Family Holdings #3 - Distribution and infrastructure determine the AI battle at Alphabet and Brookfield

This week's topics:

Brookfield is taking a fundamental step in AI infrastructure with the launch of cloud company Radiant. By combining its existing position in energy, real estate, and data centers with its own cloud application, the group is making the AI chain operational internally. In a market where AI is increasingly constrained by physical and energy limitations, Brookfield is positioning itself as an active infrastructure provider rather than merely a capital provider. This strategy opens up opportunities for structural value creation, but also entails clear implementation risks, particularly on the energy and nuclear side.

In a personal interview, Warren Buffett looks back on his life, investment philosophy, and philanthropic choices. Together with his children, he discusses the values that have shaped his success, the influence of mentors such as Charlie Munger, and why discipline, integrity, and simple kindness are more important than pure intellect.

In Brief:

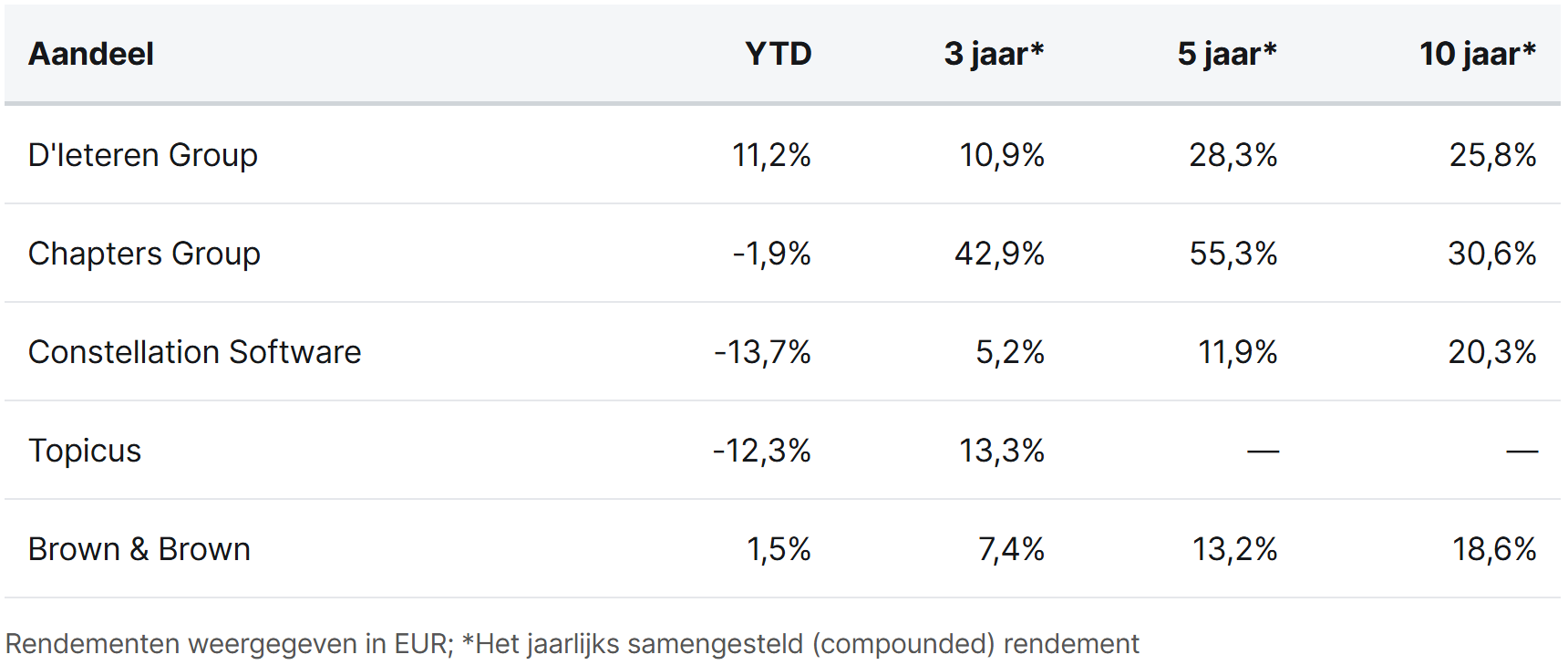

D’Ieteren Group (Brussels: DIE) announced that its subsidiary PHE has entered into exclusive negotiations to acquire a 51% stake in Spanish parts distributors Polaris and Regueira, which together are expected to generate approximately €340 million in revenue in 2025. In addition, analysts expressed strong optimism about D’Ieteren this week. Berenberg initiated coverage of the stock with a buy recommendation and a price target of €224, highlighting the strong cash flow visibility, dominant market positions, and value creation within Belron. Bank of America also raised its price target from €175 to €199, while maintaining its buy recommendation. The analysts point to the robust intrinsic value of the portfolio and apply a holding discount of approximately 30%.

Chapters Group (Hamburg: CHG) is investing millions in German company Fuxam, a fast-growing provider of all-in-one campus and learning management software for universities, colleges, and training institutes. The investment strengthens Chapters' position in the educational software sector. In addition, a governance restructuring took place within the management company: €4.06 million worth of shares were sold through Stanza Management Beteiligungen, after which CEO Jan-Hendrik Mohr, chairman Mathias Saggau, and supervisory board member Edda Heidbrink jointly repurchased shares worth more than €2.2 million.

Constellation Software (Toronto: CSU) made two acquisitions through its Harris division. The company acquired GlobalMeet, a leading platform for enterprise webcasting and interactive virtual events, with approximately 115 employees. It also purchased K-Ecommerce and Orckestra from KKR, two complementary e-commerce and omnichannel platforms from Canada.

Topicus (Toronto: TOI) further expanded its automotive vertical with the acquisition of UK-based Qube Automotive, a provider of after-sales, data, and reporting software for international vehicle manufacturers. Qube supports OEMs with insights into the entire vehicle and customer lifecycle, offering solutions for trade parts sales, parts logistics, and web-based reporting. With the addition of Qube, Topicus now has six automotive software companies in the UK & Ireland region, further strengthening its position in this vertical niche.

Brown & Brown (New York: BRO) acquired British company Sure Insurance Services, a market leader in insurance solutions for medical travel and medical tourism, through its subsidiary Nexus Underwriting. Sure will continue to operate under Millstream, with founder Alison Thornberry remaining on board.

D'Ieteren Group, Chapters Group, Constellation Software, Topicus, and Brown & Brown are currently trading on the Toronto and Brussels stock exchanges at prices of EUR 170.20, EUR 40.70, CAD 2,818.38, CAD 112.77, and USD 79.88 per share, respectively.

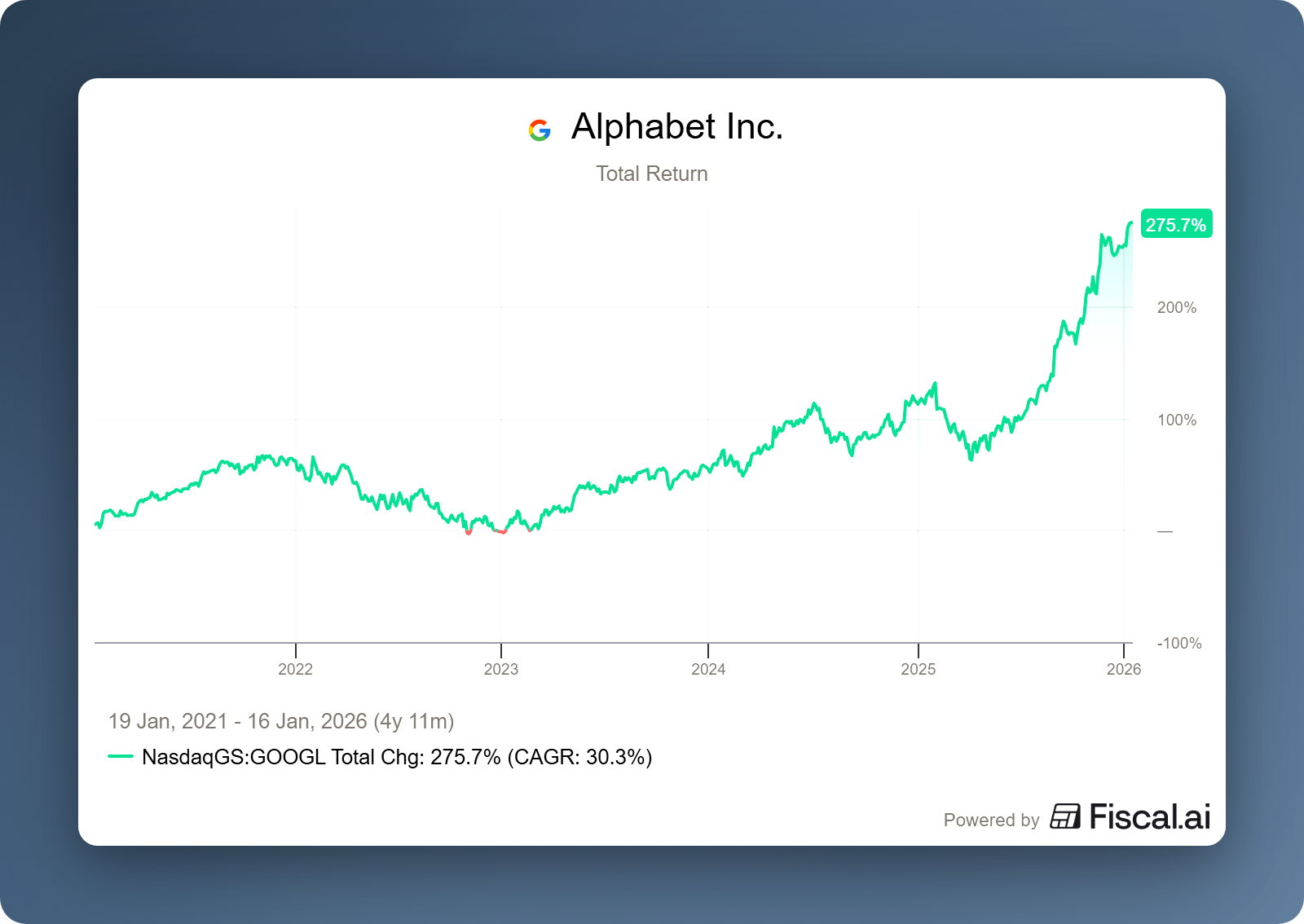

Alphabet wins the AI battle through unprecedented distribution deals

The recent news flow surrounding Alphabet revolves almost entirely around one theme: Gemini. Not so much because of technical model updates, but because of something much more fundamental: distribution. In a market where there is still little visibility on structural revenue models and margins for large language models, there is one thing that remains certain in practice, namely market share and the degree of exposure among end users. Those who succeed in making their model part of everyday use on a large scale create familiarity and reduce the willingness to switch. In the current, rapidly changing AI landscape, distribution therefore seems to be perhaps the most valuable form of future value creation.

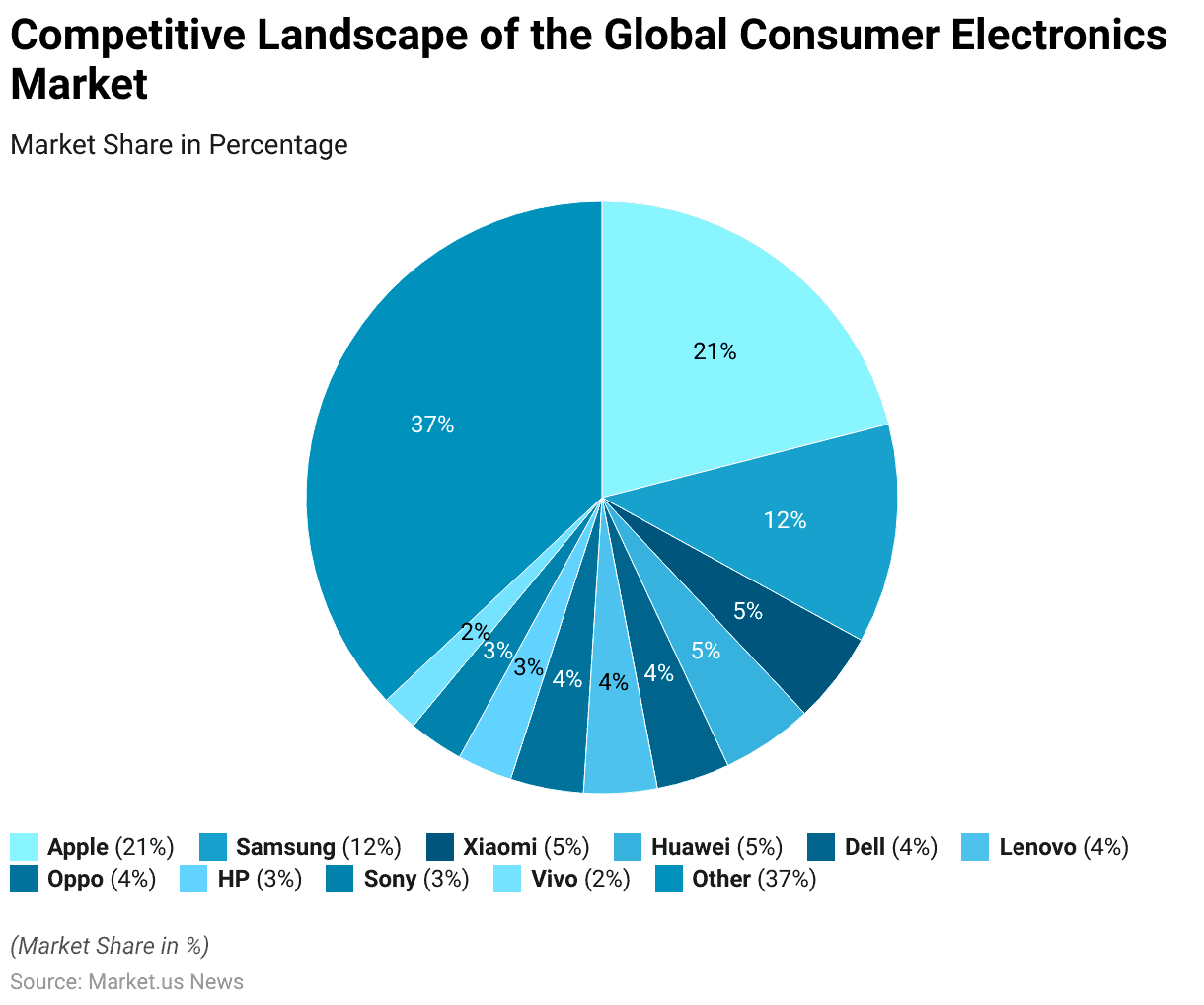

It is precisely on this point that Alphabet has taken an important strategic step in relation to competitors such as OpenAI over the past week. Samsung Electronics announced its intention to double the number of devices on which Gemini is active, from approximately 400 million to 800 million in 2026. This strategic choice was explicitly confirmed by co-CEO TM Roh, who stated: "We will apply AI to all our products, features, and services as quickly as possible."

Roh sees any consumer reluctance as temporary: "Although AI technology may still raise some doubts at the moment, it will become much more widespread within six to twelve months."

That same week, earlier rumors were confirmed that Apple will use Gemini as the foundation for the revamped Siri. This gives Alphabet access to an installed base of more than two billion active devices, a scale that is exceptional even within Big Tech. What makes this collaboration particularly striking is its economic structure. According to market rumors, Google will receive approximately one billion dollars per year for this deal, a clear win-win scenario for Alphabet. The world's largest electronic ecosystem chooses your model as the standard, and instead of having to pay for it, you also get paid for it. It almost sounds too good to be true.

The fact that Gemini is now finding its way to consumers via Apple as well as Samsung translates into serious scale. Samsung accounts for approximately 12% of the global consumer electronics market, while Apple represents around 21%. Together, this means that an estimated 33% of all electronic devices worldwide come into direct or indirect contact with Gemini.

This scale naturally raises questions. Elon Musk called the collaboration an "unreasonable concentration of power." Alphabet already has a long history of investigations and proceedings concerning abuse of power and dominant market positions. Both in the United States and in Europe, the company has repeatedly faced competition cases. Against this backdrop, it is not inconceivable that regulators will eventually consider Gemini as a new, potential form of digital infrastructure monopoly.

First Global AI Tracker of 2026

— Similarweb (@Similarweb) January 7, 2026

Gen AI Website Worldwide Traffic Share, Key Takeaways:

→ Gemini surpassed the 20% share benchmark.

→ Grok surpasses 3% and is approaching DeepSeek.

→ ChatGPT drops below the 65% mark.

🗓️ 12 Months Ago:

ChatGPT: 86.7%

Gemini: 5.7%… pic.twitter.com/D1lNf1G5sr

These concerns stand in stark contrast to the speed with which Gemini is gaining ground. According to data from Similarweb, Gemini broke through the 20% market share barrier in generative AI traffic for the first time in 2026 and now has a share of around 21.5%. This still contrasts with GPT's dominant but declining position of approximately 64.5%. This development has not gone unnoticed by the market. Alphabet recently surpassed Apple to become the second-largest publicly traded company in the world. At the same time, it joined a very exclusive group as only the fourth company ever to have a market capitalization of more than $4 trillion.

Alphabet is currently trading on the New York Stock Exchange at a price of USD 329.96 per Class A share.

Receive weekly insights in your inbox

Exclusive analyses and updates on family holdings and global market developments.

Brookfield completes the AI chain with cloud business

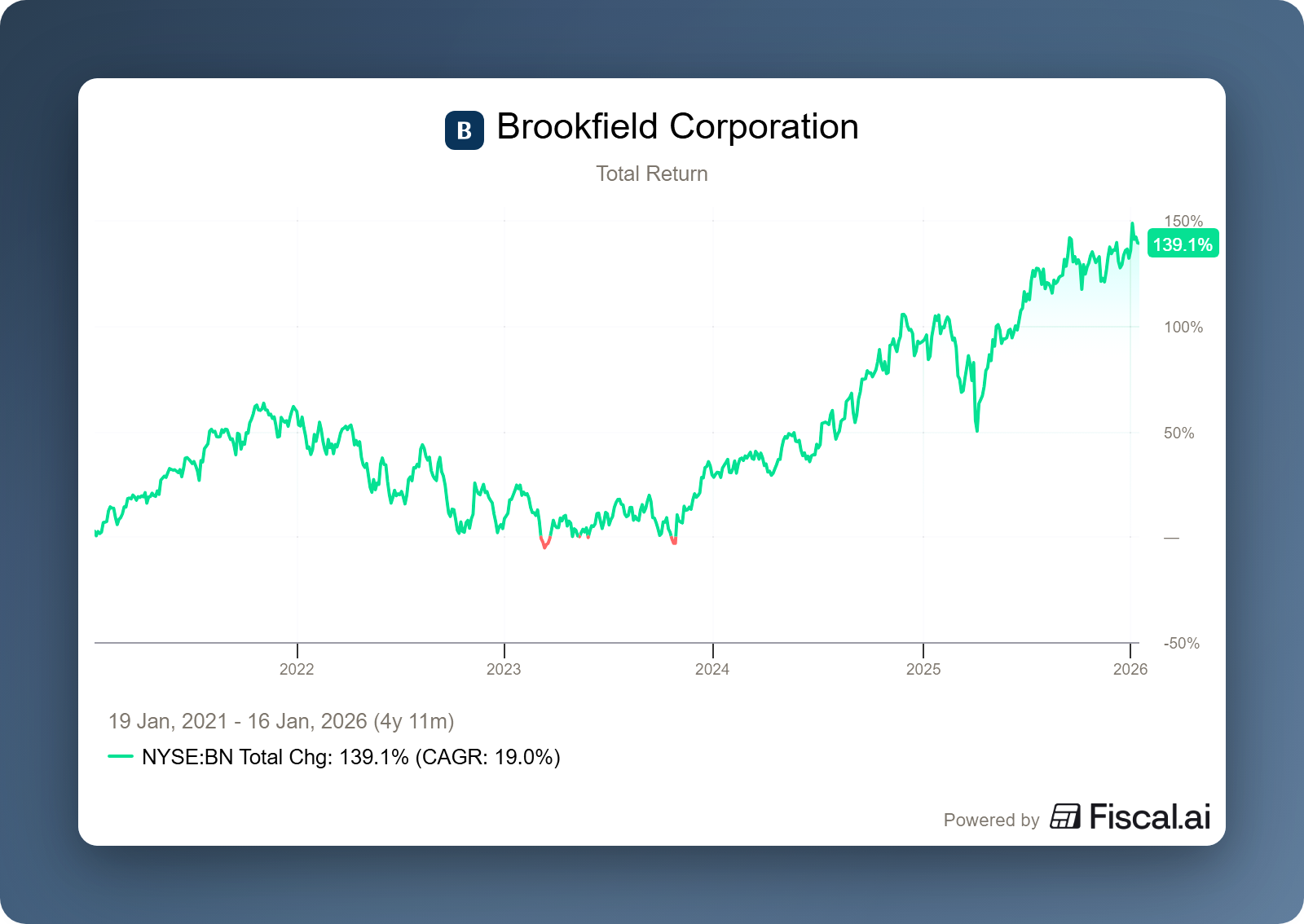

The step that Brookfield (New York: BN) recently took in AI infrastructure is difficult to compare with the moves made by traditional technology companies. Whereas most players approach AI from the perspective of software, models, and applications, Brookfield has opted for a fundamentally different angle. With the launch of cloud company Radiant and a new $10 billion AI fund, the group is shifting from being a capital provider to an active owner that can now actually deploy its physical AI infrastructure internally.

This shift is driven by an increasingly visible reality within AI. The bottleneck lies less in algorithms and increasingly in physical limitations. Computing power is energy-intensive, data centers are capital-intensive, and reliable power supply is no longer a given. Market-wide, AI capex is growing explosively, while returns remain uncertain due to rising energy costs, network congestion, and logistical complexity. Brookfield is tackling this problem at its source by managing infrastructure, energy, and computing internally, claiming that this will enable it to structurally reduce the costs of AI development compared to its competitors.

According to Sikander Rashid, Brookfield's global head of AI infrastructure, the company is focusing specifically on governments and companies that want to store data locally and maintain control over their infrastructure. "We want to be able to set up and manage these computing clusters ourselves, rather than relying on, for example, five different partners in five different markets," says Rashid. Radiant plays a key role in this. The cloud company is given priority over data centers developed under the AI fund, with projects in France, Qatar, and Sweden, among other places. This allows Brookfield to plan capacity from its own portfolio in utilities and renewable energy.

With this step, Brookfield is explicitly entering the playing field of established cloud players such as Google, Microsoft, and Amazon, but also of newer AI cloud companies such as CoreWeave and Nebius. It is striking that many other private equity firms are avoiding this step. After all, operating AI clouds yourself requires large investments in expensive chips and entails operational risks. While parties such as Blackstone limit themselves to financing cloud players, Brookfield has chosen to operate itself. A remarkable choice, but one that is understandable given Brookfield's existing asset base. The group is already one of the largest owners of land, data centers, and energy assets in the world, including one of the largest portfolios of solar and wind energy. Brookfield is also a major shareholder in Westinghouse, a builder of nuclear reactors.

In a recent deep dive by investor CapexAndChill, he argues that it is precisely on this last point that considerable value creation can still be achieved in the future, provided that the implementation is successful. He points to the unique structure of the collaboration with the US government, which can partially cover political and regulatory risks, but at the same time emphasizes that nuclear projects remain exceptionally sensitive to implementation, timing, and cost control. For those who want to delve deeper into this subject, this article is a valuable addition.

Brookfield Corporation is currently trading on the New York Stock Exchange at a price of USD 47.31 per share.

Interview with the Buffett family

In this interview, Warren Buffett reflects on his impressive life, reminiscing about his early fascination with statistics and his transition from horse racing to the stock market. He discusses his business evolution in detail, the shortcomings of modern corporate governance, and the crucial lessons he learned from mentors such as Tom Murphy and Charlie Munger.

A central theme is his philanthropic vision, in which he explains why he entrusts the management of his fortune to his three children. His children themselves talk about their modest upbringing, their mutual cooperation, and the enormous responsibility that this inheritance entails. Finally, Buffett emphasizes that personal success does not come from intelligence alone, but above all from discipline, integrity, and showing simple kindness.

Receive weekly insights in your inbox

Exclusive analyses and updates on family holdings and global market developments.

Would you like more information about our services?

Contact us

Disclaimer:

No rights can be derived from this publication. This is a publication by Tresor Capital. Reproduction of this document, or parts thereof, by third parties is only permitted with written permission and with reference to the source, Tresor Capital.

This publication has been compiled with the utmost care by Tresor Capital. The information is intended in a general sense and is not tailored to your individual situation. The information should therefore expressly not be regarded as advice, an offer or a proposal to purchase or trade investment products and/or purchase investment services, nor as investment advice. The authors, Tresor Capital and/or its employees may hold positions in the securities discussed, either for their own account or for their clients.

You should carefully consider the risks before you start investing. The value of your investments may fluctuate. Past performance is no guarantee of future results. You may lose (part of) your investment. Tresor Capital accepts no liability for any inaccuracies or omissions. This information is for indicative purposes only and is subject to change.

Read the full disclaimer at tresorcapitalnieuws.nl/disclaimer .