Economy & Markets #37 - Reforms in France remain difficult and the U.S. corrects

This week's topics:

New Vacancy: Prime Minister of France

Last Tuesday, the French Prime Minister submitted his resignation to President Macron. With Lecornu, the third Prime Minister in one year is now at the helm. His mandate is delicate: he must bridge the divisions between the parties and at the same time steer the 2026 budget through parliament, an almost impossible task.

At the same time, pressure from the opposition is growing. Marine Le Pen is demanding new elections and finds support from approximately 65% of the French population. Her opponents fear a victory for Le Pen and are therefore calling for a radical institutional reform: the introduction of a Sixth Republic, in which the president loses power and referendums play a greater role in decision-making.

The discontent among the population was widely expressed on Wednesday. Action groups such as Bloquons Tout, the Gilets Jaunes and various trade unions largely brought the country to a standstill. Ironically, this also partially negated the intended economic benefit of Bayrou's reform: by exchanging public holidays such as Easter Monday and Liberation Day for extra working days, productivity would increase.

The tensions necessitated massive security deployment: 80,000 officers were mobilized to maintain order.

Ideally, a combination of higher growth and substantial savings would stabilize French government debt. In practice, however, this seems hardly feasible. The working population is shrinking, productivity growth remains stagnant (without any significant contribution from AI) and social unrest makes it difficult to lower labor costs.

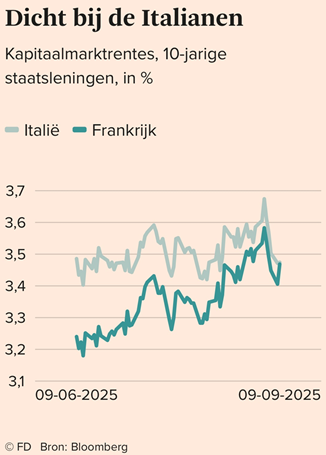

Bond managers are now signaling deteriorating fundamentals: French government bonds are quoting a higher risk premium than Italian bonds, a remarkable reversal. The French debt position now amounts to approximately €3.4 trillion. By comparison, the Greek debt crisis in 2012, the largest single sovereign restructuring of modern times, involved only $264 billion.

In the event of a French debt crisis, savers and bond investors are particularly vulnerable: pension funds, banks and insurers would suffer direct losses. The question is not whether, but on whom the burden will be passed on. Possibilities range from higher burdens for households and companies (already tried), to European solidarity via contributions or Eurobonds. An alternative scenario is that the ECB opts for financial repression: higher inflation and artificially low real interest rates to erode the debt burden.

The most politically likely route is a combination of European solidarity and financial repression. For investors, this means that bonds will remain under pressure, while alternatives will become more attractive. The extra liquidity that the ECB creates will find its way to markets that offer protection against negative real interest rates.

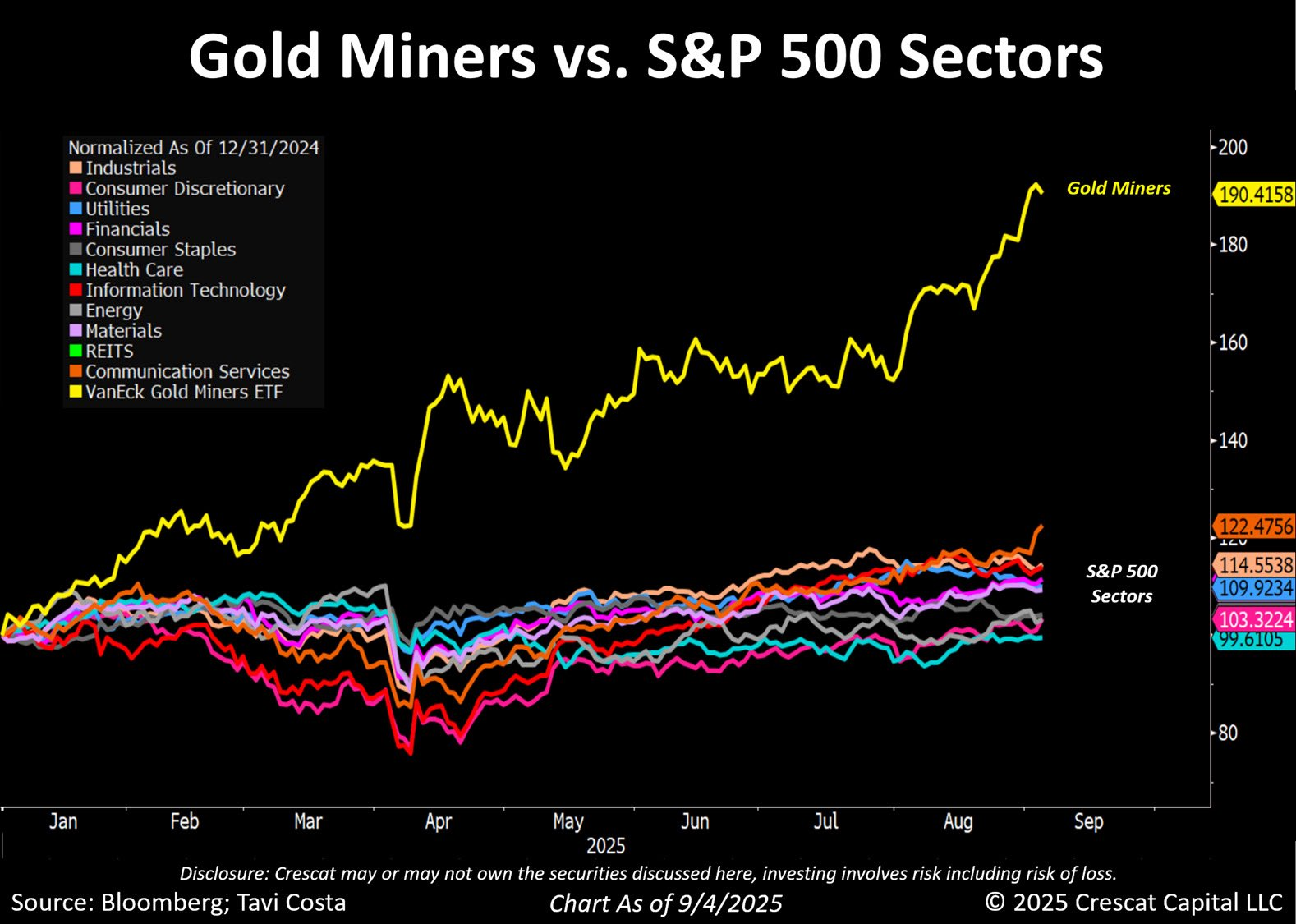

In this context, equities (outside France) and gold are particularly obvious. Equities act as a natural inflation hedge, especially in sectors that can directly pass on price increases. Gold historically benefits from negative real interest rates and acts as a safe haven in times of monetary and political uncertainty.

Largest Revision Ever in US Labor Market Figures

In the US, bad economic news is now considered good news. On Tuesday, the Bureau of Labor Statistics published a significant revision of labor data: over the period of April 2024 – March 2025, 911,000 fewer jobs were created than initially reported. This is the largest downward revision ever.

This makes the picture of the labor market under President Biden considerably less robust than previously thought. Earlier, the figures for the last three months of Trump's term had already been adjusted sharply downwards (May: −125,000, June: −133,000). August recorded only +22,000 jobs, while June even showed a loss of 13,000 jobs. The momentum in the labor market, therefore, seems to be definitively weakening.

The political dimension is clear: on August 1, President Trump dismissed the chief statistician of the BLS, Erika McEntarfer, after the revisions came out. The figures did not fit the picture he wanted to paint of the American economy. Indirectly, the weak data reinforce Trump's attack on the Federal Reserve. The key question is: on which indicators does the Fed base its interest rate policy, and do these figures still provide a reliable and current picture of the economy?

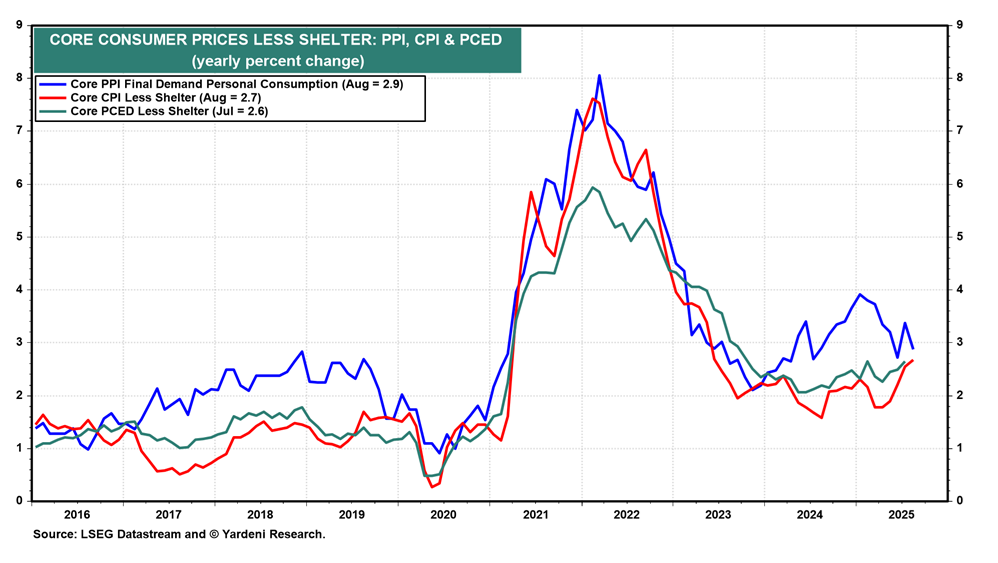

Criticism has been voiced for some time that the Federal Reserve relies on outdated data. For example, official house price indices such as Case-Shiller are up to six months behind, while more current sources such as Zillow are not taken into account. Now that labor market statistics also appear to be unreliable, Trump's criticism of Chairman Jerome Powell gains more weight: the economy is cooling down, inflation is stabilizing around 3%, and the policy rate could or should be lowered more quickly.

At the same time, the most recent price data paint a mixed picture. Producer prices (PPI) fell by 0.1% month-on-month in August, while economists had predicted an increase of +0.3%. The effects of import duties do not yet appear to be visible. Consumer prices (CPI), on the other hand, rose more sharply than expected: +0.4% month-on-month and +2.9% year-on-year, the highest level since January.

In any case, the trend of recent weeks is clear: interest rates are falling further, in anticipation of a possible policy adjustment by the Fed next week.

Receive weekly insights in your inbox

Exclusive analyses and updates on family holdings and global market developments.

Gold Miners Experience a Strong Rally: "Long Gold, Short Oil" as Winning Trade

As mentioned earlier in this letter, gold is the hedge in a period of financial repression. The gold price has already risen by approximately 40% in USD this year. Even more striking: gold mining shares have advanced by +80–100%. For years, they underperformed physical gold due to cost inflation, political risks, and operational setbacks, but that gap is closing rapidly this year.

The sector benefits from a unique cocktail: higher revenues thanks to the rising gold price, combined with lower costs due to the falling oil price. Energy and transport are key components in the cost base, and the decreased oil price is significantly boosting margins.

UBS pointed out earlier this year that miners are still trading approximately 30% below their pre-Covid average (price-earnings ratio). That discount mainly reflects investor distrust after years of disappointment, not weak fundamentals. Meanwhile, the major players have sharpened their strategies.

- Newmont increased capital distributions to shareholders, focuses only on Tier-1 mines, and recently reported strong profits and cash flows, with a positive outlook (gold > $4,000/oz in 2026).

- Barrick sold non-core assets and focuses on more profitable projects.

It is striking that smaller miners in particular are showing the strongest performance. According to the fund manager in zone portfolio, their production can grow by +5–7% per year in the coming years, compared to 2–3% for the sector as a whole. After years of restructuring and divestment, they are once again becoming attractive takeover targets. In addition, insiders at small caps often own 3–10% of the shares, a powerful signal of skin in the game.

Looking ahead to 2025, record margins are expected: an operating margin of around 50% and a net profit of over $900 per ounce (~30%). Despite the strong rally, gold miners remain attractively positioned.

European AI Invests in European AI

ASML announced this week an investment of €1.3 billion in the French AI startup Mistral. Under the leadership of the new CEO Christophe Fouquet, ASML is taking a stake of ~11% and becoming the largest shareholder. In addition, the company will get a seat on the strategic committee. The transaction is part of a €1.7 billion round, valuing Mistral at €11.7 billion and positioning it as the most valuable AI startup in Europe.

According to Fouquet, the investment is primarily aimed at utilizing AI within ASML's own R&D and product development, and not at European strategic autonomy. Mistral, founded in 2023, develops its own Large Language Models (LLM’s) and is considered a European challenger to OpenAI and Anthropic. Mistral's valuation rose to €12–14 billion within two years but remains small compared to the American market leaders (OpenAI ~$500 billion, Anthropic ~$170–183 billion).

Sofina was also involved early in the growth of Mistral. The Belgian holding company already invested €385 million in December 2023 and built up a 0.38% stake. It is unclear whether Sofina also participated in this round.

The investment increases ASML's ability to integrate AI into the development of its chip machines. Think of proprietary software that further optimizes production processes. The deal fits into a broader wave of AI-related investments, which repeatedly refute the previously suggested "DeepSeek moments". While AI shares temporarily came under pressure this year due to concerns about Chinese competition and MIT studies on delayed adoption, the capital expenditures of hyperscalers (Meta, Alphabet, Amazon, Microsoft) repeatedly exceed expectations.

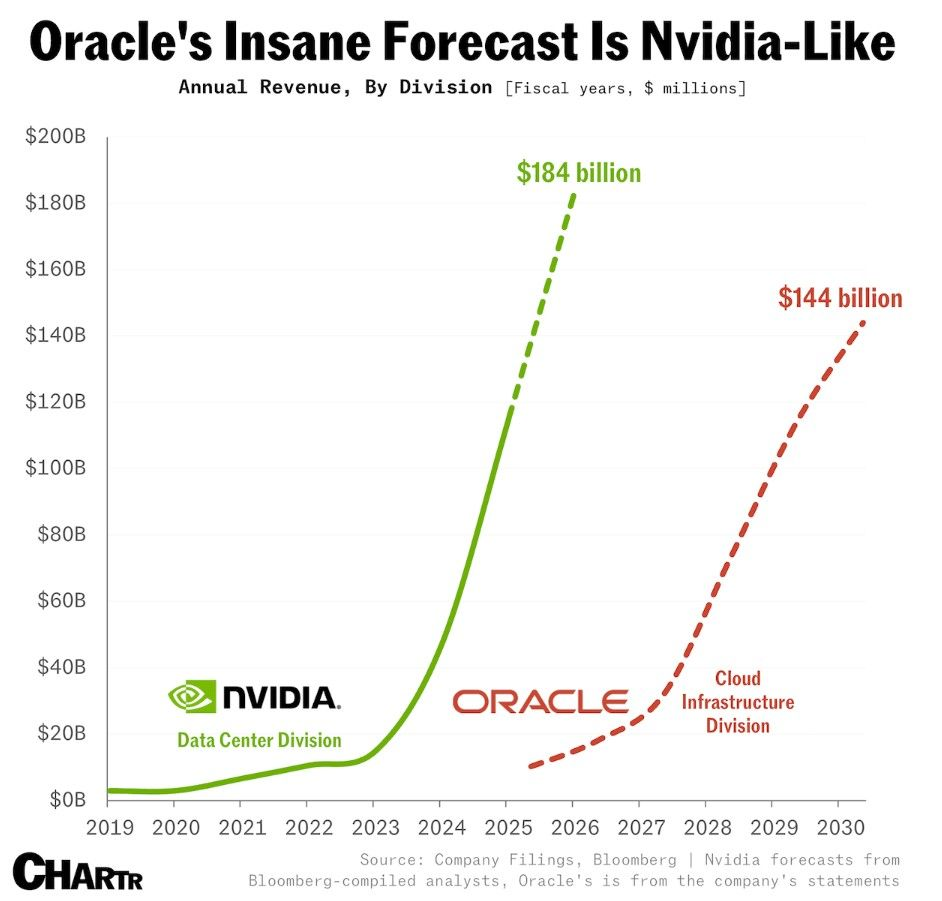

A striking example came this week from Oracle. The company reported a record backlog (RPO) of $455 billion, +359% year-on-year, entirely driven by AI contracts. OpenAI signed a commitment of $300 billion to Oracle data centers over the next four years – a remarkable amount given the current annual revenue of only $15 billion. Oracle's cloud business is growing by 77% this year to $18 billion and is targeting $32 billion, $73 billion, $114 billion, and $144 billion in revenue in the coming years. The share jumped 38% in one day; Chairman and major shareholder Larry Ellison (40% stake) saw his wealth rise to $393 billion.

Receive weekly insights in your inbox

Exclusive analyses and updates on family holdings and global market developments.

Would you like more information about our services? Please feel free to contact us.

Contact us

Disclaimer:

No rights can be derived from this publication. This is a publication of Tresor Capital. Reproduction of this document, or parts thereof, by third parties is only permitted after written permission and with reference to the source, Tresor Capital.

This publication has been prepared by Tresor Capital with the utmost care. The information is intended to be general in nature and does not focus on your individual situation. The information should therefore expressly not be regarded as advice, an offer or proposal to purchase or trade investment products and/or purchase investment services nor as investment advice. The authors, Tresor Capital and/or its employees may hold position in the securities discussed, for their own account or for their clients.

You should carefully consider the risks before you begin investing. The value of your investments may fluctuate. Past performance is no guarantee of future results. You may lose all or part of your investment. Tresor Capital disclaims any liability for any imperfections or inaccuracies. This information is solely indicative and subject to change.

Read the full disclaimer at tresorcapitalnieuws.nl/disclaimer .