Family holdings #34 - From good to excellent: the choice for Swedish excellence

This week's topics:

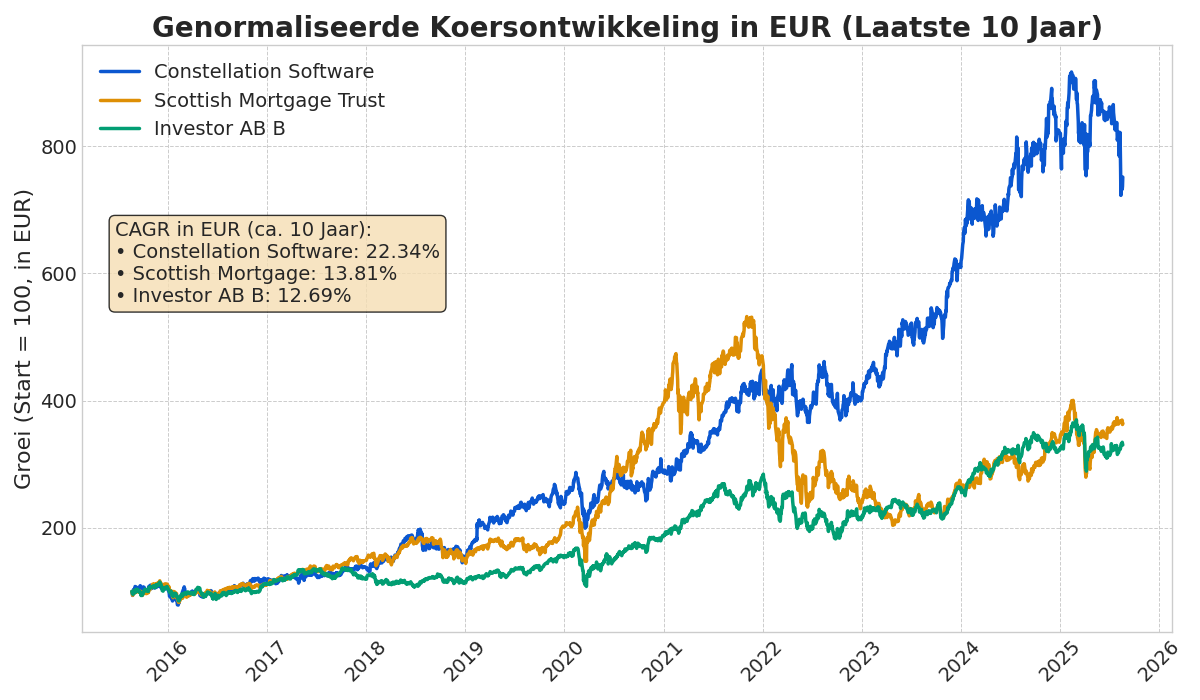

The AI revolution manifests itself in various ways: from the pragmatic, decentralized innovation at VMS company Constellation Software to the large-scale, strategic investment in a national AI supercomputer by the Wallenberg family through their holding company Investor AB. While the valuation of AI infrastructure company Databricks is exploding, which boosts the value of holdings such as Scottish Mortgage Trust, the VMS sector is seen as a defensive investment that strengthens its competitive advantage by cleverly integrating AI.

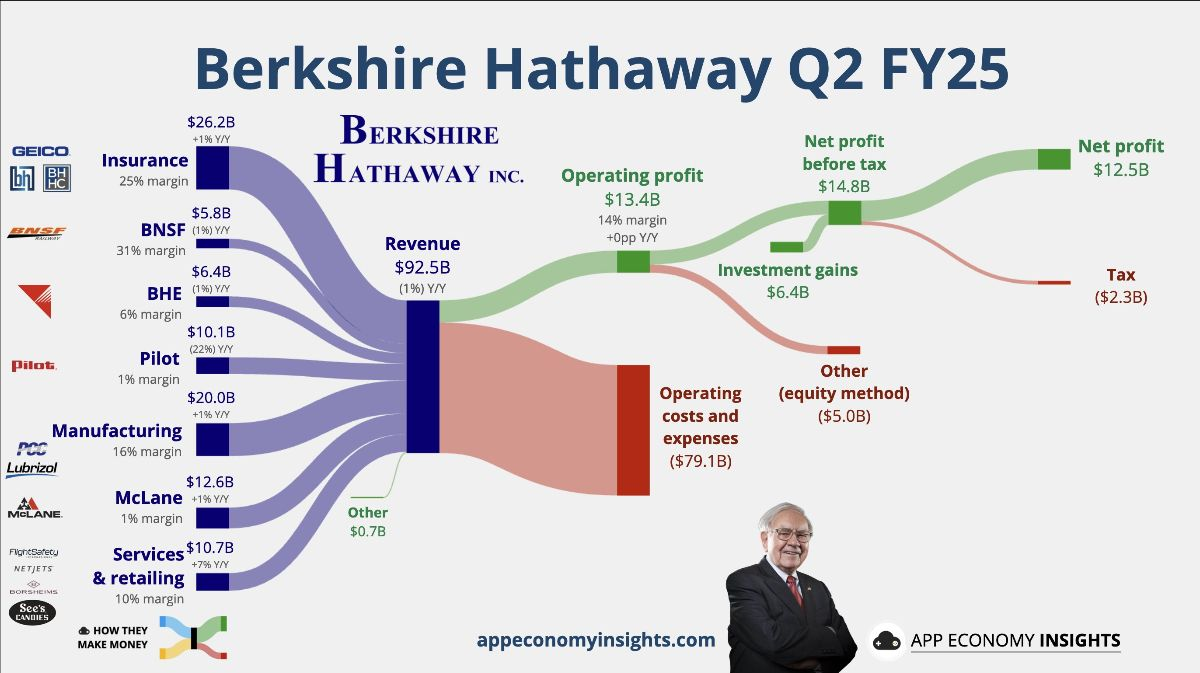

Despite a reported profit decline that is distorted by one-off items, Berkshire Hathaway shows strong underlying operational growth, creating an attractive disconnect with the share price that has fallen due to succession concerns.

The robust half-year growth of Topicus, driven by acquisitions, is better than it seems, because the full, significant impact of the strategic investment in Asseco Poland will only become visible after consolidation in the coming quarters.

The investment case for Alphabet is partly based on the undervaluation of YouTube's growth and the potential of Waymo, the vision that AI complements rather than cannibalizes Search's dominant position, and the proven technological superiority of Google Cloud.

In Brief

Sofina’s (Brussels: SOF) planned sale of the private school group Cognita, the second-largest holding in its portfolio, appears to be stalling. According to reports in the Financial Times, the billion-dollar deal is on shaky ground.

The sale is struggling with too large a difference between the asking and bidding price, partly due to uncertainty about the British market following the introduction of a 20% VAT levy on school fees by the Labour government. For Sofina, which acquired a 13.4% stake in Cognita in 2019, the failure of this exit would be a setback, although education remains an important pillar in their investment strategy.

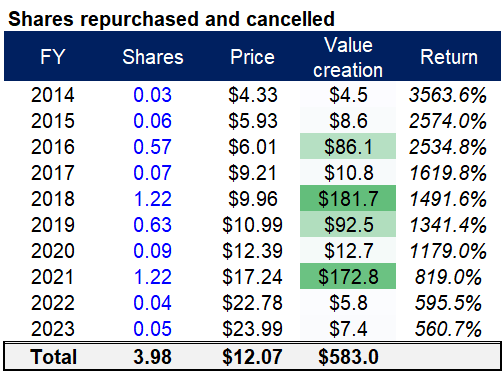

Terravest (Toronto: TVK) recently announced a new share buyback program. The Canadian holding company plans to repurchase 1,558,516 shares, representing 7.19% of the outstanding shares. With the closing price of August 20 (CAD 143.23), this represents a total value of approximately CAD 223 million. This news is all the more significant given the historical context.

An analysis by @bizalmanac on X (formerly Twitter) shows that Terravest created more than CAD 600 million in value for shareholders in the period 2018-2021 through exceptionally well-timed share repurchases (see image). This selective and sporadic policy emphasizes the careful capital allocation of management. Precisely for this reason, this new buyback program is seen as a very strong signal that management considers the shares undervalued.

AddTech and Lifco: Opting for Swedish Excellence

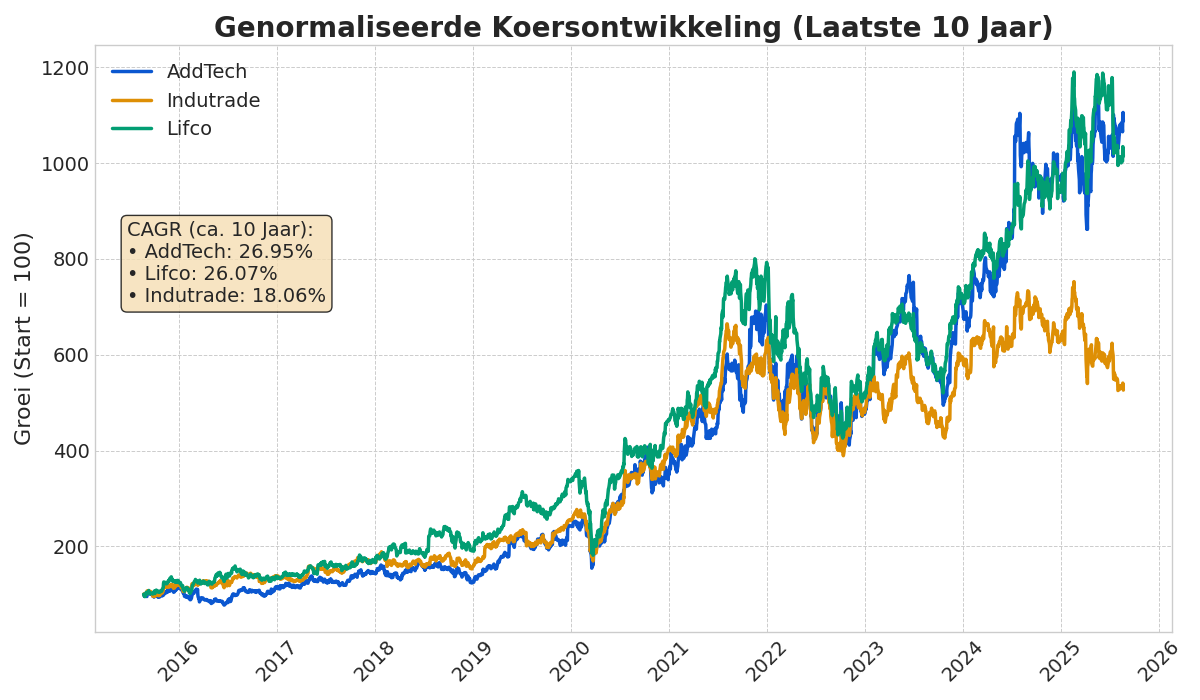

The Swedish investment holding company Indutrade (Stockholm: INDT) has been part of our family holding strategy for many years. It was the first Swedish serial acquirer that we added to the portfolio. However, earlier this year, we parted ways with Indutrade to consolidate the position in Addtech (Stockholm: ADDT-B) and Lifco (Stockholm: LIFCO-B).

We deliberately choose to report any transactions, and in particular new positions (such as AddTech earlier this year), with a significant delay. We believe it is only logical that our clients are the first to be informed of the changes in their portfolio before we release this more widely in the newsletter.

Consolidation in Swedish top class

In line with our disciplined investment philosophy, which is aimed at owning only the most superior companies for the long term, we have fully sold our position in Indutrade. The released funds have been reinvested in our existing positions in Lifco AB and Addtech AB, two companies that, according to our analysis, perform significantly stronger on the most crucial selection criteria.

The decision is the result of an in-depth comparative analysis based on four fundamental pillars. Although Indutrade is a solid and well-diversified company, it lags behind on the two most important criteria for us: profitability and return on invested capital.

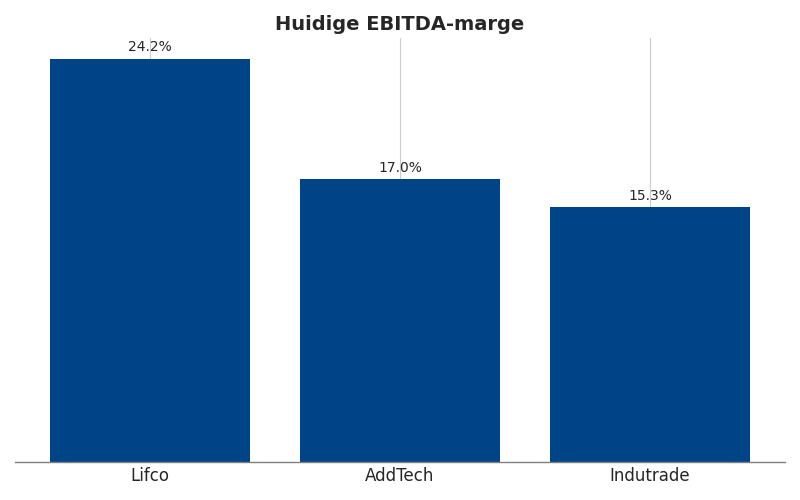

1. Superior profitability

The data show a clear hierarchy. Lifco is the undisputed leader with an EBITDA margin of 24.2%, which is exceptional and indicates the very high quality and pricing power of its subsidiaries. Addtech follows with a respectable 17.0%, but Indutrade has the lowest margin of the three at 15.3%. Lifco's superiority is structural and visible throughout the entire value chain.

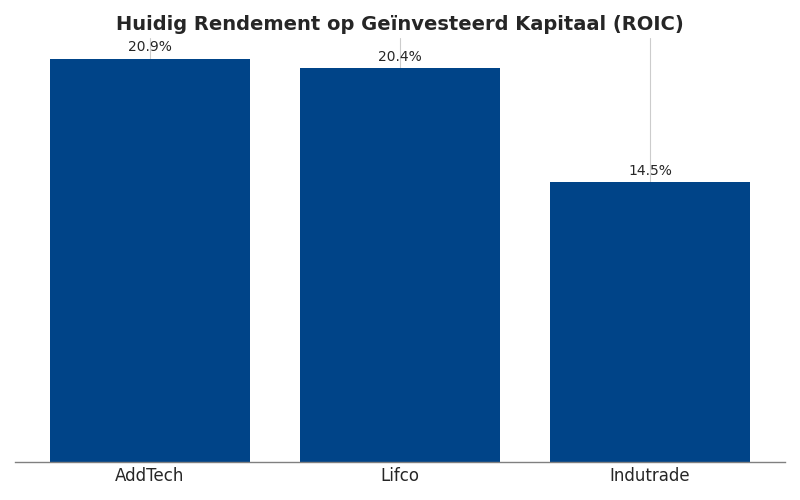

2. Higher return on capital (ROIC)

A high ROIC is the ultimate indicator of a superior business model and a strong competitive position ('moat'). Here too, the division is clear. Addtech (20.9%) and Lifco (20.4%) generate a return that is significantly higher than that of Indutrade (14.5%).

A ROIC of above 20% indicates companies that are exceptionally good at allocating capital to projects and acquisitions that yield well above their cost of capital. Indutrade's ROIC is not only lower than its peers, but also below its own strategic target of 20%.

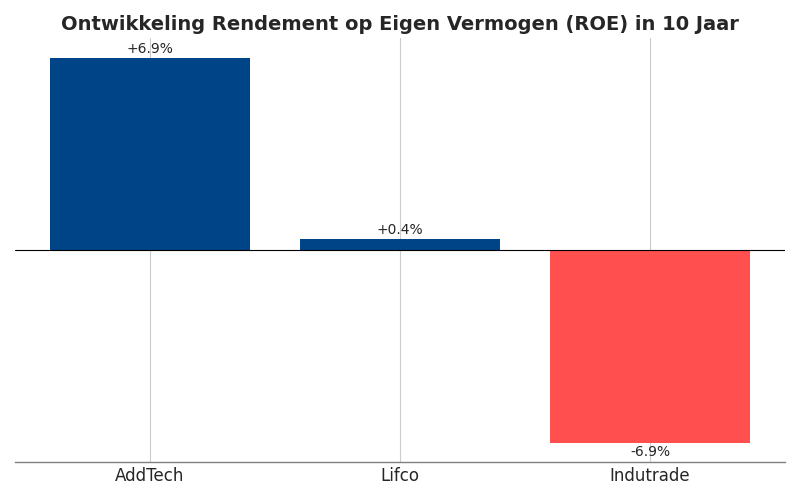

The downward trend in return on equity (ROE) over the past ten years was an additional and decisive warning signal for us. Where Lifco remained stable (+0.4%) and Addtech showed a strong improvement (+6.9%), Indutrade showed a worrying decrease of -6.9%. This may indicate a structural decline in profitability or acquisitions that are less profitable than those in the past.

3 & 4. Balance sheet and diversification

On the other two pillars, a strong balance sheet and a diversified portfolio, all three companies score well. They all have healthy, prudently managed balance sheets with conservative debt ratios. However, Lifco distinguishes itself with an exceptionally low debt ratio of only 0.83x EBITDA, which makes it the most financially robust of the three. The conclusion is therefore that, although Indutrade is a good company, Lifco and Addtech are the superior choices in the context of our excellence-oriented strategy. The consolidation is a logical step in continuously sharpening the portfolio. AddTech, Indutrade and Lifco are currently traded on the Stockholm stock exchange at a price of SEK 345.40, SEK 234.40 and SEK 349.20 per share.

AI Developments: From VMS Competition to Sovereign Supercomputers

Developments in the field of artificial intelligence (AI) are rapidly unfolding, compelling investors to continuously evaluate the impact on their portfolios. Recent news highlights how various organizations, from specialized software companies to influential investment holdings, are approaching the opportunities and challenges of AI. This week, we highlight three specific examples: Constellation Software's pragmatic innovation strategy, the Wallenberg family's establishment of a national AI initiative, and the exploding valuation of AI infrastructure company Databricks.

VMS and the Pragmatic Innovation of Constellation Software

Building on our previous deep dive on the role of AI in the Vertical Market Software (VMS) sector, we are already seeing a good illustration of the strategy of VMS serial acquirers this week. We concluded in the deep dive that the deep integration, high switching costs, and mission-critical nature of VMS software create a robust 'moat' that is not easily threatened by AI. Instead, we see AI being used as a tool to improve existing products and efficiency.

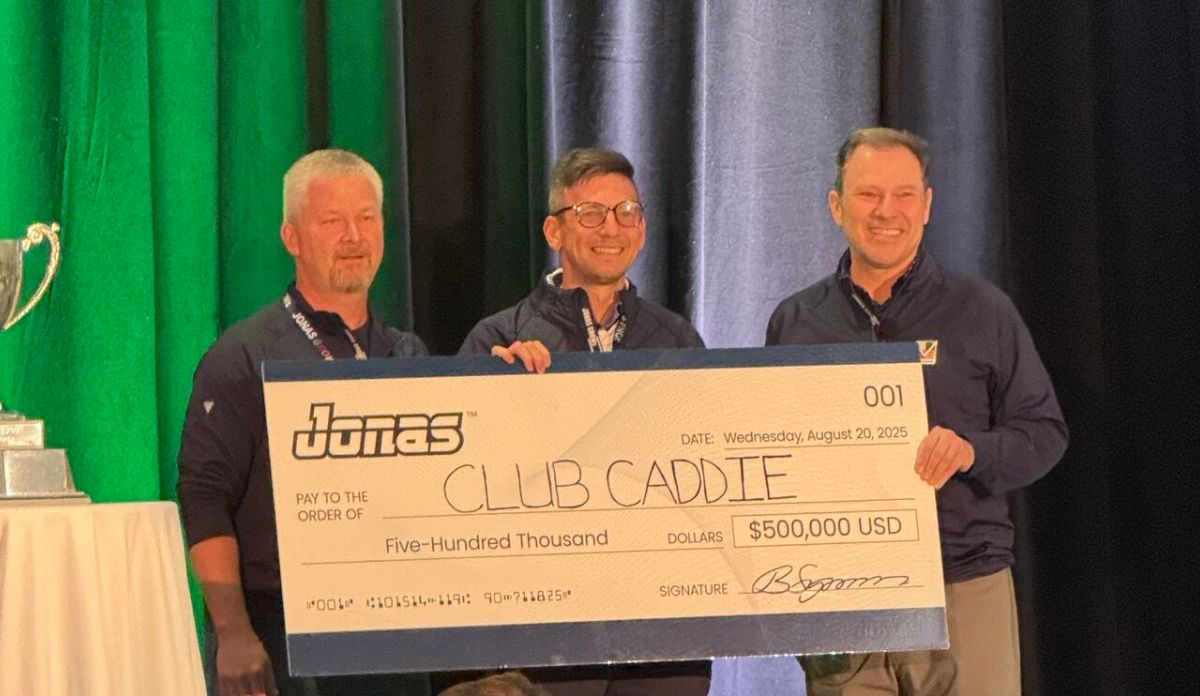

A striking example is the internal AI competition that investment holding Constellation Software organized through its subsidiary Jonas Software. From 129 pitches, the product "Looper" from Club Caddie was chosen as the winner, which was rewarded with a check for USD 500,000. Looper enables golf course operators to directly access data on transactions, members, and inventory via simple questions, complete with visualizations. This initiative demonstrates how Constellation uses its decentralized structure to stimulate innovation from the bottom up, exactly as CEO Dexter Salna put it: "If someone finds a good application of AI, we share it across our hundreds of companies."

This approach aligns with a recent observation by investor Adrián Value. He emphasized on X (formerly Twitter) the complexity of existing VMS solutions: "There must be a million lines of code behind it (...) This is a piece of mission-critical software that is hard to replace." AI can accelerate the writing of new code, but replacing the decades of accumulated, deeply embedded logic and customer relationships is a very different challenge. AI development is, as the tweet states, "the easy part." The real value lies in understanding, integrating, and selling the software, a process that requires in-depth domain knowledge.

The Swedish AI Ambition

On a very different scale, we see a strategic move by the influential Swedish Wallenberg family of the investment holding Investor AB. Key subsidiaries from the portfolio (AstraZeneca, Ericsson, Saab, and SEB), together with the Wallenberg Investments foundation, have founded the company Sferical AI. The goal is to operate a sovereign AI supercomputer to strengthen the competitiveness of Swedish industry.

This initiative, which follows a collaboration with NVIDIA, will be based on the latest NVIDIA DGX SuperPOD systems. It demonstrates a proactive, top-down approach in which crucial infrastructure is invested in at a national level to avoid falling behind in the AI era.

Marcus Wallenberg, Chairman of Wallenberg Investments, states: "Through this initiative, we are creating the opportunity for some of Sweden's leading companies to position themselves at the forefront of the rapid structural transformation caused by the development and use of AI."

Valuations in AI: The Databricks Effect

While some are building the applications and infrastructure, others are benefiting from the enormous capital inflow into the sector. The investment holding Scottish Mortgage Investment Trust (London: SMT) saw the value of its unlisted participation in Databricks increase by 60% to a valuation of more than USD 100 billion in just nine months.

Databricks provides software that helps companies analyze their datasets and prepare them for the use of AI, positioning itself as a crucial player in the 'picks and shovels' side of the AI revolution. This enormous valuation jump, driven by a new funding round of more than USD 1 billion, underscores the immense investor appetite for AI-related companies.

However, sentiment is tempered by a warning from OpenAI CEO Sam Altman, who compared the current excitement to the dotcom bubble. He acknowledges both the hype and the fundamental importance of the technology in the long term. For Scottish Mortgage, the increase in value means a direct increase in net asset value (NAV) and a confirmation of their strategy to invest in high-quality, private growth companies.

At the same time, the Databricks case shows the enormous valuations that are being assigned to the enablers of the AI transition, with the associated risk of overheating. These developments reinforce our conviction that the VMS sector is well-positioned. The 'moat' of these companies is not threatened, but rather deepened by cleverly integrating AI. While valuations at the forefront of the AI hype may be volatile, the underlying VMS companies continue to benefit from their sustainable business models, while pragmatically deploying AI to create value.

In addition to the companies mentioned, within the family holding strategy, we also capitalize on the necessary AI infrastructure with, for example, the owners of data centers (Google Cloud from Alphabet) or the builders of them (think of Brookfield and KKR). And what about all the (renewable) energy needed to make this transition possible (MBB, Brookfield, and KKR). Sofina, Prosus, and Scottish Mortgage Trust also invest directly in the best AI companies. This gives us broad exposure to the AI revolution within our holding portfolio.

Constellation Software, Investor AB, and Scottish Mortgage Trust are currently traded on the stock exchanges of Toronto, Stockholm, and London at prices of CAD 4,527.30, SEK 298.10, and GBP 10.90 per share, respectively.

Receive weekly insights in your inbox

Exclusive analyses and updates on family holdings and global market developments.

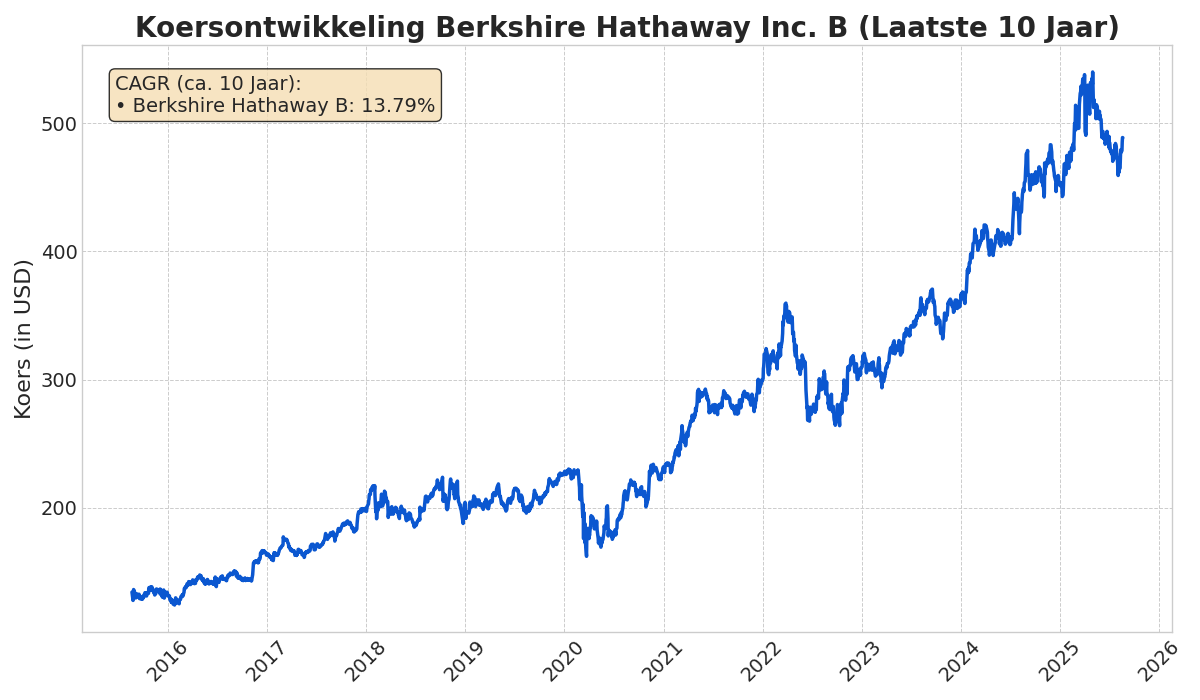

Berkshire's Second Quarter Requires Closer Examination

The American investment holding Berkshire Hathaway (New York: BRK-B) published its figures for the second quarter of 2025 earlier this month. While the reported operating profit fell by 4% to USD 11.16 billion, a deeper analysis of the figures shows a picture of operational resilience. We already published a review of Berkshire's transactions in the equity portfolio last week.

The reported profit decline is distorted by a non-cash currency loss of USD 877 million on foreign debt. Analyst Chris Bloomstran rightly notes that when this effect is corrected, operating profit actually increased by 7.9% to USD 12.0 billion. This gives a clearer picture of the companies' performance. Net profit was further affected by a one-off write-down of USD 3.8 billion on the investment in Kraft Heinz.

The underlying segments performed predominantly strongly:

- Insurance: Profitability remains robust, despite a decline compared to a record year. GEICO is operationally "largely recovered" and the reinsurance arm showed discipline by writing less in a less attractive market.

- BNSF (Railways): An outperformer with a profit increase of 19.5%. The railway company is "firmly turning the corner" thanks to operational improvements.

- BHE (Energy): Higher profit, mainly due to the absence of new reservations for forest fires. However, new legislation creates uncertainty about future investments in renewable energy.

- Manufacturing, Service & Retail: A mixed picture, with a strong performance from aviation supplier PCC, but continued weakness in consumer and construction-related businesses.

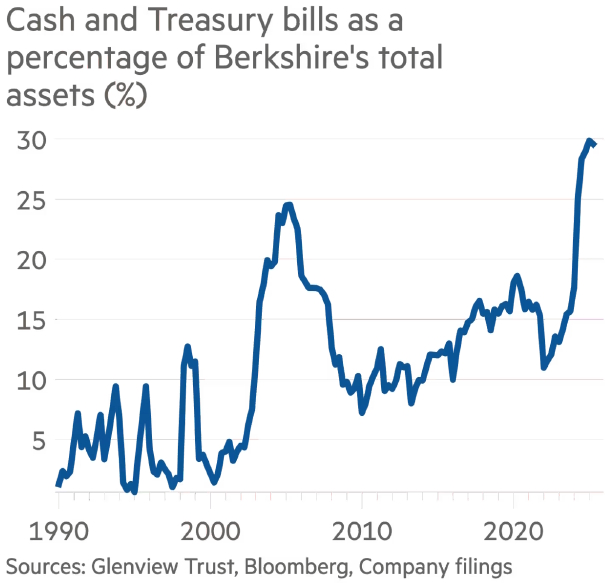

With a cash position of approximately USD 340 billion, no shares were repurchased in the first half of 2025. This was a clear signal that Buffett considered his own shares too expensive in the spring. However, the recent 14% price decline since the peak in May, caused by uncertainty surrounding the succession, brings the valuation back to a more attractive level.

The current situation at Berkshire Hathaway illustrates a classic dilemma. The market is pricing in a "succession risk," resulting in a weak share price. At the same time, the underlying operational machine, corrected for accounting effects, actually shows an improvement. This disconnect between sentiment and fundamental performance, combined with the rock-solid capital discipline, confirms the strength of the conglomerate. The recent price decline could well be the signal for the company itself to resume the repurchase of its own shares.

Berkshire Hathaway is currently traded on the New York Stock Exchange at a price of USD 492.39 per B-share.

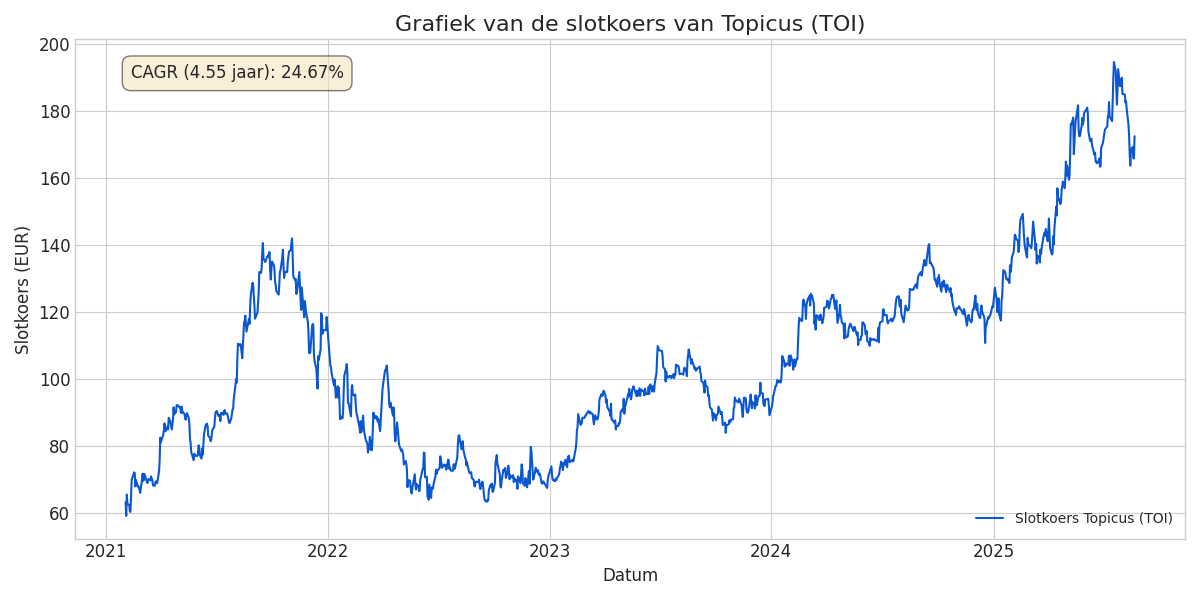

Topicus Results Better Than They Initially Appear

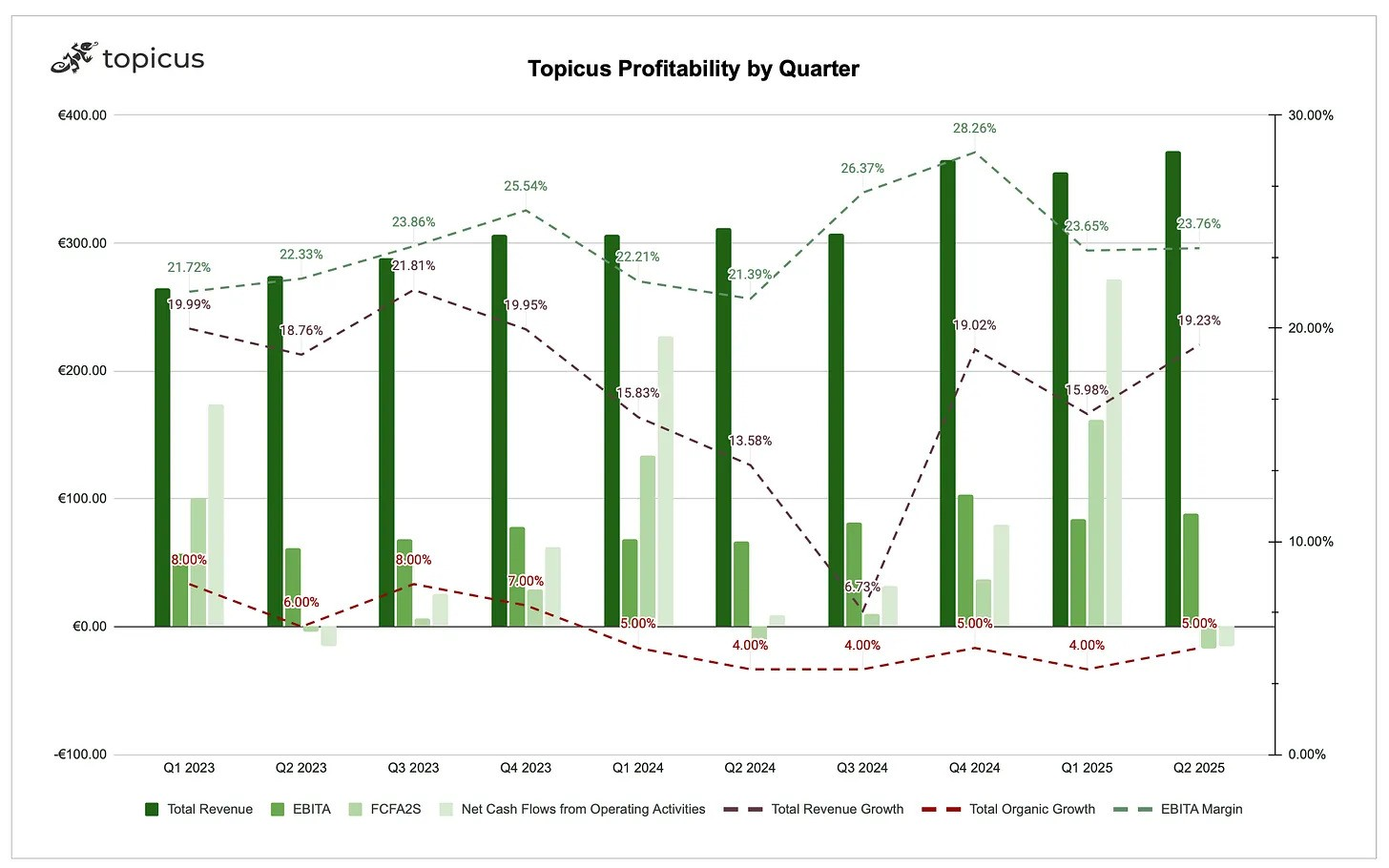

On August 1, 2025, Topicus.com Inc. (Toronto: TOI), the European VMS serial acquirer, announced its results for the first half of 2025. The figures show a robust performance, characterized by significant revenue and profit growth.

In the second quarter, revenue increased by 20% year-on-year to EUR 372 million, while revenue for the entire first half of the year increased by 18%. This represents the highest growth since the third quarter of 2023. Organic growth was 5% in the quarter, which is in line with the trend of the past year and a half. The most important part of the revenue, the recurring maintenance revenue, even increased by 7%. The remaining growth is due to the completion of 18 acquisitions during the first six months of the year.

The operating cash flow (CFO) was negative in Q2 (-/- EUR 14.9 million). As the attached image below illustrates, this is a seasonal pattern, as a significant portion of the annual maintenance contracts are billed in the first quarter. It is therefore more relevant to look at the semi-annual cash flow, which has increased by 9% compared to last year, which emphasizes the financial health of the company.

Last week we wrote an extensive analysis about Asseco Poland (you can read it back here).

Asseco Interests Not Yet Fully Consolidated

The investment in Asseco Poland is of great importance for the future of Topicus. The company's current interest in Asseco is classified as a Fair Value in Comprehensive Income (FVOCI) investment, which means that it is seen as a long-term investment and not yet as a subsidiary. As a result, the unrealized profit due to the increase in the share price is included in the books, but the underlying P&L results of Asseco are not yet consolidated.

The planned acquisition of an additional 15% of Asseco's shares is expected to be completed in Q3. At that time, Topicus will likely also take board seats, which will change the classification and Asseco's P&L results will be included in Topicus' consolidated figures. RBC Capital Markets estimates that with the current interest, revenue growth year-on-year in the second quarter would already have been around 33%, and with the additional 15% this would even increase to a growth of approximately 53%.

A Still Attractive Future Outlook

In the second quarter, a significant amount of capital of EUR 220 million was deployed, marking the third highest quarter in the company's history since the IPO. With the EUR 36 million deployed after the quarter and the expected completion of the second investment in Asseco Poland in Q3, total capital deployment for 2025 is estimated at EUR 775 million, an increase of 18% year-on-year. This substantial deployment of capital is supported by a strong balance sheet and additional financing capacity, allowing Topicus to continue to actively consolidate in fragmented vertical software markets in the coming quarters.

In an investment memo from Seeking Winners it is stated that with expected revenue of approximately EUR 1.7 billion this year, the company is still only touching about 2% of its total addressable market. In comparison, parent company Constellation Software is around 3.4%. This difference especially highlights how much growth potential is still open to Topicus, both autonomously and through further capital allocation.

The half-year figures confirm that the company is able to accelerate its growth without compromising on quality. The cash flow remains predictable, the allocation of capital is tight, and with the investment in Asseco, a strategic lever has been added that will directly add extra value. This means that Topicus is not only facing a strong end to 2025, but also a long period in which compounding and scaling will be central.

Topicus.com Inc. is currently traded on the Toronto Stock Exchange at a price of CAD 173 per share.

Alphabet: More Than Just Google Search

In recent months, there has been much discussion in the market about the future position of the American investment holding Alphabet (New York: GOOGL), particularly the impact of generative AI on the core activity of Google Search. The analysis by Luc Kroeze, entitled "Google Search: End of an Era or Beginning of a New Chapter?", offers a valuable contribution to this debate. We recognize the complexity he outlines in predicting and valuing the future of a dynamic company like Alphabet. For us, however, this complexity is not an obstacle, but rather an opportunity to create a competitive advantage through in-depth analysis.

Our View on the Valuation of YouTube and Waymo

Our own analysis and valuation models come to similar conclusions about the strength of Alphabet, but we take a different approach on a few crucial points. For example, we see the assumption of a 5-year compound annual growth rate (CAGR) of 12.5% for YouTube as too conservative. Historically, YouTube has achieved an average annual growth of almost 20% in recent years.

In our opinion, given its dominant position and the loyalty of its users, YouTube is better compared to platforms such as Netflix, but with an even stronger 'moat'. Where Netflix is used almost exclusively for entertainment, YouTube is a platform that is also indispensable for gathering specific information in the form of shorter content (such as educational videos, tutorials, or news). The daily use of YouTube by a broad audience makes it a fundamental part of digital life, and in our opinion, that justifies a more optimistic growth forecast.

We also differ in opinion on the valuation of the company's 'other bets', including Waymo. We believe that omitting these future and current assets in the valuation does not give a complete picture. Although the costs are included, a valuation of zero ignores the significant potential and technological advantage. Within our sum-of-the-parts analysis, we therefore include a conservative, but realistic valuation, in order to correctly reflect the future and current value of these innovative subsidiaries, without setting expectations too high.

AI Does Not Cause Cannibalization But Complementarity

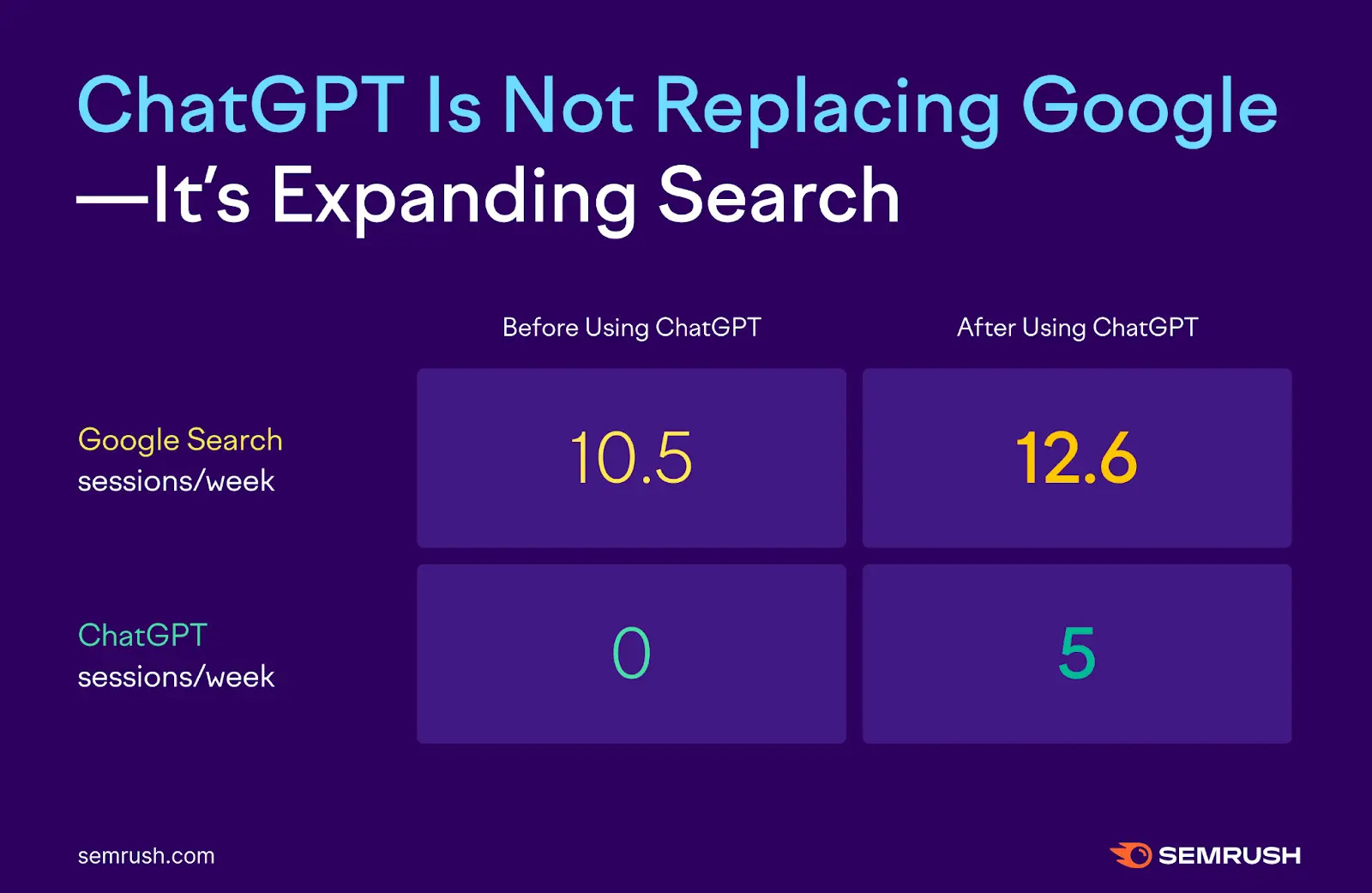

The core question about the extent to which AI will disrupt the search market is partially answered by the recent, extensive study by Semrush. The research, based on the analysis of more than 260 billion rows of clickstream data, shows that there is no cannibalization, but complementarity. The study concludes that the total search activity of users is increasing, with people adding ChatGPT to their existing information needs, without this being at the expense of their use of Google Search. This confirms our view that Google Search retains its dominant position and at the same time has the potential to further develop in the new AI landscape.

Recent Deal with Meta Confirms Our View

Finally, a recent, positive news item has further strengthened our belief in Alphabet's strategic position. The contract of more than USD 10 billion that Meta Platforms has concluded for their cloud services with Google is a remarkable victory. The choice of a tech giant like Meta for Google Cloud over established market leaders such as Amazon and Microsoft highlights the technological superiority and increasing confidence in Google's cloud infrastructure.

This strong sentiment and the broad base of Google Search, YouTube, Google Cloud and the countless other companies, underlines our belief in the lasting value and growth potential of Alphabet. We see it as a fundamental investment in the heart of the digital economy.

Alphabet is currently traded on the New York Stock Exchange at a price of USD 203.59 per A-share.

Receive weekly insights in your inbox

Exclusive analyses and updates on family holdings and global market developments.

Would you like more information about our services? Please feel free to contact us.

Contact us

Disclaimer:

No rights can be derived from this publication. This is a publication of Tresor Capital. Reproduction of this document, or parts thereof, by third parties is only permitted after written permission and with reference to the source, Tresor Capital.

This publication has been prepared by Tresor Capital with the utmost care. The information is intended to be general in nature and does not focus on your individual situation. The information should therefore expressly not be regarded as advice, an offer or proposal to purchase or trade investment products and/or purchase investment services nor as investment advice. The authors, Tresor Capital and/or its employees may hold position in the securities discussed, for their own account or for their clients.

You should carefully consider the risks before you begin investing. The value of your investments may fluctuate. Past performance is no guarantee of future results. You may lose all or part of your investment. Tresor Capital disclaims any liability for any imperfections or inaccuracies. This information is solely indicative and subject to change.

Read the full disclaimer at tresorcapitalnieuws.nl/disclaimer .