Family Holdings #7 - Record growth meets growing concerns

This week's topics:

KKR achieved a record level of assets under management of USD 744 billion in 2025 and raised USD 129 billion in new capital despite market turmoil surrounding software and private credit. The investment company is strengthening its position through the acquisition of Arctos Partners to capitalize on sports investments and continues to focus heavily on the physical backbone of AI through its infrastructure division. Although the share price is under pressure, the current valuation of 12x expected earnings for 2027 offers an interesting perspective due to robust management fees and diversification.

TerraVest had an exceptionally strong first quarter, with significant revenue and cash flow growth, supported by both acquisitions and solid 9% organic growth in the fully integrated base portfolio. Cash Available for Distribution increased by 34%, but at the same time, the company is facing a mixed macro climate. Uncertainty surrounding import tariffs and new US CDL regulations is putting temporary pressure on transport-related activities, while demand from the data center sector is at a record high.

Where the market has lost confidence in Alphabet with a massive oversubscription of a bond issue, the European Union is distancing itself. At the same time, Google is being investigated for its use of content in AI Overviews and for possible manipulation in advertising auctions. Meanwhile, Alphabet is benefiting from the higher valuation of Anthropic, in which it holds a strategic 7% stake.

In Brief:

Constellation Software ( Toronto: CSU) further expanded its activities through two additional acquisitions within the Jonas division. In the United Kingdom, Pollution Monitors was added, a supplier of specialized gas detection and environmental monitoring systems for sectors such as academic institutions, pharmaceutical manufacturing sites, and defense. In addition, Jonas acquired Colombia's Suplos, a cloud platform for supply chain automation that operates in Colombia, Panama, and Peru. Suplos helps buyers digitize their supply chains and achieve transparency and cost savings.

Brown & Brown ( New York: BRO) announced an accelerated share repurchase of $250 million, executed through an Accelerated Share Repurchase program with JPMorgan. The program is part of the previously approved repurchase capacity of $1.0 billion and is expected to be completed in the second quarter of 2026.

Addtech ( Stockholm: ADDT-B) further expanded its activities with the acquisition of Kapp Nederland B.V., a specialist in measurement and calibration solutions for the process industry, water sector, and research institutions, among others. The company, with approximately €8 million in revenue and 20 employees, will be incorporated into the Process Technology division.

Chapters Group (Frankfurt: CHG) has acquired a stake in HybridForms, a low-code platform for digital workflows and mobile data collection in areas such as public services, healthcare, and infrastructure inspections, through its portfolio company Icomedias. HybridForms is used for critical processes such as construction and safety inspections, medical registrations, and on-site documentation, and is positioned as a scalable complementary product within the broader Chapters software stack.

Constellation Software, Brown & Brown, Addtech, and Chapters Group are currently trading on the Toronto, New York, Stockholm, and Frankfurt stock exchanges at prices of CAD 2,314.72, USD 68.98, SEK 317, and EUR 30.40 per share, respectively.

| Share | YTD | 3 years* | 5 years* | 10 years* |

|---|---|---|---|---|

| Constellation Software | -30,3% | -4,1% | 7,0% | 18,4% |

| Brown & Brown | -14,2% | 2,8% | 10,2% | 16,3% |

| Addtech | -1,3% | 22,3% | 19,9% | 29,0% |

| Chapters Group | -27,7% | 28,8% | 44,7% | 27,4% |

Returns shown in EUR; *The annual compounded/compounded return

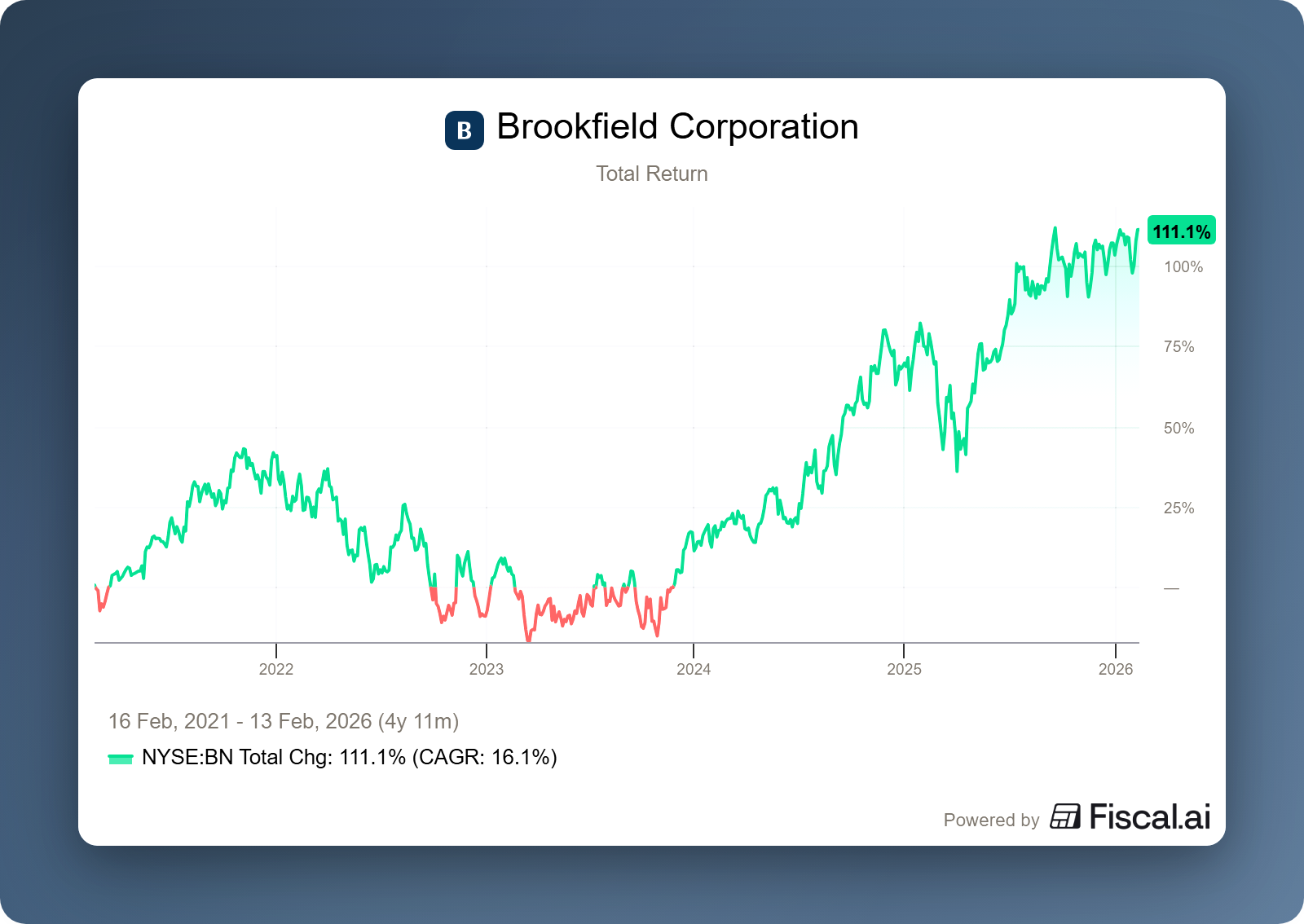

Brookfield continues to grow thanks to BAM and BWS

Canadian investment holding company Brookfield Corporation (New York: BN) and its publicly traded asset management arm Brookfield Asset Management (New York: BAM) recently published their results for 2025. The past year once again underscored the scale and resilience of the Brookfield platform. Management characterized market conditions as "improving but demanding": capital markets gradually recovered but remained characterized by volatility, higher interest rate uncertainty, and geopolitical tensions. In that climate, operational execution remained remarkably solid. Where other private equity and alternative asset managers had to absorb sharp corrections at times, Brookfield remained relatively resilient and its share price remained remarkably stable during various phases of market stress.

At the same time, 2026 marks an important governance milestone. Following a carefully designed multi-year succession plan, BAM will have a new CEO for the first time. Bruce Flatt, who has been the face of both BAM and the broader group for many years, will hand over the day-to-day leadership of the asset management division, while remaining CEO and Chairman of Brookfield Corporation. Flatt refers to this as the next phase of institutionalisation for the company.

Distributable Earnings

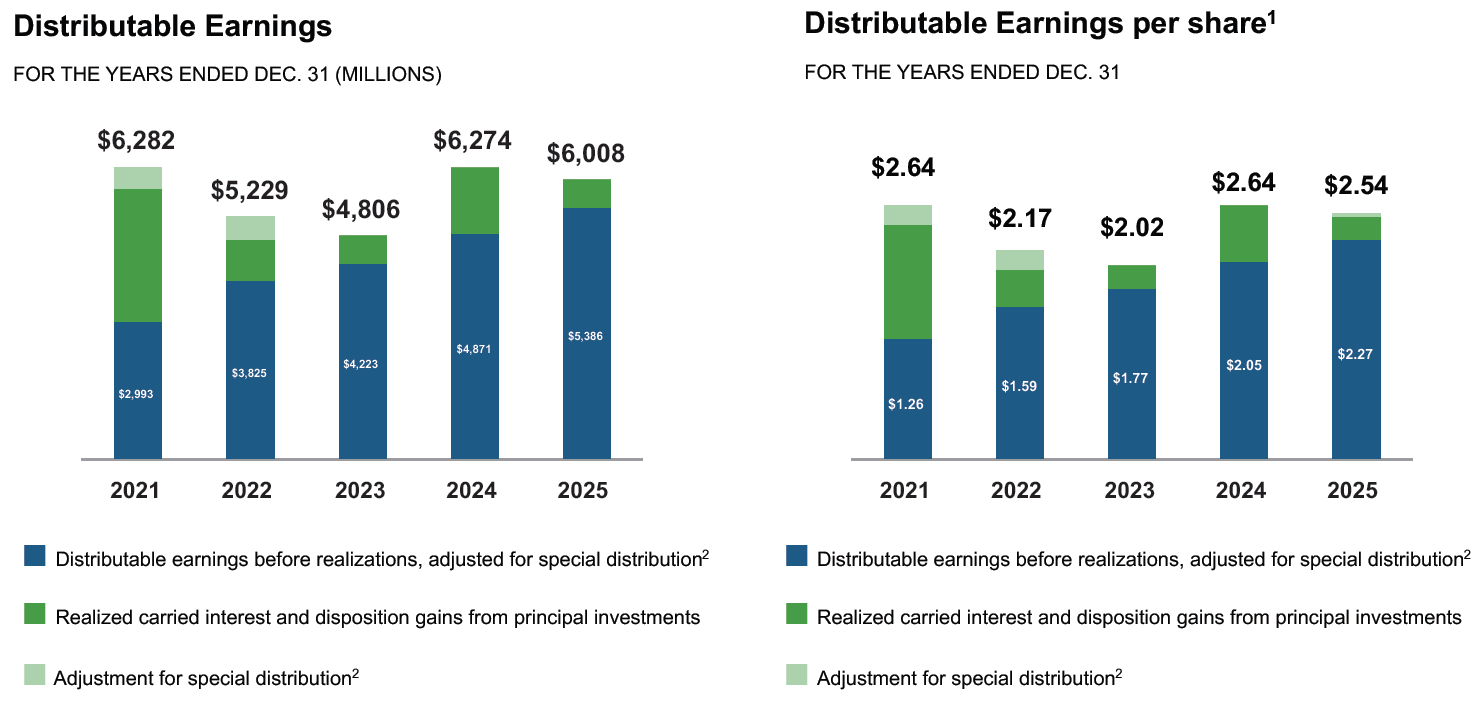

The key performance indicator for Brookfield Corporation remains Distributable Earnings (DE). This figure reflects how much profit is actually available for reinvestment in new projects or for distribution to shareholders. Within DE, a distinction is made between earnings before and after the realization of investments. The purest measure is earnings before realizations, as this best reflects what the platform earns operationally, regardless of incidental sales profits, timing of exits, or market cycles. These are the structural cash flows that arise from asset management, insurance activities, and operating interests.

Looking at the blue bars in the left graph, we see that DE before realizations in 2025 rose to $5.386 billion, an 11% increase compared to 2024. This means that the underlying earning power of the platform has increased again, despite a year in which market conditions were not always easy.

The fact that total DE (including realizations) in 2025 was lower than in 2024 requires some nuance. In 2025, total DE amounted to $6.0 billion, compared to $6.27 billion a year earlier. The difference is almost entirely explained by an exceptionally large realized gain in 2024. That year included a disposition gain of $1.0 billion, while in 2025 this amounted to only $62 million. The profit in 2024 was related to the sale of part of the stake in Brookfield Asset Management, which freed up capital for other growth divisions within the group. Adjusting for this one-off factor, Brookfield would still have shown growth of approximately 13.9% in 2025 after realisations. The apparent decline is therefore primarily a timing effect and not an indication of deteriorating fundamentals.

On the right-hand side of the chart, we see that DE per share before realisations also reached a new record high. In 2025, this amounted to $2.27 per share, representing a compound growth rate of approximately 16% per year since 2021. This underscores how consistently the platform has been able to grow value per share. This record level is therefore not solely the result of higher absolute earnings, but also of targeted capital allocation. As in 2024, management again repurchased more than $1 billion of its own shares in 2025, at an average price of $36 per share. That price level was only briefly reached during a sharp market correction around what is known as "Liberation Day." In hindsight, this was an excellent move by management.

Asset Management Division In addition to BN's own balance sheet activities, Brookfield Asset Management (BAM) is the group's structural fee engine. While BN is partly dependent on investment results and realized profits, BAM earns most of its income from managing capital for third parties. This is done through management fees and performance fees on funds in private equity, infrastructure, real estate, and credit.

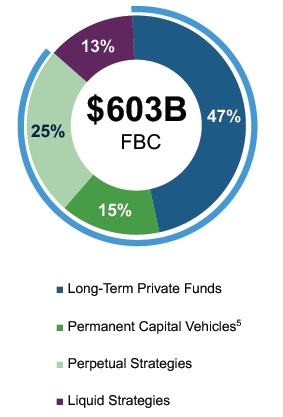

2025 was an exceptionally strong year in that regard. BAM raised $112 billion in new capital, $35 billion of which was in the fourth quarter alone. This inflow brought Fee-Bearing Capital (FBC), the portion of assets under management on which management fees are actually received, to $603 billion, an increase of 12% compared to a year earlier.

This figure is more important than it might seem at first glance. Fee-bearing capital forms the basis on which future management fees are calculated. The larger this basis, the more stable and predictable future cash flows will be. It is particularly reassuring that no less than 87% of this capital is committed for the very long term. This means that management has an exceptionally high degree of visibility on future income, which significantly increases the predictability of earnings.

This structural growth in FBC translates directly into higher Fee-Related Earnings (FRE), the profit derived from recurring management fees, excluding performance fees and investment gains. Since 2021, FRE has grown at a compound annual growth rate of approximately 19.5%. In 2025 alone, FRE rose by 22% to $3.0 billion. This translated into a DE of $2.7 billion, bringing them one step closer to their 2030 target of $4.2 billion, which previously required compound growth of 18%.

insurance division The second emerging growth engine within Brookfield Corporation is its insurance division, Brookfield Wealth Solutions (BWS). While Brookfield has historically been known primarily as an investor in real assets, since 2020 it has built up a new pillar that is now contributing an increasingly large share of its total profits. We previously wrote extensively about the strategic significance of this division in our newsletter. What was then seen as an ambitious expansion of the platform is now becoming increasingly visible in the figures.

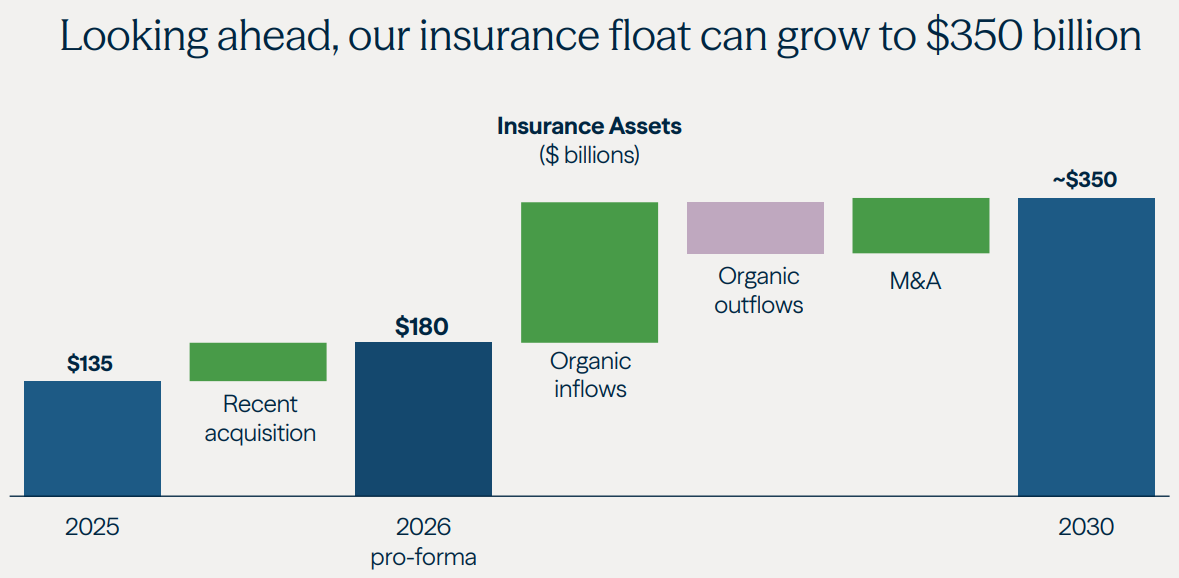

Although BWS was only established in 2020, the division now manages $143 billion in insurance assets. That scale translated into $1.67 billion in Distributable Earnings in 2025, an increase of nearly 24% year-on-year. This meant that, for the first time, the insurance arm exceeded the combined contribution of the traditional operating subsidiaries, which together generated $1.60 billion in DE. To put the shift into perspective: in 2023, the operating subsidiaries still generated about twice as much DE as the insurance division. Within just two years, that picture has completely reversed.

It is striking that the returns achieved now exceed the company's own targets. Management indicated that a return on equity above the mid-teens target (14-16%) was achieved in 2025, confirming that the combination of scale, funding mix, and investment strategy is beginning to work effectively.

The outlook for 2026 reinforces this picture. During Investor Day 2025, the target was still set at $185 billion in insurance assets. CEO Sachin Shah has now raised this expectation to approximately $200 billion by the end of 2026, an increase of around 40% compared to the current level. This should translate into more than $2 billion in distributable earnings, representing a profit increase of approximately 20% compared to 2025. This would give BWS a scale comparable in absolute terms to that of many medium-sized listed insurers, but with the unique advantage of access to Brookfield's global real-asset platform for the investment of premiums and float.

Looking ahead

Last month, Connor Teskey was formally appointed CEO of Brookfield Asset Management (BAM). Bruce Flatt will remain Chairman of BAM and retain his role as CEO of the holding company, Brookfield Corporation (BN). In his Letter to Shareholders, Flatt emphasizes that this is not a sudden change of course, but the culmination of a multi-year succession plan. The message is that Brookfield is now so institutionalized that its culture and investment discipline are guaranteed independently of individuals.

Another central theme in Flatt's vision is the exponential demand for infrastructure due to the rise of Artificial Intelligence (AI). Brookfield is in the unique position of being able to supply both the necessary renewable energy and the physical data centers. In his letter, Flatt refers to the "enormous capital requirements for global digitization." Through partnerships with tech giants such as Microsoft and NVIDIA, Brookfield is positioning itself as the indispensable financier and builder of the AI backbone.

Expectations for the coming years are ambitious, but based on a well-filled pipeline:

- Carried Interest (BN): Management expects investment realizations to increase significantly in the second half of 2026, with further acceleration in 2027 and 2028. This will propel profit sharing as a source of income to new heights.

- Growth forecast (BAM): During the presentation, management was remarkably optimistic about 2026. It is argued that if current market conditions persist, 2026 will show a "step-by-step improvement" compared to an already record-breaking 2025. While the current five-year plan assumes growth of 15%, management indicates that the current outlook may even exceed this level, approaching 20%.

With growth of approximately 20% in its key divisions (Asset Management and Wealth Solutions) and confirmation that this growth will continue in 2026, Brookfield appears to be more than delivering on its promises. Bruce Flatt sums it up well in his letter: global uncertainty is creating opportunities that a financially strong player like Brookfield can capitalize on.

Brookfield Corporation ended the trading week on the New York Stock Exchange at a price of USD XXX per share.

Receive weekly insights in your inbox

Exclusive analyses and updates on family holdings and global market developments.

KKR presents robust figures in turbulent market environment

The American investment holding company KKR & Co. (New York: KKR) closed 2025 with record figures in terms of capital investments and assets under management (AUM), despite a recent challenging stock market climate. While the alternative investment sector is under pressure due to concerns about the impact of AI on software investments and risks in private credit (for more information on this, read our deep dive this week), the core of KKR's results points to a robust earnings model that is largely decoupled from the current market panic.

The past year was historic for KKR in many ways. Total assets under management (AUM) rose 17% to a record high of $744 billion. This growth was driven by strong fundraising, with $28 billion in new capital raised in the fourth quarter alone.

The key financial highlights for 2025 are:

- Stable income: 85% of profits now come from recurring income streams, which provides a buffer against market volatility.

- Management fees: Asset management fees increased by 18% to $4.1 billion for the full year.

- Strategic growth: The insurance arm, Global Atlantic, saw its AUM grow to $219 billion, of which $164 billion is invested in credit strategies.

In addition, KKR raised a record $129 billion in new capital in 2025, the highest level in the firm's 50-year history. Credit alone raised $68 billion, underscoring the strong demand for private credit and asset-based finance strategies.

Operational profitability also remained impressive: fee-related earnings (FRE) rose by 15% year-on-year, while the FRE margin came in at around 69% for the full year, one of the highest levels in the sector and indicative of significant operational leverage.

It is also important to note that KKR had $118 billion in dry powder at the end of 2025. In a volatile market, this not only means defensive flexibility, but above all offensive firepower to invest when opportunities arise.

Despite strong growth figures, there are clear pain points that are causing concern among investors. In the fourth quarter, KKR narrowly missed earnings expectations ($1.12 per share versus an estimated $1.14). This was mainly due to a one-off repayment of carried interest in one of the private equity funds that underperformed. In addition, the entire sector is grappling with "software fears." Although there is concern in the market that AI developments will disrupt the business models of software companies in private equity portfolios, KKR emphasized that their software exposure is manageable at 7% of assets under management (AUM).

Management emphasizes that AI not only poses a risk but also offers a huge investment opportunity. Through its infrastructure division, KKR is investing heavily in the physical backbone of this technology, including data centers, power supply, and cooling technology. The infrastructure business has grown organically from USD 18 billion to USD 100 billion in five years, underscoring the successful focus on this growth market.

At the same time, management points out that periods of market volatility have historically proven to be strong investment years. With a globally diversified portfolio, limited exposure to 2021 vintages, and record embedded gains of approximately $19 billion on its balance sheet, KKR believes it is well positioned to accelerate future realizations as market conditions improve.

Acquisition of Arctos Partners

During the presentation of its 2025 annual figures, KKR officially announced the acquisition of Arctos Partners. For many investors, Arctos is a new name, but within the sector, the firm is known as a pioneer in institutional investments in professional sports teams. With $15 billion in assets under management, Arctos has gained a unique market position as the only party authorized by the major American sports leagues (such as the NBA, MLB, and NHL) to hold minority interests in multiple teams simultaneously.

KKR's management sees Arctos as the ideal basis for setting up a completely new branch within the company: KKR Solutions. This new division will integrate Arctos' current activities and serve as the platform for a broad-based multi-asset class secondaries business that KKR intends to expand in the coming years. According to Co-CEOs Joseph Bae and Scott Nuttall, this move provides access to three specific growth areas: the sports world, capital solutions for asset managers, and secondary markets. Scott Nuttall explained that the sports world is at a tipping point where professional capital management is becoming essential for the next phase of growth for clubs and leagues. By combining KKR's deep pockets and global network with Arctos' specialized expertise, management expects KKR Solutions to make a significant contribution to the targeted profit growth for 2026 and beyond.

conclusion Although KKR's share price is under pressure and moving towards 52-week lows, analysts point to a historically low valuation of around 12x expected earnings for 2027. The correction in KKR's share price is greater than the company's total exposure to the software sector. We refer you to this week's deep dive.

On the other hand, there is a company that managed to increase its management fees by more than 50% in three years (while costs rose by only 25%), raised record amounts from investors, and structurally improved its profitability through operational leverage. With a highly diversified model spread across asset management, insurance, and strategic holdings, KKR is now less cyclical and less dependent on any single asset class than ever before.

If the monetization climate normalizes in 2026, KKR will have both the embedded value increases ($19 billion) and the balance sheet space and capital to take full advantage of this. For long-term investors, the current weakness may therefore be an entry opportunity rather than a structural warning.

KKR is currently trading on the New York Stock Exchange at a price of USD 102.23 per share.

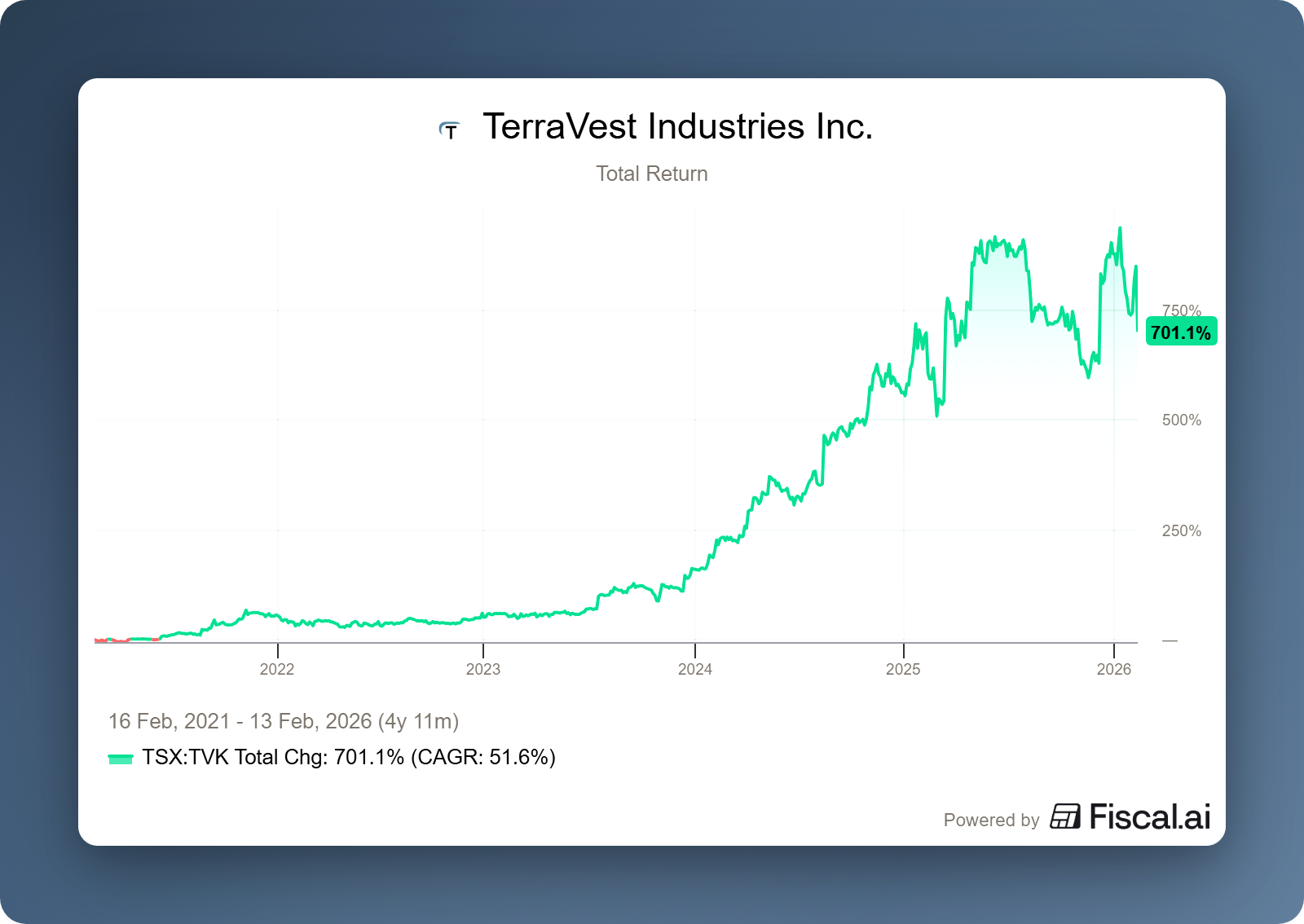

TerraVest between rates and technology

Canadian investment holding company TerraVest Industries (Toronto: TVK) recently published its results for the first quarter of fiscal year 2026. The company reported revenue growth of 74% to $408 million, and cash flow from operating activities rose 164% year-on-year. Of course, for a serial acquirer such as Terravest, most of this growth comes from acquiring new companies, but the company's core portfolio also showed impressive organic growth of 9%. We should note, however, that this includes the two companies Aureus and Wave, which have been added to the core portfolio because they are fully integrated into the ecosystem.

The most important indicator of value creation at TerraVest is Cash Available for Distribution (CAFD). This rose by a solid 34% to $33.2 million in the past quarter. This underscores the effectiveness of the recent acquisition strategy and the focus on free cash flow.

Headwinds and tailwinds

In a recent press release, CEO Dustin Haw emphasized that the outlook for the company will remain uncertain as long as the turmoil surrounding import tariffs between the United States and Canada continues. Although TerraVest itself is hardly directly affected by these tariffs due to its broad North American production footprint, the uncertainty in the market is certainly weakening demand for capital goods such as tank trailers. Customers are postponing their investments until the political dust has settled.

Shortly after the figures were released, US Secretary of Transportation Sean Duffy went one step further. He announced a strict "Safety First" policy, finalizing a crucial rule with immediate effect that drastically restricts access to commercial driver's licenses (CDLs) for non-resident drivers.

While Duffy's policy and tariff discussions are putting a temporary brake on the transportation sector, explosive growth in the data center sector is acting as a powerful counterbalance. Several TerraVest subsidiaries are currently experiencing unprecedented demand for products that are essential for the large-scale rollout of data centers in North America. According to National Bank Financial, January, a month that has not yet been included in the current quarterly figures, was the month with the strongest order intake for data center-related infrastructure in the company's history.

Although the industrial sector remains under pressure, TerraVest's results clearly demonstrate the company's strong performance. They confirm the quality of the business and the consistent execution capabilities of the management team.

TerraVest is currently trading on the Toronto Stock Exchange at a price of CAD 137.64 per share.

Receive weekly insights in your inbox

Exclusive analyses and updates on family holdings and global market developments.

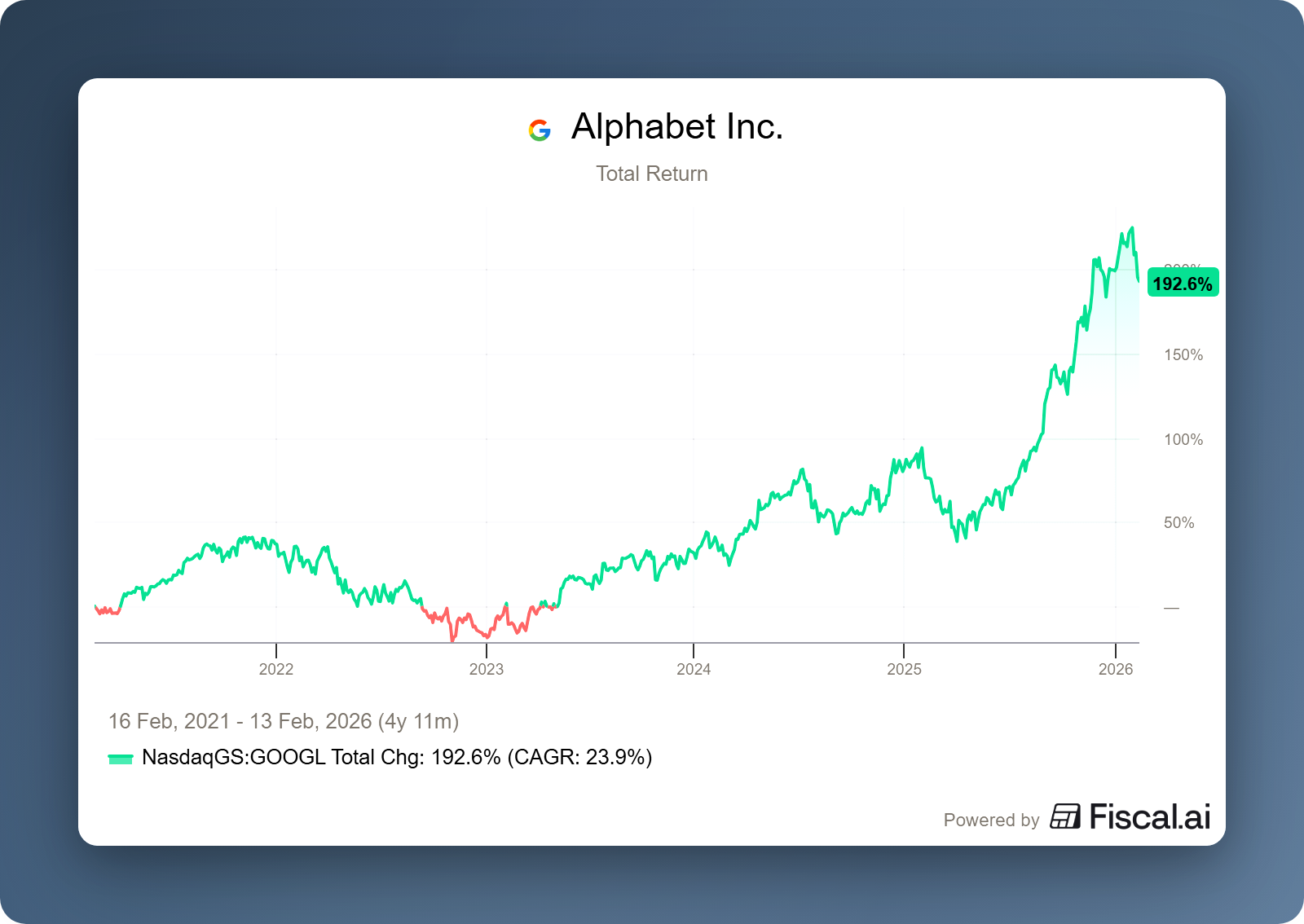

A century of trust and fines

In the dynamic world of Big Tech, a week is an eternity. For a giant like the American investment holding company Alphabet (New York: GOOGL), there is always something to report. This week was no exception; we have listed the most notable events for you.

A Century of Trust

Alphabet kicked off the week with a powerful signal to the capital markets. Immediately after announcing a massive $180 billion investment plan for 2026, the company entered the bond market. What started as an intention to raise $15 billion turned into a veritable rush of investors. With subscriptions totaling no less than $100 billion, Mountain View decided to increase the issue to $20 billion.

The most striking part of the issue was a 100-year bond. This is a unique phenomenon that we have seen before with Disney and Coca Cola. The fact that Alphabet can issue debt securities with a maturity date in the 22nd century underscores the market's rock-solid confidence in the company's viability in the ultra-long term.

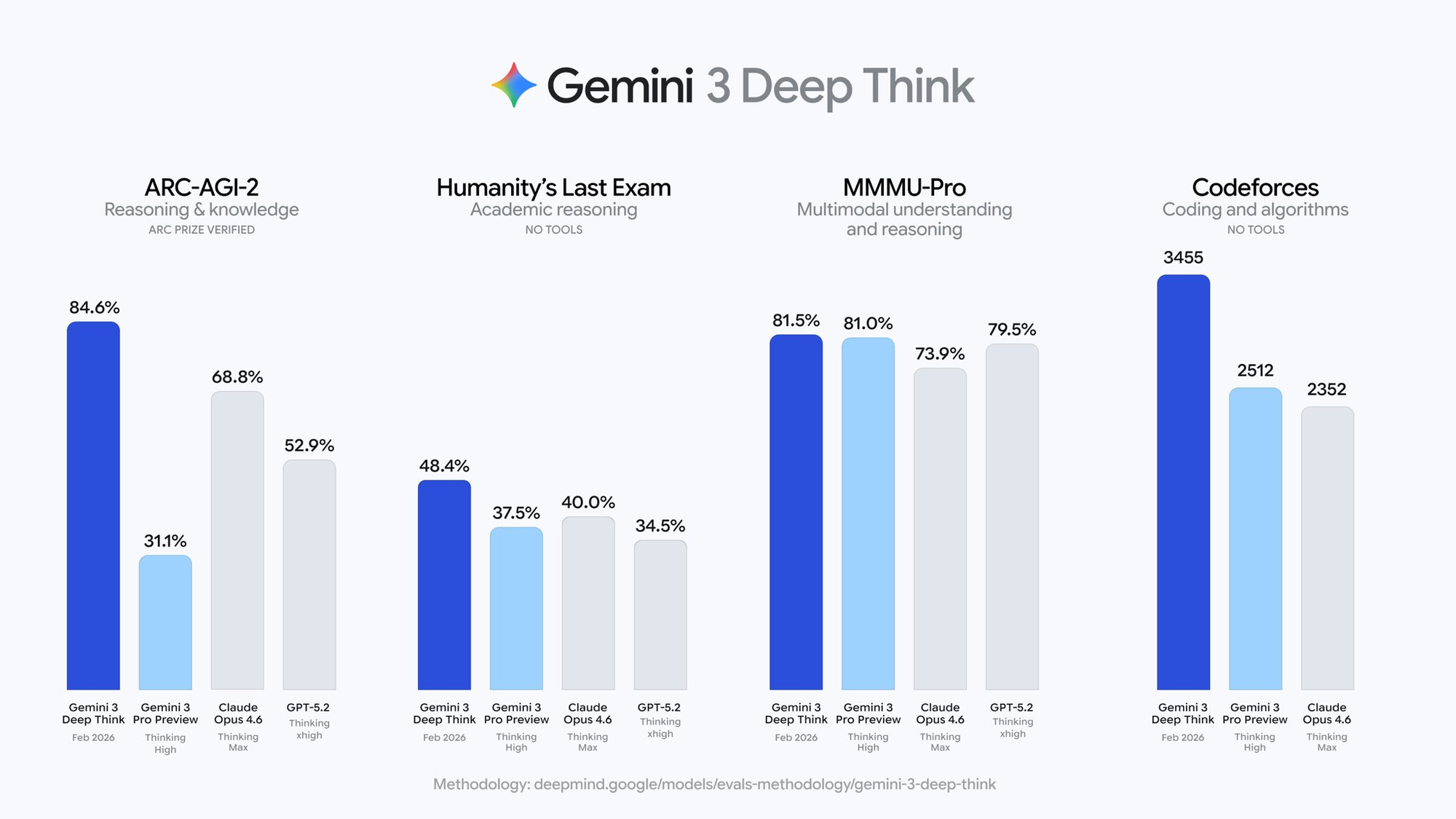

The AI Race

Anthropic's long-awaited capital round has been completed at a valuation of $380 billion, slightly higher than the previously estimated $350 billion. Alphabet still owns a 7% strategic stake in the company and can therefore record $2.1 billion in unrealized gains on paper. The British holding company Scottish Mortgage Trust also has a position in Anthropic and is therefore reaping the benefits.

The question, however, is how stable these ratings are in a market where the "throne" changes weekly. Just seven days after Anthropic raised the bar again with Claude Opus 4.6, Google claims to have regained the lead with Gemini 3 Deep Think. At Tresor Capital, we remain level-headed about this: the technical significance and legitimacy of these weekly benchmarks are difficult for an outsider to verify. It seems to be a permanent state of leapfrogging, with the truth often lying somewhere in the middle.

A Century of Rules

While Alphabet enjoys the blind trust of investors, it receives nothing but rules and fines from the European Union. Just five weeks ago, we wrote about Gemini's impending dominance in a recent analysis. This prediction became reality sooner than expected this week.

The European Publishers Council (EPC) has now officially accused Google of "hijacking" content for its AI Overviews without permission or fair compensation. According to the EPC, this undermines the economic foundation of the open web. While Google defends the new features as consumer convenience, the regulator sees a burgeoning digital infrastructure monopoly and a dangerously skewed balance of power.

The cup of poison was not yet empty: two days later, Bloomberg revealed that the EU had also launched an investigation into manipulation within advertising auctions. The Commission suspects that Alphabet is artificially driving up prices to the detriment of advertisers. While the market is looking 100 years ahead, Brussels is focusing on immediately curbing the current omnipotence.

Alphabet is currently trading on the New York Stock Exchange at a price of USD 306.33 per Class A share.

Receive weekly insights in your inbox

Exclusive analyses and updates on family holdings and global market developments.

Would you like more information about our services?

Contact us

Disclaimer:

No rights can be derived from this publication. This is a publication by Tresor Capital. Reproduction of this document, or parts thereof, by third parties is only permitted with written permission and with reference to the source, Tresor Capital.

This publication has been compiled with the utmost care by Tresor Capital. The information is intended in a general sense and is not tailored to your individual situation. The information should therefore expressly not be regarded as advice, an offer or a proposal to purchase or trade investment products and/or purchase investment services, nor as investment advice. The authors, Tresor Capital and/or its employees may hold positions in the securities discussed, either for their own account or for their clients.

You should carefully consider the risks before you start investing. The value of your investments may fluctuate. Past performance is no guarantee of future results. You may lose (part of) your investment. Tresor Capital accepts no liability for any inaccuracies or omissions. This information is for indicative purposes only and is subject to change.

Read the full disclaimer at tresorcapitalnieuws.nl/disclaimer .