Family Holdings #36 - Why Alphabet is winning the AI race and MBB is a bargain

This week's topics:

The German investment holding MBB SE combines a disciplined 'buy and hold' strategy with a hands-on entrepreneurial mentality, driven by the megatrends of energy transition and cybersecurity, and is traded by the market at a large discount that values the profitable unlisted companies at a negative value.

Despite weak quarterly figures due to market headwinds and uncertainty about US tariffs, a striking equity investment on the balance sheet of TerraVest hints at a possible, as yet unannounced, strategic acquisition.

In Brief:

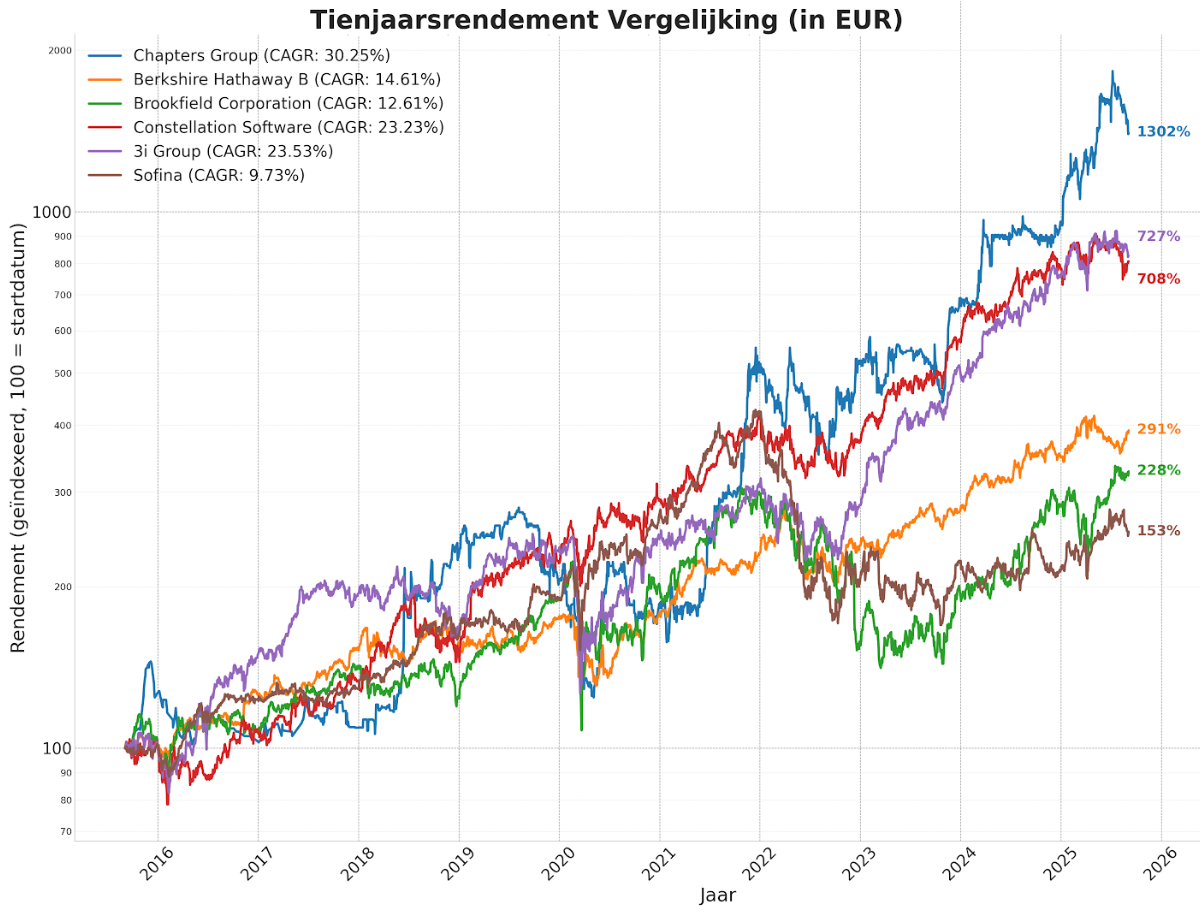

3i Group (London: III) is selling its stake in the German MAIT after a successful buy-and-build trajectory. Since the entry in 2021, 14 acquisitions were made, EBITDA doubled, and the share of recurring revenue grew significantly. With a return of 2.7x and an IRR of approximately 27%, the exit is one of 3i's most profitable investments in recent years. The new owner will be the holding company Deutsche Beteiligungs AG (DBAG).

Berkshire Hathaway (New York: BRK.B), with a 27.5% stake still the largest shareholder of Kraft Heinz, sees the announced split largely dismantling the "blockbuster merger" story of 2015. Warren Buffett expressed disappointment about this development. Despite years of support, the stock has lost almost 70% of its value since the merger. Regarding a possible exit, Buffett said that Berkshire will always act in the interest of the company itself and will not accept exceptional deals.

Brookfield (New York: BN), together with Sumitomo, SMBC Aviation Capital, and Apollo, is taking aircraft leasing company Air Lease off the stock exchange. The deal values the company at USD 28.2 billion (including debt). Air Lease owns 495 aircraft and is the fifth-largest lessor worldwide. The sector still benefits from high rental prices due to supply shortages. The transaction is expected to be completed in the first half of 2026, with Dublin as the new location.

Chapters Group AG (Frankfurt: CHG) has sold part of its stake in Software Circle plc, a British serial acquirer focused on niche software companies in the UK and Ireland. The stake decreases from 103.6 million to 83.9 million shares, leaving Chapters with 21.5% of the shares.

Constellation Software (Toronto: CSU) continues its acquisition strategy unabated. In the past week, several more deals were added, including Pixeon in Brazil (480 employees, active in healthcare IT) and BMF in Germany (specialist in data and software solutions for the automotive and e-commerce sector). This brings the number of transactions this year to 61 acquisitions.

Sofina (Brussels: SOF) continues to participate in the European AI race through its stake in Mistral AI. The French company raised EUR 2 billion in a new capital round at a valuation of approximately EUR 12 billion, more than double that of last year. Sofina already participated in previous rounds, making it one of the first institutional investors to support Mistral, alongside Nvidia and Andreessen Horowitz, among others. Thanks to this early involvement, Sofina directly benefits from the significant increase in value.

3i Group, Berkshire Hathaway, Brookfield, Chapters Group, Constellation Software, and Sofina are currently traded on the stock exchanges of London, New York, New York, Frankfurt, Toronto, and Brussels at prices of GBP 39.22, USD 499.05, USD 65.92, EUR 37.50, CAD 4,596.35, and EUR 252.60, respectively.

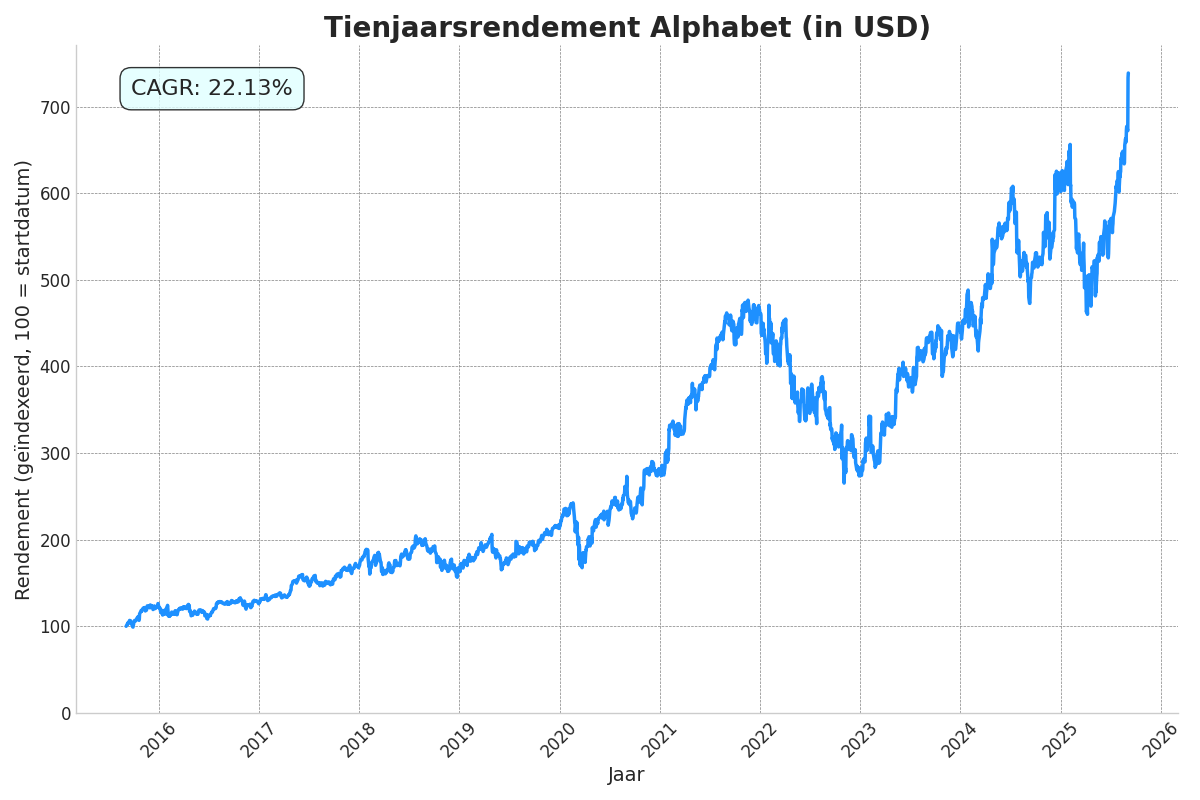

Lawsuits turn headwinds into tailwinds for Alphabet

It was an eventful week for the American investment holding company Alphabet (New York: GOOGL), the parent company of Google, YouTube, Waymo, and many other companies. A major legal victory in the United States was overshadowed by a multi-billion euro fine from Brussels. The conflicting developments paint a complex picture of the challenges and opportunities facing the company. On balance, the company's share price rose sharply. The following is an explanation.

Brussels Still Imposes Multi-Billion Euro Fine on Google

Where earlier this week there was speculation about a postponement, the European Commission has today imposed a harsh sanction in the long-running investigation into Google's dominance in advertising technology. The Commission is fining Alphabet EUR 2.95 billion for abusing its market power.

According to the regulator, Google has systematically favored its own online display advertising technology since 2014, to the detriment of competing ad tech companies and online publishers. The decision, which was originally scheduled for early this week but was briefly delayed, requires the company to present a plan within 60 days to stop the conflict of interest and the favoring of its own services.

The Commission also maintains its earlier position that a divestiture of business units remains a possible structural remedy. However, it will first await Google's proposals before considering further steps. In an initial response, Google called the decision "wrong" and announced that it would appeal.

Chrome Remains Google's Thanks to Gemini?

In addition to the European developments, there was also an important breakthrough in the United States this week. There, an antitrust procedure was underway regarding the question of whether Google illegally exploited its dominant position in online search and the associated advertising revenues to suppress competition. The Department of Justice (DOJ) had previously argued that Google effectively maintained a monopoly through exclusive contracts, bundling, and technical advantages.

In its ruling, the federal judge acknowledged that Google is still the clear market leader in search and online advertising, but concluded that the market has changed to such an extent that sufficient new competition has emerged through generative AI models. Names such as ChatGPT (OpenAI), Claude (Anthropic), and Perplexity AI were explicitly mentioned. These models are not yet fully-fledged general search engines (GSEs), but they are clearly moving in that direction.

Based on this, the court ruled that there is currently no reason to force Google to divest its Chrome browser or structurally split the organization. Instead of harsh remedies, the judge sees the market itself already moving towards more competition. The only concrete obligation imposed on Google is that the company must share data with competitors, so that a more level playing field is created.

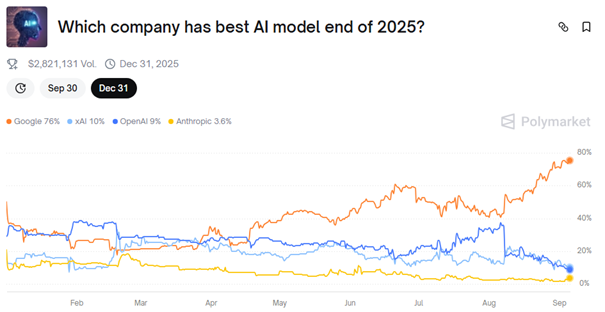

What makes the American judge's ruling so remarkable is that Google's own AI model, Gemini, has long been seen as the best model in the market. On platforms such as Polymarket, where thousands of investors and users price in their expectations, Gemini has been firmly at the top for months. At the end of August, Google's model is rated as having a more than 75% chance of being considered the best AI model by the end of 2025, far ahead of competitors such as xAI (10%), OpenAI (9%), and Anthropic/Claude (3.6%).

This creates a unique paradox. The judge concluded that "sufficient competition" is emerging due to the rapid rise of generative AI models, and used that as an argument not to force Google to divest Chrome. But within that group of models, Google's own Gemini is already seen as the market leader when it comes to the technical capabilities of the model. In other words, the competition that the judge identifies as a counterweight to Google's power in search is already partly dominated by Google itself.

Collaboration with Apple

This already strong position was further confirmed this week after Apple announced that it will launch its own AI-driven web search tool next year. This new functionality is initially intended to be integrated into Siri, and later also into Safari and Spotlight. The idea is to transform Siri from a simple voice assistant into a fully-fledged "answer engine."

On paper, this seems to be the prelude to direct competition with Google. But behind the scenes, the reality is different. Apple is currently testing a customized version of Gemini as the core technology for the new Siri summarizer, and is even considering using Gemini more broadly within the AI search architecture. This means that Google is not a competitor, but rather a partner in Apple's new AI strategy.

Revaluation of Stake in Competitor Anthropic

A final example of Alphabet's position as an AI leader comes via the GenAI model Claude, which was mentioned in the court ruling as one of the models that are increasing competition with Google. Claude is the AI product of the company Anthropic, which has quickly developed into a promising player in the sector.

The remarkable thing is that Alphabet also directly benefits here. The company owns approximately 14% of Anthropic, a stake that arose after an investment of an estimated USD 2.5 to USD 3 billion in 2023. So Google is not only facing Claude as a competitor, but is also earning money as a shareholder of Anthropic. And that is paying off: the recent capital round valued Anthropic at USD 183 billion, inflating Alphabet's stake to around USD 25 billion, a tenfold increase in just two years, accounting for almost 1% of the total market capitalization of the investment holding company.

That position is strengthened by the fact that Google has the largest database of video data in the world via YouTube. In a phase where AI models still have difficulty fully understanding and generating photos and videos, that is a huge advantage. This content can be used to further train and differentiate Gemini, with video as a potential new frontier for AI. In addition, Google has a unique position in the cloud: it is the only one of the three major providers (besides AWS and Microsoft) that has a leading internal AI model that can be brought directly to customers via its cloud applications.

We largely agree with the vision of Bill Ackman, who recently stated that Alphabet is increasingly convincingly monetizing its AI potential. From the AI Overviews in Search, which already reach billions of users, to the growth of Cloud with increasingly higher margins: Alphabet's moats are not getting smaller, but wider. The combination of models, proprietary chips, and distribution channels ensures an increasingly strong differentiation.

Through the potential collaboration with Apple, Gemini can also be integrated into hundreds of millions of iPhones and Macs. This not only ensures enormous exposure, but also habit formation among consumers. And in a market where the differences between models are hardly visible to the average user, it is precisely that habituation factor, the "stickiness," that will determine who the long-term winners will be.

Looking to the future, we consider the scenario outlined by @borrowed_ideas very realistic. The development of generative AI models is, and will likely remain, an extremely capital-intensive process. With the multitude of players, from ChatGPT and xAI to DeepSeek, Perplexity, and Claude, future price pressure seems almost inevitable. Margins will come under pressure and companies without deep pockets will disappear from the market. Ultimately, there is probably only room for two to three global leaders.

We are therefore convinced by these developments and opportunities that Alphabet with Gemini will be one of them. Despite the recent recovery of the share price to new all-time highs, we still see significant underlying potential. Alphabet combines unparalleled scale, access to unique datasets, and the financial muscle to not only survive this consolidation battle, but to emerge stronger.

Alphabet is currently traded on the New York Stock Exchange at a price of USD 233.22 per A-share.

Receive weekly insights in your inbox

Exclusive analyses and updates on family holdings and global market developments.

MBB: an entrepreneurial investment holding company

In the world of listed holding companies, few manage to combine the discipline of a capital allocator so seamlessly with the hands-on mentality of an entrepreneur. The German MBB SE (Frankfurt: MBB) is such a rare entity.

A recent interview with Executive Chairman, founder, and major shareholder Christoph Nesemeier and CFO Torben Teichler, held during the Hamburger Investorentage, offered a deeper insight into the engine room of this German holding company. It reveals a philosophy rooted in long-term thinking, operational partnership, and an almost stubborn refusal to be guided by the short-term whims of the market.

At the heart of MBB's success is a clear rejection of the mainstream private equity model of quickly buying and selling. "We have been a 'buy and hold' company since our founding," emphasized co-founder Nesemeier in the interview. "We have always kept the companies in the portfolio for the long term, because we are firmly convinced that a long-term development offers far more design possibilities than the short-lived 'in and out'. You also make a different commitment when you step into a company for the long term." This points to an active approach to 'buy and build'.

The most striking example is the evolution of Friedrich Vorwerk. After the acquisition, the company was first strengthened by the acquisition of its largest regional competitor, Bohlen & Doyen, creating an undisputed market leader. Subsequently, access to the capital market was sought via an IPO, not as an exit, but as an enabler. This market access provided the financial muscle to fully exploit the central role in the German energy transition, a capital-intensive megatrend. This methodology, identifying a solid base, strategically strengthening it, and then financing it for dominance in a growth market, is the essence of value creation by MBB.

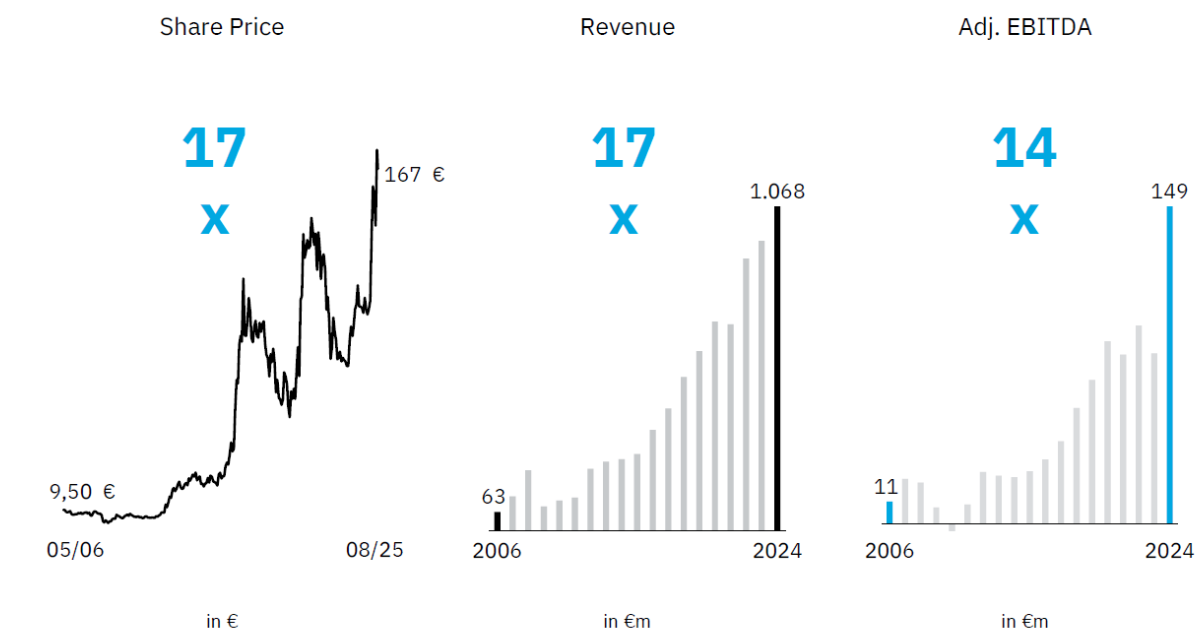

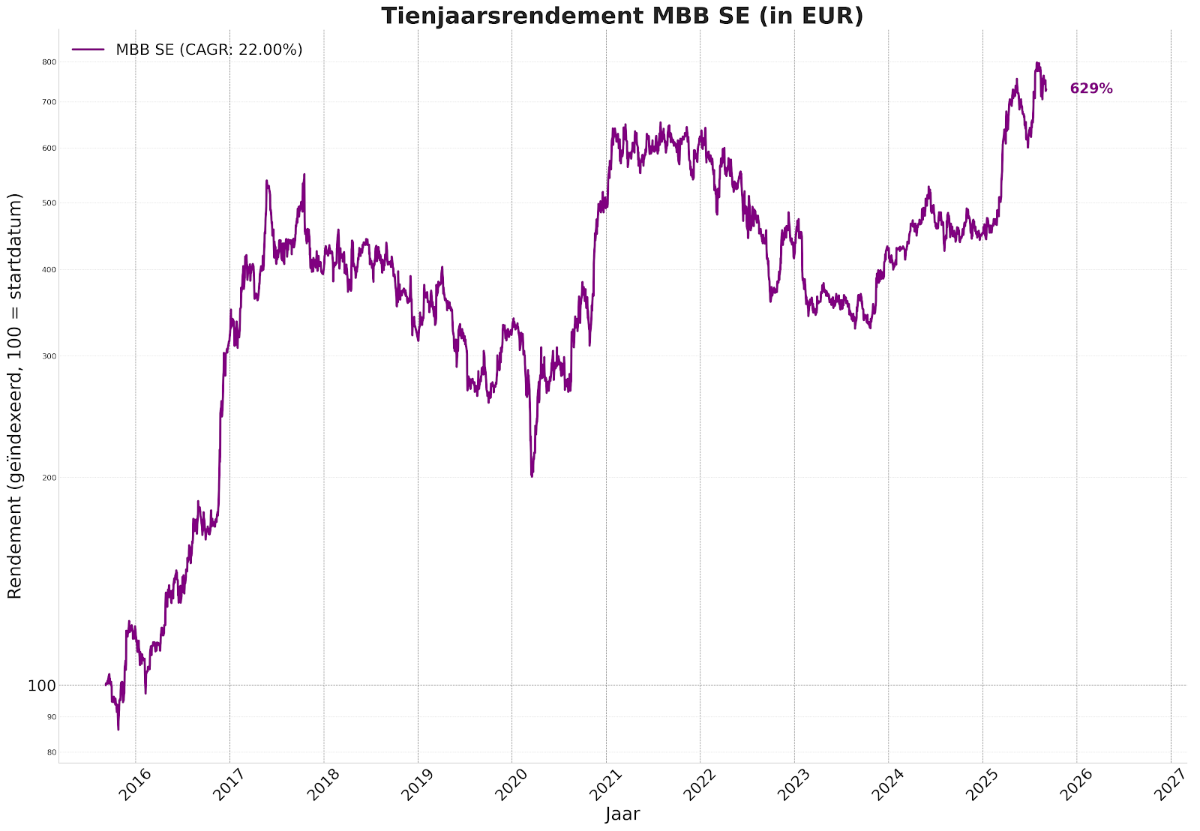

The results speak for themselves (see also the figure below): since the IPO in 2006, both the stock price and the revenue have grown by a factor of seventeen, and the operating profit by a factor of fourteen.

The Double Growth Engine: The Energy Transition and Cybersecurity

MBB's impressive performance in the first half of 2025, with revenue growth of 17 percent and a jump in operating profit of 37 percent, is driven by two powerful and sustainable trends. Friedrich Vorwerk is the architect of the Energiewende, while DTS IT is the digital fortress in a cyber war.

MBB's strategy rests on identifying and expanding positions in sustainable trends. Christoph Nesemeier explained the two current pillars in the interview. "MBB is in the fortunate position that with Friedrich Vorwerk we occupy a trend, the energy transition, that continues unabated and is even growing," he stated. "And with our joker DTS in cybersecurity, we also have a wonderful company that is developing fantastically."

CFO Torben Teichler added that DTS is gaining "enormous traction" with revenue growth of more than 20 percent and the securing of "large, great flagship assignments." These statements are supported by the hard figures: the Service & Infrastructure segment, which includes both companies, saw revenue increase by 49 percent in the first half of 2025, with Vorwerk reporting an order book of EUR 1.1 billion.

The Culture

What is one of the most distinctive factors is the operational culture of MBB. The head office in Berlin has only eleven employees. "We work together in a very collegial manner and in very flat hierarchies," CFO Teichler explained. "I believe that this is an aspect that makes us very fast and successful, especially in investment decisions. We can act quickly and operate like a speedboat, which many others in more complex structures simply cannot."

This agility is combined with the direct involvement of the founders and major shareholders, Nesemeier and Gert-Maria Freimuth, which enables fast, entrepreneurial decisions. This pragmatic culture is also reflected in their investment criteria. They consciously avoid sectors that they do not understand thoroughly. "You will never find an MBB that is suddenly active in biotech or venture capital," Teichler assured. "We like business models that we can understand with a healthy, intelligent common sense."

Sparring Partner

The true strength of the MBB philosophy manifests itself most clearly when subsidiaries such as Aumann and Delignit are confronted with headwinds from the automotive sector. Where a typical holding company would focus on cost reduction, MBB's message is fundamentally different. "We encourage them not to retreat depressively into a corner, but to attack precisely then, to pick up new trends, and as management to aggressively step into these themes," Christoph Nesemeier stated.

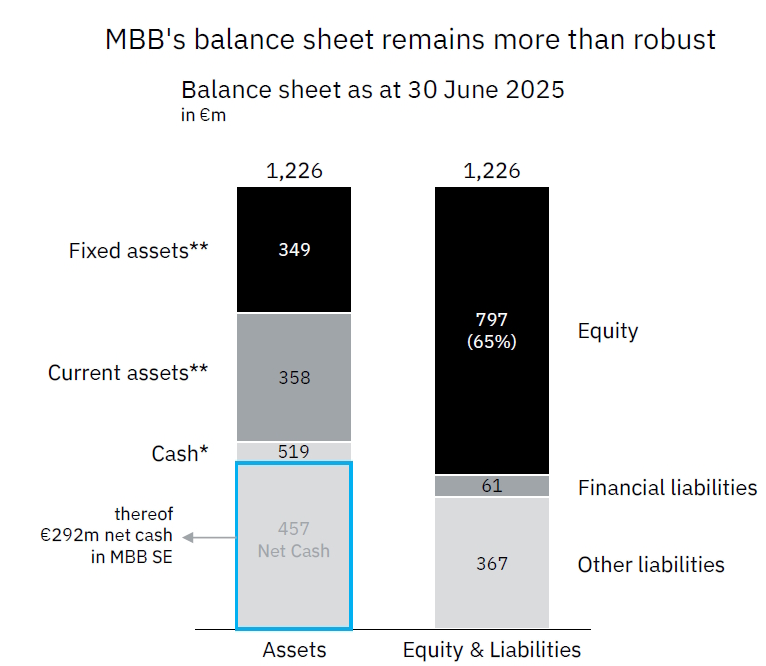

This anticyclical, entrepreneurial attitude is made directly possible by one of the most important pillars of the MBB structure: a rock-solid financial position. "We relieve our companies of the burden of negotiating a loan with a bank, because they are all so equipped on the capital side that they can save themselves that time."

That freed-up management time is not used to consolidate, but to innovate. A perfect example is the successful diversification at Aumann. While the automotive sector is weak, the 'Next Automation' segment, focused on growth markets such as clean tech, aviation & defense, and healthcare, is growing by 20 percent. This shows that the strategy of broadening is paying off and forming a buffer.

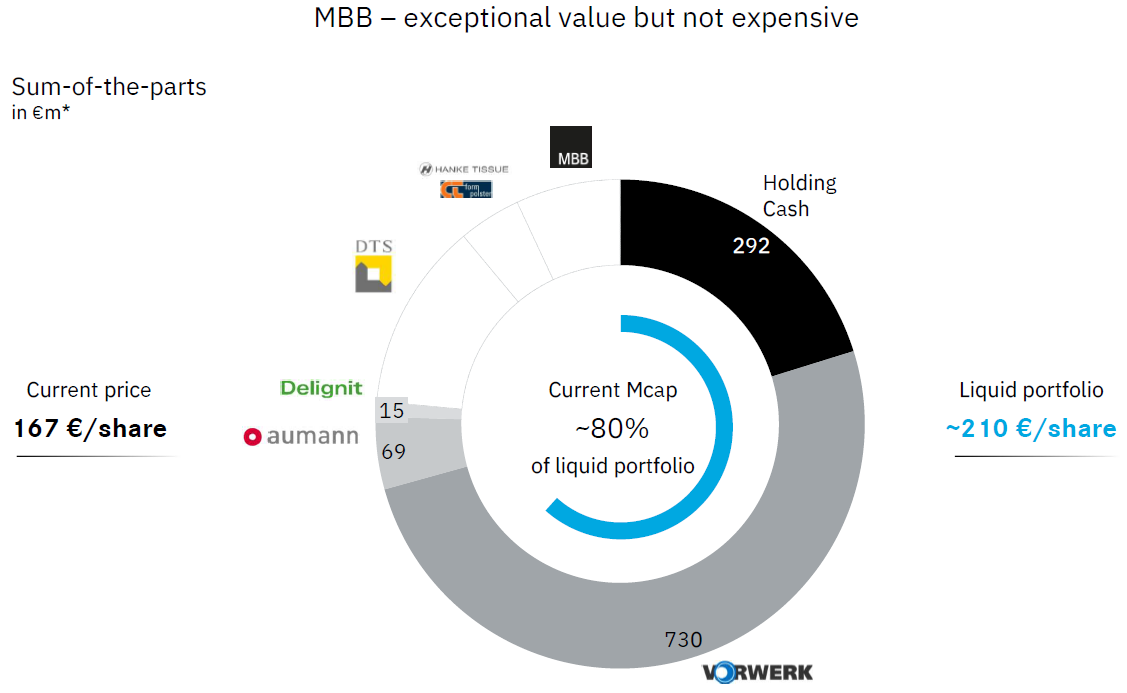

A sum-of-the-parts analysis, which is supported by the calculation in MBB's own presentation, quantifies this discount. The stock price on August 28 of EUR 167 per share is significantly lower than the value of the liquid assets alone. The EUR 292 million in cash at holding level and the market value of the stakes in Vorwerk, Aumann, and Delignit together form a liquid portfolio of EUR 1.1 billion, which amounts to approximately EUR 210 per share.

For investors who are willing to look through the short-term mist, this offers a rare opportunity. MBB embodies the combination of operational excellence, a disciplined ownership mentality, and an attractive valuation, despite the price jump of more than 60% in 2025. MBB therefore remains one of the cornerstones of our family holding strategy.

MBB ended the trading week on the Frankfurt Stock Exchange at a price of EUR 162.20 per share.

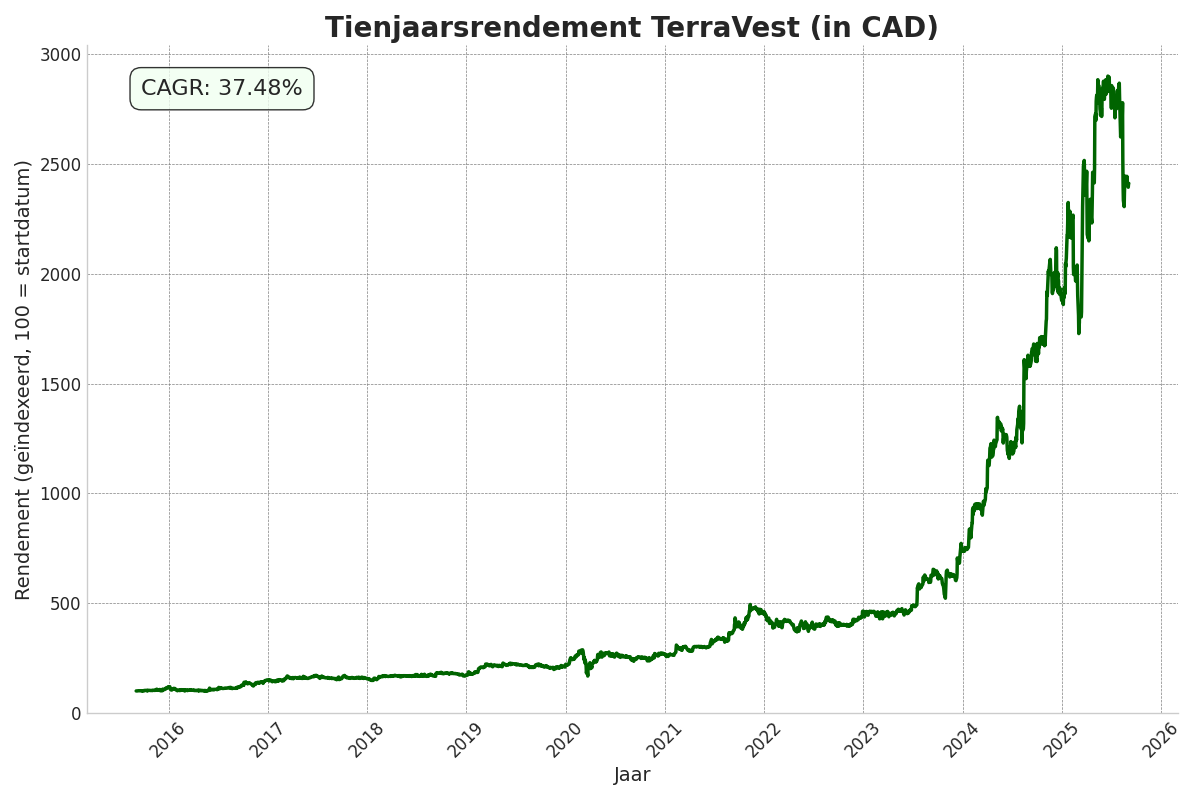

TerraVest under pressure, but hints at hidden deal

The Canadian investment holding company TerraVest (Toronto: TVK) reported weak Q3 results. Revenue increased by 70% to USD 406 million, largely thanks to the acquisition of EnTrans, but organic growth came in at -2%. This makes it clear that the growth comes from acquisitions, while the underlying portfolio is under pressure. For the first time, management explicitly acknowledged that recent U.S. tariff measures are leading to uncertainty and postponement of orders.

According to CEO Dustin Haw, "the portfolio as a whole is still performing well, with recent acquisitions making a significant contribution." Synergies between new and existing activities are seen as an important source of future improvement. At the same time, management points out that tariff uncertainty has recently led to weaker demand in some divisions. Because TerraVest mainly produces products for the domestic market, it is expected that the direct impact of new tariffs will remain limited, but the tone is clearly less optimistic than in previous quarters.

The company also emphasized that it is responding to markets where it has a strong position through targeted investments in production efficiency and product lines. Thanks to the new credit facility concluded in March, TerraVest also says it is well-positioned to continue its acquisition strategy.

The most interesting aspect of the quarterly figures is actually a booking in the company's cash flow statement. There, a USD 36.1 million "investment in equity instruments" is booked, supplemented by a USD 11.6 million fair value gain. Together, this amounts to USD 58.9 million in equity investments on the balance sheet, which is striking for a serial acquirer who normally does not invest in listed shares. Analysts emphasize that this is probably not a passive investment, but the first step in a strategic stake. This fuels speculation that TerraVest may be building a position in a listed company, possibly as a harbinger of a takeover.

Analysts Lower Target Price, but Remain Positive

Analysts at the National Bank of Canada recently signaled the underlying uncertainty in the market. They lowered their target price for TerraVest from USD 200 to USD 185, but maintained their 'Outperform' rating. The adjustment is mainly driven by expected headwinds in the gas transport and storage segment, which is linked to the heavy truck market. The analysts anticipate that North American production of Class 8 trucks will fall by more than 25% in the second half of 2025, which will temporarily put pressure on demand for TerraVest's products. Nevertheless, the bank remains positive in the long term, thanks to the strong acquisition strategy and a proven track record in successfully integrating new companies. The target price is based on the expected profitability for 2026.

From Tresor Capital, we remain positive about the prospects despite the weak quarter. TerraVest's growth will likely continue, but it is crucial that the large recent acquisitions are first successfully integrated. As we already emphasized in our newsletter last week, EnTrans has an exceptionally strong management team, with a CEO who has previously demonstrated excellent leadership. We see this team not only as valuable for the integration of EnTrans itself, but also as a strategic asset that can make future acquisitions within TerraVest more profitable.

TerraVest is currently traded on the Toronto Stock Exchange at a price of CAD 143.67 per share.

Receive weekly insights in your inbox

Exclusive analyses and updates on family holdings and global market developments.

Would you like more information about our services? Please feel free to contact us.

Contact us

Disclaimer:

No rights can be derived from this publication. This is a publication of Tresor Capital. Reproduction of this document, or parts thereof, by third parties is only permitted after written permission and with reference to the source, Tresor Capital.

This publication has been prepared by Tresor Capital with the utmost care. The information is intended to be general in nature and does not focus on your individual situation. The information should therefore expressly not be regarded as advice, an offer or proposal to purchase or trade investment products and/or purchase investment services nor as investment advice. The authors, Tresor Capital and/or its employees may hold position in the securities discussed, for their own account or for their clients.

You should carefully consider the risks before you begin investing. The value of your investments may fluctuate. Past performance is no guarantee of future results. You may lose all or part of your investment. Tresor Capital disclaims any liability for any imperfections or inaccuracies. This information is solely indicative and subject to change.

Read the full disclaimer at tresorcapitalnieuws.nl/disclaimer .