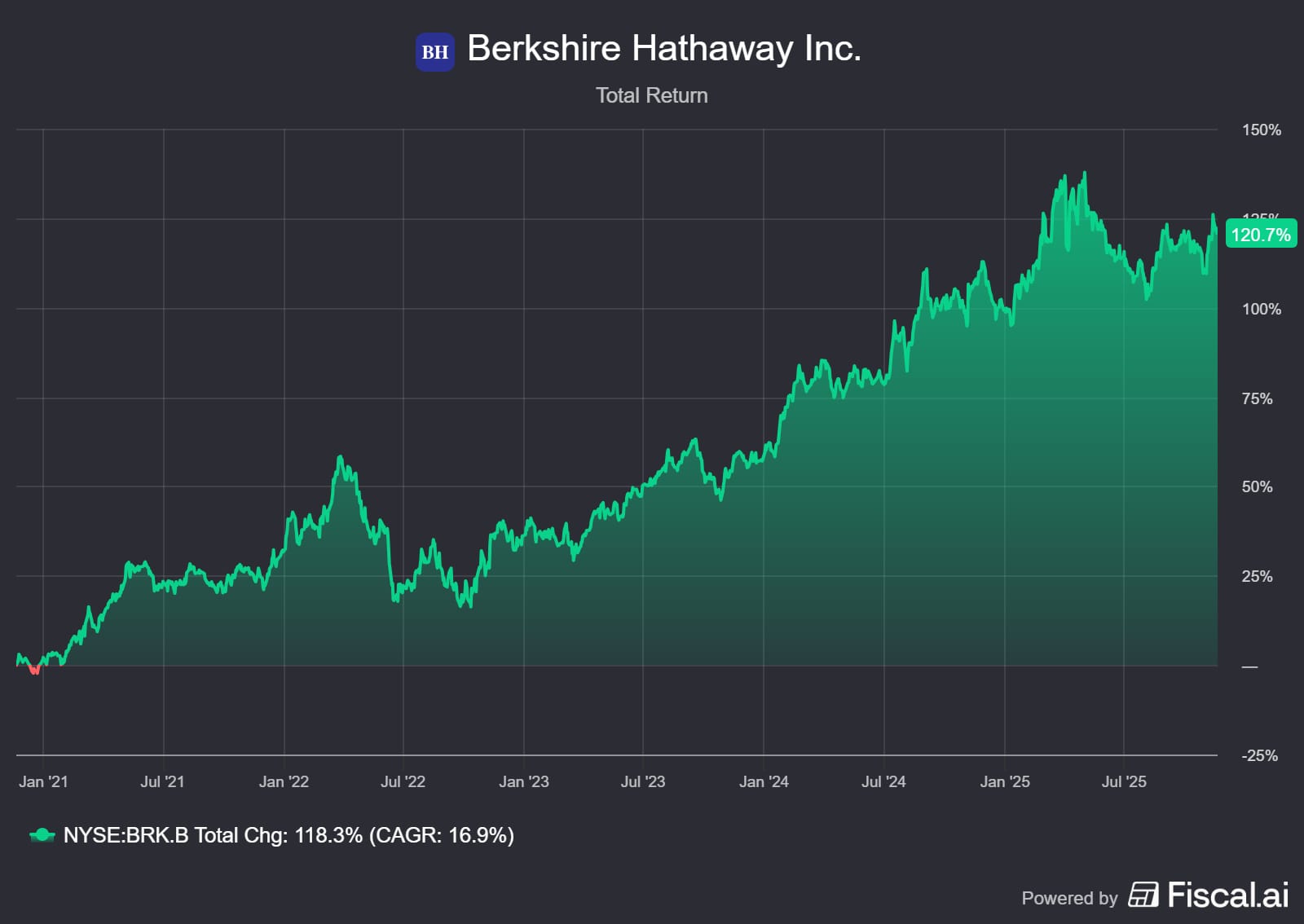

Family Holdings #47 - Berkshire now buys Buffett's eternal regret share after all

This week's topics:

Berkshire Hathaway has taken a surprising new position in Alphabet, accounting for nearly 18 million shares worth USD 4.3 billion, placing it directly in the portfolio's top 10. At the same time, Berkshire is further reducing its position in Apple. The investment in Alphabet appears to come from portfolio managers Todd Combs and Ted Weschler, who have more often built up technology positions.

Brookfield Corporation exceeded expectations and has a record USD 178 billion of liquidity for various investment opportunities, as well as launching a USD 100 billion AI infrastructure program with Nvidia. CEO Bruce Flatt is strategically positioning the company for an expected climate of financial repression, which historically has been the ideal breeding ground for appreciation of real assets such as real estate and infrastructure. Backed by these secular trends and share repurchases, management expresses the expectation that distributable earnings will grow 25% per year over the next five years.

In Brief:

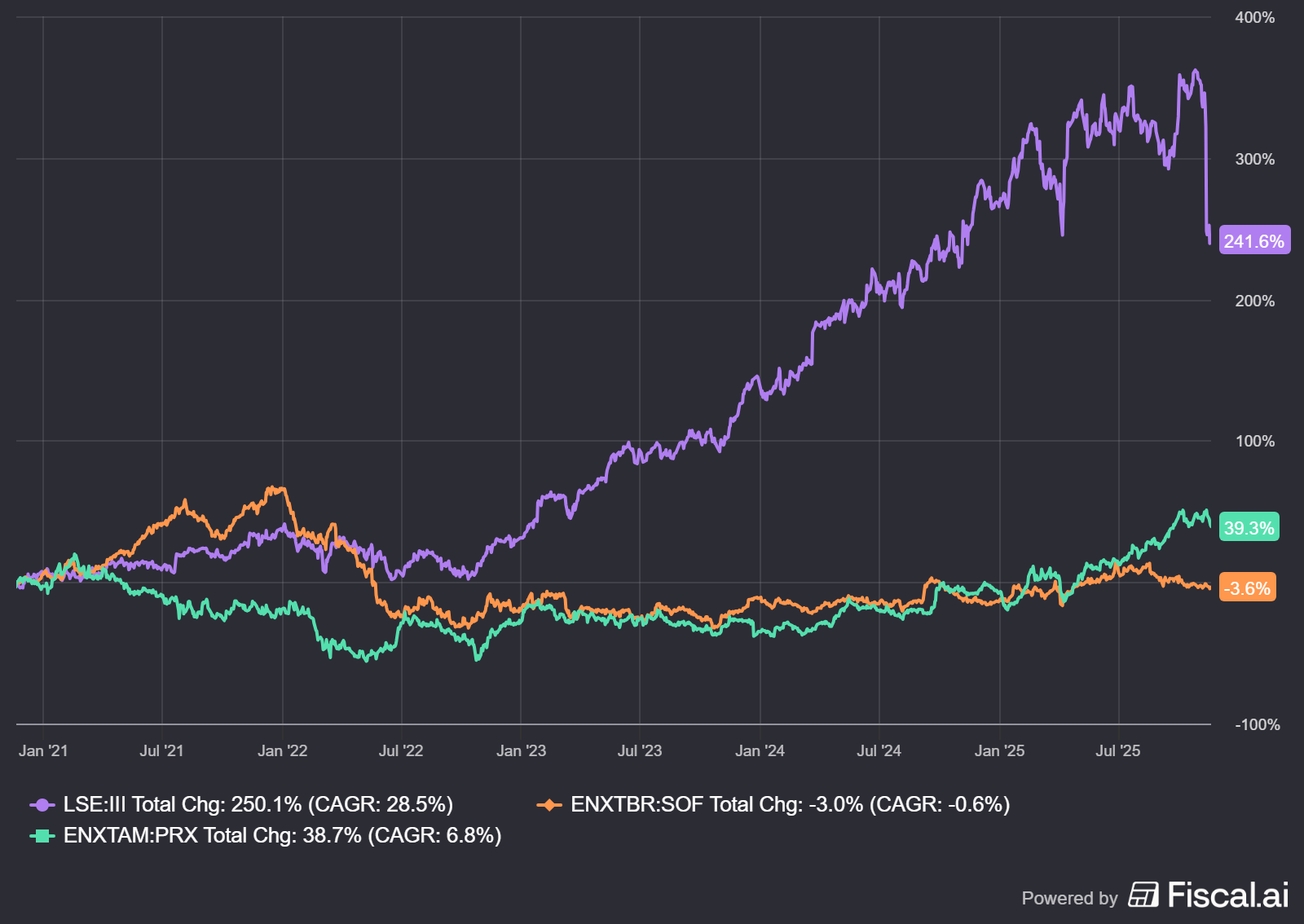

3i Group (London: III) reports hefty insider purchases: commissioner Peter McKellar bought 25,000 shares for GBP 861,500, followed by a purchase of 15,000 shares by CFO James Hatchley worth GBP 509,550. Since last week, directors and managers have now collectively bought about GBP 3.7 million worth of shares. A strong signal of confidence.

Sofina (Brussels: SOF) is seeing the value of its indirect 0.18% stake in ByteDance, the parent company of TikTok, rise sharply following a transaction in which a Chinese fund bought shares at a valuation of USD 480 billion. This increases the value of Sofina's stake by more than 40% to around EUR 750 million, by far the largest position in the portfolio.

Prosus (Amsterdam: PRX), benefits from strong numbers at Chinese tech giant Tencent, which accounts for about 70-80% of its net asset value. Thus, these numbers are extremely important for the investment holding company. Tencent reported revenue growth of +15% YoY to EUR 23.6 billion, above analyst expectations, with solid growth in gaming (+16%), marketing (+21%) and fintech & business services (+10%). International gaming in particular performed strongly at +43% YoY, driven mainly by the world-famous game Clash Royale and a series of acquisitions. Management attributes the strong results to targeted AI investments, which are now delivering concrete returns. Especially in ad targeting, game engagement and efficiencies in coding, game and video production, Tencent is already seeing clear performance improvements.

3i Group, Sofina and Prosus are currently trading on the London, Brussels and Amsterdam stock exchanges at prices of GBP 32.73, EUR 239.40 and EUR 56.62 per share, respectively.

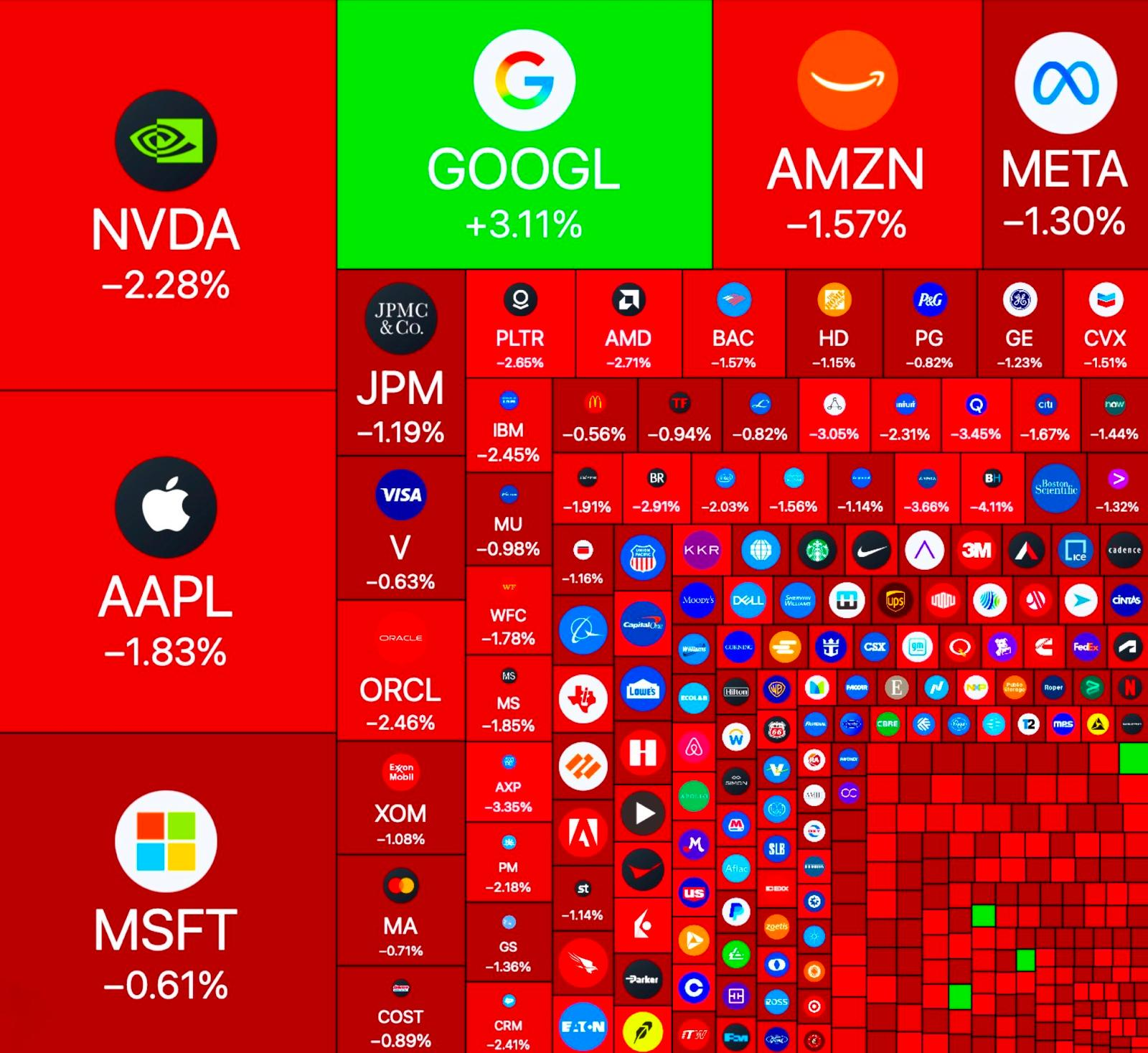

Alphabet to new heights through Gemini 3.0

While the broader market ended this week in the red, Alphabet (New York: GOOGL) was a clear exception. Whereas prior to Friday, Nov. 21, the Nasdaq was still at a loss of -3.12%, Alphabet actually posted a 1.35% gain and reached a new all-time high of $306.42. That breakout was largely due to early reactions to the new Gemini 3.0 model. Early impressions suggest that Alphabet is taking a clear step forward with this release, further outpacing the competition in the LLM market.

Even with the now obsolete 2.5 model, Gemini was able to continually snatch market share from ChatGPT, still the market leader within the LLM landscape, in recent months. Recent data shows that 12 months ago Gemini had only 5.6% market share versus ChatGPT's dominant 86.6%. Today, that picture is completely different: OpenAI's market share has fallen to 72.3%, down 14.3 percentage points.

Interestingly, most of that shift went to Alphabet. Gemini rose 8.1 percentage points to a current 13.7% market share. The remaining gains came almost entirely to DeepSeek, which did not exist a year ago and now has an estimated 4.2% market share. In contrast, competitors such as Claude, Anthropic and Grok are showing market expansion.

This makes Gemini the only model that is actually and significantly taking market share away from ChatGPT. With the current uncertainty surrounding the funding and governance of OpenAI and the introduction of the new Gemini 3.0 model, this trend only seems to be accelerating. Even OpenAI CEO Sam Altman couldn't ignore it and publicly congratulated the Gemini team on X.

Congrats to Google on Gemini 3! Looks like a great model.

- Sam Altman (@sama) November 18, 2025

Gemini 3 represents a marked leap forward in the functionality of large language models. The model particularly excels in reasoning ability: it can better parse complex issues, combine multiple layers of information and recognize subtle cues that previous generations simply missed. In practice, this means that Gemini 3 needs less guidance; it understands more quickly what the user means, even in the face of vague or incomplete instructions.

In addition, the model is significantly stronger in "situational understanding": sensing context, intent and nuance. This makes Gemini 3 not only more accurate but also more reliable in longer interactions, such as analyzing documents, preparing decision materials or guiding technical workflows.

CEO Sundar Pichai, in a recent tweet, shared a series of examples demonstrating this in practice. Those demonstrations underscore how far along the model is by now: tasks that a year ago were considered futuristic are now performed in no time.

1/ Gemini 3 in action, a quick🧵

- Sundar Pichai (@sundarpichai) November 18, 2025

You can give Gemini 3 anything (images, pdfs, scribbles, etc) and it will create whatever you like: an image becomes a board game, a napkin sketch transformed into a full website, a diagram could turn into an interactive lesson. pic.twitter.com/xCry35mFbW

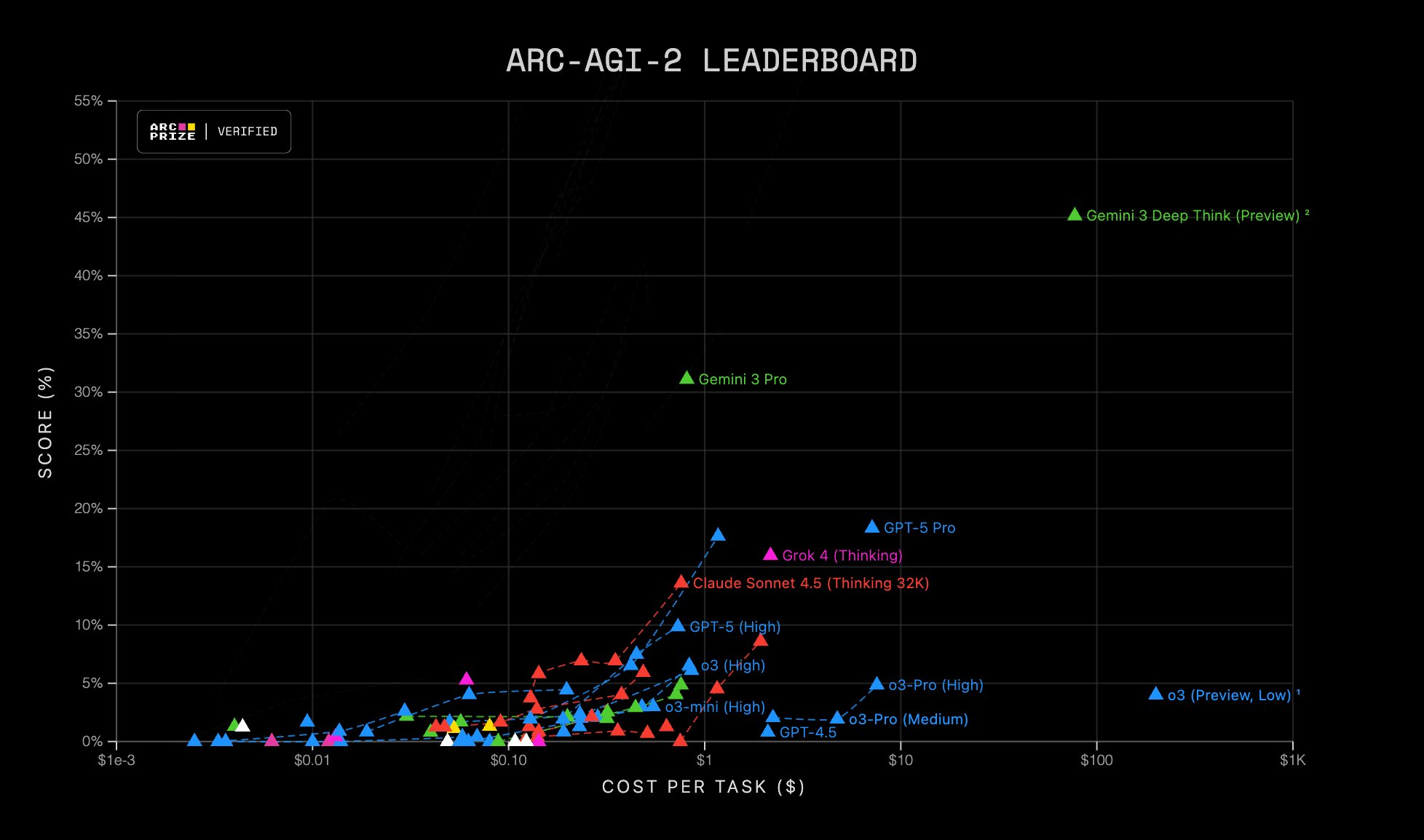

One of the most striking improvements in Gemini 3.0 is its ability to understand computer systems. According to recent benchmarks, Gemini correctly interprets about 73% of computer interactions, compared to 36% with Claude and only 3.5% with GPT. The exact testing methods are not fully public, so these figures should be interpreted with some caution. But the direction is clear: This is the first real step toward fully automated AI agents, a development that virtually every major player in the industry is working on.

In this area, Alphabet seems to have a distinct advantage. Because it owns virtually all of the underlying Internet and cloud infrastructure itself, it can train and deploy Gemini directly within its own ecosystems. In contrast, competitors must build on top of Google's infrastructure, which will make the development of advanced AI agents significantly more complex and slower.

This rapid progress obviously comes with a price tag. We see that reflected in the new pricing structure for Gemini 3 Pro. Google's input tokens have become 60% more expensive than with Gemini 2.5, and output tokens 20%. For developers running complex workloads, this means that the cost goes up substantially. It is estimated that the new model is 8-16 times more expensive than GPT for input and 6-9 times more expensive for output.

Still, the latest price/performance chart shows well why Alphabet dared to take this step. Gemini 3 Pro stands completely apart from the rest of the market and delivers a much higher score per task than competing models, even when you factor in the higher cost. Where most models linger around the 0-10% score, Gemini 3 Pro shows performance heading toward 30-50%.

On the one hand, the new pricing reflects Alphabet's confidence in the model's quality and distinctiveness. The implicit message is that performance is strong enough to justify higher rates without hurting demand. On the other hand, one wonders if Google could not also have chosen a period of extremely low pricing to build market share even faster and further weaken competitors with limited cash flow.

Since we have no insight into the operational cost per user, it remains speculation as to exactly what strategy is being pursued. What is clear is that the LLM market is still in its early stages. Therefore, we would not be surprised if large providers deliberately keep their margins low for the time being to build scale and market share, and only raise prices structurally when the market is more mature.

Alphabet is currently trading on the New York Stock Exchange at USD 297.41 per A share.

Receive weekly insights in your inbox

Exclusive analyses and updates on family holdings and global market developments.

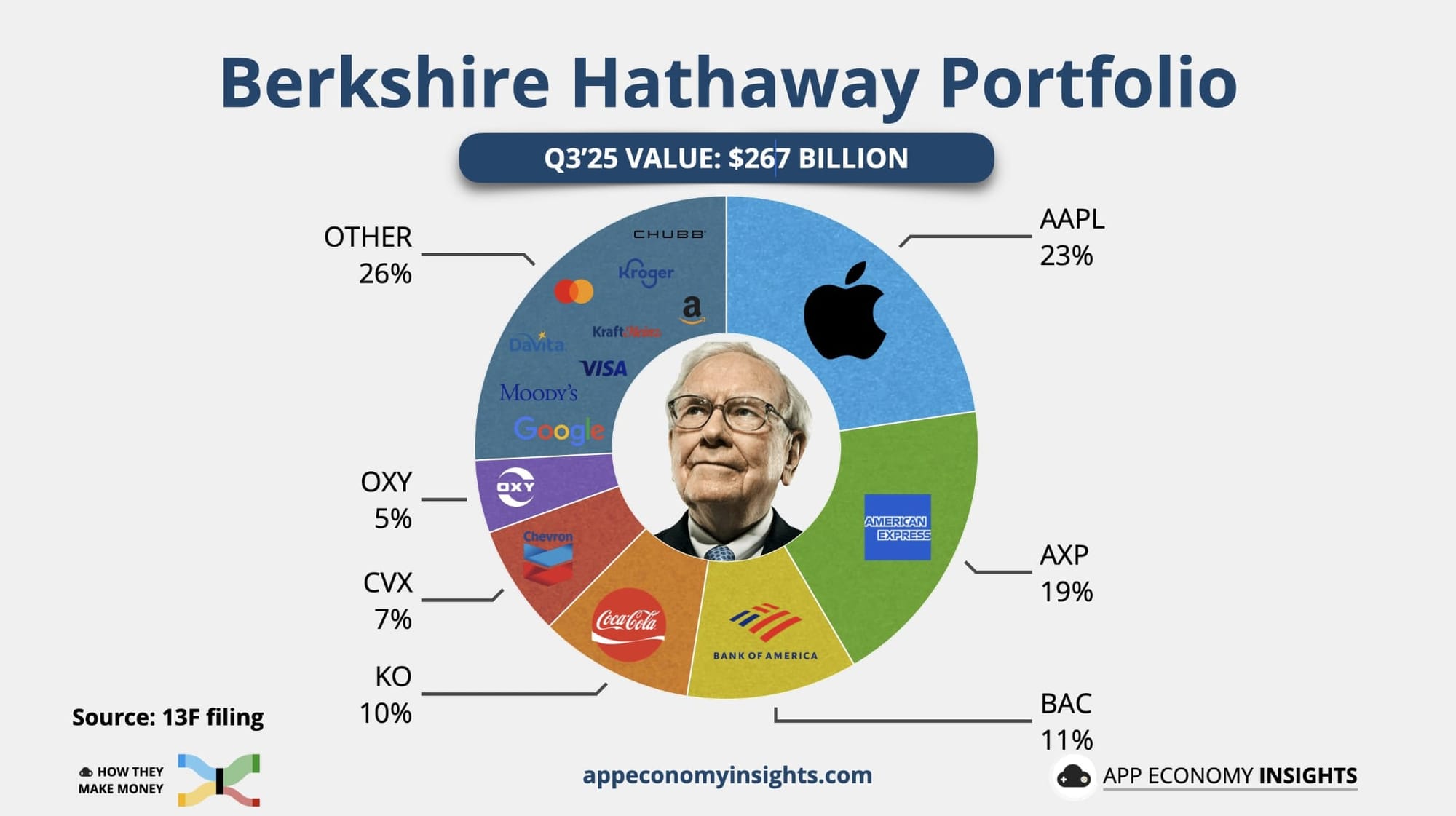

Berkshire makes surprising investment in Alphabet

US investment holding company Berkshire Hathaway (New York: BRK-B) disclosed its equity portfolio transactions last week. The SEC, financial markets regulator, requires companies with investment portfolios of more than US$100 million to disclose their positions in US stocks on a quarterly basis.

The further reduction of the position in Apple fits the pattern we have seen for several quarters. Berkshire's portfolio managers Warren Buffett, Todd Combs and Ted Weschler have sharply reduced the position due to a sharp rise in valuation. Combs and Weschler both manage a portion of the Berkshire portfolio completely independent of Buffett.

Combs and Weschler were ultimately the ones who convinced Buffett to allow technology into the portfolio, despite his repeated statement that the sector was outside his circle of competence. They were also the first within Berkshire to open positions in Apple, Amazon, NuBank, PayTM and data company Snowflake. They are probably also responsible for investments in serial acquirers such as HEICO and Pool Corp.

A notable new appearance in Berkshire's portfolio concerns its position in technology holding company Alphabet. With nearly 18 million A shares, worth USD 4.3 billion at the end of September, Alphabet immediately enters Berkshire's top 10 portfolio. What we don't know is when Berkshire took position. Chances are that Berkshire entered below the USD 180 share price as recently as July. Meanwhile, the share price has passed USD 290 and this stake is already worth about USD 5.2 billion.

Buffett regularly spoke highly of Alphabet and its search engine Google in the past, and on several occasions indicated that it was a mistake not to buy shares. Perhaps the "Oracle from Omaha" or one of his lieutenants Combs/Weschler has been reading Tresor Capital's newsletter. We took advantage of the uncertainty and associated decline in the stock price earlier this year by taking a sizeable position in several steps in this promising investment holding company with an average purchase price of under USD 180. We also discussed this during the Tresor Capital relationship day, a report of which you can read back via the link below.

In view of Buffett's upcoming resignation, it will be interesting to see if new top executive Greg Abel will give even more autonomy to Combs and Weschler next year. With more than USD 350 billion, it is safe to speak of a serious war chest. Since technology, serial acquirers and other interesting sectors do fall within their circle of competence, it seems they have a larger investment universe than Buffett. So perhaps we can soon expect a little more emphasis on the word "investment" versus "holding," which has dominated in recent years.

Last letter to shareholders as CEO

Traditionally, Buffett published a letter to shareholders as part of Thanksgiving and his annual donations to his children's charities. In this letter, Buffett confirms that he will step down as CEO at the end of this year and hand over his responsibilities to Greg Abel. He expresses his complete confidence in Abel, stating that there is no CEO, management consultant or academic to whom he would rather entrust the management of his own assets and those of shareholders. Abel is described as a tireless worker and an honest communicator who now understands certain aspects of the portfolio, such as the insurance business, better than Buffett himself.

The investment company is structured so that its survival remains an asset to the U.S. economy. Buffett estimates that Berkshire Hathaway will need only five or six board chairmen over the next century, provided it selects leaders who are not out for personal enrichment or dynasty-building. Although the company's size makes it more difficult to achieve exceptional returns, Berkshire remains less likely to suffer a fatal disaster than any other company. Still, Berkshire is not immune to fluctuations because even under current management, the stock has already experienced three falls of about 50%.

As a closing message, Warren Buffett ultimately addresses not the balance sheet, but the behavioral psychology of the investor by strongly advising not to dwell too long on mistakes made. He says it is essential to simply learn from missteps and look forward again, selecting the right heroes to emulate is crucial. Here he points specifically to Tom Murphy as the ultimate example of a brilliant manager and person of integrity, because true greatness is not determined by accumulating wealth or publicity. Buffett refers to the lesson of Alfred Nobel who read his own obituary and turned his life around, and argues that you must determine now what will be written about you later in order to then live a life that justifies that text.

Berkshire Hathaway is currently trading on the New York Stock Exchange at USD 506.22 per B share.

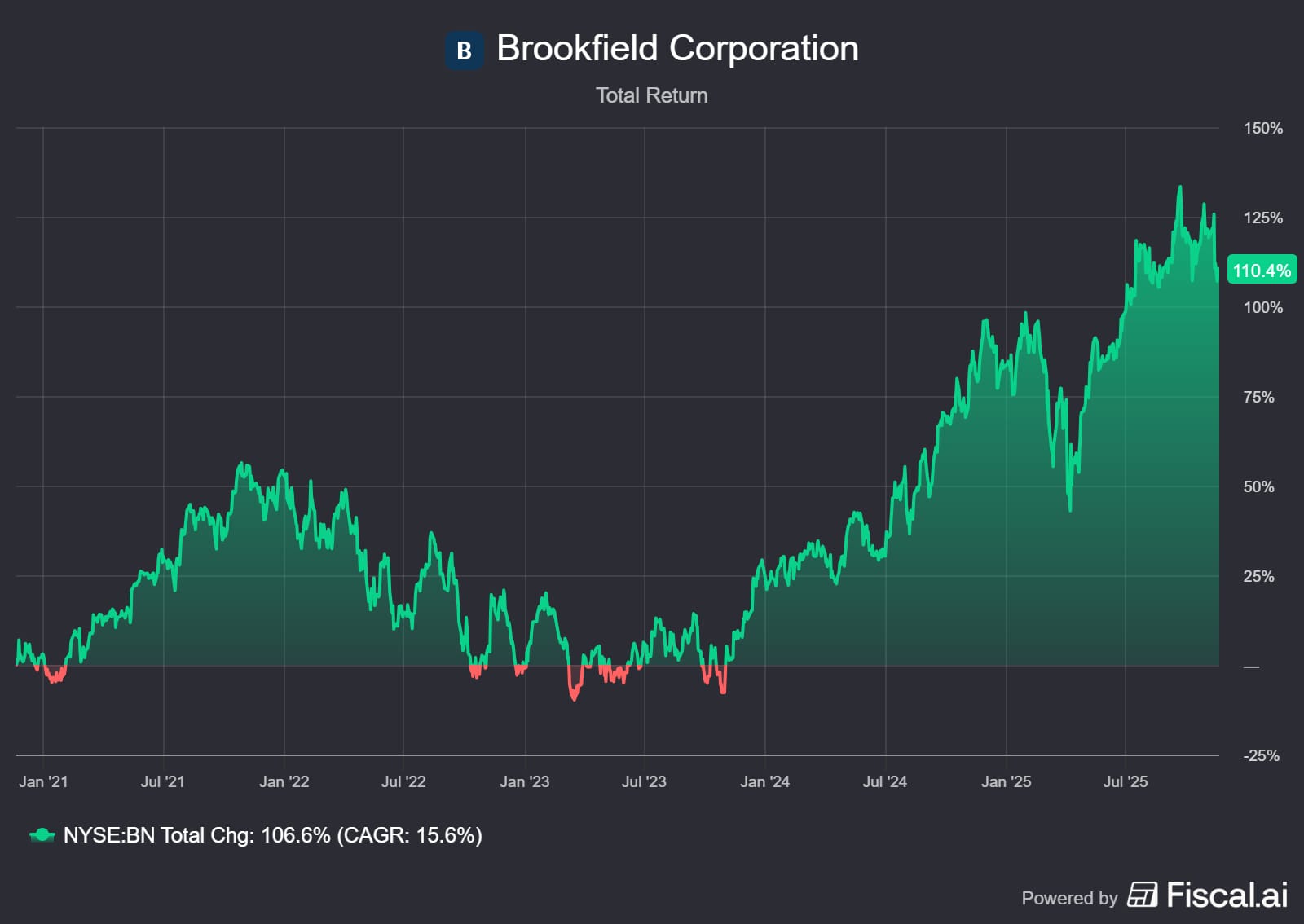

Brookfield's compounding flywheel spins at full speed

Canadian investment holding company Brookfield Corporation (New York: BN) published strong second-quarter earnings earlier this month. It also published top executive Bruce Flatt's letter to shareholders.

The numbers

First, the focus on the quarterly results. These reaffirm the strength of the business model, where capital allocation and operational expertise come together to create long-term shareholder value. To correctly assess Brookfield's performance, we look not primarily at net earnings, but at Distributable Earnings.

What are distributable earnings and realizations?

Distributable Earnings (DE) refers to the distributable profits generated by the investment holding company from its various activities. It represents the cash flow available to distribute to shareholders through dividends or share repurchases, or to reinvest in the company. Unlike standard accounting profit, this measure is not obscured by non-cash items such as depreciation on real estate and infrastructure, which in reality often actually increase in value.

A crucial part of this profit measure is what are known as realizations. These are the gains that are actually cashed in when an investment such as a wind farm or office building is sold at a profit. Unlike unrealized paper appreciation, when this money is sold, it flows directly into the treasury, making it available for reinvestment. Realizations are thus the ultimate proof that Brookfield's internal valuations are actually paid for by the market.

In the third quarter of 2025, distributable earnings before realizations rose to USD 1.33 billion, up 6% from USD 1.26 billion in the same quarter last year. Per share, this amounts to USD 0.56, also an increase of 6%. Including realized gains from asset sales, total distributable earnings for the quarter were USD 1.5 billion or USD 0.63 per share.

It is noteworthy that this earnings per share exceeded analysts' expectations, which averaged USD 0.60. This positive surprise was mainly driven by the higher than expected realized carried interest (performance fee) which came to USD 154 million against an expectation of USD 131 million. Moreover, there is still a lot of value in the pipeline as accumulated but not yet realized carried interest has now reached USD 11.5 billion. In the future, this is expected to come in as cash at the holding company level, after which Brookfield can reinvest or distribute it.

| Segment | Q3 2024 (USD) | Q3 2025 (USD) |

| Wealth Management | 694 million | 687 million |

| Wealth Solutions. | 364 million | 420 million |

| Operational Activities | 356 million | 366 million |

| Other & Operating expenses | (155) million | (140) million |

| Total (before realizations) | 1,259 million | 1.333 million |

The publicly traded asset management arm, in which Brookfield Corporation has a controlling stake, experienced its best quarter for fundraising in three years. As much as USD 30 billion in new capital was raised, thanks in part to strong interest in energy transition and infrastructure funds. As a result, fee-related earnings, the highly stable and valuable income stream from management fees, rose 17% to a record USD 754 million. Again, Brookfield outperformed market expectations, as analysts were counting on USD 672 million in earnings from this arm while USD 687 million was realized.

In addition, the Wealth Solutions division, which focuses on pension and insurance solutions, grew very convincingly. The profit contribution of this branch increased by 15% to USD 420 million. Brookfield now has USD 139 billion in insurance assets. During the explanation of the figures, management provided insight into the profitability of this branch. The spread, or the difference between the return on investments and the cost of liabilities, was 1.65% this quarter. Although the long-term target is around 2%, this temporary decline is a sign of strength, not weakness. Indeed, management is deliberately choosing to remain disciplined and hold a significant portion of funds in cash, waiting for the right opportunities in private credit and real assets. Brookfield refuses to chase forced returns, knowing that patience will eventually be rewarded with superior returns. The goal remains unchanged to double its insurance assets to USD 350 billion over the next five years.

Solidly stocked war chest

One of the most impressive figures from the quarterly report is the amount of available capital. At the end of the third quarter, Brookfield had a record amount of liquidity of USD 178 billion. This huge war chest consists of cash, financial assets and unsolicited capital from investors. It allows management to strike quickly and on a large scale when attractive investment opportunities arise.

In addition to investing in new opportunities, management is not forgetting its own shareholders. In the third quarter, another USD 42 million worth of treasury shares were repurchased. This brings total share repurchases in the first nine months of 2025 to over USD 905 million. This is a clear signal that management still views treasury shares as undervalued relative to intrinsic value. To illustrate: Brookfield is currently trading at about 17x distributable earnings (excluding realizations).

In the past quarter, Brookfield also showed how it is putting capital to work for growth. For example, it announced that it is acquiring the remaining 26% of Oaktree Capital Management, fully integrating the credit business within the group. Partnerships were also formed in the technology sector, including a deal with Bloom Energy to power data centers and a partnership with the U.S. government through Westinghouse to build new nuclear power plants. CEO Bruce Flatt illustrated the enormous scale of this project by stating that the capacity of this USD 80 billion investment is equivalent to the power supply for the entire state of Utah.

Real estate and the divergence in the market

We are also seeing positive signs in the real estate portfolio that are at odds with the general and often negative market sentiment surrounding commercial real estate. Brookfield is benefiting from the flight to quality currently visible in the market. The occupancy rate of the so-called super core portfolio remained extremely high at 96%, underscoring the continued demand for assets of the highest quality.

Concrete evidence of this was provided by Nick Goodman in the conference call, who reported that Canary Wharf in London is heading for its best leasing year in a decade. The leasing pipeline is stronger than it has been in years. This confirms Brookfield's investment case that there is a huge divergence between aging offices that are struggling and modern "trophy assets" that are actually thriving. In addition, the company managed to complete a USD 1.9 billion refinancing for a luxury resort in the Bahamas and refinanced two large office properties in New York. This shows that the capital markets are wide open to prime real estate.

Bruce Flatt's view: why real assets are the winners of the next decade

In addition to the quarterly numbers, CEO Bruce Flatt's cover letter traditionally offers a deeper look into Brookfield Corporation's long-term strategy. Where the numbers tell the story of the past quarter, Flatt outlines the playing field for the next decade.

The unsustainable debt mountain and the three ways out

Flatt devotes a significant portion of his letter to today's macroeconomic realities. He notes that global government debt is creeping toward 100% of GDP. In fact, in the United States, the figure is already around 125%, which is double the pre-financial crisis level. The cost of financing this debt has nearly doubled since 2020, while real economic growth in the developed world has slowed to less than 2% per year. This is an unsustainable situation that Flatt says can only be solved in three ways.

The first and most constructive path is a period of accelerated economic growth that outpaces debt growth. Innovations such as artificial intelligence could drive productivity such that debt ratios fall naturally. The second path is austerity. However, Flatt dryly notes that political enthusiasm for austerity has declined dramatically in most of the developed world, making fiscal discipline an unlikely scenario.

This leaves the third option as the most likely outcome: financial repression. Here, policymakers choose to keep interest rates quietly below inflation levels. We are already seeing this dynamic emerging worldwide, with central banks using their balance sheets to keep debt levels manageable. For savers, this is disastrous as purchasing power evaporates, but for the owner of real assets, this is the ideal scenario. Indeed, assets such as infrastructure, real estate and power plants benefit directly from inflation through indexed income, while the real value of the debt with which they are financed falls. Flatt states unequivocally that in this climate, an allocation to real assets is essential for any portfolio.

The physical backbone of tech giants

Another prominent theme in the shareholder letter is Brookfield's role as a facilitator of the AI revolution. Flatt emphasizes that investors often focus on the chips and software but forget that this technology requires massive physical infrastructure. The demand for electricity and data centers is growing exponentially. This is where Brookfield strategically positions itself as the indispensable partner for the world's largest technology companies desperate for stable and green power.

The letter makes explicit reference to the unique position acquired by subsidiary Brookfield Renewable (BEP). With a development pipeline of more than 200 gigawatts and a leadership position in technologies that provide baseload power, such as hydro and nuclear, Brookfield has become the partner of choice. Flatt specifically mentions recent milestones: a groundbreaking hydropower deal with Google that followed a similar deal with Microsoft that focused primarily on wind and solar power. These collaborations with Google and Microsoft underscore that Brookfield is not just a supplier, but a strategic ally in the global AI race.

Compute power as the new electricity

In addition to power, Brookfield is now moving into the chips themselves with the announcement of a groundbreaking USD 100 billion program in partnership with chip giant Nvidia and the Kuwait Investment Authority. With this initiative, computing power, or "compute," is no longer seen as just hardware but as a new infrastructure category similar to power grids or toll roads.

The program will be anchored by the new Brookfield Artificial Intelligence Infrastructure Fund, which will launch with a target of USD 10 billion in equity. Brookfield argues that intelligence is becoming in this era what electricity was in the industrial era: a fundamental utility for the global economy. Under the name "Radiant," Brookfield is also launching a new AI cloud platform. Its ambition is to fully integrate capital, real estate, power and software. In doing so, Brookfield is starting from a position of power with thousands of GPUs already under contract and several gigawatts of power capacity on its balance sheet. You can see an explanation from Nvidia top executive Jensen Huang in the video above.

Conclusion: a proven recipe for the next decade

In a world burdened by unsustainable debt and facing financial repression, it is precisely Brookfield's physical assets that provide the ultimate protection and value creation. Management expresses the expectation that distributable earnings could grow by 25% per year over the next five years. This is driven by secular trends such as the huge energy needs of AI, the aging population that calls for better retirement products and the recovery of real estate markets. With a strong balance sheet, diverse revenue streams and a proven track record of 19% annual returns over the past 30 years, Brookfield remains well positioned to continue its compounding machine.

Brookfield Corporation is currently trading on the New York Stock Exchange at USD 44.57 per share.

Receive weekly insights in your inbox

Exclusive analyses and updates on family holdings and global market developments.

Would you like more information about our services? Please feel free to contact us.

Contact us

Disclaimer:

No rights can be derived from this publication. This is a publication of Tresor Capital. Reproduction of this document, or parts thereof, by third parties is only permitted after written permission and with reference to the source, Tresor Capital.

This publication has been prepared by Tresor Capital with the utmost care. The information is intended to be general in nature and does not focus on your individual situation. The information should therefore expressly not be regarded as advice, an offer or proposal to purchase or trade investment products and/or purchase investment services nor as investment advice. The authors, Tresor Capital and/or its employees may hold position in the securities discussed, for their own account or for their clients.

You should carefully consider the risks before you begin investing. The value of your investments may fluctuate. Past performance is no guarantee of future results. You may lose all or part of your investment. Tresor Capital disclaims any liability for any imperfections or inaccuracies. This information is solely indicative and subject to change.

Read the full disclaimer at tresorcapitalnieuws.nl/disclaimer .