Family Holdings #32 - Major acquisitions, insider purchases and AI investments

This week's topics:

Prosus reallocates capital by selling its stake in competitor Meituan to strengthen its core food delivery division (Just Eat, iFood), while simultaneously investing in a new generation of AI startups.

Markel is divesting its loss-making reinsurance business as part of a strategic repositioning to restore the focus and profitability of its core business, niche insurance.

In Brief:

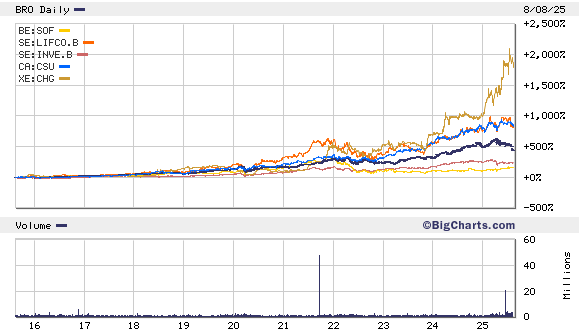

Brown & Brown (New York: BRO) has completed the previously announced acquisition of Accession Risk Management Group for a gross purchase price of USD 9.8 billion. With this strategic acquisition, the American investment holding company gains control of the specialized broker Risk Strategies and insurance wholesaler One80 Intermediaries. Although Accession's operations will maintain their decentralized sales and service model, they will now have access to Brown & Brown's global network and resources.

To maximize synergy, Brown & Brown is combining its 'Programs' and 'Wholesale Brokerage' segments into a new 'Specialty Distribution' division. One80 Intermediaries will be integrated into this new division, with key figures from both companies, including John Mina and Matt Power, joining the new leadership teams to guide the integration.

Chapters Group (Frankfurt: CHG) has completed two acquisitions this week. The acquisitions of AdFlow Systems and Artificial Intelligence Finance demonstrate a disciplined strategy of building market leadership positions in specific niches.

Through its subsidiary Waterkant Software, the serial acquirer has acquired AdFlow Systems GmbH, a leading provider of software for advertising management and production for media companies. This is the second participation within the 'Newspaper Publishing' sector, indicating a clear strategy to build a strong platform in this vertical market. Crucially for success, both founders, Dietmar and Christian, remain on board to ensure continuity and their expertise. The joint goal is to strengthen product development and further develop future themes such as AI.

In addition, the listed Software Circle plc, in which Chapters has a stake of more than 25%, has acquired 95% of the shares of Artificial Intelligence Finance LTD. A total consideration of EUR 5 million was agreed for this transaction, consisting of a direct payment and an earn-out. Here too, the continuity of leadership is an important element; co-founder Karl Deeter remains to manage the day-to-day operations of the company.

Constellation Software (Toronto: CSU) has once again lived up to its reputation as one of the world's most active serial acquirers. In a period of just over a week, the decentralized operating groups, Volaris and Jonas, jointly completed five acquisitions that underscore the global reach of the strategy. Volaris significantly strengthened its presence in emerging markets, with the acquisition of ResReserve in South Africa, a supplier of software for the hotel sector that is being integrated into the existing Adapt IT portfolio. In addition, Useall was acquired in Brazil, a supplier of business management software with more than a thousand customers.

At the same time, Jonas demonstrated the diversity of its M&A approach. The most significant transaction was the acquisition of Uruguayan Geocom by subsidiary Vesta Software, a platform with a turnover of more than USD 35 million in 2024 and the ambition to double in size within two years. This was complemented by two more targeted acquisitions: in New Zealand, RxOne was purchased, a supplier of pharmacy software that strengthens a previous carve-out in that sector, and in Texas, the portfolio was expanded with the add-on acquisition of myCAMPapp, a SaaS solution for summer camps. The high frequency and strategic diversity of these transactions once again illustrate the effectiveness of Constellation Software's decentralized model, in which the operating groups continue to add value autonomously.

Lifco (Stockholm: LIFCO-B) has signed an agreement for the full acquisition of the British MaxiMover. MaxiMover is a specialized company that focuses on the design and production of customized conversions for vans with a lowered floor up to 3.5 tons. With this acquisition, Lifco strengthens its position in a niche market within the transport sector.

The company, based in Lincoln, England, reported net sales of approximately GBP 39 million for the financial year ending in May 2025 and employs 47 people. Following completion, which is expected in the third quarter of 2025, MaxiMover will be consolidated within Lifco's Business Area Systems Solutions, in the Transportation Products division.

Investor AB (Stockholm: INVE-B) has recently given a clear confirmation of the 'skin in the game' principle, as key figures within management have expanded their personal stake in the Swedish family holding company. CEO Christian Cederholm bought 2,500 shares on August 1, 2025, while director Jacob Lund acquired 1,000 shares that same day. A day later, on August 2, Thomas Kidane added another 1,600 shares to his position.

These transactions, in which management invests with its own capital, are more than a formality for us; it is a powerful signal that the interests of management and shareholders are fully aligned. It shows that they are not only managing other people's capital, but are also convinced of the long-term value creation of the company. Such actions, in which management puts its money where its mouth is, are an essential criterion in our assessment of the quality and sustainability of an investment.

Sofina (Brussels: SOF) demonstrates the power of its long-term technology strategy by capitalizing on the explosive growth in the AI sector, both through direct and indirect investments. A striking example of its direct approach is the position in the French AI pioneer Mistral, which is currently in talks to raise capital at a valuation of USD 10 billion. At the same time, Sofina is reaping the benefits of its carefully selected portfolio of venture capital funds, with a particular emphasis on its partnership with the renowned firm Sequoia Capital. This strategy provides access to some of the most promising, unlisted tech companies in the world.

The value of this indirect exposure is strikingly illustrated by the recent developments at two prominent holdings within the Sequoia portfolio. AI company Anthropic is in talks for a new funding round that would value the company at an impressive USD 170 billion, a spectacular increase from the USD 61 billion in March of this year. In addition, Figma, the leading software for collaborative design, has realized a successful IPO with a valuation of more than USD 18 billion. This combined approach, in which direct investments in companies with high conviction are mixed with exposure via the best fund managers in the world, enables Sofina to effectively participate in the most important technological trends.

Brown & Brown, Chapters, Constellation Software, Investor AB, Lifco and Sofina are currently trading at prices of USD 93.03, EUR 41.80, CAD 4,692.31, SEK 288, SEK 344.60 and EUR 276.20 per share.

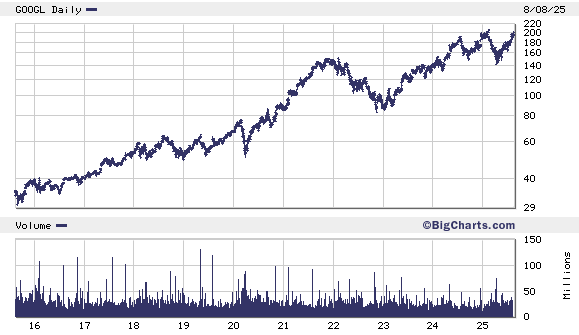

Anatomy of innovation: Alphabet's investment in the foundations of AI

In today's artificial intelligence-driven markets, it is tempting to focus solely on the developers of the large language models themselves. However, the most sustainable long-term value creation is often found in the companies that provide the essential infrastructure, the "picks and shovels" of the technological gold rush. The recent developments surrounding AI storage platform Vast Data and the strategic positioning of a giant like investment holding company Alphabet (New York: GOOGL) offer a perfect case study in how smart capital finances the backbone of the future.

One of the most followed stories in the private tech market is the rise of Vast Data, a company that specializes in a crucial, but often overlooked, part of the AI revolution: data storage. The company is currently in advanced talks for a new funding round with prominent parties such as Alphabet's venture capital division CapitalG and existing strategic investor Nvidia. This round could push the startup's valuation to an impressive USD 30 billion, a spectacular jump from the valuation of USD 9.1 billion in 2023.

The explosive valuation of Vast Data is no coincidence. The company develops a specialized storage technology that is specifically designed to enable the efficient data transfer between the GPUs (Graphics Processing Units) in large-scale AI data centers. In an ecosystem where the computing power of AI models is the main limiting factor, Vast Data's technology forms an essential link.

The demand for their solutions is underscored by a customer base that includes names like Elon Musk's xAI and CoreWeave, and strong financial health. "The company is reportedly cash flow positive and annual recurring revenue (ARR) is expected to grow from USD 200 million in January 2025 to USD 600 million next year."

Alphabet's potential investment, through its growth investor CapitalG, is more than a standalone transaction; it is a direct reflection of the deep-rooted, patient capital allocation strategy of the investment holding company. The core of this approach is formed by the focus on "moonshots": highly ambitious, risky long-term projects that seek radical solutions to major global problems.

Within the innovation lab 'X', led by Astro Teller, the mission is to turn science fiction into reality, accepting that the chance of success of an individual project is low, but the potential impact is enormous. In a recent interview in the 'Inc. Founders Project' podcast, Teller further explained the unique thinking behind such 'moonshots'.

Over the years, this strategy has produced several successful projects and spin-offs that now operate as independent, value-creating entities. The most well-known examples are Waymo, the pioneer in self-driving cars, and Wing, the subsidiary for package delivery with drones. These projects are not just technological feats, but aim to bring about a fundamental shift in society. Waymo could lead to a decrease in private car ownership in favor of "transport as a service," while Wing has the potential to change our consumption patterns towards an "access society" instead of an "ownership society."

Even projects that do not achieve their original, ambitious goals create value within Alphabet's ecosystem. The "Loon Project," which aimed to offer internet via balloons in the stratosphere, was discontinued because it proved not commercially viable. However, the knowledge and technology in the field of optical communication that were developed during this project were invaluable. They formed the basis for the creation of Tara, a company that now delivers cheaper and faster internet connections via lasers than traditional methods. This ability to learn from failures and reuse technology is a characteristic of a resilient and sustainable innovation culture.

Ultimately, Alphabet's dual focus – on the one hand, internal, groundbreaking 'moonshots' and, on the other hand, external, strategic investments in crucial infrastructure players such as Vast Data – demonstrates a coherent and mature vision. The company understands that true technological dominance comes not only from developing the end application, but also from owning and financing the fundamental building blocks. By investing on both fronts, Alphabet is positioning itself not as a passive participant, but as an active shaper of the technological and social landscapes of the future.

Alphabet is currently trading on the New York Stock Exchange at a price of USD 200.98 per A-share.

Receive weekly insights in your inbox

Exclusive analyses and updates on family holdings and global market developments.

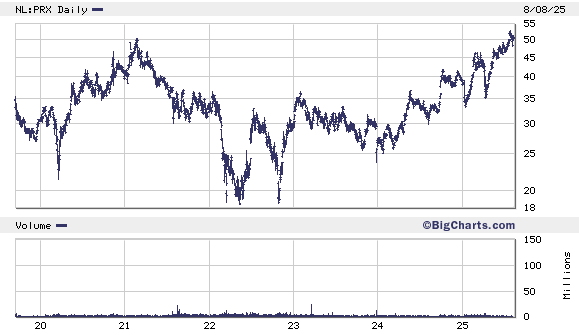

Prosus in transition: capital allocation from food delivery to next-generation AI

The Dutch investment holding company Prosus (Amsterdam: PRX) is in a dynamic phase of strategic transformation, with active and disciplined capital allocation at its core. Recent developments show a dual focus: on the one hand, consolidating and strengthening core activities in the competitive meal delivery sector, and on the other hand, patiently sowing the seeds for future growth by investing in a new generation of specialized AI companies.

One of the most significant strategic moves is the reduction of its stake in the Chinese meal delivery company Meituan, which represents a value of more than USD 4 billion. This decision is not purely financially driven, but is a direct response to increasing competition. Meituan announced plans to expand into markets where Prosus itself is active, such as Brazil, using aggressive marketing campaigns and price reductions. By selling the stake, Prosus is not only reallocating capital, but also ceasing to indirectly finance a direct competitor.

The released capital is being used, among other things, for an ambitious consolidation move in the European market. Prosus is on the verge of receiving EU approval for the acquisition of Just Eat Takeaway worth EUR 4.1 billion. To address the competition concerns of the regulators, Prosus has offered to gradually reduce its 27.4% stake in competitor Delivery Hero and relinquish its board seat. This acquisition would transform Prosus into one of the largest meal delivery companies in the world and demonstrates its willingness to engage in complex transactions to strengthen market leadership.

iFood

At the same time, heavy investments are being made in the crown jewel of the portfolio, the Brazilian iFood. The company has announced a direct investment of BRL 17 billion (approximately USD 3.1 billion) for the period up to and including March 2026, an increase of 25% compared to the previous period. This capital injection is aimed at increasing platform traffic, stimulating repeat purchases and expanding the operational areas, with the aim of growing the number of monthly orders from 120 million to 200 million within three years. The investment also includes a significant expansion of the workforce, particularly in the technology sector.

In addition to strengthening its core activities, Prosus demonstrates a clear vision for the future by investing in the next technological wave: artificial intelligence. This is not only visible in the strategy of iFood, which has taken a 20% stake in the Brazilian marketing technology company CRMBonus to integrate AI-driven marketing and loyalty tools, but also in the recent activities of its venture capital arm, Prosus Ventures.

Artificial Intelligence

Via Prosus Ventures, investments are being made globally and at an early stage in a diversified portfolio of specialized AI startups. Recent transactions show a broad thematic focus. For example, investments were made in CodeKarma, a platform that increases the productivity of software developers, and in Secures, which focuses on fundamental research laboratories.

In India, the edtech startup Arivihan was financed, while in Brazil, an investment was made in Ursula, a company that builds "emotionally intelligent digital beings." Another notable investment is in Brainfish, which aims to revolutionize customer service using AI. This series of early, targeted investments demonstrates a patient approach to building exposure to the potential winners of the future.

The recent maneuvers by Prosus paint a picture of an active and disciplined investment holding company. The company is not afraid to make strategic decisions in its mature portfolio, such as divesting a stake in an emerging competitor, and then investing heavily in the consolidation and growth of its core assets. At the same time, a foundation for future growth is being patiently laid through the venture capital arm by investing in the disruptive power of AI.

Prosus ended the trading week on the Amsterdam stock exchange at a price of EUR 50.50 per share.

Markel puts its money where its mouth is: Divestment of reinsurance is first step in strategic turning point

For long-term investors, quarterly figures are often noise, but sometimes they reveal the beginning of a fundamental change of course. The recent results of investment holding company Markel Group (New York: MKL) and the simultaneous announcement of the divestment of the reinsurance division are such a moment.

Following the appointment of Simon Wilson as the new CEO of the insurance division earlier this year, a new, ambitious course was promised, aimed at restoring focus and profitability. Recent actions show that these were not empty promises and that management is prepared to make painful but necessary decisions to strengthen the company for the long term.

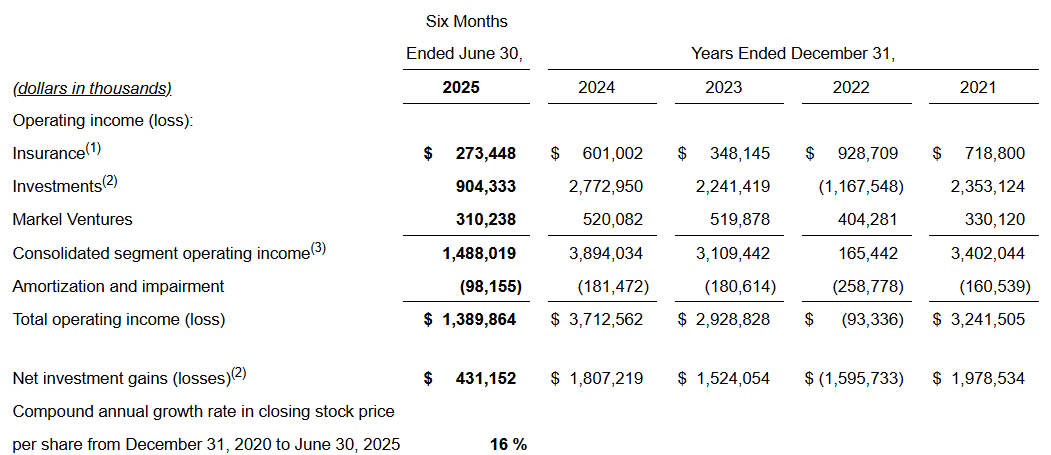

A two-sided result

On the surface, the results of the core activity, the insurance division, were weak for the second quarter of 2025. Operating income decreased by 27.5% and the combined ratio, a crucial measure of profitability, deteriorated to 96.9%. However, these figures were significantly influenced by negative developments at two specific problem divisions that were already being phased out: the Global Reinsurance division and the directors' and officers' liability insurance (D&O). The pain in the figures is therefore an echo from the past and a direct result of the clean-up operation that is now underway.

At the same time, Markel's diversified model proved its worth, as the weakness in these specific parts was offset by strong performance elsewhere. The Markel Ventures engine, the collection of non-insurance companies, performed excellently with a growth of 17% in operating income, which compensated for the headwinds in the insurance division. This illustrates the value of Markel's diversified "three engines" model. Within the insurance arm, the healthy parts, such as State National and Nephilia, also showed strong growth. The problem was therefore not widespread, but isolated—and is now being surgically addressed.

The strategic choice for focus

The most significant event was the announcement that Markel is selling the renewal rights of its Global Reinsurance activities to Nationwide. This marks a definitive departure from the reinsurance market. CEO Simon Wilson was clear about this: Markel simply did not have the scale to be a leading player in this competitive market.

The division was structurally loss-making, with a combined ratio of no less than 125.7% in the last quarter. Divesting this part is a textbook example of strategic discipline: instead of fighting for a marginal position, capital and management attention are focused on the areas where Markel does have a deep and sustainable competitive advantage.

This intervention is a logical consequence of the previously announced internal reorganization. Wilson's plan to replace the complex company structure with a decentralized model with clear profit and loss responsibility per business unit is thus taking direct shape. Divesting the weakest links is essential to give the remaining, healthy parts the space to excel. The message is clear: the focus is no longer on growth for the sake of growth, but on profitable growth in the core market of specialized niche insurance.

Active capital management supports the change of course

While the operational engines are being adjusted, management is also demonstrating an active and shareholder-friendly attitude in the area of capital allocation. The repayment of USD 600 million in expensive preferred shares provides a direct annual saving of USD 36 million in dividend costs. In addition, a record amount of USD 860 million in own shares was repurchased in the first half of 2025, which strongly signals management's confidence in the course taken and future value creation.

Markel's potential rests on three pillars: the investments, Markel Ventures and the insurance division. While the first two have been performing solidly for years, the insurance engine was the Achilles heel. The current interventions are intended to thoroughly overhaul this engine and align the performance with that of the best players in the sector. This will take time, but the course taken is the right one. If this operation succeeds, Markel can transform from an ambitious 'mini-Berkshire' into an excellent, stand-alone investment holding company with three powerful, independent value engines.

Markel is currently trading on the New York Stock Exchange at a price of USD 1,916.90 per share.

Receive weekly insights in your inbox

Exclusive analyses and updates on family holdings and global market developments.

Would you like more information about our services? Please feel free to contact us.

Contact us

Disclaimer:

No rights can be derived from this publication. This is a publication of Tresor Capital. Reproduction of this document, or parts thereof, by third parties is only permitted after written permission and with reference to the source, Tresor Capital.

This publication has been prepared by Tresor Capital with the utmost care. The information is intended to be general in nature and does not focus on your individual situation. The information should therefore expressly not be regarded as advice, an offer or proposal to purchase or trade investment products and/or purchase investment services nor as investment advice. The authors, Tresor Capital and/or its employees may hold position in the securities discussed, for their own account or for their clients.

You should carefully consider the risks before you begin investing. The value of your investments may fluctuate. Past performance is no guarantee of future results. You may lose all or part of your investment. Tresor Capital disclaims any liability for any imperfections or inaccuracies. This information is solely indicative and subject to change.

Read the full disclaimer at tresorcapitalnieuws.nl/disclaimer .