Family Holdings #5 - Holdings benefit from secular megatrends

This week's topics:

Brown & Brown made a strategic break with its traditional acquisition model in 2025 with the major Accession acquisition, shifting the focus from incremental growth to complex integration. Although the annual figures for 2025 showed strong revenue growth, organic growth declined sharply, mainly due to headwinds in Specialty Distribution and an exceptionally weak fourth quarter, exacerbated by market softening and talent loss. For 2026, management is only expecting a moderate recovery, while the promised synergies from Accession are not expected to become visible until around 2028.

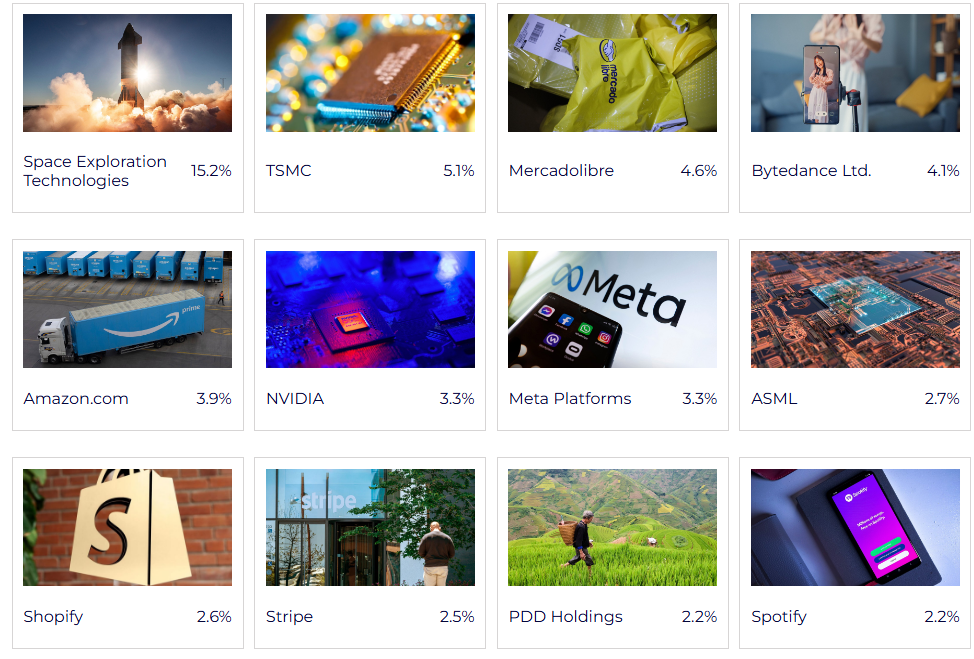

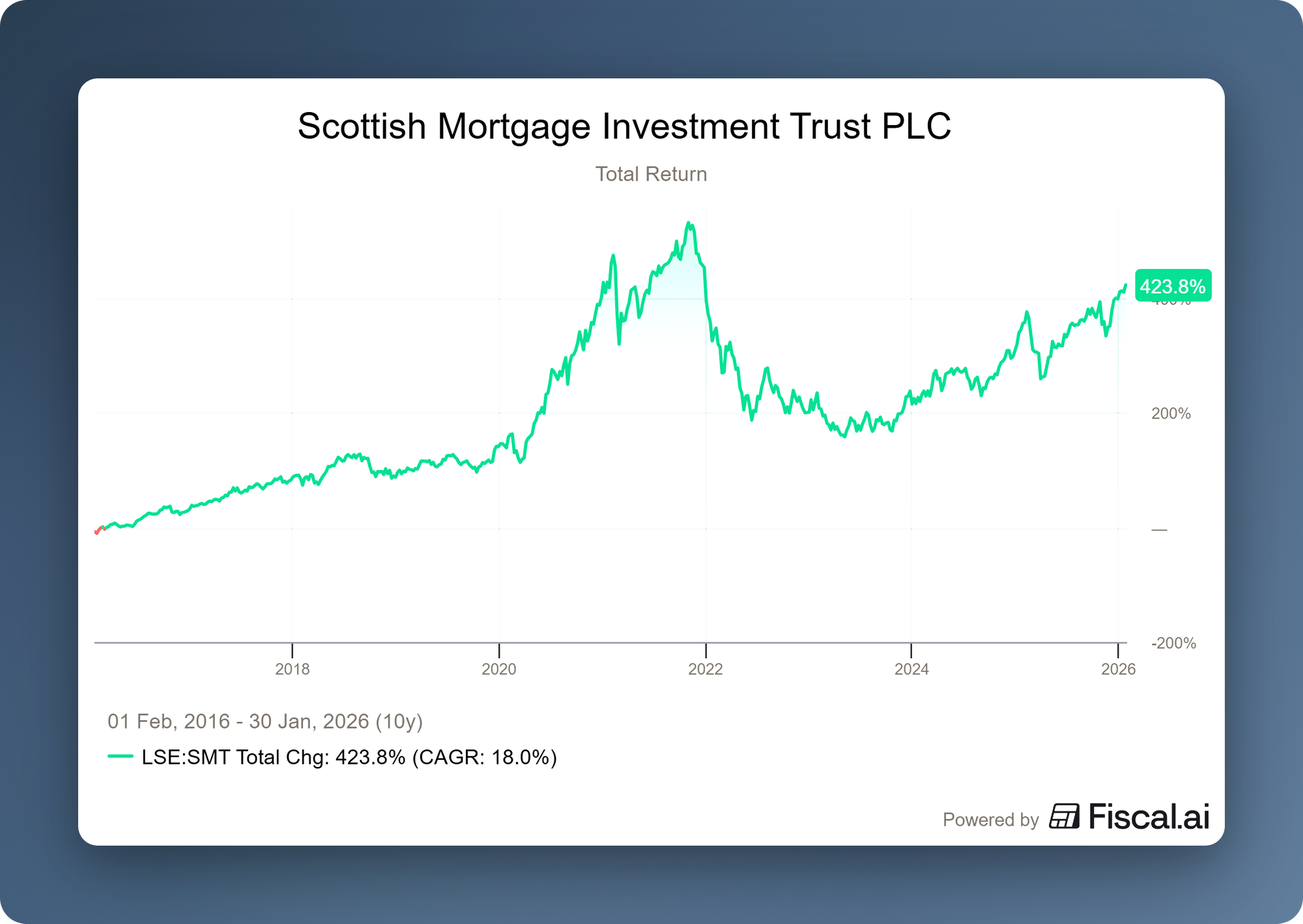

Scottish Mortgage Trust distinguishes itself with an extreme long-term vision focused on exponential growth and invests in disruptive companies such as SpaceX, which have the potential to completely transform their markets. The strategy combines listed shares with private investments of up to 30 percent of the portfolio and only sells winners when the potential for further multiplication is considered limited. The holding company prioritizes maximizing profits over capital preservation and focuses on future technologies rather than stable companies with a traditional competitive advantage.

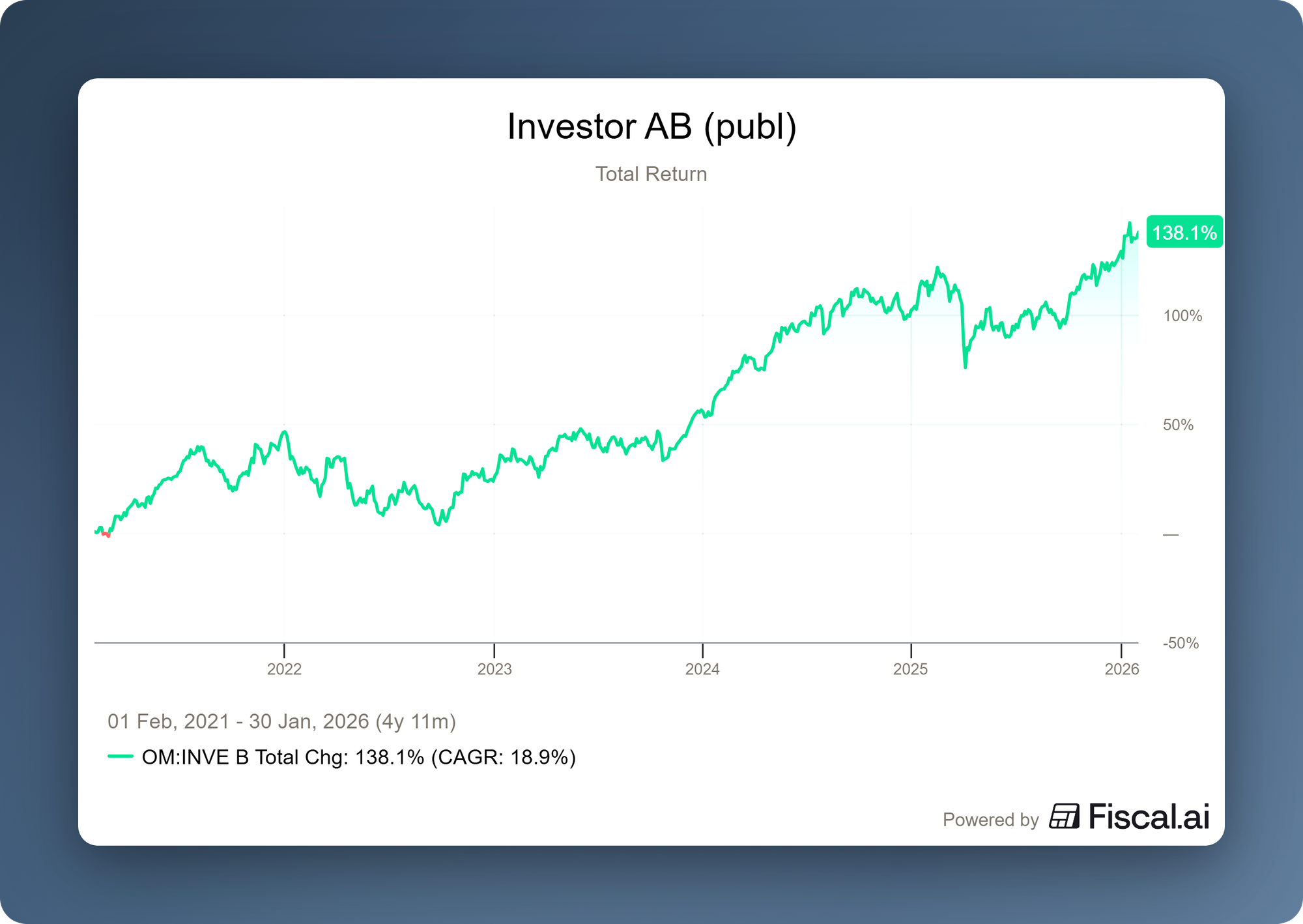

Investor AB combines an active long-term strategy with targeted exposure to the defense sector and artificial intelligence through core holdings ABB and Saab. Record orders at ABB due to the electrification of data centers for AI applications and organic growth at Saab underscore the strong momentum.

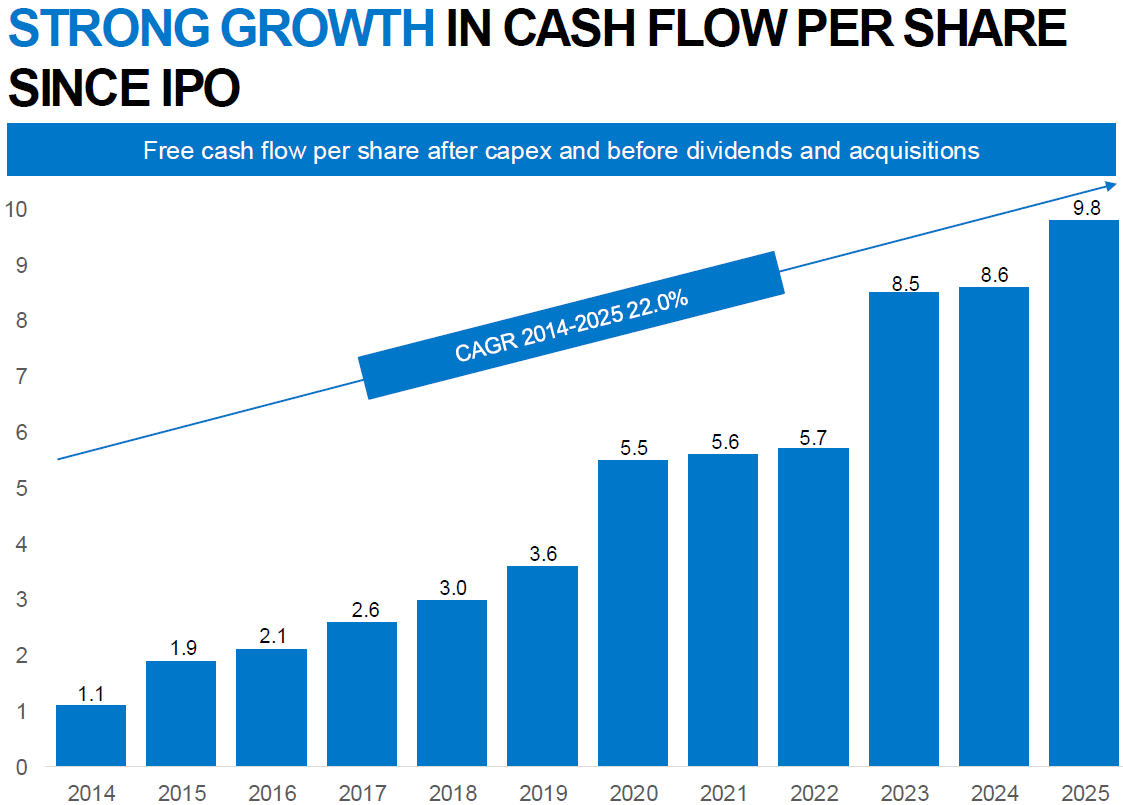

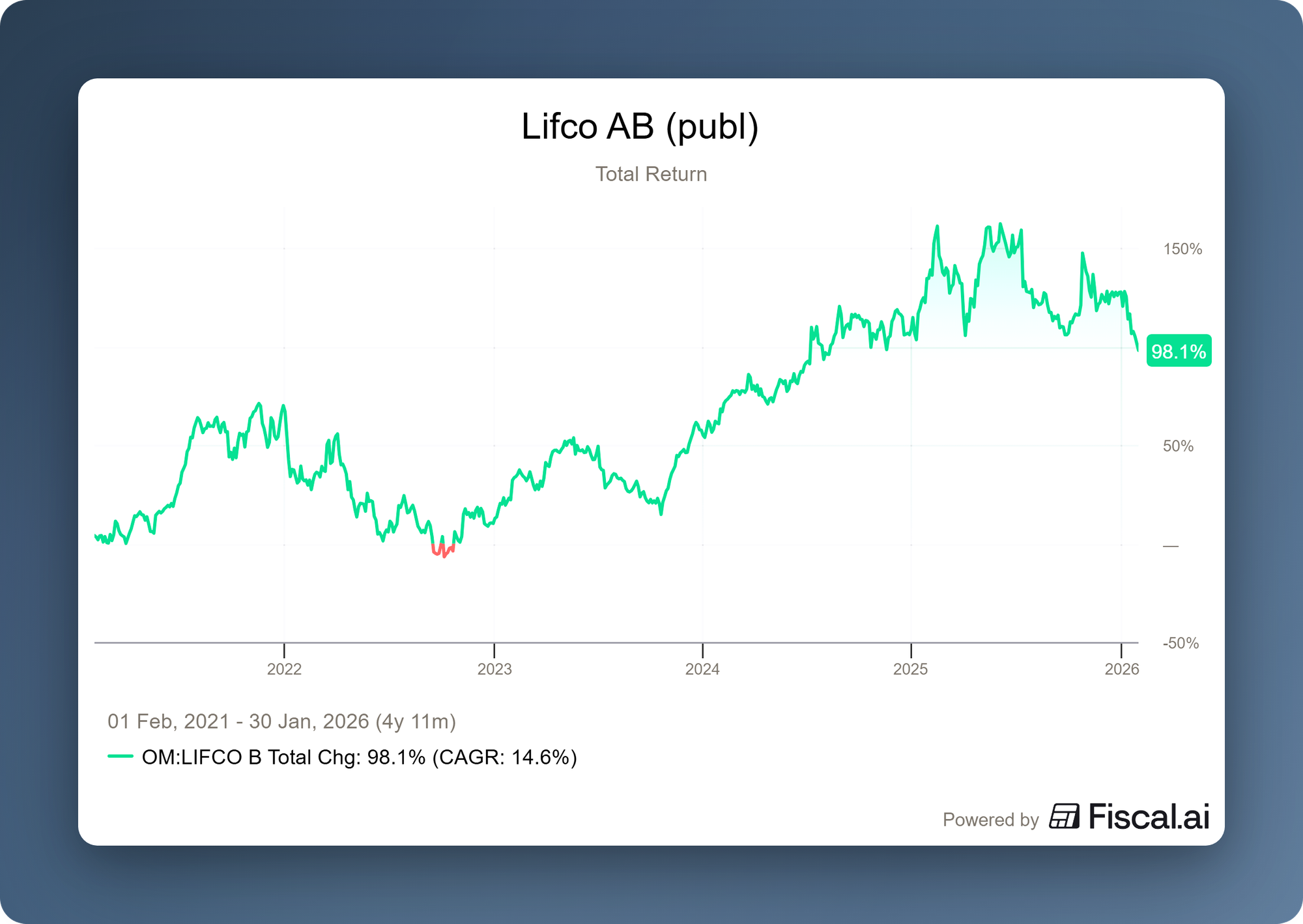

Lifco achieved revenue growth of 8.1% in 2025 through 16 acquisitions of niche players with a competitive advantage and a strong focus on free cash flow. Operating profit rose to SEK 6.3 billion, with management emphasizing value creation and capital efficiency. The purchase of shares worth approximately SEK 15 million by the CEO underscores confidence in the long-term value of the Swedish company.

In Brief:

At Constellation Software ( Toronto: CSU), the acquisition machine continues to run at full speed with two new acquisitions in its home country. Subsidiary Jonas Software acquired Ottawa-based Benbria, which provides customer experience and feedback management software, while the Volaris division purchased TSI Auto Solutions. TSI specializes in data reporting for car dealers and, with its long history and small team of twenty employees, fits perfectly into the profile of business-critical vertical software.

D'Ieteren ( Brussels: DIE) Automotive subsidiary Joule has secured a major contract for the bicycle leasing of more than 70,000 Belgian federal civil servants. This award confirms the strategic value of the earlier acquisition of Joule in 2022 and should help the lease fleet grow to at least 30,000 bicycles by 2030. The contract underscores D'Ieteren Automotive's shift from a pure car importer to a broader mobility player that is capitalizing on the structural trend toward electric bicycle traffic and fiscal greening.

Heico Corporation ( New York: HEI.A) has completed the acquisition of Axillon Aerospace's Fuel Containment division. This division, which will continue under the name Rockmart Fuel Containment, specializes in self-sealing fuel tanks for military helicopters and combat vehicles such as the F-16 and Apache. The acquisition fits perfectly with Heico's strategy. It is a business-critical niche player with a rich history and stable cash flows, enabling the serial acquirer to capitalize on continued demand in the defense industry.

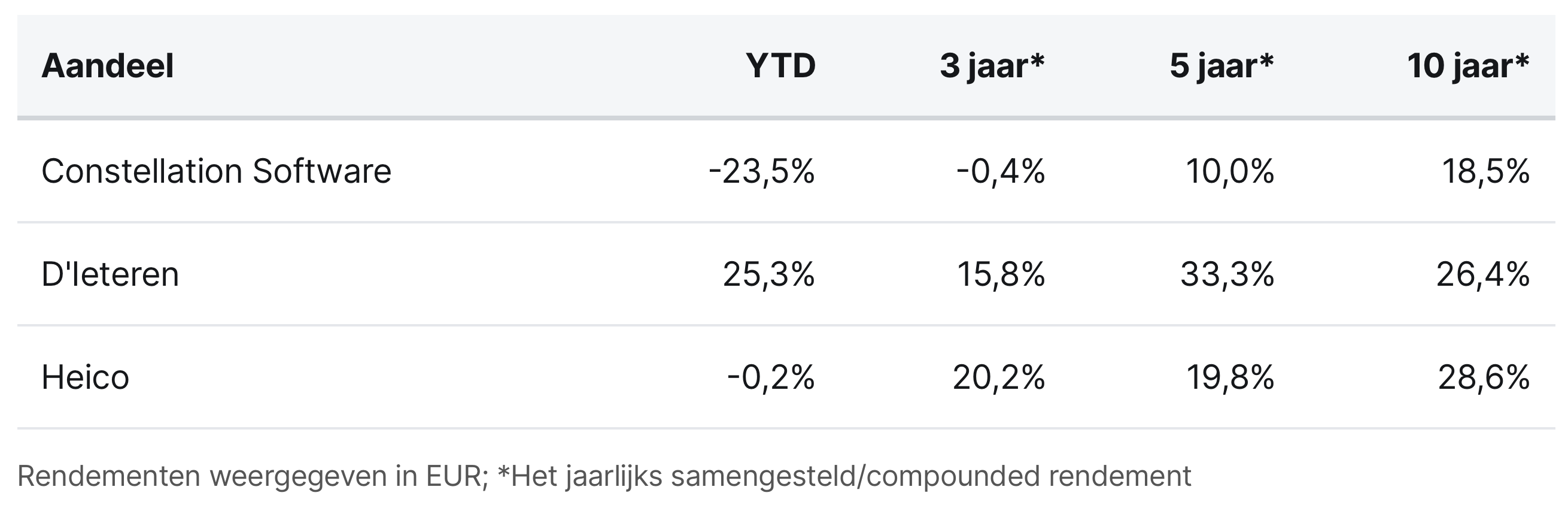

Constellation Software, D'Ieteren, and Heico are currently trading on the Toronto, Brussels, and New York stock exchanges at prices of CAD 2,548.50, EUR 192.90, and USD 253.05 per share, respectively.

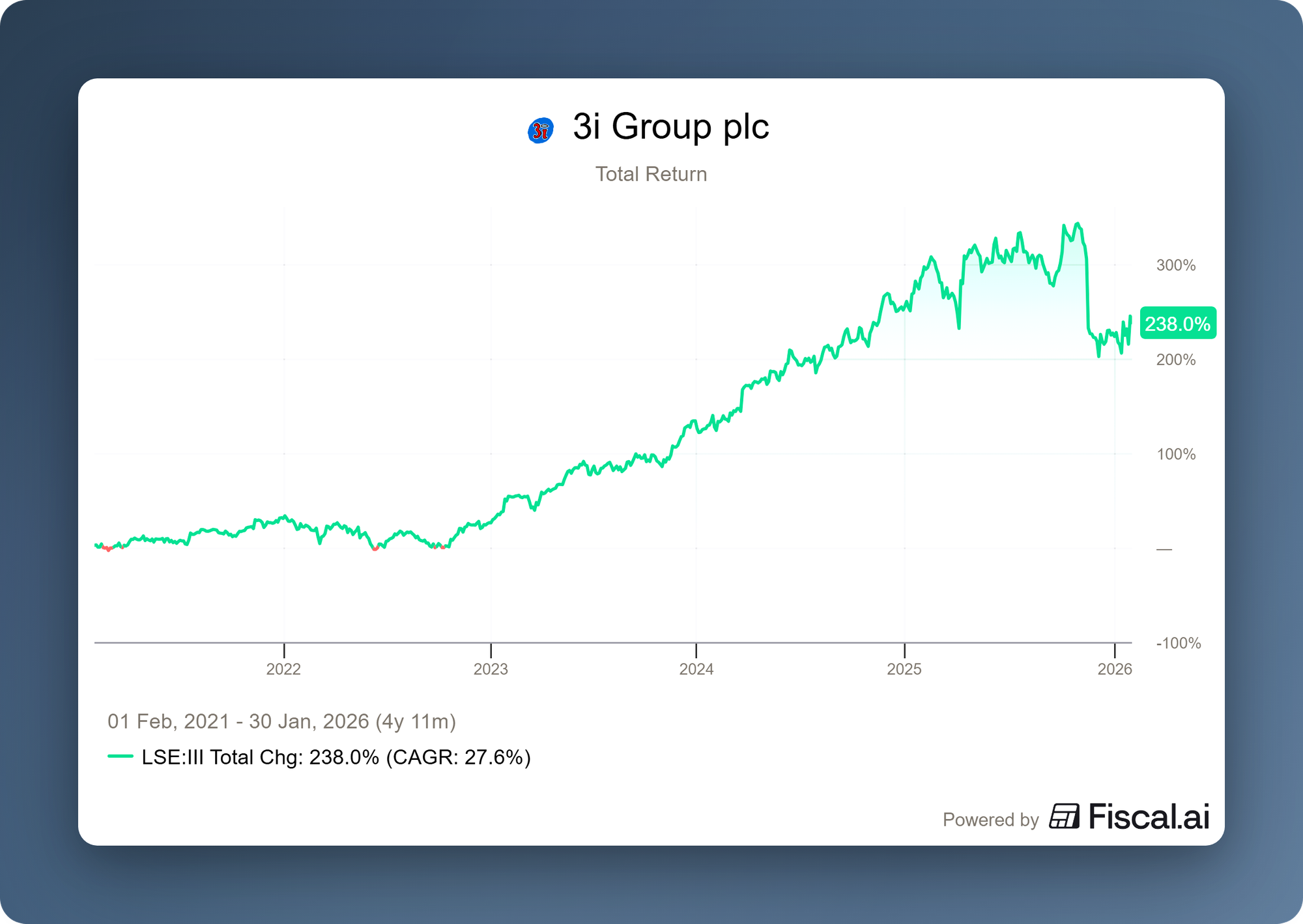

Robust Action propels 3i Group upward

British investment holding company 3i Group (London: III) presented robust figures for the third quarter of the 2026 financial year this week. Despite the previously predicted slowdown in growth in France, the group's results and rising net asset value show that the investment company is firmly in the saddle.

The net asset value per share rose to 3,017 pence as of December 31, 2025. This means:

- An increase of 5.6% compared to Q2 2025 (September).

- An increase of 18.7% over the first nine months of the fiscal year.

- An impressive increase of 22.8% compared to December 2024.

Action results

As management had previously predicted, organic growth (Like-for-Like, LFL) came under pressure in 2025. This was mainly caused by cautious consumers in France, which was the reason for the negative reaction of the share price in the recent period. However, the figures show that, despite these specific headwinds, results remain robust.

LFL sales growth for the 2025 calendar year came in at 4.9%. This is slightly lower than hoped for, but according to management, this can be entirely attributed to the French market. Excluding France (which accounts for approximately one-third of sales), growth was 7.2%. Although the French market reached a low point in October and November with negative growth in the mid-single digits, December showed a recovery (flat growth). More importantly, this recovery appears to be continuing in 2026: in the first four weeks of the new year, France recorded LFL growth of 2.1%, while the entire group stood at 6.1%.

In addition to organic growth, the expansion of the store network continues at a record pace. In 2025, Action opened no fewer than 384 new stores, representing growth of 13% and bringing the total number of stores to 3,302. This expansion is fully in line with the multi-year average of 13% to 14%, and given the enormous 'white space' identified by management and the successful entry into new countries, there is every confidence that this growth rate can be maintained in the coming years.

Management is showing its confidence in the discount chain by buying an extra 2.9% stake, paid for by issuing 3i Group shares. This brings 3i Group's total stake in Action to 65.3% (compared to 52.7% in 2022).

Remaining portfolio

Apart from Action, the rest of the portfolio is also performing well. Royal Sanders continues to perform strongly thanks to healthy volume growth and the successful integration of previous acquisitions, which prompted 3i to invest an additional £56 million in the company this quarter. 3i Infrastructure (3iN) also contributed positively to the result; the underlying portfolio is performing well and the share price rose by 3%, bringing the value of 3i's stake to over £1 billion.

In the healthcare sector, companies such as SaniSure and Cirtec are showing stable or even accelerating growth. In addition, Audley Travel and Luqom made good operational contributions. The other interests in the software and industry segments remained generally stable, with the exception of Wilson, which is currently experiencing difficulties in a challenging recruitment market.

conclusion Although it is still too early to conclude that the problems in France have been completely resolved, the initial figures for calendar year 2026 show a clear recovery. Management emphasizes that the other major markets, including the Netherlands, Germany, and Poland, continue to report impressive growth ranging from mid-single digits to double digits. It is possible that the years of organic growth between 8% and 10% are now behind us, but even at a growth rate of 5% to 6%, the business model remains extremely powerful thanks to the combination with an annual expansion of the store portfolio by 13%.

3i Group PLC ended the trading week on the London Stock Exchange at a price of GBP 33.51 per share.

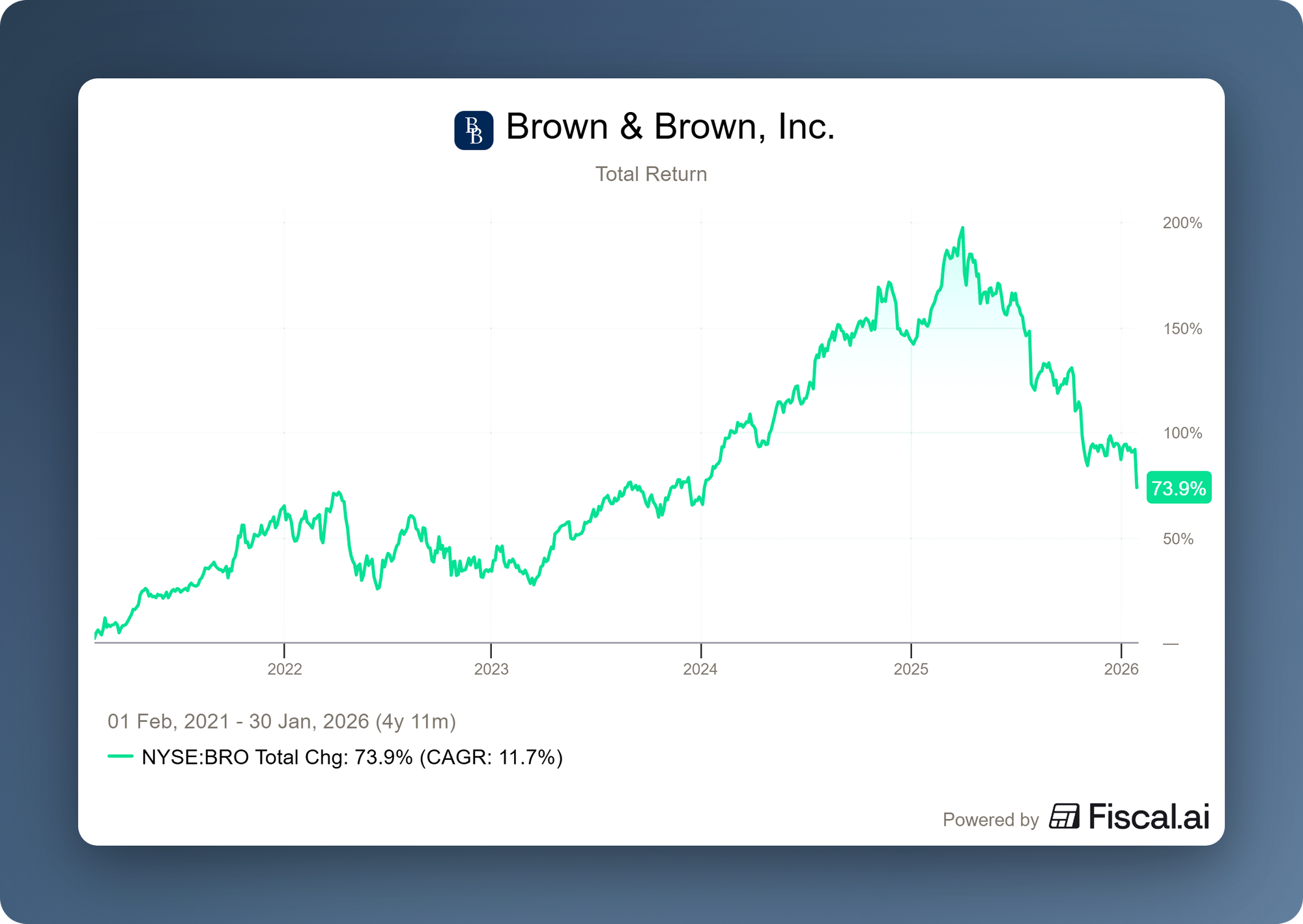

Brown & Brown continues acquisition strategy, but market remains challenging

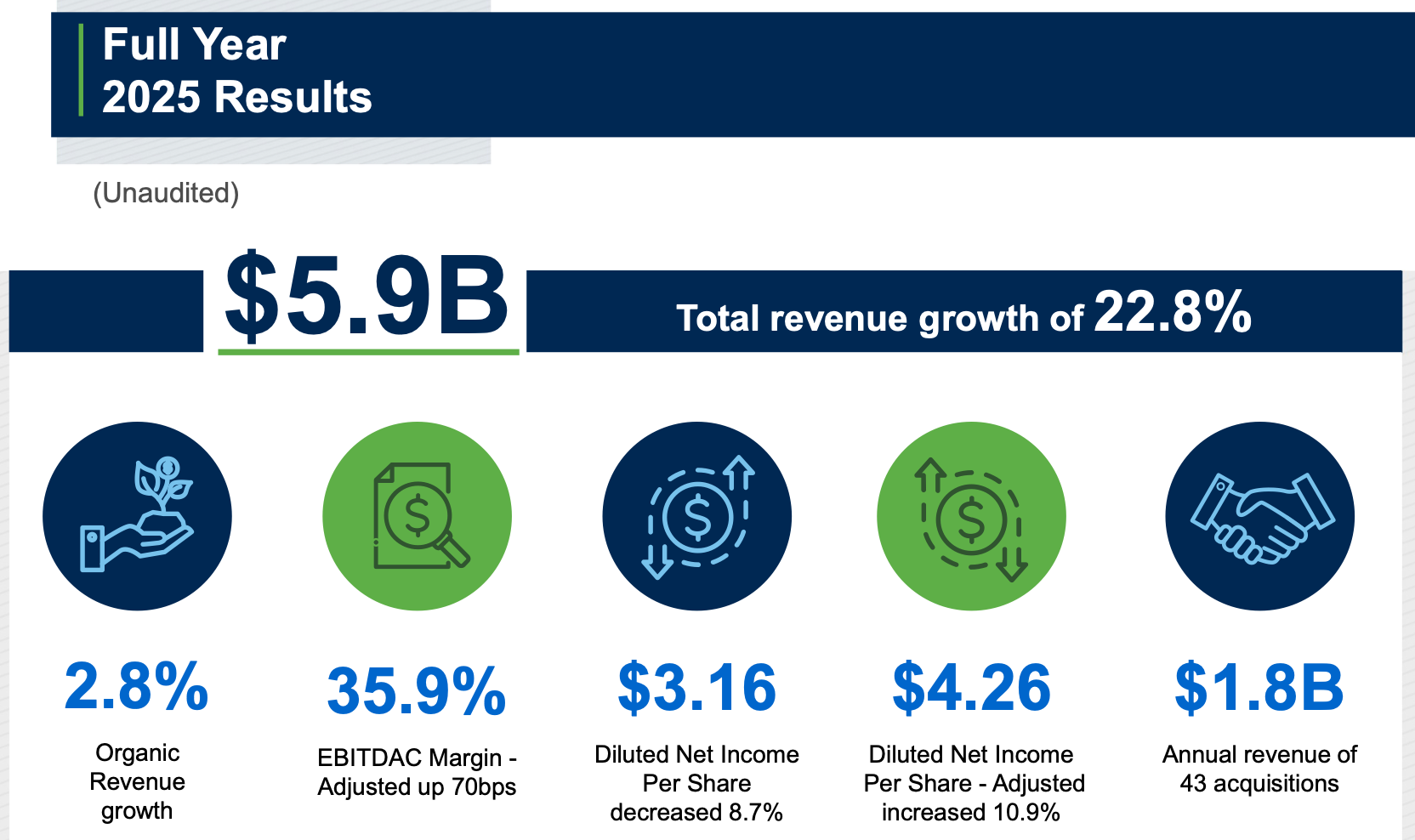

Within Tresor Capital's investment philosophy, we take a critical look at large, transformative acquisitions. Whereas the American insurance company Brown & Brown (New York: BRO) has excelled for decades as a serial acquirer of smaller, manageable companies, the acquisition of Accession (parent company of Risk Strategies and One80) in 2025 marked a clear departure from this strategy. With a transaction value that represented almost 30% of its own market capitalization at the time, the focus shifted from incremental growth to a large-scale integration project. For analysts, the recent annual figures for 2025 were therefore the first real benchmark for determining whether the ambitious synergies justify the operational risks.

The results

At first glance, the reported results appear robust, with total revenue growth of 22.8% and strong margins. However, for a company that is growing so aggressively through acquisitions, organic growth is the only true measure of the actual health of the portfolio and market position. In this regard, Brown & Brown fell short last year. With organic growth of only 2.8% over the year as a whole, and even a negative spike in the last quarter, there has been a clear correction from the five-year average of around 8-10%.

Management points to a combination of circumstances:

- Multi-year policies:In the fourth quarter of 2024, many long-term contracts were concluded, which created an unfavorable comparison for the current figures.

- One-off items:Adjustments to incentive commissions were higher than anticipated, which reduced growth by approximately 100 to 150 basis points.

- Project delays:Several projects have been postponed until 2026, which increased pressure in the short term but provides a buffer for the near future.

The challenges in the fourth quarter were particularly evident in the Specialty Distribution segment. Although management had already prepared the market for a decline of 4% to 6% during the presentation of the third-quarter figures, the final organic decline of 7.8% was even greater than feared.

CFO Watts pointed to the exceptionally high bar set in the previous year, when revenue was boosted by a uniquely high volume of claims following large-scale flooding ($28 million in processing revenue). This unfavorable basis for comparison was reinforced in the last quarter by a faster-than-expected rate decline in the catastrophic property insurance (CAT property) market. In addition, the segment saw part of itsbinding authority business flow back to the regular,admitted market. This combination of factors put pressure not only on revenue but also on margins in this specific segment, underscoring the need for operational adjustments in 2026.

Legal battles and integration issues

In addition to disappointing organic growth, the transition phase is being hampered by a fierce battle for talent. In a coordinated move, an American start-up managed to poach 275 employees and approximately $23 million in revenue from Brown & Brown. It was therefore not surprising that the first question during the Q&A session focused on this. Analysts wondered aloud whether there was a fundamental problem with the culture or the compensation structure that caused such a large group to be willing to move to a smaller start-up. CEO Powell Brown immediately countered this by stating that, in his opinion, this was not a sign of a failing culture, but a "highly unusual" and coordinated attack by a competitor.

acquisition Furthermore, there is naturally a great deal of attention focused on what management is saying about the status of the Accession integration. However, the initial results following the acquisition gave cause for reflection: with quarterly revenue of $405 million, the immediate impact fell short of market expectations, which had been in the range of $430 to $450 million. Nevertheless, management is preaching patience. They emphasize that the integration is proceeding according to plan and that the targeted synergy benefits of $30 to $40 million will only be fully visible in the figures in the course of 2028. For investors, this means keeping their sights set on the distant horizon, while short-term results navigate a somewhat uncertain transition phase.

Expectations for 2026

This transition phase is far from guaranteed. Although management spokeconfidently to stakeholders during the recentearnings call , expectations for 2026 were immediately tempered. There is talk of a "moderate improvement," with the first half of the year remaining challenging. For the Specialty Distribution segment, flat organic growth is even expected in the first quarter. This is partly due to a normalization in the market; the period of the so-called "hard market," characterized by rising premiums and strict conditions, is showing signs of softening, particularly in the property sector. In such a 'soft market', organic growth is less self-evident and the emphasis inevitably shifts to market share and operational efficiency.

On top of that, the current interest rate climate is a double-edged sword. Although falling interest rates can stimulate broader economic activity and thus demand for insurance, they also directly depress the investment returns of fiduciarily managed funds. Brown & Brown must now prove that its business model is robust enough to create value without the tailwind of a hard market and high interest rates. The realization of synergies in 2028 remains the dot on the horizon, but the road to get there requires, above all, a critical look at the fundamentals in 2026.

Brown & Brown is currently trading on the New York Stock Exchange at a price of USD 72.28 per share.

Receive weekly insights in your inbox

Exclusive analyses and updates on family holdings and global market developments.

Scottish Mortgage focuses on the long term

Last week , the Belgian newspaper De Tijd published an extensive interview with Scottish Mortgage Trust (London: SMT) director Tom Slater. De Tijd journalist Serge Mampaey aptly sums it up in the introduction to the article:

The British trust was founded in 1909 to provide credit to Malaysian plantations. At the time, this was a high-risk venture with potentially huge returns, a philosophy that still applies today.

Thanks to early investments in companies such as internet giant Amazon, streaming giant Netflix, electric car manufacturer Tesla, and chip machine wonder ASML, SMT grew to become the second-largest holding company on the London Stock Exchange, after Action owner 3i.

Scottish Mortgage distinguishes itself in the holding company world through its pronounced focus on exponential growth. The investment company seeks out companies that have the potential to completely disrupt their markets and then holds on to them for the very long term. Slater emphasizes that short-term results are irrelevant in this regard.

"Quarterly results are hardly relevant to us. We look at ten years or more," said Slater.

The strategy is based on the principle that a small number of extreme winners determine the returns of the entire portfolio. A clear example of this is the position in SpaceX. SMT invested a total of USD 200 million in Elon Musk's space company. This investment has since grown to a value of USD 3.3 billion. This illustrates the power of holding on to winners for the long term. "It shows the potential of holding on to hyper-growth companies for a very long time. It makes up for the bad investments," says Slater.

According to Slater, the valuation of SpaceX, which was recently valued at USD 800 billion, is justified given its dominant position and the enormous commercial opportunities offered by falling launch costs and satellite communications.

Scottish Mortgage was one of the guest speakers at our client relations day in November 2025. You can read a report on this event via the link below:

Discipline in valuation

Although the philosophy revolves around holding on to winners, valuation is an essential factor in selling decisions. SMT recently reduced its positions in both Tesla and Nvidia. This decision was not based on a lack of confidence in the companies, but on the limited scope for further price multiplication.

"Does this stock have the potential to roughly quintuple again?" was the question Slater asked himself about Tesla after the price rise surrounding the US elections. The answer was: probably not. Nevertheless, admiration for Musk remains intact. "Elon Musk has often proven that he can do the almost impossible. I wouldn't bet against him."

Private markets and relationships

An important part of the strategy is gaining access to private companies and building long-term relationships. SMT may invest up to 30 percent of its portfolio in unlisted companies. ByteDance is an important position within this. Recent developments surrounding the mandatory sale of the US branch have been welcomed. "Once the deal is finalized, ByteDance will become a story that will be more appealing to investors," says Slater. In addition to SpaceX and ByteDance, SMT also has interests in AI developer Anthropic, cloud software company Databricks, payment technology company Stripe, and fintech bank Revolut. This means it has six of the ten most valuable private companies in its portfolio.

Maintaining relationships with management teams is crucial for discovering new opportunities. Years of being a shareholder in companies such as Alibaba and Tencent gave SMT access to new investment opportunities in China. Even with companies in which they are not currently a shareholder, such as Alphabet, lines of communication remain open thanks to past contacts.

Future technology

SMT continues to look to the future, with a focus on artificial intelligence, the energy transition, and healthcare. Slater sees great opportunities in companies that are transforming the physical world, such as Aurora in autonomous transport and Zipline in logistics drone solutions.

The director is clear about the holding company's risk profile. Investors looking for stability and capital preservation are in the wrong place at SMT. "If you're looking for Buffett-style quality companies with stable growth and a wide moat around them, we're not the right fit," warns Slater. "For us, the question of how to make money is much more important than the question of how to avoid losses."

Scottish Mortgage Investment Trust ended the trading week on the London Stock Exchange at a price of GBP 12.56 per share.

Investor AB benefits from artificial intelligence and defense

The Swedish investment holding company Investor AB (Stockholm: INVE-B) may be more than 100 years old, but that does not mean that the Wallenberg family's company is not moving with the times. Through its active role on the supervisory board, Investor AB steers the long-term strategy of the companies in its portfolio, with a clear focus on future-proofing. As a result, the holding company is once again reaping the benefits of its exposure to the defense sector and artificial intelligence (AI) this year.

Industrial giant ABB is by far the most important position within the holding, accounting for 17% of the net asset value. Saab also occupies a prominent position in third place, representing 10% of the net asset value. Both recently reported strong figures.

Record orders and AI boost at ABB's largest stake

ABB is taking full advantage of the energy transition and the rise of artificial intelligence. The company saw its order intake increase by 36% in the fourth quarter to a record level of USD 10.32 billion. Revenue rose 13% to USD 9.05 billion and operating EBITA increased 19% to USD 1.58 billion. Demand for data center electrification in particular is growing explosively due to the global rollout of AI applications. This specific division now accounts for 9% of total group revenue, and ABB is collaborating with partners such as Nvidia in this area.

CEO Morten Wierod states that geopolitical uncertainty has become the new norm, but that customers continue to invest in long-term trends such as automation despite this. Management is underlining its confidence in the future with a dividend increase to CHF 0.94 and a new share buyback program worth up to USD 2 billion. The group is targeting comparable revenue growth of 6% to 9% by 2026. The market responded positively to these growth prospects, which led to analysts upgrading their recommendations to 'buy'. The share price has already risen by 12% in 2026.

Structural tailwind for the defense sector

The changing geopolitical reality is creating sustained and structural demand for security and advanced defense systems. Saab has a clear competitive advantage in this niche and reported organic revenue growth of 23.4% for the full year 2024. This result was well above previous expectations of 15% to 20%. In the fourth quarter, organic growth was as high as 29.3% with revenue of SEK 20.9 billion. Investors recognise the strategic value and strong momentum of the company. This confidence is reflected in a solid 30% increase in the share price since the start of 2026.

Our position in Investor AB allows us to indirectly benefit from the operational strength and unique competitive position of ABB and SAAB. With companies and governments continuing to focus on long-term investments in AI infrastructure and security, Investor AB has struck gold with these two heavyweights in its portfolio.

Investor AB ended the trading week on the Stockholm Stock Exchange at a price of SEK per B share.

Receive weekly insights in your inbox

Exclusive analyses and updates on family holdings and global market developments.

Lifco shows resilience and CEO significantly increases stake

Swedish serial acquisition holding company Lifco (Stockholm: LIFCO-B) has once again demonstrated the strength of its decentralized business model with its 2025 figures. In a year characterized by fluctuating market conditions, the company managed to further increase its revenue and profitability, while cash flow grew by double digits. Lifco continues to adhere to its successful strategy of acquiring profitable niche players with a clear competitive advantage and strong cash flows.

Management's primary focus is on growing free cash flow per share, which is seen as the ultimate measure of long-term value creation. Since the IPO in 2014, free cash flow per share has grown at a compound annual growth rate (CAGR) of 22%. This cash flow is available to pay dividends and is used to continue investing in new acquisitions. Operating cash flow increased by 22.8% to SEK 2 billion in the fourth quarter. This result is partly due to a strict focus on working capital management and the company's asset-light structure.

In addition to cash flow development, Lifco also showed growth in terms of sales and profitability. Sales increased by 8.1% to SEK 28.2 billion in 2025. This increase was driven by both organic growth and acquisitions, with the organic component accounting for 4.2%. Operating profit (EBITA) increased by 6.8% to SEK 6.3 billion, with the margin remaining high at 22.4%.

The Systems Solutions division was the absolute driver in the fourth quarter, while Dental and Demolition & Tools proved their defensive strength, despite significant currency headwinds that weighed on reported growth.

strategic acquisition Lifco continues to use the cash flow generated for targeted acquisitions. In 2025, a total of sixteen companies were added to the group. Today, the company announced the acquisition of Ethoss Regeneration. This UK-based company develops and sells advanced synthetic bone graft material for dental implantology. Ethoss achieved a turnover of approximately GBP 4.3 million in 2024.

CEO shows confidence with share buyback

An important signal for shareholders is the share buyback by CEO Per Waldemarson. Insider transaction reports show that, at the same time as the figures were reported, he purchased a block of 50,000 Lifco shares at an average price of SEK 300.60. This represents a total investment of approximately SEK 15 million. Such purchases by management confirm that the interests of executives are aligned with those of shareholders and demonstrate strong confidence in the long-term value of the company. Insiders may sell their shares for a variety of reasons, but they usually buy for only one reason: they consider the company to be attractively valued and expect the share price to rise.

Lifco ended the trading week on the Stockholm Stock Exchange at a price of SEK 306.20 per share.

Receive weekly insights in your inbox

Exclusive analyses and updates on family holdings and global market developments.

Would you like more information about our services?

Contact us

Disclaimer:

No rights can be derived from this publication. This is a publication by Tresor Capital. Reproduction of this document, or parts thereof, by third parties is only permitted with written permission and with reference to the source, Tresor Capital.

This publication has been compiled with the utmost care by Tresor Capital. The information is intended in a general sense and is not tailored to your individual situation. The information should therefore expressly not be regarded as advice, an offer or a proposal to purchase or trade investment products and/or purchase investment services, nor as investment advice. The authors, Tresor Capital and/or its employees may hold positions in the securities discussed, either for their own account or for their clients.

You should carefully consider the risks before you start investing. The value of your investments may fluctuate. Past performance is no guarantee of future results. You may lose (part of) your investment. Tresor Capital accepts no liability for any inaccuracies or omissions. This information is for indicative purposes only and is subject to change.

Read the full disclaimer at tresorcapitalnieuws.nl/disclaimer .