Family Holdings #38 - The impact of AI on VMS companies, part 2

This week's topics:

KKR CFO Robert Lewin reaffirmed the financial goals for 2026, supported by the diversified model of Asset Management, Insurance and Strategic Holdings. The focus is on long-term value creation by, following the example of compounders such as Berkshire Hathaway, reinvesting the profits from its own balance sheet and allowing them to generate returns for a long time.

The market capitalization of Alphabet passed USD 3,000 billion after its Gemini app had more downloads than ChatGPT, an important signal in the AI competition. At the same time, the company is strengthening its strategy by deeply integrating Gemini into the Chrome browser and through deals with Reddit, PayPal and Lyft.

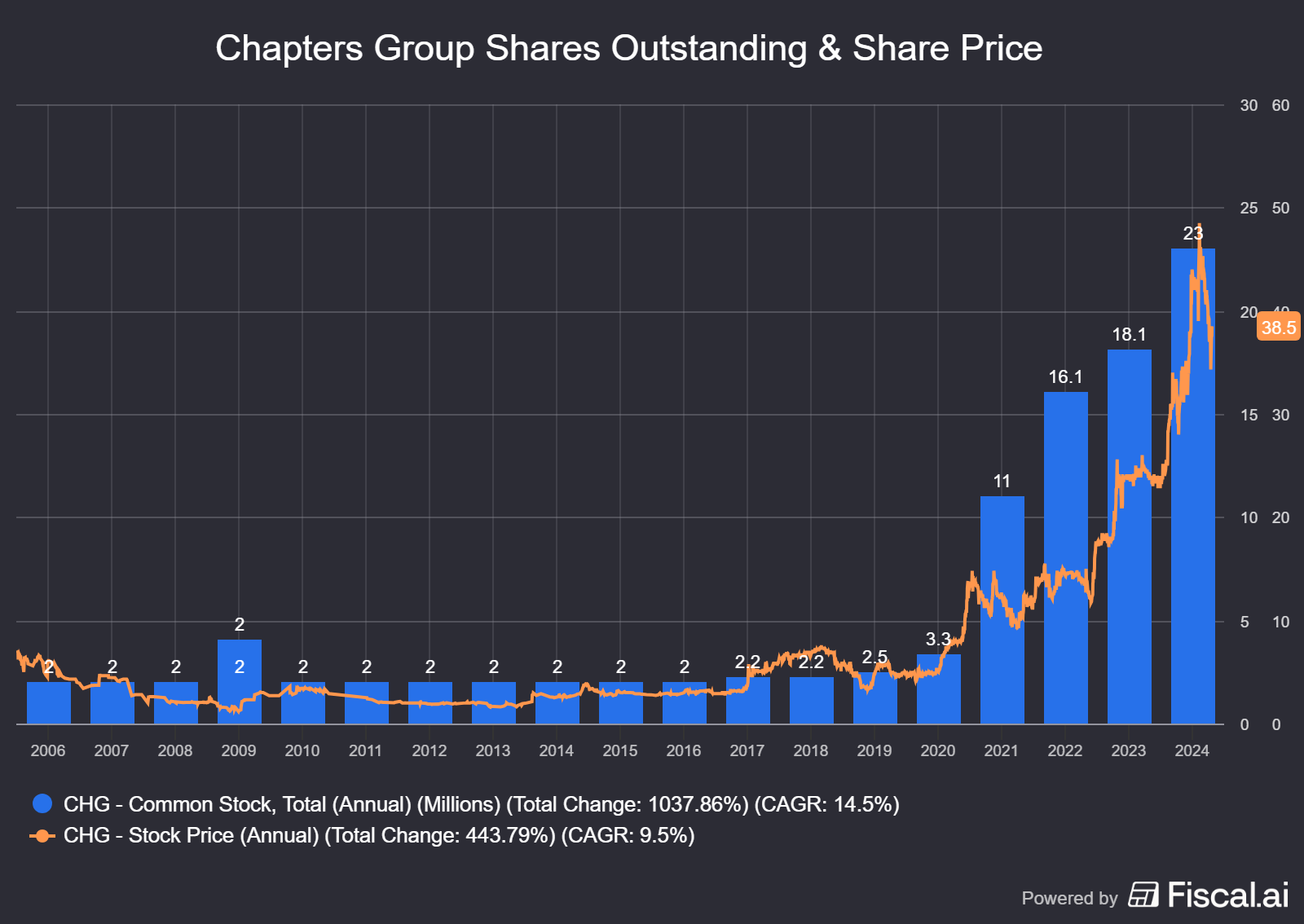

Chapters Group reported strong revenue and profit growth for the first half of the year, driven by a high acquisition rate, although organic growth lagged somewhat behind its own target. The focus is on creating value through high-return acquisitions, which should ultimately alleviate concerns about the increased dilution of shares.

In Brief:

Constellation Software (Toronto: CSU) has acquired the Hungarian Jegymester, the market leader in ticketing, through its subsidiary Jonas this week. Jegymester, founded in 1995 and based in Budapest, provides solutions for both online and on-premise ticket sales for a wide range of clients, from sports organizations to cultural institutions. In 2024, the company generated revenue of €11.7 million and has approximately 20 employees.

Constellation is also strengthening its position within hospitality tech: the Romanian Bit Soft is joining Volaris Group. Bit Soft develops software solutions for hotels and restaurants, thereby strengthening Constellation's European presence in this growth market.

Prosus (Amsterdam: PRX) made a successful stock market debut in Mumbai with Urban Company, the largest technology platform for household services in India, at a valuation of approximately USD 2.8 billion. Prosus, which has been an investor since 2021, doubled its stake to 7.35% just before the IPO, bringing the total investment to USD 139 million.

Urban Company, founded in 2014, connects millions of consumers with trained service providers for cleaning, beauty and repairs, among other things. The platform grew by 38% in FY25 and became profitable, with an EBITDA margin of approximately 10% on its Indian consumer activities.

The IPO, which was oversubscribed one hundred times, is a milestone for the Indian technology sector. For Prosus, it is the third successful IPO from its India portfolio in twelve months, after Swiggy and BlueStone. This confirms the strategic value of its investments and underlines its position as an influential foreign investor in India’s digital economy.

Constellation Software and Prosus are currently traded on the Toronto and Amsterdam stock exchanges at prices of CAD 4,418.64 and EUR 56.93 per share, respectively.

The Impact of AI on VMS Companies, Part 2

In our previous article, "Deep dive: software and AI, opportunity or threat?", we analyzed the potential impact of artificial intelligence on the Vertical Market Software (VMS) sector. The core of our vision was that, contrary to prevailing market fears, AI is more of an opportunity than a threat for established VMS companies. The deep-rooted competitive advantages, such as high switching costs and decades of domain knowledge, were identified by us as crucial lines of defense.

Recent developments and new insights from experts and business leaders offer additional, concrete support for this vision. This addendum serves to share that new information and further strengthen our original analysis.

The core of the software moat: domain knowledge, not technology

A frequently heard fear is that AI lowers the technological threshold for building software to such an extent that new competitors can flood the market with cheaper alternatives. Jeff Horing, co-founder of renowned tech investor Insight Partners, offers a clear counterargument in a recent podcast. According to Horing, the barrier to displacing complex business software has never been the technology itself.

"It was never a technology barrier. It was always a business knowledge barrier." - Jeff Horing

In his view, AI represents the next generation of productivity tools, akin to previous innovations in software development. While impactful, these also did not lead to the widespread replacement of market leaders like SAP. The true value and 'stickiness' of VMS software lie not in the elegance of the code, but in the profound interconnectedness with the customer's business processes.

Horing therefore does not see AI as a threat, but as a "massive TAM accelerator": a tool that can significantly expand the total addressable market for existing software companies by enabling new functionalities and automation on top of existing, data-rich systems.

A voice from the field: Jan Mohr, CEO of Chapters

This vision is strongly confirmed in a recent conversation we had with Jan Mohr, the CEO of Chapters Group (Frankfurt: CHG), a serial acquirer of VMS companies in our portfolio. Mohr emphasizes that he is not aware of any case where a customer has left to build a cheaper solution with AI themselves.

On the contrary, he sees commercial opportunities: "I know more cases where this is a commercial opportunity than cases where it is a commercial threat." The ability to build an intelligent layer on top of the existing 'system of record' creates new revenue streams. Mohr makes a crucial distinction:

- The real 'moat': The costs are not in rebuilding the software, but in the migration process. Mapping all processes, data migration, retraining personnel, and reconfiguring all links with other systems; that is the real barrier to entry. These are the switching costs that make customers reluctant to change, regardless of whether the new system is built by AI or by people. Especially for mission-critical software in, for example, hospitals or public transport companies, where the complexity and risks are immense, a switch is a project of many years and millions of euros.

- Vulnerable software: Software with low switching costs and less complex data integrations, such as business intelligence tools like Tableau or Power BI that are placed on top of a dataset, is vulnerable. Such visualization and analysis functions can largely be replicated for free by AI today. However, the VMS model focuses precisely on the systems that generate, manage, and secure a company's core data, the systems that are not easily replaced.

The market leader's response: Constellation Software

As discussed in our previous article, Constellation Software (Toronto: CSU) is the undisputed leader in the VMS sector. Constellation founder and CEO Mark Leonard addressed the situation in the announcement of a special webinar on the impact of AI in a characteristically transparent and modest manner:

- "AI has created uncertainty for our employees, shareholders, and customers. CSI's management does not claim to know the future of AI. We have a group of AI specialists within CSI. They don't know the future of AI either. However, they do help us monitor our own AI progress and that of AI in general in our markets."

This passage is telling. Instead of bombastic statements about how they are going to dominate AI, Leonard acknowledges the uncertainty and emphasizes the process. This pragmatic and humble attitude is more reassuring than grandstanding. It also aligns seamlessly with the vision of a large CSU shareholder we recently spoke to, who states that the company's strength was never the modernity of the code, but the deep understanding of the niche market and the rock-solid customer relationships.

The internal focus on AI within Constellation, which began in 2022, became visible to the outside world in 2025 when subsidiary Volaris organized its second AI Summit, which was attended by more than 4,200 employees. The strategic approach was articulated there by COO Brian Beattie, who emphasized that it is not just about a new tool:

- "AI is about helping to create a business transformation, and it's about building new processes with AI as the core... It's a fundamental shift that's taking place."

More recently, Vela LatAm, another subsidiary, announced the creation of an AI Center of Excellence to share knowledge and accelerate innovation. The focus is on redesigning processes and delivering more value to customers.

The value of 'hard-won secrets'

The true power of a VMS company, and the reason why AI does not pose an existential threat, is perfectly illustrated by a case study from the Dealer Management Software (DMS) market. This is mission-critical software for car dealerships, dominated by old players such as Reynolds & Reynolds (founded in 1866) and CDK.

In 2016, Jay Vijayan, the former CIO of Tesla, started a new, 'modern' competitor called Tekion. With a well-known name from the tech world and a huge funding of USD 640 million, Tekion seemed destined to disrupt the old guard. Almost a decade later, however, customer testimonials show that the product is still a "hot mess."

The reason is the core of the VMS moat: great software is built on "hard-won secrets." These are deep insights into the customer and their work processes that have been incorporated into the product over decades. It's about the user flow, the interface, the frictionless processes; knowledge that a customer often can't even articulate themselves.

The author gives a powerful example from his own time at Amazon. The company wanted to modernize its website for years, but kept postponing it. The reason: the old, ugly-looking website had a higher conversion rate and therefore simply sold more. Switching to a nicer design would directly cost revenue. Only after years of optimizing every detail did they discover the 'secrets' of the old site. One such secret was that the precise font size and color of the words "In Stock" influenced sales by a significant percentage, a difference of literally billions of dollars per year.

What Reynolds & Reynolds has learned in decades, Tekion tried to buy with hundreds of millions of dollars: a deep customer understanding, distilled into a flawless product. The fact that an ex-CIO of Tesla with USD 640 million in capital takes a decade to build a still fairly mediocre product illustrates the depth of the 'moat'. These 'secrets' are the real barrier, not the technology. For the VMS sector, therefore, the best companies, those with the deepest market penetration and the most 'secrets', are best positioned to benefit from new technologies such as AI. They will use it to make their existing, indispensable products even better.

The market's fear of the impact of AI on VMS companies seems to be a misunderstanding of where the real value and competitive advantages of these companies lie. These are not technological in nature, but rooted in domain knowledge, customer relationships, and the high switching costs inherent in deeply embedded, mission-critical software.

For the qualitatively strong VMS serial acquirers in our portfolio such as Constellation Software, Chapters Group, Asseco Poland (Warsaw: ACP) and (Toronto: TOI) Topicus, we therefore see AI as a catalyst for further growth and value creation, not as an existential threat. Moreover, these VMS companies themselves, with their dozens of independently operating subsidiaries, offer an additional layer of risk diversification.

Asseco Poland, Chapters Group, Constellation Software and Topicus are currently traded in Poland, Germany and Canada at prices of PLN 205.40, EUR 38, CAD 4,409.19 and CAD 161.27 per share, respectively.

Receive weekly insights in your inbox

Exclusive analyses and updates on family holdings and global market developments.

KKR Confirms Growth Strategy and Financial Goals for 2026

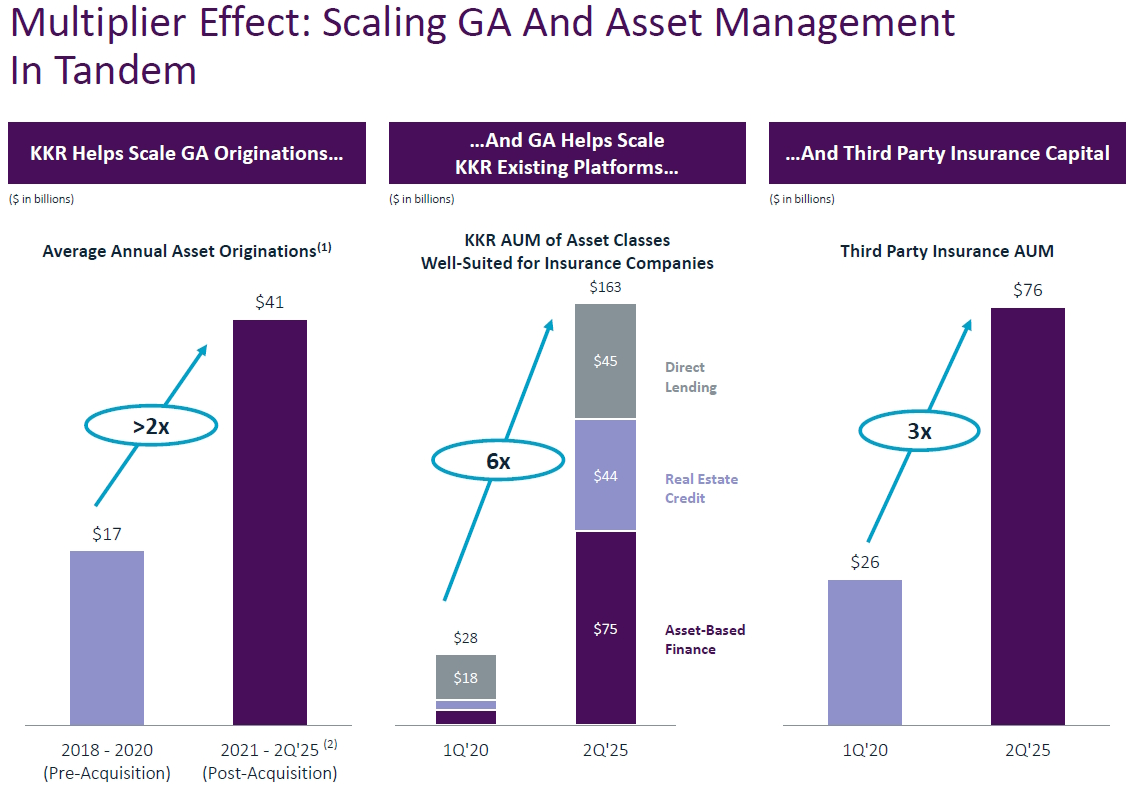

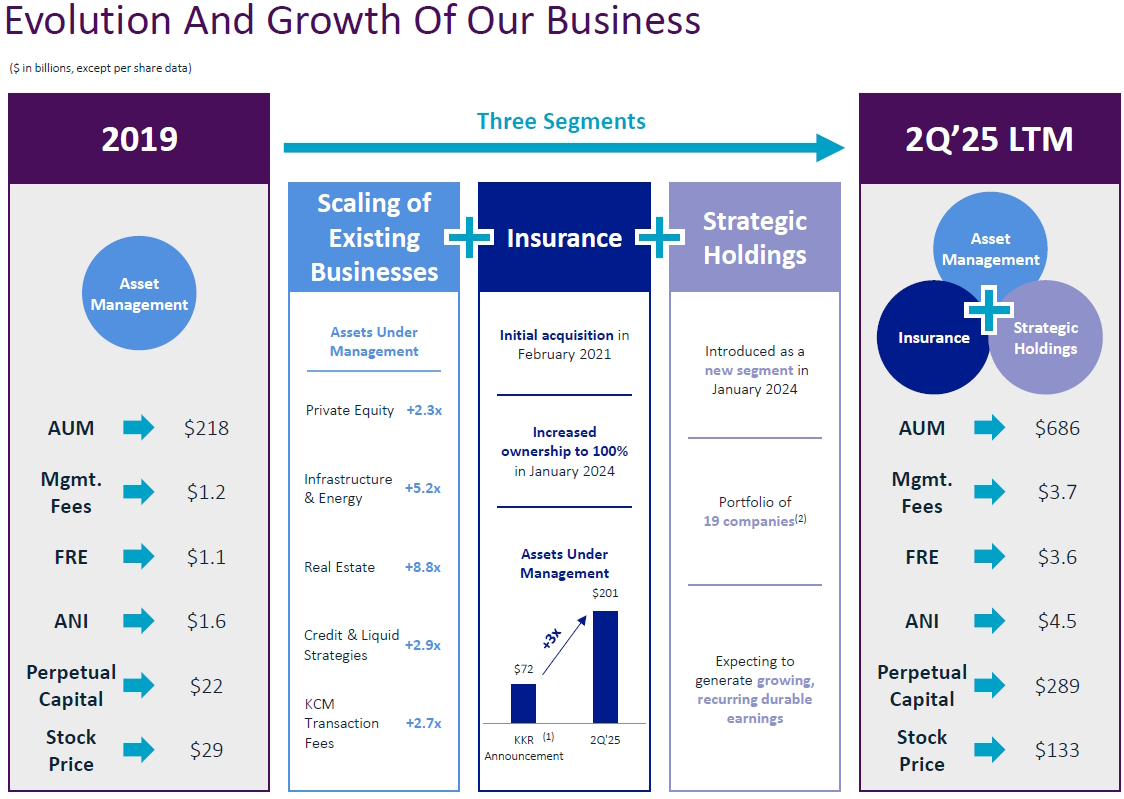

During the recent Barclays Global Financial Services Conference, CFO Robert Lewin of KKR (New York: KKR) provided a detailed overview of the strategy and growth drivers of the American investment holding company. The core of the message is the strength of the differentiated business model, which relies on the synergy between its three core activities.

This model rests on the pillars of Asset Management, Insurance (via Global Atlantic) and Strategic Holdings. The historical core is Asset Management, with nearly USD 700 billion in assets under management. This is complemented by the insurance branch Global Atlantic, which attracts long-term liabilities to invest via the KKR platform. Finally, the Strategic Holdings segment leverages private equity expertise as an additional, capital-friendly growth engine.

Lewin outlined a constructive macroeconomic picture, characterized by stock markets at record highs, tight credit spreads, and low volatility. Although inflation is expected to remain above the 2% target, KKR anticipates two interest rate cuts in 2025 and three in 2026.

In private equity, KKR distinguishes itself through a disciplined and linear deployment of capital, in contrast to the sector that invested at high multiples in 2021-2022. This is evidenced by the fact that the American private equity franchise has distributed twice as much capital as it has called in over the past eight years.

Fundraising remains robust, with the recent Americas Private Equity Fund already raising USD 16 billion. Lewin does not expect a wave of acquisitions in the private equity sector, but an organic consolidation in which weaker players shrink. This benefits large parties such as KKR, which sees investment opportunities primarily outside the US, with a focus on Europe, Japan and India.

The infrastructure branch has grown organically from USD 15 billion to USD 90 billion AUM (Assets Under Management) in five years, making it a global leader. The credit branch, with USD 260 billion AUM, is the largest business unit, with growth primarily driven by Asset-Based Finance (ABF).

The private wealth activities are also successful. The 'K-Suite' products, aimed at wealthy individuals, already raised USD 10 billion in the first eight months of 2025.

At Global Atlantic, the focus is on long-term profitability. The strategy to increase the allocation to alternative investments from 1% to 5-8%, despite a short-term depressing effect on profits, builds up significant "hidden profitability" for the future.

The Strategic Holdings segment forms the core of KKR's ambition for long-term value creation. The strategy is to invest capital through its own balance sheet, following the example of compounders such as Berkshire Hathaway, and let it generate returns for a long period. This breaks through the traditional fund cycles and gives KKR the flexibility to act as an investor and owner with full control.

The focus is on reinvesting profits from cash-generating companies to maximize the compounding effect, rather than paying out high dividends (a strategy that competitors such as Blackstone are more in favor of). This approach allows KKR to operate indefinitely in various sectors, including business services, consumer goods and healthcare.

Currently, the segment includes interests in nearly 20 companies, with the goal of growing operational cash profit from more than USD 350 million next year to more than USD 1.1 billion in 2030. This stable and growing income stream reduces the overall risk profile of the company.

Finally, KKR reaffirmed its confidence in achieving the financial targets for 2026, including a Fee Related Earnings (FRE) per share of more than USD 4.50 and an After-tax Distributable Earnings (ANI) per share between USD 7 and USD 8.

KKR is currently traded on the New York Stock Exchange at a price of USD 148.87 per share.

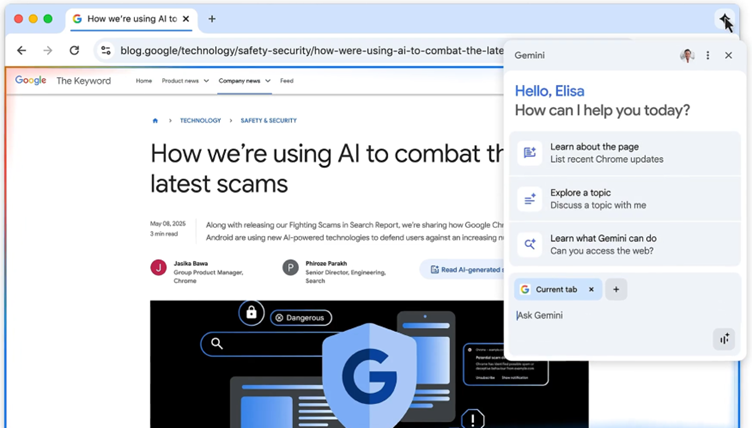

Alphabet Breaks the USD 3,000 Billion Barrier

The American investment holding company Alphabet (New York: GOOGL) remains in the spotlight. Google's Gemini app surpassed ChatGPT in terms of the number of downloads in the App Store and lifted the company to a market capitalization of USD 3,000 billion. However, a programming competition in Azerbaijan this week showed that the battle for the best LLM model is still open: OpenAI's GPT-5 solved all 12 problems, Gemini got stuck on 10. The difference is small, but underscores that this AI race will continue for years.

Meanwhile, Google is rolling out Gemini in Chrome for American users, a step that turns the browser itself into an AI agent. Users can ask Gemini questions about open pages, have summaries made of multiple tabs at the same time, and directly perform actions in integrated apps such as Docs, YouTube, Calendar, and Maps. This shifts Chrome from a passive gateway to the internet to an active assistant that understands context and performs tasks.

The applications are broad: think of automatically summarizing long research articles, comparing information from multiple sources, or directly scheduling appointments from a web page. In the coming months, "agentic capabilities" will follow, allowing Gemini to handle repetitive tasks independently, such as booking appointments or placing online orders.

Furthermore, Alphabet closed three notable deals in one week:

- Reddit: in discussions about deeper data integration and dynamic pricing structures, on top of the existing USD 60m+ content license.

- PayPal: strategic collaboration around AI shopping and payments, with PayPal as the core provider in Google's ecosystems.

- Lyft: Waymo starts autonomous ride-sharing in Nashville via Lyft's platform, which offers scale without its own app development.

The common thread: the infrastructure is in place, the AI agent comes to life. Alphabet is gradually building the bridge between AI models, everyday apps, and commercial ecosystems.

Alphabet is currently trading on the New York Stock Exchange at a price of USD 253.60 per A-share.

Chapters Group's Preliminary Half-Year Results in Line with Expectations

The German investment holding company Chapters Group (Frankfurt: CHG) presented preliminary half-year figures for 2025, once again showing strong growth. Revenue amounted to approximately EUR 85 million, an increase of 51% compared to the same period last year. The operational gross profit (EBITDA) was approximately EUR 19 million, representing a margin of over 22%, a clear confirmation of the company's operational efficiency.

CEO Jan Mohr emphasized the contribution of the Public Sector and Financial Technologies segments, and sees the first tangible effects of the internal Manuscript Method reflected in higher profitability. Organic growth this year is likely to be in the mid-single digits. This is below the mid-term target of +10% that management previously announced, and therefore somewhat on the lean side. Nevertheless, we do not see this as a major risk. Chapters is still early in its growth phase, and the recent acquisitions and integrations require time before they fully contribute.

In the first half of the year, the company has already made several VMS acquisitions, and with the consolidation of Expatrio in the fintech segment, the deal machine is further accelerated. Management expects synergy benefits that will be particularly visible from 2026 onwards. Since June 30, Chapters has already made four more acquisitions.

Analysts note that the number of outstanding shares has increased sharply in recent years, which may lead to dilution in the short term. At the same time, as long as the capital raised is deployed at a ROIC of ~25%, the management's objective, the value creation for shareholders will ultimately outweigh the dilution.

Our conclusion: Chapters combines strong operational efficiency with a high acquisition pace. As long as the company delivers on its promise of high returns on invested capital, the market will sooner or later look beyond the dilution.

Chapters Group ended the trading week on the Frankfurt Stock Exchange at a price of EUR 38.30 per share.

Receive weekly insights in your inbox

Exclusive analyses and updates on family holdings and global market developments.

Would you like more information about our services? Please feel free to contact us.

Contact us

Disclaimer:

No rights can be derived from this publication. This is a publication of Tresor Capital. Reproduction of this document, or parts thereof, by third parties is only permitted after written permission and with reference to the source, Tresor Capital.

This publication has been prepared by Tresor Capital with the utmost care. The information is intended to be general in nature and does not focus on your individual situation. The information should therefore expressly not be regarded as advice, an offer or proposal to purchase or trade investment products and/or purchase investment services nor as investment advice. The authors, Tresor Capital and/or its employees may hold position in the securities discussed, for their own account or for their clients.

You should carefully consider the risks before you begin investing. The value of your investments may fluctuate. Past performance is no guarantee of future results. You may lose all or part of your investment. Tresor Capital disclaims any liability for any imperfections or inaccuracies. This information is solely indicative and subject to change.

Read the full disclaimer at tresorcapitalnieuws.nl/disclaimer .