Family Holdings #2 - Headlines vs. Fundamentals: Private Equity & Software

This week's topics:

A correction in private equity holdings was mainly driven by headlines about private credit and politics, not by a deterioration in fundamentals. Events at Blue Owl and political noise were quickly translated into sector-wide concerns. At the same time, large platforms such as Brookfield, KKR , and Apollo see 2026 as primarily a transition year: less dependence on cheap money and multiple expansion, more focus on underwriting, structure, and operational execution.

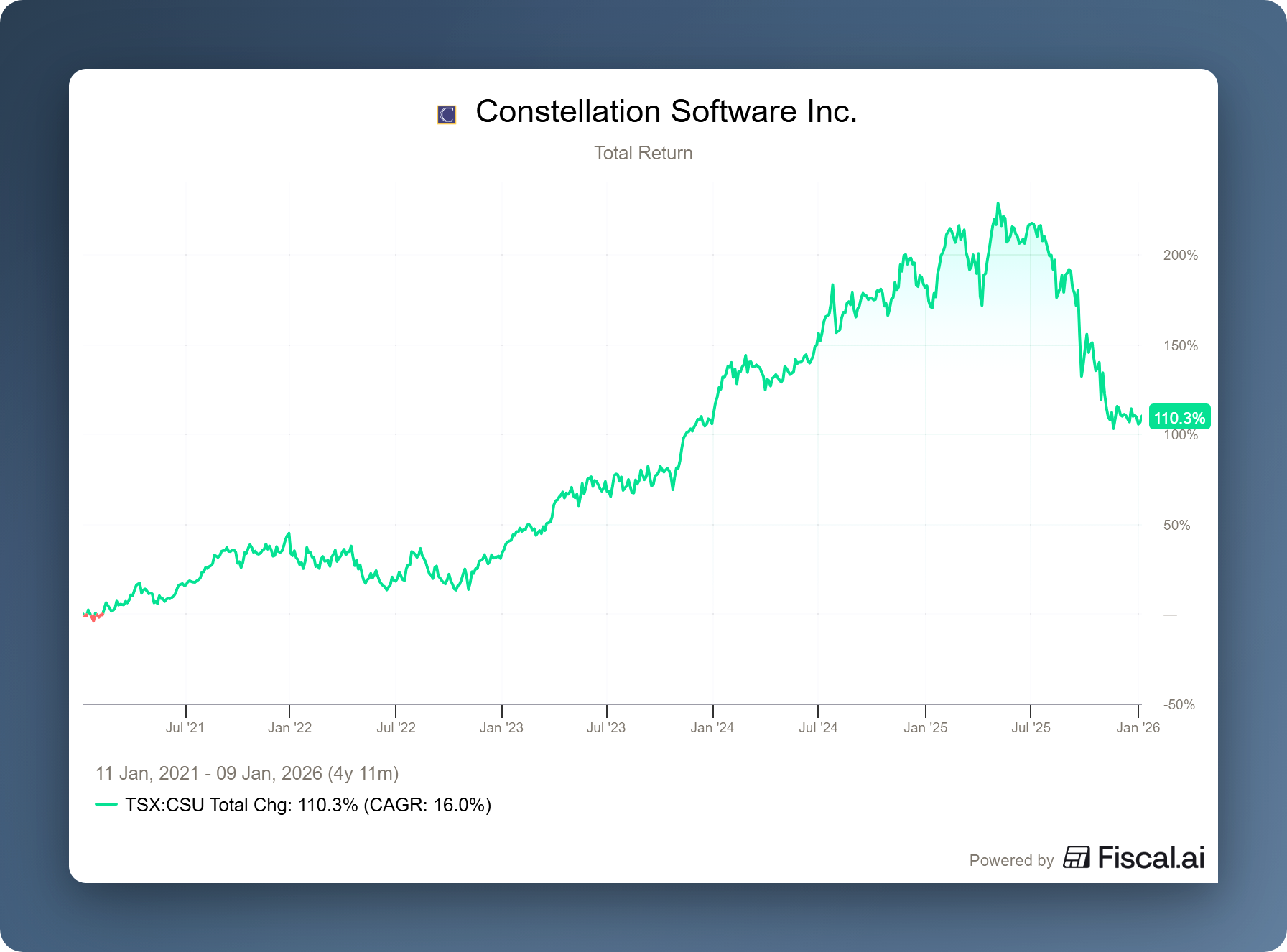

Constellation Software experienced a sharp price correction in 2025, mainly driven by concerns about AI and the departure of founder Mark Leonard as CEO. According to analyst Paul Treiber (RBC), this decline is mainly sentiment-driven and the underlying fundamentals remain very strong. Both RBC and Tresor Capital see the software sector, and Constellation and Topicus.com in particular, as attractively positioned for 2026, with further cash flow growth ultimately leading to higher valuations.

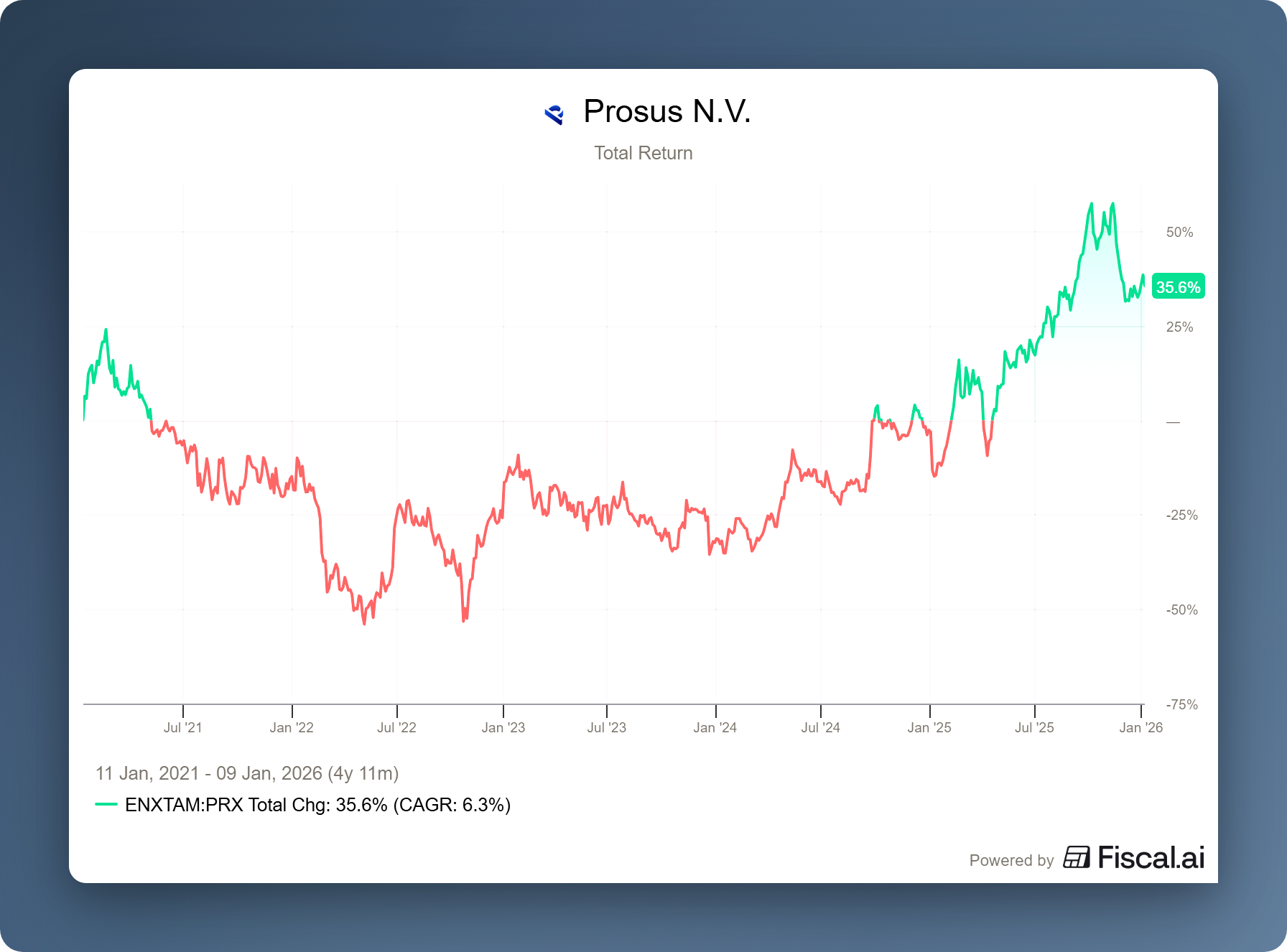

Prosus has sharply criticized European competition policy following the acquisition of Just Eat Takeaway, which was only approved after a mandatory sale of its stake in Delivery Hero. CEO Fabricio Bloisi argues that these regulations hinder large-scale investments and the formation of European tech champions, and are at odds with recent calls to relax the rules. According to Prosus, this undermines the investment climate in Europe and limits the ability to scale up against American and Chinese competitors.

In Brief:

Constellation Software ( Toronto: CSU) has acquired a stake in Layers through its venture capital arm VMS Ventures, thereby responding directly to the digitization of the education market in South America. In addition, it has invested in AssetCore, which focuses specifically on the emergence of AI in asset management. In addition to these investments, regular activities continue unabated, as this week subsidiary Volaris completed the acquisition of BIG Consulting. Founded in 1995, this Wisconsin-based company provides data analysis and business insights to the agricultural sector in the American Midwest.

TerraVest ( Toronto: TVK) acquired US-based KBK Industries for USD 90 million, representing an EBITDA multiple of 5.6×. KBK manufactures above-ground and underground fiberglass and steel storage tanks from Texas and Kansas, strengthening TerraVest's position in highly regulated markets such as C-Stores, agriculture, and energy. The acquisition fits seamlessly with previous expansions in Canada and Maryland and improves geographical spread, which is important given transport costs and exposure to trade tariffs. With factories in the north, east, and south, TerraVest now controls a significant part of the North American fiberglass tank chain.

KKR ( New York: KKR) is selling its majority stake in OneStream to European private equity firm Hg Capital in an all-cash deal worth USD 6.4 billion, representing a premium of 31% over the last closing price. For KKR, this marks a particularly successful exit. The firm expects a gross IRR of 24.9% on its original investment in 2019 and has already realized USD 2.8 billion in proceeds since the IPO in 2024. All this translates into a return of 4.5x the original investment.

Sofina ( Brussels: SOF) and Scottish Mortgage Trust ( London: SMT) could benefit from a recent increase in the value of their stake in ByteDance. TikTok's Chinese parent company is valued by venture capital firm HSG (formerly Sequoia China) in a new fund at between USD 350 and 370 billion, above the level of a recent share buyback of more than USD 330 billion. The rising valuation is driven by strong financial results, with revenue in the first two quarters of 2025 exceeding that of Meta and annual profits expected to reach around USD 48 billion. Sofina and Scottish may sell part of their stake to HSG's new fund to take some profits.

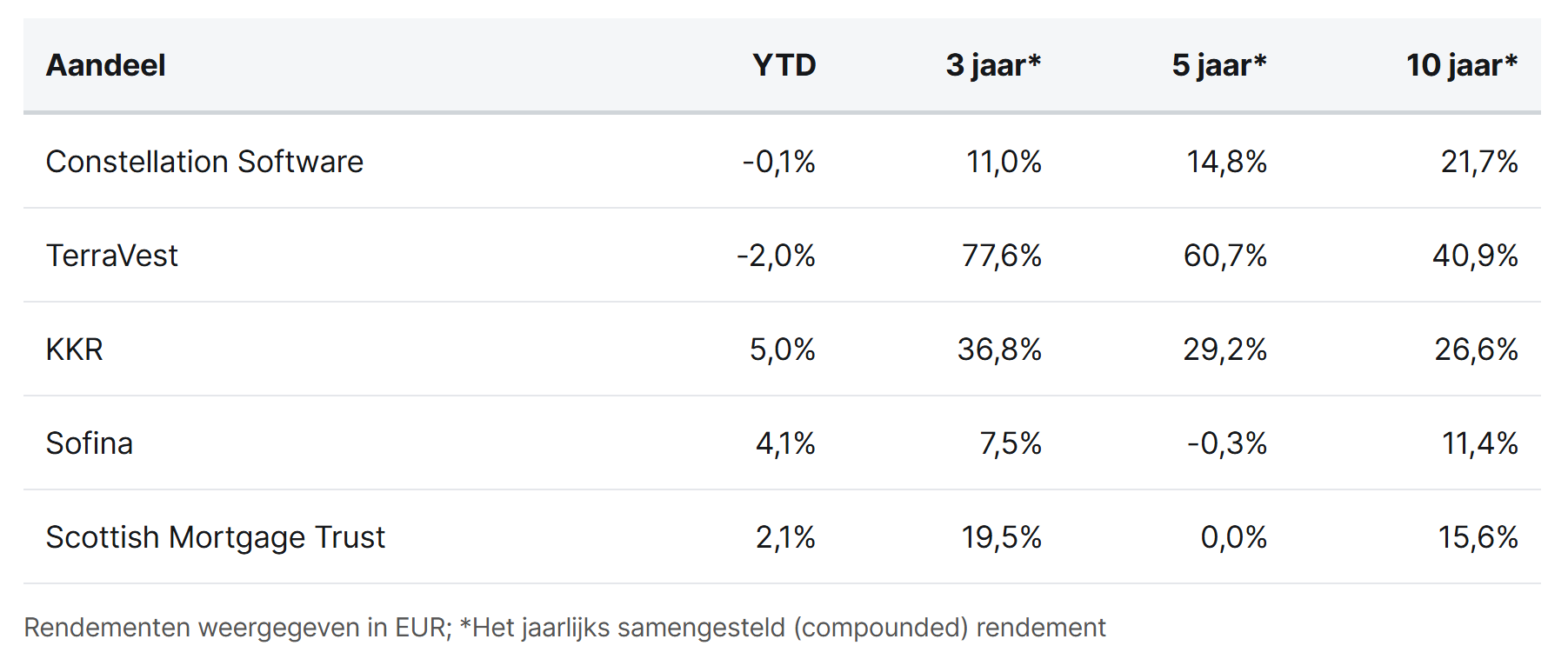

Constellation Software, TerraVest, KKR, Sofina, and Scottish Mortgage Trust are currently trading on the Toronto, New York, Brussels, and London stock exchanges at prices of CAD 3.311, CAD 160.22, USD 132.38, EUR 257.20, and GBP 12.04 per share, respectively.

The 5 Predictions for 2026

On an investment forum, we were asked to make five interesting predictions for the year 2026. Although we do not have a crystal ball, of course, it can be an interesting thought experiment. We are sharing them here without obligation, but we would like to emphasize the disclaimer below.

Disclaimer: This article is intended solely as a thought experiment on possible developments and scenarios for 2026. It does not represent the position, prediction, or investment advice of Tresor Capital. There is no guarantee that the developments described will actually occur. Do not base any investment decisions on this article. Always conduct your own research and form your own opinion.

- The revenge of the other 493

2026 will be the year in which the stock market finally broadens. At present, the market is highly concentrated, which is logical at this stage of the bull market, as investors' full attention is focused on the AI winners that are most often in the news. However, if we look back at the internet era, we see a clear pattern: in the first phase of such technological revolutions, it is mainly the large technology companies that benefit. In the second phase, however, the focus shifts to companies that are able to implement efficiency improvements by implementing the new technology. Instead of the Magnificent 7, the remaining 493 companies in the S&P 500 will come to the fore in 2026 as they successfully integrate AI into their business operations. - Software is dead, long live software!

After a very difficult period for software stocks in the second half of 2025, the focus will shift back to the sustainable nature of these companies in 2026. Current stock prices unfairly assume that software will be swallowed up by AI. However, software companies, and vertical market software companies in particular, with their deep-rooted customer relationships, are ideally positioned to implement AI and add value. In 2026, the market perspective will shift and it will become clear that AI is not a threat, but a huge opportunity for this sector. - The sleeping giant Berkshire Hathaway awakens

Berkshire Hathaway's new CEO, Greg Abel, will succeed in investing a substantial amount of capital, either in large acquisitions or in autonomous growth projects. Abel has built a foundation of more than 20 years of successful investing in energy infrastructure and an excellent track record at Berkshire Hathaway Energy. This fits in seamlessly with current macroeconomic trends such as the US government's significant investment needs, for example in the construction of nuclear reactors, and the rising energy demand from AI data centers. This creates an ideal scenario for Berkshire Hathaway to put more capital to work at attractive returns. - The IPO window opens

2026 will be the year in which the IPO window will open wide again. Due to trade tariffs and the resulting uncertainty, there were relatively few IPOs last year, but once calm returns in 2026, companies will feel more comfortable taking the step to go public. Major players such as SpaceX, Anthropic, and OpenAI already appear to be preparing for an IPO, which will also encourage other companies. Listed holding companies such as Sofina and Scottish Mortgage Trust will benefit from this as more of their private holdings are listed. This will provide greater liquidity, better price formation, and more certainty about the valuation of their unlisted positions, enabling them to realize attractive capital gains. In addition, private equity holdings such as Brookfield, KKR, and Apollo can benefit from the reopening of the IPO window by reducing their discount and realizing capital gains and performance fees on their investments. - D'Ieteren floats Belron on the stock market

D'Ieteren, together with several private equity partners, holds a stake in Belron, the parent company of Carglass. Now that the investment cycle for these private equity parties is largely complete, these partners want to realize a substantial part of their capital by floating Belron on the stock market. It is possible that D'Ieteren will also sell part of its stake in the IPO to strengthen its cash position and replenish its war chest. In any case, Belron's IPO will ensure more transparent pricing around the valuation of the subsidiary. This could be an important trigger for the revaluation of D'Ieteren shares, which are currently trading at a significant discount. Moreover, after a somewhat difficult 2025 in operational terms, 2026 looks set to be the year in which Belron makes a nice recovery. If the fundamentals continue to improve and the market allows it, it could be very interesting to float Belron on the stock market in 2026.

Receive weekly insights in your inbox

Exclusive analyses and updates on family holdings and global market developments.

Recent price pressure versus reality in private equity holdings

The private equity investment holding sector is in a transitional phase. The era of "cheap money" is behind us, and the market is forcing major players to return to basics: underwriting quality and operational execution. Although the week began with turmoil due to political statements and liquidity concerns, the contours of the future are clearly emerging in sectors such as nuclear energy and AI infrastructure.

Correction after a nice rebound

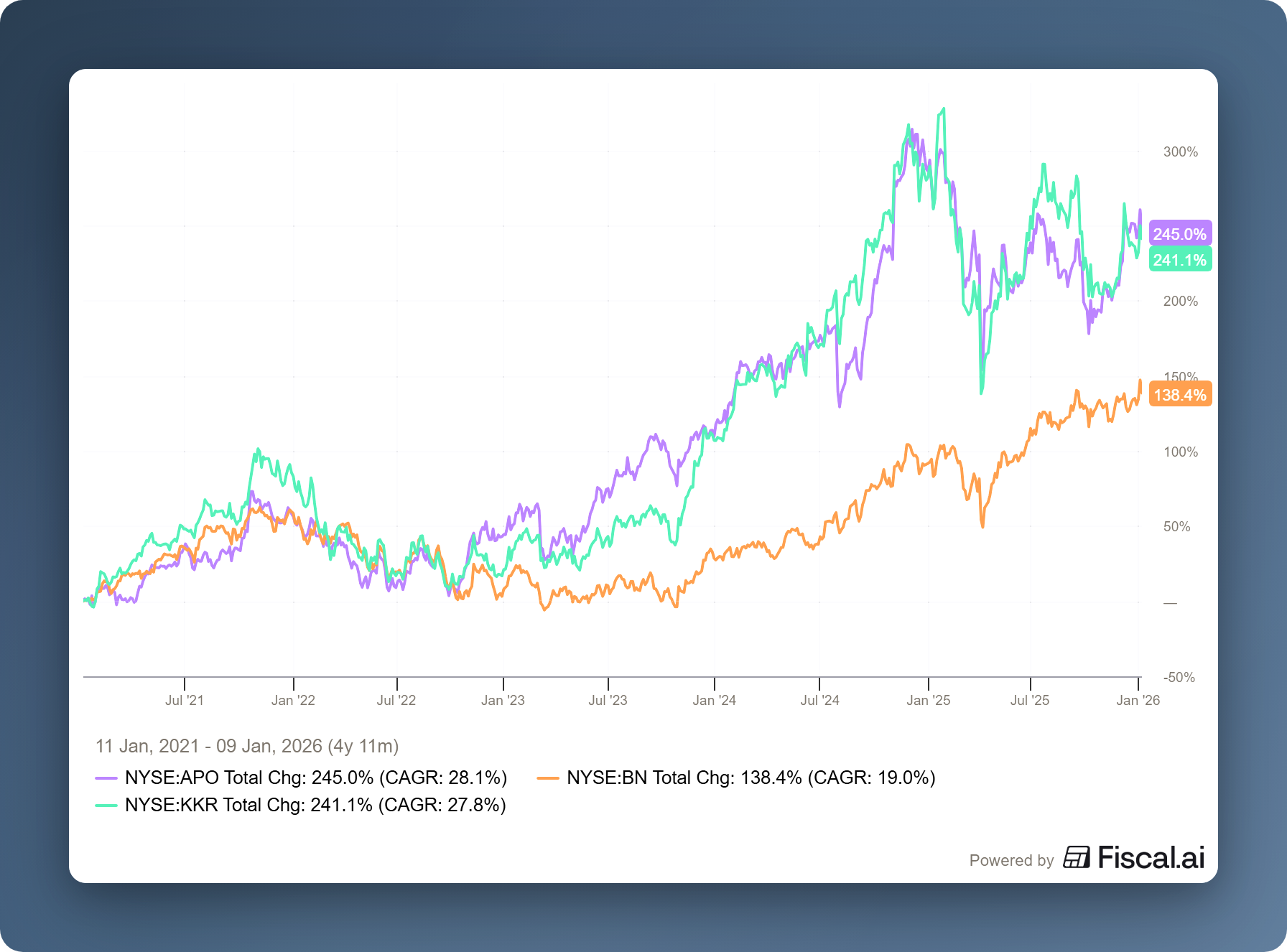

After a strong start to the year for private equity holdings such as Apollo (New York: APO), Brookfield (New York: BN), and KKR (New York: KKR) and alternative asset manager Blackstone (New York: BX), with share price increases of roughly 6–7% in the first four trading days, a clear correction followed on January 7. The shares lost 3–6% that day. That movement was caused by two different events that day.

First, there was news about Blue Owl Capital, where investors were shocked by a sudden increase in exit requests in a private credit fund. This involved a so-called Business Development Company (BDC): a semi-liquid fund that provides loans to medium-sized companies and periodically offers limited redemption options to investors. After a sharp increase in redemption requests, Blue Owl decided to temporarily raise the redemption limit to approximately 17% of the fund's assets, well above the usual 5% per quarter. This step was not a proactive choice, but a response to the fact that more investors than usual wanted to exit at the same time. The market interpreted this incident as a sector-wide loss of confidence, which also put other alternative asset managers under pressure.

BREAKING: President Trump announces steps to ban large institutional investors from buying single-family homes.

— The White House (@WhiteHouse) January 7, 2026

"People live in homes, not corporations." - President Donald J. Trump 🇺🇸 pic.twitter.com/MvG2mGodR2

Political noise also played a role. In a post on Truth Social, Donald Trump claimed that large institutional investors are contributing to the decline in affordability of owner-occupied homes for American households, particularly first-time buyers, and announced his intention to investigate ways of limiting their purchases of single-family homes.

Listed private equity holdings and alternative asset managers came under pressure as a result, because investors often lump them together with large-scale real estate investors, regardless of their actual exposure to this very specific real estate sector.

What are the expectations for 2026?

This week's price pressure stands in sharp contrast to how the major private market platforms themselves view the coming years. Despite the noise surrounding liquidity, politics, and sentiment, Brookfield, KKR, and Apollo Global Management paint a strikingly unanimous picture of 2026 as a year of transition, not a turning point.

The period of cheap money and automatic multiple expansion is behind us, but demand for long-term capital for essential infrastructure, energy, and digital backbone is actually increasing. This shifts the source of returns from financial leverage to underwriting quality, structure, and operational execution.

In its 2026 Investment Outlook, Brookfield focuses primarily on where structural investment demand is actually moving. CEO Bruce Flatt explicitly mentions digitization, deglobalization, and decarbonization as forces that translate into hard physical bottlenecks: electricity grids, data centers, logistics, and energy infrastructure. According to Brookfield, these are not cyclical themes, but assets with contractual cash flows and long maturities, which remain essential even in times of lower growth. This explains why Brookfield has been relying less and less on multiple expansion in recent years and is instead focusing on scale, operational control, and predictability.

This vision is further explored in a recent interview with Sachin Shah, CEO of Brookfield Wealth Solutions. In conversation with Paige Ellis on the YouTube channel In the Money, Shah discusses how private markets are shifting from an exclusively institutional domain to a broader core allocation, driven in part by the need for stable, long-term cash flows. Shah outlines how private markets have proven their value to institutional investors over the past decades and why those same strategies can now play a role in solving the growing pension problem.

In its recent High Grading outlook, KKR focuses specifically on portfolio composition. Henry McVey and the investment team argue that the reward for extra risk has shifted: risk premiums (spreads) compensate less for lower quality. Their answer is "high grading": within existing strategies, shifting to stronger borrowers, higher in the credit structure (more senior and secured positions) and stricter credit terms. KKR shows that this is not an escape from risk, but a conscious choice later in the cycle, whereby additional returns must come primarily from selection and structure, not from market direction.

In its 2026 Outlook, Apollo primarily addresses sentiment surrounding private credit. CEO Marc Rowan points out that public debate often projects a small, volatile corner of leveraged lending onto a much broader market. According to Apollo, approximately $38 trillion of the credit market consists of positions with high credit ratings, mostly on the balance sheets of insurers and pension funds, while the riskier part that makes the headlines is only a fraction of that. Apollo emphasizes that at Athene, more than 97% of the bond portfolio is investment grade .

Taken together, these outlooks show that the sector is not becoming more defensive, but more selective. Less reliance on easy beta (market tracking), more on discipline, scale, and execution. That is precisely where the largest, proven platforms have historically demonstrated their advantage.

The situation at Blue Owl mainly says something about the dynamics of rapidly grown, semi-liquid structures on the fringes of the market. This contrasts sharply with the more mature platforms, where recent quarterly reports show record inflows and sustained demand for credit, infrastructure, and energy strategies. There is no widespread liquidity problem at parties such as Brookfield, KKR, and Apollo. Concerns about single-family homes are also disproportionate: this asset class represents only a marginal part of the total portfolio of the major platforms, while the core of value creation lies in infrastructure, energy, data centers, and high-quality commercial real estate.

At the same time, we do not take the risks lightly. The growth of private credit inevitably makes private equity holdings more sensitive to the credit cycle, especially as vintages from 2021–2022 will face (expensive) refinancing in the coming years. However, the distinction lies not in the label "private credit," but in quality, structure, and funding. This is precisely why these parties are increasingly linking their models to long-term, insurance-like capital and investment-grade-like exposures. Not out of caution, but because this offers a combination of stability and clout.

Our conclusion for 2026 is not that private markets will become "defensive," but that the sector will enter a new phase. The period in which returns were mainly boosted by cheap money and multiple expansion is behind us. For 2026, we therefore expect a year in which the distinction between "story" and "revenue model" will become more visible again.

Apollo Global Management, Brookfield, and KKR are currently trading on the New York Stock Exchange at prices of USD 144.96, USD 48, and USD 134.87 per share, respectively.

Constellation Software will continue to outperform the market

Canadian investment holding company Constellation Software (Toronto: CSU) has had an unfortunate year. Halfway through 2025, the software giant was still up a respectable 12%, but by December 31, its loss in local currency exceeded 25%.

Investors are concerned that artificial intelligence will replace (part of) Constellation's software. In addition, iconic founder Mark Leonard was forced to step down as CEO for health reasons. We wrote about this extensively several times last year, as in the deep dive below.

Analyst Paul Treiber of RBC Dominion Securities is known as one of Constellation's leading followers. He sent a clear signal last week by reiterating his "Outperform" rating for the acquisition machine and raising the price target to CAD 5,600. This new price target is well above the Wall Street average of around CAD 5,080.

Treiber argues that Constellation is likely to continue to generate one of the highest returns within the universe of stocks tracked by RBC, based on the company's ability to continue to compound capital through acquisitions, its strong underlying fundamentals, and its ROIC-based management compensation structure.

RBC expects the Canadian technology sector to show healthy returns in 2026 that could potentially exceed those of the broader market. While performance in 2025 was still highly uneven, with outliers such as Shopify and Celestica masking the underperformance of most software stocks, the bank expects the recovery in 2026 to be much more broadly based.

Treiber notes that the compression of valuation multiples in the software sector has likely bottomed out and that solid growth in revenue and operating profit will support returns in 2026. An important part of this vision is the easing of fears surrounding artificial intelligence; RBC believes that valuation pressure from AI concerns is unlikely to increase further and may even resolve as the tailwinds offered by AI become clearer. Constellation Software is labeled by the bank as one of the best ideas for the coming year.

We endorse Treiber's vision and have already tipped the software sector as a contender for 2026 in a recent deep dive, which mentions Constellation Software and its subsidiary Topicus.com, among others. You can read the reasoning behind this in the article below.

The positive outlook for Constellation is supported by consistently strong results. In the third quarter of 2025, revenue rose by 16%, driven primarily by acquisitions. Operating cash flow grew by as much as 33%, confirming that the investment holding company's engine is running at full speed and that operational leverage is working extremely well.

In customer discussions during the fourth quarter, we also pointed out the consistently strong figures reported by Constellation and Topicus.com, which do not yet show any negative impact from artificial intelligence. The price correction of these companies can therefore be attributed to sentiment, a so-called valuation correction.

A stock price reflects two things: earnings or cash flow per share, and how much investors are willing to pay for it (the so-called price/earnings ratio or price/cash flow ratio). If the market valuation now adequately reflects the AI risk, the most significant part of the valuation pressure should now be behind us. If cash flow continues to grow by more than 30%, investors will sooner or later have to reflect this in the share price.

Benjamin Graham, Warren Buffett's mentor, once said it aptly:

In the short term, the market is avoting machine, but in the long term, it is aweighing machine.

Recent fears that artificial intelligence will undermine the competitive position of niche software companies are based on a fundamental misunderstanding of where the real economic competitive advantage lies. After all, the value of these companies lies not in the source code, which is easier to replicate using AI, but in their deep integration into specific business processes and the high switching costs that result from this.

We therefore do not regard AI as an external disruptor, but rather as a productivity lever that enables established players to improve their margins and optimize their services. We therefore do not share investors' fears that Constellation's more than 1,400 subsidiaries and Topicus's 200-plus companies will be disrupted on a large scale. On the contrary, we see this as an excellent opportunity to further increase productivity.

Constellation Software is currently trading on the Toronto Stock Exchange at a price of CAD 3.311 per share.

Prosus warns about European investment climate

Dutch investment holding company Prosus (Amsterdam: PRX) has strongly criticized European competition authorities following the recent acquisition of Just Eat Takeaway. The regulator only gave the green light to the EUR 4.1 billion deal after Prosus agreed to divest its 27% stake in competitor Delivery Hero entirely.

CEO Fabricio Bloisi stated in the Financial Times that this forced sale thwarts his plans to invest USD 15 billion in the continent. The goal was to forge a European tech giant with a valuation of USD 100 billion, but he believes that current regulations make this impossible.

According to Bloisi, this state of affairs is at odds with Mario Draghi's recent report. In it, Draghi argued for more flexible rules to allow European champions to compete with their American and Chinese rivals.

Prosus is currently trading on the Amsterdam stock exchange at a price of EUR 53.78 per share.

Receive weekly insights in your inbox

Exclusive analyses and updates on family holdings and global market developments.

Would you like more information about our services?

Contact us

Disclaimer:

No rights can be derived from this publication. This is a publication by Tresor Capital. Reproduction of this document, or parts thereof, by third parties is only permitted with written permission and with reference to the source, Tresor Capital.

This publication has been compiled with the utmost care by Tresor Capital. The information is intended in a general sense and is not tailored to your individual situation. The information should therefore expressly not be regarded as advice, an offer or a proposal to purchase or trade investment products and/or purchase investment services, nor as investment advice. The authors, Tresor Capital and/or its employees may hold positions in the securities discussed, either for their own account or for their clients.

You should carefully consider the risks before you start investing. The value of your investments may fluctuate. Past performance is no guarantee of future results. You may lose (part of) your investment. Tresor Capital accepts no liability for any inaccuracies or omissions. This information is for indicative purposes only and is subject to change.

Read the full disclaimer at tresorcapitalnieuws.nl/disclaimer .