Family Holdings #50 - TerraVest and SpaceX: rocketing upward

This week's topics:

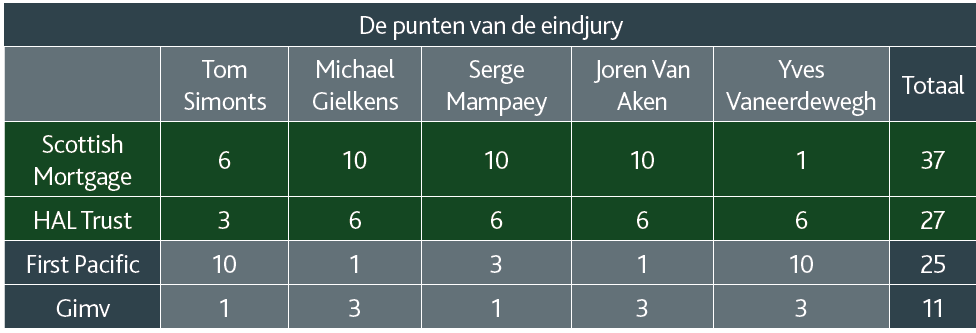

TerraVest achieved excellent results in a challenging 2025 financial year, with revenue growth of 50% and an 18% increase in free cash flow per share. Growth was driven by a record amount of acquisitions, including the recent expansion into water management through subsidiary Green Energy Services. The proven strategy of acquiring and optimizing family businesses continues to create value and significantly reduces effective purchase multiples. For 2026, the focus will shift to the integration of Entrans, recovery in the transport market, and exploiting opportunities in defense and data centers.

SpaceX's potential valuation jump to $1.5 trillion is a powerful driver for our portfolio, with Alphabet's early stake could explode to over $100 billion and opening up strategic options for data centers in space. For Scottish Mortgage , SpaceX is already the largest position, which in this scenario could triple in value to approximately $4.5 billion. In addition, Sofina may also benefit indirectly through Sequoia Capital.

The German investment holding company MBB announced this week that it will make use of its authorization to buy back its own shares. The board of the German family holding company currently sees a significant undervaluation in the share price.

In Brief:

Sofina ( Brussels: SOF) is investing in Qargo as part of a $33 million capital round, together with venture capital fund Balderton Capital. The Ghent-based transport software developer has seen its recurring revenue increase fivefold in a year and a half and will use the new capital for further international expansion into the United States.

Topicus ( Toronto: TOI) enters the Romanian market with the acquisition of Sobis, a provider of software solutions for local governments and tax collection. The acquisition adds mission-critical applications to the group and expands its geographic presence in Eastern Europe.

Addtech's ( Stockholm: ADDT) Automation division acquires an 80% stake in Austrian company Cubro Acronet GesmbH, a provider of network monitoring and security solutions. The company has annual sales of approximately €15 million with 37 employees and will be added to the IT & Sensors business unit. The transaction is expected to be completed in early January 2026.

3i Group (London: III) subsidiary Evernex, a global leader in data center maintenance services, is acquiring Morocco-based Sunrise Technologies to strengthen its operations in North Africa. Sunrise specializes in the maintenance of complex IBM storage systems and virtualization technology. The acquisition will increase the technical capacity of Evernex's service center in Casablanca.

Prosus ( Amsterdam: PRX) subsidiary Meesho has been listed on the stock exchange, making it the first horizontal e-commerce marketplace in India to become publicly traded. Prosus remains involved as a major shareholder in the platform, which focuses on the fast-growing Indian mass market.

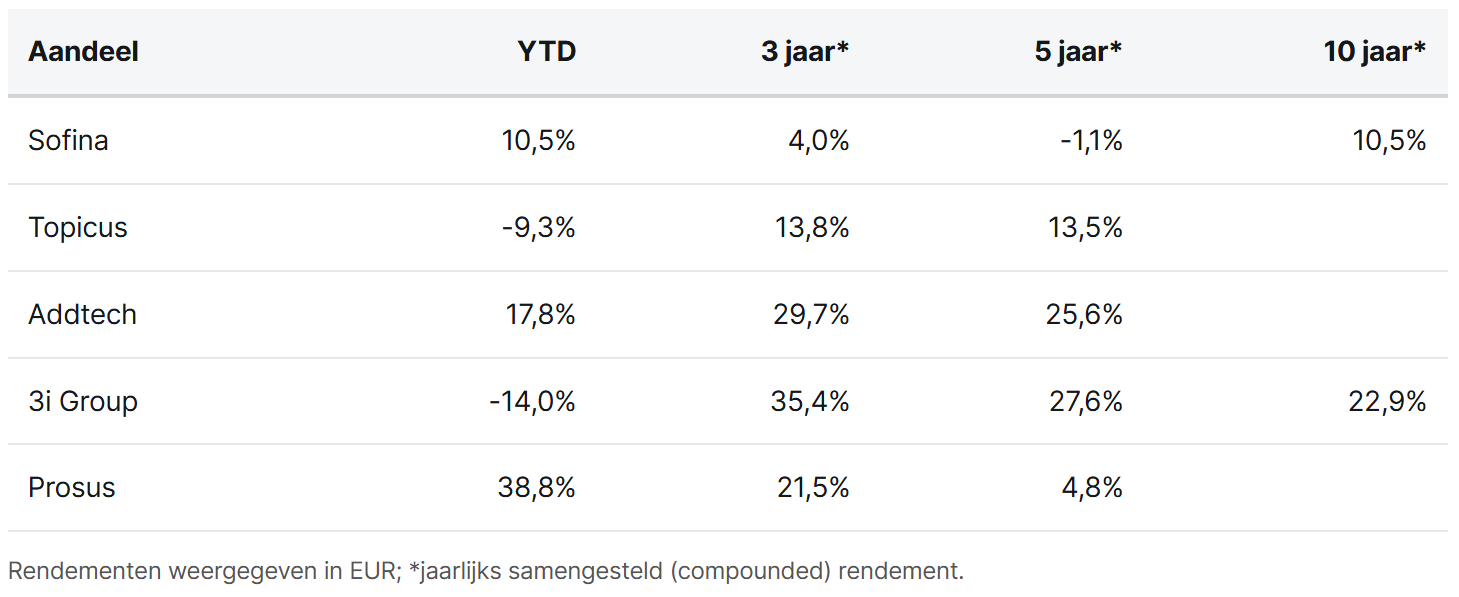

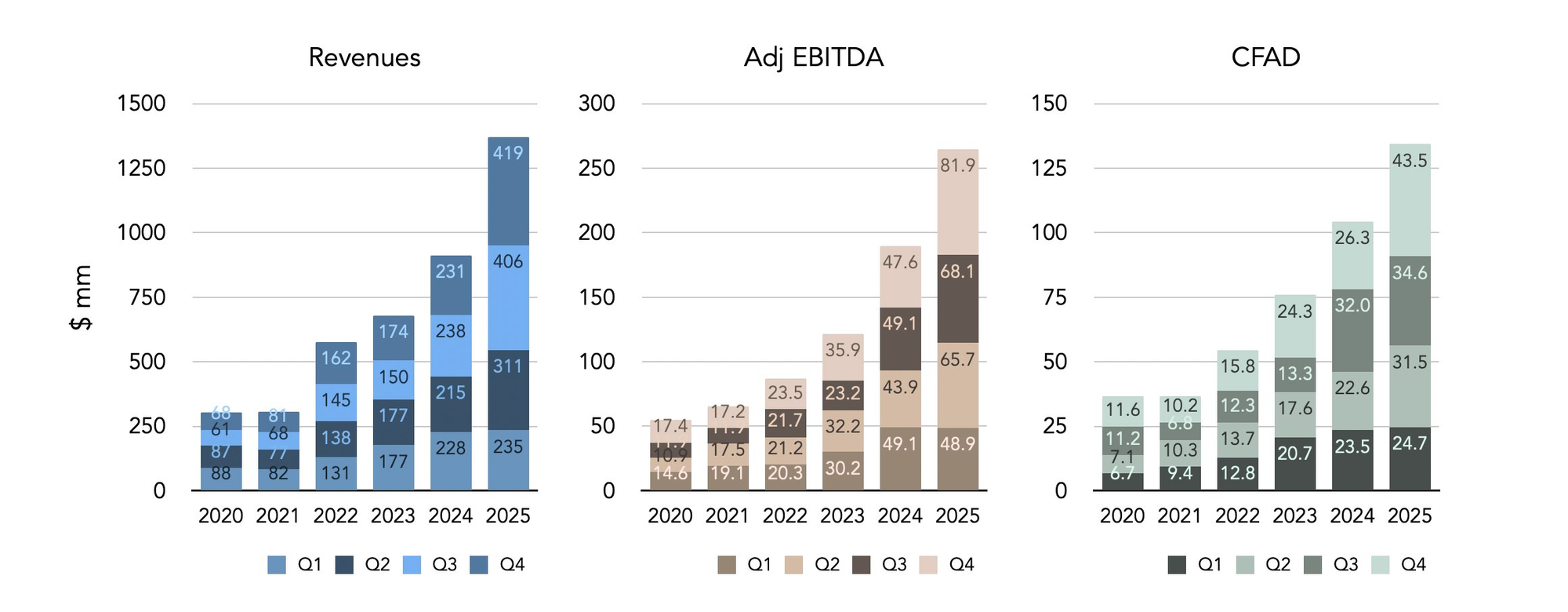

Sofina, Topicus, AddTech, 3i Group, and Prosus are currently traded on the Brussels, Toronto, Stockholm, London, and Amsterdam stock exchanges at prices of EUR 238.20, CAD 121.99, SEK 334.40, GBP 31.28, and EUR 53.25 per share, respectively.

Scottish Mortgage triumphs in Clash of the Conglomerates

In the 276th edition of Mister Market Magazine , Tresor Capital partner Michael Gielkens participated in the expert panel for the annual "Clash of the Conglomerates." In this competition, organized by Pierre Huylenbroeck, ten holding companies from different countries were scrutinized. After the preliminary rounds, four finalists remained, who were judged by a five-member jury.

In addition to Michael Gielkens, the panel consisted of Tom Simonts (KBC), Serge Mampaey (De Tijd), Joren Van Aken (Degroof Petercam), and Yves Vaneerdewegh (Selectum). The goal was to determine which holding company would take over the title of "Best Holding Company in the World" from previous winners such as Constellation Software and Sofina.

The winner of this edition is Scottish Mortgage Investment Trust. With a total of 37 points, the Scottish trust remained well ahead of the runner-up, HAL Trust. Below you will find the final jury's complete scoreboard:

Gielkens' contribution has been shortened in the magazine, but for Tresor Capital's business relations, the full and unedited analysis of the finalists and the favorite dropouts is provided below.

The ranking of the four finalists

1) Scottish Mortgage

This is undoubtedly the favorite and an important position in the Tresor Capital portfolio. The holding company is characterized by its focus on 'outliers' and the knowledge that only a fraction of all companies are responsible for all value creation on the stock market. What makes Scottish Mortgage unique is its access to the private market. While many investors are limited to listed names, this holding company offers access to companies that are not yet publicly traded.

Approximately 30% of the portfolio consists of such private companies, including space pioneer SpaceX, ByteDance (the parent company behind TikTok), fintech giant Stripe, and AI challenger Anthropic. These are companies that are fundamentally changing the economy. For long-term investors, this is the way to gain exposure to these winners, which are not available for purchase on the regular stock market.

A detailed report of the presentation during the recent customer relations day can be found in the article below.

2) HAL Trust

The Rotterdam-based holding company owned by the Van der Vorm family has undergone a striking change in its communications policy. After years of extremely concise reports, HAL now suddenly publishes very extensive and detailed reports. This new openness, combined with the recent smart acquisitions of Boskalis and VolkerWessels, shows that the holding company is once again in full swing.

In the recent past, there have been some missteps in sectors where they had less knowledge, but as long as they stay close to their circle of competence, HAL is very interesting. With considerable cash reserves, HAL has the luxury of waiting patiently for opportunities.

3) GIMV

In recent years, the Flemish holding company has taken steps to sharpen its focus. The arrival of the new major shareholder WorxInvest, replacing the Flemish government, has brought a breath of fresh air. They have introduced a new remuneration structure that finally ensures real 'skin in the game', and the focus is shifting to larger deals.

Although this makes Gimv more interesting, Brederode and Sofina are clearly the preferred choices in this segment. Historically, they have a stronger track record in capital allocation and offer greater potential.

4) First Pacific

The Hong Kong-listed holding company offers a dominant position in the Indonesian consumer market through Indofood. First Pacific provides interesting exposure to emerging markets, but Prosus is a much stronger preference in this case. First Pacific remains a value play, lacking the pure compounder qualities that are evident in a player such as Prosus.

The favorites among the dropouts

1) MBB

This German holding company is a textbook example of the power of the Mittelstand. MBB excels at acquiring and improving niche companies, with a strong focus on the energy transition and cybersecurity. The founders have shown themselves to be extremely disciplined in their capital allocation. At the current share price, no account is being taken of the potential of subsidiary DTS, nor of the optionality of the well-filled coffers with which a new Vorwerk could be purchased.

2) 3i Group

3i's share price recently fell sharply after Action slightly missed expectations. That seems like an exaggerated reaction. The slowdown is specifically limited to France, while sales in other markets continue to surge by more than 22%. Action's underlying growth model remains intact: the company has already opened 255 new stores this year and has even raised its target to 380 openings for the whole year.

3i confirmed its unconditional confidence in its crown jewel by immediately investing an additional £755 million in Action. Management also sent a crystal-clear signal: insiders, including the CEO and partners, recently purchased approximately €4 million worth of company shares. There could hardly be a more powerful sign of undervaluation.

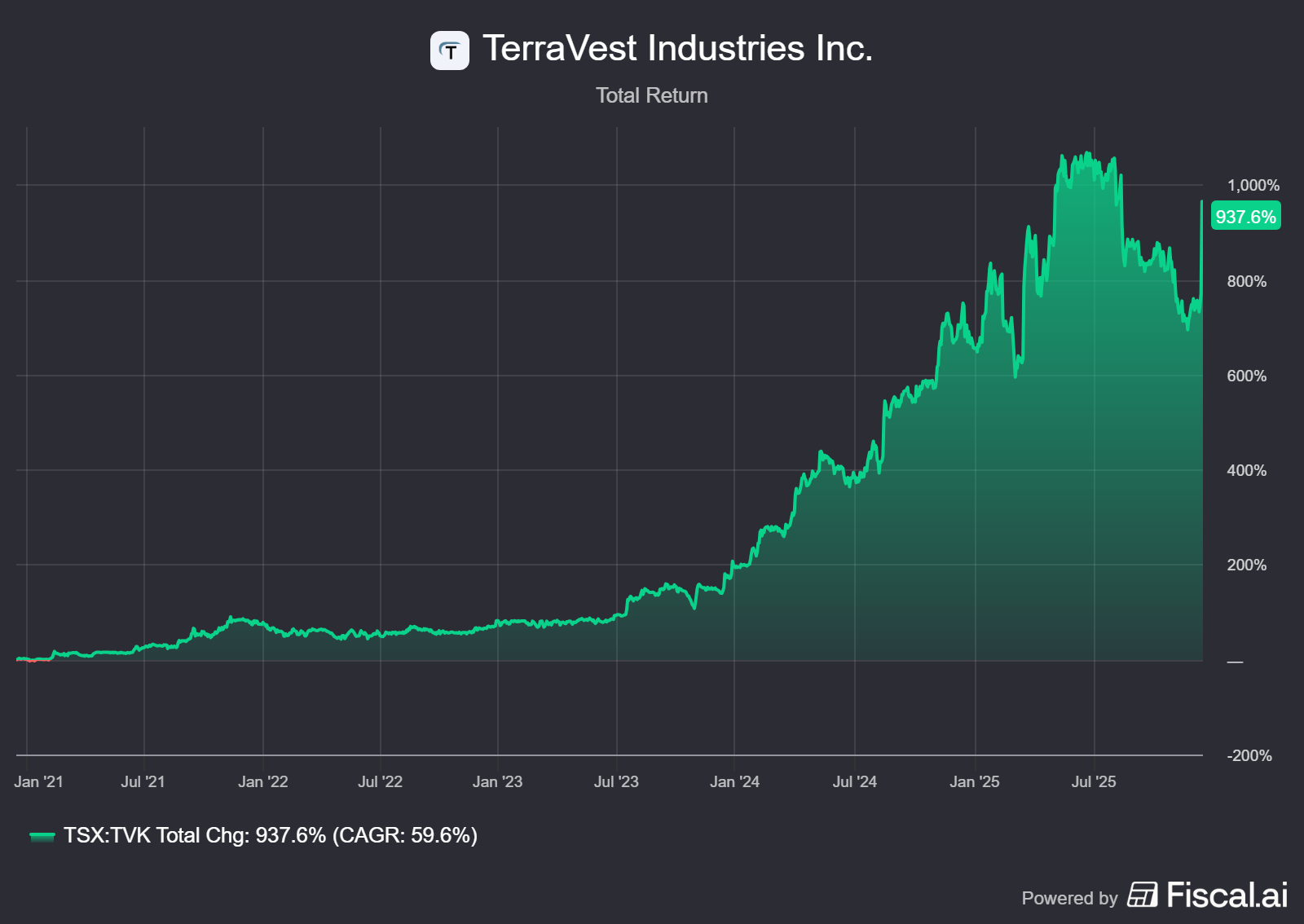

TerraVest surprises with strong figures in a difficult year

TerraVest (Toronto: TVK) published its annual results for fiscal year 2025 this week, a year marked by increased uncertainty due to new trade and tariff measures. Management indicated that recent tariff announcements have led to uncertainty within the North American manufacturing industry, which has temporarily led to lower demand for some of TerraVest's activities. At the same time, the company emphasizes that the majority of its portfolio is focused on domestic markets, which significantly limits the potential impact of these tariffs.

Despite these challenging circumstances, TerraVest managed to exceed expectations, which immediately translated into a share price increase of approximately 25% in the two days following the announcement of the figures.

The figures:

- Fiscal year: revenue of $1.371 million (+50%); adjusted normalized profit of $265 million (+40%).

- Last quarter: revenue of $419 million (+81.4%); adjusted normalized profit $81.9 million (+72.1%).

Even more important than revenue and profits is Cash Available for Distribution (CFAD), a measure of the cash flow available for dividends and capital allocation. This is the capital that management can use to reinvest or distribute to shareholders. This figure also rose to record highs of $6.37 per share for the year, an increase of 18%.

The reason for the growth

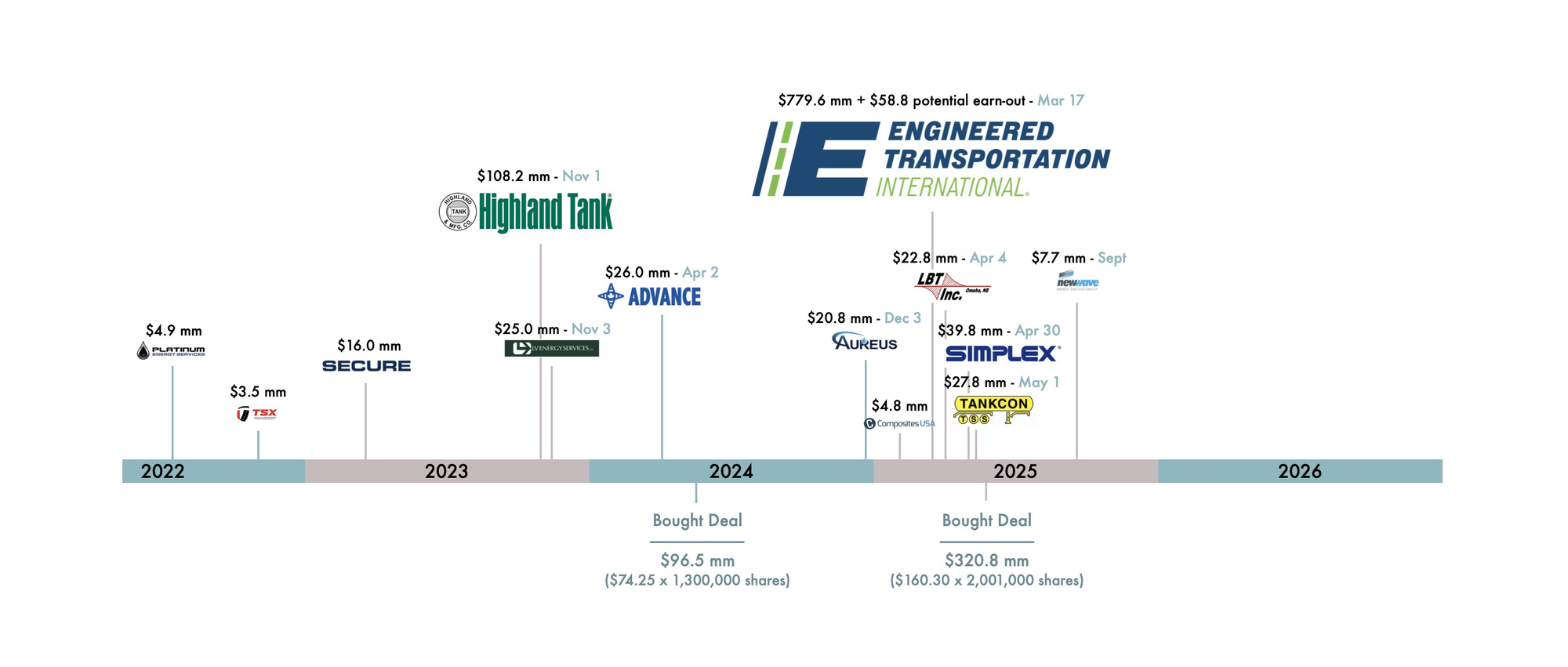

Although TerraVest achieved organic growth of +7%, most of the revenue growth came from the exceptionally active acquisition strategy of the past year. In total, the company spent a record $858 million on acquisitions in fiscal year 2025, almost six times as much as in the previous year. This sharp increase is almost entirely attributable to the major acquisition of Entrans International, as can be seen in the image below.

Management also announced a new strategic acquisition. In September 2025, Green Energy Services Inc. (GES), a subsidiary in which TerraVest holds a majority interest, entered into an agreement to acquire the Canadian assets of New Wave Energy Services Ltd. (“Wave”). Wave provides integrated water solutions, including in-field water management, water treatment, water storage, and long-distance water transportation in Canada.

These activities fall within a relatively new but rapidly emerging sector within the TerraVest portfolio. At the same time, they fit seamlessly with the company's existing competencies: custom engineering, steel fabrication, and the supply of critical infrastructure for essential resources. Water and waste management also share many characteristics with TerraVest's traditional markets: highly fragmented, locally organized, capital-intensive, and structurally growing.

Receive weekly insights in your inbox

Exclusive analyses and updates on family holdings and global market developments.

Why TerraVest is getting stronger with new verticals

That this ability to enter new, adjacent sectors is one of TerraVest's greatest strengths is clear from a recent interview with Guy Gottfried. Gottfried is a US-based asset manager and founder of Rational Investment Group, a fund with a concentrated long-term strategy. He identified TerraVest very early on and has built a close relationship with its management over the years.

It is striking that Gottfried decided to sell his entire position in TerraVest around 2010–2013. The reason was a strategic change of course that, in his opinion, did not match his original expectations. A few months later, however, the share returned to the portfolio, this time not as a small position, but ultimately as the largest position in the history of his fund.

The reason for this turnaround was his deeper understanding of TerraVest's acquisition strategy. Gottfried concluded that the markets TerraVest targets consist of hundreds of small, often family-run businesses, where acquisitions typically take place at multiples of around 5× EBITDA. Through operational improvements and synergies, these multiples fall to low single-digit levels on a post-synergy basis.

These synergies are achieved through a combination of economies of scale, operational improvements, and price discipline. TerraVest reduces raw material costs, particularly for steel, through centralized purchasing and economies of scale. At the same time, production processes are further automated to reduce labor costs and increase capacity. Unprofitable product lines and inefficient structures are being phased out, while the group is actively focusing on cross-selling, internalizing production, and utilizing existing overcapacity.

Pricing also plays an important role. Whereas previous, often family-run owners were reluctant to raise prices, TerraVest's portfolio approach enables it to enforce more consistent price discipline without losing market share.

This approach enables TerraVest to reduce acquisitions that are initially made at 5–7× EBITDA to an effective 2–3× EBITDA after realizing synergies. According to Gottfried, it is precisely this quality—the combination of capital discipline, operational execution power, and scale—that makes the company ideally suited to successfully enter new, capital-intensive industrial sectors, such as water and waste management. Entering this new market provides access to hundreds of small, often family-run businesses.

We previously wrote our own analysis of TerraVest, which you can read below.

What to expect for 2026?

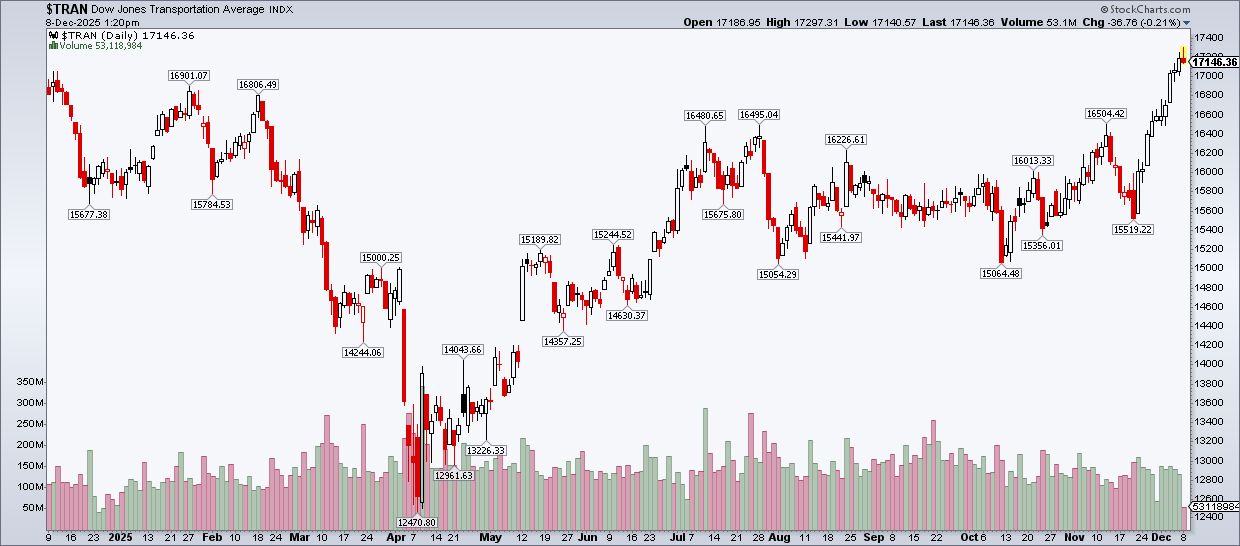

Recovery in the transport market

2025 was a difficult year for the American truck and transport sector, partly due to tariffs and economic uncertainty. However, by the end of the year, the first signs of recovery were visible. The Dow Jones Transportation Average showed a clear year-end rally, which historically often points to improving cyclical sentiment. A potential catalyst for this division of TerraVest.

Entrans is the largest acquisition in TerraVest's history and will therefore play a decisive role in 2026. The priority lies in further operational integration, realizing purchasing and production synergies, and leveraging TerraVest's economies of scale.

In addition, the market is eagerly awaiting the first defense-related contracts. Entrans has the technical capabilities and product portfolio to serve defense end markets and earlier this year signed several interesting contracts with the US Department of Defense. These military orders are expected to be reflected in the figures in 2026. Any further contract announcements in 2026 would not only add new revenue, but above all further strengthen TerraVest's strategic positioning towards this new, structural growth market.

Data Centers Management explicitly points to strong demand from data center end markets, both for storage tanks (Highland Tank) and load banks (Simplex). In this market, speed of delivery is currently more important than price, which plays into TerraVest's hands. To meet the high demand, the company has deployed other business units within Compressed Gas and Processing Equipment to deliver additional capacity at an accelerated pace. This exposure to data center infrastructure is expected to increase further in 2026.

We therefore do not expect 2026 to be a year of new mega deals, but rather a period in which TerraVest will focus on further vertical expansion within existing, recently tapped markets and potential new markets.

TerraVest is currently trading on the Toronto Stock Exchange at a price of CAD 153.34 per share.

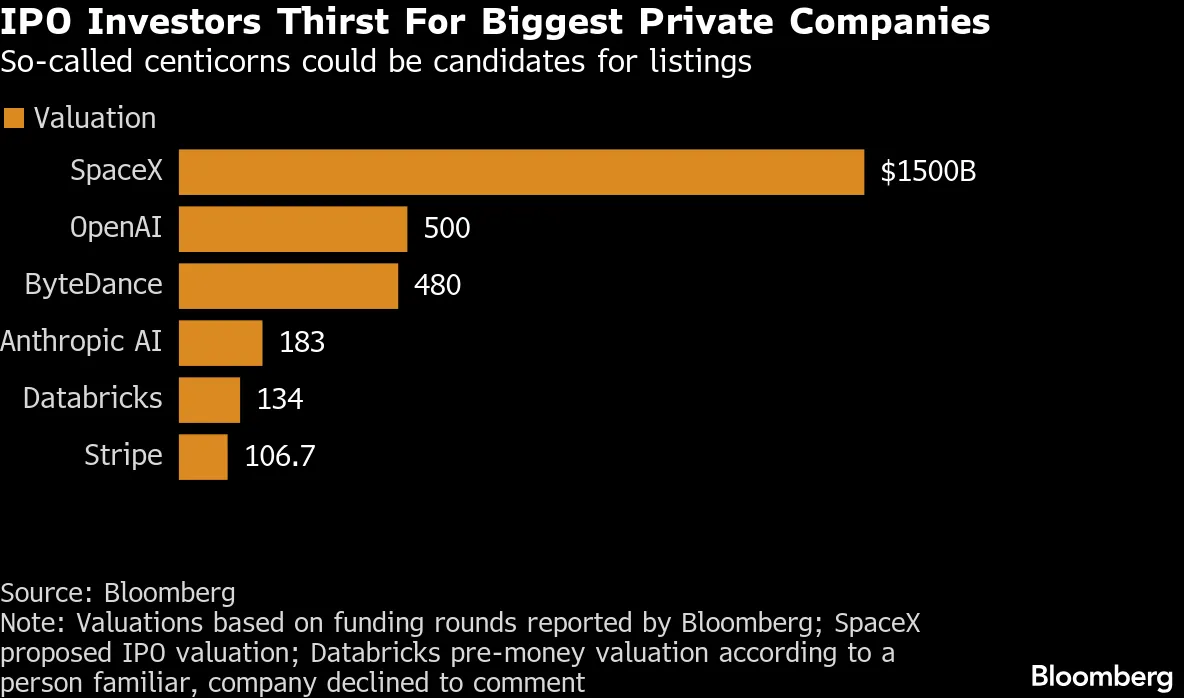

Our portfolio aboard the SpaceX rocket

SpaceX is preparing an internal share sale that could value the company at $800 billion, making it once again the most valuable private company in the world. In parallel, the company is exploring an IPO from 2026 onwards, targeting a valuation of around $1.5 trillion. This would make SpaceX significantly larger than the current most valuable private technology company, OpenAI.

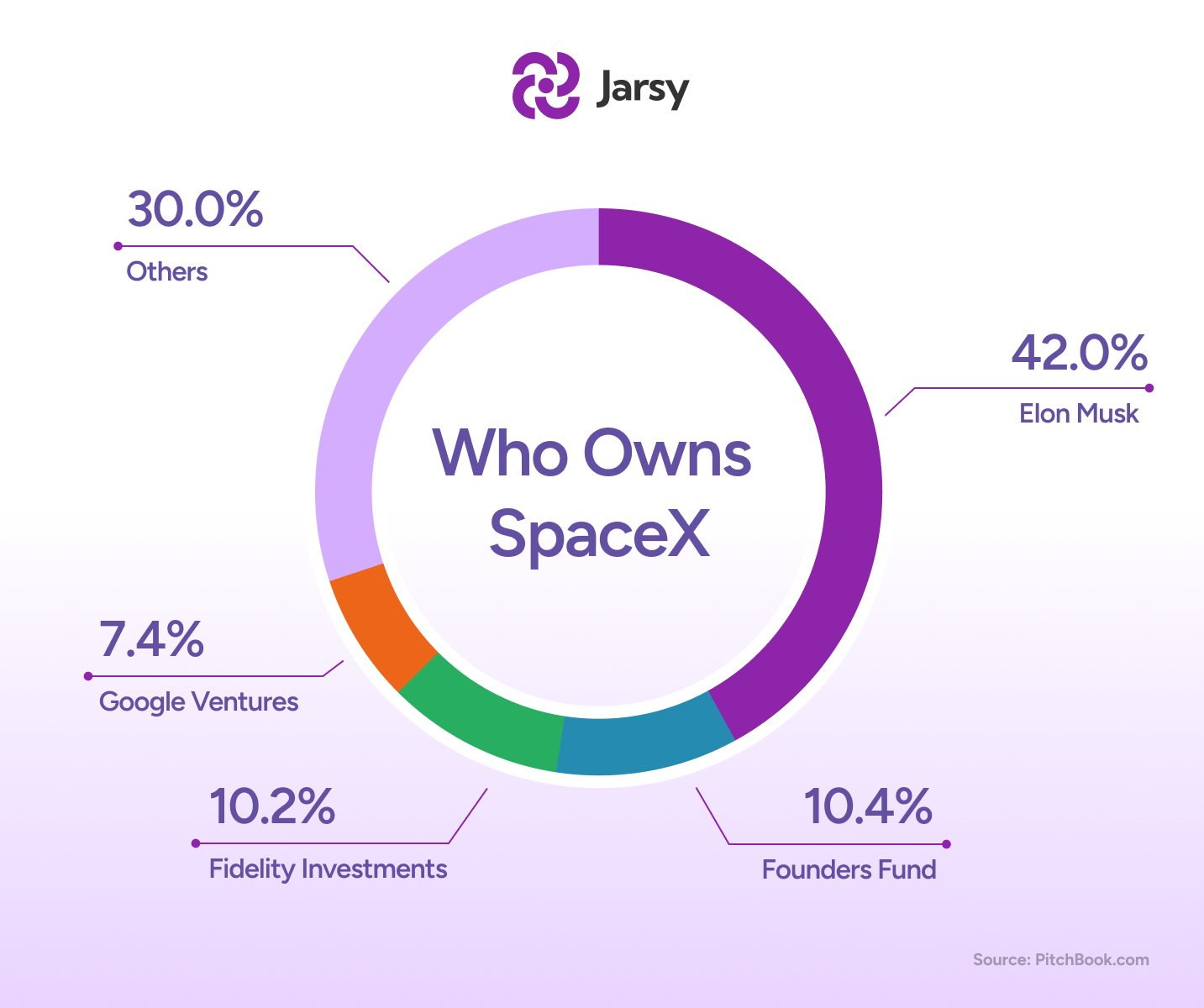

With such a valuation, Elon Musk's personal net worth will also skyrocket. Musk owns an estimated 42% of SpaceX, which at a valuation of $1.5 trillion alone amounts to a stake of approximately $630 billion. Combined with his existing interests and bonuses, particularly in Tesla, this creates a realistic scenario in which Musk becomes the world's first trillionaire. A concept that does not even exist today, meaning a fortune of USD 1,000 billion!

Alphabet as shareholder and future partner

Not only SpaceX itself, but also other companies are benefiting from this jump in valuation. This includes companies in our portfolio. More than ten years ago, Google invested approximately $900 million in SpaceX, representing a stake of around 7.4%. After the most recent secondary share sale (valuation of $800 billion), that stake is now worth around $50 billion, a return of roughly 56x. If SpaceX lives up to the rumors and soars to a valuation of $1.5 trillion, Alphabet's stake will be worth approximately $111 billion, a return of roughly 123x the original investment.

Alphabet's early investment in SpaceX also turned out to be a strategic masterstroke. The biggest challenge facing Big Tech today is not software or talent, but energy. The explosive growth of frontier AI models requires unprecedented amounts of power and cooling, which is putting pressure on electricity grids, causing water shortages, and requiring billions in investments in physical infrastructure worldwide.

One of our moonshots is to one day have data centers in space where we can harness the sun’s energy, orders of magnitude more than what we can generate on Earth.

The space offers an elegant solution to virtually all structural limitations of AI infrastructure:

- Unlimited solar energy, without atmospheric losses;

- Natural cooling, thanks to the extreme cold of space;

- No scarce inputs such as land, grid capacity, or water.

With Project Suncatcher, Google is preparing to launch the first test satellites for space-based computing in 2027. It seems obvious that this will also be done in collaboration with SpaceX.

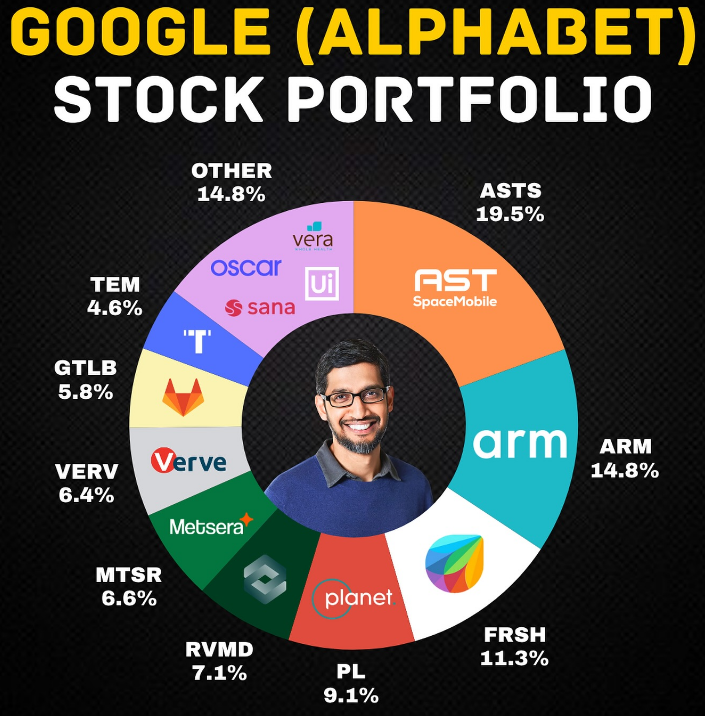

In addition to its stake in SpaceX, Alphabet also owns a 3.28% stake in AST SpaceMobile, a publicly traded company often viewed by the market as a smaller, public counterpart to SpaceX in the field of satellite communications. Alphabet participated in a strategic financing round in 2024 at a valuation of approximately $1 billion. Since then, AST SpaceMobile's market value has risen to approximately $31 billion, representing a return of approximately 31×. Alphabet's stake is currently valued at approximately $750 million and is one of the largest individual publicly traded equity positions in the portfolio.

With interests in both SpaceX and AST SpaceMobile, Alphabet has strategically positioned itself in two of the most high-profile players in the new space economy. Together, these positions offer not only financial upside potential, but above all strategic optionality towards a future in which data centers and computing power move into space and evolve from science fiction to reality.

Receive weekly insights in your inbox

Exclusive analyses and updates on family holdings and global market developments.

Scottish Mortgage's largest position

Another holding in our portfolio that is benefiting is Scottish Mortgage Investment Trust. The Scottish investment holding company currently has SpaceX on its balance sheet at a value of approximately $1.6 billion, making it the largest individual position in the portfolio, accounting for approximately 8.2% of total assets.

As SpaceX is a private company, the exact valuation basis used by Scottish Mortgage is not publicly known. However, it is obvious that the position is valued on the basis of the most recently reported capital round, which earlier this year implied a valuation of around $400 billion. If this assumption is correct, Scottish Mortgage represents a stake of approximately 0.3% in SpaceX. At the recently discussed internal valuation of $800 billion, this stake would amount to approximately $2.4 billion. In the scenario of a future IPO around $1,500 billion, the value could even rise to approximately $4.5 billion.

Would you like to read more about Scottish Mortgage's investment in SpaceX? Click on the link below.

Sofina's potential exposure via Sequoia

Finally, there is also the possibility that the Belgian investment company Sofina has an indirect interest. The company participates as a limited partner in a wide range of private equity and venture capital funds, including Sequoia Capital. It is known that Sequoia participated in a capital round for SpaceX in 2021, at a valuation of approximately $74 billion at the time. However, no public information is available about the exact size of the stake that Sequoia acquired in the process.

Nor is it publicly known whether Sofina actually has exposure to SpaceX through its holdings in Sequoia funds, nor how large that exposure might be. This means that an indirect interest remains plausible but unquantifiable.

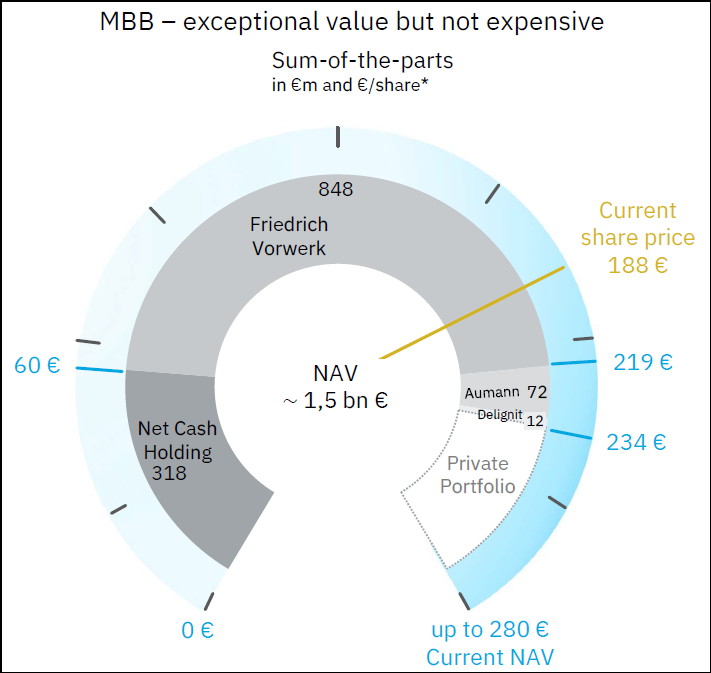

MBB puts its money where its mouth is with new buyback

German investment holding company MBB (Frankfurt: MBB) announced this week that it will exercise its authorization to repurchase its own shares. The management of the German family holding company currently sees a significant undervaluation in the share price. This fact, combined with the strong capital position, will be used to create value for shareholders.

The program started on December 11 and will run until April 14, 2026, at the latest. MBB intends to repurchase up to EUR 22 million of its own shares on the stock exchange. At the time of the announcement, MBB's share price was still EUR 189 per share, but since then, the price has risen by around 6%.

The most interesting aspect of this program is the price limit set by the board. Shares may be purchased at a price of up to EUR 222 per share. This level can be seen as a lower limit for what management considers to be the fair value of the company. As long as the share price remains below this level, MBB considers the purchase of own shares to be an attractive allocation of capital.

The undervaluation mentioned by MBB did not come out of nowhere. As we discussed in detail in our newsletter for week 48, the market is taking too narrow a view of the holding company. Many analysts and investors focus primarily on the listed subsidiary Friedrich Vorwerk, which is benefiting from the energy transition. Although this is a growth gem, the rest of the portfolio is underexposed.

Founder and CEO Christof Nesemeier previously referred to subsidiary DTS as his "wild card." This cybersecurity specialist acts as a second, powerful growth engine within the holding company, one that is hardly valued by the market. DTS shows impressive margins and growth figures that are effectively included "for free" in MBB's current share price.

In a recent interview, Nesemeier indicated that he considers MBB to be very attractively valued, despite its rise of more than 100% this year. Referring to the sum-of-the-parts chart above, Nesemeier sees the intrinsic value at around EUR 280 per share. If you subtract the value of Vorwerk and the cash position from MBB's market capitalization, it can be said that the market implicitly assigns a much too low (or even negative) value to DTS. With the buyback, MBB wants to take full advantage of this.

MBB ended the trading week at a price of EUR 200 per share.

Receive weekly insights in your inbox

Exclusive analyses and updates on family holdings and global market developments.

Would you like more information about our services? Please feel free to contact us.

Contact us

Disclaimer:

No rights can be derived from this publication. This is a publication of Tresor Capital. Reproduction of this document, or parts thereof, by third parties is only permitted after written permission and with reference to the source, Tresor Capital.

This publication has been prepared by Tresor Capital with the utmost care. The information is intended to be general in nature and does not focus on your individual situation. The information should therefore expressly not be regarded as advice, an offer or proposal to purchase or trade investment products and/or purchase investment services nor as investment advice. The authors, Tresor Capital and/or its employees may hold position in the securities discussed, for their own account or for their clients.

You should carefully consider the risks before you begin investing. The value of your investments may fluctuate. Past performance is no guarantee of future results. You may lose all or part of your investment. Tresor Capital disclaims any liability for any imperfections or inaccuracies. This information is solely indicative and subject to change.

Read the full disclaimer at tresorcapitalnieuws.nl/disclaimer .