Economy & Markets #39 - U.S. attracts views again, Milei balances and Asia flourishes

This week's topics:

Capital is flowing back to the US stock markets

This week, the US reported GDP growth of 3.8% in the second quarter, clearly above the consensus expectation of 3%. In the first quarter, growth was still -0.5%, because companies brought forward extra imports due to rising trade tariffs (imports are deducted in the GDP calculation).

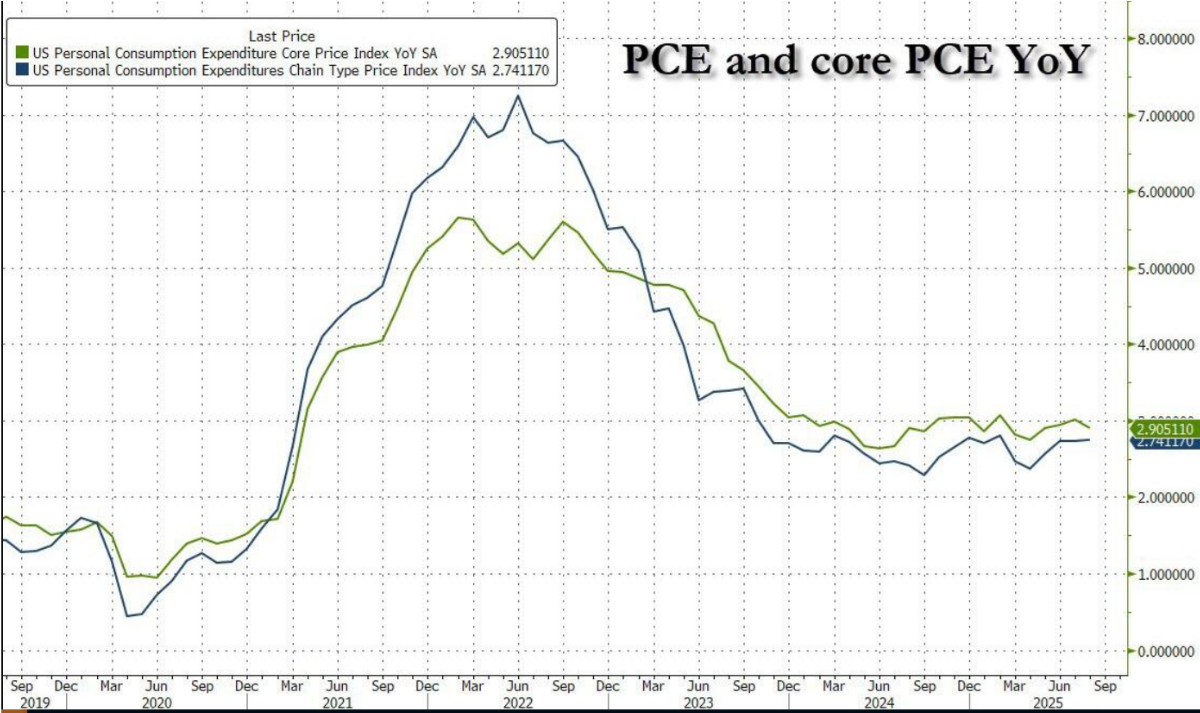

Other economic figures were also positive. Orders for durable goods rose by 2.9%, a signal that both companies and consumers are willing to invest and have confidence in the economy. In addition, the decline in unemployment claims to 218,000 underscored the strength of the labor market. Finally, the PCE inflation figure came in at 2.9%, in line with expectations.

This means that the feared wave of inflation as a result of the tariff war is not materializing. Moreover, the picture is at odds with the message that Fed Chairman Jerome Powell outlined earlier this week: an economy that would weaken while inflation remained stubbornly high. Despite the concerns of European investors, the American economy is performing remarkably well, even in an environment of trade wars and geopolitical tensions.

While institutional parties were still considering reducing their American positions in the first quarter, the American stock markets are clearly higher this year (in local currency) than the European ones. More and more capital is flowing back to the US. Large investors who previously shifted the center of gravity to Europe and other regions are returning to American stocks and bonds. The turnaround began in August: after months of outflows, money was again invested in American stocks. In one week, the inflow even amounted to almost 58 billion dollars, the highest level in more than a year. According to US TIC data, a net 920 billion dollars has already flowed into the American capital markets this year.

This movement is driven by four factors:

- Robust economic figures that underscore the strength of the American economy, as opposed to disappointing figures in Europe.

- Prospect of interest rate cuts by the Federal Reserve, favorable for small caps and other interest-sensitive segments. In Europe, most of the cuts have already taken place, so the stimulating effect is fading there.

- A weaker dollar that offers American exporters a competitive advantage.

- The continued appeal of the American technology sector, with artificial intelligence as the main growth engine.

Milei's reform agenda is facing limitations

On December 10, 2023, Javier Milei was sworn in as President of Argentina. The economist and former television personality gained international recognition for his flamboyant style: wielding a chainsaw, he promised to "dismantle" the state and radically broke with the political establishment.

That symbol translated into harsh policy measures. The number of ministries was reduced from eighteen to eight, tens of thousands of civil servants lost their jobs, and old privileges disappeared into the shredder. Subsidies, long the holy grail in Argentine politics, were also resolutely abolished, resulting in higher bills for bus, electricity, and gas.

For a country that once belonged to the wealthiest in the world but has since defaulted nine times and undergone 22 IMF restructurings, shock therapy seemed inevitable. And surprisingly, it worked: inflation, which was still 211% when he took office, fell back to 43.5% in May of this year. Where such interventions normally cause deep recessions, Argentina actually showed recovery: from -1.6% growth in 2023 to an expected +5.5% in 2024. The approach earned Milei applause from conservatives and libertarians, including Elon Musk and the Spanish economist Daniel Lacalle, but also sharp criticism from progressive economists such as Thomas Piketty.

The financial markets initially reacted enthusiastically. Argentine bonds and shares rose, and investors hoped for a comeback. But the mood changed. First came "Cryptogate": Milei had publicly promoted the cryptocurrency $LIBRA, which collapsed shortly thereafter, costing investors USD 0.3 billion. Subsequently, his party suffered a heavy defeat in the elections in the province of Buenos Aires, accounting for more than 40% of the electorate. The markets reacted violently: the peso lost more than 5%, and the Merval index fell by approximately 9%.

During the UN meeting this week, the US Treasury Secretary stated his willingness to provide a support package of USD 20 billion (via swap lines and purchases of Argentine bonds) to restore confidence. For Milei, however, this means a difficult balancing act: international support is necessary to keep the economy afloat, but for a libertarian, this feels like an infringement of the free market principles on which his policy is built.

Receive weekly insights in your inbox

Exclusive analyses and updates on family holdings and global market developments.

Asian stock markets on the rise: opportunities for long-term investors

In the recent report Thoughts from the Road | South East Asia, KKR emphasizes that Southeast Asia is currently in an attractive "sweet spot" within the global capital markets. While many international investors are still underweight in the region, Asian stock markets are showing impressive returns this year: Korea +59%, China +38%, and Japan +22%. For comparison: the S&P 500 was up +14% in the same period. According to KKR, this underscores the increasing importance of Asia in global portfolios.

Structural drivers of the recovery

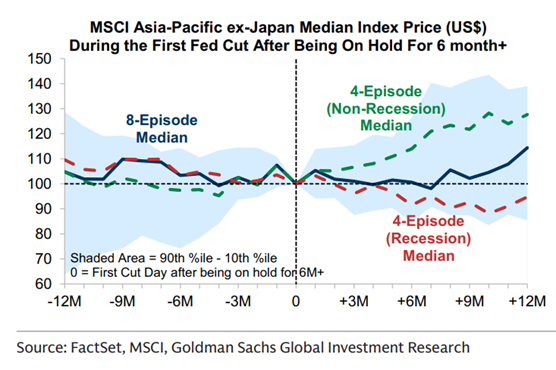

- Interest rate cuts and weaker dollar. Historically, Asian markets benefit strongly when the Federal Reserve cuts interest rates in a context of economic growth. An analysis by Goldman Sachs shows that in the first twelve months after an interest rate cut, returns of up to 25% are achievable (see green line in the graph above). The explanation: many Asian companies export to the US and have USD debts. Lower interest rates and a weaker dollar ease their financing costs and stimulate demand.

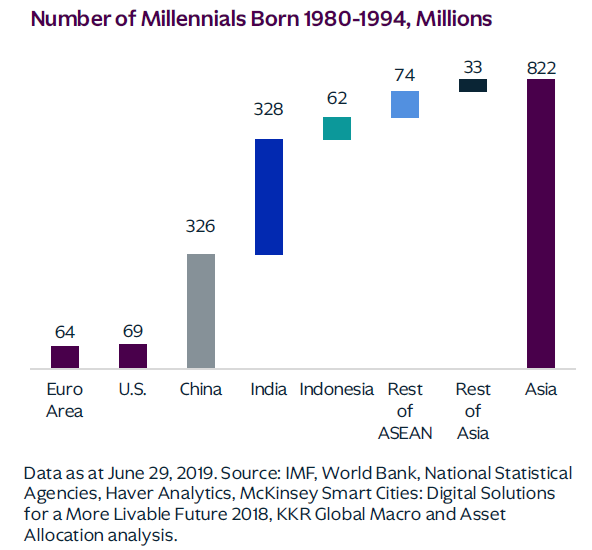

- Demographics as a growth engine. In Northeast Asia (China, Korea, Japan), aging populations are driving investments in productivity and automation. At the same time, approximately 822 million millennials form a powerful consumption wave. According to the World Bank, two-thirds of the global middle class will live in Asia by 2030, creating structural demand for technology, travel, and luxury goods.

- Geopolitics and trade. Where higher tariffs hit Europe hard, Asia proves more resilient thanks to strong regional integration. Initiatives such as the RCEP (30% of global GDP, 2.3 billion consumers) and the ASEAN Economic Community (600 million inhabitants) strengthen intra-Asian trade and make the region less dependent on exports to the West. Currently, 58% of Asian trade remains within the region, and Asia provides approximately 60% of global GDP growth.

- Contrast with Europe. Europe is struggling with disinvestment and offshoring of production to Asia and the US, especially in capital-intensive sectors such as chemicals, refining, and automotive. Closures in the Rotterdam-Antwerp-Ruhr area triangle illustrate that not only jobs are disappearing, but entire value chains and regional economic dynamics are under pressure.

Problems on the supply side of gold and copper

Gold and gold miners have been mentioned more often in this newsletter as the ultimate hedge against financial repression, an environment in which central banks and governments erode the value of money by keeping interest rates artificially low and tolerating high inflation. In such a climate, gold, alongside other interest-sensitive assets, has developed into the best-performing investment category. The demand comes not only from investors but also from central banks that prefer gold over currency reserves. The result: virtually all currencies have fallen in value relative to gold in recent years.

Last week, however, worrying news came from the Grasberg mine in Indonesia, the world's largest gold mine and the second-largest copper mine. The mine, once in Dutch hands but owned by Freeport McMoRan for decades, accounts for approximately 3% of global copper production and yields approximately 50 tons of gold annually (approximately 2% of world production) as a byproduct. On September 8, 2025, a heavy inflow of wet material ("mud flow") occurred in the underground Grasberg Block Cave (GBC), blocking tunnels and evacuation routes. Although Grasberg is often still recognizable in photos of the former open-pit mine, production is now entirely underground, making the impact of such incidents much greater. The expectation is that recovery work and safety inspections may shut down the mine completely until 2026. Freeport McMoRan's stock took a direct hit and fell by 22% this week as the duration of the mine closure became clearer.

The consequences differ per metal. A temporary production outage in gold hardly affects the real economy, because gold is primarily an investment and reserve asset. For copper, it is different: it is crucial for the energy transition and the rapid construction of data centers. Higher copper prices translate almost directly into higher operating costs for industry and energy projects. This supply shock can therefore have far-reaching consequences, not only for commodity markets but also for the implementation of energy and digitization plans worldwide.

Receive weekly insights in your inbox

Exclusive analyses and updates on family holdings and global market developments.

Would you like more information about our services? Please feel free to contact us.

Contact us

Disclaimer:

No rights can be derived from this publication. This is a publication of Tresor Capital. Reproduction of this document, or parts thereof, by third parties is only permitted after written permission and with reference to the source, Tresor Capital.

This publication has been prepared by Tresor Capital with the utmost care. The information is intended to be general in nature and does not focus on your individual situation. The information should therefore expressly not be regarded as advice, an offer or proposal to purchase or trade investment products and/or purchase investment services nor as investment advice. The authors, Tresor Capital and/or its employees may hold position in the securities discussed, for their own account or for their clients.

You should carefully consider the risks before you begin investing. The value of your investments may fluctuate. Past performance is no guarantee of future results. You may lose all or part of your investment. Tresor Capital disclaims any liability for any imperfections or inaccuracies. This information is solely indicative and subject to change.

Read the full disclaimer at tresorcapitalnieuws.nl/disclaimer .