Family Holdings #39 - Constellation Software Shares AI Vision: Founder Mark Leonard Steps Down

This week's topics:

Berkshire Hathaway sold its entire stake in the Chinese BYD after a return of 4,000%. In addition, it reinvested in Japanese trading houses.

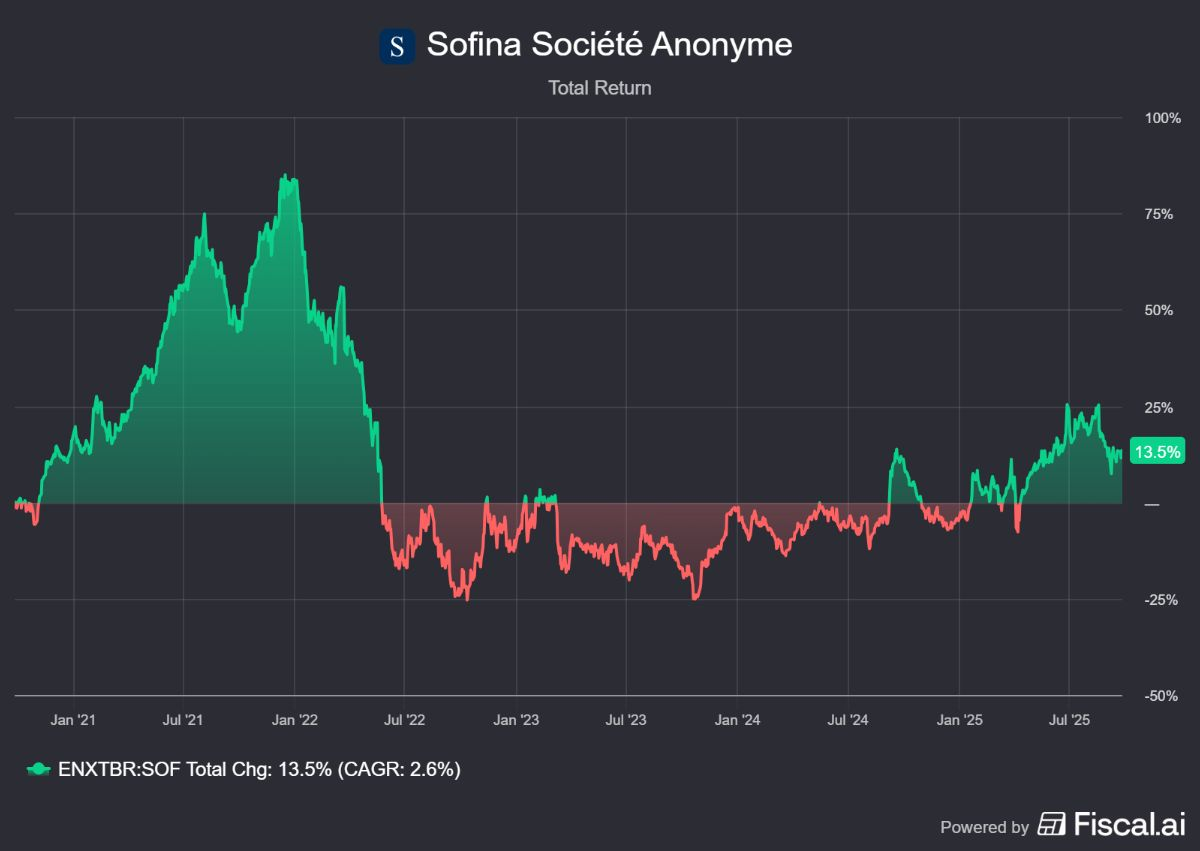

The Belgian holding company Sofina is raising EUR 545 million through a share issue which, despite a strong balance sheet, is being implemented at a significant discount. This transaction is the first step in a broader strategy to increase investment capacity by more than EUR 1 billion, together with a future bond issue.

In Brief:

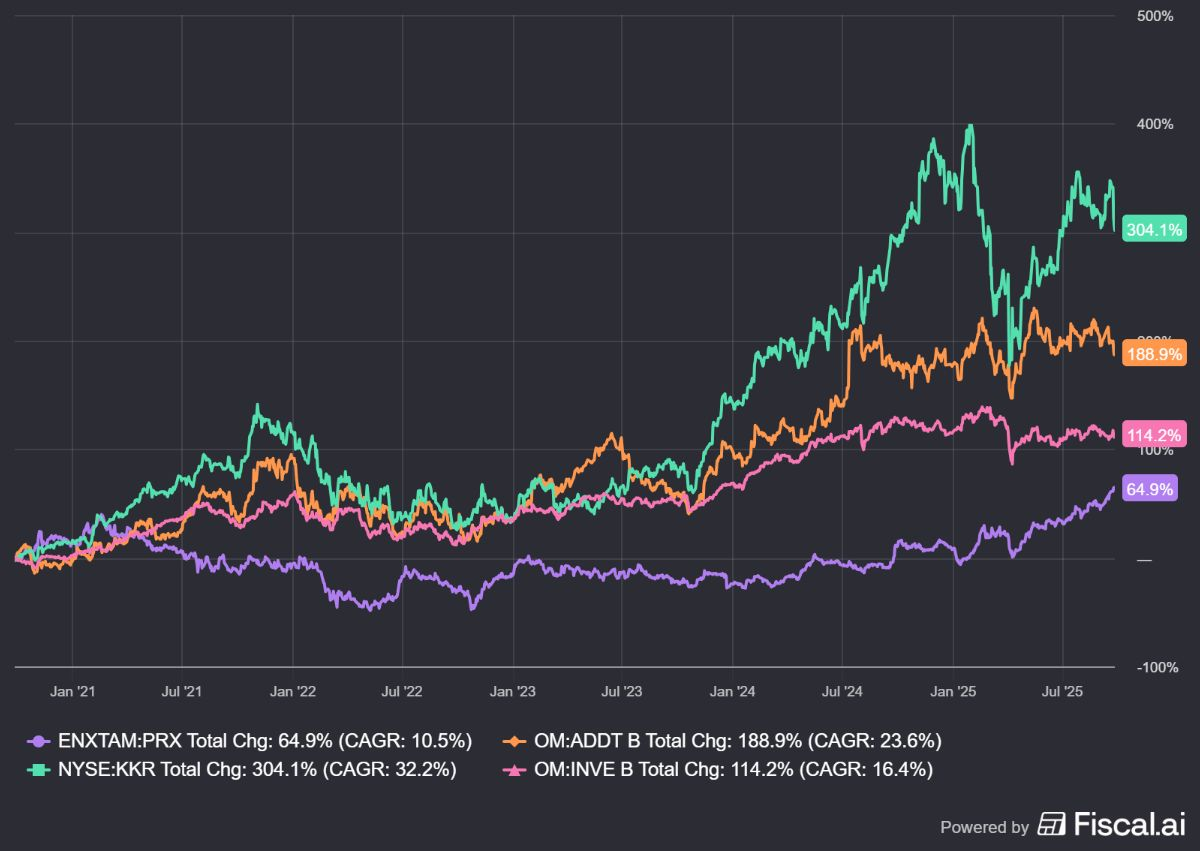

Prosus (Amsterdam: PRX), through its subsidiary OLX Group, is fully acquiring the French online classifieds platform for cars, La Centrale (a type of Marketplace), from Providence Equity Partners for EUR 1.1 billion in cash. With this acquisition, OLX enters the structurally attractive French market and strengthens its position in the European used car sector. The transaction aligns with Prosus's ambition to build a leading European e-commerce ecosystem and validates the company's positive momentum, with its share price reaching all-time highs again this week.

Addtech (Stockholm: ADDT-B) announces a reorganization effective October 1, 2025. The restructuring is designed to support the ambitious target of 15% annual growth in operating profit. Addtech validates this ambition with a historical average of over 20% since its IPO in 2001.

The company is expanding into six business areas, including new focus areas such as Electrification, Safety, and Process, which address trends like the energy transition and digitalization. The new structure should lay the foundation for both strong organic growth and increased acquisition capacity. Addtech will report according to the new structure for the first time in the third quarter, on February 5, 2026.

KKR (New York: KKR) signals strong profitability for the third quarter. In an interim update, the company already reports USD 925 million in income from the sale of participations (monetization income). This amount, which is well above the market expectation of USD 711 million, is mainly realized through the sale of positions, supplemented by dividend and interest income.

At the same time, KKR demonstrates its strength on the investment side. The firm leads a consortium that is acquiring a 45% stake in the infrastructure division of the American Sempra for USD 10 billion, linked to a large-scale LNG project in Texas. The high pace of both successful divestments and new, large-scale deals underscores KKR’s leverage on a recovering capital market cycle.

Investor AB (Stockholm: INVE-B) has received a price target increase from SEK 355 to SEK 366 from the Swedish bank SEB, with a reiterated buy recommendation. According to SEB, the return for Investor's shareholders could be significantly higher in the future than current market expectations. The bank outlines a strategic roadmap that focuses on structural adjustments in the ownership structure and increased transparency. The successful implementation of this strategy could, according to SEB's analysis, propel the share price to a range of SEK 578 to SEK 636 within a period of five to seven years.

Prosus, Addtech, KKR, and Investor AB ended the trading week on the Amsterdam, Stockholm, and New York stock exchanges at prices of EUR 58.40, SEK 312.00, USD 134.01, and SEK 288.10 per share, respectively.

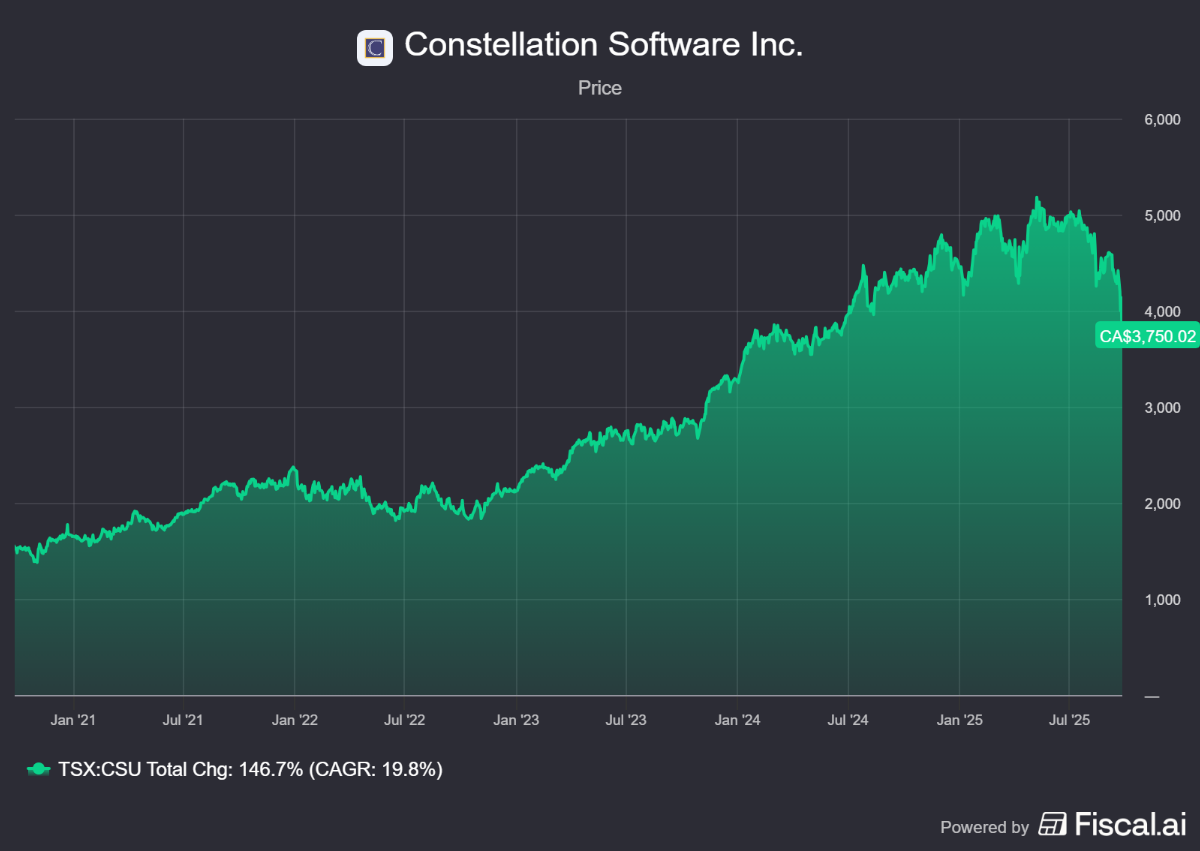

Constellation Software shares AI vision; founder Mark Leonard steps down

The share price of Constellation Software (Toronto: CSU) has been under pressure for some time. As an investor in the company, we have regularly written about the Vertical Market Software (VMS) giant and its peers in the past period. This week, we gained a clearer insight into how management itself views the impact of AI and how it is being implemented within the organization.

On Monday, CEO and founder Mark Leonard, flanked by four internal AI specialists, spoke during a webinar with investors and analysts. Outside of the extensive annual shareholders' meeting, Constellation is quite averse to publicity; for Leonard personally, this appearance was even the last time in his role as president of the company. Three days after the AI webinar, the company unexpectedly announced that Leonard would immediately step down as president for health reasons.

In the official statement, Chairman of the Board John Billowits expressed his gratitude: "On behalf of the board of directors and all employees of Constellation, I wish Mark a full and speedy recovery. Since the founding of Constellation in 1995, his visionary leadership, humility, and wisdom have inspired countless leaders and employees to build what has become a truly exceptional global software company."

Leonard will remain active as a member of the company's board of directors, but his position as president will be taken over by COO Mark Miller. Leonard himself added: "The board of directors and I have full confidence in Mark Miller and our executive team to execute Constellation's business plan. Mark Miller has been a trusted advisor and a driving force within Constellation's executive team for over thirty years, and I can't think of anyone more experienced, knowledgeable, and capable to lead the company at this time."

AI webinar

During the webinar, it was striking how cautiously Leonard approached the AI hype. He opened with an anecdote about AI pioneer Geoffrey Hinton, who predicted in 2016 that radiologists would soon be replaced by AI, a prediction that proved premature. In the nine years since then, the number of radiologists has actually increased by 17%, while the US population grew by only about 6% during the same period. The number of radiologists per capita thus increased from 7.9 to 8.5 per 100,000. Leonard’s message: even someone like Hinton ("you and I will never know more than a fraction of what Jeff knew about AI") can misjudge the impact.

With that lesson in mind, Leonard warns against hasty conclusions. Leonard states that no one can predict whether the programming world is facing a "renaissance or a recession" now that AI is making its entrance; perhaps productivity will increase tenfold, perhaps it will remain at 10%. According to Leonard, a tenfold productivity gain would be a great outcome: "You can imagine that you no longer have to accept software that does 80% of what you want; you get software that does 100% of what you want, fully tailored to your needs." At the same time, that same productivity gain could lead to a huge oversupply of programmers.

Constellation is therefore closely monitoring developments but is not carried away by every hype. At the end of the call, Leonard reiterated that AI claims deserve healthy skepticism in a market flooded with opportunistic noises.

Anyone who thought that Leonard would use his upcoming farewell for a grand or emotional message was disappointed. In his characteristic calm, nuanced style, he spoke for an hour and a half with various business unit operators about AI. Realistic, solution-oriented, sometimes almost dry, but never spectacular. Exactly the tone that has characterized Constellation for thirty years.

Opportunities and threats to Constellation's competitive advantage

A common thread in the webinar was why AI does not simply wipe out the companies in Constellation’s portfolio. The sustainable competitive advantages lie primarily in deep-rooted domain knowledge and customer processes, more than in data alone. Constellation’s companies know the processes of end-users inside and out. One of the AI experts in the call put it this way: "Our companies have an incredible knowledge of the processes and workflows of end-users, often even better than the end-users themselves." Leonard described it as "the distillation of a conversation between the supplier and the customer that has often been going on for decades." That years of practical knowledge is converted into algorithms, functionality, and reports. Unique, company-specific information is embedded in the code that a generic AI system cannot simply replicate.

Large customers sometimes add their own AI tools to Constellation’s software, but those often remain superficial. Critical functionality requires deep integration with existing systems and workflows, integrations that are developed in close collaboration with customers. Even if customers experiment with AI, delivering real end-to-end solutions usually remains the domain of the original software supplier.

Vertical market software moves on a spectrum. On one side are generic, horizontal applications that are cheap and simple (think of Microsoft Excel, for example), but often offer no more than half of the desired functionality. On the other side are very expensive, fully customized systems that closely match the wishes of an organization in detail. These are solutions for the very largest companies that see software as a strategic differentiating factor and are willing to invest millions in company-specific systems or extensive implementations. Constellation serves the middle of this spectrum: packages that delve deep enough into niche processes, at a price level that remains feasible for most customers. Some customers eventually grow so much that they see software as a strategic core and accept the costs of full customization; then Constellation sometimes loses them to parties like SAP. That interaction has existed for years.

With AI, those boundaries are expected to shift. AI makes it possible to deliver more customization more efficiently and at lower costs, which keeps customers on board longer. At the same time, it becomes easier for large customers to pursue customization themselves. Leonard put it this way: "AI makes it much more interesting for us to deliver customization, but at the same time increases the chance that the customer will do it themselves." It is the classic double-edged sword. The greater the productivity gain, the more room for Constellation to offer customization, but also the stronger the incentive for customers to experiment themselves.

Case study: IDEA Data Solutions

A striking example of how Constellation’s defense walls against AI work in practice is the story of IDEA Data Solutions. This company, part of the Omegro portfolio within Constellation’s Volaris group, focuses entirely on ERP software for superyachts. It is vertical market software in optima forma, arising from decades of interaction with a very specific customer group.

Superyachts form a mini-world in themselves. Vessels with sometimes eighty crew members require complex maintenance schedules, strict safety inspections, certifications, and sophisticated crew management. In the late 1990s, founder Klaus Allebrodt saw at a shipyard in Mallorca how new ships were still being delivered with stacks of paper manuals. The crew had to work through hundreds of pages to find out which part needed maintenance when or where a spare part was located. IDEA changed that. Their software digitized the entire information chain and added modules for inventory management, ISM compliance, certification, shore personnel, and crew organization. The goal was simple but crucial: to ensure that a superyacht is ready to sail at any time.

The further course underscores how important niche focus and customer dialogue are. In 2008, IDEA was acquired by SpecTec, then the market leader in maritime software. The idea was that economies of scale would follow, but in reality, the focus shifted to commercial shipping in Germany and Switzerland. The core activity for superyachts lost priority and innovation stalled. Only after the acquisition of SpecTec by Constellation (via Volaris) in 2014 and the carve-out of IDEA in 2018 did the company regain the space to fully focus on its niche. That led almost directly to growth and innovation. Even in the difficult COVID years (2020–2022), when the entire superyacht industry was affected, IDEA managed to achieve double-digit growth year after year. Today, management expects the business to triple in ten years, thanks to tight quarterly reviews and a consistent focus on the niche market.

The basis of that ambition is something that AI cannot replicate. IDEA’s success rests on deep-rooted sector knowledge and long-term relationships with customers. In over twenty years, the software has been shaped by hundreds of feedback rounds with captains, engineers, and owners. That is precisely what makes IDEA indispensable for users. A generic AI can perhaps search manuals, but does not understand how shipyard, captain, and owner work together to keep a yacht operational. CEO Christian Mühle emphasizes the power of the customer-focused approach that Omegro (Volaris) taught them: “Omegro has taught us to view planned initiatives through the lens of the customer. No matter how good an idea is, if a customer is not willing to invest, there is no real product.” That insight only arises through years of collaboration and continuous alignment with the customer.

Current AI bottleneck: good, but not good enough

A major obstacle is that current AI models struggle with large, complex software packages. They achieve impressive speeds when building something new, but lose track of existing systems. Detecting errors or implementing major changes therefore remains difficult. New techniques such as larger context windows and multi-agent architectures should gradually improve this. Within Constellation, a specialized team is now testing AI in almost all phases of the software cycle: from coding and testing to documentation and system design. Teams working with this explore more alternatives in the design phase and sometimes see clear efficiency gains, although other applications still lag behind.

Generative models are strong in writing new code, but less so in debugging existing systems. This is because they are trained on datasets with correct code, while examples of faulty code and solutions hardly exist. The models are trained on open-source codebases, not on datasets of defects, making it difficult for them to recognize and resolve errors in existing, complex systems. Delivering a first version often works well, but analyzing and repairing legacy systems flawlessly is another story. What seems like a tenfold acceleration in the construction phase can thus result in a tenfold increase in the maintenance burden.

Constellation therefore chooses a pragmatic approach. AI is only applied where it adds concrete value, and the results are critically assessed. An AI expert from Constellation emphasized during the webinar the need to distinguish between real value and ‘AI washing’: adding an AI label for marketing purposes. Often a solution works in eighty percent of the cases, but the remaining twenty percent, often crucial edge cases, causes the most problems. Whether AI code requires more or less maintenance over the entire lifecycle is still unknown. Building new modules with AI is possible, but production code is closely monitored. Rebuilding entire systems solely to utilize AI capabilities is not an option for the time being.

Rolling out AI via familiar bottom-up approach

The way Constellation implements AI follows the same philosophy as the rest of the company: fully decentralized. The holding company does not impose a blueprint but allows the business units to experiment themselves. As soon as a successful application arises within a group, the insights are shared so that other units can benefit from them. The management thus consciously chooses to spread best practices instead of central obligations. Below is an overview of the mentioned AI implementations within Constellation:

Adoption and product development

- In one operational group, 27% of the business units are now developing an AI product or feature for customers.

- In another division, experimenting with AI solutions was made mandatory for everyone.

Internal application

- One operational group reported a month-on-month increase of 450% in the use of AI tools by employees. The majority now work with it in one way or another.

- In R&D, 61% of the business units in some groups use AI tools, in other groups even more than 70%. The effectiveness varies greatly: some teams achieve significant efficiency gains, while others see hardly any results.

Support, sales, and marketing

- In support, sales, and marketing, more than half of the companies now use an AI assistant on the front lines. Yet only 10% to 20% of the questions were handled fully automatically, while 50% to 60% was expected. This emphasizes how difficult practical cases are, even with a wealth of information.

- In sales and marketing, approximately 50% of the business units use AI for lead generation, writing marketing texts, and answering RFPs faster, among other things. There are concrete examples of deals that were concluded thanks to AI-driven product combinations or faster tender responses.

The best estimate is that around 20% of all Constellation companies are currently carrying out serious AI projects with potentially large impact, while the rest are mainly still experimenting. It is expected that this percentage will clearly increase in the coming 18 months as successful cases spread. The general picture is that AI has a broad presence, but that the degree of maturity varies greatly. Everyone touches it, only a part already uses it in depth.

The legacy of Mark Leonard

The news that Leonard is stepping down with immediate effect caused quite a shock on the stock market, with the share losing more than 15% intraday. That reaction seems primarily emotionally driven and less driven by fundamental concerns. Leonard is seen as a visionary and exceptional capital allocator. Under his leadership, Constellation grew into a globally operating software holding company with more than a thousand subsidiaries.

A profile in the Canadian newspaper The Globe and Mail paints a picture of an iconoclastic leader. Leonard, described by the newspaper as "large and powerfully built, like a linebacker, with a deep voice and a British accent," was known for his fierce intelligence and a directness that was sometimes perceived as sharp. At the same time, he was always curious and willing to change his mind based on convincing data. His appearance, including an exceptionally long, Gandalf-like beard and informal clothing style, stood in stark contrast to the sharp suits of the Bay Street investors (Canada's Wall Street) who idolized him.

Leonard’s unique approach stems from his background. After an MBA, he started as a venture capitalist in the 1980s, but after eleven years he considered himself an unsuccessful investor. He hated the model where firms only invest for a few years and then sell again. He was more interested in buying and permanently holding companies that he liked. His inspiration came from the Canadian entrepreneurial legend Roy Thomson, who made a fortune by buying up local newspapers in small communities, companies with loyal customers and little competition. Leonard replaced the newspapers with software suppliers in niche markets, but the model remained identical.

His focus on shareholder value was extreme. In 2015, he stopped receiving a salary. The reason, he wrote in his annual president's letter, was that he wanted to lead a more balanced life and travel more comfortably without doing so at the company's expense. He refused to "profit" from shareholders and wanted to set the right example but preferred comfort and speed at his own expense over the economy class and sober hotels that the corporate culture prescribed. "So I'm afraid you'll usually see me at the front of the plane from now on," he wrote. "I love what I do and don't want to stop unless my health deteriorates or the board of directors thinks it's time for me to go."

Crucially, from the beginning, he designed a structure that does not depend on one person. Constellation operates decidedly decentralized. In acquisitions, the existing management remains in place, maintaining autonomy and the company-specific culture. The holding company facilitates capital and knowledge sharing but does not interfere with daily management. This created a “culture of cultures” in which each acquired company retains its own identity and still benefits from the scale and experience of the holding company.

This foundation ensures that the continuity of Constellation Software does not depend on one individual. Leonard as a person and in his way of leading cannot be replaced, but the structure he has built allows his departure to be fully absorbed at an operational level. To keep the change as small as possible, the supervisory board is handing over the baton to someone with an exceptional track record: Mark Miller, one of the most loyal and experienced forces within the company.

Receive weekly insights in your inbox

Exclusive analyses and updates on family holdings and global market developments.

Introduction: The New Mark

The story of Mark Miller is virtually seamless with that of Constellation. In the early nineties, he was at the cradle of Trapeze, specializing in public transport planning. Together with co-founders Ian Keaveny and Fran Fendelet, he built the company from the ground up. Instead of building remotely, he traveled to customers, listened to daily pain points, and translated them one-on-one into functionality.

Their first customer was in St. John's, Newfoundland, where they helped implement the software on-site and understand the needs of the transport company. In 1995, Trapeze became Constellation's first acquisition. Miller remained involved, further developed Trapeze, and became a confidant of Leonard. Even then, Miller operated in the manner of the Constellation of today.

His career path, as described in an article on the Volaris website, testifies to a deep-rooted operational focus and an unwavering belief in the power of culture. Miller's leadership was not formed in the boardroom, but on the work floor, in direct interaction with customers and employees. This hands-on approach, which he already used in the early days of Trapeze, is the common thread in his career. He learned early on that the success of a software company depends not only on the technology, but especially on the ability to solve the specific problems of a customer.

This insight, combined with his talent for identifying and nurturing leadership within acquired companies, made him the ideal architect of the Volaris Group. Under his leadership, Volaris grew into a conglomerate of hundreds of autonomous software companies, each with its own identity, but united by the principles of Constellation: a long-term horizon, operational discipline, and an incessant focus on generating cash flows. His way of leading is one of 'coaching, not commanding'. He gives managers the freedom to do business, but at the same time forces them to learn from the best practices that are shared within the network. This balance between autonomy and collective intelligence is the essence of the Constellation model, and Miller is the embodiment of it.

In 2001, he became COO of the parent company, a role he held for nearly twenty-five years. He closely monitored the hundreds of deals that Constellation has closed since then and was responsible for the daily coordination of growth. In 2011, he also took over the leadership of Volaris Group, which has now grown into a mini-Constellation in itself, where more than two hundred software companies were acquired under his leadership.

He successfully applied the now well-known Constellation principles of autonomy and knowledge sharing. In some respects, this brought him even closer to the acquisitions than Leonard, who focused more on capital allocation in a broad sense. This picture is confirmed in a recent interview on YouTube in which he explains his way of leading and vision on culture. For those who want to get to know Miller better, that recording is recommended.

Miller has been in the company's DNA from day one. He doesn't have to adopt the culture; he is a co-designer of that culture. His own words are telling: "I don't remember all the companies we manage, but I do remember the challenges they faced, and I spread those solutions among the other companies". He does not see the portfolio as a list of names, but as a collection of issues and solutions that he wants to connect with each other. In style and attitude, he does not differ much from Leonard. Miller is not a showman, but a thoughtful leader who listens, formulates carefully, and travels a lot to speak to management teams personally. He sees culture as a sum of individual enterprises.

For shareholders, it is relevant that Miller has significant skin in the game. He owns approximately one percent of Constellation Software, worth approximately USD 630 million at current rates. In addition, he has interests in Topicus.com (approximately USD 59 million) and Lumine Group (approximately USD 24 million). Together, this amounts to more than USD 700 million in private capital linked to Constellation and its spin-offs.

His confidence in the future of the company was underlined again this week: on September 26, he bought more than CAD 1 million in additional shares through his holding. He was not the only one; Chairman John Billowits and director Jean Soucy also bought shares this week. So Miller is not only a director, but also one of the largest individual shareholders. An important fact for us at Tresor Capital when analyzing investment opportunities.

The transfer from Leonard to Miller should emphasize how robust the Constellation model is. Leonard was the founder and face of the company, but not the heart of the culture. That is correct in the hundreds of autonomous companies that generate their cash flows year in, year out. Nothing changes for them. Meanwhile, Leonard will still have an important role as a supervisory director in stimulating, challenging, and coaching the management team that he himself has put together.

The acquisition machine continues to run smoothly, as was evident this week with the acquisition of Estuary, a Vietnamese supplier of salestech software, by the Vela Group.

Deze discipline blijkt ook uit de manier waarop Constellation afwijkt van de standaardpraktijken op Bay Street. Het bedrijf keert geen aandelenopties uit, vermijdt de inkoop van eigen aandelen (een praktijk die Leonard als aandeelhoudersonvriendelijk beschouwt) en betaalt slechts een minimaal dividend omdat aandeelhouders de voorkeur geven aan de inzet van kapitaal voor nieuwe acquisities. De extreme kostendiscipline werd duidelijk tijdens de tech-bubbel van de COVID-19-pandemie: waar concurrenten vaak 15 keer de omzet of meer betaalden voor overnames, wordt geschat dat Constellation in die periode gemiddeld slechts 0,8 keer de omzet betaalde.

Deze filosofie van Constellation vertaalt zich ook naar de overnamestrategie. Leonard benadrukte dat AI geen enkele reden is om de investeringsmachine te vertragen. Nieuwe technologieën zijn in de geschiedenis van het bedrijf nooit een reden geweest om te stoppen met het aan het werk zetten van kapitaal; dit was ook niet het geval tijdens de dot-comrevolutie begin jaren 2000. De kernstrategie blijft ongewijzigd. Het management stelt dat de opkomst van AI hooguit de prijs of de diepgang van de due diligence van een specifieke deal kan beïnvloeden, maar nooit de fundamentele drang om te acquireren zal stoppen.

Dat is meteen ook waarom we weinig zorgen hebben over de opvolging van Leonard. De decentrale structuur, het fundament dat al dertig jaar staat, en de ervaring van Mark Miller als operator en dealmaker maken dat de continuïteit is geborgd. Miller leidt al jaren Volaris, waar hij meer dan tweehonderd acquisities begeleidde in precies dezelfde cultuurstijl. Voor beleggers is het bovendien belangrijk dat Miller zelf meer dan USD 700 miljoen privévermogen heeft gekoppeld aan Constellation en zijn spin-offs. Skin in the game is voor ons bij Tresor Capital een van de belangrijkste selectiecriteria, en Miller voldoet daaraan ruimschoots.

Het aandeel handelt inmiddels op waarderingsniveaus die we lange tijd niet gezien hebben, en is zelfs een van de meer aantrekkelijk gewaardeerde holdings binnen ons universum (conform intern beleid delen we die specifieke gegevens nooit extern). Voor het eerst zien we een correctie die niet veroorzaakt werd door een brede marktdaling, en pas voor de derde keer überhaupt in de geschiedenis van Constellation een correctie van een dusdanige omvang. Als langetermijnbeleggers zien wij dit eerder een kans dan een bedreiging.

Dat wordt bevestigd door het gedrag van de insiders. De aankoop van aandelen door Mark Miller eerder deze week, samen met andere insiders, wat het totaal aan insider-aankopen op ruim CAD 1,8 miljoen brengt, is het sterkst mogelijke signaal van vertrouwen. Peter Lynch, een van de meest succesvolle beleggers aller tijden, stelde het treffend: "Insiders verkopen hun aandelen om allerlei redenen, maar ze kopen ze slechts om één reden: ze denken dat de koers zal stijgen." De logica is helder: waar de verkoop van aandelen vele oorzaken kan hebben, zoals de behoefte aan liquiditeit of diversificatie, is er voor een aankoop doorgaans maar één motivatie: de overtuiging dat het aandeel ondergewaardeerd is en in de toekomst zal stijgen.

Dat een koersdaling niet prettig is, moge duidelijk zijn. Een mooi rendement op korte termijn terug zien lopen voelt als een verlies, weliswaar ongerealiseerd, maar toch. Toch mag van beleggers in aandelen een dikke huid worden verwacht. Waarom zouden aandelen een structureel beter rendement dan veiliger geachte obligaties verdienen, de zogenaamde risicopremie, als er niet tussentijds een koersfluctuatie zou kunnen optreden?

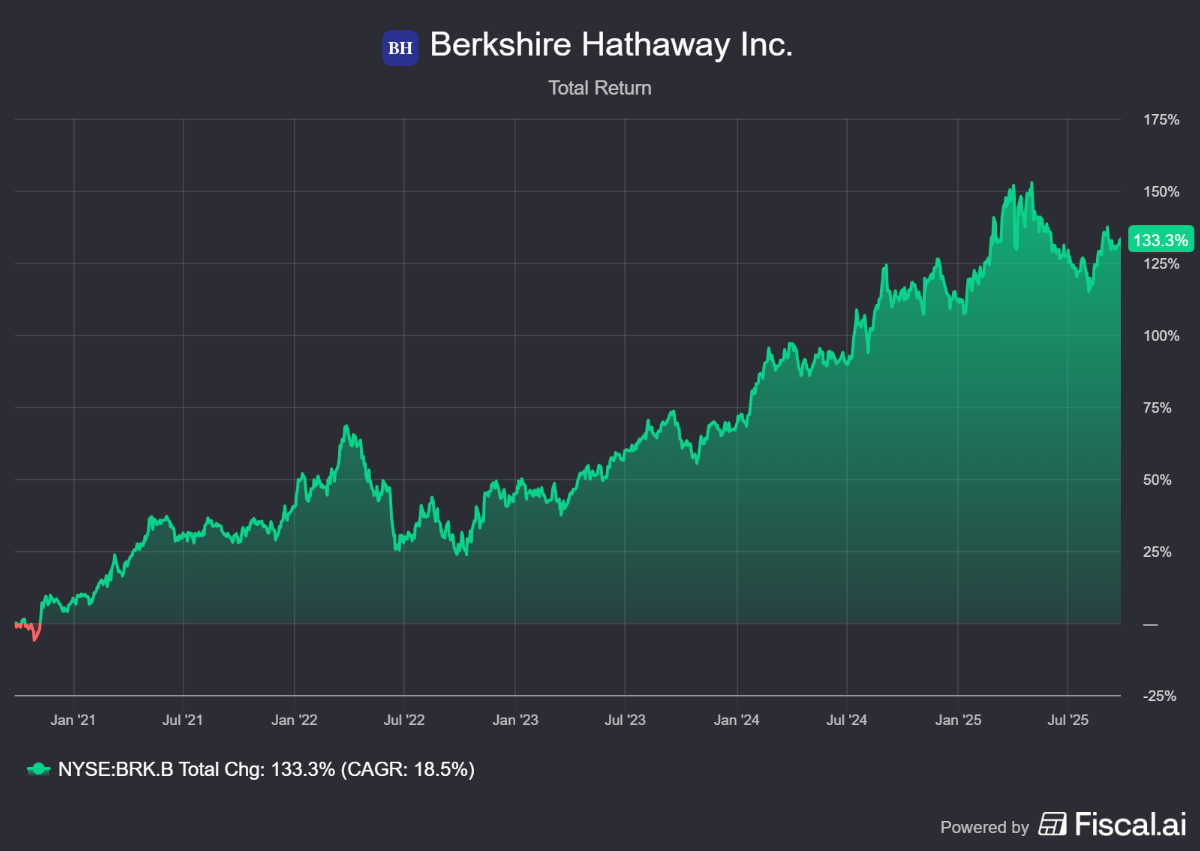

We eindigen met een veelzeggende quote van wijlen Charlie Munger, de rechterhand van Warren Buffett bij Berkshire Hathaway. Ondanks het feit dat Berkshire als een financieel fort wordt beschouwd, is de beurskoers meermaals met maar liefst 50% gedaald. Tegen die achtergrond deed Munger deze uitspraak:

“Als je niet met volatiliteit kunt omgaan, ben je niet geschikt om in aandelen te investeren. Je zult dan het middelmatige resultaat krijgen dat je verdient, vergeleken met de mensen die rustiger blijven onder deze marktfluctuaties.”

Constellation Software ended the trading week on the Toronto Stock Exchange at a price of CAD 3,660 per share.

Berkshire Hathaway's strategic shift: from China to Japan

Berkshire Hathaway (New York: BRK-B), the American investment holding company led by Warren Buffett, is carrying out a clear strategic repositioning of its listed portfolio. Recent transactions show a conscious reduction of risk in China, illustrated by the complete sale of its stake in automaker BYD, while capital is being reallocated to Japanese trading houses, where it has increased its stake in Mitsui & Co.

Farewell to a success story in China

After a period of 17 years, Berkshire Hathaway has sold its entire position in the Chinese electric car manufacturer BYD. The investment, which began in 2008 with an investment of approximately USD 230 million for a 10% stake, has grown into one of the most successful in the company's history. The sale yields an exceptional return of approximately 4,000%.

The investment is often attributed to the conviction of the late Charlie Munger, who at the time recognized the potential of founder Wang Chuanfu and his technological lead. However, the exit marks more than just taking profit; it seems to be an active choice to reduce the geographical risk in the portfolio.

Deepening of investments in Japan

Where Berkshire is exiting China, capital is being reallocated to Japan. Berkshire has increased its stake in the trading house Mitsui & Co. to above 10%, further strengthening its position as a major shareholder. This step follows shortly after a similar increase at peer Mitsubishi and confirms the structural nature of Berkshire's Japan strategy.

This strategy began in 2020 with initial positions of approximately 5% in the five major Japanese trading houses (Mitsubishi, Mitsui, Itochu, Marubeni and Sumitomo). These "sogo shosha" closely align with Berkshire's philosophy: they are deeply rooted, diversified conglomerates with stable cash flows and an increasing focus on shareholder returns. The systematic increases underscore the confidence of Buffett and his intended successor Greg Abel in the long-term value of these positions.

Positive signals from the largest position

Apart from the strategic shifts, there were positive signals about Berkshire's largest equity position, Apple. The recently launched iPhone 17 is experiencing stronger than expected demand, which has prompted Apple to request a 30-40% production increase from suppliers. Although Berkshire reduced its position last year, it still owns 280 million shares, which represent a weighting of approximately 20% in the equity portfolio.

The Berkshire Hathaway B shares ended the trading week on the New York Stock Exchange at a price of USD 500.03 per share.

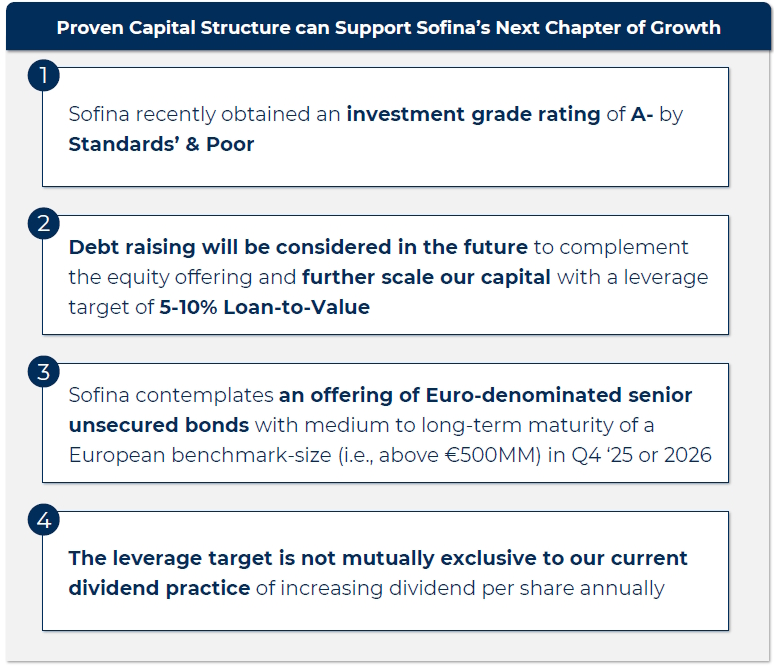

Sofina's capital increase: a strategic move for more firepower

The Belgian holding company Sofina surprised investors this week with the announcement of a substantial capital increase. The company is issuing up to 2.45 million new shares, worth a maximum of EUR 545 million. For existing shareholders, this means a dilution of approximately 7%. The reference shareholder, the Boël family (approximately 55% stake), has pledged to participate fully, giving the transaction a solid foundation.

Strategic rationale for the capital round

According to CEO Harold Boël, the capital increase is intended to "do more of what we are good at, on a larger scale and with more flexibility." The net proceeds will be used to increase the annual investment rate by 5% to 15%, which amounts to three to five additional transactions per year for the Sofina Direct portfolio.

With the additional resources, the holding company wants to strengthen its permanent capital base in order to be able to handle larger investment tickets and have the flexibility to extend the term of investments in successful private companies. The latter is an important strategic element, as the period that companies remain unlisted is becoming increasingly longer. It enables Sofina to optimize value creation over a longer horizon.

A striking timing and structure

The timing of the capital increase is remarkable. As of June 30, 2025, Sofina reported a net financial debt of only EUR 76 million on a portfolio of almost EUR 10 billion, resulting in a very low loan-to-value ratio of 0.8%. With such a strong balance sheet, the company could have taken on significantly more debt without jeopardizing its creditworthiness.

The issue price of EUR 223.00 per share implies a significant discount. This price is 12.1% below the theoretical ex-rights price (TERP) and represents a discount of 24.7% compared to the last reported net asset value (NAV) of EUR 296 per share as of June 30, 2025.

However, this transaction is the first phase of a broader strategy. Sofina recently obtained an A- investment grade rating from Standard & Poor's. With this credit rating, the holding company plans to enter the bond market in the fourth quarter of 2025 or in 2026 for an issue of at least EUR 500 million. The combined proceeds of more than EUR 1 billion will significantly increase Sofina's firepower and are intended to bring the Loan-to-Value ratio to a target zone of 5-10% in the long term.

Impact on the portfolio and the shareholder

For existing shareholders, the transaction results in dilution in the short term. At the same time, the structure with preferential rights (1 new share per 14 existing) offers them the opportunity to subscribe at a price that is significantly below both the market price and the intrinsic value.

In the long term, this strategic financing positions Sofina to further strengthen its unique market position. As one of the few Belgian players with access to the most prominent international private equity and venture capital funds, Sofina can maintain and expand its key role. The additional resources will be used in the five focus sectors (Consumer Goods, Digital Transformation, Education, Healthcare and Sustainable Supply Chains), where the holding company already has strong positions in companies such as ByteDance, Drylock and Vinted.

For current shareholders, this means dilution in the short term, but also the opportunity to expand their stake at an attractive price. After all, the shares are offered with a double discount, which almost feels like a consolation prize. Looking to the future, this additional capital offers a favorable prospect of a higher investment rate and faster growth for Sofina.

Sofina ended the trading week on the Brussels Stock Exchange at a price of EUR 254.40 per share.

Receive weekly insights in your inbox

Exclusive analyses and updates on family holdings and global market developments.

Would you like more information about our services? Please feel free to contact us.

Contact us

Disclaimer:

No rights can be derived from this publication. This is a publication of Tresor Capital. Reproduction of this document, or parts thereof, by third parties is only permitted after written permission and with reference to the source, Tresor Capital.

This publication has been prepared by Tresor Capital with the utmost care. The information is intended to be general in nature and does not focus on your individual situation. The information should therefore expressly not be regarded as advice, an offer or proposal to purchase or trade investment products and/or purchase investment services nor as investment advice. The authors, Tresor Capital and/or its employees may hold position in the securities discussed, for their own account or for their clients.

You should carefully consider the risks before you begin investing. The value of your investments may fluctuate. Past performance is no guarantee of future results. You may lose all or part of your investment. Tresor Capital disclaims any liability for any imperfections or inaccuracies. This information is solely indicative and subject to change.

Read the full disclaimer at tresorcapitalnieuws.nl/disclaimer .