Family Holdings #49 - Asseco takes the first steps of the Topicus blueprint

This week's topics:

Asseco presented its figures for the first three quarters this week, which show the first tentative outlines of the Topicus/Constellation playbook. Margins are taking their first step upward, while revenue grew remarkably strongly on an organic basis. However, Topicus did not yet have a formal management role during this reporting period; the real integration will only start in October, after approval of the second tranche. This means that most of the margin improvement potential is still ahead of us. The growing backlog and possible future defense contracts could act as additional catalysts.

HeicoCEO Victor Mendelson reiterated at the recent Gabelli Aerospace & Defense Symposium why the company is performing so exceptionally well: a radical focus on free cash flow, conservative accounting, and an acquisition strategy centered on entrepreneurship and decentralized responsibility. In addition, Heico continues to build strong positions in specialized segments within aviation, defense, and aerospace. Both organic growth and recent acquisitions, such as Wencor, confirm that the proven model remains effective on a larger scale.

AlphabetCEO Sundar Pichai mentioned in a recent BBC interview that current AI investments are strongly reminiscent of the internet revolution: lots of enthusiasm and the risk of overinvestment. Nevertheless, as was the case then, he sees a lasting technological breakthrough that will significantly change the way we work and live. Alphabet is in a relatively strong position in this regard. Thanks to high cash flows and the fact that new AI infrastructure can be deployed immediately within Search, YouTube, and Cloud, the investments remain more bearable for the company than for many of its peers.

In Brief:

Constellation Software ( Toronto: CSU) was active again this week through its platform companies. Jonas acquired UK-based Mine Tech Services, a provider of mining consultancy, operational analytics, and custom software that supports more than 50 global mining operations. In addition, Lumine Group made an all-cash offer to delist Synchronoss Technologies (SNCR) from the Nasdaq at $9 per share, a premium of approximately 70% on the closing price on December 3. The transaction values SNCR at $116 million in equity value and $258 million in enterprise value. Analysts estimate that the acquisition was executed at an EV/EBITDA multiple of approximately five times expected EBITDA.

Topicus ( Toronto: TOI) announced further expansion in Scandinavia. Subsidiary TSS acquired Scalepoint, a SaaS provider for claims handling in the insurance sector. Scalepoint offers multi-tenant solutions for motor, property, and health claims, has 200 employees, and has processed more than 15 million claims to date. This is now the fourth TSS acquisition in Denmark. In addition, the Polish Topicus unit Sygnity completed the carve-out of Comarch HIS's Healthcare Information Systems business for approximately PLN 28 million. The division provides EHR, monitoring, and facility management software to more than 80 hospitals and 200 outpatient clinics, with over 30,000 daily users.

Prosus ( Amsterdam: PRX) announced this week that founder Jitse Groen will step down as CEO of Just Eat Takeaway.com on January 1, 2026. He will be succeeded by Roberto Gandolfo, currently Chairman of the Supervisory Board of JET and Head of Prosus Europe. Groen's departure marks the end of a quarter-century of entrepreneurship in which he built JET from a student room in Enschede into a global player with 60 million consumers, 362,000 partners, and €19 billion in GMV. Gandolfo, who scaled a marketplace activity at iFood from 1 million to 120 million monthly orders, will shape the next phase of growth under Prosus ownership.

Berkshire Hathaway (New York: BRK.B) has requested the STB, through its subsidiary BNSF Railway, to review the nearly 30-year-old competitive conditions surrounding Union Pacific's acquisition of Southern Pacific. According to BNSF, the promised market access has been eroded in many cases because Union Pacific has, in practice, delayed or impeded competitive access. By requesting a formal review, BNSF wants to enforce these rights and possibly tighten them. Such an outcome would give BNSF more commercial space on routes where it is currently restricted.

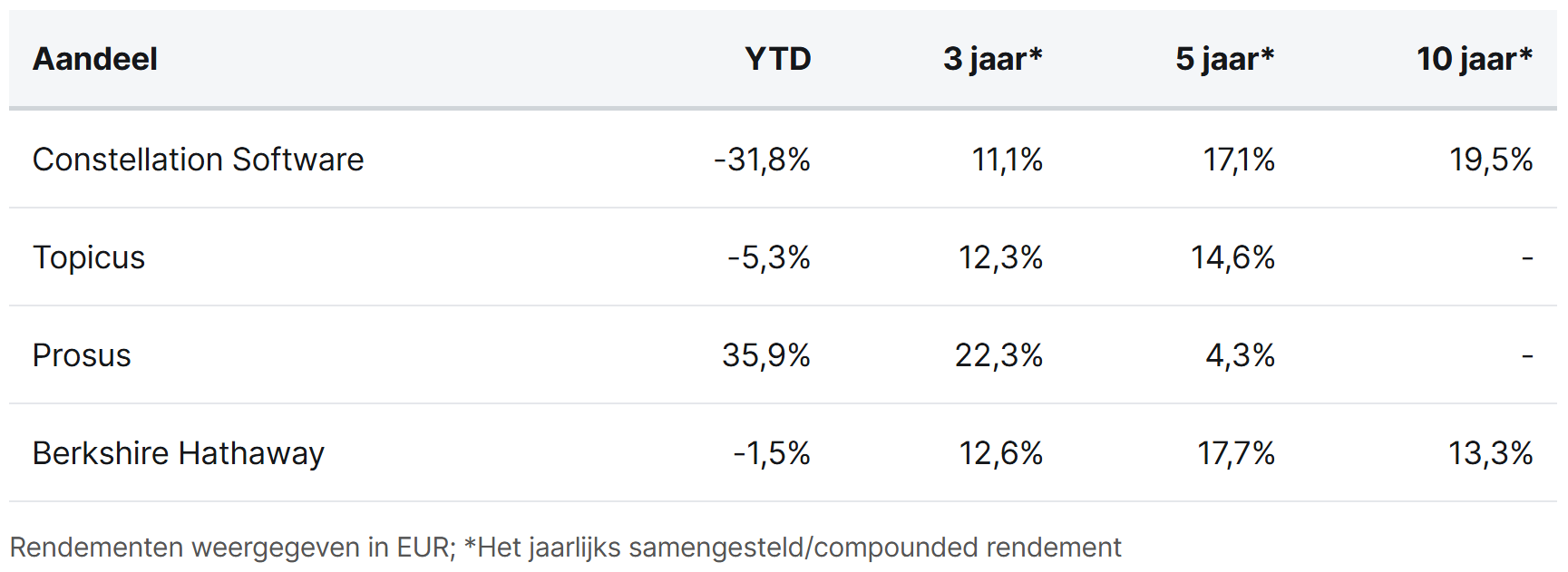

Constellation Software, Topicus, Prosus, and Berkshire Hathaway are currently trading on the Toronto, Amsterdam, and New York stock exchanges at prices of CAD 3,314.66, CAD 125.01, EUR 52.12, and USD 504.25 (B share), respectively.

1, 2, 3, Action!

Last week, Tresor Capital once again contributed to this year's 10th edition of the "Guide for the Best Investor" published by the Flemish Federation of Investors (VFB). Analyst Joep Dikken wrote an extensive analysis of 3i Group and their gold mine Action. The piece brings together our two recent articles on the company and combines strategic insights with a simple valuation analysis.

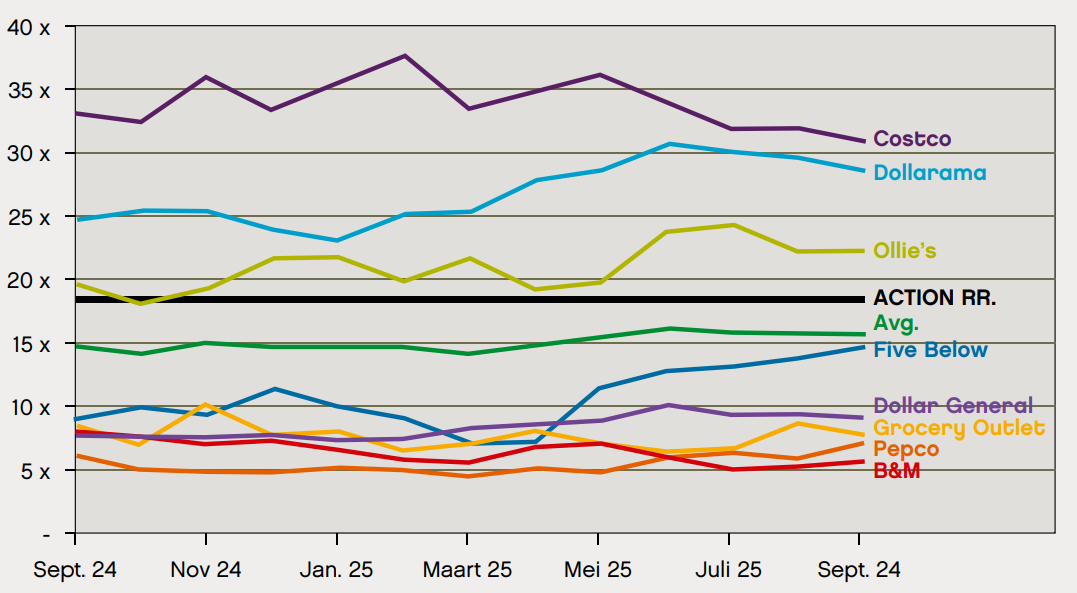

In our article, we pointed out that 3i is keeping Action's valuation remarkably cautious. For years, management has valued the chain at a multiple of 18.5x EBITDA, at the lower end of the spectrum when compared to international peers, which amounts to €46.9 billion. After all, retailers such as Costco, Dollarama, and Ollie's are structurally valued at 22× to over 30× EBITDA.

Given Action's exceptional qualities—a payback period of less than one year, a decade of structurally above-average growth, and an expansion model that has exceeded all expectations for ten years—it is likely that an IPO would lead to a significantly higher valuation than the current internal valuation. Even a conservative 25× EBITDA, still below Costco's level, already implies a value of approximately €63 billion today.

An equally realistic alternative is that Action will not go public in the coming years. In that case, 3i will probably keep the valuation deliberately conservative. But even under these cautious assumptions, a similar picture emerges: take the current 18.5× EBITDA multiple, assume moderate annual growth of 14% (10% store expansion and 4% like-for-like; historically, these figures were closer to 14% and 8% respectively) and apply a required return of 10%, you still arrive at a value of approximately €61 billion.

Whichever scenario you choose, the conclusion remains the same: the implicit value of 3i's stake in Action covers virtually the entire market value of 3i Group. The rest of the portfolio, which has been generating an IRR of at least 20% for years, is essentially free.

For those who would like to read our full analysis in the magazine:

The VFB regularly publishes comprehensive guides containing analyses of a wide range of companies. These editions bring together in-depth contributions from leading Dutch and Belgian analysts and are highly recommended for any serious investor.

3i Group PLC ended the trading week on the London Stock Exchange at a price of GBP 32.31 per share.

Receive weekly insights in your inbox

Exclusive analyses and updates on family holdings and global market developments.

Asseco takes its first steps

After postponing the publication of its figures last week due to the sale of its position in Sapiens, Asseco Poland (Warsaw: ACP) finally presented its results for the first three quarters this week. These figures essentially revolve around the application of the well-known Topicus and Constellation playbook, aimed at structural margin improvement.

Earlier this year, the head of M&A at one of Constellation's platforms summed up Asseco's investment case in a single sentence in a Speedwell podcast:

Constellation/Topicus is fairly confident that it can acquire virtually any software company and bring it to around 30% profitability, regardless of the form or size of that company.

Asseco's figures show the initial effects of the Canadian blueprint for margin improvement. It is important to emphasize that the recent reporting period runs until the end of September. During this period, Topicus only held a 10% stake and did not yet have an official management role within the company. Although there are rumors that Topicus was already exerting influence behind the scenes, the second tranche of 15% was only approved in October. Since then, the Topicus board members have officially taken their seats.

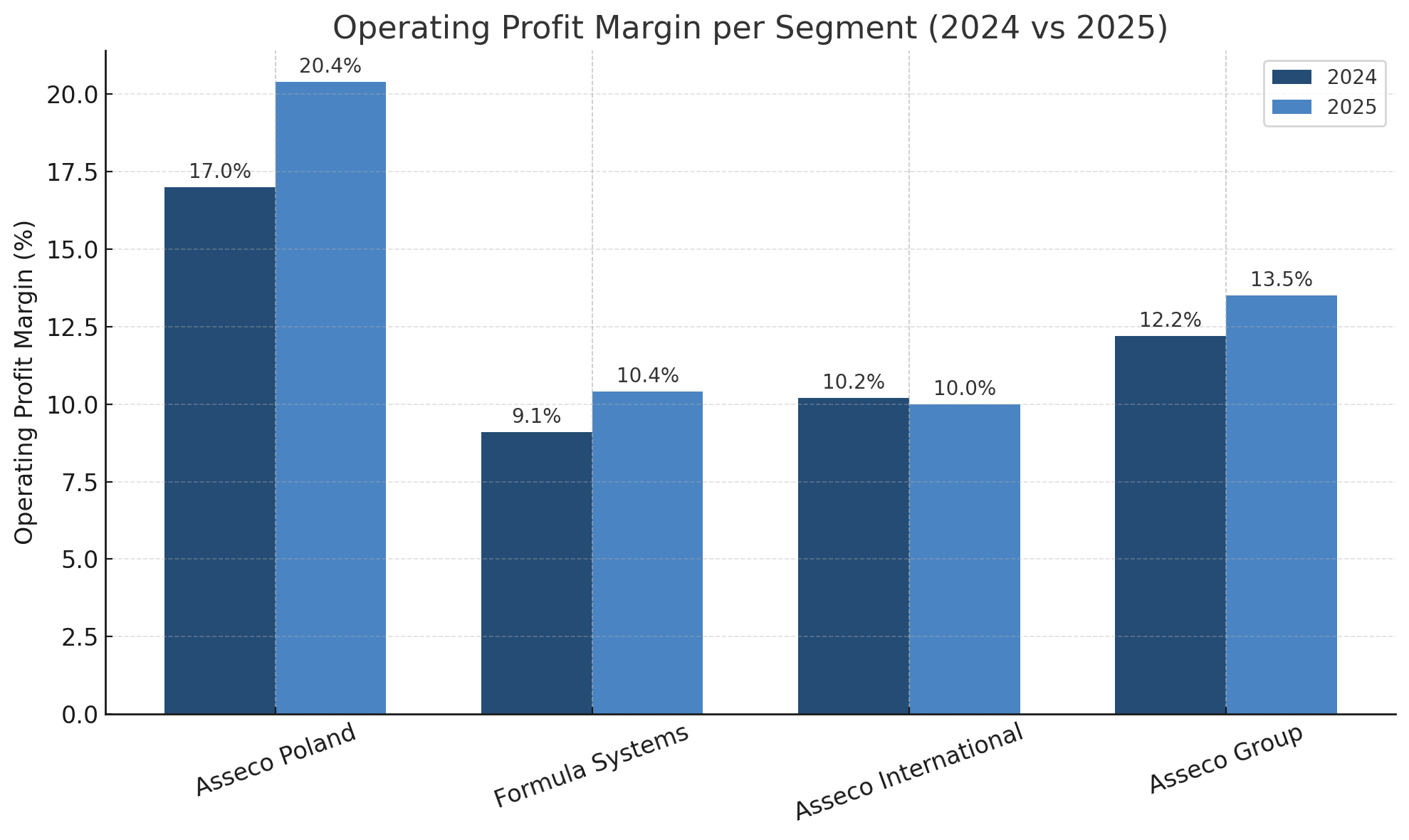

The image below shows that the Asseco Poland and Formula Systems segments in particular are achieving clear margin improvements. For the group as a whole, the operating profit margin rose from 12.2% to 13.5%, indicating broad, structural efficiency gains.

That is encouraging, but it also shows that Asseco still has considerable room for further margin improvement. If we take the 30% profitability that Constellation/Topicus claims to achieve with acquired software companies as a reference, then a large part of the value case is still potentially open.

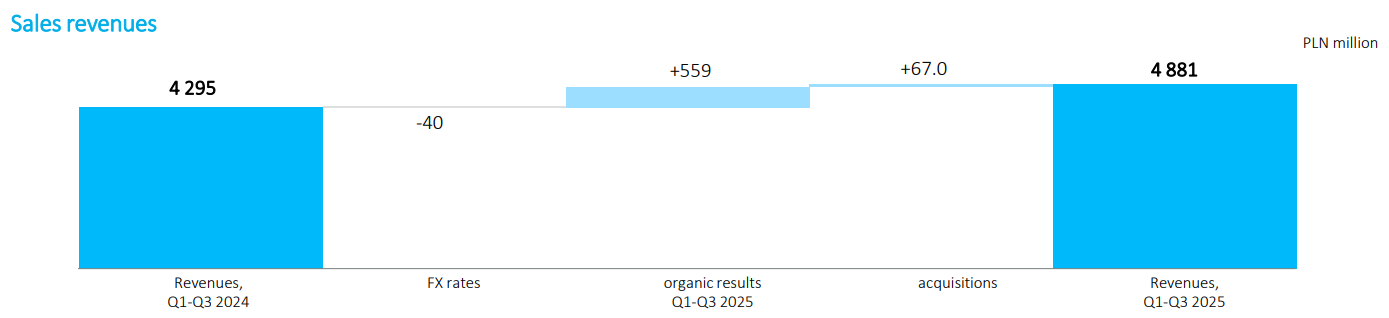

Although margin improvement is at the heart of the investment case, it is equally important that the company continues to grow strongly in terms of revenue. After adjusting for non-controlling interests, revenue rose by 13.6%. Asseco is a serial acquirer and has already completed nine acquisitions this year, but this growth appears to be almost entirely organic.

This could mean several things: more orders from new customers, successful upselling of additional services within the existing customer base, or price increases. The order backlog, which grew by 12%, supports this picture and suggests that demand for Asseco's products and services will remain strong in the future.

For those who want to learn more about Asseco, we recommend the recent in-depth analysis by analyst Ole Ensrud on The Outsiders' Corner. In this piece, he dissects Asseco's structure, historical value creation, geographical footprint, and the strategic plans for the collaboration with Topicus.

In addition, we would like to refer to our own analysis, in which we specifically discuss the broader Polish economic landscape. In it, we show why Asseco, as the country's second-largest cloud infrastructure player with deep roots in key sectors, is perfectly positioned to benefit from the strong, structural growth of the Polish economy.

Conclusion:

The investment case at Asseco has been cautiously set in motion: the first signs of margin improvement are visible, but the real work needs to be done in the coming quarters and years. Now that the second tranche has been approved and the Topicus board members have officially joined, the Constellation playbook can really be rolled out. If Topicus manages to make the same impact as it did at Sygnity, there is still considerable potential for improvement and value creation.

In addition, management states that the company is counting on an upturn in the defense segment. Asseco has relevant digital solutions, such as battlefield observation systems, software for uniformed services, and satellite applications, which could become popular when the Polish armed forces start new IT procurement processes. Although no major military contracts are currently in sight, this could be an additional catalyst for the coming years.

Asseco Poland ended the trading week on the Warsaw Stock Exchange at PLN 211.60 per share.

Heico: Profit is an opinion, cash is a fact

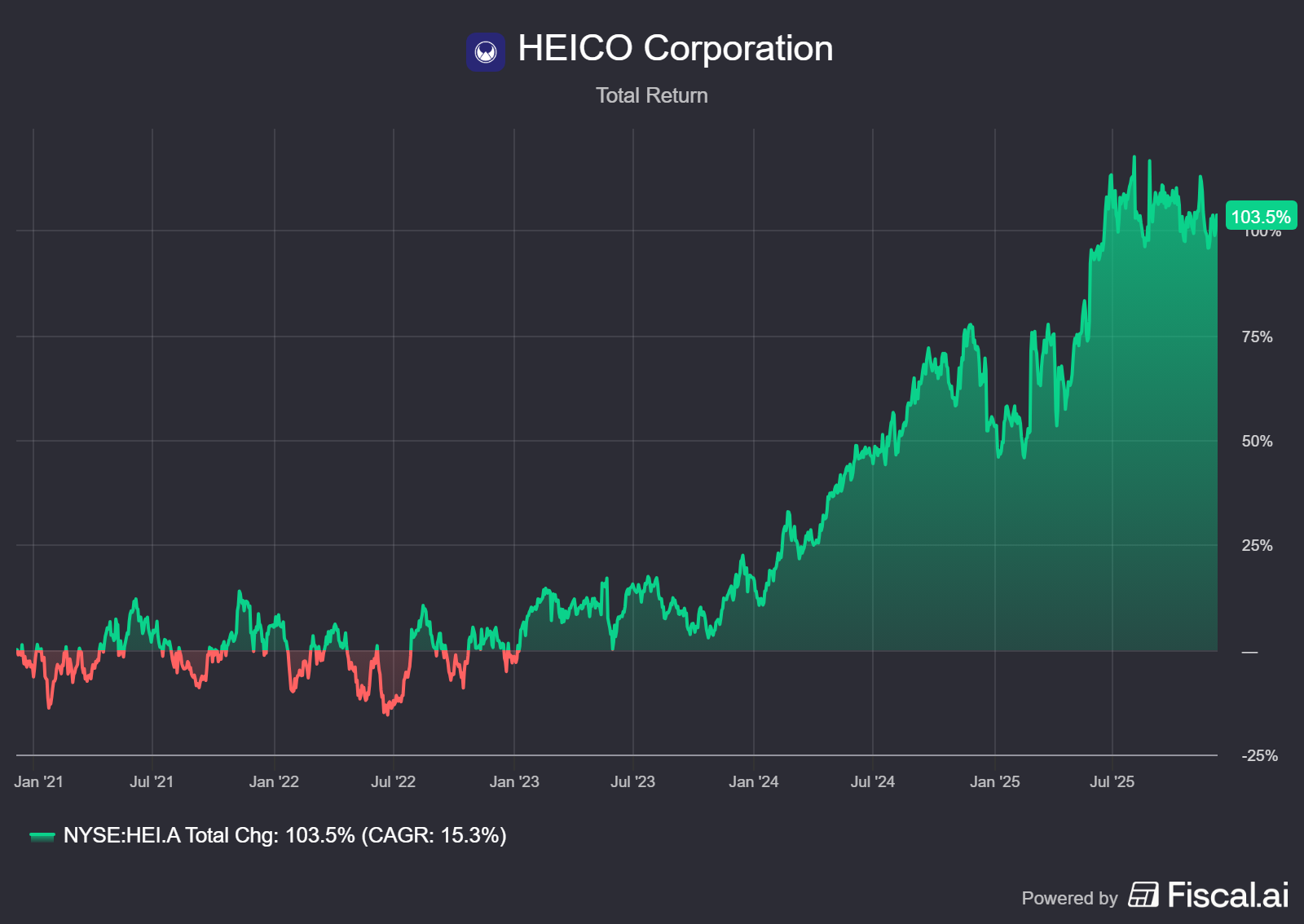

The story of American serial acquirer Heico (New York: HEI-A) is one of the most impressive compounding cases on the stock market. Since the Mendelson family took over the then small company with a market value of just USD 25 million in 1990, Heico has grown into a dominant player with an enterprise value of approximately USD 40 billion.

We recently wrote an extensive Deep Dive about the strength of Heico. The recent Gabelli Aerospace & Defense Symposium offered an excellent opportunity to take a closer look at the management's thinking. Victor Mendelson, co-president and CEO of the Electronic Technologies Group, shared insights that confirm why this company deserves a core position in our portfolio.

Cash is the only truth

Heico's financial discipline is legendary and stems from a simple lesson that Larry Mendelson instilled in his sons Eric and Victor. In business, there are only three things that matter: cash, cash, and more cash. Profits on paper are patient, and accounting constructs can obscure reality. Free cash flow, on the other hand, never lies.

This translates into conservative accounting. Heico refuses to follow the trend of 'adjusted EBITDA', whereby actual costs are eliminated to present profitability in a more favorable light. Management looks at hard EBITA and considers depreciation a necessary proxy for maintenance investments (CapEx). This focus on actual cash flows enables its management to quickly integrate acquisitions and aggressively repay debt.

The generic drug of aviation

Although we already discussed the PMA model in our previous analysis, Mendelson made a striking comparison during the symposium. He describes the Flight Support Group as the manufacturer of generic drugs for aviation. As in the pharmaceutical industry, Heico offers an alternative that is qualitatively identical or superior to the original, but at a fraction of the price. This breaks the monopoly position of the OEMs and creates a loyal customer base.

Within the Electronic Technologies Group, which Victor directly manages, the philosophy is subtly different but equally effective. Here, Heico focuses on components that he describes as products that you don't fly away in, but without which you can't get off the ground. These are subcomponents for defense and aerospace that are essential to the functioning of systems that cost millions. Because the cost price of the Heico component is negligible compared to the total price of, for example, a missile shield, price sensitivity among customers is minimal. This enables Heico to maintain dominant positions in small niches with correspondingly high margins.

Successful integration of Wencor

As a serial acquirer, the integration of new companies is crucial. Mendelson provided an update on the recent acquisition of Wencor, the largest deal in the company's history. The feedback has been extremely positive. The cultural fit appears to be seamless, and performance is exceeding expectations. This confirms that the decentralized model, in which founders remain on board and retain their entrepreneurial spirit, also works on a larger scale.

Heico continues to adhere to its strategy of acquiring healthy companies that are managed by their founders. These entrepreneurs often retain a stake of around 20% in their own companies, which means that the subsidiaries also retain skin in the game and their interests remain fully aligned with those of the shareholders. With a well-filled M&A pipeline and a proven ability to reinvest capital at high returns, the Mendelson family's compounding machine continues to run at full speed.

Heico is currently trading on the New York Stock Exchange at a price of USD 243.10 per A share.

Alphabet CEO: "Big Tech will overinvest in AI"

In a recent BBC interview, Sundar Pichai, CEO of Alphabet (New York: GOOGL), draws an interesting parallel between the current AI rally and the internet revolution of the late 1990s. According to Pichai, we are once again in a period of high market optimism and substantial capital allocation, with a realistic chance that the sector will collectively invest more than is strictly necessary. But, he emphasizes, even the internet bubble could not stop the structural breakthrough of the internet. The technology has forever changed and improved the way we live and work. He now sees the same thing happening with AI.

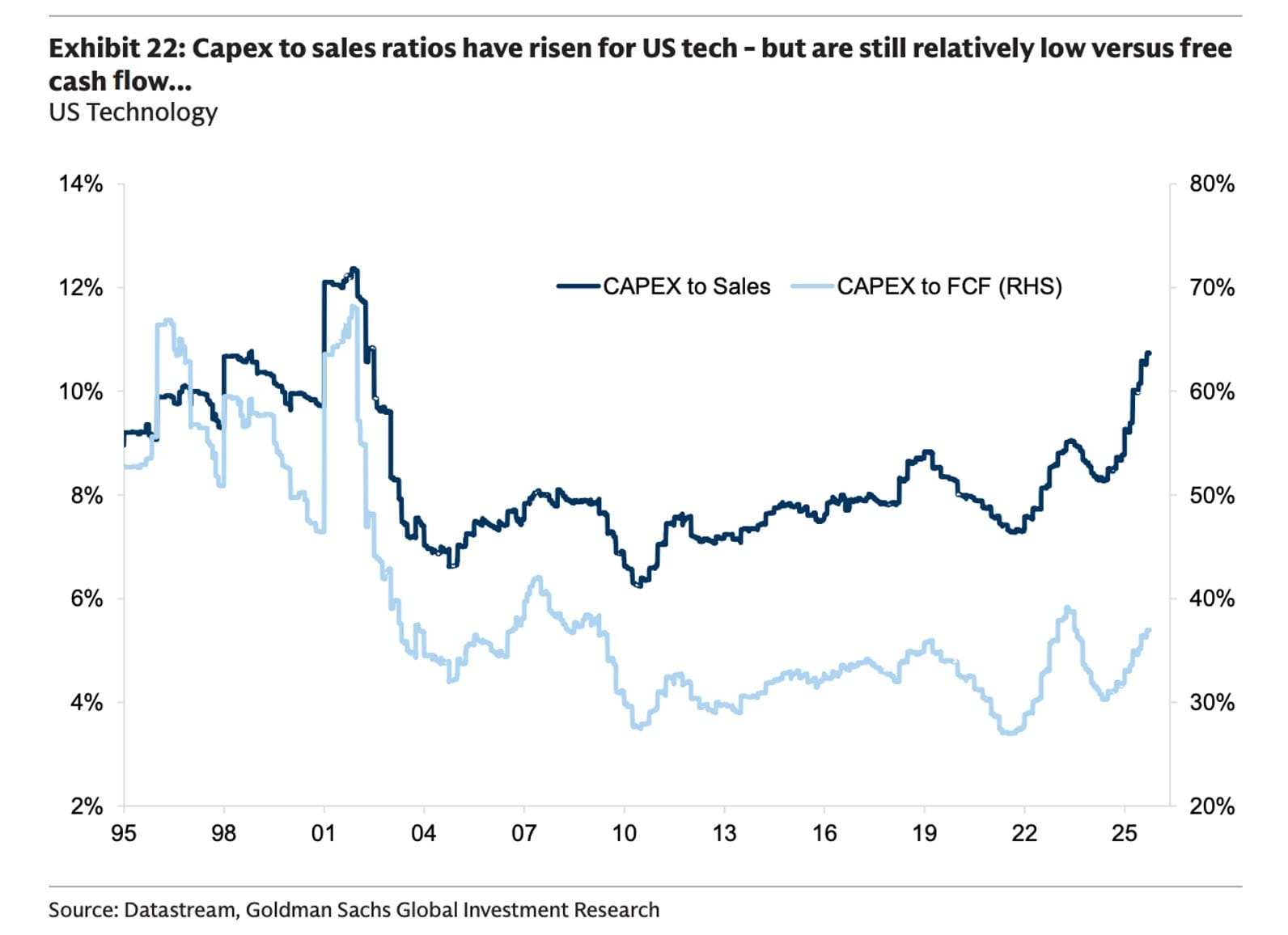

The scale of Alphabet's investment cycle is unprecedented: four years ago, capex (capital expenditure) was below $30 billion; this year, Alphabet will exceed $90 billion for the first time. Collectively, Big Tech is now investing more than $1 trillion in AI infrastructure. The chart below shows that these enormous investments by Big Tech need to be put into perspective. Yes, the absolute amounts are many times higher today than during the internet bubble. But the underlying profit and cash flow generation of these companies is also much stronger than it was then.

Whereas tech companies swallowed up a large portion of their available cash with investments during the dot-com period, that share is now considerably lower. In other words, the investment amounts are extremely high, but the companies making them are much more financially robust. As a result, the current AI investment cycle appears much less fragile than the bubble years around 2000. Alphabet is an important example of this. Despite the enormous scale of its current investments, the company continues to generate more than enough cash flow to cover these expenses.

On top of this, many companies will only be able to recoup their AI investments in the longer term. Most companies are now building AI capacity in the hope of monetizing it in the future, for example through new products, customers, or business models that have yet to emerge. For them, the current capex is an advance payment on unknown future demand.

Alphabet is in a completely different position: the company can immediately deploy the same infrastructure within existing, profitable products such as Search, YouTube, Android, and Cloud. As a result, the extra capacity starts generating value immediately, rather than years later. This allows Alphabet's broad ecosystem to act as a built-in safety net that supports the current level of investment.

At Tresor Capital, we therefore consider the risk of potential overinvestment in Alphabet to be well manageable.

Alphabet is currently trading on the New York Stock Exchange at a price of USD 320.87 per Class A share.

Receive weekly insights in your inbox

Exclusive analyses and updates on family holdings and global market developments.

Would you like more information about our services? Please feel free to contact us.

Contact us

Disclaimer:

No rights can be derived from this publication. This is a publication of Tresor Capital. Reproduction of this document, or parts thereof, by third parties is only permitted after written permission and with reference to the source, Tresor Capital.

This publication has been prepared by Tresor Capital with the utmost care. The information is intended to be general in nature and does not focus on your individual situation. The information should therefore expressly not be regarded as advice, an offer or proposal to purchase or trade investment products and/or purchase investment services nor as investment advice. The authors, Tresor Capital and/or its employees may hold position in the securities discussed, for their own account or for their clients.

You should carefully consider the risks before you begin investing. The value of your investments may fluctuate. Past performance is no guarantee of future results. You may lose all or part of your investment. Tresor Capital disclaims any liability for any imperfections or inaccuracies. This information is solely indicative and subject to change.

Read the full disclaimer at tresorcapitalnieuws.nl/disclaimer .