Family Holdings #48 - MBB reveals its joker and Prosus steps out of Tencent's shadow

This week's topics:

KKR benefits from Japan's increasing openness to private equity and plays a key role in modernizing Japan's capital market. With the Ownership Works-model, in which employees become co-owners, KKR responds perfectly to the Japanese paradox of employees who typically stay with the same employer for years but feel remarkably uninvolved in their work.

Prosus showed in its half-year results that the broader portfolio is starting to contribute more and more strongly, despite Tencent still accounting for about 80% of NAV. Thanks to commercial synergies, the holding company manages to increase revenue per user and successfully integrate new categories. At the same time, operational improvements are driving sharp increases in margins and free cash flow, demonstrating Prosus is slowly but surely moving away from its role as a mere Tencent proxy.

Judges Scientific, one of the U.K.'s most high quality serial acquirers, announced a major board change this week. Founder and CEO David Cicurel will step down from his position in February 2026 and become Non-Executive Chair. We visited the company in 2022 and take a brief look back.

In Brief:

Alphabet (New York: GOOGL) saw its share price rebound solidly this week after it was announced that the company is in talks with Meta about a large-scale deal in which Google would provide several billion dollars worth of TPU capacity for deployment in Meta's data centers starting in 2027. In addition, Meta would like to lease chips through Google Cloud as early as next year. While neither company has officially confirmed this, it suggests that major players are actively looking for alternatives outside of Nvidia to further scale their AI capabilities, with Google's TPU architecture currently seeming the most obvious alternative.

Brookfield (New York: BN), along with Reliance Industries and Digital Realty, is investing $11 billion in the southern Indian state of Andhra Pradesh through a joint joint venture. The goal is to develop 1 gigawatt of AI data center capacity in the region.

KKR (New York: KKR) becomes the new majority shareholder of Rotterdam-based IT company Techone, which is being sold by investor Nedvest at a valuation of €600 million. Techone serves 35,000 SME customers, has 1,000+ employees, nearly 20 offices and achieved €156 million in revenue in 2024. The company provides digital workplace solutions around Microsoft, including cybersecurity and networking services, and has made 57 acquisitions in recent years.

Lifco (Stockholm: LIFCO-B) has signed an agreement to acquire all the shares of UK-based DB Orthodontics Ltd. DB Orthodontics manufactures and sells orthodontic equipment to dental professionals in the United Kingdom and worldwide. Last fiscal year, the company achieved sales of about 8.9 million pounds and has 54 employees.

3i Group (London: III) insiders bought additional shares again this week. Two members of senior management together bought over 15,000 shares at prices around £33 per share, good for nearly £500,000.

Alphabet, Brookfield, KKR, Lifco and 3i Group are currently trading on the New York and Stockholm stock exchanges at prices of USD 317.45 (A-share), USD 47.03, USD 122.56, SEK 347.20 and GBP 31.58 per share, respectively.

| Share | YTD | 3 years* | 5 years* | 10 years* |

|---|---|---|---|---|

| Alphabet | 51,5% | 43,7% | 30,2% | 22,6% |

| Brookfield | 9,2% | 19,5% | 17,6% | 14,9% |

| KKR | -26,6% | 28,9% | 27,2% | 22,8% |

| Lifco | 14,6% | 24,6% | 19,9% | 21,7% |

| 3i Group | -13,4% | 36,1% | 28,9% | 21,8% |

Returns shown in EUR; *The annual compounded/compounded return

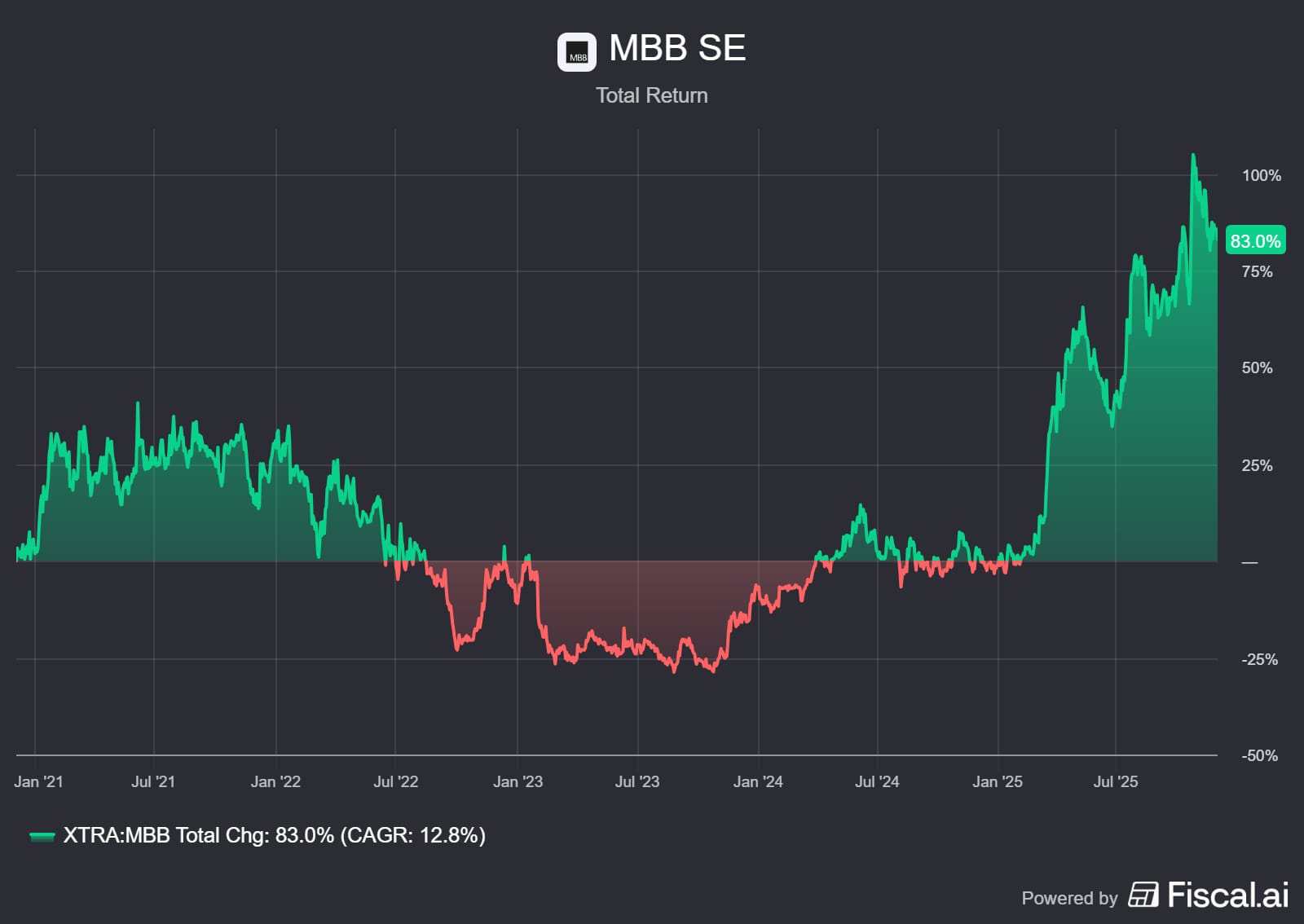

MBB SE reveals its joker

German investment holding company MBB SE (Frankfurt: MBB) published strong third-quarter figures earlier this month. Since we already dwelled extensively on the record results of subsidiary Friedrich Vorwerk in the week 43 newsletter (see link below), in this article we mainly share the new insights. Indeed, now that the final figures are in and after studying the recent interview of founder, major shareholder and CEO Christof Nesemeier with Börsen Radio Network AG, our attention shifts to the rest of the holding company. It is clear that behind the success of Vorwerk there is another gem in the MBB portfolio.

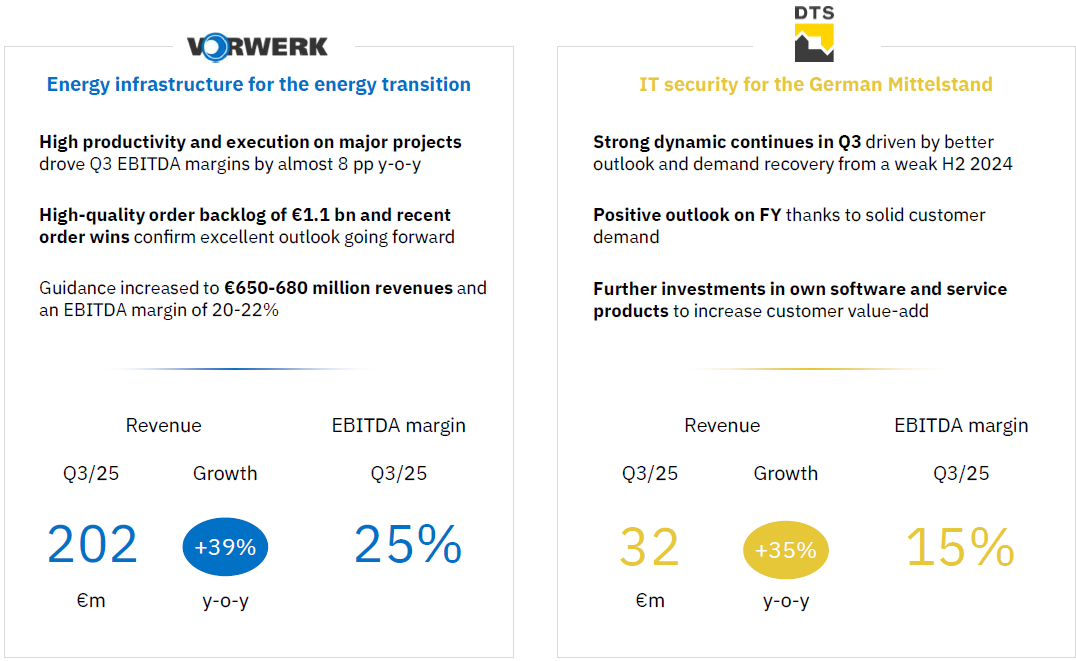

MBB celebrates its 30th anniversary this year and 2025 looks set to go into the books as one of the best years in the family holding company's history. Revenue rose 13% in the first nine months to EUR 862 million. Operating profit grew by a spectacular 54% to EUR 144 million. The driving force is undeniably Vorwerk, but there is a second growth engine operating in the shadows that Nesemeier refers to as his joker. This concerns subsidiary DTS.

The joker in the portfolio

During the interview, Nesemeier makes an interesting statement about the composition of the portfolio. Whereas the market is primarily focused on Vorwerk's explosive growth, the CEO points to DTS as the hidden value in the holding company. MBB entered DTS in 2008 when it was still a simple IT service provider. Today it has transformed into a full-fledged IT security company with proprietary software and a Security Operations Center.

The figures substantiate his enthusiasm, as DTS's sales rose 25.2% in the first nine months to EUR 90.3 million. In the third quarter, this growth even accelerated to 39%. The operating profit margin is around 15% and the company is on track for significant annual sales.

"We are now on our way to EUR 120 million annual sales, which is something we could not have dreamed of a few years ago," Nesemeier said. Although the market is relatively cautious because interesting government contracts have not yet come off this year, he says DTS is developing wonderfully. Nesemeier says that MBB has so far made hardly any acquisitions for DTS, but wants to change this to build a significant player. He sees an explosive mix emerging from the core business, financial potential and experience from previous IPOs, which could make for exciting future prospects. While he will not promise anything about an IPO at this time, MBB will aggressively develop the business.

Financial strength and capital allocation

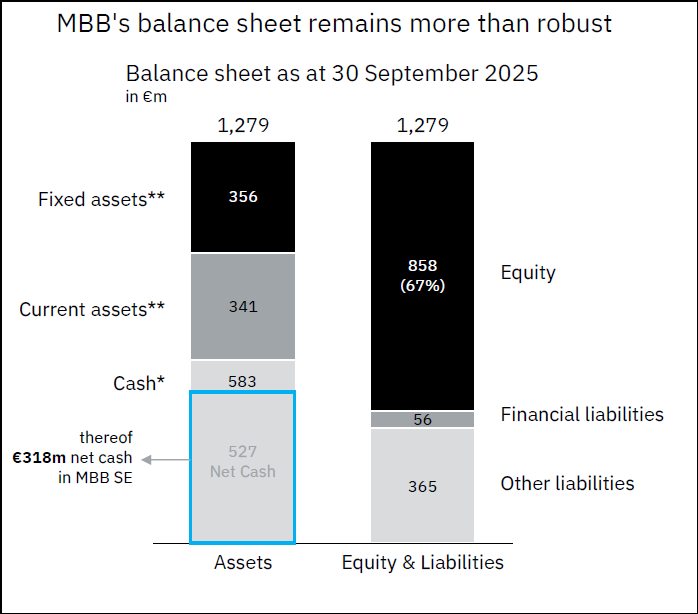

MBB's balance sheet can be summarized in one word as solid. At the group level, the holding company has a net cash position of EUR 527 million, of which EUR 318 million is directly attributable to the holding company. This huge amount of cash raises the question of what is next.

Nesemeier and CFO Torben Teichler say they are deliberately taking a completely opportunistic approach. There is no rush to buy purely for the sake of buying. MBB looks for capital-light business models, looking broadly at sectors ranging from infrastructure to aviation.

Nesemeier assumes that "in time there will certainly be another significant downturn." He speculates on a scenario where capital becomes scarce and "the money is out of the market," so that MBB, with its filled cash, can be one of the few to strike to acquire very good companies at very good prices. In this way, he intends to add, in his own words, "willingly complete opportunism," a seventh portfolio company to the group.

The M&A pipeline is well filled, and the quality of leads has improved with the changing interest rate environment. Until then, share repurchases act as an important capital allocation tool when the discount to net asset value becomes too large.

Two speeds in segments

The portfolio shows a clear picture of two speeds. On the one hand, the Service & Infrastructure branch is thriving, and on the other hand, the technology and consumer branches are facing headwinds. The Service & Infrastructure segment, which includes Vorwerk and DTS, is the absolute engine of growth with revenue increasing by almost 45% and operating profit almost doubling to EUR 118.4 million.

Vorwerk's order book remains at a very high level at EUR 1.1 billion, and new orders in hydrogen and LNG infrastructure continue to flow in. In contrast, the Technological Applications segment with Aumann and Delignit saw a 27.5% drop in sales due to restraint in the automotive industry. Despite lower volumes, Aumann managed to increase its operating profit margin to 11.8% thanks to strict cost management.

"The companies are getting slightly smaller and have to reinvent themselves in part, but that is not why these are bad companies," the CEO states. He points to what he sees as rock-solid fundamentals and full greenhouses at Aumann in particular. MBB sees it as an opportunity to redevelop these companies, with their highly skilled engineers who have worked on leading technologies.

Nesemeier does not expect a quick recovery to old times in the auto industry, but sees value in his companies' technology and cash flow generation. Also in the Consumer Goods segment, with Hanke and CT Formpolster, demand remains weak due to cautious consumer confidence and sales fell 12%. However, there is light at the end of the tunnel with a capacity expansion at Hanke that will be completed in the fourth quarter.

Valuation and conclusion

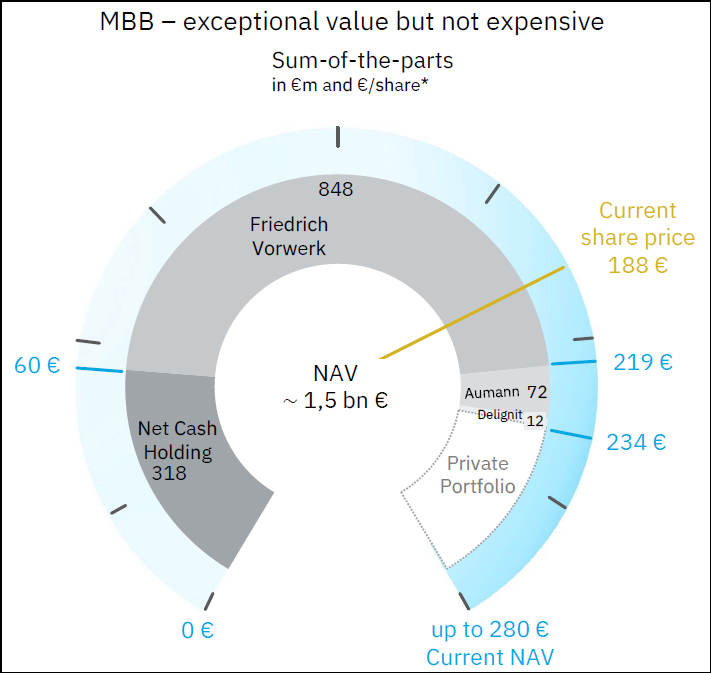

Management has raised its forecast for the full year 2025, now expecting sales between EUR 1.1 and EUR 1.2 billion with an operating profit margin of 15 to 17%. Nesemeier says that despite the increase this year, MBB shares are not expensive.

Looking at the intrinsic value, according to Nesemeier, one sees a value that is "rather towards EUR 280 on the way."

Nesemeier understands that a stock that made nearly a 100 percent return at its peak this year may look expensive. However, those looking at the intrinsic value, he says, see a value that is "more likely to be heading toward EUR 280." With a current share price around EUR 180, this implies a discount of more than 30 percent, which he says is record-setting. To back up his words, he bought significant additional shares at EUR 165 a few weeks ago.

Investors effectively get the private companies like fast-growing joker DTS for free. The combination of a proven management team that has been at the helm for 30 years, and a huge cash position for future M&A, makes MBB an interesting holding company to follow. DTS and Vorwerk provide the strong growth in operating profitability, while management patiently awaits acquisition opportunities to add a seventh leg to the holding company. The focus on capital allocation and the patience to wait for the right opportunities fits seamlessly into our philosophy.

MBB ended the trading week on the Frankfurt Stock Exchange at a price of EUR 181.40 per share.

Receive weekly insights in your inbox

Exclusive analyses and updates on family holdings and global market developments.

KKR and the evolution of the Japanese capital market

According to the Financial Times, there has been a fundamental shift in how Japan views foreign capital. Whereas in the past private equity was dismissed as "vultures" (vultures), the sector is now being embraced by both the government and the business community. American investment holding company KKR (New York: KKR) is playing a key role in this transformation and is even now introducing innovative ownership structures to the Japanese market.

The Japanese paradox and Ownership Works

An important part of KKR's strategy is the introduction of Ownership Works in Japan, the first international expansion of this initiative founded in the US. The program aims to also give employees on the floor ("blue-collar workers") shares in the companies where they work. In doing so, the investment holding company creates skin in the game right into the deepest layers of portfolio companies.

This plays into a uniquely Japanese paradox: The country has extremely low employee turnover, but employee engagement is one of the lowest in the world. According to a report by Gallup, only 7% of employees feel engaged at work, which places Japan in spot 137 out of 141 countries.

Pete Stavros, co-head of private equity at KKR, sees a huge opportunity here. By making employees co-owners, KKR wants to increase that engagement. This a proven model for value creation. KKR says that companies with this model achieved a return of 3.5 times the investment, compared with an average of 2.5 times for companies without this program. Meanwhile, Japanese companies in KKR's portfolio, such as Bushu Pharma and software developer Yayoi, have already started using Ownership Works.

Demographics and government support

The macroeconomic cocktail in Japan remains ideal for a party of KKR's scale. The country is struggling with an aging group of founders without successors and a shrinking labor market. The government actively supports initiatives such as Ownership Works, as it aligns with their policy of encouraging more household wealth growth. The presence of senior government officials at the launch of this initiative underscores how much attitudes toward private equity have changed. It also helps KKR to soften its image and be stronger in competitive bidding processes.

In addition to domestic dynamics, KKR is benefiting from geopolitical realities. With China off-limits to many Western investors, a lot of capital is flowing into Japan. KKR is using its scale and expertise to take undervalued companies off the stock market and modernize outside the public market. This is not a temporary trend, according to the Financial Times, but a necessary evolution of the Japanese economy, with both capital and employees becoming more closely involved in the success of the company. In turn, KKR shareholders are also reaping the benefits.

KKR is currently trading on the New York Stock Exchange at USD 122.65 per share.

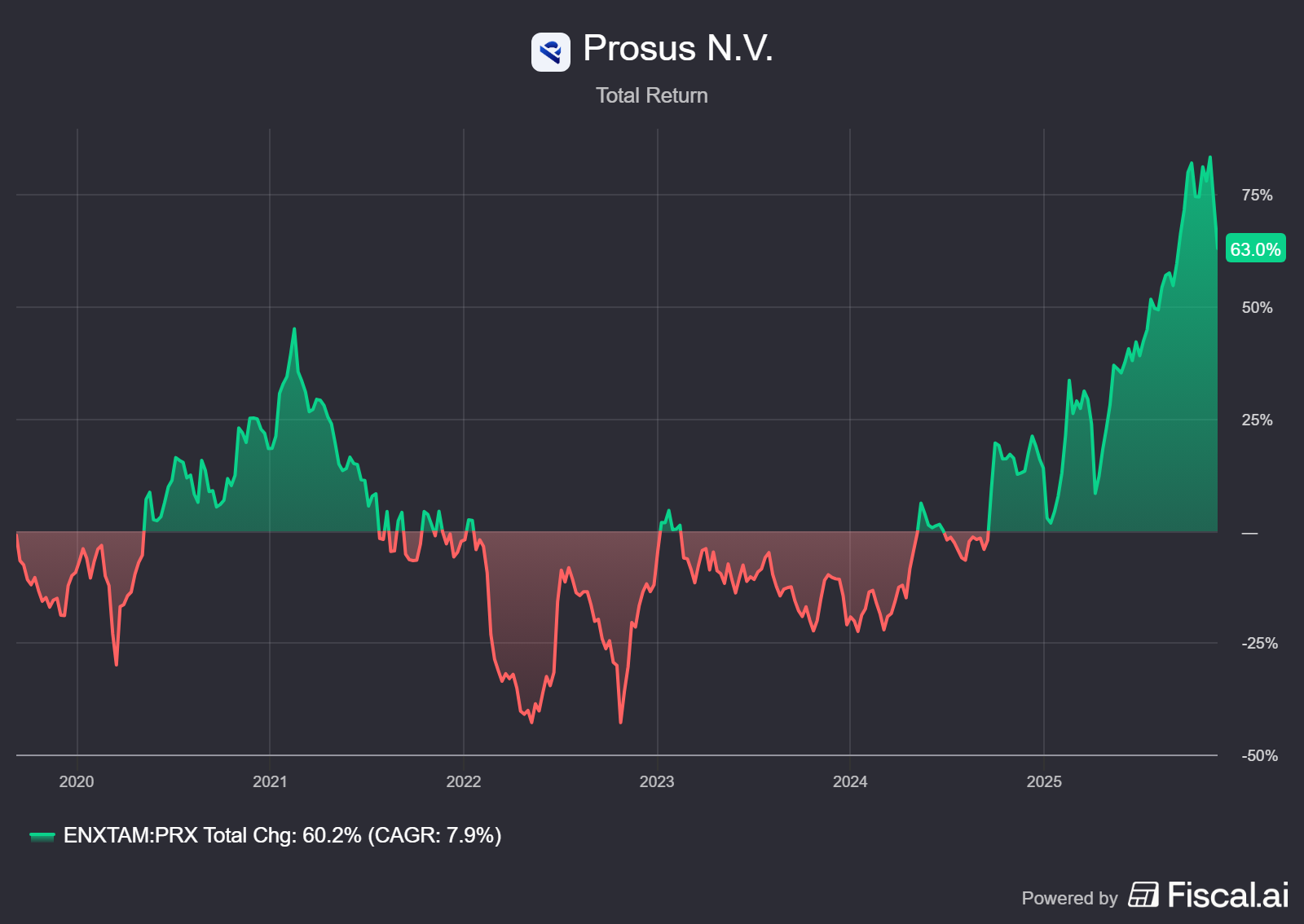

Prosus shows own strength

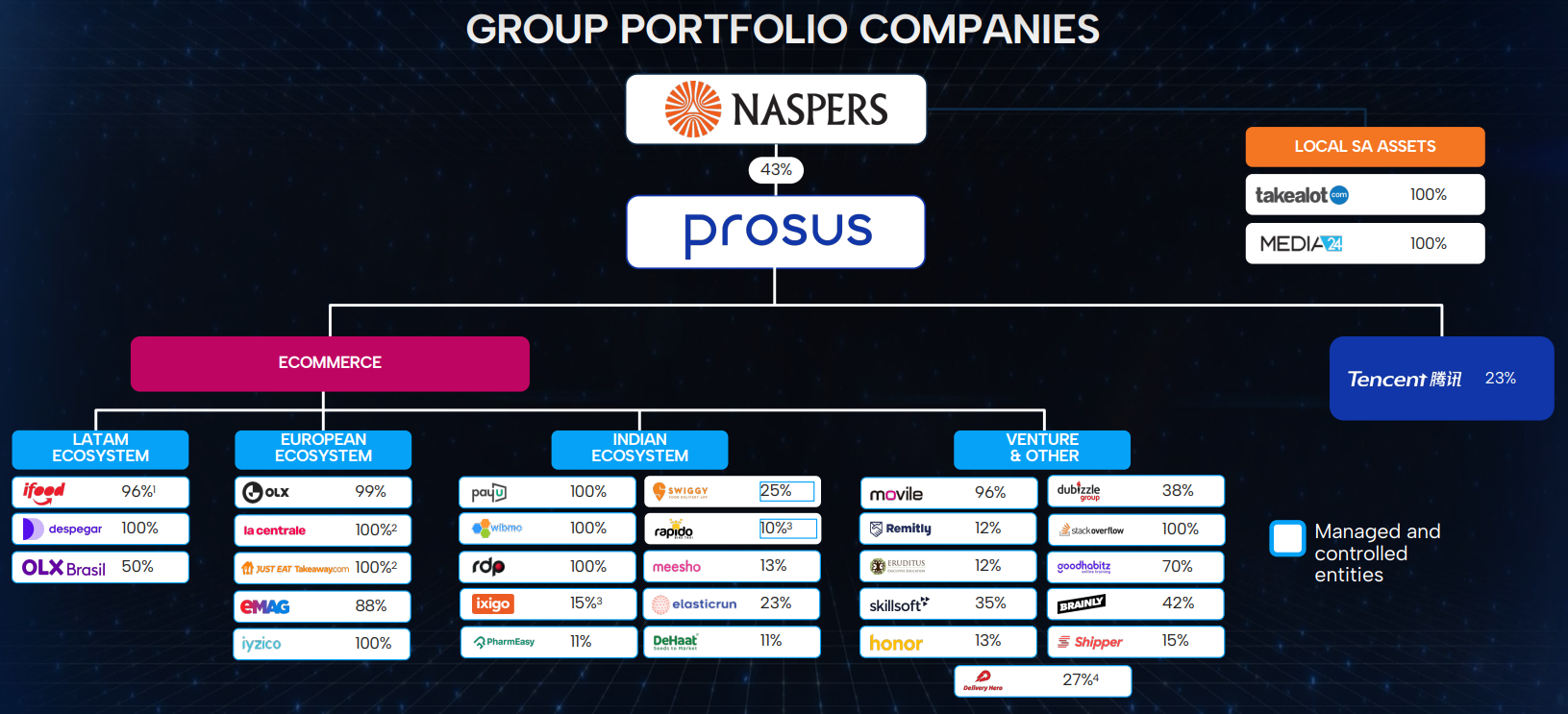

In recent months, we have increasingly featured European tech investment holding company Prosus (Amsterdam: PRX) in the In Brief segment of our newsletter. The company has been in the news regularly recently due to a series of new holdings, ranging from large strategic acquisitions to smaller technology-driven deals. Recently, CEO Fabricio Bloisi presented the results for the past six months (HY2026), a presentation in which his characteristic Brazilian flair and optimism was undiminished. Tencent still represents about 80% of Prosus' NAV, but the latest figures show that the rest of the portfolio is starting to contribute more and more emphatically.

Broadening and complementary ecosystem

Prosus now owns and manages 29 companies, mainly active in Latin America, Europe and India. With recent acquisitions such as Rapido (India, consumer tech), Advolve (Brazil, AI marketing) and the full acquisition and delisting of Just Eat Takeaway (JET) in Europe, the holding company is positioning itself increasingly emphatically in the full value chain of the digital economy.

From payment platforms to delivery services, transportation, marketplaces and marketing, Prosus now has a strategic piece of the puzzle in many markets. That broad presence creates not only economies of scale, but also mutual cross-sell and upsell opportunities. This is exactly the area in which management has been experimenting in Latin America in recent periods.

Bloisi explained that after acquiring Despegar (online travel platform), iFood leveraged its huge user base of now 70 million customers to integrate travel into the iFood ecosystem. An entirely new travel category has been launched within the app in which iFood:

- travel promotions shows,

- roll out personalized offers,

- Despegar deals integrates into the user flow.

Through discounts, vouchers, cashback promotions and loyalty points, iFood encourages its existing users to make their first booking through Despegar. Initial results suggest that this approach is working, as about 5% of Despegar's Brazilian arm's sales now come in through the iFood platform. This suggests that the combination of multiple strong B2C platforms within one region can bring clear strategic benefits.

Efficiency improvements drive cash

Prosus is placing increasing emphasis on operational efficiency, with its acquisition of Advolve playing a key role. This company brings an AI-driven marketing approach that automates ad creation, testing and optimization. According to CEO Bloisi, this is already delivering some 25% lower acquisition costs, with broad applicability across the portfolio. AI is also becoming more deeply integrated into internal processes and commercial decision-making.

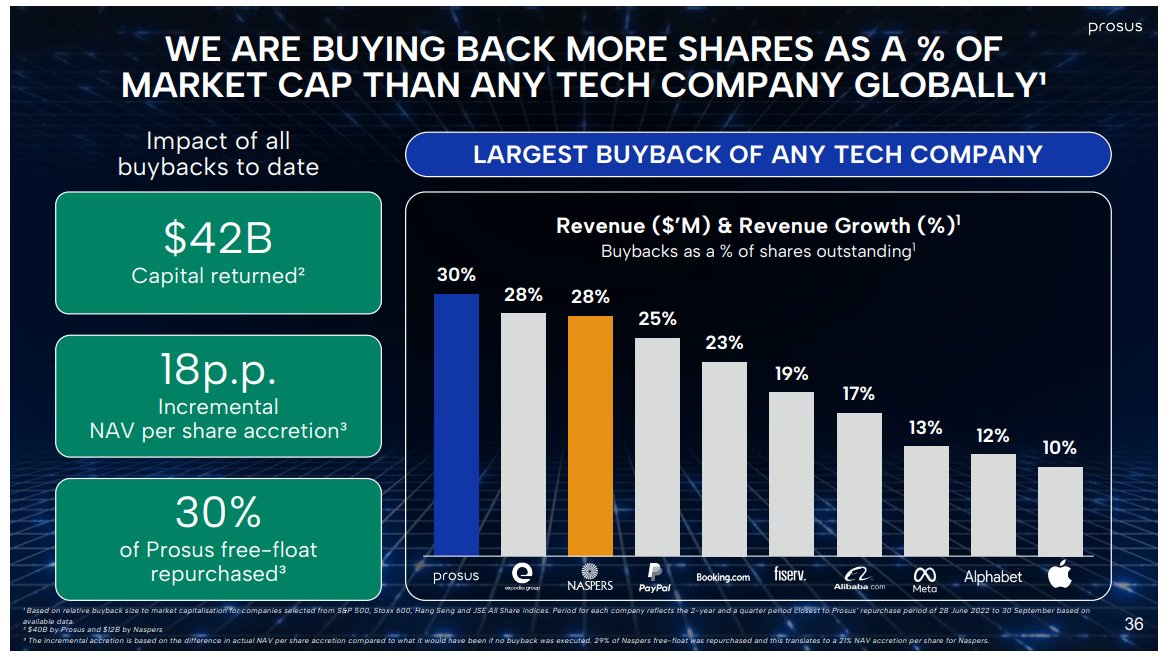

The impact is clearly visible in the numbers: revenue increased 22% (26% excluding Emag), adjusted EBITDA increased 58%, and margin jumped from 11% to 15%. Free cash flow (excluding Tencent dividends) turned around from -$873 million three years ago to +$59 million, a half-year record.

This improved efficiency also increases the scope for capital allocation. Since the start of the buyback program, Prosus and Naspers have together repurchased $42 billion of shares, reducing the free float by approximately 30%. According to management, as a result, NAV per share is about 18 percentage points higher than in a no buyback scenario, an exceptional performance, both in absolute and relative terms.

Conclusion

Prosus shows with these half-year results that it is increasingly trying to break free from its image as a Tencent proxy. While Tencent remains structurally dominant with 80% of NAV, the rest of the portfolio is visibly starting to generate value on its own. Most companies show solid growth and clear efficiencies, with Emag being the only major exception.

At the same time, management is proving that the broader strategy is starting to work. By cleverly linking platforms in the same region, as with iFood and Despegar, Prosus is increasing both the breadth of offerings and revenue per user across multiple businesses simultaneously. Moreover, those commercial synergies are now reinforced by the operational discipline the company has built over the past year and a half. The recent figures show that Prosus is capable of actually cashing in on margin improvements and implementing them broadly within its portfolio. The question now is whether the company can replicate this approach when integrating Just Eat Takeaway.

Prosus ended the trading week on the Amsterdam Stock Exchange at a price of EUR 54.26 per share.

Leadership change at Judges Scientific

Judges Scientific (London: JDG), one of the UK's highest quality serial acquirers, announced a major board change this week. Founder and CEO David Cicurel will step down as CEO effective Feb. 9, 2026, and assume the role of Non-Executive Chair. Current Business Development Director Dr. Tim Prestidge will be promoted to CEO, while Ralph Elman will move to the position of Deputy Chair.

For investors, this move marks the beginning of a new phase, but not a break with the past. Cicurel remains closely involved in the acquisition strategy, historically the core of Judges' value creation, and thus remains the intellectual center of the M&A machine he has built over the past 20 years. Under his leadership, Judges grew into a decentralized group of niche companies with high margins, strong cash flows and a track record of exceptional returns on invested capital.

Our impression of Cicurel and Judges - company visit in 2022

During our company visit to Judges in London in 2022, we got a particularly direct insight into the culture that has shaped Cicurel over two decades: down-to-earth, ethical, disciplined and deeply focused on long-term value creation. Despite the group's impressive achievements, Cicurel remained remarkably approachable; he personally poured us coffee, a detail that fit perfectly with the culture of modest excellence we also saw at the subsidiaries.

Our conversations at the time focused on supply-chain issues, currency effects, pricing power and the functioning of the acquisition pipeline. Cicurel told us then that succession had been carefully prepared. Now, three years later, that appears to be exactly the case.

Those who want to read more about that company visit and the strategic insights we gained then can find the full report here:

Receive weekly insights in your inbox

Exclusive analyses and updates on family holdings and global market developments.

Would you like more information about our services? Please feel free to contact us.

Contact us

Disclaimer:

No rights can be derived from this publication. This is a publication of Tresor Capital. Reproduction of this document, or parts thereof, by third parties is only permitted after written permission and with reference to the source, Tresor Capital.

This publication has been prepared by Tresor Capital with the utmost care. The information is intended to be general in nature and does not focus on your individual situation. The information should therefore expressly not be regarded as advice, an offer or proposal to purchase or trade investment products and/or purchase investment services nor as investment advice. The authors, Tresor Capital and/or its employees may hold position in the securities discussed, for their own account or for their clients.

You should carefully consider the risks before you begin investing. The value of your investments may fluctuate. Past performance is no guarantee of future results. You may lose all or part of your investment. Tresor Capital disclaims any liability for any imperfections or inaccuracies. This information is solely indicative and subject to change.

Read the full disclaimer at tresorcapitalnieuws.nl/disclaimer .