Family Holdings #8 - The purchases and sales of the holdings

This week's topics:

After a year in which Scottish Mortgage beat the global index, everything points to a successful 2026. The driving force is its strong position in the private market, with SpaceX as the absolute standout. Strategic revaluations and interests in private giants such as ByteDance and Stripe give the trust enormous latent value. Although the market is speculating on IPOs, the fund is taking a patient approach; the current liquidity in the secondary market allows them to stick to their long-term vision.

Despite negative sentiment surrounding the sector, insiders at KKR are showing rock-solid confidence. With joint purchases of more than $35 million in own shares, the Co-CEOs and supervisory directors are sending a clear signal: the market is too pessimistic and the share price has been punished too harshly. For Tresor Capital, this skin in the game is crucial confirmation that the interests of management and shareholders are aligned.

The Swedish holding company Investor AB continues to impress, with the underlying operating profit (EBITA) of its portfolio companies rising by no less than 113% over the past five years. While the market is concerned about the impact of AI on financial values, Investor sees the price declines of holdings such as Nasdaq Inc. and EQT as a buying opportunity and is aggressively expanding its interests. This active capital allocation, combined with strategic private expansions such as in the medical sector (Vectura), underscores why the traditional undervaluation of the holding company is steadily declining.

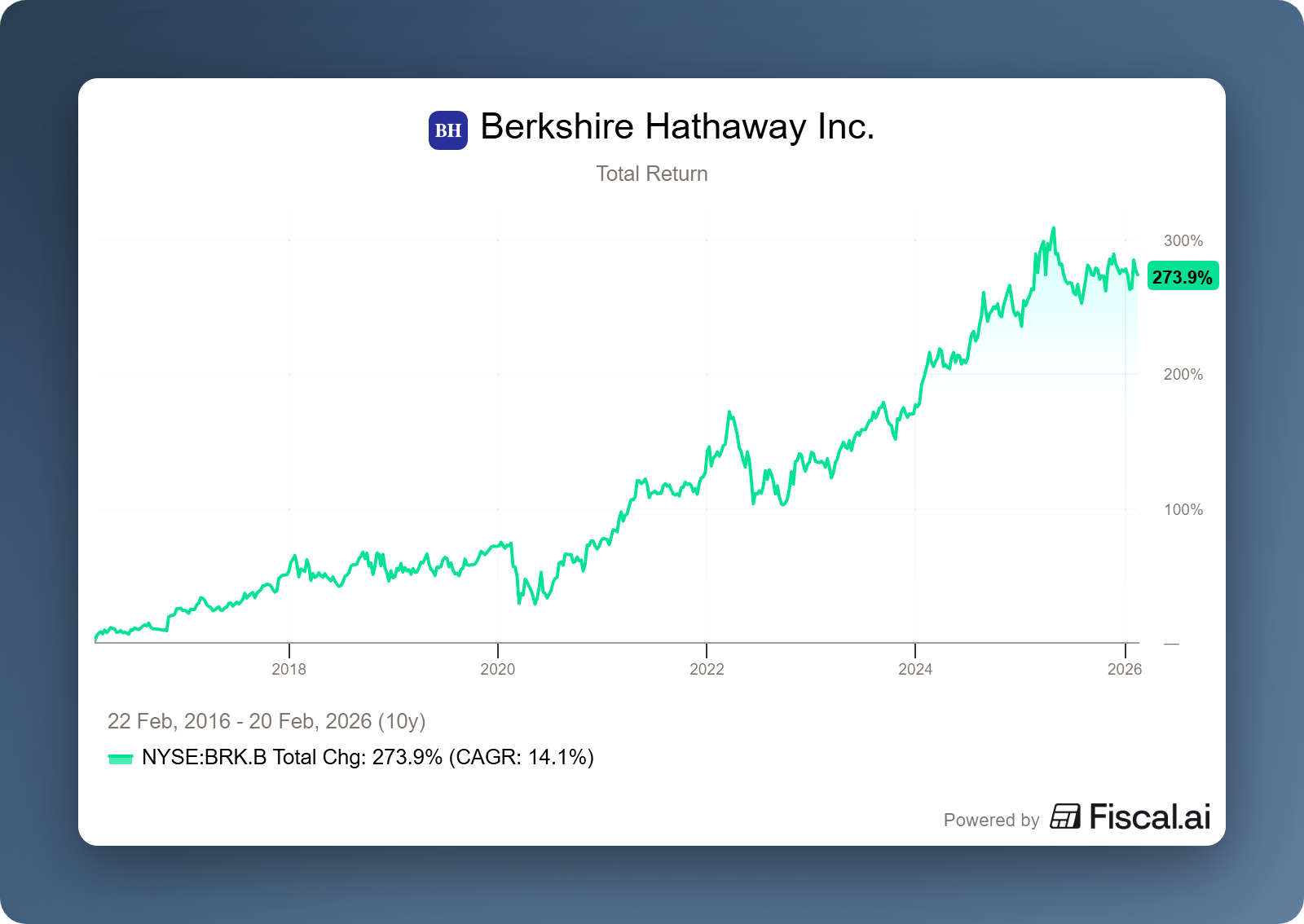

Berkshire Hathaway's recent 13F filing shows that the portfolio is gradually shifting. The stake in Apple was further reduced and Amazon was significantly reduced, while a modest position in The New York Times was built up. At the same time, energy subsidiary PacifiCorp is selling assets to limit financial risks, indicating an initial clean-up of the portfolio and a rapidly increasing cash position.

In Brief:

Constellation Software ( Toronto: CSU) Lumine expanded its telecom software portfolio with the acquisition of Synchronoss for $9 per share, representing an enterprise value of approximately $258 million, corresponding to approximately 5× the expected EBITDA for 2025. Synchronoss provides cloud and messaging services to global Tier-1 operators such as Verizon, AT&T, and SoftBank and has approximately 750 employees.

Danaher ( New York: DHR) announced its largest acquisition in more than five years with the acquisition of Masimo for $180 per share, totaling approximately $9.9 billion in cash, a 38% premium to the last closing price. Masimo is a leading manufacturer of pulse oximeters and is involved in an ongoing patent dispute with Apple over the Apple Watch. The transaction is expected to close in the second half of 2026, subject to customary approvals.

Brown & Brown (New York: BRO) has acquired the assets of American Adventure Insurance, a niche insurer that provides dealer-based insurance solutions for motorhomes, boats, motorcycles, recreational vehicles, and other products.

Prosus Ventures (Amsterdam: PRX) expanded its AI portfolio with two new deals. It invested $5 million in Qureos, a platform that automates the entire recruitment process, from sourcing to interviews, and is now used by more than 1,000 organizations. In addition, Prosus led the $15.8 million Series A round for BeConfident, Latin America's largest AI learning platform with 3 million users, which offers 24/7 conversation-based learning via WhatsApp and its own app.

Constellation Software, Danaher, Brown & Brown, and Prosus are currently trading on the Toronto, New York, and Amsterdam stock exchanges at prices of CAD 2,535.40, USD 211.26, USD 69.56, and EUR 44.12 per share, respectively.

| Share | YTD | 3 years* | 5 years* | 10 years* |

|---|---|---|---|---|

| Constellation Software | -25,7% | -2,4% | 6,9% | 18,2% |

| Danaher | -8,4% | -5,2% | 1,5% | 13,6% |

| Brown & Brown | -12,9% | 3,6% | 10,2% | 26,3% |

| Prosus | -17,1% | 9,6% | -2,2% |

Returns shown in EUR; *The annual compounded/compounded return

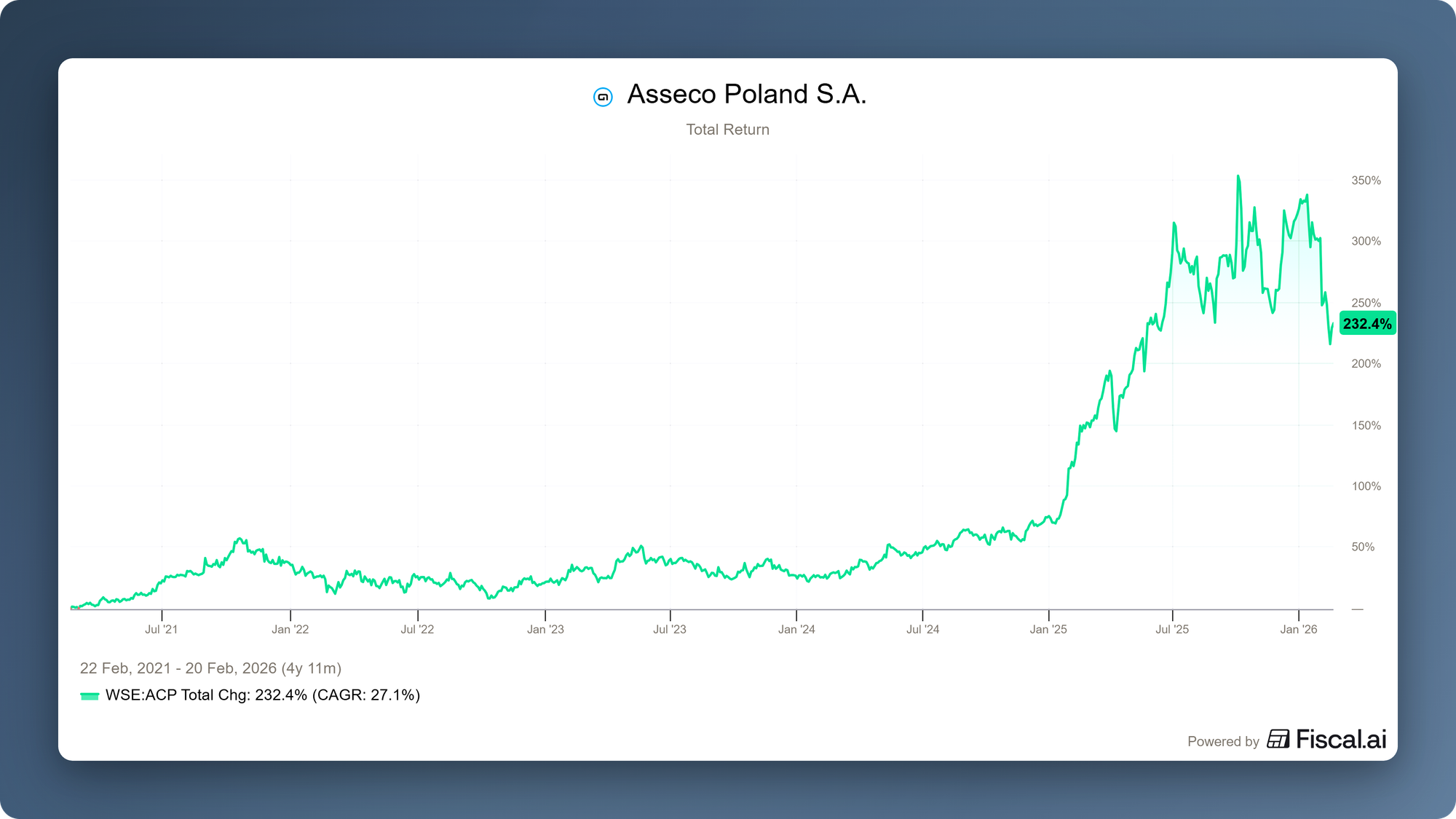

Asseco Poland focuses on defense and cybersecurity

Global geopolitical tensions are rising and governments are substantially increasing their defense budgets. Against this backdrop, Polish investment holding company Asseco Poland (Warsaw: ACP) is positioning itself emphatically as a key player in the field of cybersecurity and national security. The serial acquirer is making strategic use of the in-depth expertise it has gained in Israel and through contracts with organizations such as NATO and Frontex. For those interested in the full context, this article about Asseco Poland is highly recommended.

Vice President Rafał Kozłowski indicates that the defense sector is extremely interesting for the company. Asseco aims to transfer the knowledge gained from the Israeli market in the field of cyber security to its home market. In Israel, the company provides support for the operation of the Iron Dome defense system through acquired local companies. In Poland, Asseco is currently executing its first defense contracts on a modest scale. The company is considering both organic growth and acquisitions in this sector, with a specific focus on purchasing companies that could enable broader market consolidation in Poland in the future.

The defense market has specific rules for public procurement. In the public sector, the awarding of contracts is determined not only by price and experience, but above all by the degree of trust, organizational maturity, and the ability to operate in a highly regulated security environment. Formal and operational factors are crucial, such as handling sensitive information, securing the supply chain, managing access controls, and maintaining readiness to provide continuous services. This requires a level of operational readiness that smaller players often cannot offer. Large IT players such as Asseco therefore have a significant advantage.

Valuation and long-term outlook

Analyst Adrian Kowollik of East Value Research indicates that Asseco is one of the strongest companies on the Warsaw Stock Exchange. He points to the company's strong fundamentals and emphasizes that the solutions Asseco provides are business-critical for sectors such as government and healthcare. This creates a high degree of customer loyalty, which also acts as a strong buffer against technological disruptions caused by artificial intelligence.

Kowollik emphasizes that Asseco remains attractively valued, despite the sharp jump in its share price following the announcement of a partnership with Topicus, its largest shareholder. This collaboration also provides a catalyst for further improvement in profitability and return on invested capital in the coming years, citing similar examples from TruBridge and Sygnity. Paweł Łągwa of CMT Advisory notes that 2026 and 2027 promise to be particularly rich in acquisition activity in the technology sector.

Asseco Poland is currently trading on the Warsaw Stock Exchange at PLN 182.80 per share.

Receive weekly insights in your inbox

Exclusive analyses and updates on family holdings and global market developments.

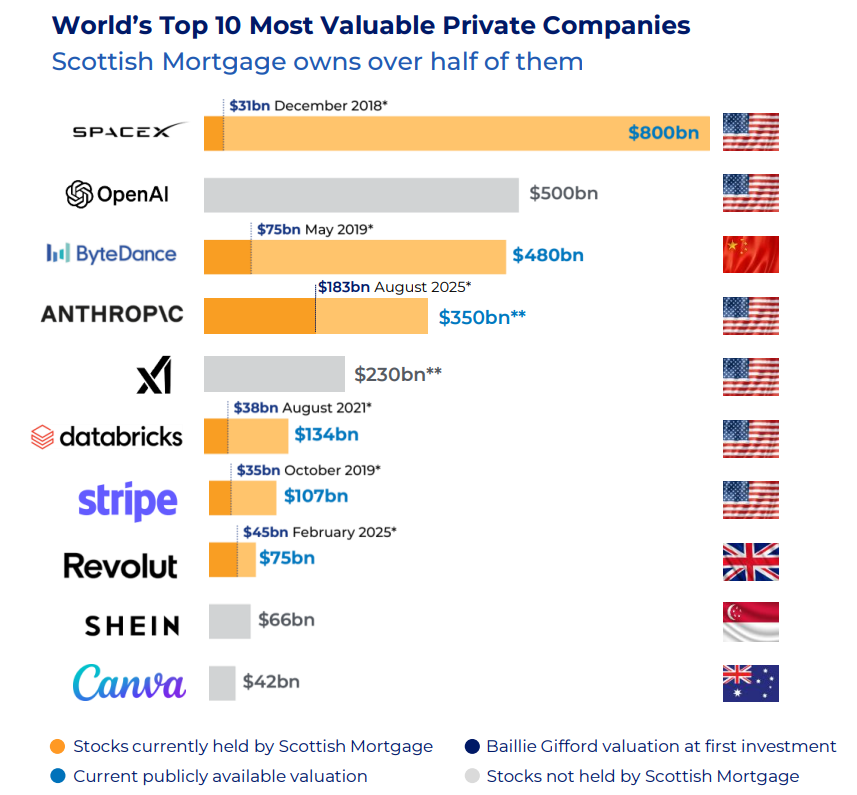

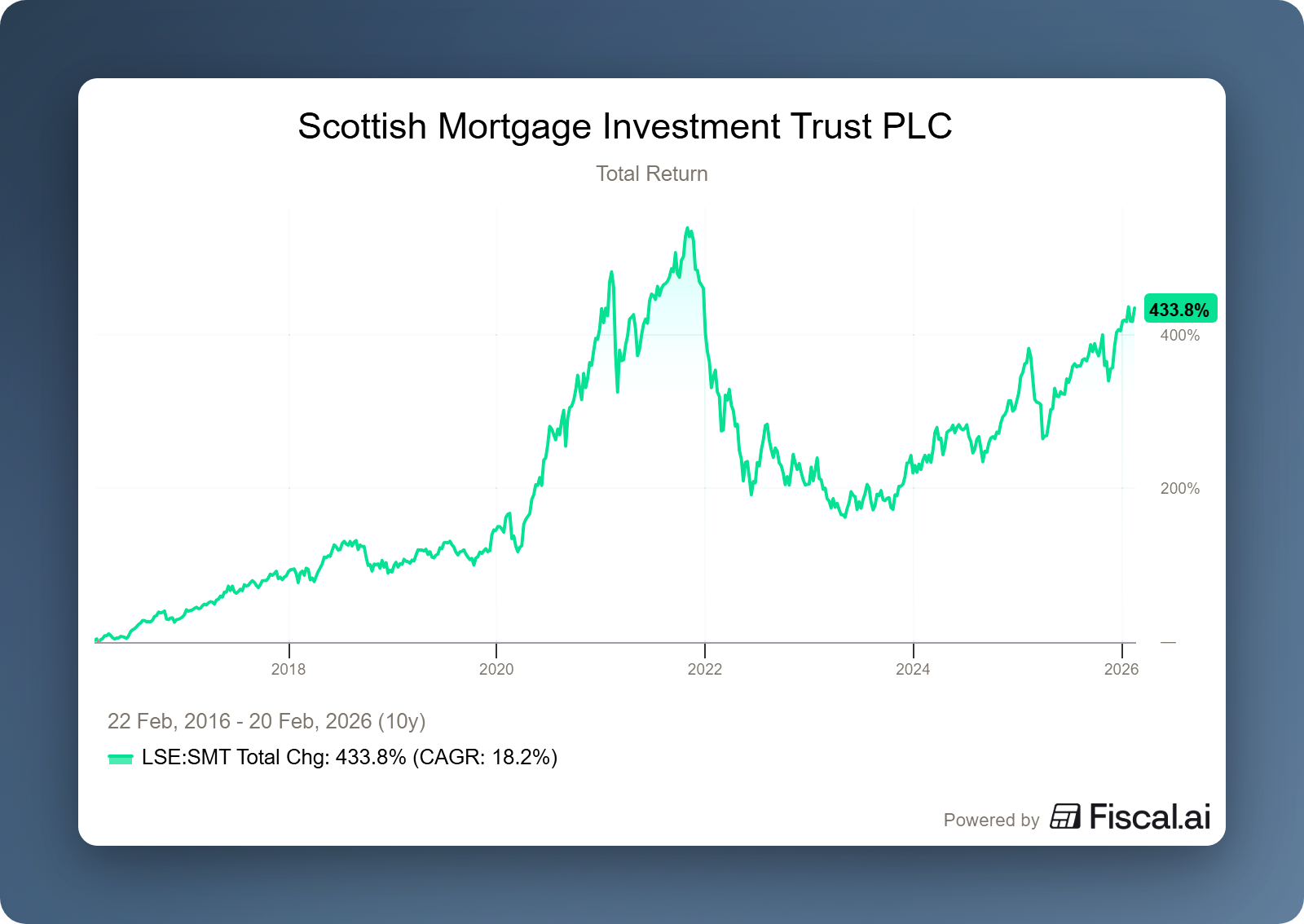

A rock-solid 2025 looks set to be the prelude to a successful 2026 for Scottish Mortgage Trust.

The British investment holding company Scottish Mortgage Investment Trust (London: SMT) recently published its figures for the fourth quarter of 2025. Over the whole of 2025, the trust's net asset value (NAV) rose by 22.3%, while its share price showed an even stronger increase of 24.7%. This meant that SMT significantly outperformed the broader market; the FTSE All-World Index remained stuck at a return of 14.6% over the same period.

SpaceX is currently the absolute spearhead of the portfolio. While the valuation was still more conservative in the third quarter, the company was revalued to an impressive $800 billion in Q4. This revaluation was the largest individual driver of returns in the past quarter, with an absolute contribution of no less than 9.1% to the net asset value (NAV) of the trust.

It is interesting to note that the recent merger with xAI has already pushed the informal valuation in the secondary market well above $1 trillion. However, this additional markup has not yet been incorporated into the current Q4 figures, indicating a significant latent reserve for the upcoming quarterly updates leading up to a potential IPO.

In a recent interview, manager Tom Slater emphasized SMT's unique position. The trust is invested in six of the ten largest private companies in the world, including heavyweights such as ByteDance, Anthropic, Databricks, Stripe, and Revolut.

With private allocation approaching the regulatory limit of 30%, the question arises: should we sell? Slater is clear on this point:

"We are not obliged to sell. We want to maintain the mix of listed and unlisted companies for tradability, but our philosophy is to hold on to winners for a long time. SpaceX is now a cash-generating company that is highly sought after."

An initial public offering (IPO) worth $1.5 trillion would, of course, be a good time to cash in on profits, but the secondary market is now so liquid that Scottish Mortgage does not need to wait for an official listing to adjust its allocation.

In addition to SpaceX, the other five largest private holdings saw their combined valuation increase by another $400 billion in Q4, resulting in a contribution of approximately 0.8% to NAV for the quarter. Meanwhile, speculation is mounting about possible IPOs in 2026 or 2027 for several of these private heavyweights, although current access to liquid secondary markets also means that they can increasingly afford to wait patiently for an official IPO date.

Meet Scottish Mortgage at the VFB Happening

Would you like to discuss Scottish Mortgage's strategy and the dynamics between private and public markets in person? Then mark March 28 in your calendar. During the VFB Happening, Tresor's Michael Gielkens and Investment Specialist Hamish Maxwell will take to the stage to share their vision of the current market. This is a unique opportunity to gain direct insight into one of the world's most talked-about investment strategies.

Scottish Mortgage Investment Trust is currently trading on the London Stock Exchange at a price of GBP 12.62 per share.

KKR insider transactions indicate confidence among top management

At Tresor Capital, we always talk about skin in the game. We believe it is important that the interests of us and our clients as external shareholders are aligned with those of insiders such as the management and supervisory board. After all, we are not sitting at the table in the boardroom, but as important players within an organization, we are now exposed to a significant portion of their assets to the share price development of the company in question through share ownership, so we feel strengthened by the fact that our interests are aligned.

We have previously written about the pressure on the software and private equity sectors. The American investment holding company KKR has been under considerable pressure recently. Fears surrounding private credit and the underlying software exposure in private portfolios are causing investors to vote with their feet and sell off their shares.

We believe that the baby is being thrown out with the bathwater and that investors are going too far in their sentiment. The fact that insiders are thinking along the same lines was reinforced by insider purchases that are rare in their magnitude. KKR Co-CEOs Joseph Bae and Scott Nuttall both bought shares on the stock market for no less than USD 12.8 million with their own money. Director Matt Cohler also bought shares worth USD 4.5 million. Earlier this month, director Timothy Barakett also contributed USD 5.2 million. When insiders buy back more than USD 35 million worth of their own shares, we can safely say that this is a clear signal that the shares have been punished far too harshly. A well-known quote from legendary investor Peter Lynch goes:

However, it is not all sunshine and roses in the private equity holding's portfolio. Sometimes investments fail due to circumstances. For example, KKR's investment in Accell turned out to be a flop. During the pandemic, demand for bicycles exploded, prompting manufacturers to anticipate this with huge orders. However, when supply chains recovered and the bicycles were finally delivered, demand collapsed completely, leaving Accell with large and unsellable stocks. This prolonged market slump, combined with the sky-high debt burden of the initial acquisition and the additional costs of a major recall at subsidiary Babboe, ultimately made the financial position untenable.

As a result of the necessary second debt restructuring within a short period of time, KKR loses control of the company to the creditors, who convert their loans into shares. Although KKR, together with Teslin, provides a final capital injection of several tens of millions to avert bankruptcy, the private equity firm no longer has any ownership in the beleaguered bicycle giant, which manufactures bicycles for brands such as Batavus, Sparta, and Koga.

KKR is currently trading on the New York Stock Exchange at a price of USD 101.62 per share.

Broad underlying profitability demonstrates the quality of Investor AB

We previously wrote about the excellent annual results of Swedish investment holding company Investor AB (Stockholm: INVE-B). For the fifteenth year in a row, the Wallenberg family's holding company outperformed the stock market. Please refer to the article below for the full report.

We always read Ole Ensrud's articles on his blog Outsiders Corner with great interest. This includes his most recent analysis of Investor AB's annual figures. Ole takes a closer look under the hood of the companies in the portfolio to calculate what Warren Buffett once called "pass-through profits." These are the profits earned by Investor AB's subsidiaries, multiplied by Investor AB's ownership interest.

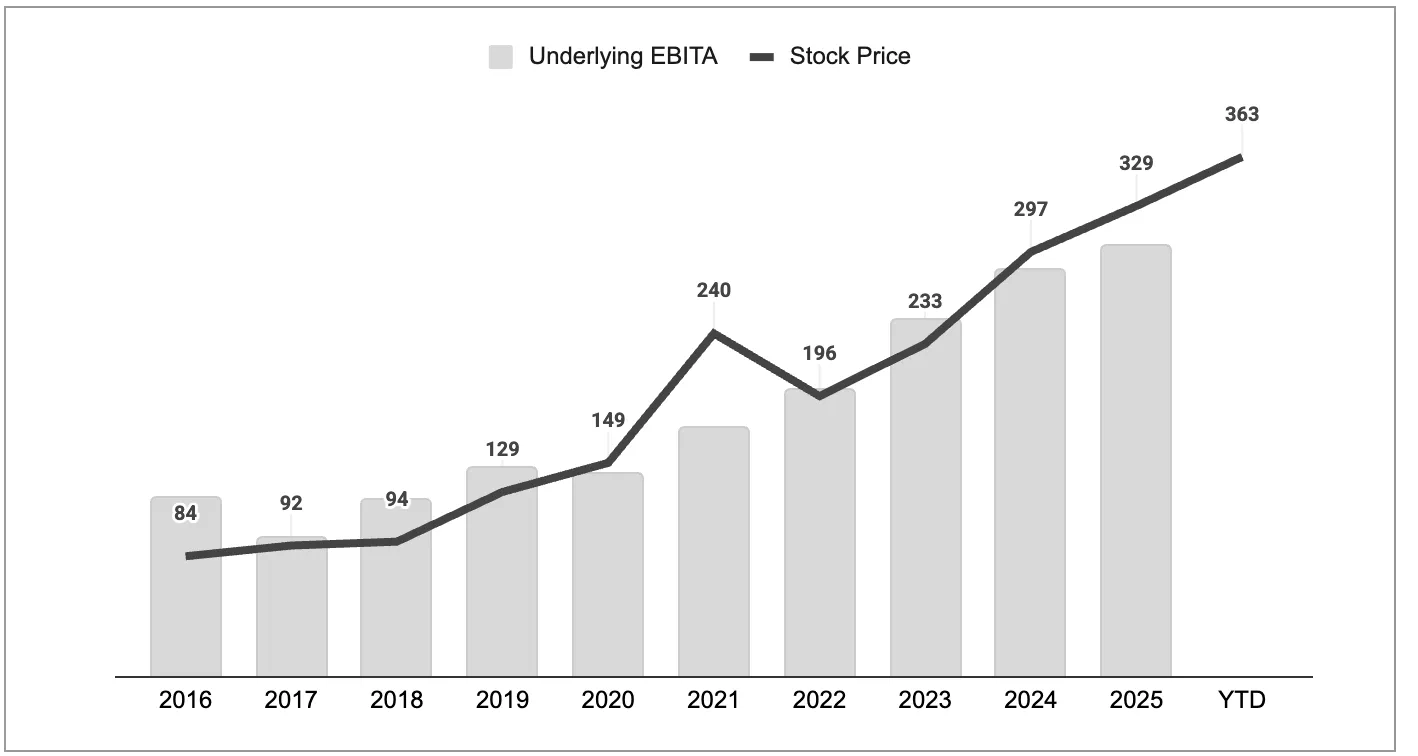

The figure above shows the underlying operating profit (bars) compared to the share price. This shows that fundamental developments are the most important driver of share price performance, followed by a modest reduction in the undervaluation relative to the net asset value. The undervaluation will have reduced further by 2026.

The figure below shows the absolute growth in operating profit over a period of 1, 3, and 5 years. Over a period of 5 years, EBITA (gross profit adjusted for amortization of intangible assets) rose by no less than 113%. The main contribution to this profit development came from automation and electrification company ABB, followed by the unlisted portfolio Patricia Industries and bank SEB.

However, Ensrud reveals an even more relevant fact: all companies contributed to the growth of the family holding company's operating profit over a period of three to five years. This supports his view that Investor AB should not be traded at a high discount, a view that we fully endorse.

Capital allocation continues unabated

Investor AB continues to invest heavily in both its listed portfolio and the private companies in Patricia Industries. Despite better-than-expected reported figures, Nasdaq Inc.'s share price fell by more than 16% in 2026. Investors are increasingly concerned about the impact of artificial intelligence on traditional financial service providers. The fear is that AI applications will undermine existing business models and put pressure on margins. Investor AB, one of the most progressive holding companies in our investment universe in terms of future-proofing (i.e., implementing digitization and AI) its subsidiaries, sees this as a buying opportunity rather than a disruption risk. Investor therefore purchased an additional USD 15.8 million in shares.

This sentiment has not only affected Nasdaq Inc., but has also led to share price losses at other financial institutions. For example, private equity subsidiary EQT AB is also under pressure this year, as investors believe that EQT's software positions are being challenged by AI. Investor AB responded in a similar manner: last week, the family holding company purchased SEK 657 million worth of EQT shares. For a comprehensive analysis of the AI fears gripping the software and private equity sector, please refer to last week's deep dive below.

In addition, the private portfolio was further strengthened. Vectura, a subsidiary of Patricia Industries, is reinforcing its market-leading position by acquiring the remaining ownership interests in GoCo Health Innovation City from Next Step Group. This strategic acquisition of the knowledge-intensive Life Science cluster in Mölndal represents a total property value of SEK 2.9 billion and fits seamlessly within the capital allocation strategy of parent company Investor AB to supplement organic growth with high-quality acquisitions. Patricia Industries is supporting this transaction with a targeted capital injection of SEK 0.5 billion. The transaction comprises four properties with over 52,000 square meters of floor space and is expected to be completed in the second quarter of 2026.

Investor AB is currently trading on the Stockholm Stock Exchange at a price of SEK 367.90 per B share.

Receive weekly insights in your inbox

Exclusive analyses and updates on family holdings and global market developments.

Buffett's last dance

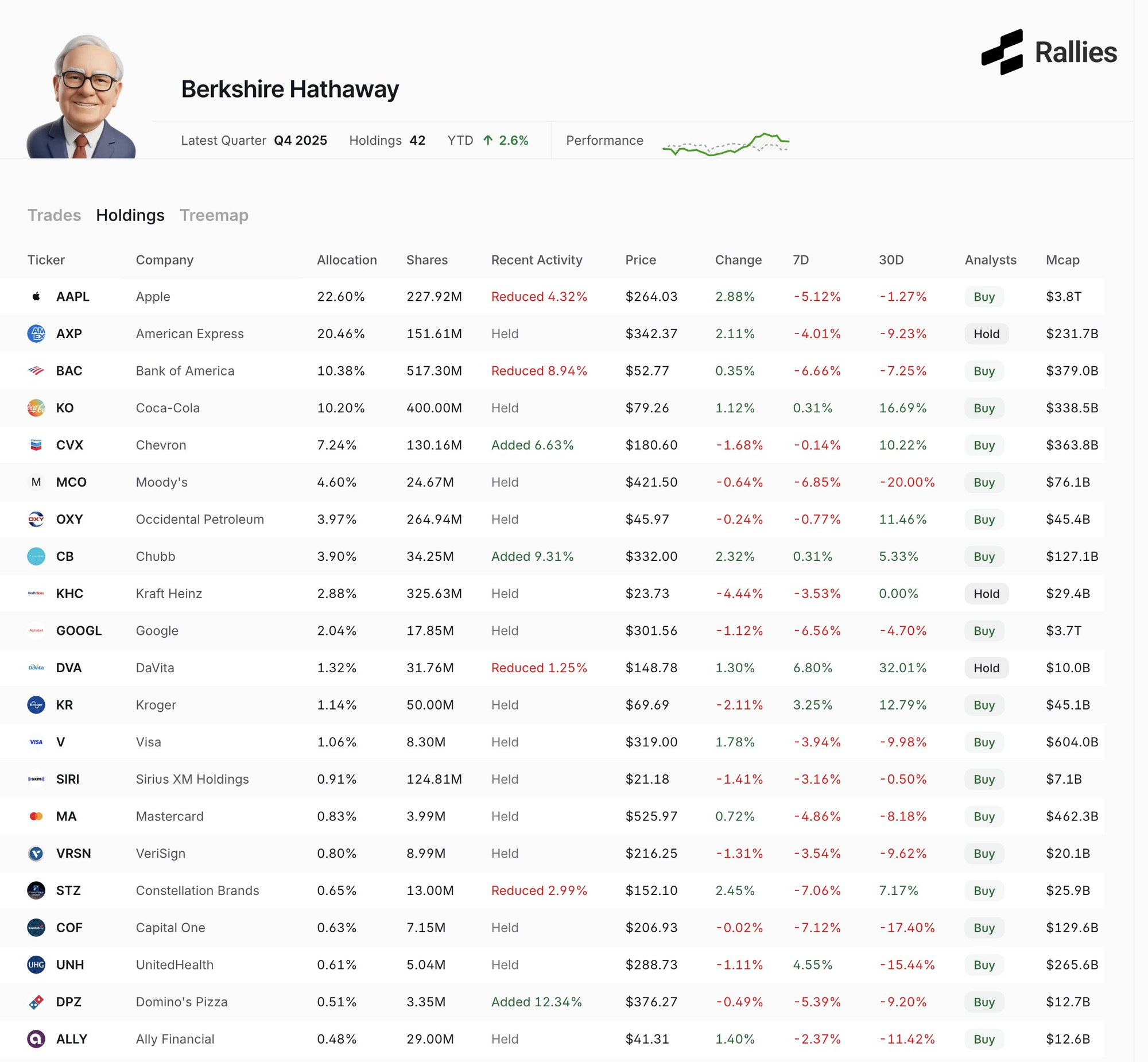

Once every quarter, large institutional investors are required to lay their cards on the table by means of the 13F filing. This document offers a glimpse into the portfolios of the world's most respected asset managers. For investors, Berkshire Hathaway's (New York: BRK-B) update is always something of a holy grail.

Although Warren Buffett has indicated several times that he has been less active operationally for some time now, this offers us one last chance to include his name in a title once more.

The most notable changes in the portfolio at a glance:

- Berkshire has again reduced its stake in the iPhone maker by 4.3%, bringing the position to a value of $61.96 billion. Although Apple remains by far the largest holding at around 22%, the trend is downward. After the sharp sell-offs in 2024 and the first half of 2025, Berkshire continues to steadily take profits.

- More striking is the move at Amazon. Berkshire slimmed down its position in the e-commerce and cloud giant by more than 75%. Buffett first bought the stock in 2019 and readily admitted at the time that he had been an "idiot" for not getting in earlier. The current sale, which leaves only 2.3 million shares remaining, appears to be part of a broader move away from the volatile technology sector. However, it is possible that this was a purchase made by portfolio manager Todd Combs. Given that Combs has since left Berkshire, it would make sense that some of his positions would also be unwound.

- Perhaps the most interesting move is the investment of more than $350 million in The New York Times. Although this is a relatively modest position, accounting for 0.12% of the portfolio, it marks the first time in years that Berkshire Hathaway has reinvested capital in journalism. Buffett has always preached that in the digital age, only three newspapers in the US would remain viable: The Washington Post, The New York Times, and The Wall Street Journal. Now that the Post has been owned by Jeff Bezos for some time, Berkshire is choosing to invest in one of the other remaining strong brands.

Sale within Berkshire's energy division

In addition to the shifts in its stock portfolio, Berkshire Hathaway is also taking an exceptional step within its energy division. Subsidiary PacifiCorp has agreed to sell a significant portion of its assets in Washington State to Portland General Electric for approximately $1.9 billion. The package includes wind farms, transmission lines, and a natural gas power plant.

Berkshire's divestment of assets is noteworthy. For decades, Warren Buffett's philosophy was to hold on to companies and infrastructure "forever," even when returns were temporarily under pressure. The sale should therefore be seen in the light of the billions in claims PacifiCorp is facing after devastating forest fires in Oregon and California, which are affecting the division's financial stability.

Two years ago, Buffett warned that he would not "knowingly throw good money after bad." Greg Abel, who earned his spurs in Berkshire's energy division, now seems to be translating those words into policy. His start as CEO is thus marked by an initial, visible clean-up of the portfolio.

At the same time, this raises questions about the destination of the funds that are being freed up. The reduction of the stake in Apple and now this energy sale are further inflating the cash position. The new stake in The New York Times is strategically interesting, but remains marginal in relation to the size of Berkshire's balance sheet. It therefore seems plausible that Greg Abel will look for a large private acquisition in 2026 or, if attractive opportunities fail to materialize, will fall back on substantial share buybacks.

Berkshire Hathaway is currently trading on the New York Stock Exchange at a price of USD 493.68 per B share.

Receive weekly insights in your inbox

Exclusive analyses and updates on family holdings and global market developments.

Would you like more information about our services?

Contact us

Disclaimer:

No rights can be derived from this publication. This is a publication by Tresor Capital. Reproduction of this document, or parts thereof, by third parties is only permitted with written permission and with reference to the source, Tresor Capital.

This publication has been compiled with the utmost care by Tresor Capital. The information is intended in a general sense and is not tailored to your individual situation. The information should therefore expressly not be regarded as advice, an offer or a proposal to purchase or trade investment products and/or purchase investment services, nor as investment advice. The authors, Tresor Capital and/or its employees may hold positions in the securities discussed, either for their own account or for their clients.

You should carefully consider the risks before you start investing. The value of your investments may fluctuate. Past performance is no guarantee of future results. You may lose (part of) your investment. Tresor Capital accepts no liability for any inaccuracies or omissions. This information is for indicative purposes only and is subject to change.

Read the full disclaimer at tresorcapitalnieuws.nl/disclaimer .