Family Holdings #4 - Swedish reliability and Belgian stars

This week's topics:

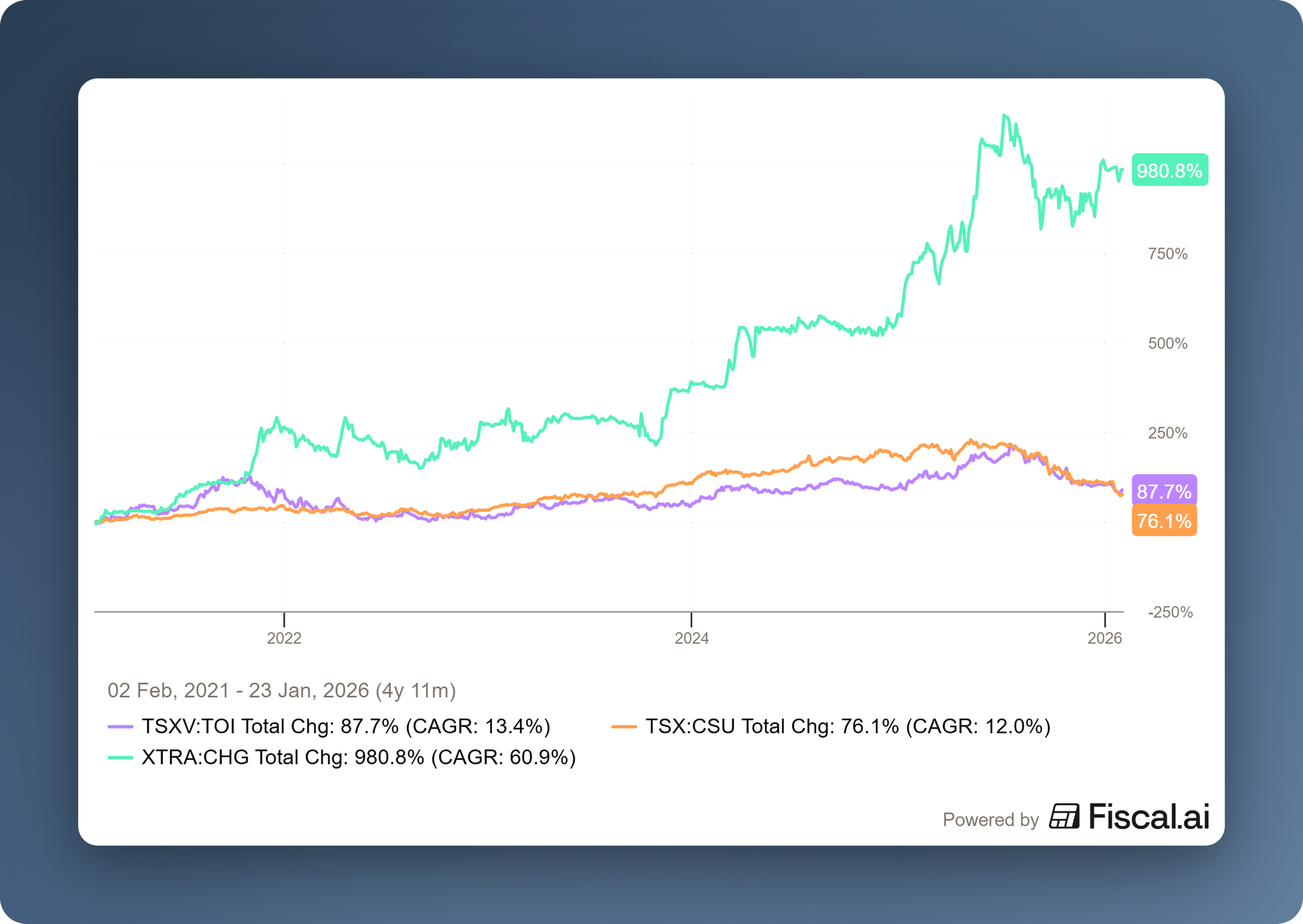

The recent turmoil surrounding AI has led to fears that software could be built virtually free of charge in the future and that even specialized niches will no longer be protected. However, this reasoning misses the real value of Vertical Market Software . It is not the development costs, but mission-critical data, complex regulations, deep integration into work processes, and high switching costs that form the moat. For established players such as Chapters Group, Constellation Software , and Topicus , AI does not pose an existential threat, but rather a productivity lever that can increase margins and, through lower market valuations, even create new acquisition opportunities.

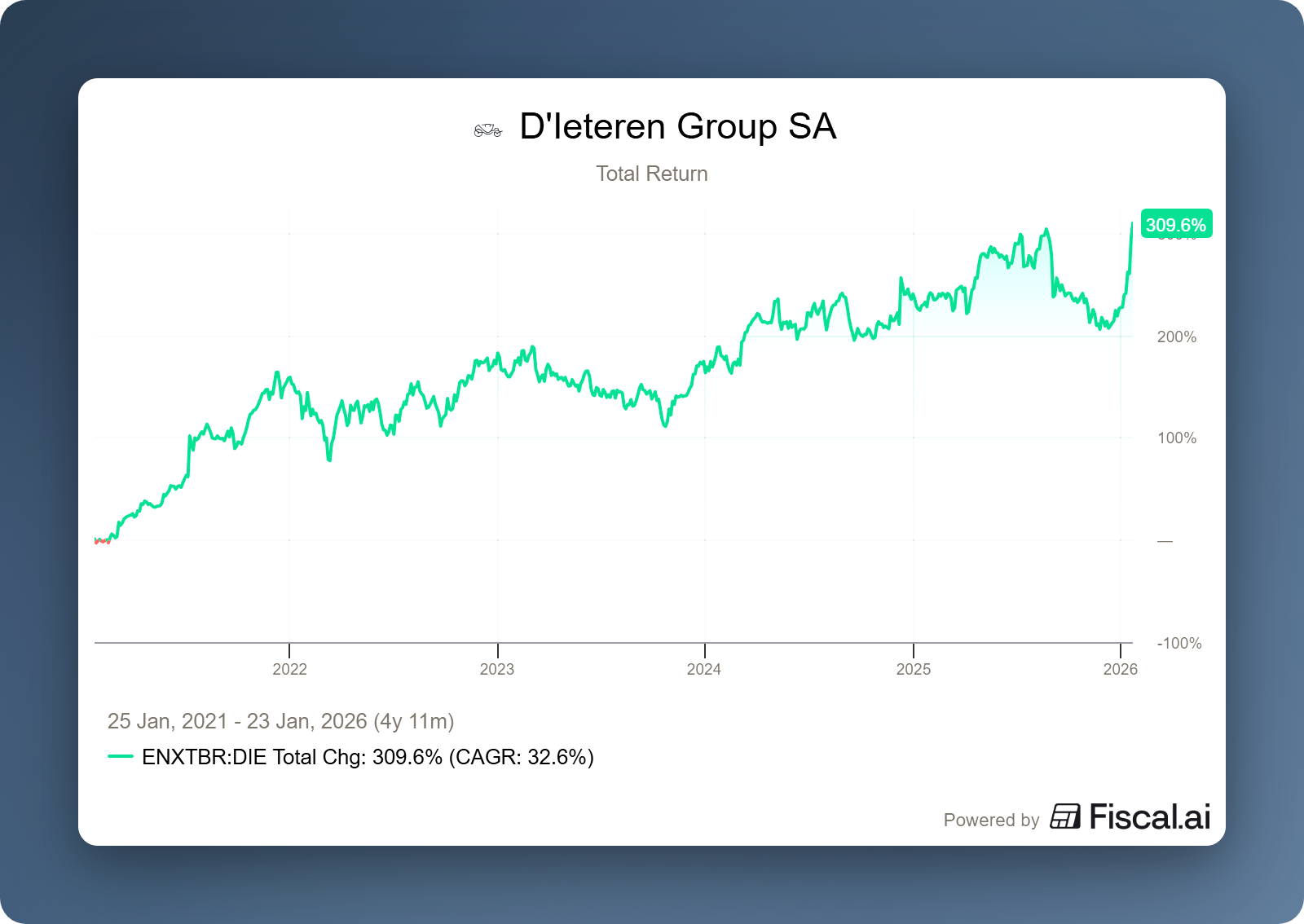

Following recent price target increases and reports, a previously outlined scenario appears to be becoming a reality. Belron, the crown jewel of D'Ieteren, is exploring a possible IPO in the second half of 2026. With strong margins, robust cash flows, and an experienced CEO at the helm, an IPO would not only unlock value at Belron itself, but could also fundamentally challenge the holding discount at D’Ieteren.

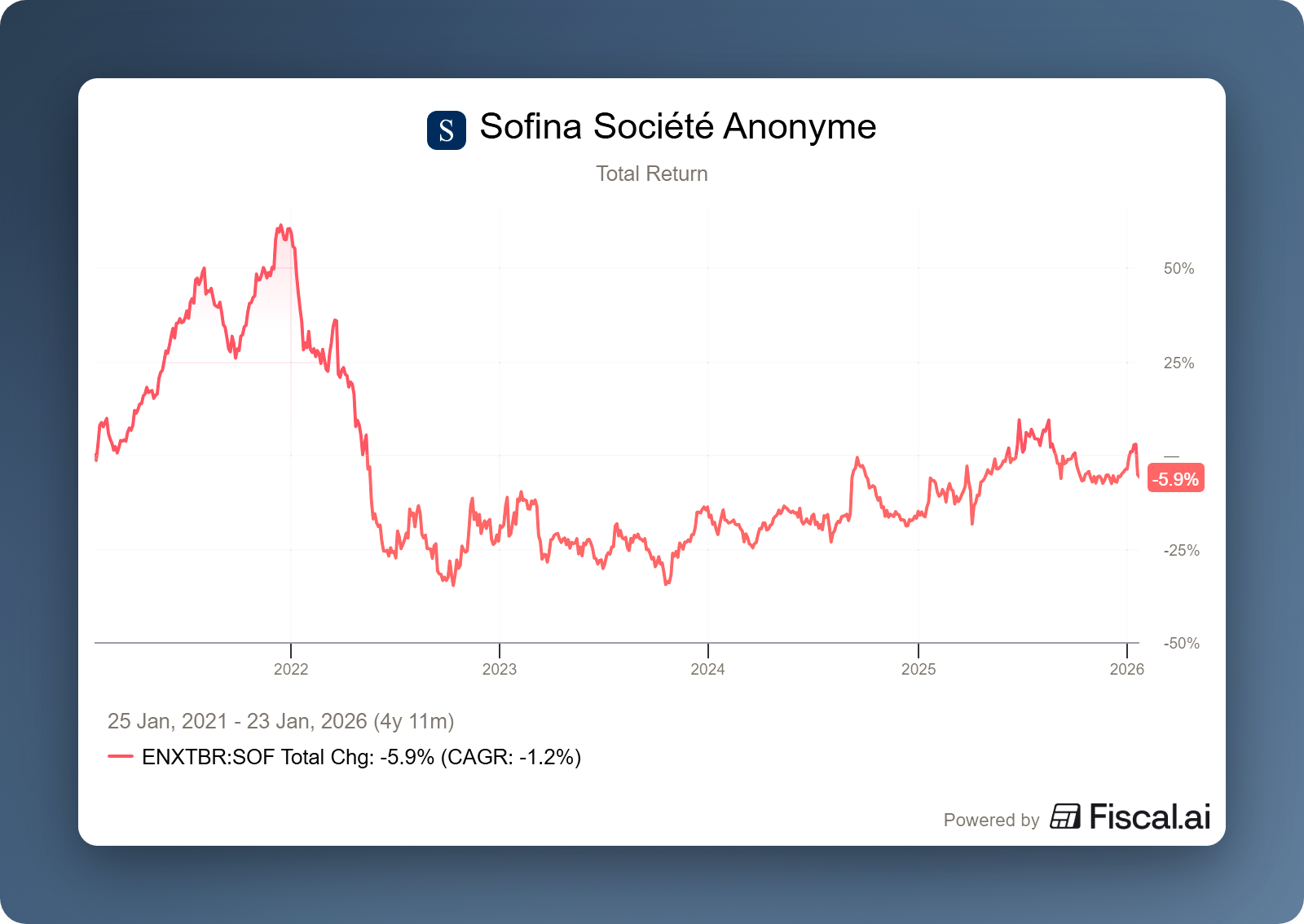

Sofina gave a first glimpse into its 2025 annual figures this week. The reported NAV per share rose slightly to €299, but adjusted for the capital increase in October, it would have been around €305, approximately 2% lower than at the end of 2024, mainly due to currency effects. Management notes that the portfolio remained stable, with ByteDance as the largest position and Vinted on the rise, while new investments in Oviva and Cerealis show that the initial capital from the share issue is already being put to work.

In Brief:

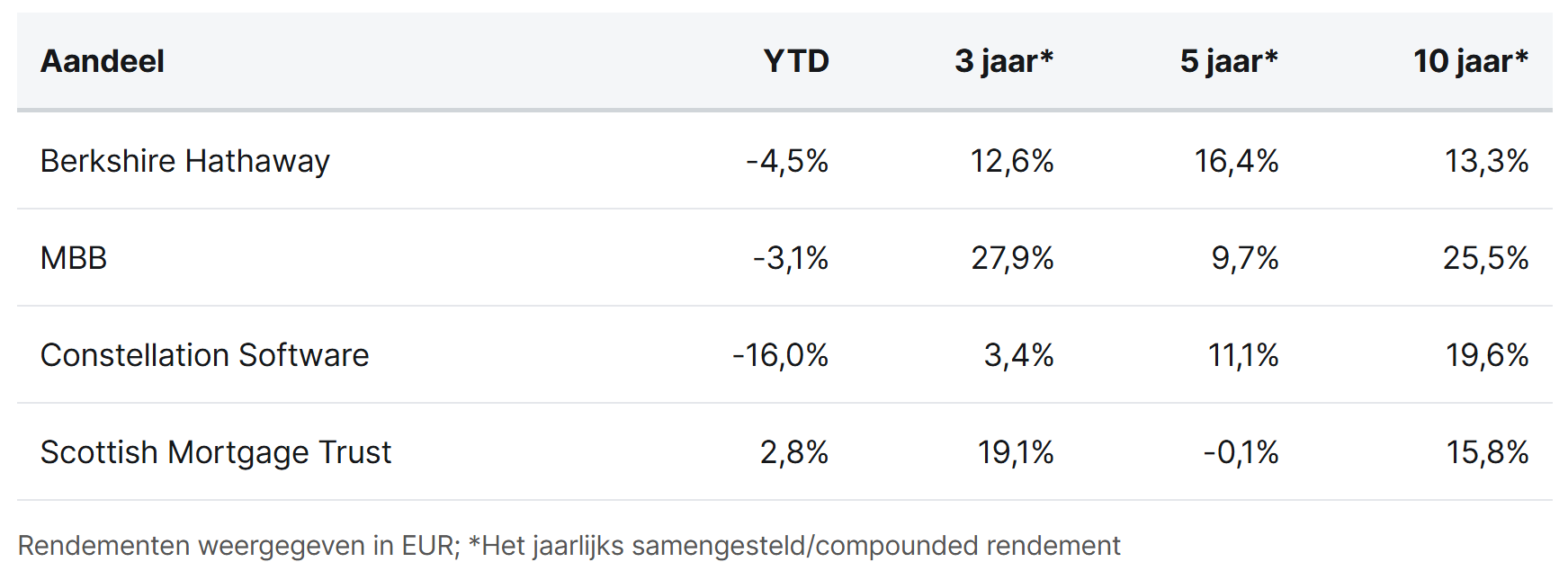

Berkshire Hathaway (New York: BRK.B) is preparing to sell its entire 27.5% stake in Kraft Heinz, according to an SEC filing submitted by Kraft Heinz. The document states that Berkshire may sell up to 325 million shares "from time to time." The decision follows public criticism from both Warren Buffett and newly appointed CEO Greg Abel of the planned split of Kraft Heinz, for which no shareholder vote was requested. The timing suggests that Abel is working on further cleaning up Berkshire's publicly traded portfolio right at the start of his mandate.

MBB ( Frankfurt: MBB) is benefiting from strong figures at its subsidiary Aumann, which announced that it will significantly exceed its profit forecast for 2025. Despite a decline in revenue of more than €100 million (due to continued pressure on the European automotive sector), Aumann achieved an EBITDA margin of approximately 14%, some 2.5 percentage points higher than in 2024. The improvement was driven by strong operational performance in Q4, faster-than-expected order fulfillment, and lower costs for structural optimizations.

Constellation Software (Toronto: CSU) added two more companies through its divisions. Within Vela, the Juniper Group acquired Singapore-based fintech company Tagit, provider of the open API banking platform Mobeix, which is active with traditional and challenger banks in Asia, Africa, and the Middle East. In addition, Volaris acquired German company ines GmbH, a provider of health information systems for more than 35 clinics and hospitals in Switzerland. The Konstanz-based company was founded in 1994 and has approximately 60 employees.

Scottish Mortgage Trust ( London: SMT) has a fast-growing unlisted holding in Zipline, which accounts for 1.9% of its net asset value. Zipline raised $600 million at a valuation of $7.6 billion, underscoring the traction of its autonomous logistics network. With weekly growth of 15% in its US operations, Zipline is extending its market leadership through economies of scale and superior technology. This enables it to further extend its lead over competitors and claim a dominant position in last-mile delivery.

Berkshire Hathaway, MBB, Constellation Software, and Scottish Mortgage Trust are currently trading on the New York, Frankfurt, Toronto, and London stock exchanges at prices of USD 480.28 (B share), EUR 200, CAD 2,780.81, and GBP 12.10 per share, respectively.

Investor AB demonstrates the value of internal diversification

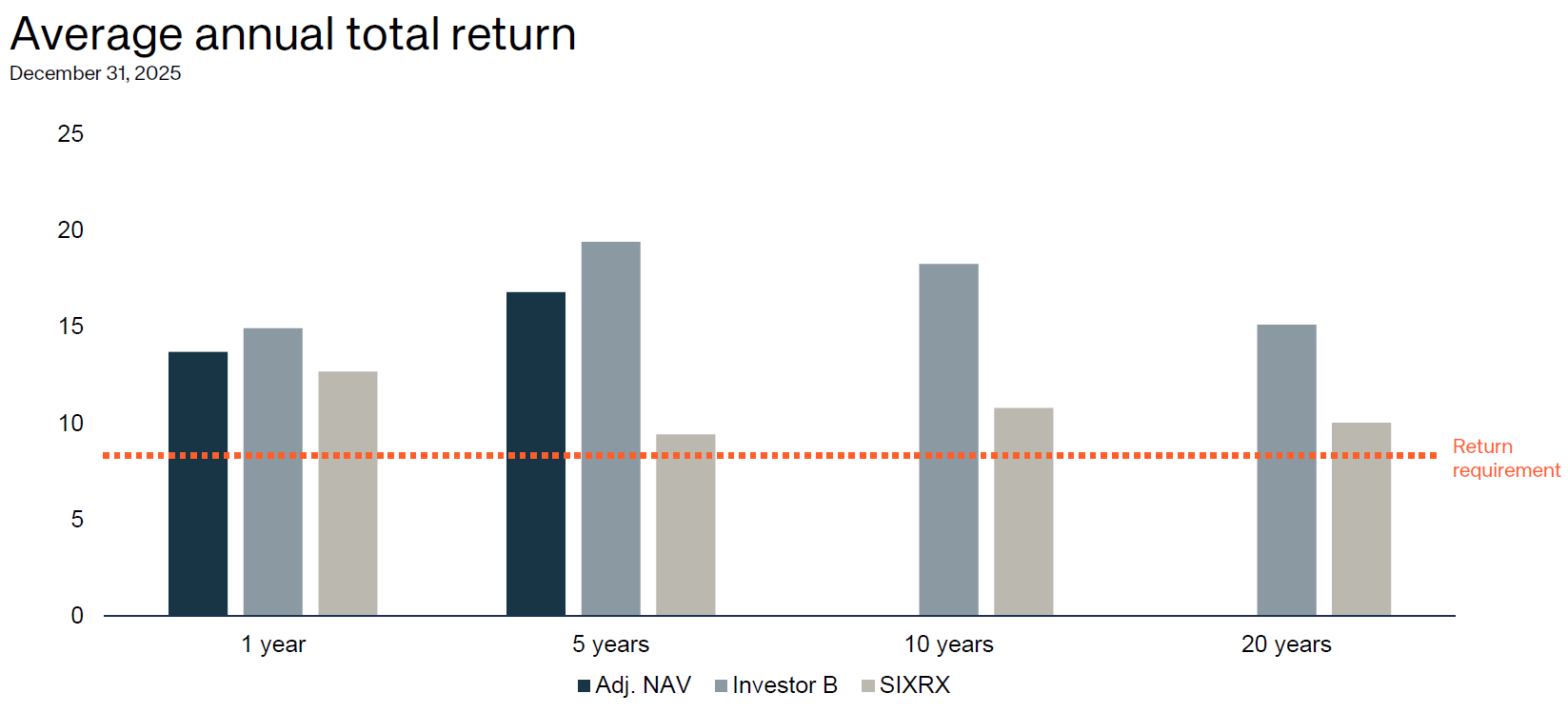

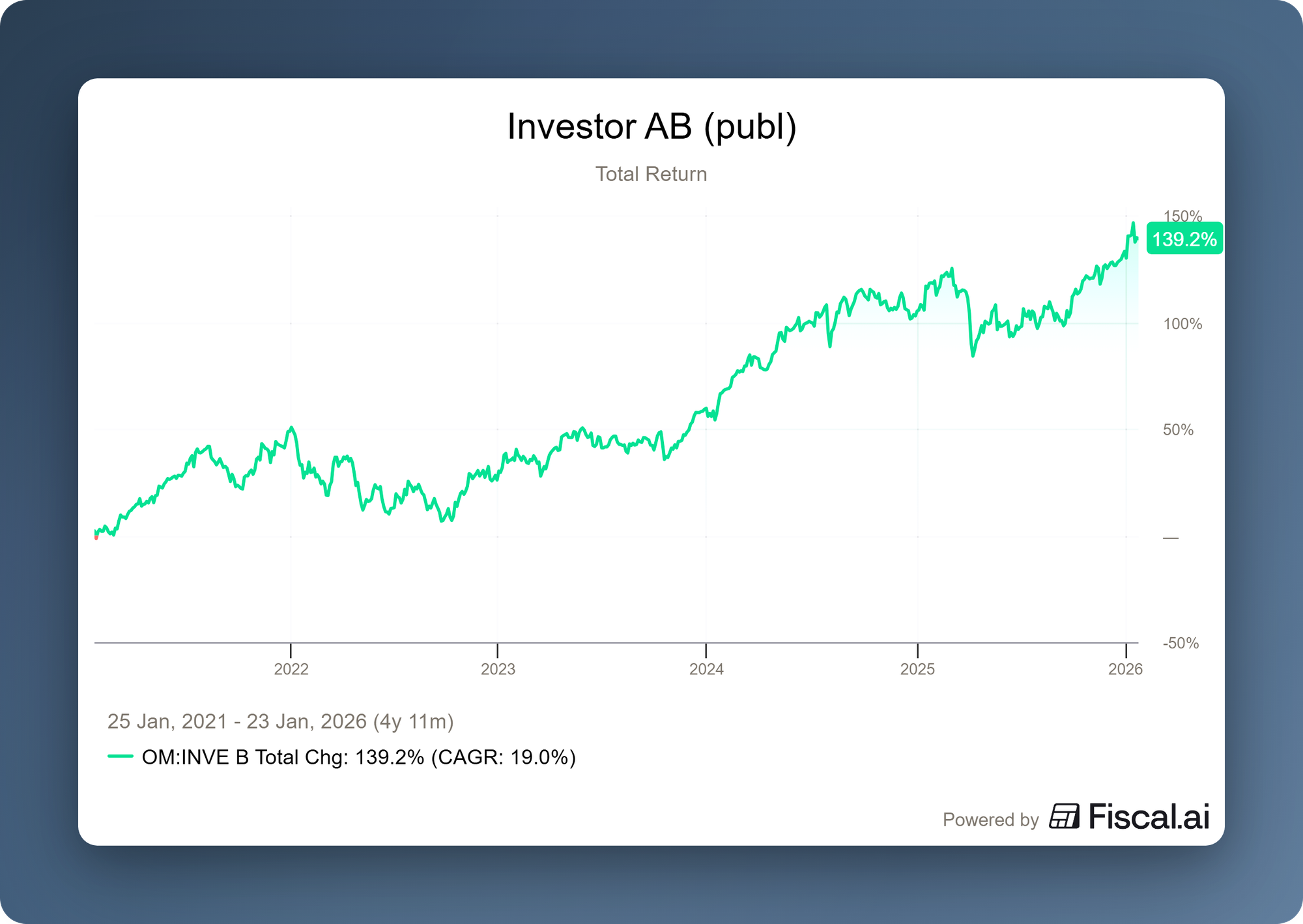

Swedish investment holding company Investor AB (Stockholm: INVE-B) published its Q4 and annual figures for 2025 last week. In a year that management described as "anything but straightforward," Investor still delivered a strong overall performance: NAV rose by 14% and Total Shareholder Return came in at 15%. This means it once again outperformed the Swedish stock index.

This outperformance fits in with a pattern that we have been following for some time. We previously reported that Investor AB has now outperformed the stock market for fifteen years in a row, with more than 80% of the total return coming from actual growth in intrinsic value rather than financial leverage or multiple expansion. In 2025, Investor confirmed this long-term DNA: despite a difficult start to the year, it convincingly made up for lost ground in the fourth quarter. Investor thus once again underlined why its model of disciplined ownership, portfolio diversification, and focus on structural value creation has consistently delivered returns for years.

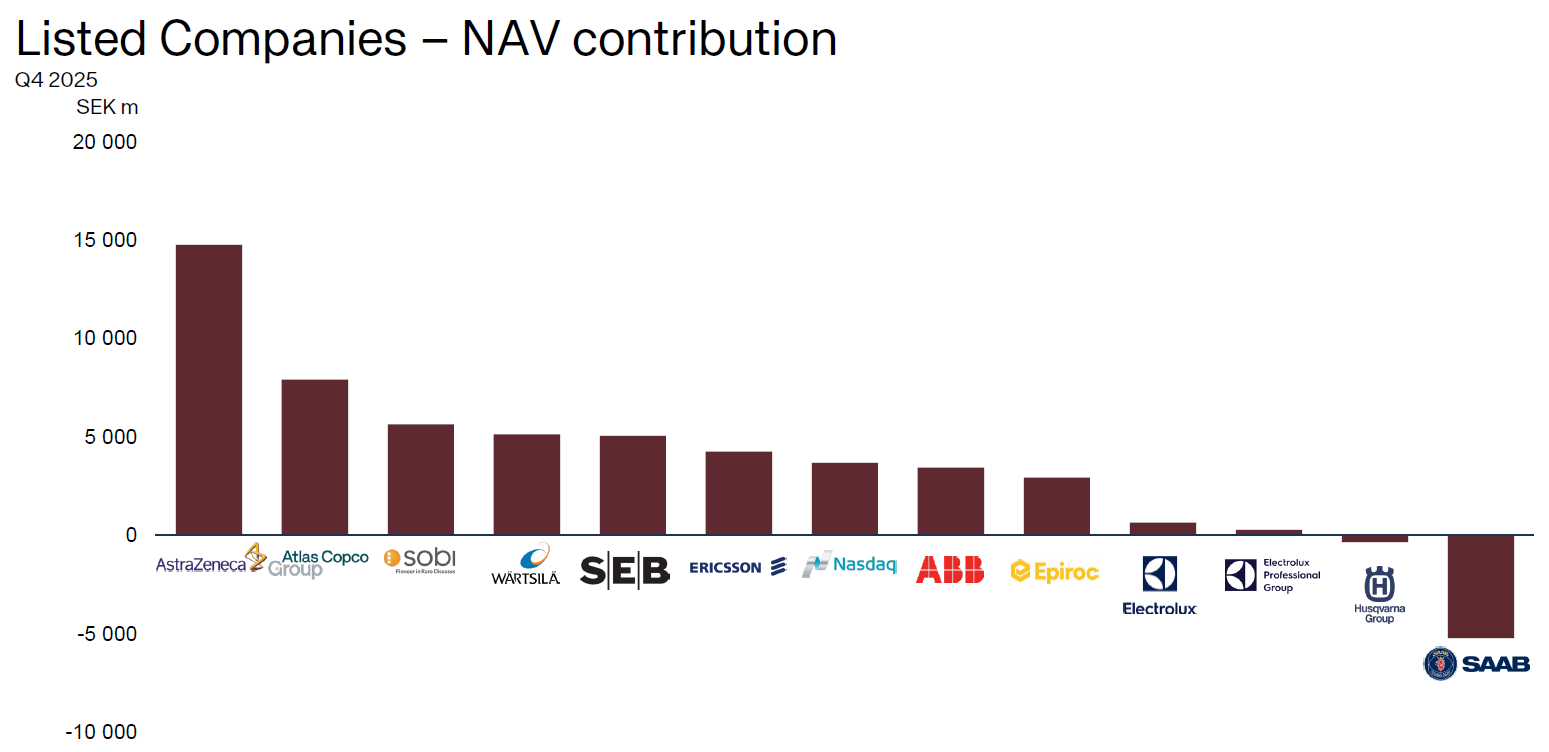

's listed companies Investor AB's listed portfolio made a solid contribution to the growth of net asset value in the fourth quarter. The figure below shows each company's contribution to NAV development in Q4. Virtually all positions contributed positively, with AstraZeneca, Atlas Copco, Sobi, Wärtsilä, and SEB as the most important value drivers. During the conference call, management emphasized that the total return of the listed portfolio in the quarter was largely in line with the Swedish market at 6 percent, but that absolute value creation was driven by a broad base within the portfolio.

AstraZeneca contributed substantially to NAV growth, in line with the size of its position within the portfolio. After the quarter, the company also announced the acquisition of Modella AI, a Boston-based AI specialist in oncology research. With this acquisition, AstraZeneca gains advanced foundation models and AI capabilities to accelerate biomarker discovery and clinical development, among other things. The transaction underscores AstraZeneca's strategy of structurally integrating data and AI into the R&D process, with the aim of reducing the complexity and lead time of oncology drug development. In addition, AstraZeneca announced that it will be listed on the US stock exchange after trading closes on January 30, which could potentially result in a higher valuation for its shares.

On the negative side of the chart, Saab stands out. Despite a very strong calendar year in 2025, in which its share price roughly doubled, Saab experienced a correction of approximately 18% in the fourth quarter. This decline coincided with a temporary cooling of sentiment surrounding defense stocks, partly due to speculation about possible peace negotiations between Russia and Ukraine. This proved to be short-lived. In the first weeks of 2026, the picture has completely reversed and Saab is already up more than 25%, driven by rising geopolitical tensions and the continued focus on European defense spending.

Investor continued to act consistently as a long-term owner in the fourth quarter. The holdings in core positions were further increased, including through additional investments in Atlas Copco and Ericsson. At the same time, a limited number of SEB shares were sold to keep the relative ownership interest stable as SEB continues its share buyback program. According to management, these transactions do not reflect tactical market timing, but rather the desire to maintain the desired ownership structure for each company. In the case of SEB, avoiding stricter regulatory requirements if the ownership interest exceeds a certain threshold plays a specific role.

Finally, portfolio company Ericsson published its quarterly results this week. The company has been under pressure for some time due to structurally weak demand for traditional telecom network infrastructure. Although management pointed to potential growth opportunities in AI-related network applications, drones, and defense-related solutions, underlying revenue growth remained under pressure in the short term. This ongoing pressure has forced Ericsson to implement cost-cutting measures and restructuring for some time now, including a significant reduction in its workforce. Nevertheless, Ericsson surprised investors with the announcement of its first ever share buyback program, worth €1.4 billion. This move was interpreted by the market as a clear signal of strong capital discipline.

Unlisted companies: Patricia Industries

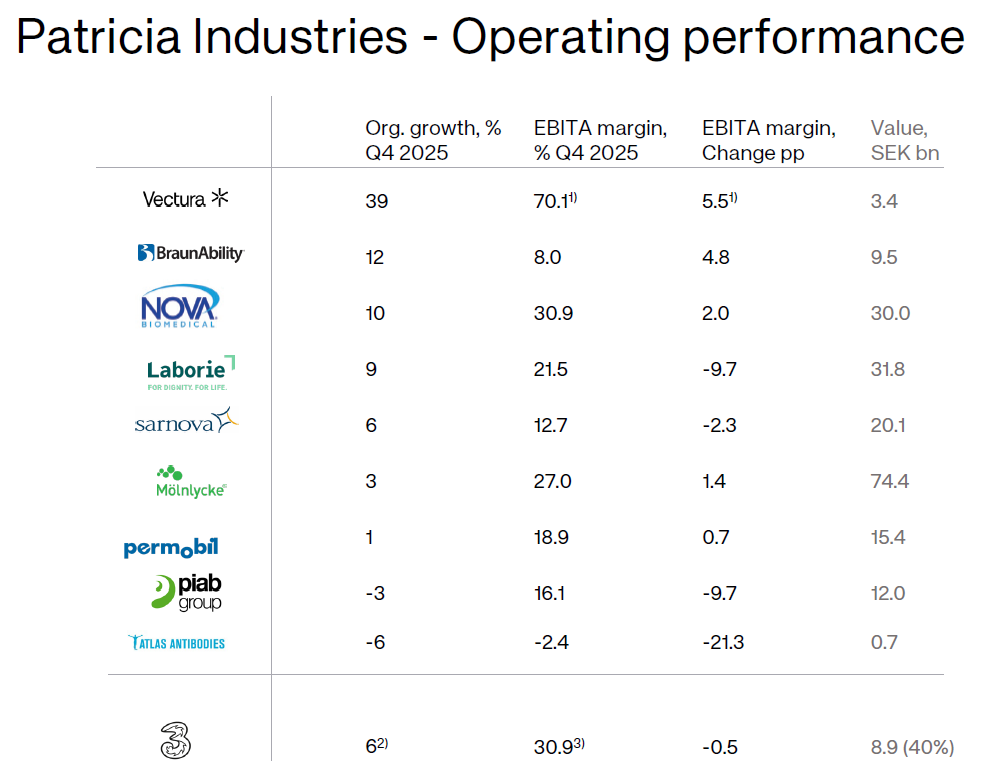

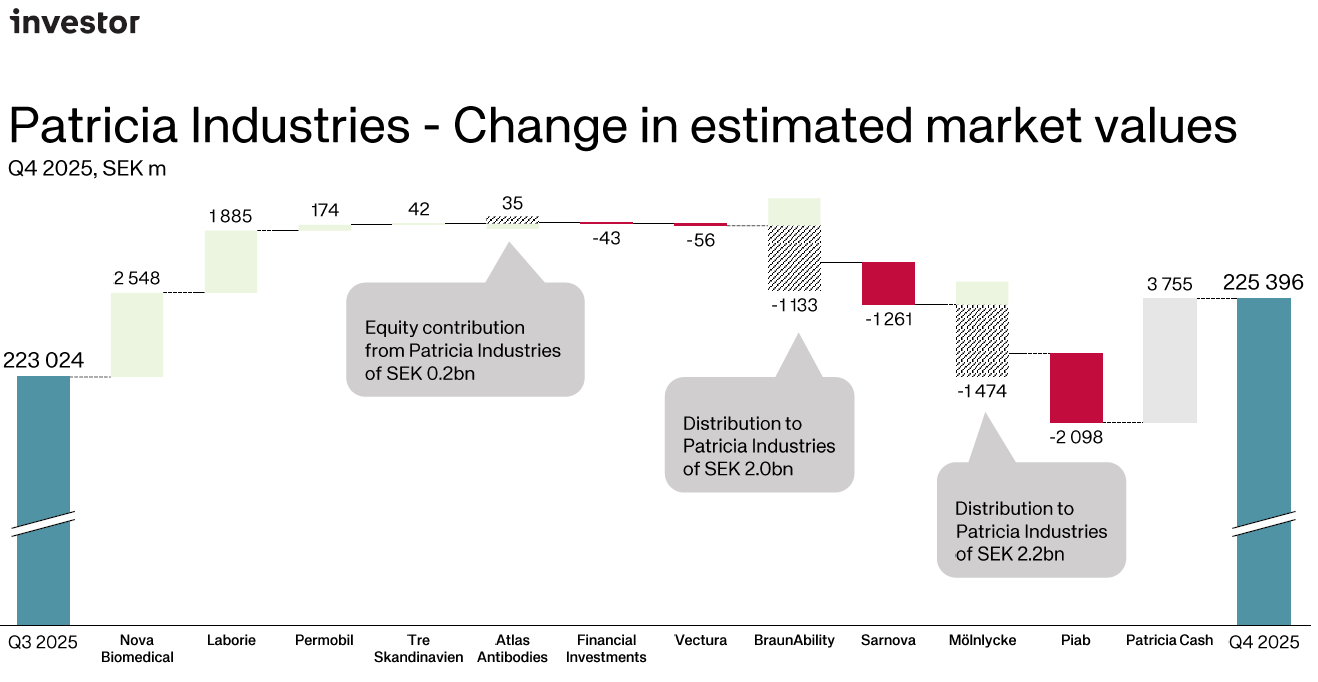

While the listed portfolio carried the year, Patricia Industries was the headwind in 2025. The total return on the private portfolio for 2025 was -9%, with management explicitly citing the weaker US dollar as the main obstacle.

Operationally, the portfolio is more resilient than the annual return of -9% suggests, but performance varies greatly from company to company. At the top end, we see clear growth companies with high or improving margins (Vectura, BraunAbility, Nova Biomedical), while at the bottom end there are companies where falling demand, restructuring, and temporary issues are weighing on growth and profitability (Piab, Atlas Antibodies).

What is striking here is that organic growth and margin development do not always coincide. For example, strong revenue growth at Laborie is accompanied by a sharp decline in margins due to integration and transition costs, while Mölnlycke has managed to further improve its margins despite modest revenue growth. This underscores the point that management made several times during the call: the operational reality varies greatly depending on the end market and the phase a company is in, while currency effects and restructuring costs added an extra layer of noise in 2025.

Whereas the previous update focused heavily on completing the acquisition of this company, in Q4 Nova Biomedical showed for the first time how the investment case is beginning to bear fruit in practice. During the call, management indicated that the integration is proceeding according to plan, with concrete steps such as merging organizations and implementing a single joint ERP system. It was previously mentioned that this could cause temporary friction. In that light, it is important that Nova achieved a good recovery after the negative organic growth (-4%) immediately following the acquisition, which was attributed to an exceptionally strong basis for comparison and a cyber incident in Q3. CFO Haquinius emphasized that the recovery in Q4 was partly helped by the normalization of operations after that incident, but also that underlying demand and profitability remained robust. The EBITDA margin of over 30% underscores that Nova Biomedical is not only a growth story, but also a high-quality profit platform. At the same time, management tempered expectations for the short term: further integration steps may still affect revenue and profit, but are seen as necessary to unlock the full scale and synergy potential.

Mölnlycke is by far the largest investment within Patricia Industries and therefore received above-average attention during the conference call in terms of analysts' questions. In Q4, Mölnlycke reported 3% organic growth, driven by the wound care (+5%) and gloves (+3%) divisions, while the EBITDA margin improved further to around 27%, despite ongoing negative currency effects and trade tariffs.

At the same time, it became clear during the call that Mölnlycke is facing structural headwinds in Europe. Both CEO Cederholm and CFO Haquinius explicitly pointed to ongoing pressure on healthcare budgets in Germany and France, which is slowing growth in those regions. Management indicated that this weakness has been evident since the first half of 2025 and that there is little prospect of a rapid recovery. On the other hand, the US and China continue to show strong momentum, underscoring the geographically diverse nature of Mölnlycke's activities.

The attached value bridge puts these operational performances into perspective. Despite solid underlying development, Mölnlycke made a negative contribution to estimated market value in Q4, mainly due to currency effects and a dividend payment of €200 million (approximately SEK 2 billion) to Patricia Industries. However, this decline is not unrelated to the fundamental quality of the company. On the contrary: the margin improvement was driven by active efficiency programs and a favorable product mix, which, according to management, offset currency and tariff pressures by several percentage points.

EQT AB and private equity funds

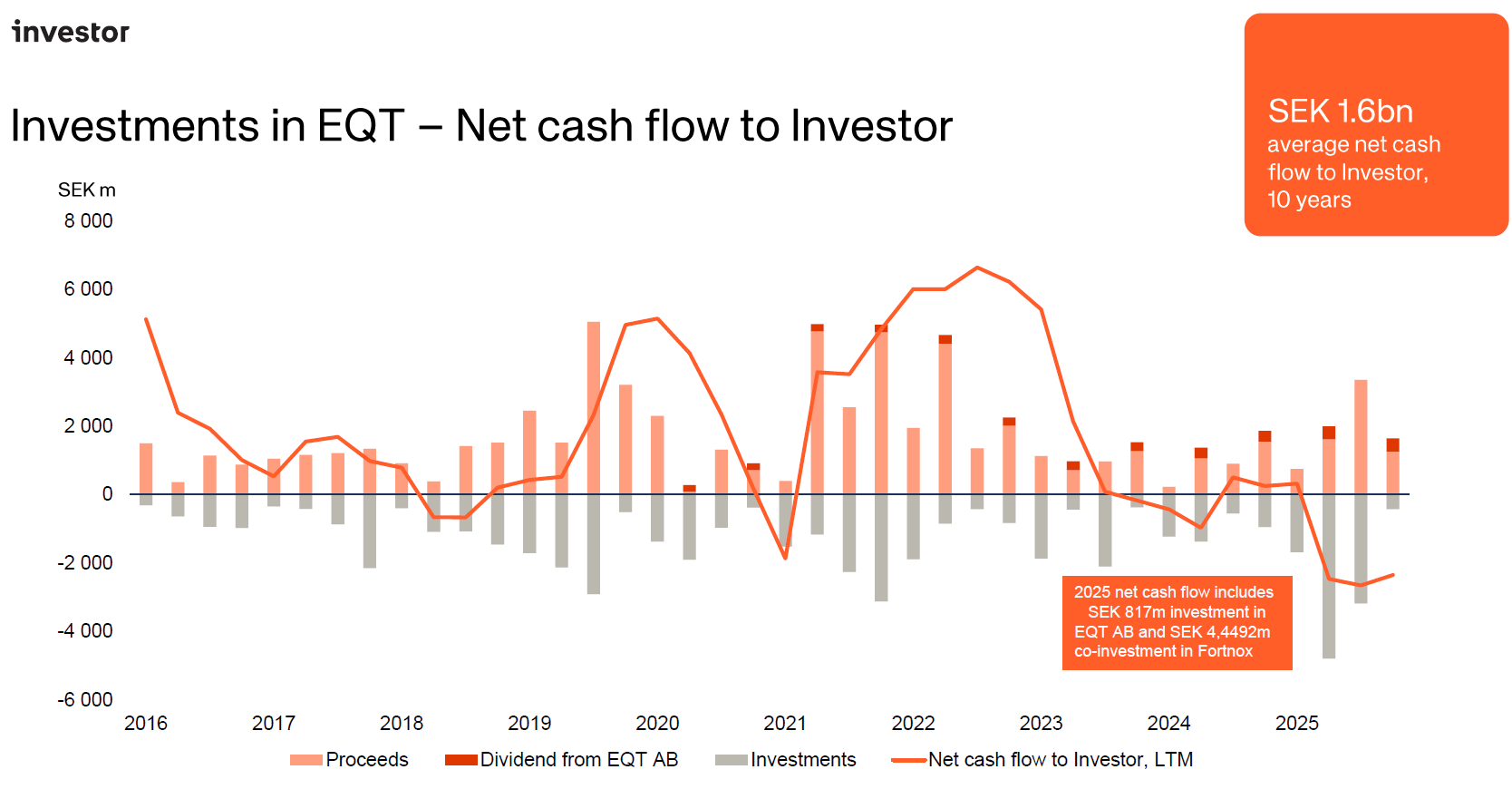

The value of the EQT component grew by 8 percent in the fourth quarter. The share price of EQT AB rose sharply by 14%, while the value of the private equity funds remained flat at 0%. As usual, fund results are reported with a one-quarter delay, so this figure reflects performance in the third quarter. Net cash flow from EQT to Investor amounted to SEK 1.2 billion this quarter, with SEK 0.9 billion coming from the funds, driven by healthy exit activities.

Investor also completed the final tranche of its investment in software company Fortnox during the quarter, bringing the total co-investment to SEK 4.5 billion. During the call, CEO Christian Cederholm explained that this transaction, alongside the EQT X fund, is a way to create value in private markets. When we zoom out to the long term, the picture remains robust with an average annual net cash flow of SEK 1.6 billion over the past ten years. Although cash flow over the last twelve months was negative due to significant investments in EQT shares and Fortnox, it would have been positive without these strategic moves.

Outlook and future-proofing

Looking ahead to 2026, Cederholm expects challenging market conditions such as currency headwinds, trade tariffs, and geopolitical uncertainty to persist. However, Investor AB's strategy remains unchanged, focused on future-proofing the portfolio by striking a balance between operational efficiency in the here and now and investing in structural growth trends such as AI and the green transition.

A specific point of attention during the Q&A was the position in China. Management emphasized that presence in this region is crucial in order to compete with local players who are leading the way in terms of speed and technology. This dynamic keeps the portfolio companies on their toes and is essential for maintaining their global competitive advantage in the long term.

As a committed owner, Investor anticipates robust cash flows that will be widely deployed across the three business units. The expansion of existing businesses is a priority, but the search for new platform companies continues unabated. With a focus on the strategic pillars of Performance, Portfolio, and People, the objective remains clear: to grow intrinsic value and dividends, thereby laying the foundation for an attractive total return for shareholders.

Investor AB ended the trading week on the Stockholm Stock Exchange at a price of SEK 338.90 per B share.

Receive weekly insights in your inbox

Exclusive analyses and updates on family holdings and global market developments.

VMS and AI anxiety: Why mission-critical software remains indispensable

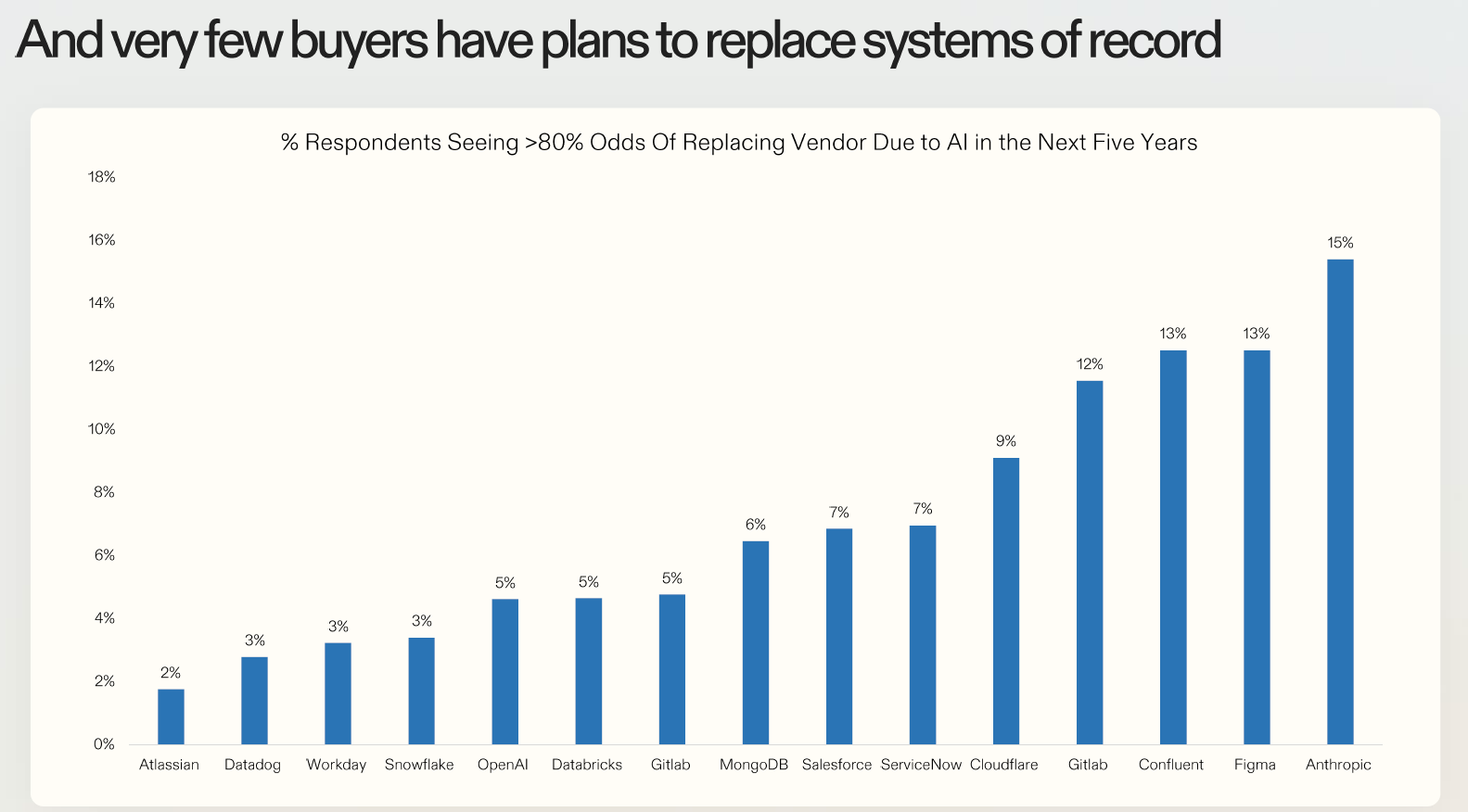

Sentiment surrounding investment holdings in Vertical Market Software (VMS) such as Chapters Group (Frankfurt: CHG), Constellation Software (Toronto: CSU), and Topicus.com (Toronto: TOI) is currently dominated by fears of disruption. There is a fear that software can be built virtually free of charge using AI, and that no niche is safe anymore. As we emphasized in our recent deep dive on Chapters Group, we take a different view, because development costs have never been the moat for this type of software. The moat lies in the fact that it is truly mission critical. A hospital or public transport company will not simply replace a proven system that forms the backbone of the organization with an AI solution that has no track record. Tresor Capital partner and co-owner Michael Gielkens commented on these barriers in the podcast: "We hear from many customers who work in educational institutions or healthcare institutions that it is simply forbidden to work with AI, or systems developed on AI, because of the data risk."

Code is not a Moat

This observation about data risk fits seamlessly with the reality of this crucial infrastructure. A fundamental nuance in this debate is introduced by former Constellation Software employee Paul. He rightly argues that AI commoditizes code, but not the 'System of Record'. The Moat is not formed by the difficulty of writing code, but by complex data migrations, workflows, and integrations. Paul makes a sharp distinction between 'Systems of Action' and 'Systems of Record'. AI excels at generating content and performing tasks, which indeed poses a threat to generic tools without unique data.

The real line of defense for these companies consists of data migration, compliance with complex regulations, and deep links to external systems. Vibe coding may make it cheap to build a simple application, but it cannot simply move fifteen years of historical business data and replicate the hundreds of necessary connections to banks and tax authorities.

Call me out in a few years when all my software investments go to zero:

— Paul, not a CFA (@Investmentideen) January 21, 2026

AI (including “vibe coding”) commoditizes code, not systems of record. CSU owns mission‑critical systems of record in niche markets. Those moats are data, workflows, integrations & switching costs – not the… https://t.co/pL3AxyUQWa

However, the companies in our portfolio manage crucial, regulated data. A financial ledger or medical record cannot be 'vibe coded', because these systems require strict data models and audit trails that auditors and regulators understand. Furthermore, AI is expected to increase margins for these types of software providers. It increases developer productivity and automates support, while licensing and maintenance costs for the customer often amount to only 1 to 2 percent of revenue. The limiting factor for customers is risk, not price, which means that the willingness to switch to a cheaper AI alternative is minimal.

X user Hershie Brody also discovered that self-built software often disappoints in practice. A tool he built quickly turned into a maintenance nightmare when external APIs changed and users kept asking for features. Entrepreneurs want to be relieved of their worries and not have to play software administrator themselves.

Historical perspective and valuation

The current panic shows parallels with previous doomsday scenarios that did not come to pass. Adam Khoo draws a comparison with the panic that prevailed around 2015, when investors feared that Amazon's dominance would spell the definitive end for physical stores. The idea was that traditional retail chains would disappear because consumers would only order online. That prediction did not come true: the established order adapted and emerged stronger from the battle. We saw a similar scenario around 2010 with the rise of 'the cloud'. The market thought that old software giants such as Microsoft and Adobe would collapse because software was no longer installed locally on computers but was offered via the internet by new players such as Amazon Web Services (AWS). Those fears also proved unfounded: these companies used their enormous clout to embrace the cloud model and strengthen their market position.

Although a correction in valuations may have been necessary after the earlier peaks, the fundamental position of business-critical software remains intact. Established players such as Constellation and Topicus are not sitting still and have an army of developers testing and sharing lessons across the organization.

The opportunities of lower valuations

Ironically, the current fear of AI actually offers opportunities for the serial acquirers in which we invest. If the market assigns lower multiples to software companies due to a higher risk perception, parties such as Topicus and Constellation can put their capital to work at significantly higher expected returns. Michael posed the rhetorical question in the podcast: "Do we know of any companies that buy software companies that might benefit from lower multiples?" Due to the decline in valuations, these investment holdings can make more acquisitions at a higher return on invested capital. In addition, AI enables our VMS companies to drastically reduce the development time of new features. As we discussed in the deep dive: "The software is actually the infrastructure layer. And on top of that software, you can build all kinds of applications with AI." If disruption does occur somewhere in the portfolio, the broad internal diversification and the power of the ecosystem ensure that these lessons are shared, making the other subsidiaries immediately more resilient.

From theory to practice

Our companies are now taking concrete steps to integrate AI. Topicus subsidiary PinkRoccade recently launched the PinkAI program internally to roll out AI across every department, from sales to customer support and development. In his New Year's letter, David Nyland, CEO of Constellation subsidiary Lumine Group, emphasized the focus on responsibly embedding AI to achieve measurable results. This is not about gadgets, but about streamlining processes and increasing safety and reliability.

The real value is shifting from simply recording data to understanding the context in which the user works. Because the applications of our portfolio companies know exactly what a doctor or civil servant is trying to achieve at that moment, AI can provide proactive support rather than just recording data. This deep integration into the work process makes the software indispensable, enabling the companies we invest in to maintain their strong competitive position.

Chapters Group, Constellation Software, and Topicus.com are currently trading on the Frankfurt and Toronto stock exchanges at prices of EUR 40.50, CAD 2,772.01, and CAD 116.31 per share.

Receive weekly insights in your inbox

Exclusive analyses and updates on family holdings and global market developments.

D'Ieteren's star has been repaired and is ready for the stock market

Two weeks ago, we shared five slightly playful but substantively serious predictions for 2026. They were explicitly intended as a thought experiment, but remarkably, one of those scenarios now seems to be taking shape, barely two weeks later.

Here you can read the five predictions for 2026.

Last week, several banks raised their target price for Belgian investment holding company D’Ieteren (Brussels: DIE). Shortly afterwards, The Financial Times reported that Belron, the group's crown jewel, is in early-stage talks with banks about a possible IPO in the second half of 2026. Analysts estimate that the IPO will have an enterprise value of €32 billion (equity of €24 billion plus €8 billion in debt) and will take place on the Amsterdam or New York stock exchange.

Belron has been the center of gravity within the D’Ieteren holding company for many years. The company is the global market leader in auto glass repair and replacement, with brands such as Carglass and Safelite. Since 2023, Belron has been led by Carlos Brito, a manager with an exceptional track record in scaling up and optimizing global market leaders. Brito earned his reputation as the architect behind AB InBev's transformation into the world's largest beer brewer, driven by an almost maniacal focus on cost control, cash flow generation, and return on invested capital. Since his appointment at Belron, it has always been thought that he was appointed for the subsequent IPO. His leadership style is described as sober and distinctly operational. Unnecessary complexity is eliminated, capital allocation is central, and every euro must demonstrably contribute to value creation for the shareholder.

In the last twelve months, Belron reported revenue of approximately €6.6 billion, with an adjusted operating profit of around €1.4 billion, representing a margin of over 21%. D’Ieteren owns 50.3% of Belron, but Belron also has a significant net debt position. Based on the latest report, net debt amounts to approximately €8.3 billion. This means that the market value (equity value) is substantially lower than the enterprise value discussed in IPO speculations. After this correction, D'Ieteren's economic interest would amount to roughly €8 to €12 billion.

This calculation assumes that the group's stake will remain unchanged. From an economic perspective, this is logical given Belron's quality and cash flow generation. However, in the event of an IPO, a broader free float may be desirable in order to increase the attractiveness for institutional investors, so it cannot be ruled out that D'Ieteren will sell part of its stake.

D'Ieteren ended the trading week on the Brussels stock exchange at a price of EUR 194.10 per share.

Sofina provides initial insight into its annual figures

Another Belgian investment holding company was also in the news this week. Sofina (Brussels: SOF) published a newsletter with an initial update on its results for the 2025 calendar year. The provisional NAV per share rose slightly from €296 to €299 compared to six months earlier. However, this figure needs to be put into context.

In October 2025, Sofina carried out a capital increase, issuing new shares at a discount. This issue has a dilutive effect on the NAV per share. Adjusted for this share issue, the NAV per share would have been approximately €305. This implies a decline of approximately 2% compared to €312 per share at the end of 2024 (and an increase of approximately 3% in the second half of the year), a movement that, according to management, can largely be explained by currency effects and not by a deterioration in the underlying portfolio.

According to CEO Harold Boël , 2025 was "the right time to scale." Companies are staying private longer, capital is increasingly concentrated among the strongest General Partners, and longer exit cycles are creating opportunities for patient long-term investors such as Sofina. The capital increase deliberately increases financial strength, with the aim of putting this extra capital to work selectively.

The top of the portfolio remains largely intact, with ByteDance (Tiktok) still the largest position. Another notable development is the rise of Vinted. The second-hand clothing platform has moved up from ninth to seventh place in the top ten, without any transactions taking place. This implies that Vinted's valuation has risen faster than that of some other core positions. It is a sign that, despite previous partial sales, this participation is regaining importance within Sofina.

The newsletter also focuses on artificial intelligence. Sofina explicitly mentions how many prompts employees have used internally. This is a striking benchmark, but on its own, this figure says little and offers little guidance for drawing meaningful conclusions about the degree of internal AI integration. The message therefore seems to be that Sofina wants to show that it is actively experimenting with AI internally, without drawing any concrete conclusions or measurable improvements. At the same time, management remains cautious in its positioning towards AI investments. Large language models are now seen as infrastructure, with scale requirements that make direct investments less attractive. Exposure to AI therefore mainly takes place through existing participations such as Mistral AI and through Sofina Private Funds.

Shortly after the newsletter, two further concrete investment updates followed. Sofina once again participated in a financing round at Oviva, a European platform for digital healthcare for chronic conditions. Sofina already had an 11.4 percent stake and co-invested in a €200 million Series D round, in which investment holding company Kinnevik also played a major role. Sofina also announced a new stake in Cerealis, one of the larger industrial and commercial players in the Portuguese agri-food sector. The group specializes in grain processing, is the market leader in pasta and industrial flours, and owns eleven commercial brands, together accounting for more than 130 products. No details have been disclosed about the size of the investment.

All in all, according to Harold Boël, the second half of 2025 was in line with the first six months. The core of the portfolio developed steadily to positively, despite a challenging macroeconomic climate, geopolitical tensions, and a volatile trading environment. With the recent capital increase, Sofina is expanding its room for maneuver. The real test is yet to come and lies in how this extra capital will be put to effective use and translated into tangible value creation.

Sofina ended the trading week on the Brussels stock exchange at a price of EUR 243.40 per share.

Receive weekly insights in your inbox

Exclusive analyses and updates on family holdings and global market developments.

Would you like more information about our services?

Contact us

Disclaimer:

No rights can be derived from this publication. This is a publication by Tresor Capital. Reproduction of this document, or parts thereof, by third parties is only permitted with written permission and with reference to the source, Tresor Capital.

This publication has been compiled with the utmost care by Tresor Capital. The information is intended in a general sense and is not tailored to your individual situation. The information should therefore expressly not be regarded as advice, an offer or a proposal to purchase or trade investment products and/or purchase investment services, nor as investment advice. The authors, Tresor Capital and/or its employees may hold positions in the securities discussed, either for their own account or for their clients.

You should carefully consider the risks before you start investing. The value of your investments may fluctuate. Past performance is no guarantee of future results. You may lose (part of) your investment. Tresor Capital accepts no liability for any inaccuracies or omissions. This information is for indicative purposes only and is subject to change.

Read the full disclaimer at tresorcapitalnieuws.nl/disclaimer .

Receive weekly insights in your inbox

Exclusive analyses and updates on family holdings and global market developments.

Would you like more information about our services?

Contact us

Disclaimer:

No rights can be derived from this publication. This is a publication by Tresor Capital. Reproduction of this document, or parts thereof, by third parties is only permitted with written permission and with reference to the source, Tresor Capital.

This publication has been compiled with the utmost care by Tresor Capital. The information is intended in a general sense and is not tailored to your individual situation. The information should therefore expressly not be regarded as advice, an offer or a proposal to purchase or trade investment products and/or purchase investment services, nor as investment advice. The authors, Tresor Capital and/or its employees may hold positions in the securities discussed, either for their own account or for their clients.

You should carefully consider the risks before you start investing. The value of your investments may fluctuate. Past performance is no guarantee of future results. You may lose (part of) your investment. Tresor Capital accepts no liability for any inaccuracies or omissions. This information is for indicative purposes only and is subject to change.

Read the full disclaimer at tresorcapitalnieuws.nl/disclaimer .