Family Holdings #37 - Half-year figures D'Ieteren and the architecture of Alphabet's dominance

This week's topics:

Alphabet is in a unique position within this capex supercycle. As @borrowed_ideas rightly notes, Google has a structural hedge: a huge internal demand for computing power via Search, YouTube, Gemini integration and Waymo. Where Meta or Amazon largely depend on external enterprise customers, Alphabet can justify its billions in AI infrastructure investments through its own ecosystems that absorb this capacity. This reduces the risk of overcapacity and strengthens the structural competitive advantage.

In Brief:

Addtech (Stockholm: ADDT-B) has acquired the German Innovatek OS GmbH through its Electrification division. Innovatek develops and manufactures customized cooling systems for industrial applications, particularly in sectors such as e-mobility, medical technology, and microscopy. The company has 52 employees and generates annual sales of approximately EUR 12 million. Innovatek will be integrated into Addtech's Power & Mobility business unit and complements existing activities in high-quality niche markets.

Constellation Software (Toronto: CSU) is expanding its portfolio again through its subsidiary Volaris, which has acquired the RFID IIS division of SML Group. These activities will continue under the name ClarityRFID. The Texan company has approximately 135 employees and provides specialized software solutions for inventory management, store experience, and enterprise intelligence, addressing the growing demand for digital solutions that help retailers and brands operate more efficiently and serve customers better.

Lifco (Stockholm: LIFCO-B) has acquired a majority stake in the Dutch Citodent Imaging. This small Amsterdam-based company has 8 employees and generates sales of approximately EUR 1.2 million. Citodent develops and sells software for managing X-ray images and diagnostic imaging for dentists throughout Europe. The company will be integrated into Lifco's Dental division. With this addition, the count for 2025 now stands at 13 acquisitions, three of which are in the Netherlands.

Prosus (Amsterdam: PRX) participated in the Series A funding round of over USD 100 million for the British deep-tech company CuspAI. This young company, founded in 2024 and based in Cambridge with teams in Amsterdam and Berlin, is developing an AI platform that enables the discovery of new materials up to ten times faster than with traditional methods. The company is already collaborating with global players such as Hyundai, Kemira, and Meta on applications in sustainable energy, water purification, and CO₂ capture. For Prosus, this is a logical extension of its existing venture portfolio focused on deep-tech and AI.

Addtech, Constellation Software, Lifco, and Prosus Ventures are currently traded on the Stockholm, Toronto, and Amsterdam stock exchanges at prices of SEK 333.60, CAD 4,398.89, SEK 333.80, and EUR 54.59 per share, respectively.

Disappointing figures from D'Ieteren, but underlying strength remains visible

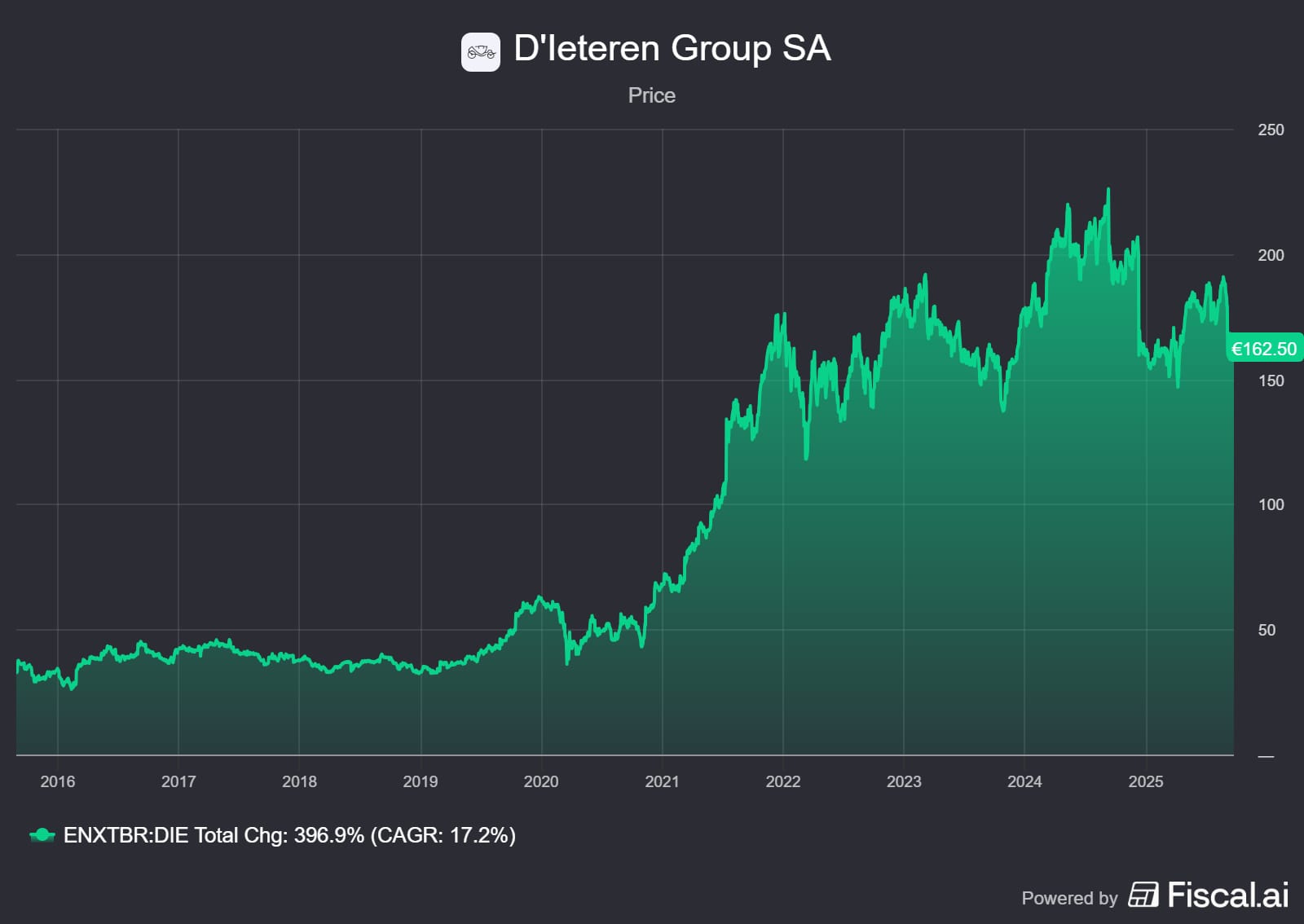

The Belgian investment holding company D'Ieteren (Brussels: DIE) disappointed with its first-half results for 2025. Profit before taxes was 22.7% lower, and revenue contracted by 2.9%. The market reacted sharply: the share price fell by almost 10% on the Brussels stock exchange. However, behind this headline lies a broader discussion: how sustainable is the family holding's strategy in a period of high debt, rising interest rates, and increasing economic headwinds?

Automotive & TVH under pressure

The Belgian automotive market took a hit, which directly impacted the figures of D'Ieteren Automotive. The number of new car registrations fell by more than 10%, causing volumes to decline and market share to decrease slightly. For a division that still symbolizes the historical roots of D'Ieteren, this is a painful signal. It underscores the structural sensitivity to the economy and the saturation of the automotive market, something we have also seen with other European players such as Exor this year.

Also concerning was the performance of TVH. This parts company from Waregem, in which D'Ieteren owns 40%, saw revenue growth come to a standstill and margins decline. CEO Francis Deprez called the markets "very weak" because forklifts and aerial work platforms are simply running less in a cooling economy. On top of that, there was the unexpected departure of CEO Dominiek Valcke, which adds uncertainty just as the organization had to adjust its growth ambitions.

Belron and PHE keep the foundation strong

In contrast to the weak links, there is Belron, the absolute core of D'Ieteren. In the Netherlands and Belgium, it is known by the brand Carglass, but Belron has also established itself as a global market leader (see also the figure above).

Despite fewer trading days in the period, the group managed to grow revenue by more than 4%, driven by ADAS recalibrations and value-added products. The margin improved again to 21.4%, underscoring Belron's status as a cash cow . PHE, the French parts distributor, also delivered solid growth and market share gains. This confirms PHE's role as the second growth pillar within the holding.

Receive weekly insights in your inbox

Exclusive analyses and updates on family holdings and global market developments.

Strategic burden: debts and super dividends

The market is particularly concerned about the debt position. At the end of 2024, D'Ieteren took on additional financing to facilitate the buyout of family member Olivier Périer, an operation accompanied by super dividends for shareholders. Critics compare this approach to Brito's tactics at AB InBev: attractive in the short term, but a structural weakening in the long term.

This skepticism is understandable. Higher interest expenses are impacting profits, and free cash flow has decreased significantly. However, it should be emphasized that management is actively reducing debt: the entire EUR 500 million bridge loan was repaid in the first half of the year, reducing net debt at the group level from EUR 653 million to EUR 296 million. This demonstrates discipline in capital allocation.

Looking at the bigger picture, we see that the real value of D'Ieteren lies with Belron, which alone generates approximately 60% of the bottom line. This makes Belron's performance the core of our investment case. And there, we see exactly what we want to see: revenue growth despite difficult market conditions and a slight improvement in the operating profit margin. It is this kind of operational resilience and efficiency gains that make Belron the group's cash cow and strengthens the foundation of D'Ieteren's value.

In addition, the management deserves recognition for the way it is tackling the debt burden. The additional financing taken out at the end of 2024 for the family buyout understandably weighed on the results, but the entire EUR 500 million bridge loan was repaid in the first half of 2025. As a result, net debt fell from EUR 653 million at the end of 2024 to EUR 296 million in mid-2025. This demonstrates that capital allocation and debt reduction are clear priorities for management.

Finally, we also see signals of confidence from within. Shortly after the price fall, insiders bought shares for over EUR 750,000, the majority of which was by CFO Edouard Janssen himself (EUR 650,000). There are many reasons for insiders to sell, but usually only one reason to buy: the conviction that the stock is undervalued.

All in all, we conclude that the correction of almost 10% after the figures is exaggerated. Yes, the peripheral activities are vulnerable, but the core of the company continues to grow and improve. Mr. Market seems to be missing the mark here, and the purchases by insiders speak volumes in that regard.

D'Ieteren ended the trading week on the Brussels stock exchange at a price of EUR 165.30 per share.

The architecture of Alphabet's dominance

Oracle's earnings call this week set the tone: demand for AI infrastructure is exploding, with a backlog of $455 billion and expected cloud revenue growth to $144 billion in four years. This illustrates how hyperscalers and AI labs are massively reserving capacity.

Alphabet (New York: GOOGL) is in a unique position within this capex supercycle. As @borrowed_ideas emphasizes, Google has a structural hedge: its own internal demand for compute via Search, YouTube, Gemini integration, and Waymo. Where Meta or Amazon are dependent on external enterprise customers, Alphabet can justify its billions in AI infrastructure investments through massive internal consumption. This reduces the risk of overcapacity and strengthens its competitive advantage.

The figures underscore this: Google Cloud now has a $50 billion run-rate with $106 billion in backlog, 55% of which will be recognized as revenue within two years. Meanwhile, nine of the ten largest AI labs are already customers of the company. In addition, Alphabet is further expanding its ecosystem through collaborations: this week, it announced a partnership with Qualcomm to integrate Gemini AI into cars via the Snapdragon Digital Chassis. With this, Alphabet is also taking steps towards software-defined vehicles and the future of mobility.

Not surprisingly, the analyst consensus is shifting. JPMorgan, BofA, Deutsche Bank, Barclays, KeyBanc, and others recently raised their price targets to $245–265. As a result, the market is slowly moving towards a valuation level that we at Tresor Capital had already included in our models at the beginning of this year.

For us, this mainly confirms that the underlying trend is still not sufficiently priced in: Alphabet combines a unique internal demand for computing power with strong cloud growth and an increasingly broad AI ecosystem.

Alphabet is currently trading on the New York Stock Exchange at a price of USD 241+ per A-share.

Receive weekly insights in your inbox

Exclusive analyses and updates on family holdings and global market developments.

Would you like more information about our services? Please feel free to contact us.

Contact us

Disclaimer:

No rights can be derived from this publication. This is a publication of Tresor Capital. Reproduction of this document, or parts thereof, by third parties is only permitted after written permission and with reference to the source, Tresor Capital.

This publication has been prepared by Tresor Capital with the utmost care. The information is intended to be general in nature and does not focus on your individual situation. The information should therefore expressly not be regarded as advice, an offer or proposal to purchase or trade investment products and/or purchase investment services nor as investment advice. The authors, Tresor Capital and/or its employees may hold position in the securities discussed, for their own account or for their clients.

You should carefully consider the risks before you begin investing. The value of your investments may fluctuate. Past performance is no guarantee of future results. You may lose all or part of your investment. Tresor Capital disclaims any liability for any imperfections or inaccuracies. This information is solely indicative and subject to change.

Read the full disclaimer at tresorcapitalnieuws.nl/disclaimer .