Economy & Markets #33 - Inflation falls, oil cheap: what does this mean for the Fed?

This week's topics:

US Heading Towards Interest Rate Cuts, While China and Europe Continue to Struggle

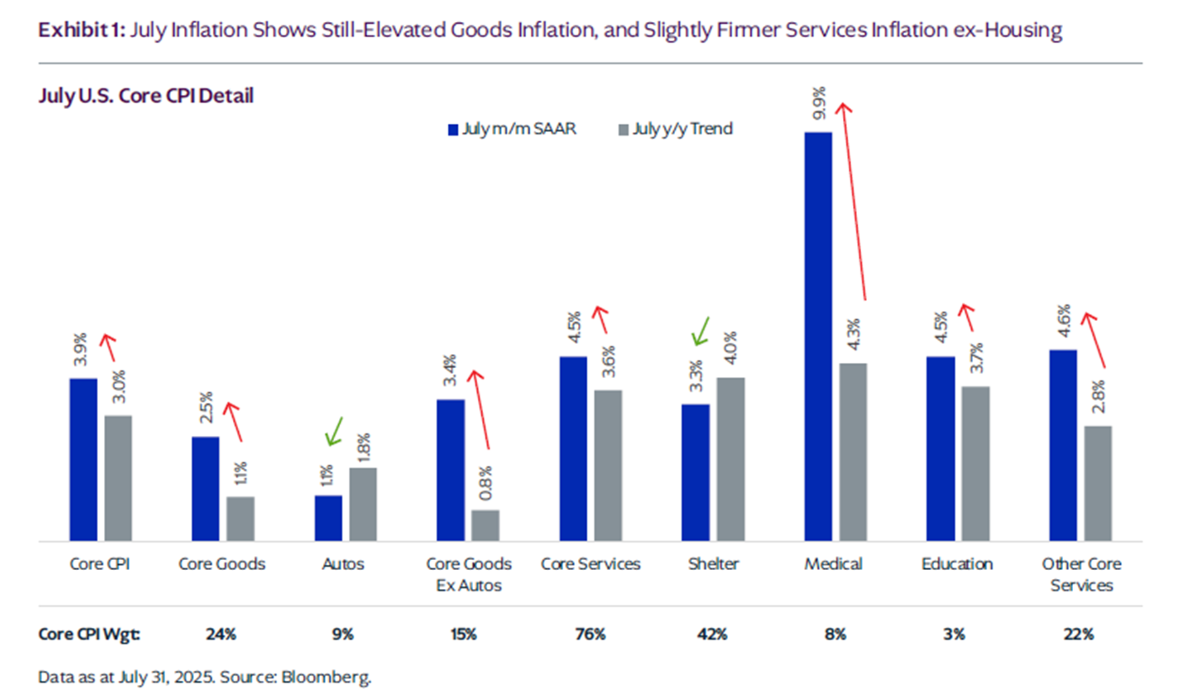

The (consumer) inflation in the United States rose by 0.32% in July compared to June and seems likely to remain in the range of 0.3% to 0.4% in the coming months. Although the tariff war is causing upward price pressure for consumer electronics, cars, and clothing, the effect on service prices remains limited. Given that the American economy relies on the service sector for approximately 70%, the economy may prove less susceptible to the many doomsday scenarios that were predicted earlier this year.

Import tariffs cause a one-time increase in prices, with the consensus now assuming that inflation will fluctuate around 3.2% until the end of this year, before rapidly falling to 2% in 2026. As the macroeconomists at KKR indicate in the chart below, import inflation remains limited and the housing market ('shelter') is pushing inflation down. Medical costs and transportation and aviation prices are causing upward price pressure in the service sector, but due to the rapid application of AI, productivity within the service sector is increasing faster than previously expected. Later in the week, producer prices were published that were higher than expected (on an annual basis +3.3% against 2.4% in May, the highest level since the beginning of 2025).

This week, the picture has further strengthened that the policy rate in the US may fall rapidly. The market is now counting on a first interest rate cut in September, followed by further steps in October, December and twice in the first half of 2026.

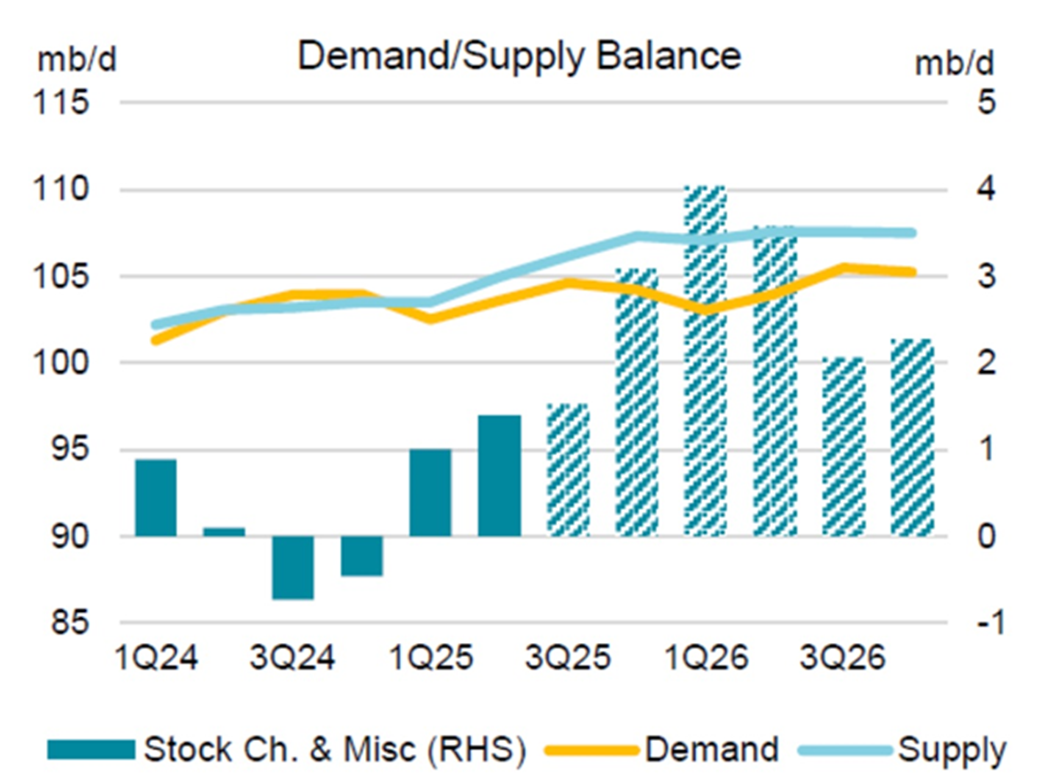

With the recently changed composition of the policy committee, the Fed seems to want to continue to act proactively to remain "ahead of the curve". In addition, oil prices have recently fallen sharply after an increase in production by OPEC, resulting in a clear surplus on the oil market.

The chart below shows that there has been an oversupply on the market since the start of this year. Because this oversupply is increasing to more than 1 million barrels per day, the downward pressure on oil prices will become even greater in 2026. Looking ahead, we can therefore state that thanks to lower gasoline prices and, indirectly, lower transport and production costs, headline inflation in the US will fall further.

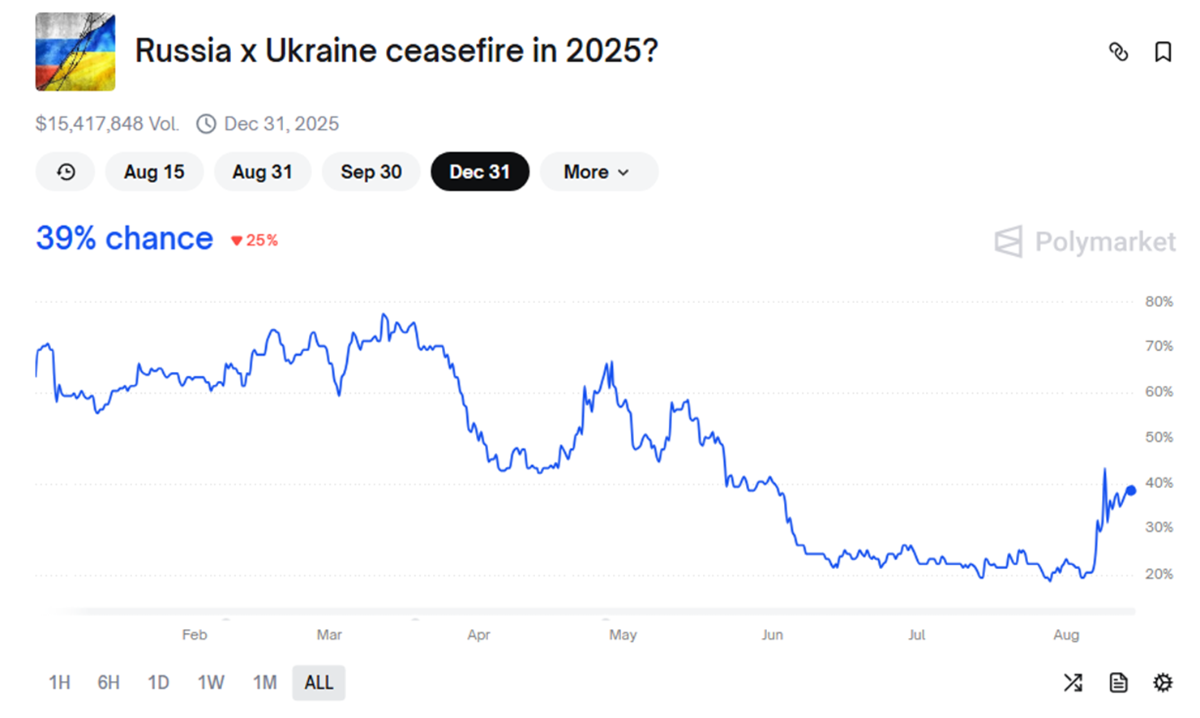

Politically, much attention is being paid to the meeting between Donald Trump and Vladimir Putin in Alaska. Polymarket (a prediction market) estimates the chance that President Trump will receive the Nobel Peace Prize this year at 12%. Several meetings will probably follow. What is striking, however, is that since the announcement of the discussions, some European defense stocks have also fallen.

It is striking that, while prices in the US are still rising, China continues to struggle with persistent producer price deflation. This is partly because the Chinese consumer has never really recovered from the corona shocks and the crash in the housing market, while the service sector only makes up half of the economy. The consensus expects a PPI contraction of approximately -2.8% in 2025 and -1.0% in 2026, despite government measures against aggressive price competition. Overcapacity in sectors such as steel, electric vehicles, solar energy and batteries remains a structural problem, which is therefore partly exported to Europe.

Other disappointing figures that were reported this week: real estate investments are down -11% year-on-year and retail sales are up 3% year-on-year, but are much lower than expected (expectation: 4.6% growth). Economic activity also remains low in Europe and the stagflation scenario looms (low growth, high inflation). The UK in particular, but also Germany, continue to struggle to adapt to a changing world.

Receive weekly insights in your inbox

Exclusive analyses and updates on family holdings and global market developments.

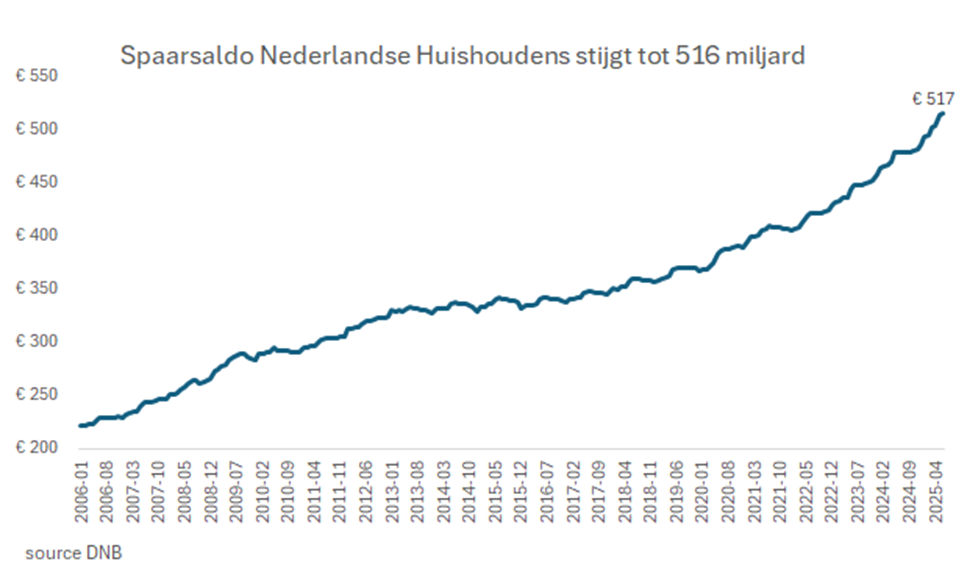

Dutch households are saving, but without return

As of the end of June 2025, Dutch households together had €516 billion in savings and checking accounts. The average balance per household is approximately €52,300, but the median of only €21,100 shows that half of the families have to make do with a much smaller buffer. Warren Buffett once put it succinctly: “If you don’t find a way to make money while you sleep, you will work until you die.” In other words: savings that do not yield a return are like never buying a house in Monopoly: you miss the rent and assets that passively increase wealth.

The biggest risk of investing is not investing

That is why we advise starting to build wealth as early as possible, even though many are afraid to invest and prefer to build wealth through a safe savings account. In previous newsletters, we already wrote about Sweden and the US, where there is a strong equity culture and thus the middle class also benefits from the compounding effect. In comparison: in Germany, a savings culture predominates, fueled by fear of inflation since the Weimar Republic, which means that more and more Germans have too little wealth to retire.

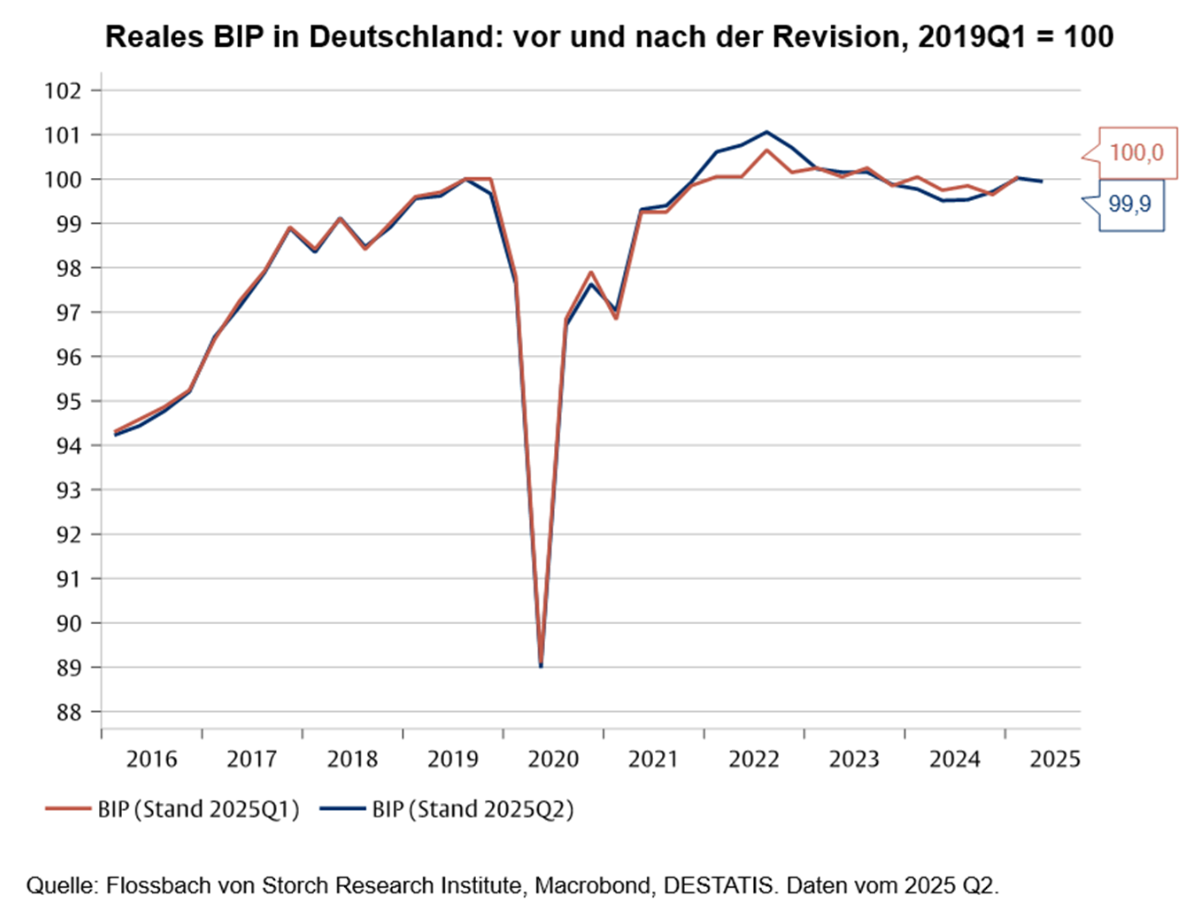

Macro data is not only being revised in the US; in Germany, too, the gross domestic product (GDP), according to the latest adjustments, appears to have grown slightly faster after the pandemic, but then contracted more strongly than previously assumed (see chart).

The image below from Flossbach von Storch shows that German GDP is still at the level of mid-2019. The economy has not grown for six years: this, combined with aging and unprofitable private investments, explains why poverty is increasing in Germany. For comparison: if we were to also set the US GDP at 100 at the end of 2019, it would have grown to 115.

Expensive technology stocks, cheap small and mid-cap stocks?

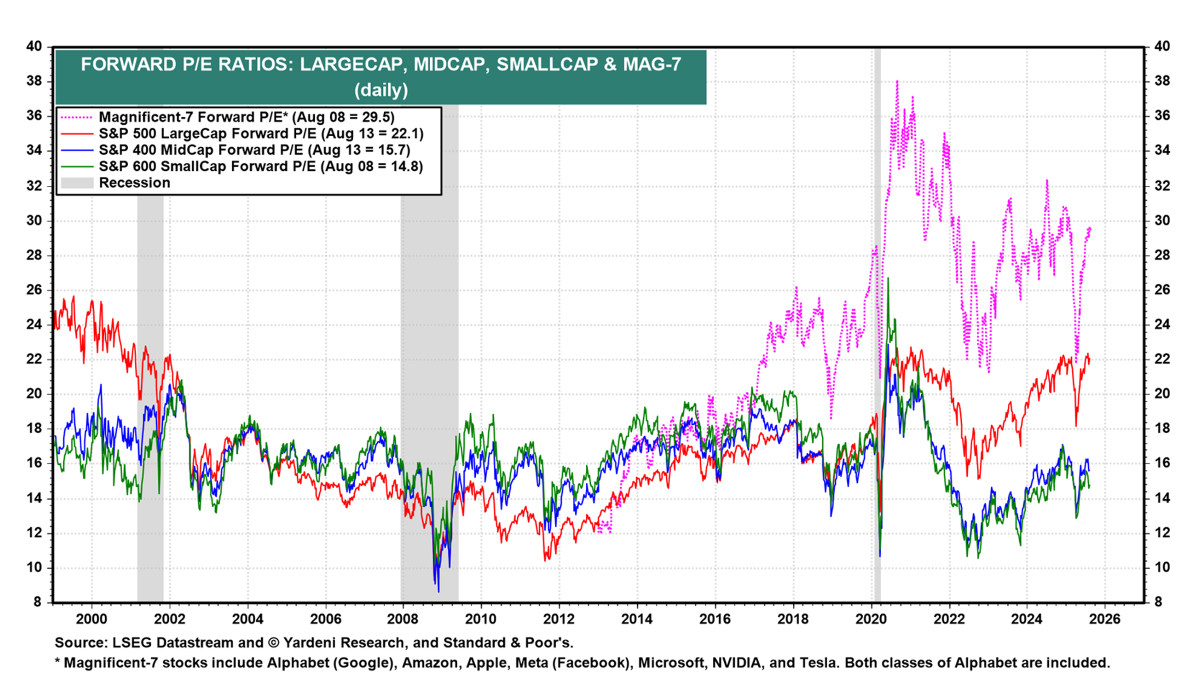

We came across an interesting chart from Yardeni Research, which clearly shows how expensive American technology stocks (the so-called Magnificent 7) are currently, measured by the price/earnings ratio. While this ratio seems to be heading towards new heights for technology stocks, it has fallen to the lowest level this century for small- and mid-cap stocks. In addition to the low valuation, small- and mid-cap companies have historically always shown strong price explosions when the policy rate was lowered. Given the previously outlined picture that the American central bank seems likely to lower interest rates sharply in the coming months, the question naturally arises whether now is the perfect time to buy small- and mid-cap companies.

However, Yardeni Research places clear caveats here. First of all, the question is whether the price/earnings ratio is the right yardstick, now that the profit growth (earnings) at technology companies is continuing strongly, while it is structurally stagnating at small- and mid-caps. So there is a fundamental reason why small- and mid-cap stocks seem cheap. According to Yardeni, the expected profits (forward earnings) of small- and mid-caps have been in a kind of coma since 2022. Yardeni Research also doubts whether the profit growth of small- and mid-caps will suddenly pick up simply because the Fed lowers interest rates again. After all, at the end of 2024, the federal funds rate was already lowered by 100 basis points, but these shares lagged behind the broader market.

Receive weekly insights in your inbox

Exclusive analyses and updates on family holdings and global market developments.

Would you like more information about our services? Please feel free to contact us.

Contact us

Disclaimer:

No rights can be derived from this publication. This is a publication of Tresor Capital. Reproduction of this document, or parts thereof, by third parties is only permitted after written permission and with reference to the source, Tresor Capital.

This publication has been prepared by Tresor Capital with the utmost care. The information is intended to be general in nature and does not focus on your individual situation. The information should therefore expressly not be regarded as advice, an offer or proposal to purchase or trade investment products and/or purchase investment services nor as investment advice. The authors, Tresor Capital and/or its employees may hold position in the securities discussed, for their own account or for their clients.

You should carefully consider the risks before you begin investing. The value of your investments may fluctuate. Past performance is no guarantee of future results. You may lose all or part of your investment. Tresor Capital disclaims any liability for any imperfections or inaccuracies. This information is solely indicative and subject to change.

Read the full disclaimer at tresorcapitalnieuws.nl/disclaimer .