Family Holdings #33 - Addition of new VMS serial acquirer

This week's topics:

In the second quarter, Berkshire Hathaway took profits on Apple shares, invested contrarianly in, among others, UnitedHealth, and permanently added the family business Bell Laboratories to the holding.

Prosus benefits from the strong, AI-driven quarterly results of core holding Tencent, while it itself reaches a strategic milestone with the approval for the acquisition of Just Eat Takeaway.

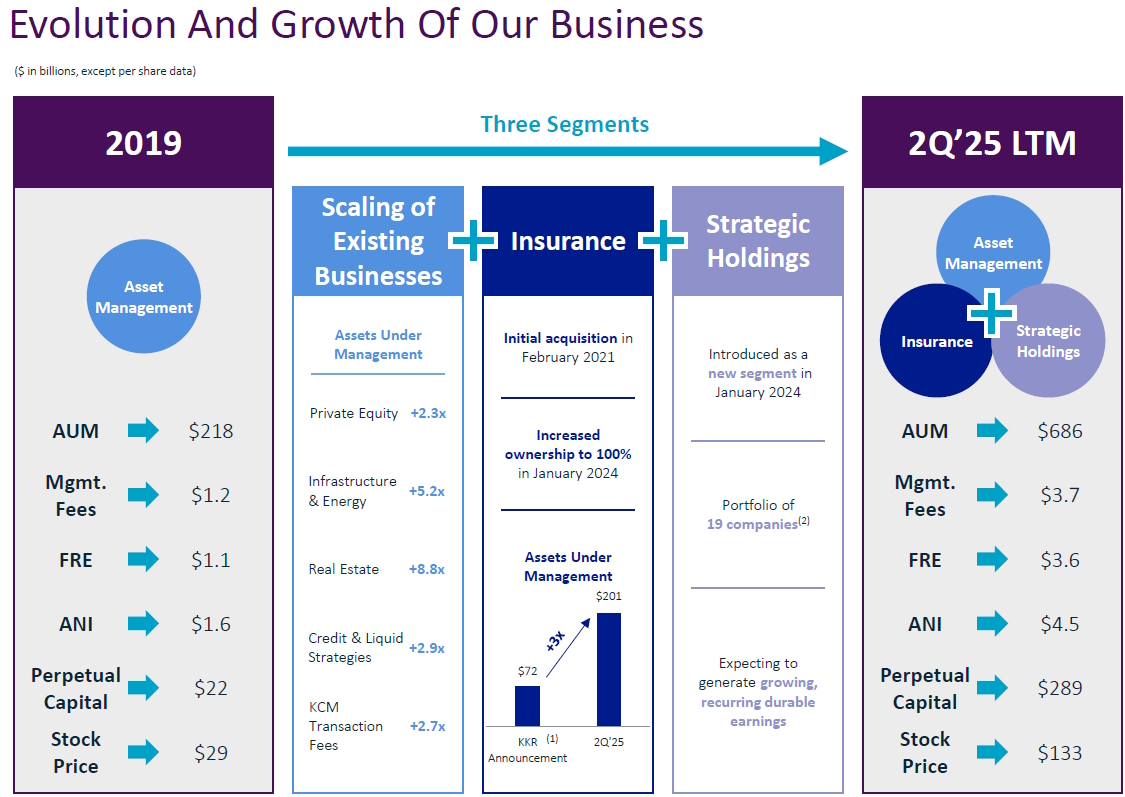

The strong Q2 figures from KKR underscore the successful strategy of growing, according to the model of a 'mini Berkshire Hathaway', into an investment holding company that creates sustainable value through asset management, insurance, and long-term participations.

In Brief:

Alphabet (New York: GOOGL) remains undervalued and positioned for strong long-term growth despite the ongoing competitive threat from AI platforms like ChatGPT. That's according to Eric Sprague in an analysis on Seeking Alpha, which you can read for free here.

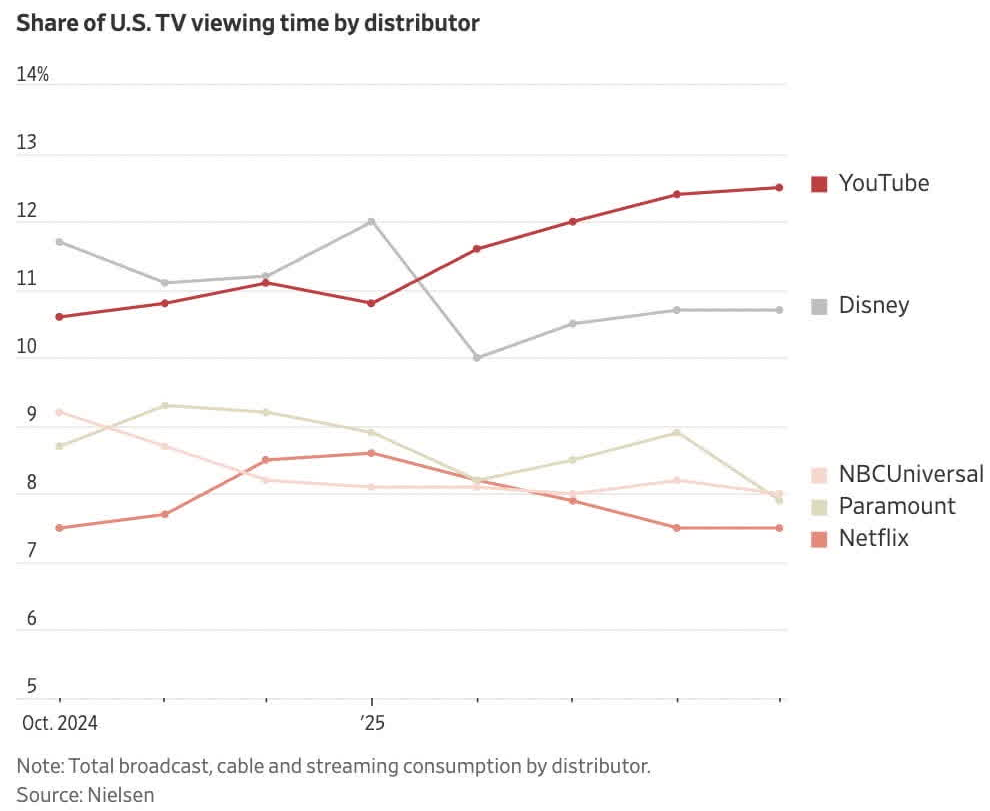

Search, YouTube, and Google Cloud all show robust revenue growth and improving profitability. Recent data shows that Google's own AI integrations, such as AI Overviews and Gemini, are increasing user engagement rather than cannibalizing the core business. The company maintains its dominant position in commercial search queries and is even seeing increased usage among the crucial Gen Z demographic. Meanwhile, YouTube's share of total US viewing time on televisions is steadily growing, surpassing competitors like Disney and Netflix.

Alphabet's long-term value is further enhanced by the significant, but often underappreciated, options in its portfolio. Waymo, the autonomous driving subsidiary, is rapidly gaining market share in key markets like San Francisco against competitors like Lyft and Uber. Strategic partnerships, such as the one with Toyota for a robotaxi service in Tokyo and the licensing of the technology for passenger cars, open the door to enormous new markets. Analysts estimate Waymo's value in a base-case scenario at USD 150 billion, assuming an annual growth of 129% over the next five years. Combined with steadily declining hardware costs and the expansion of the fleet, Waymo, according to Sprague, offers a significant, not yet fully priced-in value component for the shareholder with a long horizon.

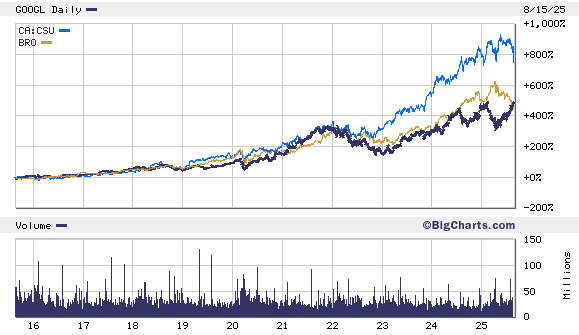

Brown & Brown (New York: BRO) continues its disciplined acquisition strategy unabated with the recent acquisition of the assets of Tire Shield. Through its Dealer Services division, the American investment holding company is adding a specialist in administrative services for GAP and tire insurance products, strategically broadening its offering for the automotive, RV, and motorsports industries.

Confidence in this continued value creation was underscored a few days earlier by a significant purchase by one of the directors. On August 8, director Paul J. Krump purchased nearly USD 250,000 worth of shares, a transaction that doubled his personal stake in the company in one fell swoop.

Constellation Software (Toronto: CSU) continued its M&A activity in August with the acquisition of Hungarian AredimTel, a provider of cloud-based call center software. Shortly thereafter, it also acquired English Verilocation, a specialist in software for fleet management and related telematics. These targeted 'bolt-on' acquisitions strengthen Constellation's market positions in the telecom and transport sectors, respectively.

Alphabet, Brown & Brown, and Constellation Software ended the trading week on the New York and Toronto stock exchanges at prices of USD 203.90, USD 95.34, and CAD 4,353.38 per share.

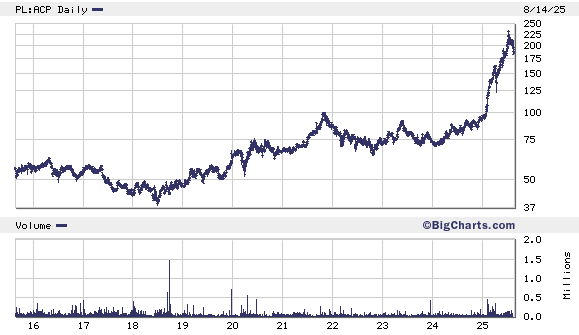

Asseco Poland, a VMS serial acquirer with Potential

In our portfolio, we focus on companies with a superior business model, led by exceptional management with a long-term vision. Sometimes a unique opportunity arises where an already strong company is enriched with the expertise of the world's best capital allocators. This is the case with the Polish software company Asseco Poland (Warsaw: ACP), a relatively new position in the portfolio. The investment case is not so much about the current financial performance, but about the enormous, latent potential that can be unlocked by the arrival of a new, strategic partner: Topicus.com.

Asseco Poland: a 'federation' of software companies in the 'Silicon Valley of Europe'

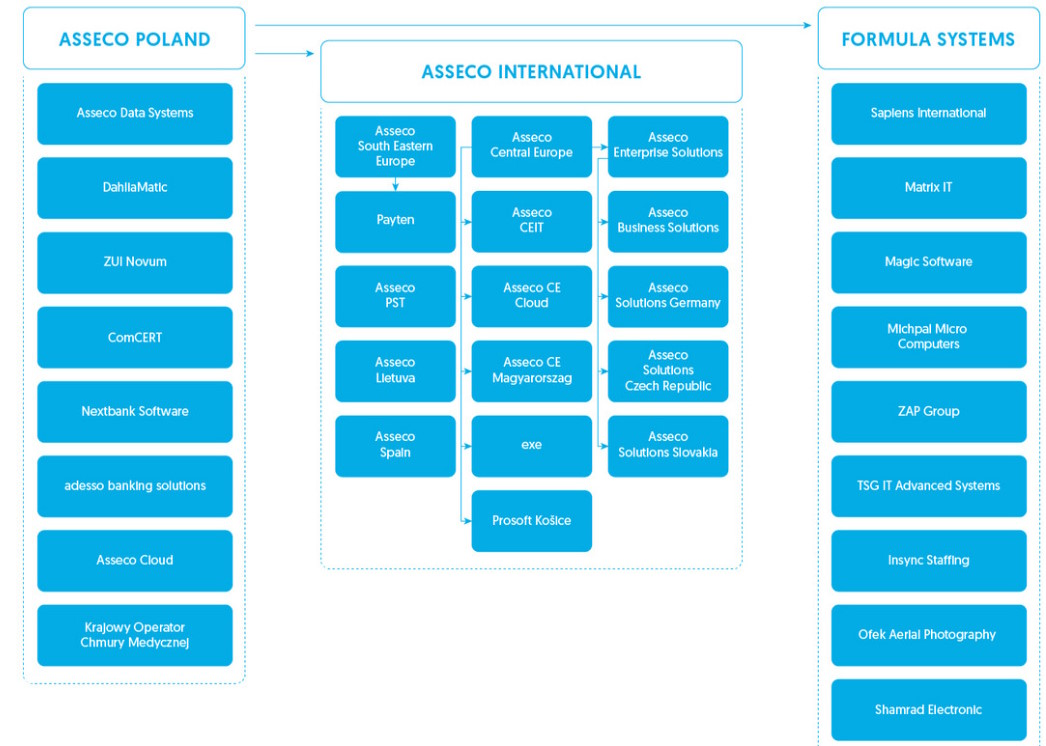

Asseco Poland is one of the largest IT companies in Poland, a country that is rapidly developing into the 'Silicon Valley of Europe' thanks to a fast-growing IT sector and a large number of highly educated specialists. Asseco describes itself, following Constellation Software ('constellation'), as a 'federation' of software companies.

This is not just a marketing term; it is a serial acquirer pur sang. Since 2004, the company has completed no fewer than 140 acquisitions, building an impressive ecosystem. The organizational structure is complex: Asseco Poland functions as a holding company with interests in large, partly listed sub-holdings such as Asseco International and Formula Systems, which in turn have dozens of subsidiaries.

Like Constellation and Topicus, Asseco has a business model and culture focused on acquiring and further growing software companies. They have a similar strategy to encourage entrepreneurs to sell their company to Asseco. The cultural similarity was a decisive factor for Topicus' investment.

Topicus director Ramon Zanders stated: "We believe in Adam Góral, the entire Asseco management team, and we stand behind their business vision. We value the values they promote and the corporate culture of the entire organization, which is very similar to ours."

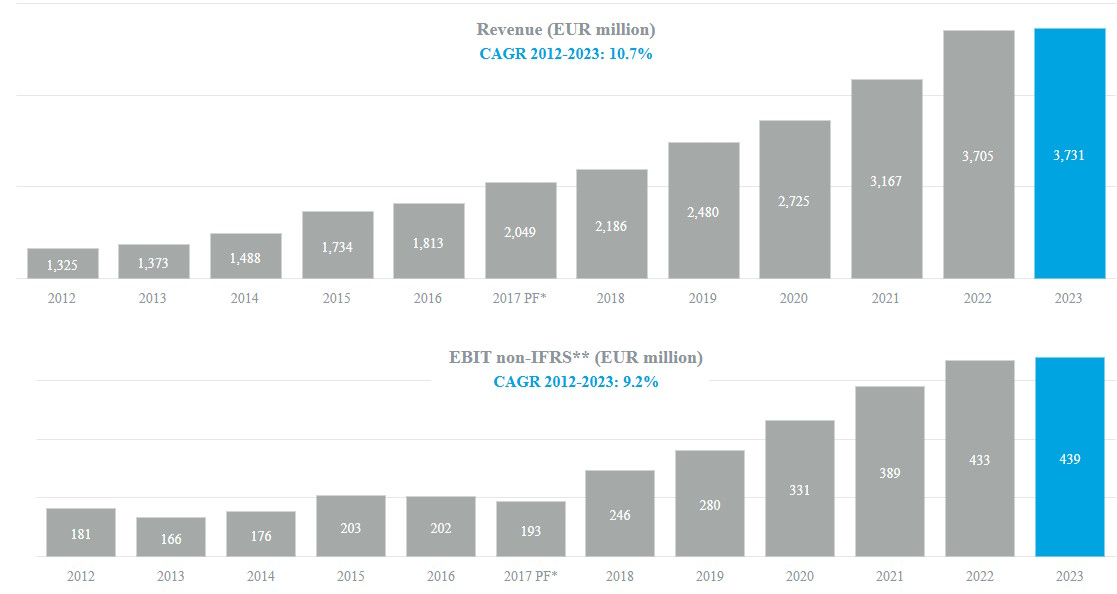

Historically, this model has paid off: between 2012 and 2023, Asseco's revenue grew by an average of 10.7% per year, while gross profit increased by 9.2% annually.

The arrival of Topicus: the catalyst

The core of the investment case is the recent entry of Topicus.com. In two transactions, Topicus acquired a stake of approximately 24.8% in Asseco for a total of EUR 417 million. This happened at a very favorable price of PLN 85 per share, while the stock market price was significantly higher at that time.

Crucially, Topicus has entered into a cooperation agreement with Adam Góral, the founder and major shareholder of Asseco (10.1% stake). Together they now control a block of approximately 35%. The main points of this agreement are:

- Topicus and Adam Góral are entitled to appoint three supervisory directors each (i.e. 6 out of 9 in total).

- Topicus and Góral will jointly determine the remuneration structure and vote on the dividend policy.

- The best practices of Topicus and Constellation Software will be implemented at Asseco.

The most important provision is that the best practices of Topicus and Constellation Software will also be implemented at Asseco. These best practices and the distinctive remuneration structure (staff must buy shares with the majority of their bonus and hold them for four years) are the foundation of Constellation's and Topicus' success.

Adam Góral himself welcomed the arrival of Topicus with open arms, indicating a cooperative attitude rather than a hostile takeover. Topicus director Ramon Zanders emphasized the cultural similarities and the intention to act as a long-term partner: "We never sell our companies or shares in them."

The Constellation blueprint: unlocking the potential

The implementation of the 'Constellation playbook' is where the real potential lies. Analyst Christian Schmidt points out Topicus' earlier, very successful intervention at Polish Sygnity. After the acquisition in 2022, Topicus has:

- Focused on proprietary product solutions and divested unprofitable activities.

- Implemented a strict cost control and optimization policy.

- The acquisition machine has been activated by leveraging Topicus' expertise in the field of M&A.

The result was a stock price explosion for Sygnity shares. The expectation is that a similar trajectory with the much larger Asseco could lead to enormous value creation.

Analyst Paul (@Investmentideen on X) aptly summarizes the core of the investment thesis. He notes that Asseco may seem expensive at first glance, but because they have to consolidate various minority interests, the actual valuation is much more attractive.

Moreover, the crucial idea is that a party like Topicus/Constellation typically pursues an internal rate of return (IRR) of 20%, based purely on the operational improvements and future cash flows of the investment, without speculating on a higher valuation multiple. This implies enormous confidence in their ability to drastically increase Asseco's underlying profitability.

Furthermore, he argues that Constellation's influence will likely lead to a focus on reinvesting capital in new growth, rather than paying off debts, which is a core component of the value creation strategy.

Recent developments: the value in the portfolio is becoming visible

A recent development underscores the quality of the assets within the complex Asseco group and serves as evidence of the latent value. On August 13, 2025, it was announced that private equity firm Advent International is acquiring Sapiens for USD 2.5 billion. Sapiens is a global provider of software for the insurance sector. The acquisition price of USD 43.50 per share represents a premium of no less than 64% compared to the closing price on August 8, 2025.

The link with Asseco is direct and significant: Sapiens' largest shareholder (44%) is Formula Systems, a company that in turn is controlled by Asseco Poland. The sale of Sapiens is expected to significantly increase the value of Formula Systems, which directly benefits Asseco and its shareholders, reportedly in the form of an amount of USD 300 million. This successful transaction is a clear example of the value hidden in Asseco's many holdings and the competence of the management to realize this value.

The cooperation agreement with founder Adam Góral ensures a stable foundation and a cooperative environment to implement the necessary operational improvements and cultural changes. With both Topicus and Góral, there is more than enough skin in the game. The successful turnaround at Sygnity serves as a promising omen, although we must be realistic that Asseco is somewhat larger.

Of course, there are risks. The execution of the strategy involves an execution risk, and the transaction with Topicus is still subject to regulatory approval (although no problems are expected).

However, we are convinced that the combination of an established market leader in an attractive growth market (the Polish IT sector) with the operational and M&A expertise of the world's best 'serial acquirer' offers a very attractive risk-return profile for the patient long-term investor.

Asseco Poland has ended the trading week on the Warsaw Stock Exchange at a price of PLN 184.60 per share.

Receive weekly insights in your inbox

Exclusive analyses and updates on family holdings and global market developments.

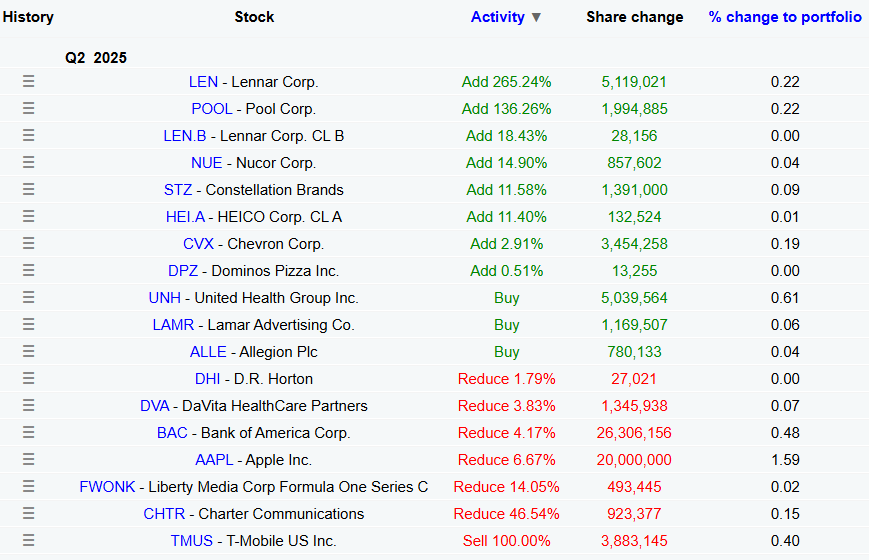

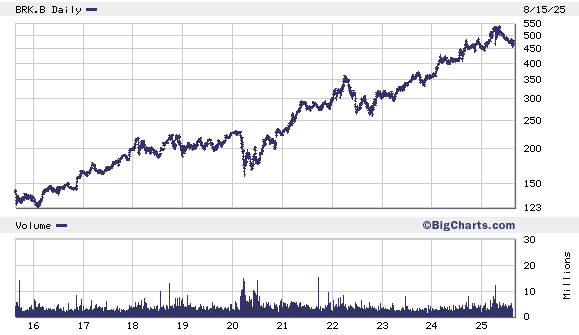

Berkshire Hathaway transactions under the microscope, plus an unexpected acquisition

The recent transactions of the American investment holding company Berkshire Hathaway (New York: BRK-B) in the second quarter of 2025 once again demonstrate the disciplined capital allocation of Warren Buffett and portfolio managers Combs and Weschler.

The investment holding has resumed the sale of Apple shares, divesting a stake worth more than USD 4 billion by selling 20 million shares. This step, a continuation of previous sales, is seen as cashing in on one of Berkshire's most successful investments ever, driven by the high valuation of the tech company. Despite the sale, Apple remains the undisputed anchor position in the portfolio with a value of USD 57.4 billion. In addition to Apple, the holdings in Bank of America were further reduced, and the position in T-Mobile was completely sold.

At the same time, Berkshire was not idle on the buying side and built up positions in recently pressured sectors. A special mention goes to serial acquirer Heico, in which Berkshire continues to expand its stake.

The "mysterious" purchases from the first quarter turned out to be the steel producer Nucor and the homebuilders D.R. Horton and Lennar, positions that were further expanded in the second quarter. The most notable new investment is a stake of approximately USD 1.6 billion in health insurer UnitedHealth Group, a classic contrarian move. UnitedHealth's stock has fallen 46% this year amid a cyberattack, a DOJ investigation, and a sudden change of CEO. In addition, smaller new positions were taken in outdoor advertising company Lamar Advertising and security specialist Allegion, and existing holdings in Chevron, Domino's Pizza, and Constellation Brands were further supplemented.

Acquisition

In addition to the stock market transactions, a classic Berkshire Hathaway acquisition was also completed. The holding company has acquired Bell Laboratories, a 50-year-old family business and a world leader in pest control products. It is the first time that the company has changed ownership since its founding in 1974 by the Stack family.

Fully in line with the Berkshire philosophy, Bell will continue to operate completely independently, retaining its existing management and corporate culture. Buffett's message to the company underscores the long-term vision: "This transaction allows Bell to assume that it will also exist for the next 50 years," giving it a definitive home within the holding company.

Berkshire Hathaway has ended the trading week on the New York Stock Exchange at a price of USD 477.20 per B-share, respectively.

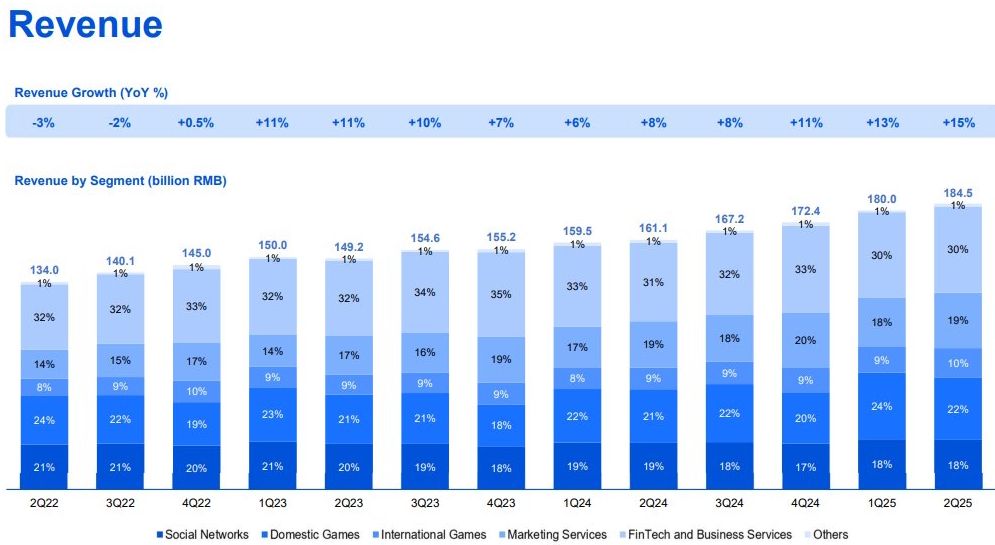

Prosus benefits from strong growth Tencent

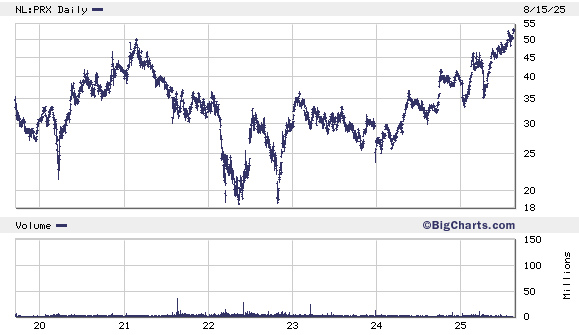

For shareholders of the Dutch investment holding Prosus (Amsterdam: PRX), all eyes remain on the performance of the core investment, Tencent. The recent strong quarterly figures from the Chinese tech giant, combined with the strategic approval for the acquisition of Just Eat Takeaway, underscore the developments at the tech investor. As of August 15, 2025, the net asset value of Prosus (accessible daily via the Prosus website) was EUR 77.30 per share, which, at a market price of EUR 53.11, implies a discount of approximately 31.3%. Tencent accounts for more than 80% of Prosus' value.

The strategic course under the leadership of CEO Fabricio Bloisi is therefore focused on simplification and focus. The annual results for fiscal year 2025, already published by Prosus in June, confirm the operational improvements. E-commerce gross profit increased from USD 38 million to USD 443 million, resulting in a margin increase from approximately 1% to 7%. Group EBITDA doubled, while free cash flow rose to USD 1 billion. In addition to core investment Tencent, Prosus now owns a profitable and growing e-commerce portfolio, with strategic interests in OLX, iFood, Meesho, and Swiggy, among others. Nevertheless, shareholders continue to await Tencent's results with anticipation.

Tencent: rock-solid Q2 results with AI as a growth accelerator

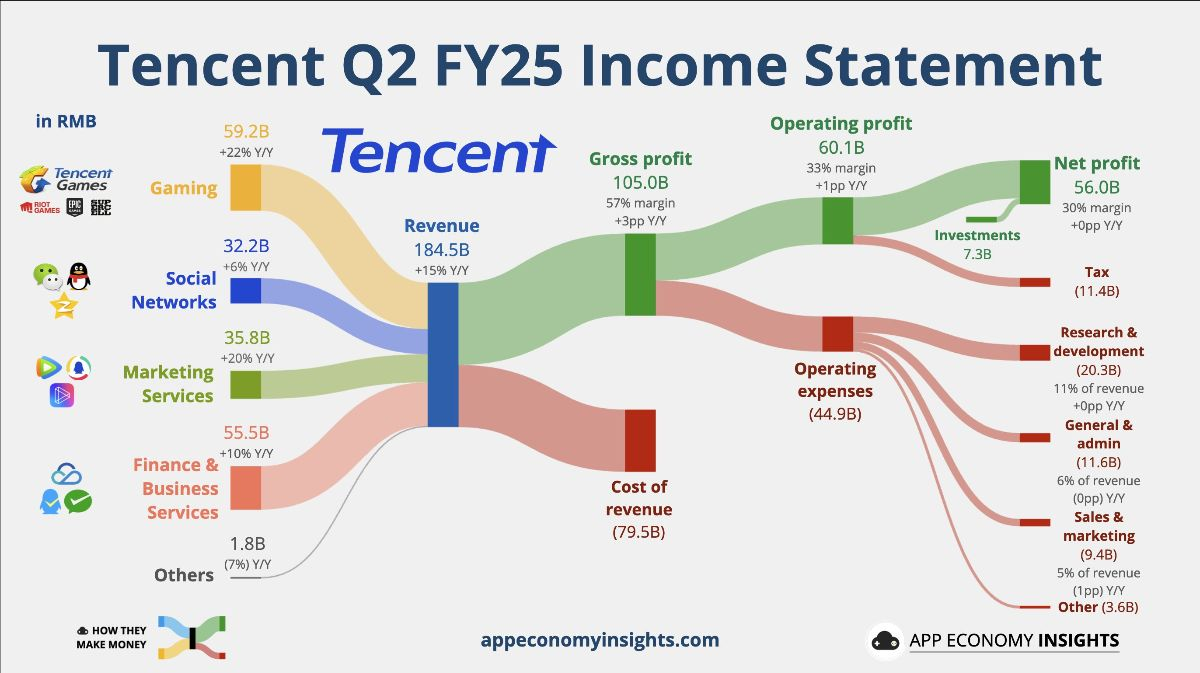

Tencent presented results for the second quarter on August 13, 2025, that far exceeded market expectations. Revenue increased by 15% year-on-year to RMB 184.5 billion (approximately USD 25.7 billion), while net profit increased by 17% to RMB 55.6 billion. This performance was supported by all segments, with artificial intelligence (AI) as the clear, overarching engine.

The gaming division remains the backbone of the company, with revenue growth from domestic games of 17 percent, driven by established titles such as Honor of Kings and the successful launch of Dungeon & Fighter Mobile. Internationally, growth continued with an impressive 35 percent. Tencent's platform approach, which integrates games with social media, streaming, and e-sports, ensures a stable and predictable revenue stream.

AI serves as an integrated strategic spearhead. In contrast to companies that develop AI as a separate product, Tencent has now deeply embedded AI into its core activities. In gaming, AI algorithms improve NPC intelligence, personalize gameplay, and accelerate content creation.

For advertising, AI analysis optimizes placement and relevance, which directly leads to a higher ROI for advertisers. Within the WeChat ecosystem, AI-driven search functions and automated customer service increase usage time and engagement, while in the Cloud & Infrastructure, commercial AI services are combined with internal optimizations for cost reduction.

This broad application of AI creates multiple, mutually reinforcing growth pillars. This not only strengthens Tencent's existing market positions, but also opens up new revenue streams in fast-growing technological niches. This offers Tencent investors an attractive alternative to the dominant American technology companies – investors in Prosus can still benefit from the global AI growth trend at a discount.

Approval of Just Eat Takeaway acquisition marks strategic milestone

In addition to growth via Tencent, Prosus is taking important steps in the consolidation of its own e-commerce portfolio. The conditional approval of the European Commission for the acquisition of Just Eat Takeaway for EUR 4.1 billion is a crucial development in this regard. Prosus, which already owns the Brazilian iFood and has interests in the Indian Swiggy, will become the fourth largest meal delivery group in the world.

To address competition concerns, Prosus has pledged to "significantly reduce" its 27.4% stake in German competitor Delivery Hero within one year and no longer exercise voting rights. According to the European Commission, this concession safeguards competition in the European market and paves the way for the completion of the transaction. The registration period for shareholders runs until October 1, after which the deal is expected to become unconditional quickly.

Prosus has ended the trading week on the Amsterdam Stock Exchange at a price of EUR 53.11 per share.

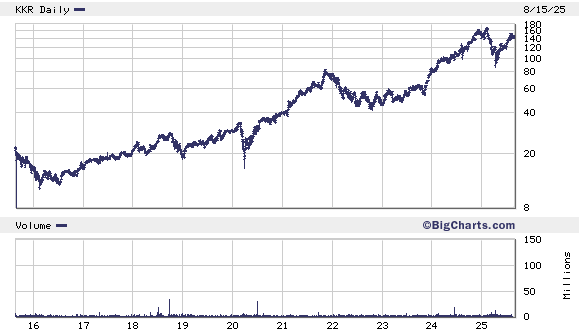

KKR: A 'mini Berkshire Hathaway' in the making?

The American investment holding company KKR (New York: KKR) is increasingly profiling itself as a modern investment holding company. The results for the second quarter of 2025 not only confirm the strength of the diversified business model, but also underscore the strategic choice to, unlike many peers, fully commit to holding investments for the long term. Where competitors often present themselves as 'asset-light' asset managers, KKR distinguishes itself through an integrated approach, in which its own balance sheet and long-term investments via the Strategic Holdings division play a crucial role.

Financial highlights Q2 2025: a testament to growth

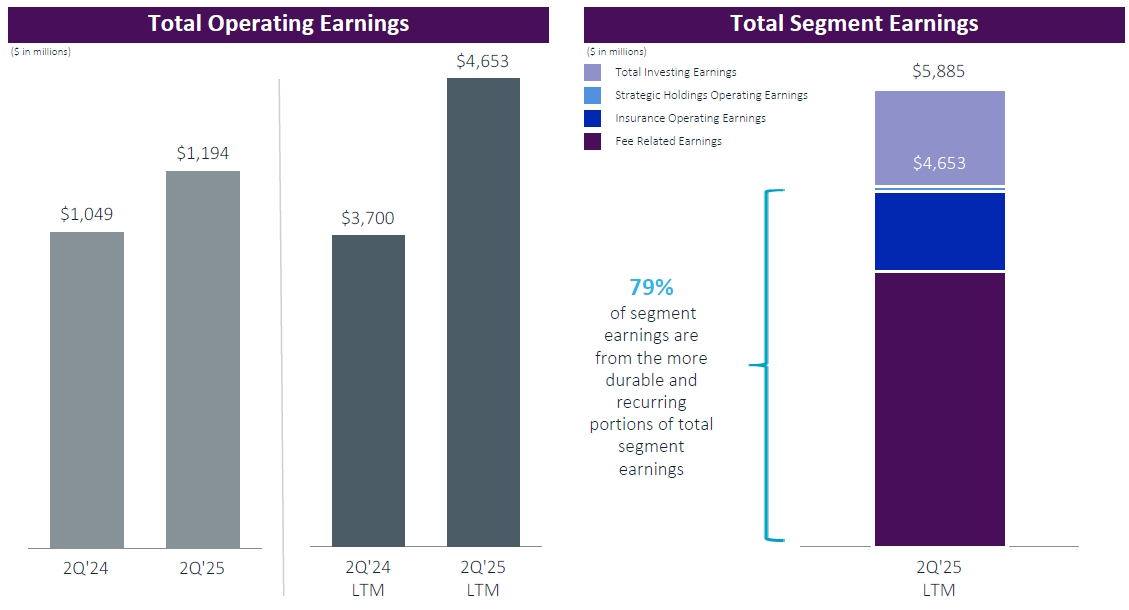

KKR reported impressive financial results for the second quarter, demonstrating the company's robust growth. The Fee Related Earnings (FRE), a measure of stable, asset management fee-based income, increased by 17% year-on-year to USD 887 million, or USD 0.98 per share. Over the last twelve months (LTM), FRE amounted to USD 3.6 billion, an increase of 34%.

The Total Operating Earnings (TOE), which represent the more sustainable and recurring profit streams of the company, increased by 14% to USD 1.2 billion. Adjusted Net Income (ANI) came in at USD 1.1 billion, or USD 1.18 per share.

Co-CEOs Joseph Bae and Scott Nuttall emphasized the dynamics: "We are active globally in investing, monetizing, and fundraising. This momentum flows through to our financial results, with more than 25% growth in Fee Related Earnings, Total Operating Earnings, and Adjusted Net Income over the past 12 months."

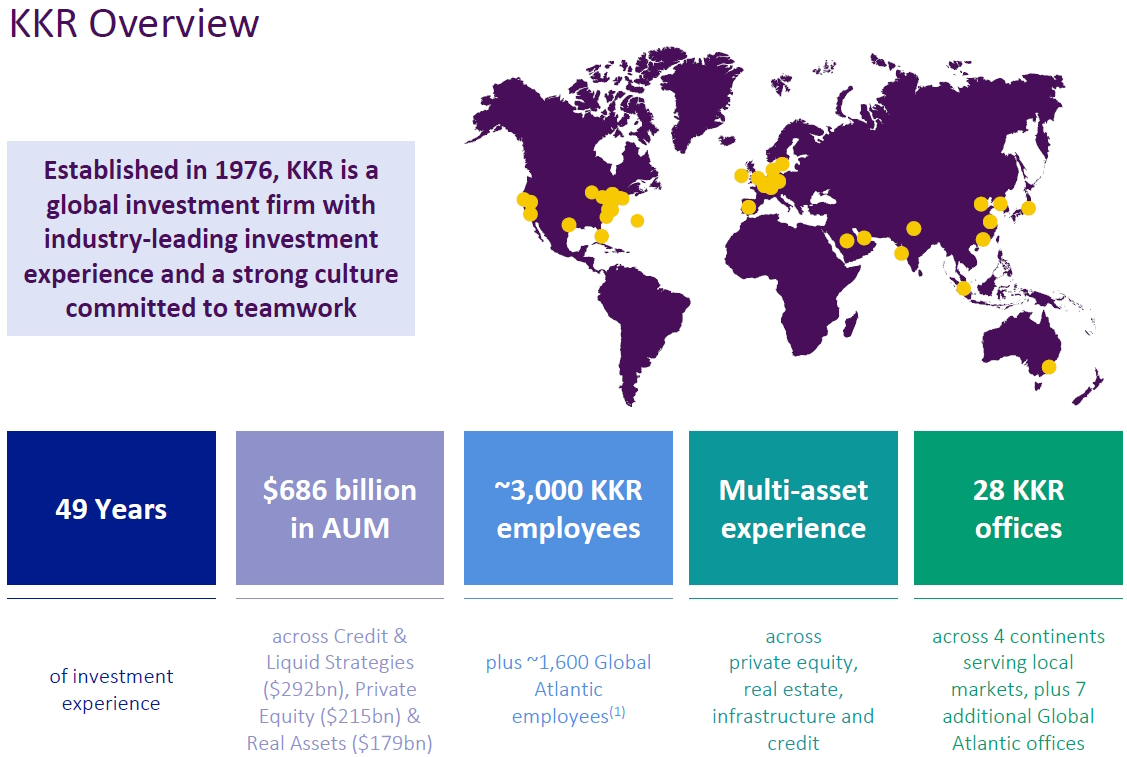

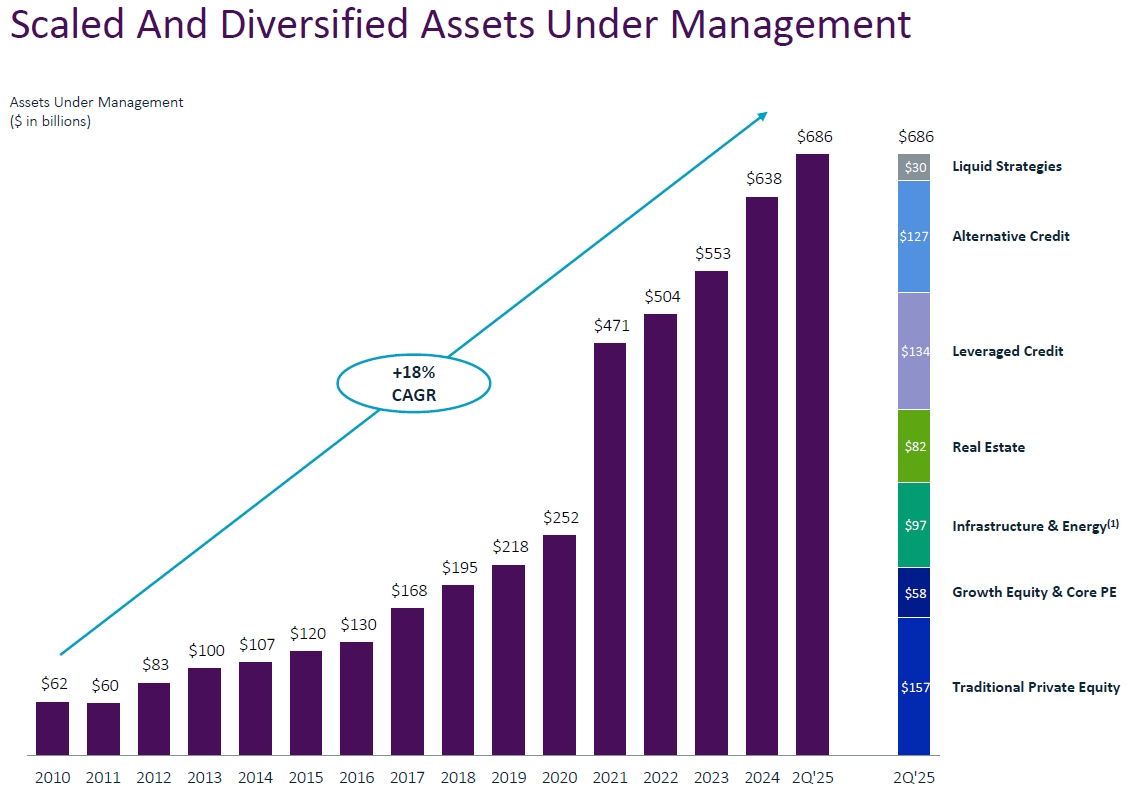

The Assets Under Management (AUM), a crucial indicator for an asset manager, grew by 14% year-on-year to a total of USD 686 billion. This growth was supported by strong fundraising, with USD 28 billion in new capital in the quarter and USD 109 billion over the past twelve months.

The three engines of the KKR investment holding

KKR's success is built on a business model with three growth engines: Asset Management, Insurance, and Strategic Holdings. This integrated structure enables KKR to deploy capital flexibly, create synergies, and generate sustainable value for the long term.

1. Asset Management: the scalable core

The asset management division remains the core of KKR, with a diversified platform across Private Equity, Real Assets, and Credit & Liquid Strategies. The AUM in this division have grown since 2010 with a compound annual growth rate (CAGR) of 18%.

- Private Equity: With an AUM of USD 215 billion, this remains a cornerstone of KKR. The traditional private equity portfolio increased in value by 13% over the past twelve months. Recent capital inflows were mainly driven by the North America Fund XIV and the K-Series for high-net-worth individuals.

- Real Assets: This branch, which includes infrastructure and real estate, grew to an AUM of USD 179 billion. The infrastructure portfolio delivered a strong return of 14% over the past twelve months. The demand for infrastructure, driven by the energy transition and digitization, remains unabated.

- Credit & Liquid Strategies: With an AUM of USD 292 billion, this is the largest segment within asset management. A notable growth area is Asset-Based Finance (ABF), where AUM grew by more than 20% year-on-year to USD 75 billion. CFO Robert Lewin sees a huge opportunity here: "ABF is an addressable market of USD 6 trillion today, which will grow to more than USD 9 trillion over the next four years."

2. Insurance: the engine of permanent capital

The full acquisition of Global Atlantic in early 2024 was a strategic masterstroke. It not only added a significant and stable capital base, but also positioned KKR as a leading player in the insurance market. Global Atlantic has USD 201 billion in assets under management and is a leader in annuities and reinsurance.

The insurance activities generate permanent capital, capital with an indefinite term, which enables KKR to invest with a long-term horizon without the pressure of immediate capital returns. KKR's total permanent capital now amounts to USD 289 billion, an increase of 16% year-on-year. This stable capital flow fuels the investment activities of the other segments. This strategy is similar to Berkshire Hathaway's model, where the stable capital flow from the insurance activities ('float') is used for long-term investments.

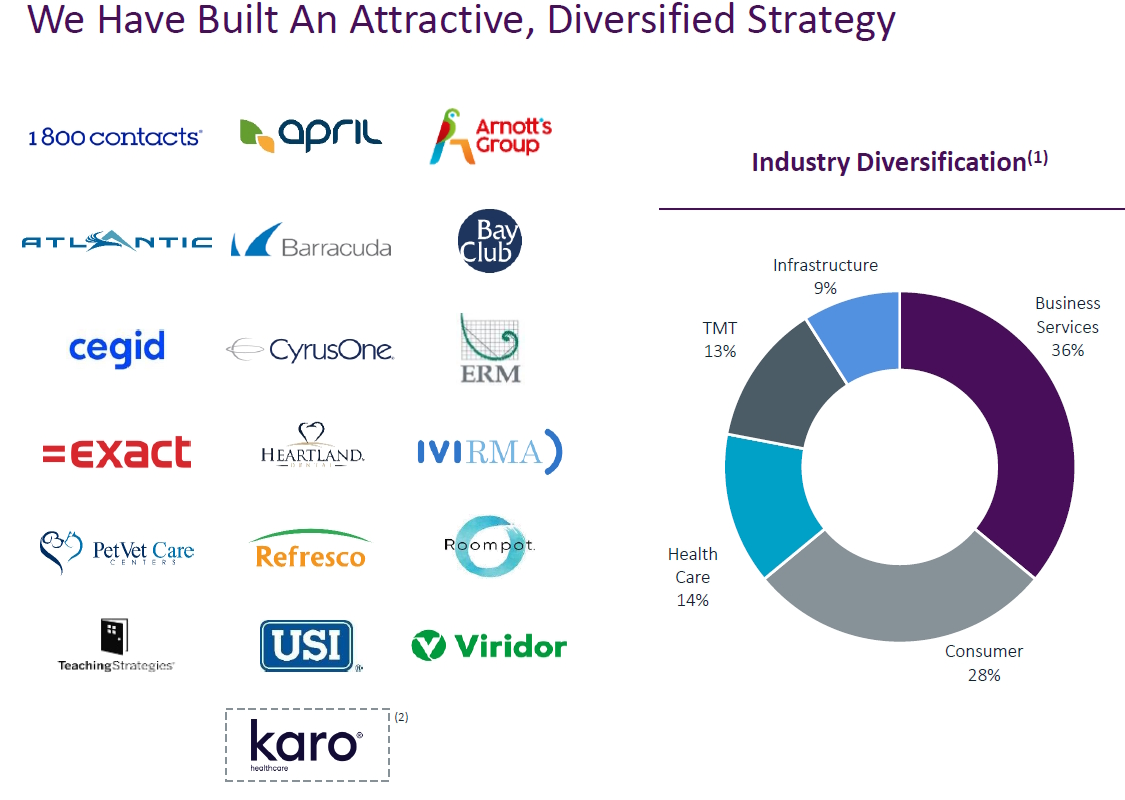

3. Strategic Holdings: the core of KKR's 'mini Berkshire' ambition

The Strategic Holdings division is what definitively distinguishes KKR as an investment holding company. This segment is the embodiment of KKR's ambition to, as Co-CEO Joe Bae put it, create "in a sense, a mini Berkshire Hathaway." It is a clear break with rivals who prioritize 'asset-light' models. While competitors Apollo and Carlyle have relatively small balance sheets outside their insurance subsidiaries, KKR has more than USD 100 billion in investments on its balance sheet, not including the insurance branch.

The core of the strategy is to hold interests in 18 quality companies, such as Exact Software, Refresco, and Roompot, for decades instead of selling them quickly. The goal is to let value compound and build a portfolio that ultimately generates more than USD 1 billion per year in dividends. KKR plans to expand the portfolio with infrastructure and real assets.

A notable difference from Buffett's model is the structure: the Strategic Holdings division pays management fees and a portion of the profit (carried interest) to the professionals in the asset management branch who manage the deals. This creates an internal synergy but also a cost structure that is absent at Berkshire Hathaway. As a shareholder of the investment holding KKR, you ultimately remain exposed to all these capital flows at the holding level.

Exposure to megatrends: the pillars of future growth

KKR is strategically positioned to benefit from a number of global megatrends that will shape the economy in the coming decades.

- Digitization and AI: The exponential growth of data and artificial intelligence is creating enormous demand for digital infrastructure. KKR is investing significantly in data centers, fiber optic networks, and mobile infrastructure. Craig Larson, Head of Investor Relations, noted: "There is a tremendous capital need. And in many respects, the opportunity is broader than just data centers."

- Energy Transition and Climate: The transition to a sustainable economy requires trillions in investments in renewable energy, energy efficiency, and climate-resilient infrastructure. KKR's infrastructure and climate funds directly address this.

- Growth of Private Wealth: KKR is increasingly focusing on the growing market of high-net-worth individuals seeking access to alternative investments. The K-Series platform, which offers products across private equity, infrastructure, and credit, saw its AUM more than double in a year, from USD 11 billion to USD 25 billion. The strategic partnership with Capital Group opens the door to an even broader audience.

Outlook and strategic vision

With USD 115 billion in uncalled capital, KKR is excellently positioned to invest in an environment where volatility creates opportunities. Management is therefore confident about the future. Robert Lewin stated: "Given all this momentum, we remain confident in our ability to achieve the 2026 targets we shared last year, both for our fundraising and for our key figures."

The recent acquisition of HealthCare Royalty Partners, a leader in biopharma royalty investments, exemplifies KKR's strategy to broaden its platform with unique, long-term capital strategies.

In conclusion: KKR is more than an asset manager; it is an investment holding company that uniquely combines capital, expertise, and a long-term vision. With significant skin in the game from the founders and a unique way of granting shares to everyone within the organization, from the cleaning staff to the executive board, KKR fosters an entrepreneurial culture within its organization.

The results of the second quarter of 2025 confirm the strength of the business model. By investing through its three engines and capitalizing on the key megatrends of our time, KKR is well-positioned to achieve sustainable, compound growth for its shareholders in the coming years.

KKR ended the trading week on the New York Stock Exchange at a price of USD 142.28 per share.

Receive weekly insights in your inbox

Exclusive analyses and updates on family holdings and global market developments.

Would you like more information about our services? Please feel free to contact us.

Contact us

Disclaimer:

No rights can be derived from this publication. This is a publication of Tresor Capital. Reproduction of this document, or parts thereof, by third parties is only permitted after written permission and with reference to the source, Tresor Capital.

This publication has been prepared by Tresor Capital with the utmost care. The information is intended to be general in nature and does not focus on your individual situation. The information should therefore expressly not be regarded as advice, an offer or proposal to purchase or trade investment products and/or purchase investment services nor as investment advice. The authors, Tresor Capital and/or its employees may hold position in the securities discussed, for their own account or for their clients.

You should carefully consider the risks before you begin investing. The value of your investments may fluctuate. Past performance is no guarantee of future results. You may lose all or part of your investment. Tresor Capital disclaims any liability for any imperfections or inaccuracies. This information is solely indicative and subject to change.

Read the full disclaimer at tresorcapitalnieuws.nl/disclaimer .