Family Holdings #35 - Exceptional leadership and MBB's strength in energy & cybersecurity

This week's topics:

Berkshire Hathaway rejects a major railway merger between BNSF and CSX and opts for capital-efficient collaboration. At the same time, capital is being deployed in Japan, where stakes in large, undervalued trading houses are being further increased.

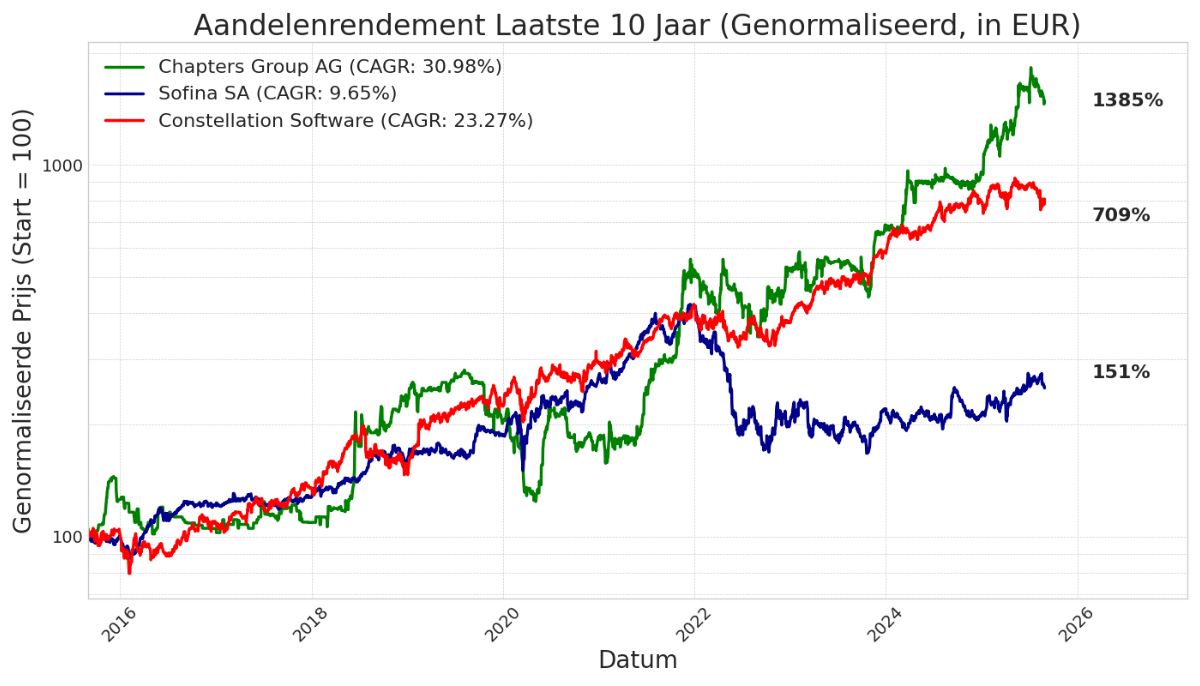

The German serial acquirer Chapters Group has been transformed into a promising 'compounding machine' thanks to its unique model. It combines a smart financial structure and a scalable, decentralized organization with a strong focus on attracting top entrepreneurs who get 'skin in the game'.

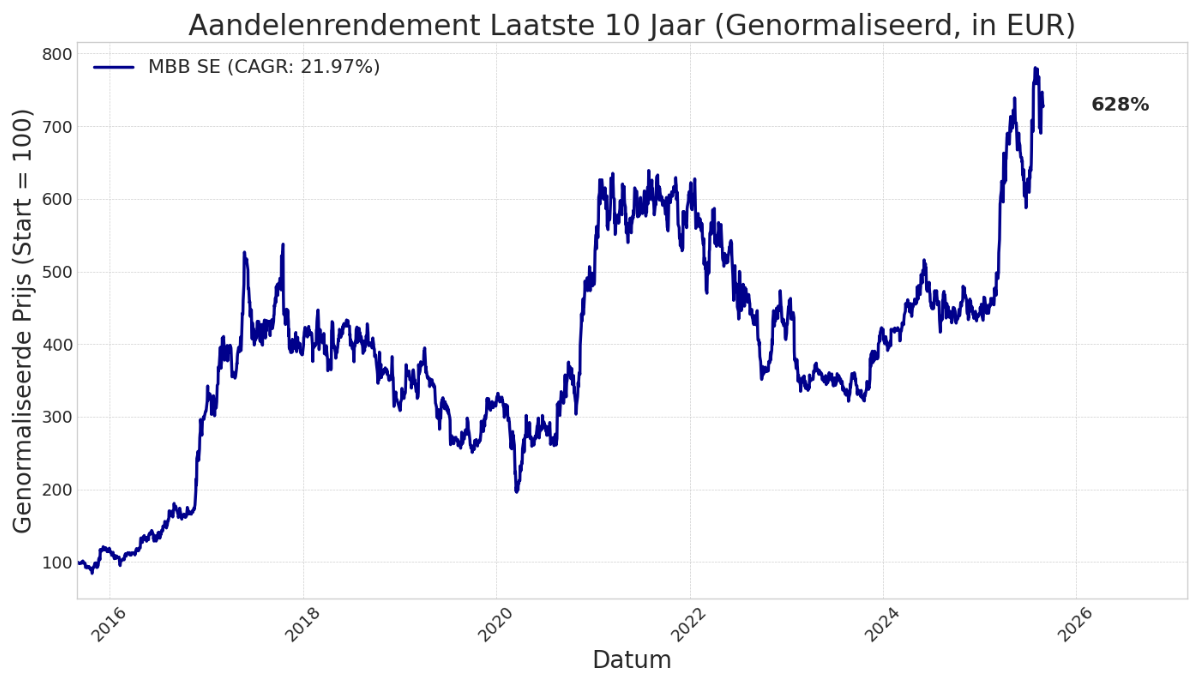

MBB reported strong results for the first half of the year, entirely driven by its subsidiaries Friedrich Vorwerk (energy transition) and DTS (cybersecurity). These performances compensated for the headwinds in the cyclical segments, while management actively managed its portfolio with strategic share sales. The holding remains significantly undervalued on a 'sum-of-the-parts' basis and has a very strong balance sheet with a substantial net cash position.

In Brief:

Chapters Group (Frankfurt: CHG) has acquired Somentec Software through its platform company Altamount Software. Somentec, based in Langen and with approximately 100 employees, has been a reliable software partner for energy companies and municipal utilities for more than 30 years. The company provides specialized solutions for billing, customer management and digital services in the energy sector.

For Chapters, this means another important step in the active buy-and-build strategy. CEO Jan Mohr added that the transaction was made possible in part by the bond issue of a few weeks ago, with which the group is now immediately investing in further profitable growth.

Constellation Software (Toronto: CSU) is continuing its acquisition strategy at a rapid pace. With three recent acquisitions in the final days of August, the total for 2025 now stands at 59 acquisitions. These transactions once again demonstrate the global reach of the model: in Norway, Maze Feedback, a supplier of customer experience software used by retail chains to measure customer satisfaction and improve staff retention, was acquired.

In addition, New Zealand-based Sportsground, the country's largest sports management platform providing online registrations and competition management tools to sports clubs and schools, was acquired. Finally, in Brazil, Projectus TI, a developer of ERP software for business administration, payroll processing, and accounting, was acquired.

Sofina (Brussels: SOF) remains in the news with two significant developments in its portfolio. ByteDance, the parent company of TikTok and Sofina's largest holding, achieved a 25% revenue growth in the second quarter to USD 48 billion, making it the world's largest social media group by revenue. Through a new share buyback program, ByteDance is now valued at USD 330 billion, an increase of 5.5% compared to six months ago.

In addition, Sofina realized an exit in the medtech sector. OrganOx, an Oxford spin-off specializing in technology for safer liver transplants, was sold to Japan's Terumo for EUR 1.3 billion. Sofina had participated in a capital round at OrganOx earlier this year, but the exact size of its stake is not publicly known.

Chapters Group, Constellation Software, and Sofina ended the trading week on the Frankfurt, Toronto, and Brussels stock exchanges at a price of EUR 39.40, CAD 4,550.34, and EUR 258.50 per share, respectively.

Leadership as the key to value creation

On X (formerly Twitter), Sidecar Capital recently shared an extensive reflection on identifying management quality within companies (view the full post here). A crucial investment principle for long-term investors, but less straightforward in practice than it sounds. After all, financial figures are easy to find and measure, but the quality of a management team cannot be captured in a spreadsheet. Yet, it is often precisely that which proves to be the decisive factor for sustainable value creation.

Sidecar makes a striking comparison with Van Halen's famous "no brown M&Ms" clause. The requirement that there should be no brown M&Ms backstage was not a sign of arrogance, but a test: if the organizer did not pay attention to that, then the technical safety details had to be double-checked.

It works the same way for investors. As shareholders, we are outside the boardroom and do not see how decisions are made daily. What we do get are indirect signals: the tone in shareholder letters, the way of communicating, the choices around capital allocation. It is those small indications that show whether a management team is reliable, pragmatic, and long-term oriented.

Sidecar itself gives a number of concrete examples of this. For example, he points to the language in press releases: are results presented factually, or colored with superlatives such as 'strong results' in the headline? Another signal that Sidecar mentions is frugality. He cites the example of Heico, a leading serial acquirer that deliberately operates from an inconspicuous office building. These kinds of details betray a focus on efficiency and shareholder value, not on outward appearances.

At Tresor Capital, we fully agree with this perspective. The core is that none of these signals is decisive on its own. It is about them, taken together, forming a consistent picture of the character and priorities of the management. It is precisely that collection of small 'brown M&Ms' in the business operations that determines whether a company is worth your capital in the long term.

To make this principle tangible, we highlight two recent examples of leadership that we consider exceptional.

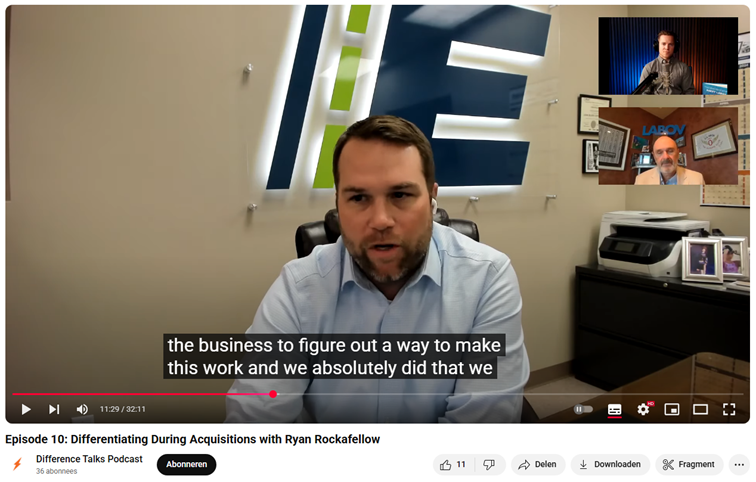

EnTrans CEO Ryan Rockafellow

In a podcast interview EnTrans CEO Ryan Rockafellow gave an insight into his way of leading. Asked about his approach, he says: "We had to change the mentality from 'I work for Heil' or 'I work for Polar' to 'I work for EnTrans'. The only way to do that is to be very open and honest about the future."

He describes how he successfully brought together Heil Trailer and Polar Tank, two brands that had fiercely competed with each other for decades, without losing the unique value of either brand. Efficiency was pursued where possible, but distinctive product features that were essential for customers were retained. That sent a clear signal: at EnTrans, the long-term relationship with the customer takes precedence over short-term optimization.

Rockafellow also opted for clear communication towards employees. The message was that the merger would result in more production, more market share, and more opportunities. That gave confidence and ensured that people who had been on opposite sides for years jointly supported the new course. The result is impressive: a market share of around 50% in the North American tank trailer market and three consecutive record years.

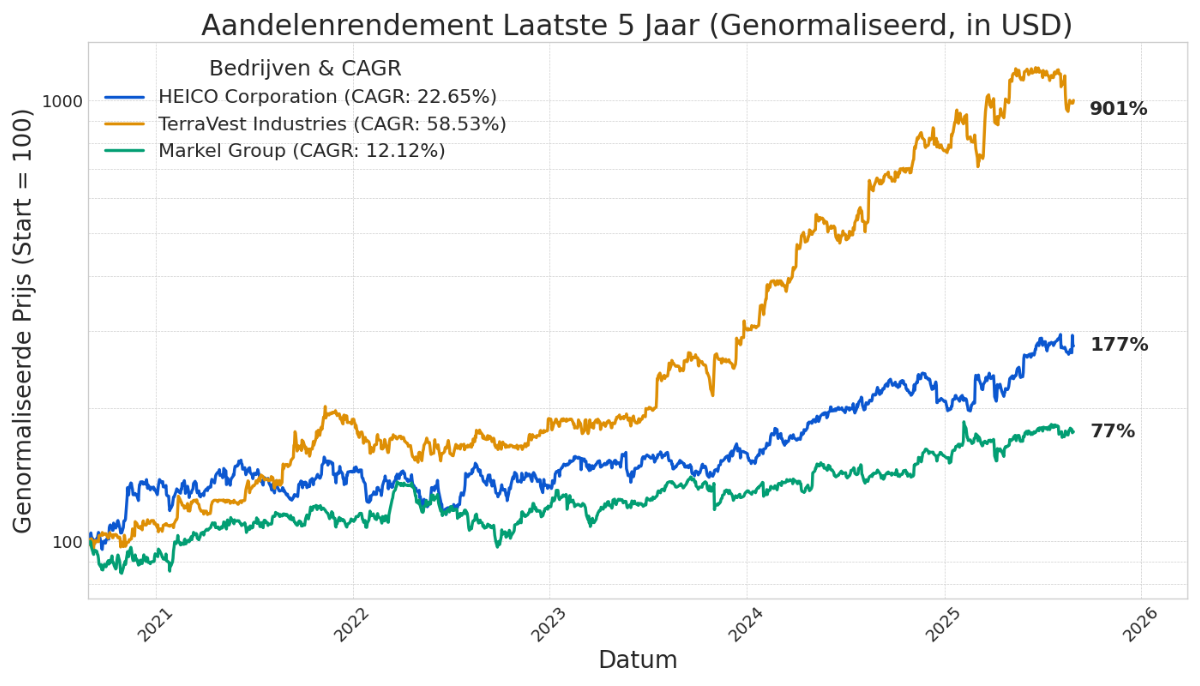

For us as a shareholder of TerraVest (Toronto: TVK), it confirms that Rockafellow and his team possess rare integration skills and a deeply ingrained culture of improvement that is strongly reminiscent of the famous Danaher model, with an incessant focus on Kaizen-like, continuous improvement. This culture is reflected, for example, in an incessant focus on shortening the turnaround time, which directly leads to higher efficiency and customer satisfaction.

The combination of proven integration strength and a strongly embedded culture is exactly what we look for in exceptional leadership. We are therefore very positive about the value that this team will add to the TerraVest platform, both in terms of autonomous growth and in future acquisitions.

Markel CEO Tom Gayner

Tom Gayner also showed in a recent interview with Barron's what we understand by exceptional leadership. Gayner gave several signals that are crucial for us as investors to assess management quality. For example, he literally asked the question: "Would you rather have a lumpy 15% or a smooth 10%?" For Gayner, the answer is clear. His priority is not to cosmetically smooth out quarterly results, but to create real value in the long term, even if that involves volatility along the way.

We consider the way Gayner communicates to be at least as important. Where many directors hide behind promotional language, he opts for simple wording that gets to the heart of the matter. His explanation of insurance as a 'bucket of money' is a good example of this: premiums come in, claims go out, and the art is to manage the balance efficiently. It sounds simple, but the thought behind this comparison shows that he keeps the essence sharply in mind.

This way of thinking is crucial: it shows that he does not see the company as an abstract entity, but as a practical system in which he, as owner, manages the capital of shareholders. Gayner does not mince words, nor does he make things unnecessarily complex. This is also evident from the way in which he openly acknowledges that the insurance division has performed disappointingly in recent years and clearly explains which measures have been taken.

For us at Tresor Capital, these are precisely the signals that confirm that we are dealing with a high-quality management team. Gayner shows that he does not shy away from difficult decisions, that he is consistent in his long-term vision, and that he looks after the interests of shareholders in a sensible manner. This approach of radical transparency, in which setbacks are openly acknowledged and solutions are clearly explained, strengthens our confidence that Markel (New York: MKL) can successfully manage the current repositioning.

Heico, Markel, and TerraVest ended the trading week on the New York and Toronto stock exchanges at a price of USD 245.01, USD 1,959.06, and CAD 144.17 per share, respectively.

Berkshire: No merger for BNSF and CSX, but more capital to Japan

The past week offered an illuminating look into the strategic thinking of the American investment holding company Berkshire Hathaway (New York: BRK-B). While the market was buzzing with rumors of a monumental acquisition in the American railway sector, Warren Buffett and Greg Abel opted for a pragmatic collaboration. At the same time, on the other side of the world, in Japan, capital was indeed deployed to further increase positions in carefully selected trading houses.

BNSF and CSX: Collaboration Instead of Acquisition

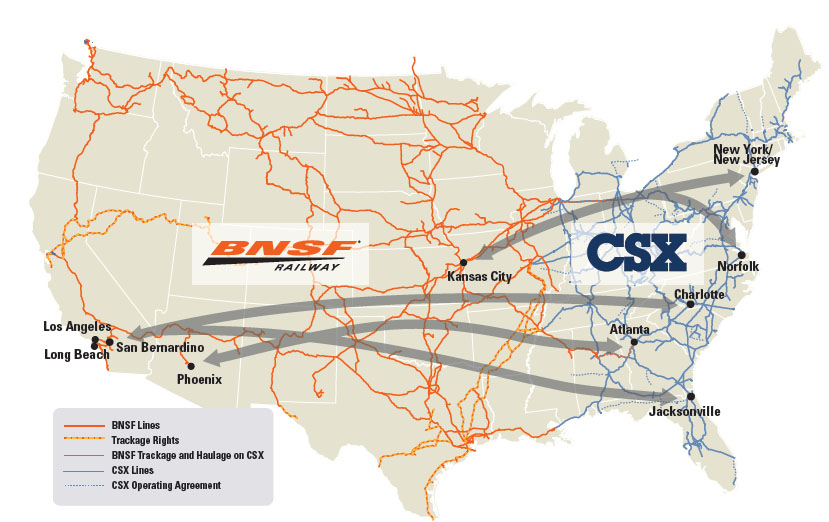

The American railway sector was recently shaken up by the announcement of a surprising merger proposal between Union Pacific and Norfolk Southern, aimed at creating the first coast-to-coast railway operator. This strategic move was the direct catalyst for widespread speculation in the market: analysts and investors overwhelmingly assumed that BNSF, the railway giant in Berkshire's portfolio, and competitor CSX were under pressure to respond with their own merger in order not to be left behind.

However, this speculation was resolutely nipped in the bud last Monday. In an interview with CNBC, later confirmed by a spokesperson, Warren Buffett made it clear that Berkshire is not interested in acquiring CSX. The market's reaction was immediate: CSX shares fell by 5% as investors' hopes for an acquisition premium evaporated.

Instead of a capital-intensive and complex-to-integrate merger, the companies revealed the true nature of their recent discussions: a more intensive collaboration. Last Friday, BNSF and CSX already announced a new Intermodal Service Agreement. This agreement creates new direct coast-to-coast services and significantly strengthens their joint freight network. Buffett confirmed that he and his intended successor, Greg Abel, spoke with CSX CEO Joseph Hinrichs on August 3 to shape this collaboration, explicitly stating that a bid for CSX was not on the table.

From our perspective, this is a classic Berkshire move. The management chooses to realize the synergistic benefits of a combined network without the risks and the enormous capital expenditure of a full acquisition. It is a pragmatic solution that increases operational efficiency and protects shareholder value, an approach that we highly appreciate.

Berkshire Increases Stakes in Japanese Trading Houses

While Berkshire is keeping its hand on the purse strings in the US when it comes to mega-acquisitions, well-considered investments are being made in Japan. On Thursday, it was announced that Berkshire had increased its stake in Mitsubishi Corp. to above 10% and had also further expanded its position in Mitsui & Co. This step is a continuation of a strategy that was initiated five years ago: building significant stakes in the five largest Japanese trading houses, the so-called sogo shosha.

The investment case in these Japanese conglomerates is based on a double conviction: a flourishing Japanese economy and a corporate culture that is becoming increasingly shareholder-friendly. The sogo shosha are deeply intertwined in the entire economy, with interests ranging from energy and food to aerospace and logistics. When the Japanese economy grows, these companies benefit optimally.

This appeal is underscored by Morningstar analyst Michael Makdad in a recent article by Barron's. He states that these companies are actively working to increase dividends and buy back their own shares, while still trading at an undervaluation of more than 20%. This combination of economic exposure, an increasing focus on shareholder returns, and an attractive valuation perfectly aligns with Berkshire's investment philosophy.

The events of the past week show a clear picture of discipline and patience. In the United States, Berkshire refuses to participate in the market-driven merger frenzy and opts for a smarter, more capital-efficient solution. In Japan, where the combination of value and a positive evolution in corporate governance is present, capital is indeed deployed purposefully.

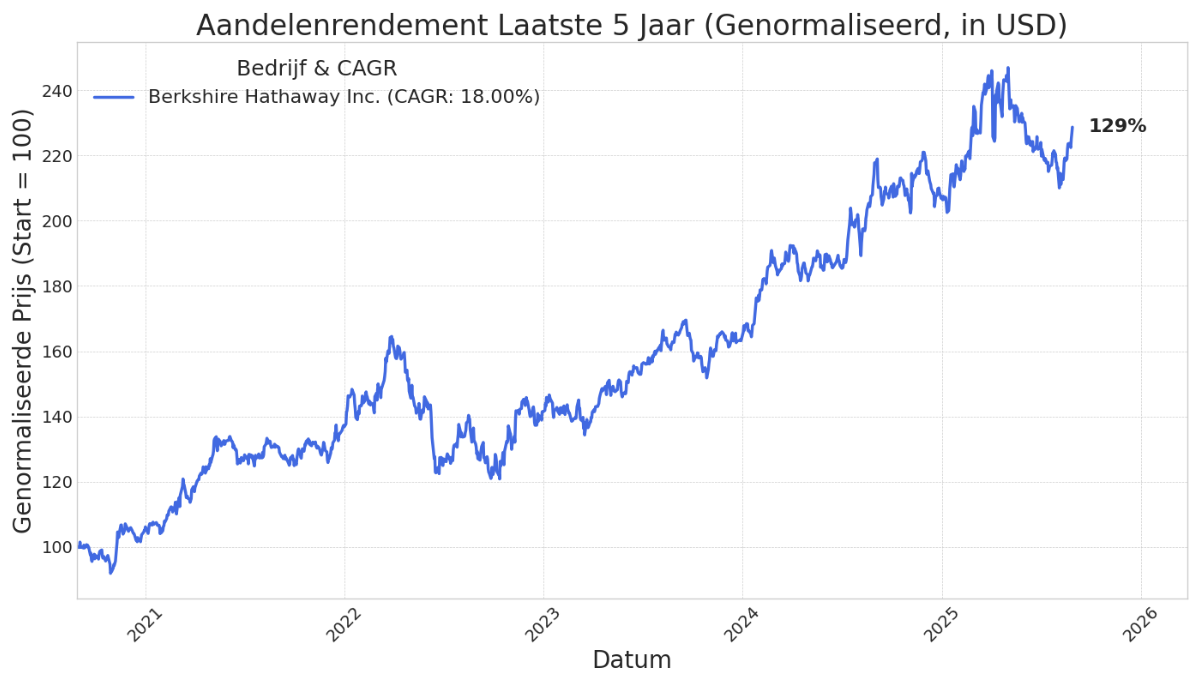

Berkshire Hathaway ended the trading week on the New York Stock Exchange at a price of USD 502.98 per B-share.

Receive weekly insights in your inbox

Exclusive analyses and updates on family holdings and global market developments.

Analysis: The architecture behind Chapters Group's compounding machine

A recent analysis of the German investment holding company Chapters Group (Frankfurt: CHG) by RollUpEurope offers a clear view of the engine behind the company's success. The analysis confirms the well-known success story, but its origin is at least as telling.

It starts in 2018. The company is then still called Medical Columbus, a struggling software micro-cap that is about to liquidate. It is Jan-Hendrik Mohr, then a young fund manager with a stake in the company, who convinces the management of a radical change of course: invest the proceeds in the 'search fund' model. This crucial moment lays the foundation for the company as we know it today.

The core of the success rests on three pillars. The first is the ingenious financial structure, aptly described as a "layer cake". In essence, Chapters Group applies proven principles of leverage and multiple expansion, but within the superior structure of permanent capital.

The head office raises capital and channels it to the operational platforms. As soon as the cash flows allow, they refinance this with cheaper bank loans, which maximizes the return. An important strategic shift in this is the increasing use of 'bullet' loans. These minimize the repayment pressure in the first years, allowing cash flows to be reinvested directly in new acquisitions. This significantly accelerates the compounding effect of the flywheel.

The second, and perhaps most important, pillar is the focus on human capital. Chapters Group is essentially a machine that excels at identifying, financing, and facilitating entrepreneurial talent. A clear overlap is visible here with successful serial acquirers such as Danaher. It is not without reason that Mitch Rales (co-founder of Danaher) and Will Thorndike (author of "The Outsiders") are shareholders, which brings with it an enormous source of expertise and credibility.

By giving entrepreneurs a significant minority stake of approximately 20% in their own platform, a perfect alignment of interests (skin in the game) is created. The success of the first platforms, such as Ookam, is living proof that this works. This is underscored by the fact that the founders of Ookam have now sold their 20% stake for a very substantial amount.

The remuneration structure is unique due to the addition of a put-call option. This gives platform leaders the opportunity to later convert their stake into shares in Chapters Group itself. This creates a double incentive: both for local entrepreneurship in the short term and for the total value creation of the group in the long term.

The third pillar is the decentralized organizational structure. In contrast to centralized models, the M&A process is run entirely by the platforms themselves, which makes the model fundamentally scalable.

This allows the management team at the holding level to concentrate on what really matters at the highest level: capital allocation and the dissemination of best practices. Chapters thus creates a model that combines the best of both worlds: the entrepreneurial freedom of a decentralized approach, but within a central framework of proven methods. This avoids both the chaos of a completely loose structure and the rigidity of a top-down managed model.

As we already indicated in our earlier analysis "Chapters Group: A Promising Software Compounder", the focus on the fragmented European VMS market is a strategic advantage. This is reinforced by the implementation of the 'Manuscript Method', a concrete machine to unlock latent profit in the spirit of the Danaher Business System.

A striking example of this, described in our "Deep Dive: More Than Just a German Constellation Software", is the anecdote of COO Marc Maurer who advised a subsidiary to increase prices by 84%. The result was 0% customer churn, which demonstrates the enormous, unrealized pricing power that is now being systematically unlocked.

The strategy is clear and its execution is what distinguishes Chapters Group as one of the most promising serial acquirers in Europe. Together with Asseco Poland, Constellation Software, Topicus.com, and a recent addition (which we are only sharing with our clients for the time being), we consider Chapters Group to be an integral part of the software group within our family holding strategy.

Chapters Group ended the trading week on the Frankfurt Stock Exchange at a price of EUR 39.40 per share.

The unprecedented power of infrastructure and cybersecurity: How Vorwerk and DTS are driving MBB's growth

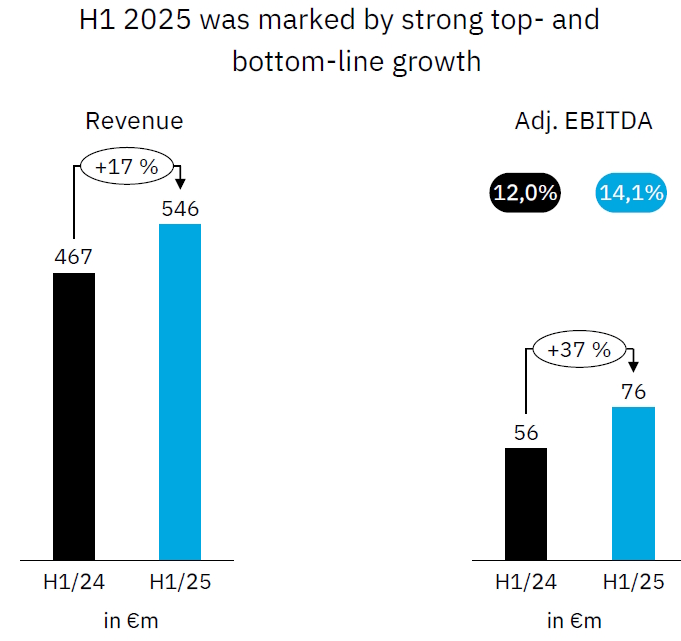

The German investment holding company MBB SE (Frankfurt: MBB) has presented its results for the first half of 2025, and the figures show impressive strength in the core of the company, which more than compensates for the weakness in more cyclical end markets. Consolidated revenue increased by a robust 16.8% to EUR 545.5 million, but the real story lies in the underlying profitability.

Operating profit (EBITDA) jumped by no less than 36.8% to EUR 76.4 million. This resulted in a margin of 14.1%, an increase of 2.1 percentage points and a "historic high for a first half year", according to CFO Torben Teichler during the explanation of the figures.

The driving force behind this strong performance was the second quarter, in which revenue increased by 9.2%, but operating profit exploded by an impressive 40.2% to EUR 46.5 million. This illustrates the operational leverage in the best-performing parts of the group.

The Service & Infrastructure segment, consisting of Friedrich Vorwerk and DTS, was the undisputed engine of the group. This segment saw revenue increase by 49% to EUR 361.6 million in the first half year and operating profit almost double with a growth of 95.4% to EUR 62.4 million.

Friedrich Vorwerk: The Pillars of the Energy Transition

Friedrich Vorwerk, specializing in critical energy infrastructure, was the absolute standout. In the second quarter alone, revenue grew by 45% to EUR 170 million, with an exceptionally strong operating profit margin of more than 21%.

According to Teichler, this is due to "smooth execution", less pressure on personnel resources thanks to successful recruitment, and "good progress on a number of mega-projects", specifically mentioning A-Nord and BalWin.

The prospects are supported by an order book of no less than EUR 1.1 billion as of June 30, 2025, and recently secured billion-euro contracts. Examples include the ETL 182 pipeline for LNG transport and a complex part of the SuedLink power cable, where Vorwerk's expertise in HDD drilling is crucial. This strong momentum led management to significantly increase the forecast for 2025 to revenue of EUR 610-650 million with an operating profit margin of 17.5-18.5%.

DTS: The Digital Fortress in a Growing Cyberwar

The digital world is in a state of escalating conflict. As The Economist recently emphasized, the rise of AI-driven hacking is transforming cybercrime from a niche activity into a widespread, industrial threat. Artificial intelligence "widens the reach" of hackers, allowing them to hit more targets with less effort. Generating deepfakes, personalized phishing attacks, and even self-adapting malware is easier than ever.

This growing threat is fueling explosive growth in the cybersecurity market. This global trend is confirmed in DTS's home market. According to the German industry association Bitkom, cited in MBB's own report, the market for security software is expected to grow by 11% in 2025. This is the powerful tailwind for DTS, MBB's specialist in this crucial field. DTS focuses in particular on IT security for the German Mittelstand, with a specialization in network access control.

DTS's performance is strong, with revenue growth of 20.6% to EUR 58.6 million in the first half year and an operating profit margin of 13.5%. A major highlight, and a "game changer" according to Teichler, was securing a five-year contract in the public sector with a value between EUR 20 and EUR 30 million. This is the largest order in DTS's history and serves as a "lighthouse project" that qualifies the company for larger, strategic assignments.

During the conference call, we asked about the strategy for margin expansion. Teichler explained that the focus is on increasing the share of its own, higher-margin software. The recent full acquisition of the remaining 19.66% in software subsidiary ISL Internet Sicherheitslösungen, making DTS now 100% owner, is a crucial step to accelerate this strategy. ISL functions as the "hub" for the development of proprietary software products.

Teichler expects that the operating profit margin can eventually rise from the current 13-15% as software sales grow disproportionately. He added that the 15% margin is certainly achievable, but that this level could rise even further depending on how quickly software sales pick up. In addition, acquisition opportunities that can accelerate this process are also being actively explored.

Headwinds in Cyclical Markets

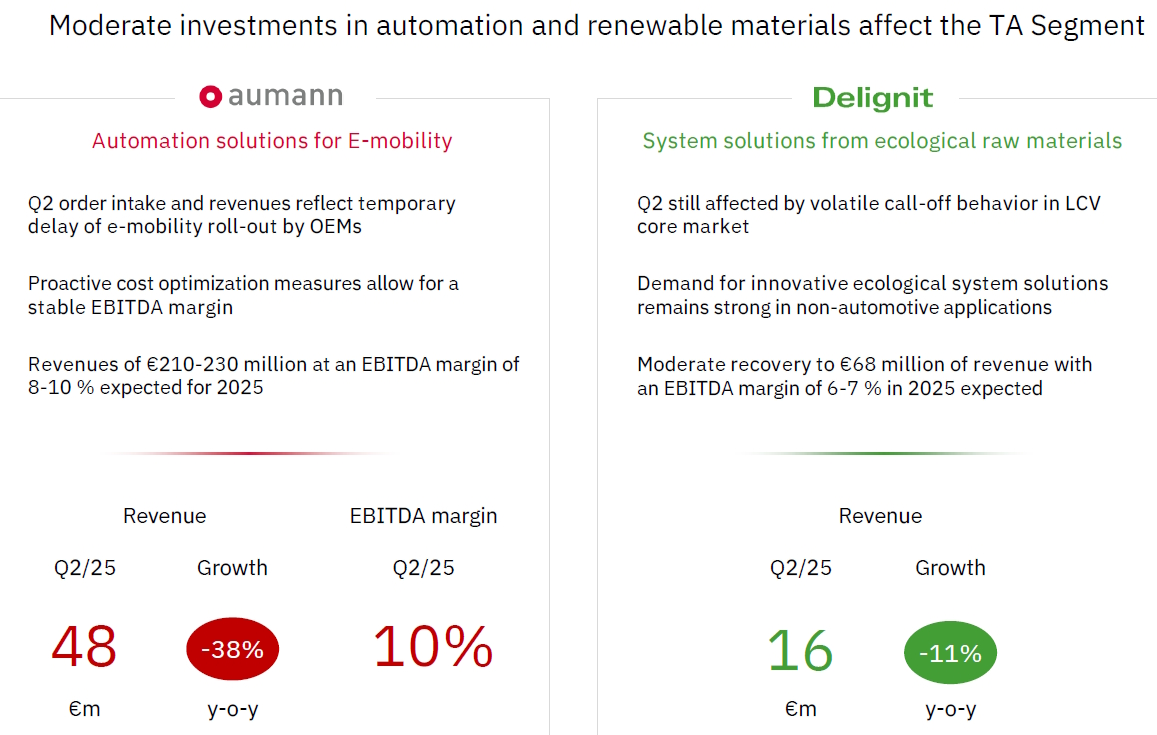

In stark contrast were the performances of the Technological Applications segment. Revenue fell by 20.3% to EUR 142 million in the first half year, mainly due to the reluctance in the automotive industry.

Aumann saw revenue fall by 23.4% to EUR 108.3 million, but managed to keep the operating profit margin stable at a respectable level of 10.8% through "proactive cost management". Although order intake in the automotive sector remains weak, the 'Next Automation' segment is growing by 20%, which underlines the successful diversification strategy.

The Next Automation segment represents Aumann's strategic diversification away from the traditional automotive industry. It focuses on automation solutions for growth markets such as clean tech, aerospace & defense, and healthcare. Despite the overall headwinds for Aumann, this segment shows a positive dynamic.

In the first half of 2025, order intake in Next Automation increased by an impressive 20.4% to EUR 21.9 million. This growth was supported by a major order in the clean tech domain, worth approximately EUR 4 to 6 million. The segment's order book also grew and amounted to EUR 47 million. This shows that the strategy to broaden is paying off and forms a buffer against the volatility in the e-mobility market.

The profitability of the segment remains robust with an operating profit margin of 13.5%. Aumann explicitly indicates that it wants to further accelerate the expansion of Next Automation, both organically and through targeted acquisitions. The underlying drivers for these markets, such as the energy transition (clean tech) and the modernization of defense, offer a structural tailwind in the long term.

The Consumer Goods segment also had to contend with weak consumer demand and start-up costs for new capacity at tissue producer Hanke, which resulted in an operating profit of only EUR 1.4 million, compared to EUR 4.2 million a year earlier.

Active Portfolio Management & Capital Allocation

A striking point in the half-year report was the sale of shares in all three listed subsidiaries.

During the earnings call, CFO Torben Teichler, in response to questions from Tresor Capital partner and co-owner Michael Gielkens, provided crucial context to these transactions. The sale in Friedrich Vorwerk, which reduced the stake to 48.55%, was primarily intended to increase the liquidity of the share. Teichler explained that MBB "had been approached by several banks" to do this because of the "strong interest from American investors" since its inclusion in the SDAX index.

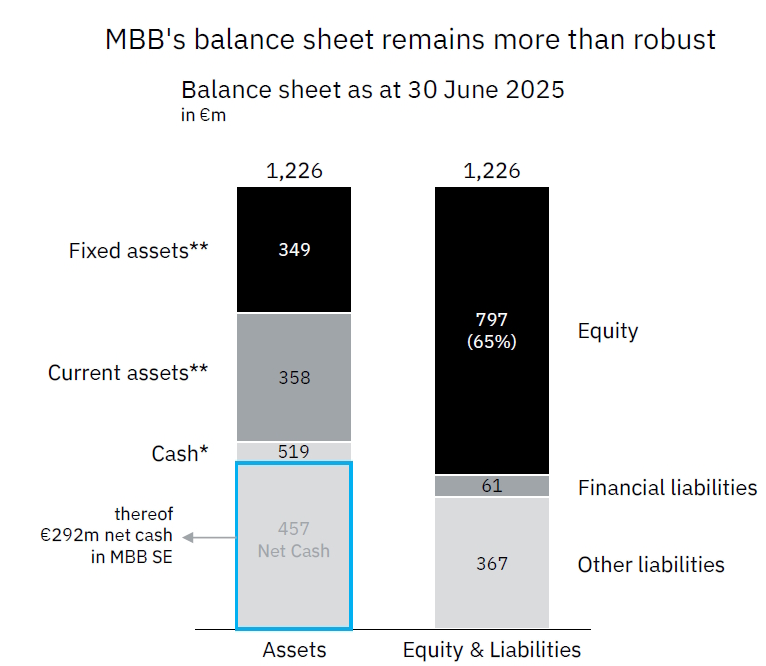

At Aumann, MBB participated in a share buyback program, which reduced the stake to 48.86%. These sales should therefore not be seen as a signal that MBB is preparing for a major acquisition, but as tactical moves to optimize the value of the subsidiaries on the capital market. With a "rock-solid" balance sheet, with a net cash position of EUR 457.4 million at group level, of which EUR 292 million at holding level, MBB is excellently positioned to take advantage of acquisition opportunities.

MBB's liquid portfolio consists of a large proportion of government bonds and corporate bonds, supplemented by a substantial equity portfolio. We asked Teichler whether MBB can be more transparent in the main positions they have in this (including Alphabet and Microsoft as top positions).

According to Teichler, this equity portfolio is largely a "large-cap blue-chip portfolio with a certain American focus", similar to what one might expect from a conservative institutional investor. The goal is to invest the money responsibly and generate returns until further acquisition opportunities or other ways to use the cash are found.

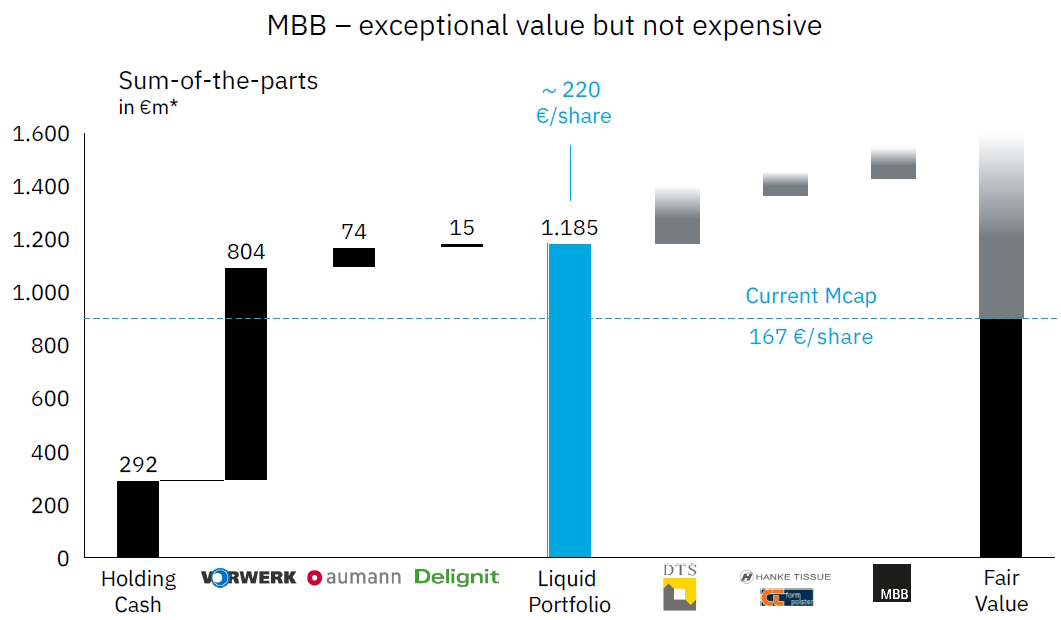

The intrinsic value of the holding company, as illustrated in the 'sum-of-the-parts' valuation in the company presentation, remains significantly higher than the current stock market price. The presentation shows a market capitalization of approximately EUR 167 per share, while the value of the liquid assets (cash and listed interests) alone amounts to approximately EUR 220 per share. This implies that the market is assigning a zero or even negative value to the rest of the portfolio, including the profitable and rapidly growing DTS.

MBB ended the trading week on the Frankfurt stock exchange at a price of EUR 164.60 per share.

Receive weekly insights in your inbox

Exclusive analyses and updates on family holdings and global market developments.

Would you like more information about our services? Please feel free to contact us.

Contact us

Disclaimer:

No rights can be derived from this publication. This is a publication of Tresor Capital. Reproduction of this document, or parts thereof, by third parties is only permitted after written permission and with reference to the source, Tresor Capital.

This publication has been prepared by Tresor Capital with the utmost care. The information is intended to be general in nature and does not focus on your individual situation. The information should therefore expressly not be regarded as advice, an offer or proposal to purchase or trade investment products and/or purchase investment services nor as investment advice. The authors, Tresor Capital and/or its employees may hold position in the securities discussed, for their own account or for their clients.

You should carefully consider the risks before you begin investing. The value of your investments may fluctuate. Past performance is no guarantee of future results. You may lose all or part of your investment. Tresor Capital disclaims any liability for any imperfections or inaccuracies. This information is solely indicative and subject to change.

Read the full disclaimer at tresorcapitalnieuws.nl/disclaimer .