Family Holdings #51 - HEICO proves once again why it is a quality compounder

This week's topics:

Berkshire Hathaway is reshuffling its top team ahead of the formal transition to Greg Abel as CEO in 2026. The departure of Todd Combs, who played a key role as investment manager and turnaround CEO at GEICO, marks a clear phase change: from analytical reform to operational stability, with Nancy Pierce as internal successor at GEICO.

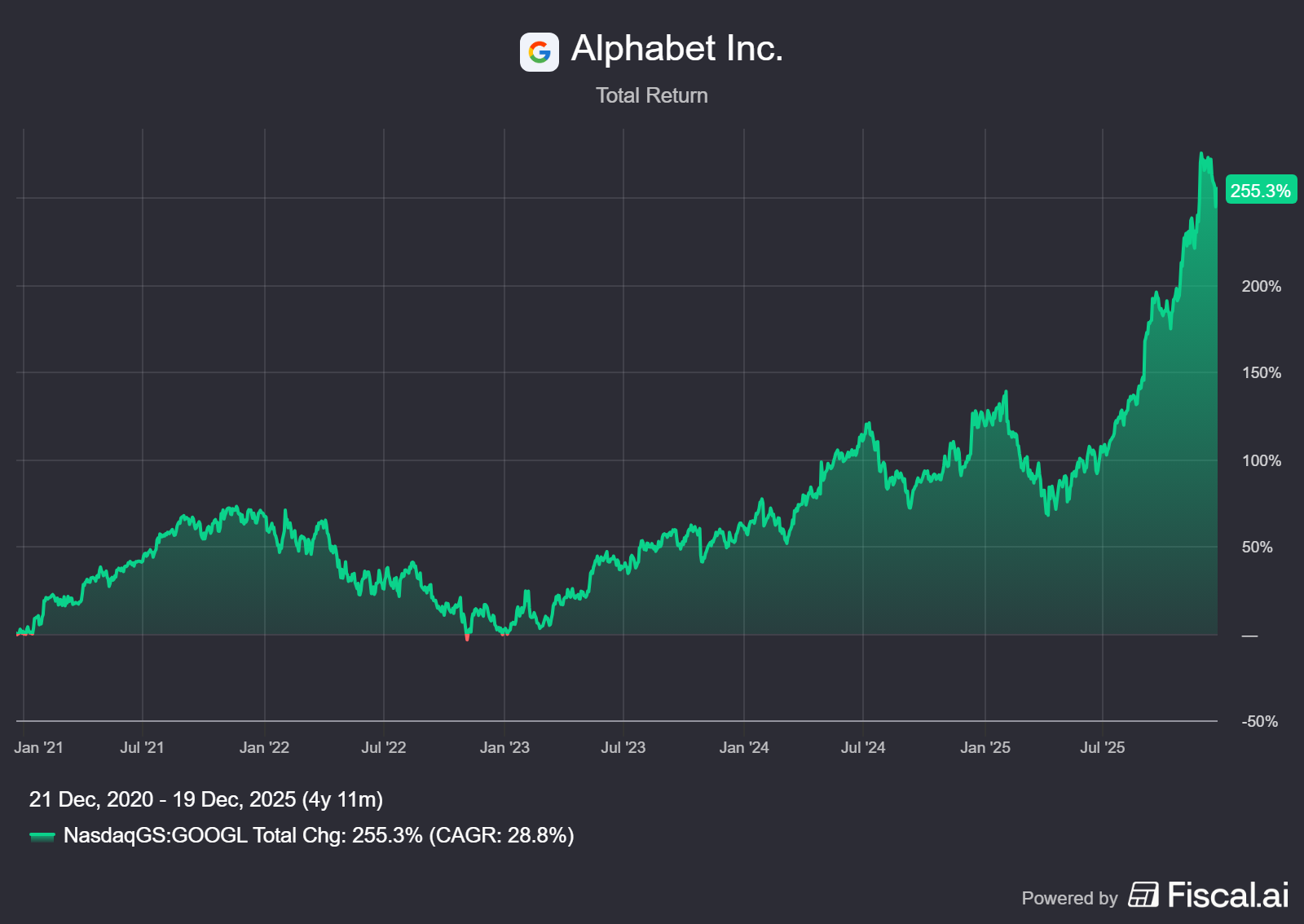

Alphabet benefited again this week from revaluations within its ecosystem, leading us to speculate about a higher intrinsic value for the company. Waymo is in talks about a new round of financing at a valuation of approximately USD 100 billion, more than double last year's valuation, driven by strong growth in fully autonomous rides and further international expansion plans. At the same time, the announced OpenAI revaluation to approximately USD 750 billion raises questions about the implicit value of Gemini, which is increasingly seen as a technological leader and is being rapidly rolled out worldwide thanks to its integration with Apple.

In Brief:

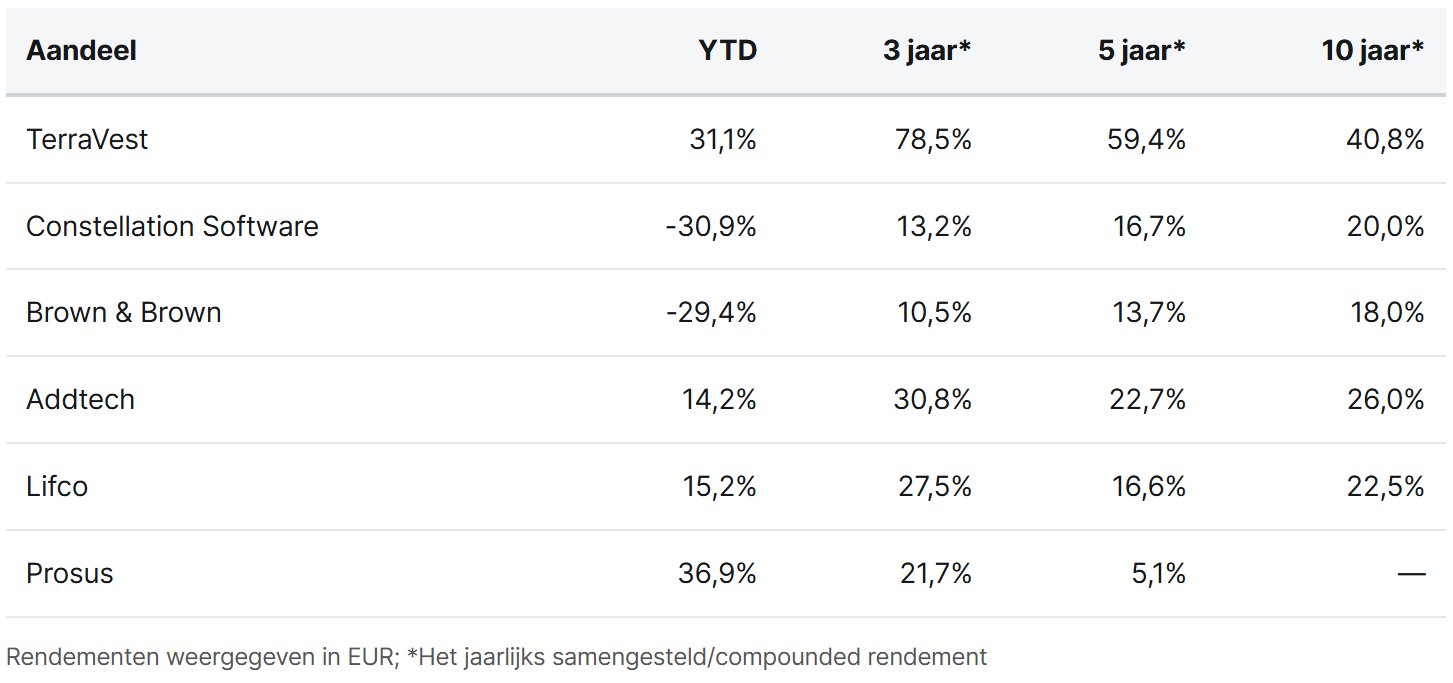

TerraVest ( Toronto: TVK) saw its first insider purchase this week by new CFO Guillaume Cloutier, who has been in office since November. He bought 800 shares at CAD 154.92 each, a purchase that took place after the recent price increase of approximately 30%.

Constellation Software (Toronto: CSU) also reported new insider activity: recently appointed CEO Mark Miller purchased an additional 1,520 shares, worth approximately USD 3.5 million. This is his second purchase since September and follows the tradition of CSU leaders investing substantial personal capital.

In addition, subsidiary Jonas made a new acquisition. It acquired Pennsylvania-based Site Service Software, a provider of software and mobile solutions for companies active in lift service, maintenance, repair, and inspections.

Brown & Brown (New York: BRO) acquired Campbell Agency this week, an agency founded in 1991 that specializes in workers' compensation insurance. Founder Kevin Campbell and partner Kian Ostovar will join Brown & Brown's offices.

Addtech ( Stockholm: ADDT-B) expanded its activities once again with three additional acquisitions. Within the Automation division, the company acquired BCK Holland and Kramer & Duyvis, two Dutch manufacturers of internal transport systems for the packaging and food & beverage industries, among others, with a combined turnover of EUR 8 million and 35 employees. Addtech also acquired the Norwegian company Purenviro AS, a specialist in solutions for the processing of environmentally harmful and odorous gases, with a turnover of approximately NOK 55 million and seven employees. These transactions bring the total number of Addtech acquisitions this year to ten.

Lifco ( Stockholm: LIFCO-B) expanded its Dental division with the acquisition of German company Karl Kaps GmbH & Co. KG, a niche manufacturer of medical and dental microscopes. Karl Kaps generated sales of approximately EUR 10.1 million in 2024 and has 33 employees. The company will be consolidated within Lifco's Dental Business Area in the first quarter of 2026.

Prosus ( Amsterdam: PRX) accelerated its share buyback program over the past two weeks. According to CEO Fabricio Bloisi, this was financed with proceeds from previous divestments, a sign of confidence in the current valuation.

TerraVest, Constellation Software, Brown & Brown, Addtech, Lifco, and Prosus are currently trading on the Toronto, New York, Stockholm, and Amsterdam stock exchanges at prices of CAD 162.23, CAD 3,343.60, USD 81.39, SEK 325.60, SEK 351.80, and EUR 53.54 per share, respectively.

HEICO confirms its status as a structural compounder

Last quarter, we wrote about HEICO's (New York: HEI.A) impressive quarterly figures, which resulted in new record highs at the time. This quarter, which is also the end of the fiscal year, the company continues on this path unabated. Once again, several records have been broken and the results leave little room for doubt: HEICO continues to perform exceptionally well operationally.

The compounding machine continues to run steadily. Growth does not come from one-off windfalls, but from a consistent and reproducible model that adds value year after year. In our previous deep dive, we took a closer look at why we expect HEICO to continue to deliver this performance in the long term. Central to this is a management team with a pronounced long-term focus, which deploys capital in an extremely disciplined manner and operates in niches with structural growth tailwinds.

For those who want to understand more deeply why we believe HEICO can continue to create value for years to come, we refer you to our previous analysis below.

Strong organic growth, margin expansion, and accelerating cash flow

The figures presented once again underscore why HEICO is one of the most consistent compounders in the industrial and aerospace sector. In the fourth quarter, sales rose by 19%, with the emphasis clearly on organic growth. Approximately 12 percentage points of that growth came from higher volumes and structurally strong end markets, supplemented by a modest but valuable contribution from recent acquisitions.

Equally relevant are developments in profitability and cash flow. The operating margin improved by approximately 1.5 percentage points to 23.6% in a single year, a strong performance for a company that already operates at a high level and a clear sign of economies of scale. Growth is therefore not at the expense of efficiency, but rather reinforces it. This is directly reflected in the figures: EBITDA rose by 26% and operating cash flow by as much as 44%, both well above the historical growth trends of 17% and 19% respectively.

This brings us to the point that investors in this sector tend to scrutinize most critically: debt. HEICO operates in a capital-intensive industry where debt is the rule rather than the exception, but recent figures show that the company is actively reducing its risk in this area. The ratio of total debt to net income improved from 4.34x to 3.14x, while the net debt-to-EBITDA ratio fell from 2.06x to around 1.6x in one year. This gives HEICO considerably more financial flexibility than many of its peers. By way of comparison, a direct competitor such as TransDigm operates structurally with a net debt-to-EBITDA ratio of around 6x.

Recent acquisition and AI positioning

With such strong figures, it is hardly surprising that co-CEOs Eric and Victor Mendelson once again emphasize the role of culture, long-term thinking, and employees within HEICO:

"We are beyond proud of HEICO's team, who generated our organic and acquired growth, by continuing our 35-year track record of exceptional performance. These results stem from hard work and actions taken over decades, not just the past year, and demonstrate the value creation of HEICO's long-term focus in everything we do."

Last week, the company announced another acquisition. Its subsidiary Wencor will take over the activities of EthosEnergy Accessories & Components. Ethos specializes in the repair of engine parts for gas turbines, aviation, and defense, and has approximately 175 employees spread across three locations. With this acquisition, HEICO is strengthening its position in the fast-growing industrial gas turbine segment, a market that, according to management, is structurally benefiting from increasing energy demand, driven in part by the rollout of AI infrastructure. This positions the company in a long-term growth market that is expected to continue to invest substantially in the coming years.

The fact that HEICO is not building exposure from scratch here, but is already active within these end markets, is evident from a recent overview image of its largest direct customers. In addition to familiar names from aviation, defense, and aerospace, we also see companies such as Samsung, Micron, and Siemens. These are players that play a central role in semiconductors, industrial automation, and data center infrastructure, essential building blocks of the current and future AI economy.

This creates indirect but concrete exposure to the further rollout of AI infrastructure, without fundamentally changing the nature of HEICO's core activities.

HEICO is currently trading on the New York Stock Exchange at a price of USD 253.09 per Class A share.

Receive weekly insights in your inbox

Exclusive analyses and updates on family holdings and global market developments.

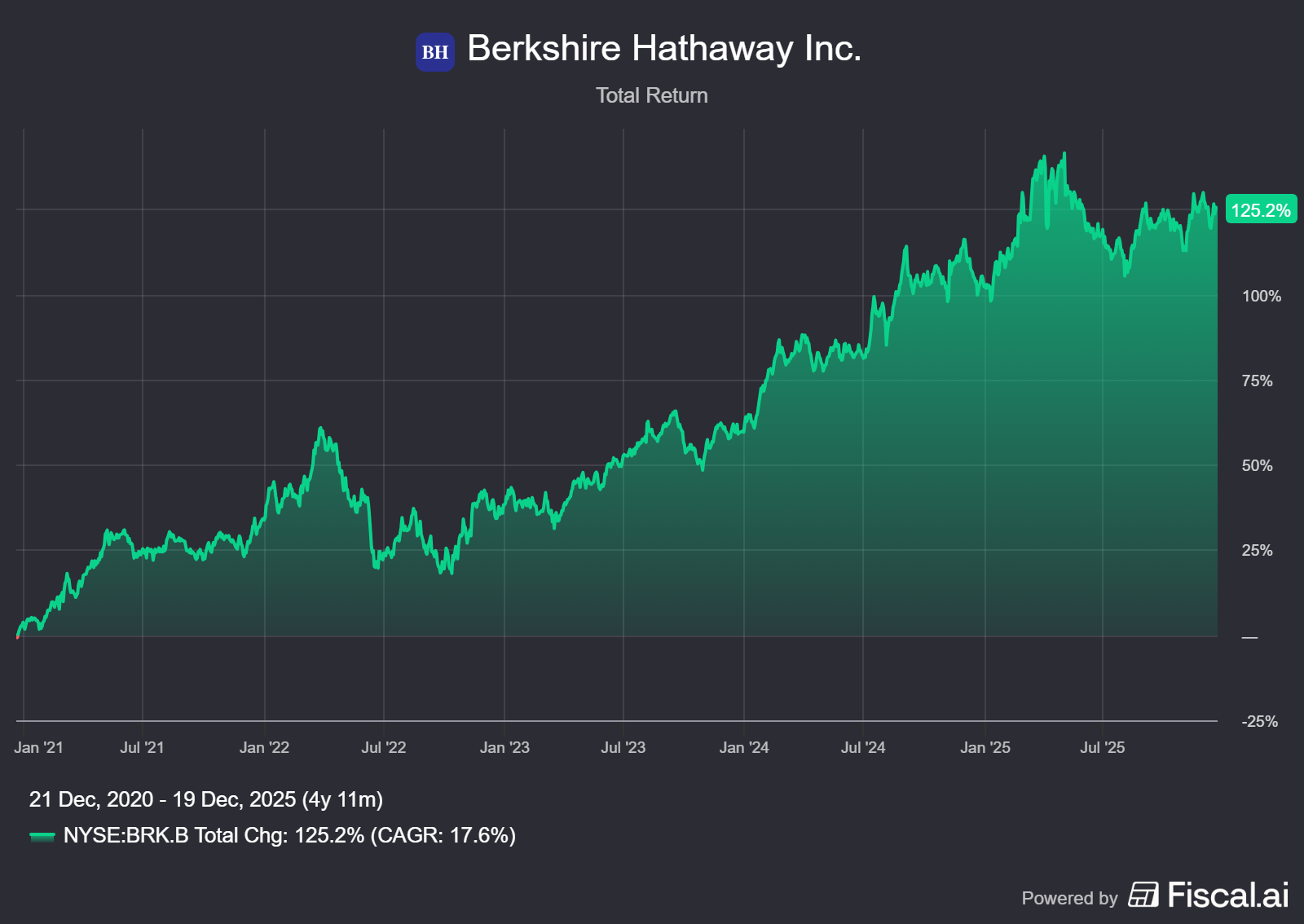

Berkshire realigns top team toward Abel era

Berkshire Hathaway (New York: BRK.B) recently announced a series of key appointments that will reshuffle both its insurance and non-insurance operations as the holding company prepares for the formal transition to Greg Abel as CEO on January 1, 2026.

The most notable change is the departure of Todd Combs. He had been one of Buffett's investment managers since 2010 and had combined that role with an operational role as CEO of GEICO since 2020. Berkshire has now confirmed that Combs is leaving to join JPMorgan Chase, where he will take on a senior investment role under Jamie Dimon.

The departure of Todd Combs

Todd Combs was brought in as an investment manager in 2010 and became one of the few people to whom Warren Buffett gave structural portfolio responsibility. In 2020, he took on an atypical dual role: Combs remained active as a portfolio manager, but at the same time became CEO of GEICO.

Buffett later emphasized that Combs had attracted many strong people to GEICO and broadened the organization's scope. Under his leadership, GEICO was gradually transformed from a traditional, strongly cost-driven insurer into an organization with a greater emphasis on data, pricing discipline, technology, and long-term underwriting quality. The focus shifted from market share at virtually any price to structural profitability in an increasingly competitive and inflation-sensitive auto insurance market.

This strategic change of course took place against a particularly difficult backdrop. Between 2021 and 2023, the US auto insurance sector suffered heavy losses, leaving Combs with a major recovery task ahead of him. Within Berkshire, he was seen as someone who was willing to take unpopular measures to make GEICO profitable again. This translated into a management style that insiders often described as tough, technocratic, and lacking in empathy.

During that period, the Reddit forum r/GEICO saw many critical comments from users who negatively assessed his leadership. Statements such as "I survived Combs" and stories about a deteriorating corporate culture, increased work pressure, and strong top-down management are regularly posted there. At the same time, nuance is required, as anyone can present themselves as a (former) employee online. Anonymity makes verification impossible, and negative experiences are often shared disproportionately on these types of platforms.

Mainstream media called Todd Combs "stellar" and said he was "snagged" by JPMorgan

— Edwin Dorsey (@StockJabber) December 14, 2025

His GEICO employees wrote:

"Is it too soon to sell 'I survived Combs' t-shirts?"

"This will be one of those rare moments when a whole company celebrates their CEO leaving" pic.twitter.com/xWnmXUgb0J

It is precisely against the backdrop of this mixed legacy that the choice of Nancy L. Pierce as the new CEO is significant. Whereas Combs was brought in as an analytical reformer and turnaround manager, Berkshire is now consciously opting for stability, operational continuity, and in-depth internal knowledge of the insurance business.

Pierce has been with GEICO since 1986 and has built her entire career within the organization. Over the past decades, she has held leadership roles in claims, underwriting, product development, and regional operations, and most recently served as Chief Operating Officer. As a result, she has a detailed understanding not only of the numbers and processes, but also of the culture, dynamics, and sensitivities within GEICO.

Surprising timing after building up Alphabet

Combs, together with Ted Weschler, symbolized Berkshire's gradual expansion into technology, outside Buffett's traditional comfort zone. Charlie Munger once explicitly noted that without the influence of this younger generation, Berkshire would probably never have invested in Apple and thus missed out on its best-performing investment to date. That is precisely why the timing of Combs' departure feels so striking. Recently, investors were given the impression that the internal investment managers would be given more leeway to allocate opportunistically to new sectors, partly due to the recent build-up of a position in Alphabet. That investment was widely interpreted in the market as a decision that came primarily from the investment team, rather than from Buffett himself.

Other changes in the structure

In addition to Todd Combs' departure, Berkshire Hathaway announced several additional appointments that together reveal a clear pattern. First, the company announced that Berkshire Hathaway veteran and CFO Marc Hamburg will retire in June 2027. Hamburg has been in that role since 1992 and has been with the company for more than 40 years. His successor is Charles Chang, currently CFO of Berkshire Hathaway Energy. Chang will take up his position in June 2026. A one-year transition period indicates a deliberate, risk-averse transfer of financial responsibility.

In addition, Berkshire is appointing an internal General Counsel for the first time in its history. Michael O'Sullivan, formerly of Snap and previously a partner at Munger, Tolles & Olson, will start in Omaha in January 2026. Observers see this step as a logical professionalization of an organization that is becoming increasingly complex, both legally and regulatorily.

Investors, including Christopher Bloomstran on X, point out that these changes together do not represent a break with Berkshire's DNA, but do mark a clear shift: from an extremely lean, Buffett-dominated model to a more structured top team around Abel. The autonomy of subsidiaries remains intact, but the central organization gains more formal clout.

Berkshire Hathaway is currently trading on the New York Stock Exchange at a price of USD 501.90 per B share.

Revaluations increase Alphabet's intrinsic value

Last week, we wrote about SpaceX's revaluation and how Alphabet (New York: GOOGL) and other holding companies as shareholders of the space company are benefiting from this:

This week, two further revaluations took place within and around Alphabet, prompting analysts to once again consider the company's current intrinsic value.

Waymo's value is rising, but how sustainable is that lead?

Waymo, Alphabet's autonomous driving subsidiary, is in talks with investors about a new round of funding that values the company at around USD 100 billion. According to both The Information and Bloomberg, this would be a multi-billion dollar financing round, possibly even more than USD 10–15 billion, with Alphabet itself as the lead investor. This would more than double Waymo's previous external valuation of USD 45 billion in September in a short period of time. The transaction is expected to be completed in early 2026.

This higher valuation did not come out of nowhere. Waymo is currently the only company in the US offering paid robotaxi services on a large scale without a safety driver or supervisor in the car. The company has a fleet of over 2,500 vehicles and reached an important milestone this spring: more than 1 million fully autonomous trips per month, accounting for 14 million trips this year, a threefold increase compared to 2024. In operational terms, this now amounts to 3.8 million driving hours, with, according to Waymo, a 10-fold reduction in accident frequency and 18 million kilograms of CO₂ emissions avoided. The growth plans are also concrete: by 2026, Waymo wants to expand to 20 additional cities, including Tokyo and London, and further increase the number of airports in addition to San Francisco, San Jose, and Miami.

Although Waymo's recent revaluation underscores confidence in the commercial breakthrough of autonomous mobility, it remains far from clear how Waymo's profitability and thus its intrinsic value will develop in the longer term. The core of that uncertainty lies in the margins per ride and the capital intensity of the model.

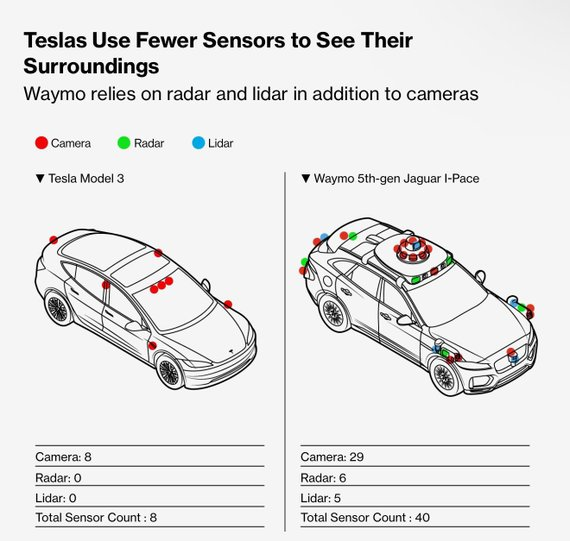

Waymo takes a fundamentally different technological approach than many of its competitors. Whereas Tesla relies on a camera-only strategy, Waymo works with a redundant sensor stack of cameras, radar, and lidar, supplemented with highly detailed HD maps for each city. This approach increases operational reliability in complex urban environments and explains why Waymo already offers fully driverless robotaxi services in several cities today.

At the same time, this choice leads to significantly higher hardware costs. The production costs of a Waymo robot taxi are estimated at approximately USD 100,000 to 150,000 per vehicle, compared to around USD 25,000 for a Tesla Model 3. This difference highlights the tension in the revenue model: operational advantage versus scalability and cost structure.

In the short term, Waymo clearly has momentum. The company has licenses, operational experience, and is already generating revenue. In the medium term, however, the valuation question becomes more complex. Competitors, particularly Tesla, are using existing vehicles to build up large amounts of driving data intended for future robotaxi applications. In the long term, this could lead to lower costs per mile and greater price pressure in the market.

In any case, Elon Musk leaves little doubt about who he believes will be the long-term winner:

Waymo never really had a chance against Tesla. This will be obvious in hindsight.

— Elon Musk (@elonmusk) December 10, 2025

OpenAI revaluation as a reference for Gemini's value

This week, news broke that OpenAI is in talks with investors about a new round of capital at a valuation of approximately USD 750 billion. If realized, this would be a significant increase from the previous valuation of approximately USD 500 billion in October and would position OpenAI as one of the most valuable private technology companies in the world.

The proposed revaluation underscores the ongoing hunger for capital within the AI sector, but at the same time raises fundamental questions. Although ChatGPT still has the largest market share within large language models, the competitive landscape is rapidly becoming more dynamic. Gemini, Alphabet's AI model, is visibly gaining ground and is increasingly being recognized by market players as a technological leader. Strategic partnerships, including integration within the Apple ecosystem, are also significantly increasing Gemini's distribution and use.

Against this backdrop, our focus on OpenAI's valuation automatically shifts to the question of what Gemini itself could be worth economically. By definition, this exercise remains an estimate, as Gemini is not a separate entity and is deeply intertwined with Alphabet's broader product and infrastructure stack. Nevertheless, it is clear that Gemini's implicit value within Alphabet's sum-of-the-parts is becoming increasingly difficult to ignore.

Alphabet is currently trading on the New York Stock Exchange at a price of USD 305.24 per Class A share.

Receive weekly insights in your inbox

Exclusive analyses and updates on family holdings and global market developments.

Would you like more information about our services? Please feel free to contact us.

Contact us

Disclaimer:

No rights can be derived from this publication. This is a publication of Tresor Capital. Reproduction of this document, or parts thereof, by third parties is only permitted after written permission and with reference to the source, Tresor Capital.

This publication has been prepared by Tresor Capital with the utmost care. The information is intended to be general in nature and does not focus on your individual situation. The information should therefore expressly not be regarded as advice, an offer or proposal to purchase or trade investment products and/or purchase investment services nor as investment advice. The authors, Tresor Capital and/or its employees may hold position in the securities discussed, for their own account or for their clients.

You should carefully consider the risks before you begin investing. The value of your investments may fluctuate. Past performance is no guarantee of future results. You may lose all or part of your investment. Tresor Capital disclaims any liability for any imperfections or inaccuracies. This information is solely indicative and subject to change.

Read the full disclaimer at tresorcapitalnieuws.nl/disclaimer .