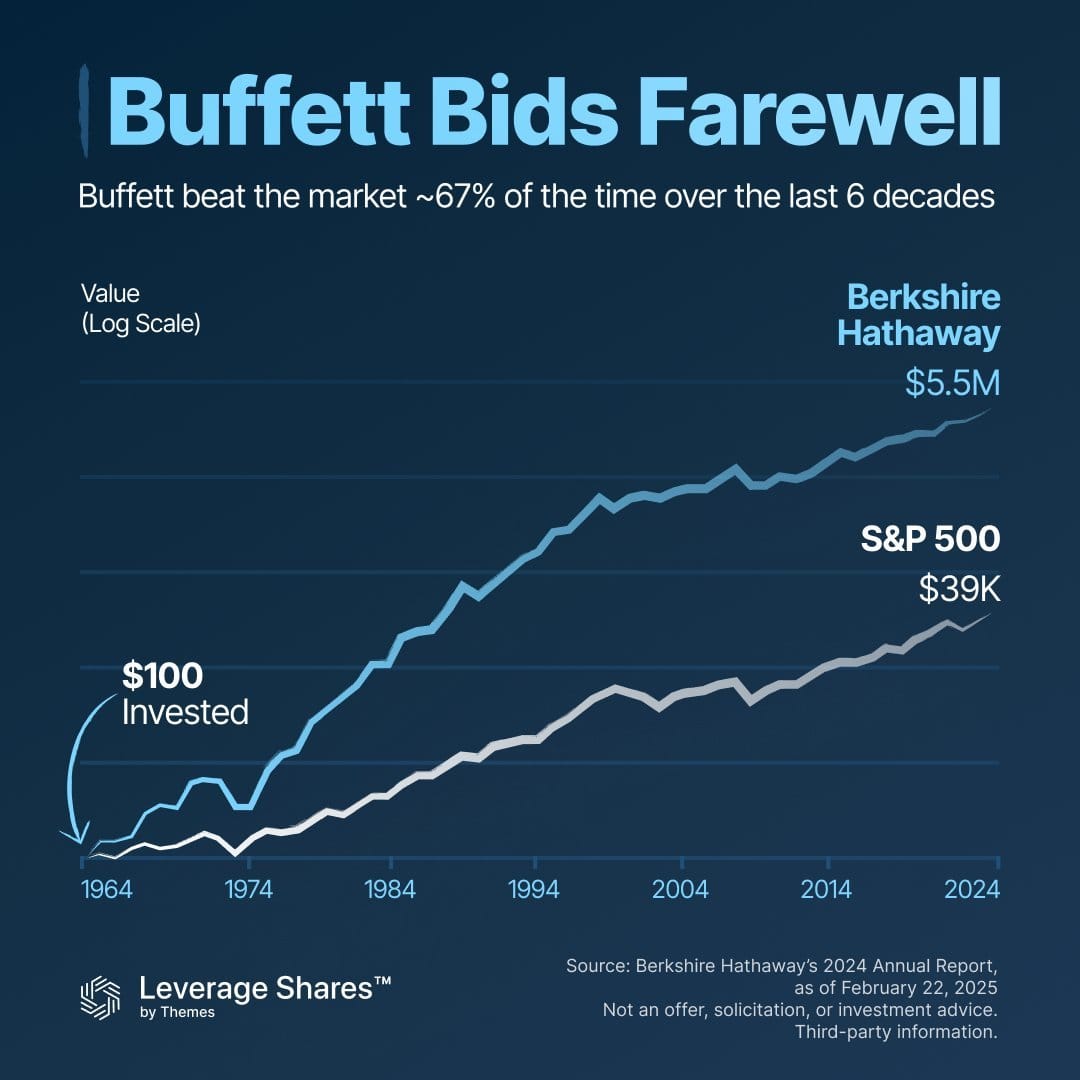

Buffett steps down: the end of an era

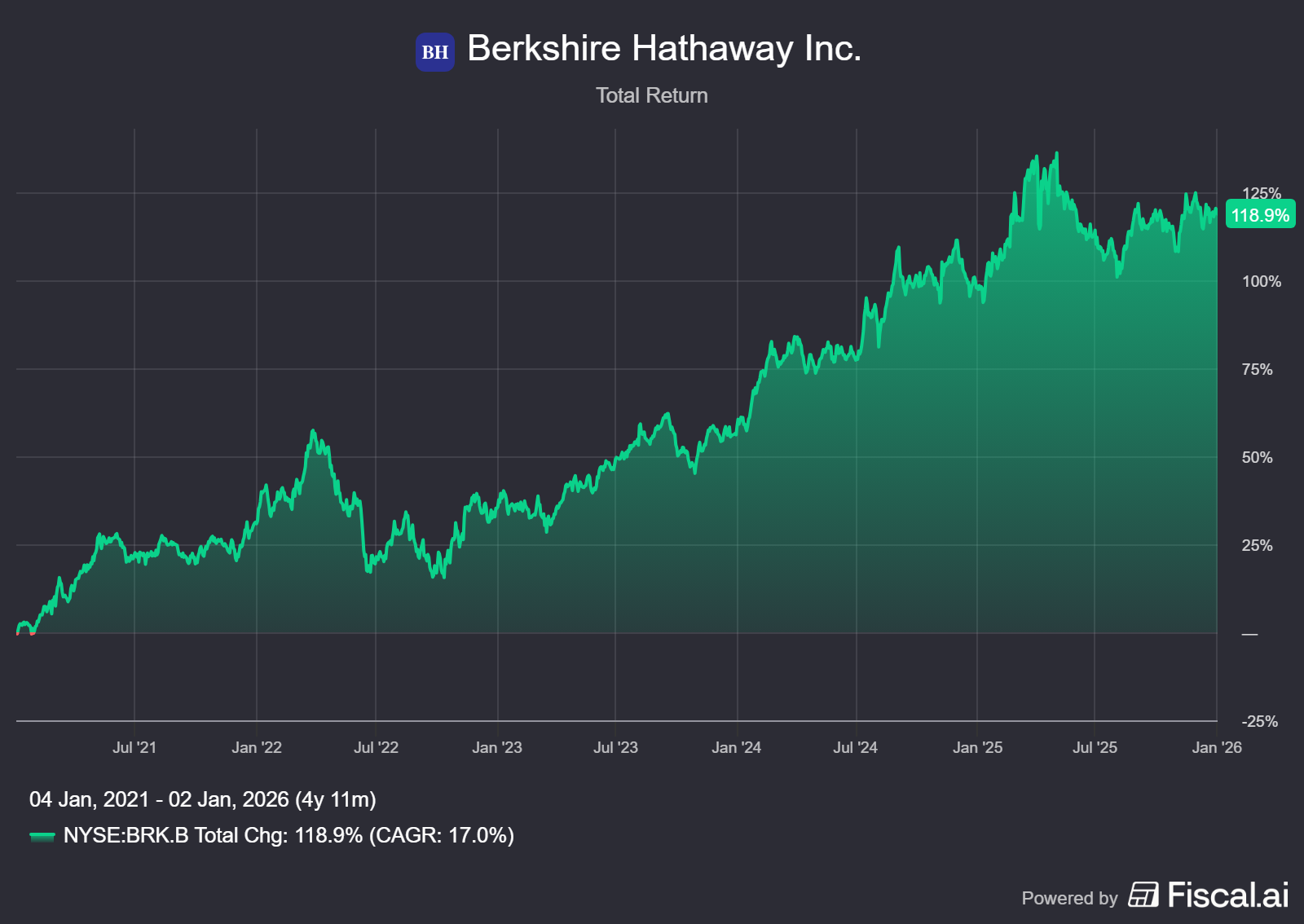

The American investment holding company Berkshire Hathaway (New York: BRK-B) underwent one of the biggest changes in decades this week. CEO Warren Buffett will serve his last day as CEO of the holding company on December 31, 2025.

After sixty years at the helm, he is handing over day-to-day management to Greg Abel. Although Buffett will remain as chairman, his message is clear: "Greg is now the decision-maker."

Warren Buffett retires today, most likely in his mind at the closing bell, just minutes from now.

— Christopher Bloomstran (@ChrisBloomstran) December 31, 2025

Congratulations to the greatest investor the world will ever know. The returns speak for themselves - Berkshire earned 6,118,651% or 19.9% annually over his 60 years running the… pic.twitter.com/VShwP9DLTg

The returns Buffett has achieved are phenomenal. Chris Bloomstran summed it up aptly in the tweet above. Since Buffett took the helm, Berkshire's value has risen by more than six million percent. This equates to an annual return of 19.9 percent. By comparison, the S&P 500 achieved 10.4 percent per year over the same period.

A statistic that illustrates the power of this difference is almost impossible to comprehend. Berkshire's shares could fall by 99.2 percent today and still have outperformed the market over the past six decades.

Anyone who invested $100 in the S&P 500 in 1964 now has approximately $39,000. That same $100 invested in Berkshire Hathaway has grown to $5.5 million today.

Just as impressive as the returns is the way in which they were achieved. As Bloomstran notes, Buffett did this with integrity and humor. He outperformed the market in about 67 percent of the years, but his real advantage was patience. He remained invested for sixty years.

In his farewell interview with CNBC, which will be broadcast in full on January 13, Buffett emphasizes that Berkshire's culture is built to survive. He states that the company "has the best chance of still being around in a hundred years of any company I know."

His confidence in his successor is unconditional. Buffett said he would rather have Greg Abel manage his money than any other top investor or CEO in the United States. Buffett made a striking comparison about the new CEO's work ethic: "I can't imagine how much more he gets done in a week than I do in a month."

What makes Abel the ideal successor is his character. He is not a "twisted individual" corrupted by power or money, but leads a remarkably normal life. "He likes to play ice hockey with his children," Buffett said. "If the neighbors didn't know who he was, they would have no idea that on January 1, he is the decision-maker at a company that employs nearly 400,000 people."

Buffett will now take more of a back seat, but for those who fear major changes, there is a reassuring message. "Everything will stay the same," says Buffett. He will still come to the office. The only visible difference will be during the iconic annual meetings in Omaha. "I will no longer be on stage speaking, but will take a seat in the directors' section."

However, the ship he built continues to sail steadily forward. With Greg Abel at the helm, a war chest of more than USD 380 billion, and a collection of diverse, high-quality companies, Buffett's legacy is secure.

On behalf of ourselves and many investors worldwide, we would like to thank Warren for the excellent returns and his wise lessons on life and investing over the years.

Berkshire Hathaway is currently trading on the New York Stock Exchange at a price of USD 500.26 per B share.

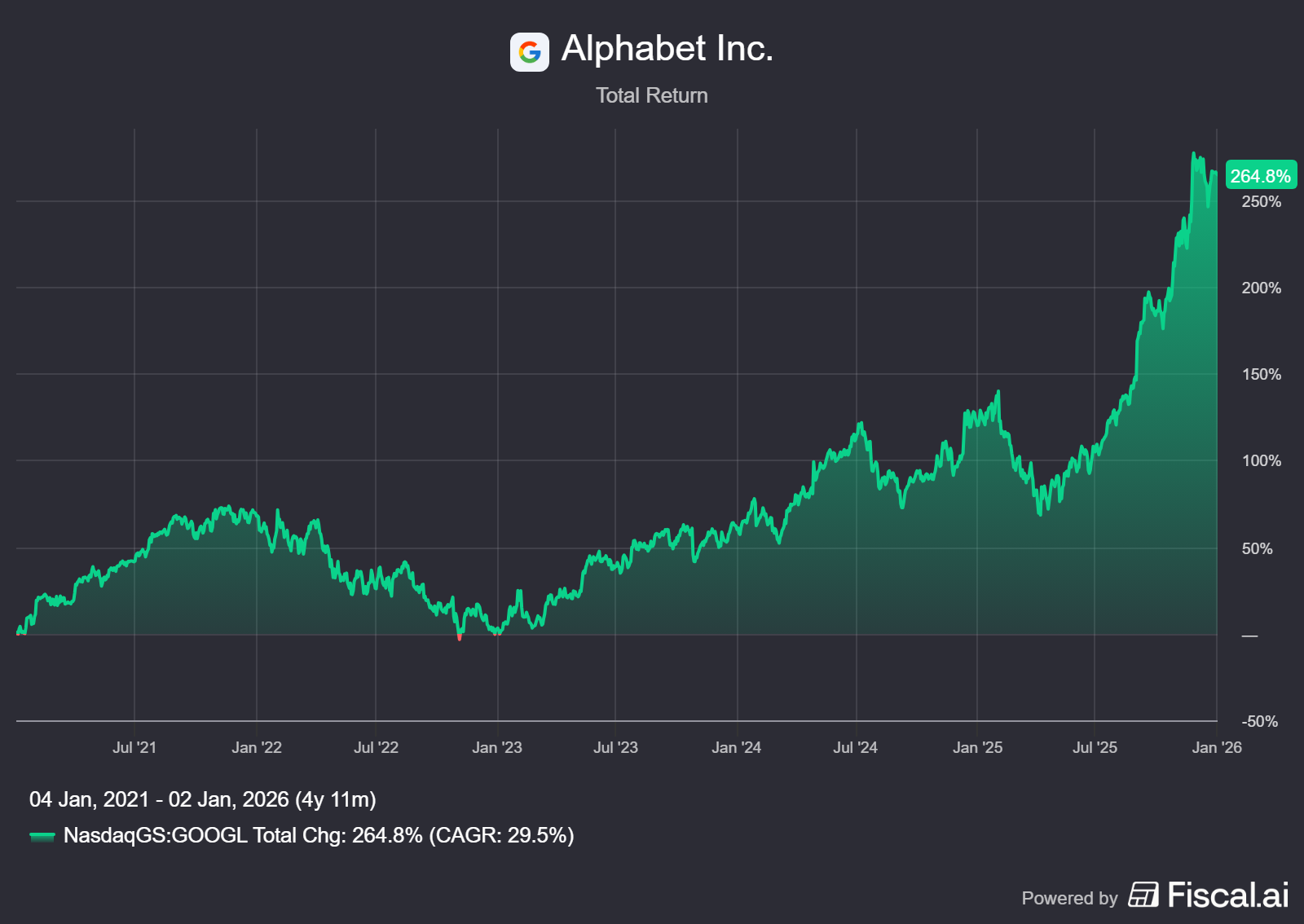

Alphabet: vertical integration and the rise of Gemini

The American investment holding company Alphabet (New York: GOOGL) is in the news almost every week. This time, Google's parent company is taking a step further in the vertical integration of its data center chain with the announced acquisition of Intersect, a developer of data center and energy infrastructure, for USD 4.75 billion in cash plus the assumption of debt.

Intersect is not a "traditional" data center operator, but a party that solves the puzzle that AI infrastructure increasingly struggles with: organizing power and capacity simultaneously. Think of developing locations where data centers and new energy generation capacity (and related infrastructure) are built in a coordinated and coherent manner, so that you can move from plan to operational capacity more quickly. Alphabet explicitly states that Intersect helps to build new power generation "in lockstep" with data center load, thereby contributing to bringing capacity online more quickly.

This move allows Alphabet to better address the strategic bottleneck of supply and time constraints. The company already had a minority stake in Intersect and had collaborated with the company on projects. With the full acquisition, Alphabet is primarily opting for speed and certainty. Speed, because building data centers and arranging power supplies increasingly have to run in parallel, and the latter in particular is becoming increasingly scarce. Certainty, because capacity that you develop and coordinate yourself is less dependent on external priorities, queues, and the negotiating power of third parties.

You see large platform companies increasingly trying to anchor critical links in the AI stack: talent, data, distribution, and especially infrastructure. Not because everything is necessarily cheaper in-house, but because the strategic costs of not having capacity (delays, missed growth, dependence on third parties) can outweigh the price of ownership at this stage. We saw the same strategy at Meta this year. The company aggressively recruited new AI talent with exceptional compensation packages and further strengthened its position with the recent acquisition of Manus AI. In doing so, Meta is explicitly bringing in agent technology that can perform tasks independently and, in the long term, can be deeply integrated into its own distribution channels such as WhatsApp, Instagram, and Facebook.

Gen AI Website Traffic Share, Key Takeaways:

— Similarweb (@Similarweb) December 25, 2025

→ Gemini is approaching the 20% share benchmark.

→ Grok's momentum continues.

→ ChatGPT drops below the 70% mark.

🗓️ 12 Months Ago:

ChatGPT: 87.2%

Gemini: 5.4%

Perplexity: 2.0%

Claude: 1.6%

Copilot:… pic.twitter.com/uyXnFJbxgV

Gemini update

Similarweb's X account publishes a monthly update on market share ratios within the largest Large Language Models (LLMs), or AI chatbots. These figures show a striking shift. Whereas Gemini had a market share of around 5.4% a year ago, this had risen to 18.2% by the beginning of December. Some analysts in the market describe this as the clearest signal yet that Alphabet is gaining ground in the AI race.

What interests us most is what lies beneath the surface. Market share is not profit, but it is an early indicator of distribution power, product momentum, and ultimately monetization potential. And that brings us back to a question we have asked many times before: what is Gemini's intrinsic value within Alphabet?

Figures such as these support our assumption that, in a sum-of-the-parts approach, Gemini should increasingly be seen less as a 'by-product' and more as a factor that can make a material contribution to Alphabet's long-term valuation.

Alphabet is currently trading on the New York Stock Exchange at a price of USD 312.51 per Class A share.

Receive weekly insights in your inbox

Exclusive analyses and updates on family holdings and global market developments.

Would you like more information about our services?

Contact us

Disclaimer:

No rights can be derived from this publication. This is a publication by Tresor Capital. Reproduction of this document, or parts thereof, by third parties is only permitted with written permission and with reference to the source, Tresor Capital.

This publication has been compiled with the utmost care by Tresor Capital. The information is intended in a general sense and is not tailored to your individual situation. The information should therefore expressly not be regarded as advice, an offer or a proposal to purchase or trade investment products and/or purchase investment services, nor as investment advice. The authors, Tresor Capital and/or its employees may hold positions in the securities discussed, either for their own account or for their clients.

You should carefully consider the risks before you start investing. The value of your investments may fluctuate. Past performance is no guarantee of future results. You may lose (part of) your investment. Tresor Capital accepts no liability for any inaccuracies or omissions. This information is for indicative purposes only and is subject to change.

Read the full disclaimer at tresorcapitalnieuws.nl/disclaimer .