Family Holdings #6 - The divergent lessons in capital allocation from Google and Markel

This week's topics:

Addtech reported a third quarter in which revenue growth remained limited, but operational quality came to the fore. The EBITA margin rose to 15.6%, driven by exceptionally strong project mixes within Energy and Industrial Solutions. Despite the challenging Swedish macro environment, order intake confirms that underlying demand remains robust. With eight acquisitions this year and the recent acquisition of RAMME Electric Machines, Addtech once again underlines why it is one of Europe's highest-quality industrial serial acquirers.

Markel Group presented a strong fourth quarter, driven by a clear normalization in underwriting: the combined ratio fell to 94.6%, suggesting that Markel is returning to the structurally profitable levels of previous years. CEO Tom Gayner reiterated that despite fluctuating annual results, the equity portfolio continues to generate consistent double-digit returns over longer periods. Looking ahead to 2026, Markel is consciously choosing quality over growth, with an expected decline in reported premiums due to the exit from reinsurance and the restructuring of the Hagerty model. The target remains a combined ratio in the low 90s, supported by price discipline and selectivity.

In Brief:

Constellation Software (Toronto: CSU) got off to a strong start in February with five acquisitions. The largest acquisition was Scottish company Zonal, which supplies software to the hospitality sector and has approximately 730 employees. American company Symplicity and Dutch company WinCar were also added to the portfolio. In addition, software components were acquired from RE/MAX, followed by the acquisition of Onegreen in Brazil.

Heico ( New York: HEI.A) has acquired EthosEnergy, a leading player in the repair of engine components for the aviation and defense industries. With 175 employees and locations in the United States and Scotland, this acquisition strengthens Heico's competitive advantage in the industrial gas turbine market.

Sofina (Brussels: SOF) is increasing its stake in The Whole Truth with a new investment of USD 21 million. The holding company is leading the capital round, doubling its ownership in the Indian health food producer to 9.3%. The company, which sells protein bars and muesli, among other things, is valued at USD 400 million in this transaction.

SpaceX, Scottish Mortgage Trust's ( London: SMT) largest holding, is becoming a co-owner of a new AI company. Elon Musk is merging SpaceX with xAI to form a new group that is aiming for the largest IPO ever, with a valuation of USD 1,500 billion. The focus is on creating AI data centers in space, powered by solar energy to circumvent the energy limitations on Earth.

Simon Borrows, CEO of 3i Group ( London: III), has further increased his stake in the holding company with a GBP 1 million purchase. This follows an identical purchase in November last year and underscores both the CEO's confidence in his company and the still attractive valuation at which the holding company is trading.

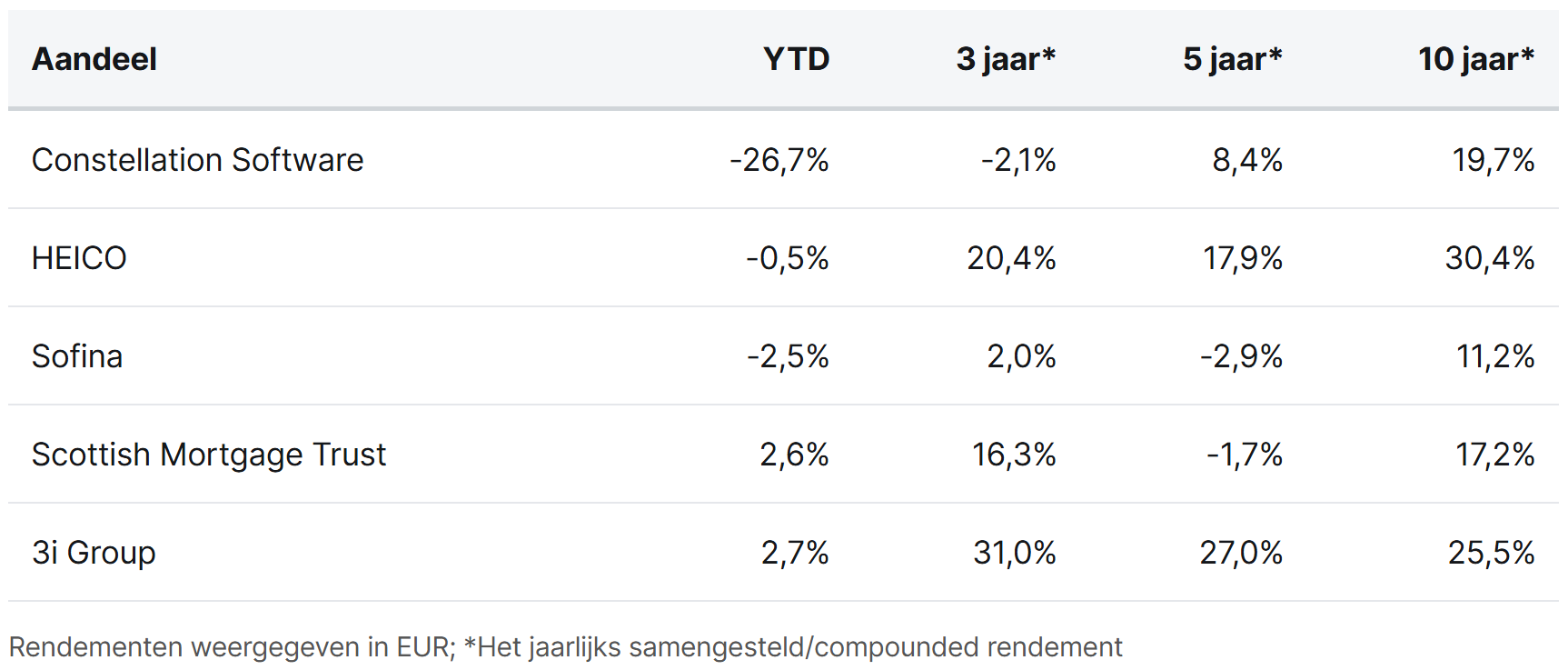

Constellation Software, Heico, Sofina, Scottish Mortgage Trust, and 3i Group are currently trading on the Toronto, New York, Brussels, and London stock exchanges at prices of CAD 2,406.10, USD 251.37 (A share), EUR 241.00, GBP 12.09, and GBP 33.46 per share, respectively.

Win free admission to the event A Heart for Investing

During the first edition of the VFB event Een hart voor beleggen (A Heart for Investing) in Ghent, Tresor Capital partner Michael Gielkens will speak about the power of holding companies. The day program, made possible in part by LYNX, offers parallel sessions with experts such as Jan Longeval, Gert De Mesure, and Pierre Huylenbroeck.

We are giving away two free tickets to our readers. If you are interested, please register before Sunday evening at 11:59 p.m. using the button below. Please note: each entrant is only entitled to one entry.

📅 Date: Saturday, February 14, 2026

🕒 Time: 8:30 a.m. - 4:00 p.m. (including lunch)

📍 Location: Valentin Vaerwyckweg 1, Ghent

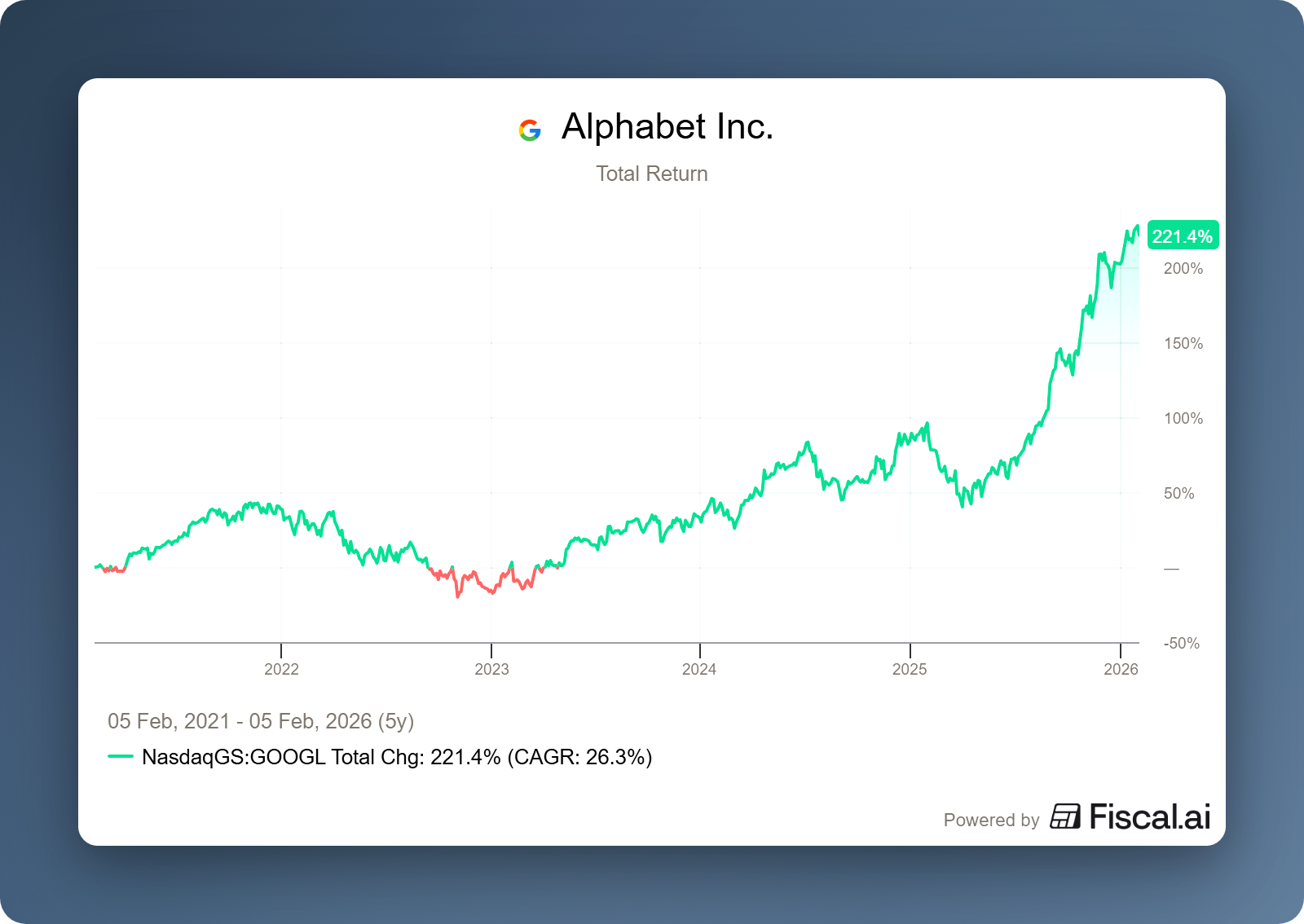

Alphabet doubles AI investments after strong figures

In today's tech market, investors hardly look in the rearview mirror anymore. Last quarter's figures are often already priced in; what really matters is the vision for the future. How is a company positioning itself in the AI race? How will that technology be commercialized? At the presentation of Alphabet's (New York: GOOGL) annual figures, the answer to those questions was louder than ever.

Just a year ago, Alphabet was dismissed as the big loser of the AI revolution. The rise of LLMs such as ChatGPT and Deepseek would spell the end of Google as a search engine. Nothing could be further from the truth. CEO Sundar Pichai, or rather Sundar 'Pitch AI', made it clear that Alphabet has not only embraced AI, but now dominates it.

The core remains undefeated

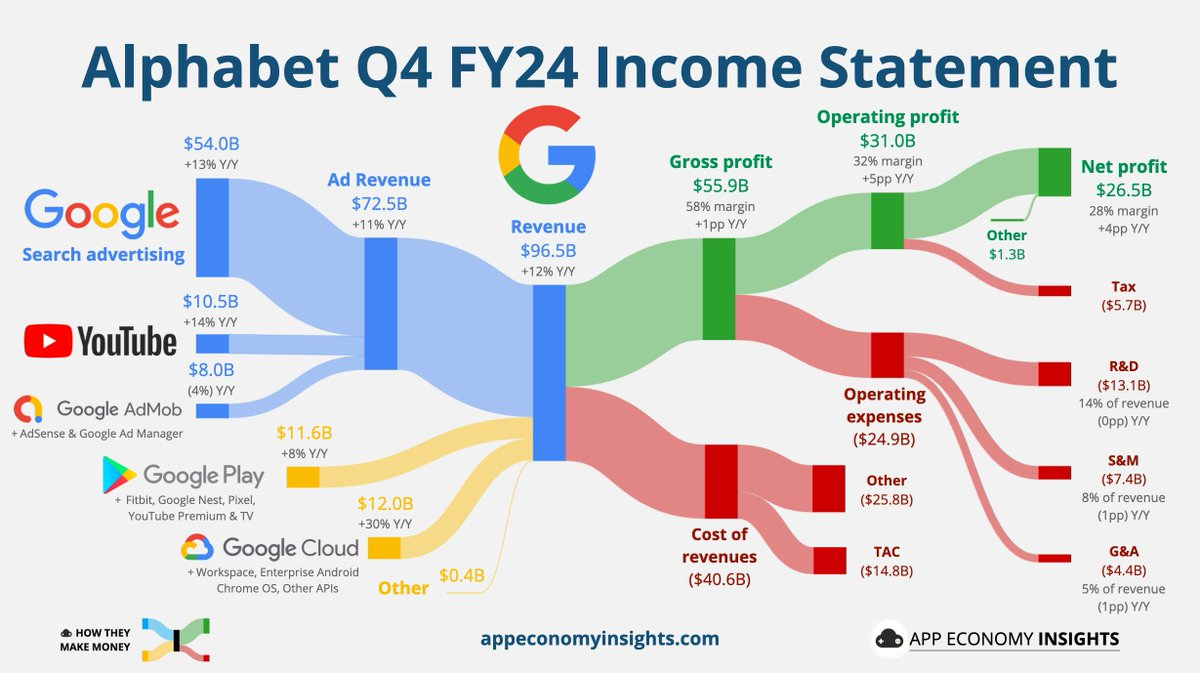

The company's engine, grouped under Google Services (Search, YouTube, AdMob, and Google Play), is running at full speed. In Q4, this branch accounted for $95.86 billion in revenue, more than 84% of the total.

- Google Search: Since the argument circulated that advertising revenue from the search engine would be disrupted, that branch has only grown faster. While the year-on-year (YoY) growth of Search in Q1 2025 was still 10%, this rose to an impressive 17% in Q4 2025. AI overviews in search results seem to stimulate advertising revenue rather than cannibalize it.

- YouTube: It was purchased in 2006 for $1.65 billion. YouTube now generates annual revenue of $60 billion (an increase of 9% YoY). YouTube Shorts in particular is a phenomenon: with 200 billion daily views, the average global citizen now watches around 25 videos per day.

- Subscriptions: The tech giant now has over 325 million paid subscriptions, led by the strong adoption of Google One and YouTube Premium. The business AI division is also growing rapidly: in just four months, 8 million Gemini Enterprise seats have already been sold. Philipp Schindler, Chief Business Officer, notes that although the transition from free users to YouTube Premium slightly depresses advertising revenue, the net impact on the business is positive; in other words, Alphabet prefers a stable, predictable cash flow over higher but volatile advertising revenue.

Google Cloud and AI applications

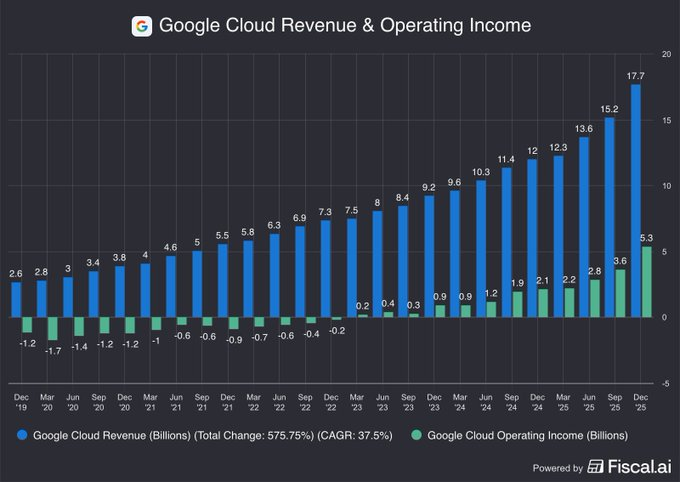

Last week, Microsoft took a hit after growth of 39% only narrowly exceeded already high expectations. Google Cloud, on the other hand, delivered a strong performance and broke new records.

In Q4, the division achieved revenue of $17.7 billion, with operating income of $5.3 billion. With these results, the Cloud division now has an annual run rate (forecast of annual revenue based on the results of the most recent period) of $70 billion, an increase of 48% year-on-year.

This acceleration is driven by increasingly larger contracts. CEO Sundar Pichai indicated that the number of deals worth more than $1 billion in 2025 was higher than in the previous three years combined. He also confirmed that Apple has selected Google Cloud as its infrastructure partner for the development of its next generation of AI models.

Looking at the margins, the cloud is not only growing in terms of revenue, but it is also becoming much more efficient. Whereas last year's operating profit margin was 17.5%, it is now 29.9%. According to Sundar Pichai, this jump in margins is mainly due to structural cost improvements in the AI infrastructure within Google Cloud. Google currently processes approximately 10 billion tokens per minute, while the Gemini app has grown to 750 million monthly active users. The costs of running and scaling AI models are falling rapidly as Google optimizes its tooling and underlying systems.

"We are becoming dramatically more efficient; we were able to lower Gemini serving unit costs by 78% over 2025."

Concerns about the figures: CapEx costs

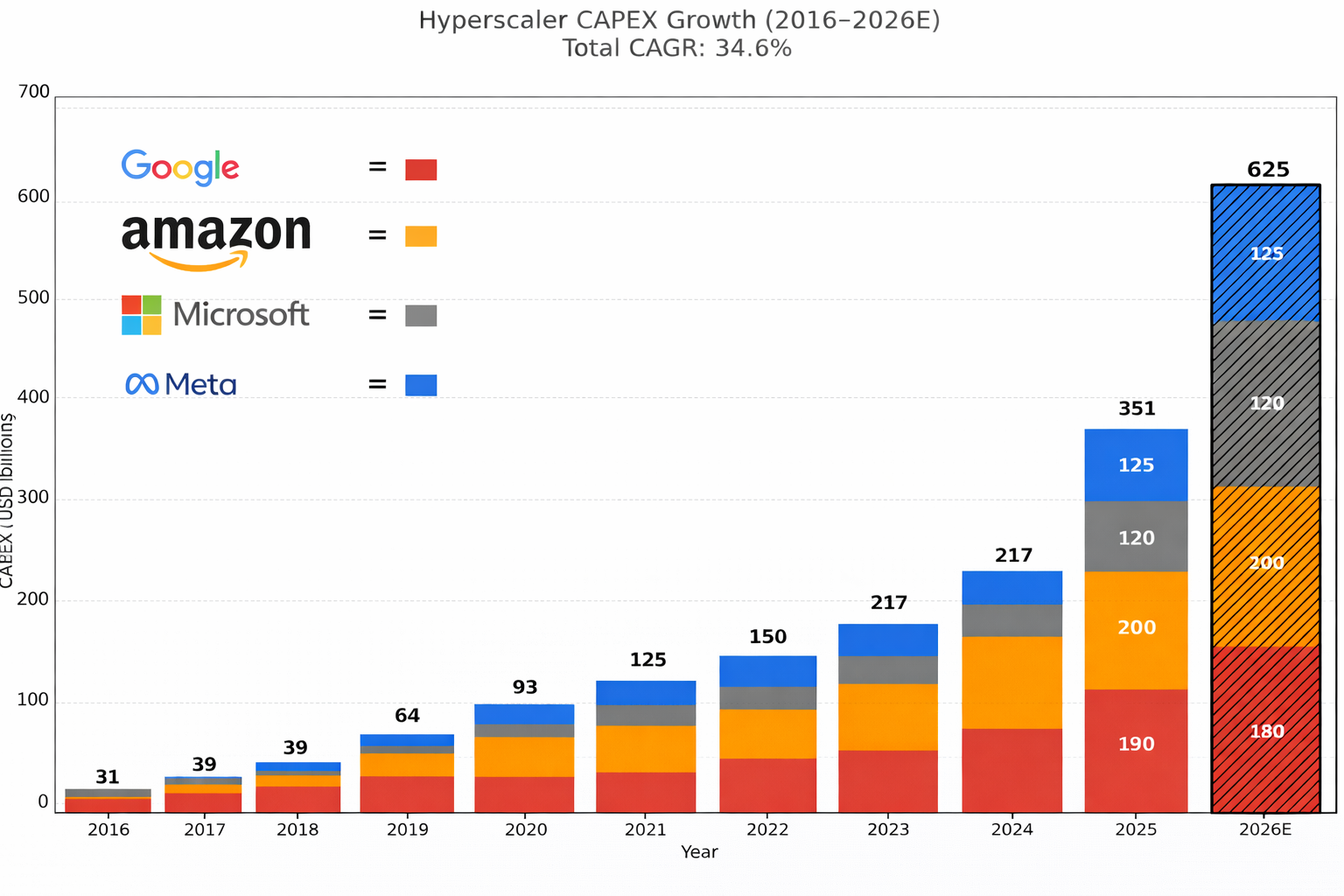

Despite strong operating results, the stock reacted negatively to the figures. The main reason for this is the CapEx guidance for 2026, which Google issued at $175–185 billion, significantly higher than analysts' expectations of around $120 billion. Investors remain visibly cautious about such extreme investment levels among hyperscalers. However, Google is not alone in this. Microsoft, Meta, and Amazon also recently announced CapEx plans that exceeded expectations. Collectively, this group of hyperscalers appears to be heading for more than $600 billion in CapEx in 2026.

According to management, the high CapEx is not a luxury or strategic excess, but a necessary condition to continue to meet demand. Sundar Pichai indicated that it is not so much the development of demand or productivity growth that causes concern, but rather the limitations on the supply side. These are the factors that determine whether Google can continue to provide sufficient computing power and infrastructure.

Google emphasized that the company was already structurally supply constrained in 2025, despite aggressively scaling up capacity. This ongoing tension between supply and demand explains why investments are being further accelerated. Approximately 60% of CapEx will be spent on machinery, including servers and specialized AI hardware, while the remaining 40% will be invested in long-term infrastructure such as data centers and network facilities. Management does not view this wave of investment as a one-off project, but as a structural part of how the company is managed:

“The more capital we can free up within the organization to invest, the better we can turn this flywheel to drive future growth.”

This quote perfectly sums up the company's biggest competitive advantage. Google generates approximately $170 billion in operating cash flow, which is also growing by 10–20% per year. This exceptional financial strength enables the company to invest heavily in computing and infrastructure right now, without having to rely on external financing. For competitors without comparable cash flows, it is becoming increasingly difficult to keep up with this pace of investment on a structural basis. In that light, it makes sense for Google to use its financial strength now to build a significant lead and further raise the barriers to entry in the market.

Sundar Pichai on SaaS

During the Q&A portion of the call, a striking question was raised about the fear that AI would undermine the seat power and pricing power of large SaaS companies. Sundar Pichai's answer was crystal clear. He said he sees the exact opposite: Alphabet's strongest SaaS customers, all of whom are market leaders in their niches, are deeply integrating Gemini into business-critical workflows to improve the product experience, accelerate growth, and increase operational efficiency. According to Pichai, AI therefore does not act as a substitute that erodes existing software economies, but as an enabling tool that strengthens established business models.

NVIDIA CEO Jensen Huang also calls the fear that AI will replace the software industry "the most illogical thought in the world." According to him, software products are not an end point that will be wiped out by AI, but rather the fundamental building blocks on which AI runs and works. This vision fits seamlessly with what we at Tresor Capital have been promoting for some time.

Alphabet is currently trading on the New York Stock Exchange at a price of USD 321.14 per Class A share.

Receive weekly insights in your inbox

Exclusive analyses and updates on family holdings and global market developments.

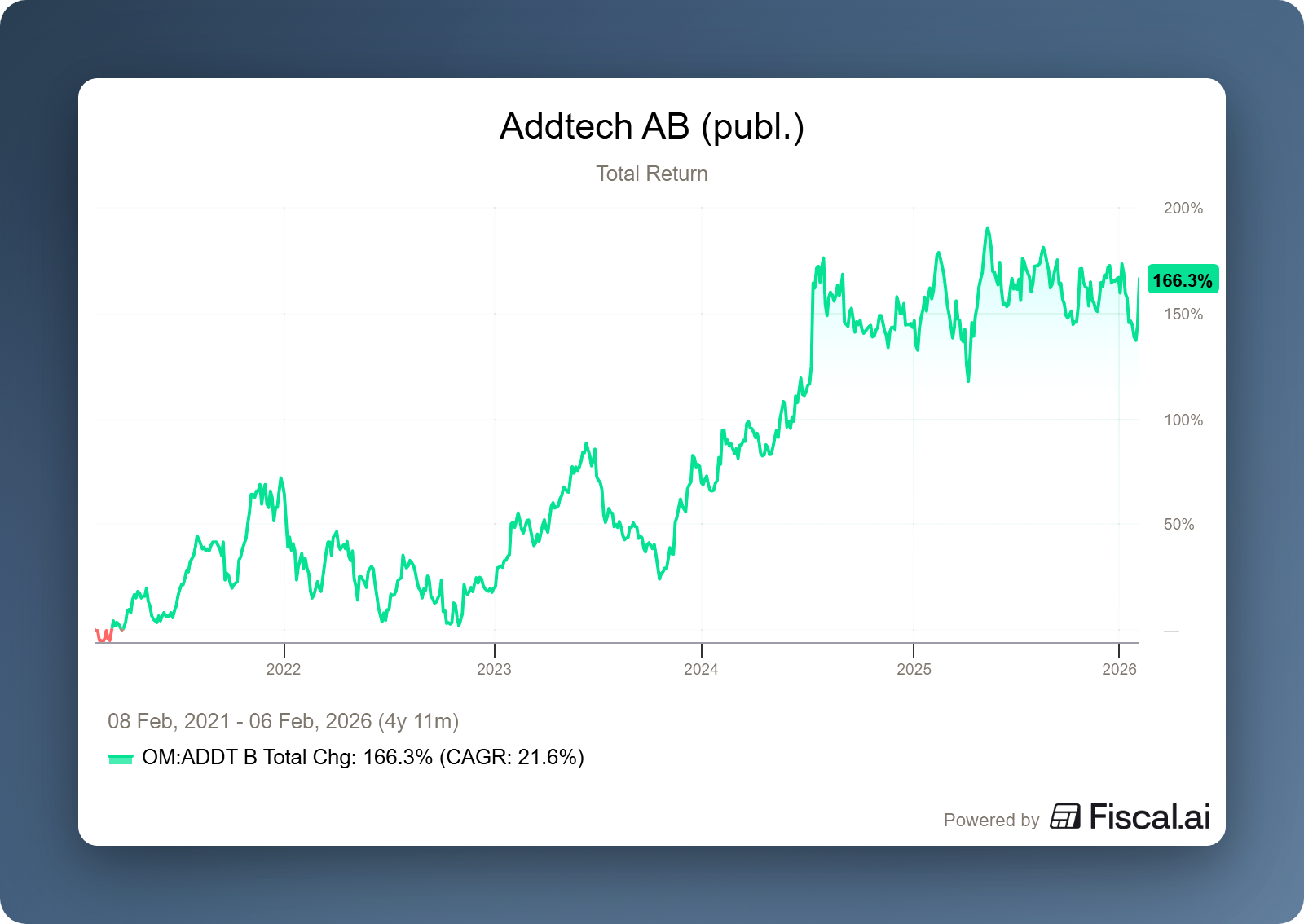

Margins rise sharply at Addtech despite flat revenue growth

Swedish serial acquirer Addtech AB (Stockholm: ADDT-B) published its third-quarter results this week. The group operates through approximately 160 highly decentralized niche companies across six industrial sectors, thereby building a broad and resilient industrial profile. In a macro environment that remains challenging for many Swedish industrial companies, partly due to the persistently strong Swedish krona and reluctance to make investment decisions, Addtech managed to further strengthen its operational performance. In doing so, the group once again underlined why it is considered one of the highest quality industrial serial acquirers in Europe.

In the third quarter, revenue increased by 1% year-on-year, driven entirely by organic growth but weighed down by a negative currency effect of approximately 3% due to the strong Swedish krona. Management emphasized that this limited topline growth does not reflect underlying market demand. Order intake remained broadly positive and customer activity high, which, according to CEO Niklas Stenberg, confirms that operational progress is stronger than reported revenue growth suggests.

However, the most impressive aspect of this report is operational efficiency. Despite limited revenue growth, Addtech managed to significantly improve its margins. The operating profit margin climbed to an impressive 15.6%, a significant increase compared to 14.4% in the same quarter last year.

This improvement was mainly driven by two crucial segments:

- Energy: This segment showed the most remarkable performance. The margin jumped by no less than 4.9 percentage points, from 15.9% to 20.8%. This underlines Addtech's strong market position within the energy transition.

- Industrial Solutions: As the group's largest revenue driver, this sector once again demonstrated its stability and economies of scale by increasing its margin from 19.0% to 20.5%.

According to management, the recent margin improvement is mainly due to product mix and project timing, and to a much lesser extent to structural price increases. In Energy in particular, it was emphasized that the strong quarterly margin is driven by a few large, profitable projects with high operational leverage. CEO Niklas Stenberg explicitly warned that this level should not be extrapolated and that the rolling 12-month margin (18.9%) is a better measure of future earning capacity. Pricing does contribute to margin development, but was described by both the CEO and CFO as supportive, not as the main explanation. In Industrial Solutions, the margin improvement stems from a combination of scale, favorable mix (including special vehicles and subsea) and contributions from acquisitions, while weaker end markets such as sawmills have been successfully offset.

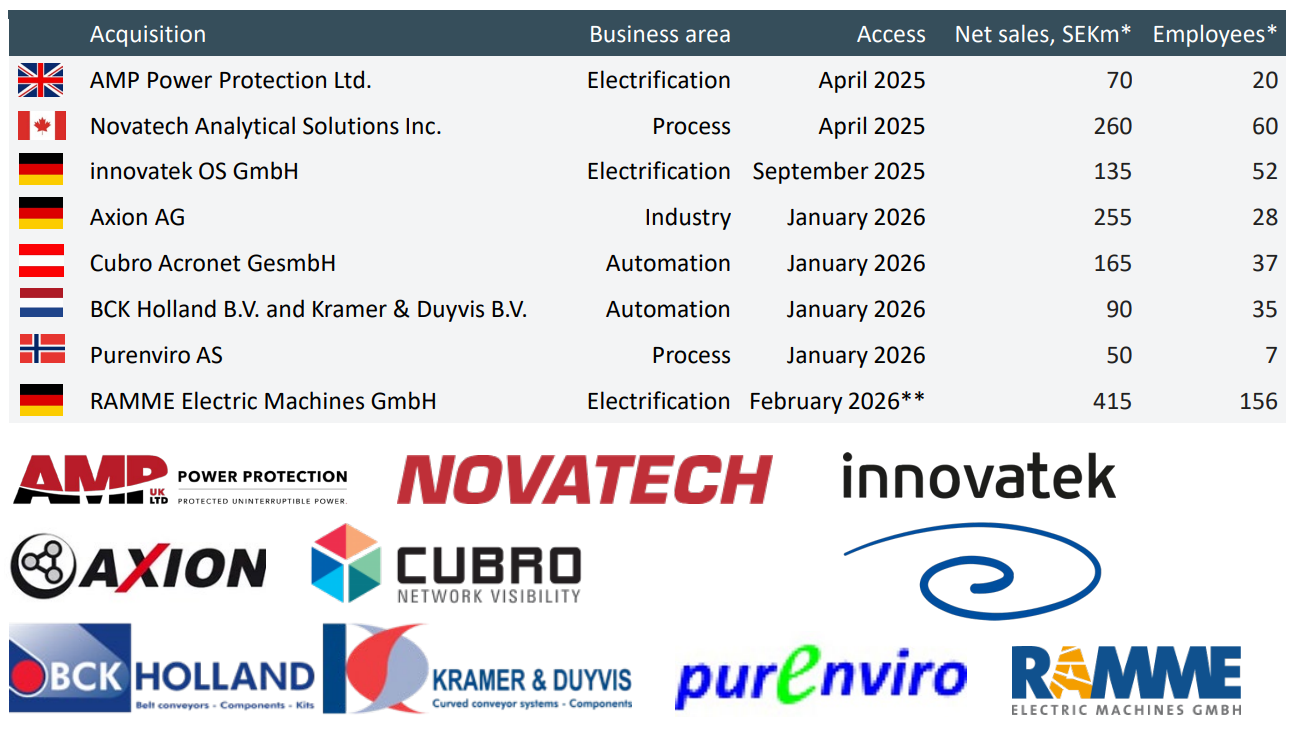

M&A remains the most important growth driver

Addtech maintained its high pace of acquisitions in the third quarter. A total of eight companies were added this financial year, representing approximately SEK 1.5 billion in additional revenue. This week also saw the acquisition of German company RAMME Electric Machines GmbH, a specialist manufacturer of electric motors for maritime applications and industrial electrification, among other things.

According to management, RAMME fits seamlessly into Addtech's strategy: a well-positioned niche player with its own products, high added value, and attractive margins. During the earnings call, CEO Niklas Stenberg indicated that RAMME's profitability is around 20%, which makes the acquisition immediately profitable for the group. Although the transaction is relatively large in Addtech terms, management emphasized that scale alone is never the starting point; strategic fit, entrepreneurship, and culture remain the guiding principles.

Conclusion

Looking ahead, management paints a picture of cautious optimism. Order intake was broadly positive in the quarter, with a book-to-bill ratio above 1 in five of the six business areas. At the same time, Addtech remains alert to continued caution in larger investment decisions in parts of the industry, particularly within Automation and Process. Importantly, management is not attempting to anchor exceptionally strong quarters in fixed expectations. Margins may continue to fluctuate by segment and by quarter, depending on project mix, timing, and end markets.

AddTech ended the trading week on the Stockholm Stock Exchange at a price of SEK 327.00 per share.

Markel Group: 'quality over quantity'

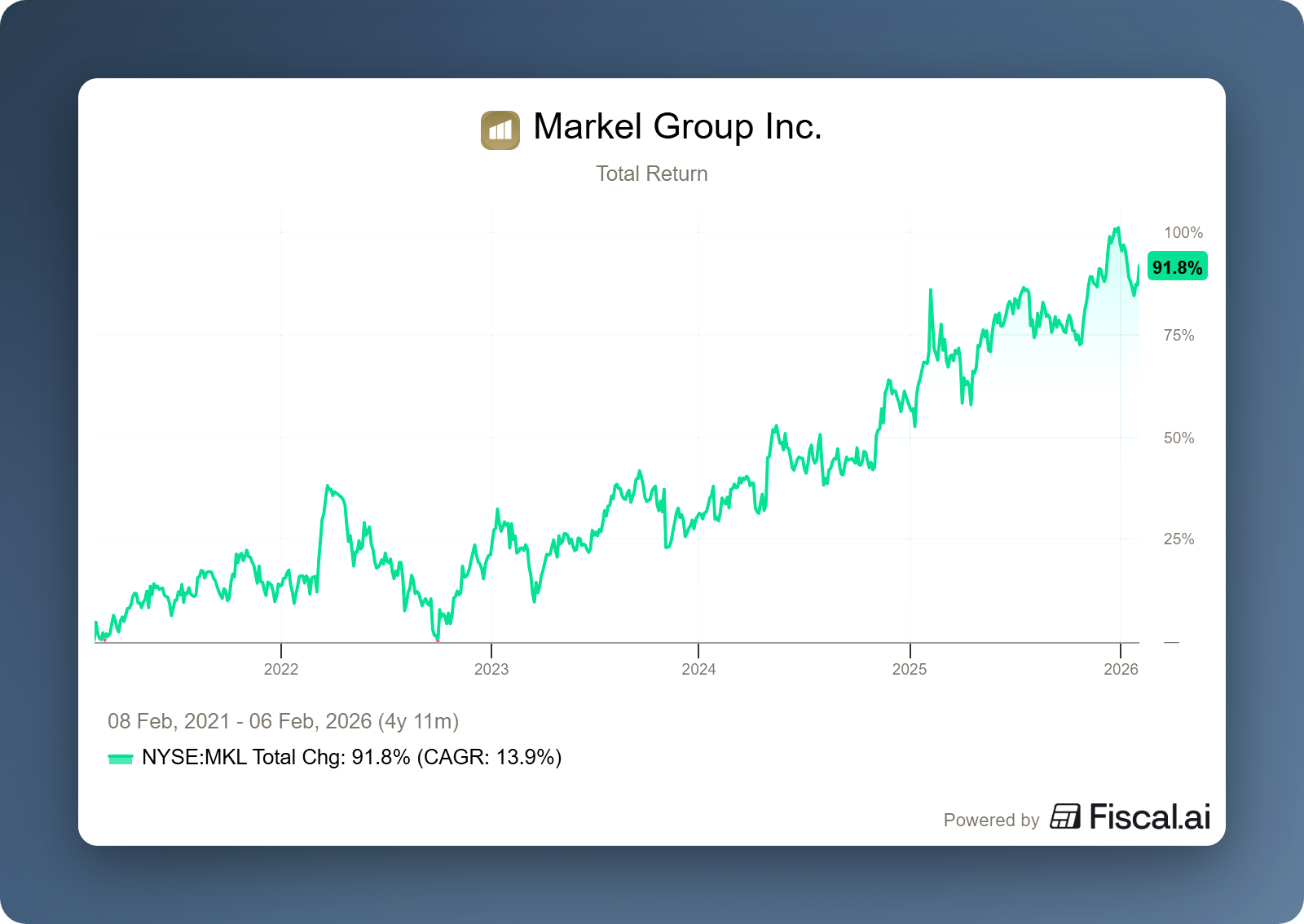

The American insurance holding company Markel Group (New York: MKL) reported strong fourth-quarter results this week. CEO Tom Gayner used the earnings call to candidly admit that the investment portfolio had performed disappointingly in 2025. "In the investment business, at any given moment, you always look smarter or dumber than you really are. I think 2025 was a year in which we looked dumber than we really are," Gayner said. However, for those who look beyond the one-year results, Markel remains a defensive quality compounder with a rock-solid track record.

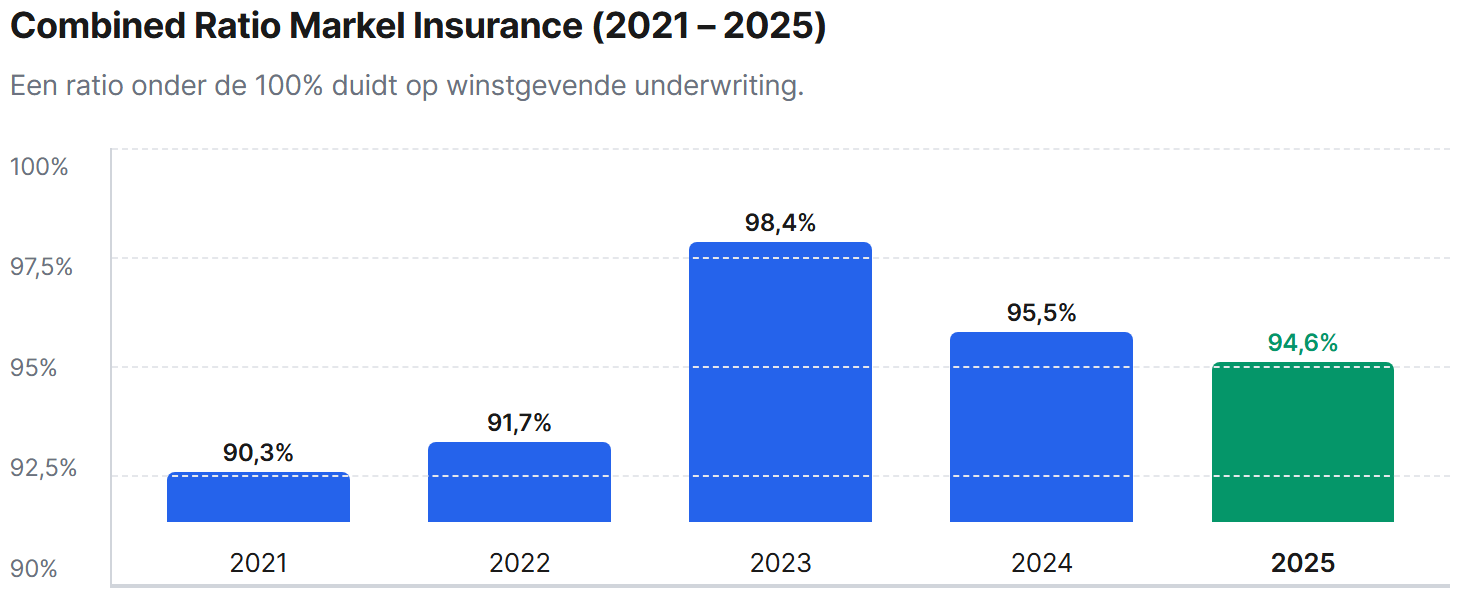

Insurance: Combined ratio on track for the low 90s

Markel's core business, its insurance subsidiary Markel Insurance, showed a clear normalization of underwriting in 2025. For the full year, the combined ratio was 94.6%, an improvement from 95.5% in 2024. This means that Markel spends 94.6 cents on claims and operating expenses for every dollar of premium income, resulting in an insurance profit of $456 million for 2025. As the chart shows, Markel is thus moving back toward the structurally profitable levels of 2021 and 2022.

However, the underlying picture remains mixed. The International division performed strongest with a combined ratio of 83.0%, driven by profitable growth in new markets. Management sees further opportunities for expansion here, particularly in professional liability insurance.

On the other hand, the Programs & Solutions division came under pressure in Q4 with a combined ratio of 101.9%, compared to 86.0% a year earlier. The deterioration was mainly due to substantial losses in the credit and surety line and disappointing results in private supplementary liability insurance. CEO Simon Wilson indicated that measures have now been taken, including strengthening reserves, tightening pricing, and a more selective underwriting policy. According to management, this will be sufficient to return the division to its target profitability in the coming years.

For 2026, the focus is explicitly on maintaining a "low-90s" combined ratio, with management explicitly citing a level of around 93% as an internal ambition. According to Wilson, this is achievable through further portfolio shifts towards activities where Markel demonstrably has a "right to win," combined with stricter selection in more capital-intensive or volatile lines. Markel does not expect structural margin expansion, but emphasizes that price discipline and selectivity are more important than volume growth.

Investment portfolio: focus on long term and capital allocation

During the 2025 earnings call, CEO Tom Gayner emphasized that Markel Group's investment strategy remains focused on achieving attractive returns over decades. The equity portfolio achieved a return of 10.5% in 2025, resulting in $156 million in dividend income and a total market value of $13 billion at year-end, of which $8.9 billion is unrealized gains. A further net investment of $143 million was made in the equity portfolio in 2025.

Although this return was lower than the 20.1% achieved in 2024, Gayner does not see this as a disappointment, but rather as part of the natural volatility of the market. He put the annual results into perspective by pointing out the importance of a long-term vision: "In any given year, results can and will be volatile, but over periods of five years and longer, the trend has always been upward. That is the power of long-term compounding." The historical figures confirm this consistency.

Looking ahead to 2026: Quality over growth at Markel Group

In 2026, Markel Group's reported revenue is expected to show a decline of approximately $2 billion in gross premium income. However, this is not a sign of contraction, but the result of conscious strategic choices to increase the quality of the portfolio.

- Exit Global Reinsurance: The sale of the renewal rights of the reinsurance branch is responsible for a decrease of approximately $1 billion.

- Hagerty Fronting Model: The shift in the collaboration with Hagerty to a fronting model (where Markel receives a fee instead of retaining the full risk and premium on its balance sheet) explains the remaining $1 billion in lower gross premiums.

Simon Wilson emphasized that Markel would rather give up market share than compromise on insurance discipline. Although prices in certain US property markets (property lines) are under pressure, the target remains a combined ratio in the low 90% range. Management sees the current market as an opportunity to operate more selectively and do more of what works and less of what doesn't. Tom Gayner concluded the call with the following words:

"By staying true to our values and providing a home for exceptional companies and leaders, we remain positioned to build shareholder value across generations."

Markel Group is currently trading on the New York Stock Exchange at a price of USD 2,126.35 per share.

Receive weekly insights in your inbox

Exclusive analyses and updates on family holdings and global market developments.

Would you like more information about our services?

Contact us

Disclaimer:

No rights can be derived from this publication. This is a publication by Tresor Capital. Reproduction of this document, or parts thereof, by third parties is only permitted with written permission and with reference to the source, Tresor Capital.

This publication has been compiled with the utmost care by Tresor Capital. The information is intended in a general sense and is not tailored to your individual situation. The information should therefore expressly not be regarded as advice, an offer or a proposal to purchase or trade investment products and/or purchase investment services, nor as investment advice. The authors, Tresor Capital and/or its employees may hold positions in the securities discussed, either for their own account or for their clients.

You should carefully consider the risks before you start investing. The value of your investments may fluctuate. Past performance is no guarantee of future results. You may lose (part of) your investment. Tresor Capital accepts no liability for any inaccuracies or omissions. This information is for indicative purposes only and is subject to change.

Read the full disclaimer at tresorcapitalnieuws.nl/disclaimer .