Economy & Markets #32 - Hectic week in the stock market

This week's topics:

Trump Gains Broader Support at the Fed

Shortly after the previous newsletter was sent (last Friday afternoon), unrest arose during U.S. trading hours. Adriana Kugler immediately announced her departure from the Fed, giving President Trump the opportunity to appoint a candidate favorable to him. With the (temporary) appointment of Stephen Miran, along with the two existing dissenters, the balance of power within the Fed shifts in favor of the pro-Trump camp — especially when Chairman Jerome Powell also steps down next year. It will come as no surprise that Miran is known for his support for lower interest rates and for reforms within the Fed, such as shorter terms for board members. The pressure on FED Chairman Jerome Powell to start lowering interest rates as early as September will certainly increase.

A second source of uncertainty is the unpredictability of Trump's trade policy. Last week, he unexpectedly announced substantial increases in import tariffs for several countries and sectors. Switzerland, in particular, stands out, facing a 39% levy on certain export products. Swiss President Karin Keller-Sutter traveled to Washington with her delegation but returned without an agreement: her proposal to reduce the tariff to 10% was rejected. Note that Switzerland primarily sells high-quality instruments (technology, pharmaceuticals, watches, and gold) in the U.S.: even with high tariffs, the production of Rolex watches will not be quickly moved from the Jura to the fly over states in the U.S.

India, along with China one of the largest buyers of Russian oil, is also hit hard by new tariffs. For India, the measures are particularly sensitive: the country is a major supplier of pharmaceutical products to the U.S. and houses many production facilities of multinationals such as Apple (electronics are incidentally excluded from the levies). Trade benefits are no longer a given, not even for traditional partners.

At the same time, OPEC unexpectedly announced a production increase over the same weekend: 547,000 additional barrels will be produced daily starting in September. This brings the total increase in 2025 to 2.5 million barrels per day. The goal seems clear: to keep both American and Indian consumers satisfied. Especially after the summer, when seasonal demand (“driving season” in the northern hemisphere and peak use of air conditioning in the Middle East and Asia) decreases, this could put extra downward pressure on oil prices.

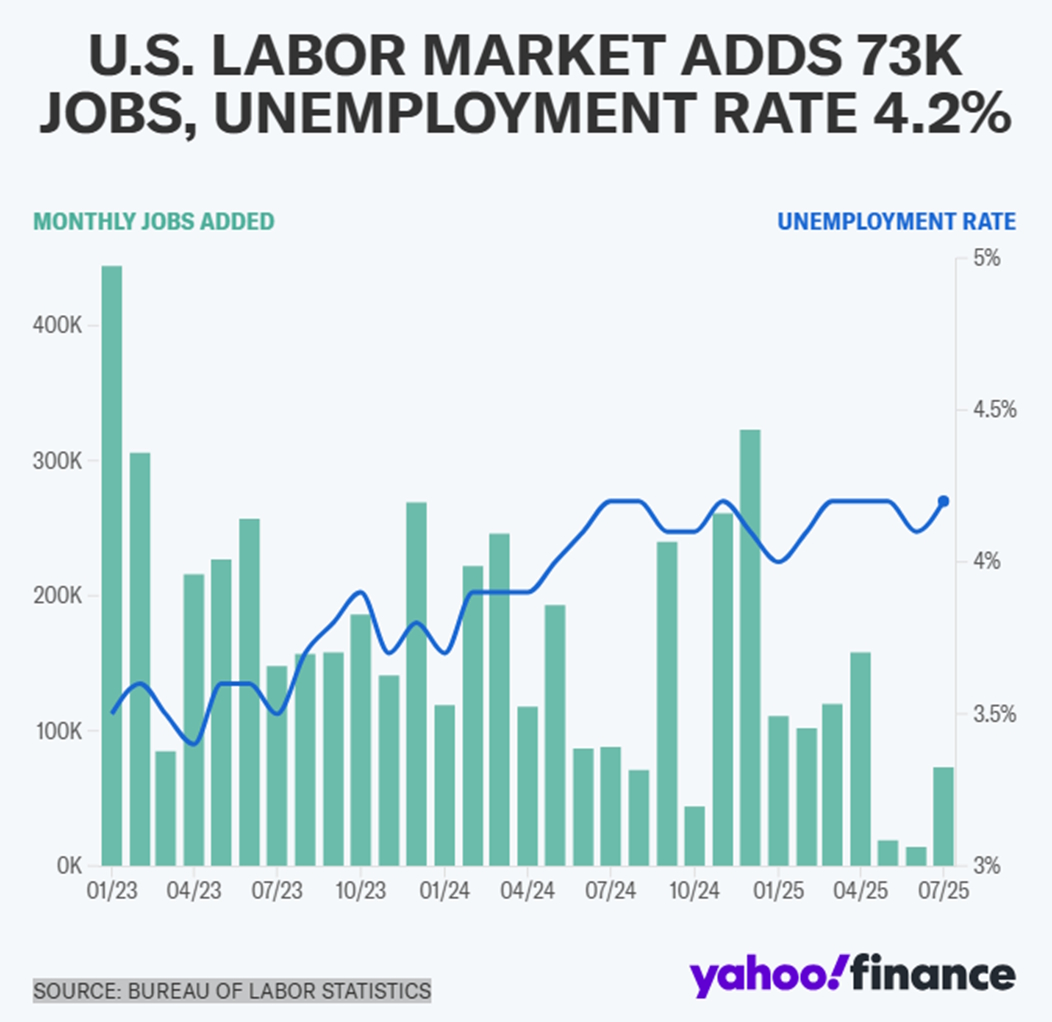

The third disruptive factor came from the July labor market report on Friday afternoon. Job growth was frankly disappointing: only 76,000 jobs were added, the smallest increase since November 2020. Moreover, the figures for May and June were revised sharply downward – from +115,000 to +12,000 and from +108,000 to +36,000 respectively – meaning that 175,000 fewer jobs were created in those months than previously reported.

The unemployment rate rose slightly, from 4.1% to 4.2%, while the participation rate remained virtually unchanged at 62.4%. This is partly due to the stalled immigration and the deportation of foreign workers, combined with very limited growth of the domestic labor force. As a result, the labor potential has virtually come to a standstill, and wage pressure is increasing. Despite the disappointing employment figures, wage growth remains strong: the average hourly wage rose by 0.4% m/m and 3.9% y/y.

Fed Chairman Jerome Powell emphasized this week that unemployment and wage developments are better indicators of the health of the labor market than the monthly job figures. Nevertheless, the revised figures suggest that economic growth is declining and falling back to 1.25 to 1.75% year on year in the U.S., which puts the FED in a dilemma: decreasing growth with rising inflation.

Uncertainty at top labor bureau after disappointing labor market figures

After the release of disappointing labor market figures, the head of the U.S. Bureau of Labor Statistics (BLS) is under pressure. President Trump announced that this top official might also do well to leave, due to the unpleasant reports. However, the independence of institutions such as the central bank and the labor bureau is crucial for confidence in the markets and sound economic decision-making.

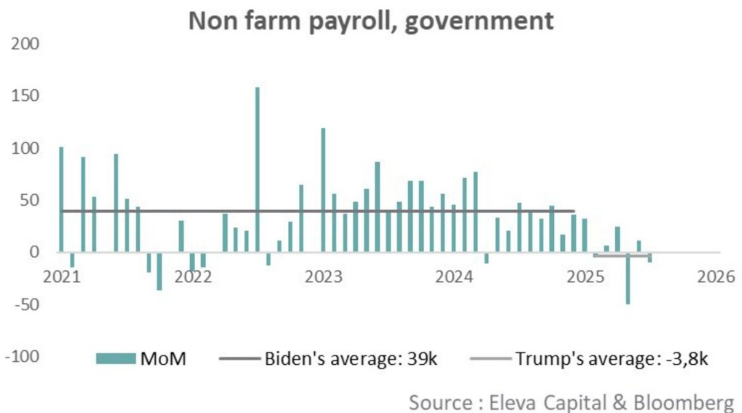

If there is too much political pressure, it can significantly undermine confidence. According to recent figures from Eleva Capital, a well-known investment boutique, some 275,000 federal jobs have disappeared since Trump took office. This fits within the conservative policy of Trump and the Republicans, who want to reduce the government deficit to give the economy and the business community more room.

Receive weekly insights in your inbox

Exclusive analyses and updates on family holdings and global market developments.

Diametric Developments in the Role of Government in the U.S. and Europe: Along the Measurement of the Laffer and Rahn Curve

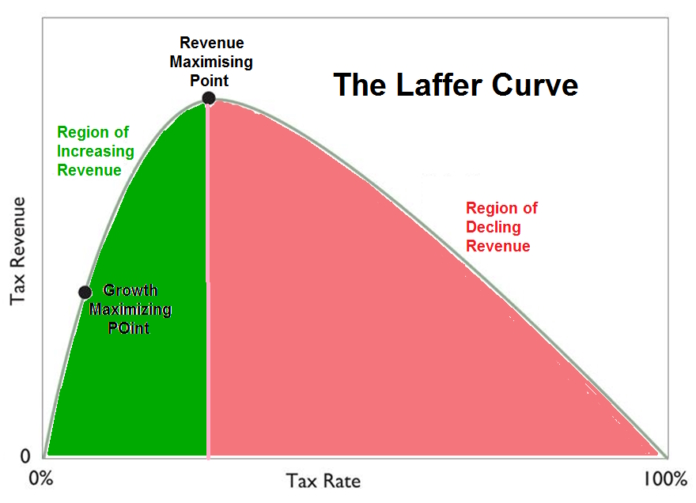

The economic policies of the United States and Europe are diverging increasingly, especially when we view them through the lens of the Laffer and Rahn Curves. While the U.S. focuses on incentives via the market mechanism and the lowest possible taxes, Europe continues to build on solidarity and collective provisions.

Nevertheless, government debts are rising rapidly in both Europe and the U.S. At the same time, the population is aging in both regions, which increases the pressure on social provisions and pension systems. In addition, the structure of the service sector and the manufacturing industry is changing dramatically, partly due to increasing globalization and competition, especially from countries like China. This combination of demographic and economic factors poses major challenges for governments in the areas of budgetary management, growth, and innovation.

As long-term allocators, it is crucial to look at which structure and which economic model is chosen in different regions. After all, this determines the sustainable growth prospects, the risk profile, and the impact of policy on returns. The diametrical development between the U.S. and Europe, viewed along the measuring stick of the Laffer and Rahn Curves, illustrates how widely varying choices in tax burden, government size, and social provisions lead to different economic dynamics and thus investment opportunities.

US: Market-Oriented Vision and Lower Tax Burden

In the US, a market-oriented vision dominates. Lower taxes for companies and the wealthy and less government spending are seen as the best recipe for economic growth. This approach relies heavily on the Laffer Curve, with the idea that tax cuts ultimately lead to more economic activity, higher investments, and – in the long term – higher net revenues for the government.

- The effective corporate tax rate in the US fell from 35% to 21% due to the 2017 reform, which led to a boost in corporate investments, although the long-term effects are subject to discussion.

- For individuals, the maximum marginal income tax rate has been around 37% since the reform (for the highest income groups). In addition, there is a relatively low social security contribution burden compared to Europe.

- The VAT rate in the US varies between 6-9%.

- According to the Congressional Budget Office (CBO), the share of government spending as a percentage of GDP fell from approximately 38% in 2010 to approximately 31% in 2024, partly due to the reduction of federal jobs and social programs.

- The American government apparatus is relatively small: in 2023, the total number of federal jobs was approximately 2 million. In comparison, the European public sector is on average much larger, even when you take into account the population size.

Europe: Higher Tax Burden and Greater Role for Government

Europe is choosing an almost opposite course. It is aiming for a higher tax burden and more extensive government spending, with an emphasis on providing public goods such as education, infrastructure, and social security.

- The average tax burden level in the European Union is around 40-45% of GDP (OECD, 2024), significantly higher than the approximately 26% in the US.

- The effective corporate tax rate varies widely in Europe but averages around 25%. Some countries (such as France and Germany) have rates around 30-33%.

- The marginal income tax rates for the highest income groups in many European countries are between 45% and 55%, plus a high social security contribution burden, which significantly increases the total tax burden on labor.

- The VAT varies in Europe between 17% and 27%.

- Government spending in many European countries amounts to between 45% and 55% of GDP, with countries such as France, Sweden, and Denmark even exceeding 50%.

- Social programs and public sector jobs are relatively extensive: in Germany, more than 4 million people work for the government, which is proportionally much more than in the US.

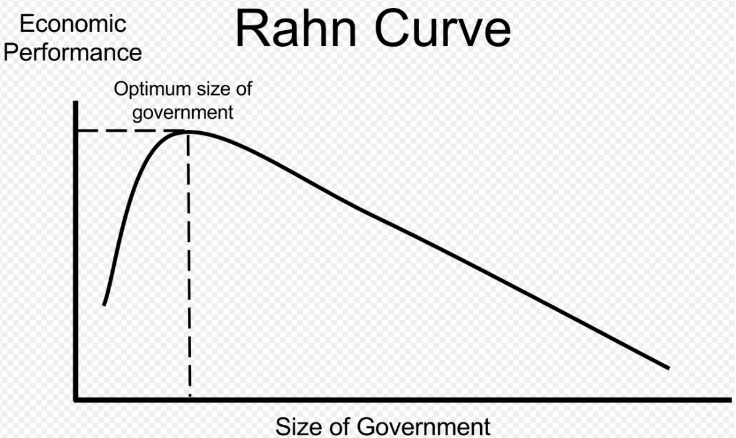

Brief Introduction to the Rahn Curve: Tension Between Size and Efficiency

The Rahn Curve is an economic model, named after Richard W. Rahn, an American economist and policy advisor. He introduced this concept in the 1990s to illustrate that – just as with the Laffer Curve for taxes – there is an optimal level of government spending that maximizes economic growth.

- Too little government investment in, for example, infrastructure, education, and innovation can seriously hamper growth in the long term. Without sufficient public resources for these essential functions, the productivity and competitiveness of the economy may decline.

- Conversely, an oversized government, characterized by inefficiency, bureaucratic red tape, and excessive social spending, can also stifle economic dynamics. This can lead to a higher tax burden, reduced incentives for entrepreneurship, and lower investments by the private sector.

In the United States, reducing government jobs and spending has long been seen as an incentive for economic growth, assuming that a smaller government creates space for innovation and private investment. However, this approach risks putting pressure on essential investments in public infrastructure and social provisions, which in the long term can hinder productivity growth. Moreover, the tension between stimulating growth and ensuring social stability remains.

In Europe, investments are being made in public goods to ensure social and economic sustainability. This leads to a greater role for the government and higher direct costs (taxes and premiums), which may dampen growth in the short term. Nevertheless, this is seen as a conscious choice to maintain inclusivity, social cohesion, and broad prosperity. The challenge lies in avoiding inefficiencies and ensuring a government that stimulates innovation and productivity without putting too much pressure on businesses and workers.

In short, the Rahn Curve emphasizes the delicate balance between the size of government and the efficiency of the economy, where both too little and too much government intervention can be harmful. The practice in the US and Europe shows different emphases and challenges within this field of tension.

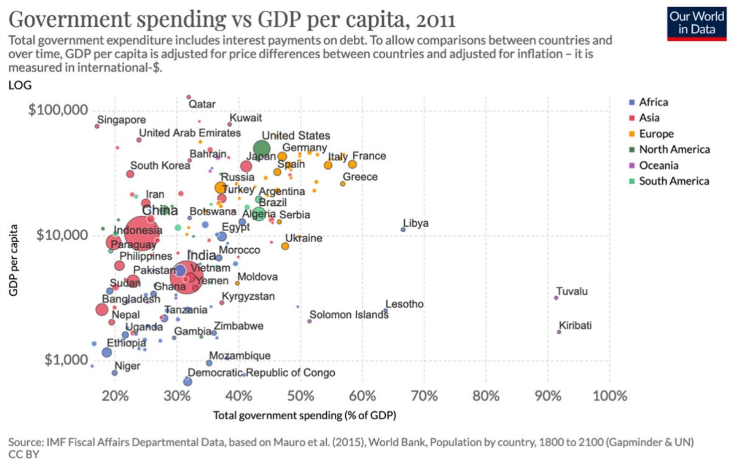

Unfortunately, there are few recent and up-to-date representations of the Rahn Curve available. The image below (from 2011) is outdated and does not reflect the developments of the past 15 years, such as the strong growth of GDP per capita in the United States (US Exceptionalism) versus the stagnation in Europe. We are therefore open to receiving new, updated versions that better illustrate these trends.

Sell in May and come back in September (or October)

At Tresor Capital, we do not engage in market timing, but the "Sell in May" phenomenon remains a popular topic and recurs in the media. Interestingly, the summer months in the US have historically performed well (SP500 data from 1950 to present):

- May average +0.3%

- June average +0.1%

- July average +1.3%

In contrast, September is traditionally the worst month, with an average negative return of approximately -0.7%. Why September? Although September is not a typical holiday period, it often marks the end of the relatively quiet summer. Investors often take profits in this month, while important quarterly figures come in. This usually creates more volatility and downward pressure on the markets.

Strong earnings season in the US

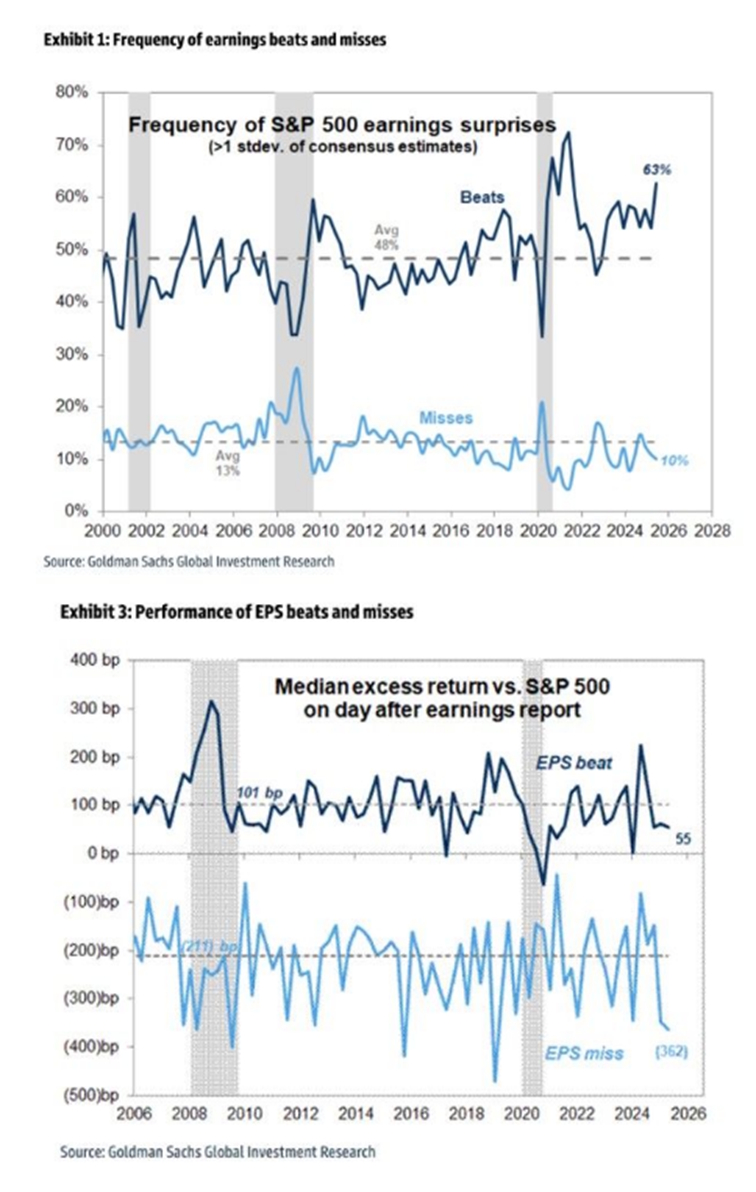

The second quarter reporting season in the United States once again shows a remarkably strong performance. Approximately 82% of S&P 500 companies exceeded earnings expectations, and 79% scored better than expected on revenue. The blended year-over-year earnings growth is a solid 10.3%, the third consecutive period with double-digit growth figures. In particular, the technology sector, financial services, and consumer goods are driving these strong results. Major tech players such as Microsoft and Meta excel, partly due to breakthroughs in AI and rising revenues from data centers, cloud, and AI applications.

Mixed picture in Europe

In Europe, the picture is more mixed. The Stoxx Europe 600 index shows little to no overall profit growth, and approximately half of the companies exceed expectations. Factors such as a strong euro and trade barriers are putting pressure on the profitability of European exporters. Nevertheless, some sectors, such as banks and defense, show resilience thanks to higher interest rates and government investments. According to recent analyses, profits are growing at many European companies, but this growth is less pronounced than in the US.

The US stock market generally has higher valuations than the European market, partly due to the larger share of technology and growth companies with high future earnings expectations. This means that the US market may be more sensitive to disappointments or profit corrections, which can amplify volatility.

However, this strong underlying trend is accompanied by significant price fluctuations. We often see significant downward corrections if figures come in even slightly below expectations, while good figures and the expression of positive expectations are hardly followed by significant price increases. Europe, on the other hand, has lower valuations and more cyclical sectors, which creates less optimistic expectations but possibly also a more defensive position in uncertain markets.

Receive weekly insights in your inbox

Exclusive analyses and updates on family holdings and global market developments.

Would you like more information about our services? Please feel free to contact us.

Contact us

Disclaimer:

No rights can be derived from this publication. This is a publication of Tresor Capital. Reproduction of this document, or parts thereof, by third parties is only permitted after written permission and with reference to the source, Tresor Capital.

This publication has been prepared by Tresor Capital with the utmost care. The information is intended to be general in nature and does not focus on your individual situation. The information should therefore expressly not be regarded as advice, an offer or proposal to purchase or trade investment products and/or purchase investment services nor as investment advice. The authors, Tresor Capital and/or its employees may hold position in the securities discussed, for their own account or for their clients.

You should carefully consider the risks before you begin investing. The value of your investments may fluctuate. Past performance is no guarantee of future results. You may lose all or part of your investment. Tresor Capital disclaims any liability for any imperfections or inaccuracies. This information is solely indicative and subject to change.

Read the full disclaimer at tresorcapitalnieuws.nl/disclaimer .