Economy & Markets #40 - AI momentum versus inflation worries and US shutdown

This week's topics:

Capital Markets Show Strong Third Quarter

The third quarter was characterized by pronounced differences between regions and sectors. The strongest performances came from Asia, with the stock exchanges in Taiwan and China (for technology companies in particular) showing a strong recovery. Chinese companies introduced new AI models and internal chip solutions, strengthening their technological independence and increasing their growth potential. The confidence of the Chinese consumer to (re)invest in their own stock market also clearly increased.

Globally, technology stocks benefited from the continued demand for digitization and artificial intelligence. Increasing investments in data centers, cloud solutions, and AI applications continue to support the technology sector. The American technology index Nasdaq rose by +11.3%. In addition, gold remained popular, supported by a loose monetary policy from central banks and investors seeking protection against inflation and geopolitical uncertainties. In the United States, the expectation of interest rate cuts provided new support to equity markets. Because the US started cutting interest rates later than Europe, we see higher returns there than in Europe. For example, the SP500 performed better with a +7.7% than the broad Eurostoxx600 (+3.7%).

While European stocks performed well in the second quarter, the sentiment remained more moderate in the past quarter. Economic headwinds (uncertainty for the export sector, low domestic consumption) and political uncertainties weighed on the stock exchanges in Frankfurt, Brussels, and Paris. Despite strong performances from defense stocks, the broader German DAX index lagged behind, partly due to disappointment over the lack of structural reforms in Germany. Defensive sectors such as healthcare and traditional consumer goods suffered from rising costs and lower profit growth.

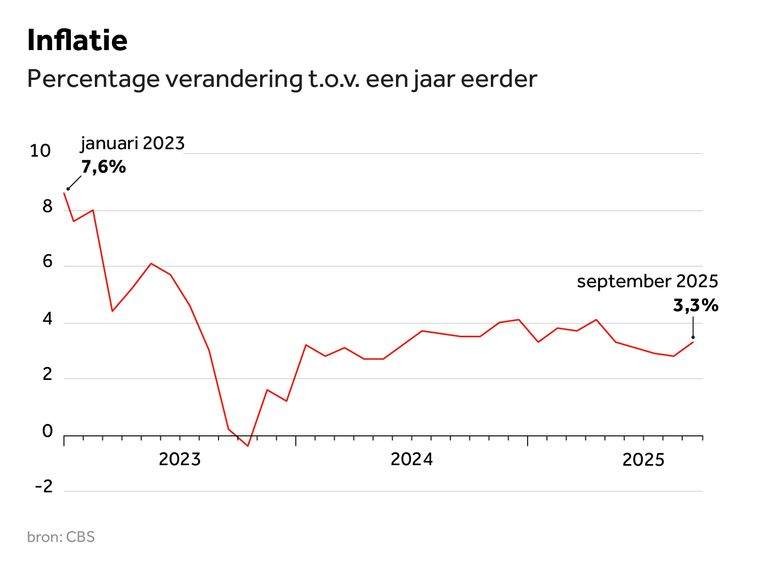

Inflation Rises Again in the Netherlands and Belgium

New figures on inflation in the Netherlands (for September) indicate that it is rising again with +3.3% yoy, after 2.8% yoy in August. The increase in the Dutch price level was mainly driven by higher energy prices (+4.0%), services (+4.1%) and food (+3.7%). The harmonized European measure (HICP) came out at 3.0%. It is striking that the oil price (-10%) and the euro/dollar exchange rate (-6%) are significantly lower than a year ago, but that disruptions (taxes and greening) in the Dutch energy market still lead to energy being an inflation driver again.

In Belgium, inflation rose from 1.9% to 2.1%. There, however, it is not so much the energy costs that are driving up the price level, but especially food and catering. In both countries, we do see that inflation remains higher than the short-term interest rate (which banks pay on savings). To maintain purchasing power, you will have to ask your bank or asset manager to build up more actively. Inflation will have to remain high to finance the Belgian government debt. According to Bloomberg, Belgium, like France, is threatened with a downgrade of its credit rating. With a national debt heading towards 120% of GDP, a budget deficit that will rise to 5.4% in 2026, and interest charges of €17 billion, public finances remain vulnerable. The difference with France is that Belgium currently does have a stable government that is implementing reforms around the labor market and social security. Nevertheless, the deficit remains structurally too high and the finances of Brussels and other sub-states continue to spiral out of control.

The Belgian government-De Wever faces a difficult budgetary task: between 8.2 and 13 billion euros still needs to be found by 2029 to limit the deficits. The focus is on stricter controls for the long-term sick (potential saving of 1–3 billion), while the falling tax revenues since 2014 are further increasing the pressure (from 52% to 48.7% of GDP). Economists also warn that the planned tax cut, which is fully financed with borrowed money, will further drive up debt.

US: Trump Plays Shutdown Hard, But For How Long?

The American government has been in shutdown since Wednesday, after the Senate and White House failed to reach an agreement on the federal budget. Almost all non-essential services are at a standstill and 800,000 civil servants have been sent on unpaid leave. President Trump blames the Democrats for the impasse, but also actively uses the situation as political leverage.

On Truth Social, he announced that he would “take the opportunity” to determine which government agencies, dismissed by him as “Democratic”, can be temporarily or permanently eliminated. His spokesperson confirmed that the White House is investigating how thousands of jobs can disappear permanently. Trump's budget director Russel Vought also sees the shutdown as an opportunity to push through structural cuts and reforms that Republicans have been pursuing for some time. This makes the stalemate not only a battle over budget figures, but also an ideological battle over the size and role of government.

For the time being, the dollar, stock markets and bonds are reacting relatively calmly. Nevertheless, Trump's approach increases the chance that the shutdown will last for a long time. After all, the conflict is not only about budgetary details, but about a fundamental redesign of the federal government. This is worrying for markets and credit rating agencies: the longer the blockade lasts, the greater the damage to confidence and economic activity. The economic impact is already noticeable: per week, the shutdown can cost the US up to $15 billion in economic growth. In the event of a longer standstill, millions of jobs and billions in consumer spending are at risk of being lost.

Analysts warn that the combination of political unrest, paralyzed government services and waning confidence in financial markets can also cause significant damage in the long term. This is also the reason why in the past the politically weakest party quickly compromised and stock markets quickly recovered. The longest shutdown of the American government was that of 2018–2019 (35 days), when Trump and the Democrats clashed over the financing of the wall on the Mexican border. Belgium, incidentally, set a world record by functioning for 541 days without a fully-fledged federal government.

Receive weekly insights in your inbox

Exclusive analyses and updates on family holdings and global market developments.

Investments in AI Infrastructure Are Growing Much Faster Than Expected: Citibank Significantly Increases Growth Estimates

Global investments in artificial intelligence (AI) are developing at an unprecedented rate. So fast, that several critics are now talking about a hype: excessively high expectations about growth paths, and companies that are valued as if their future profits are guaranteed.

This is in stark contrast to the sentiment in the first quarter of 2025. At that time, the Chinese software DeepSeek seemed to be the breakthrough that would make massive investments in data centers and the cloud unnecessary. Investors feared that AI would become commoditized faster and that the enormous capital flows towards infrastructure would prove unnecessary.

Reality turned out differently. The second quarter figures from the so-called hyperscalers, the global providers of cloud infrastructure and AI services, showed that the investment cycle has accelerated. Not only did capital expenditures increase, but new strategic collaborations and product launches were also announced. This positive momentum has only become stronger in recent weeks. The series of announcements resembles a true good news show in which hyperscalers outdo each other.

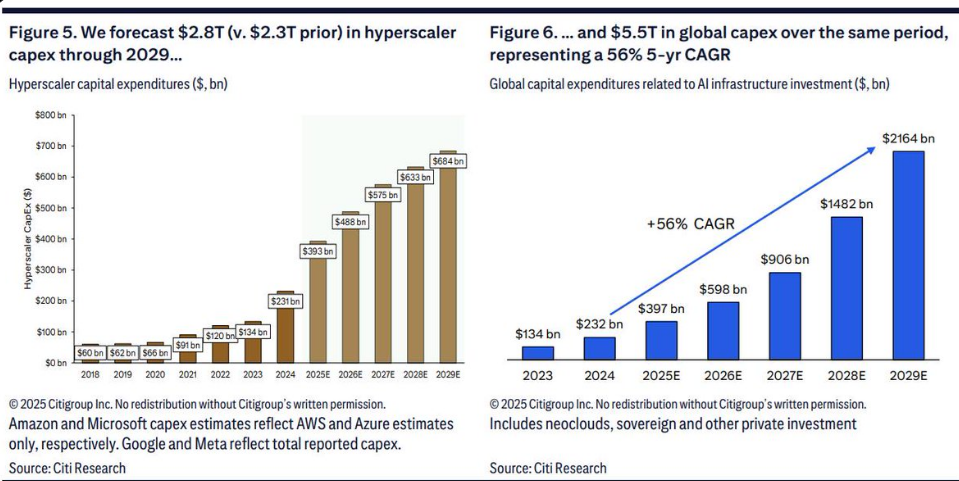

A new report from Citibank: “Raising AI Infrastructure Forecasts” describes the size and flow of investments. In it, growth expectations and investment estimates for the coming years are again significantly adjusted upwards. This confirms that AI infrastructure is not just a hype, but a structural investment wave that is unparalleled in terms of size but also in terms of speed of adaptation compared to previous technological revolutions.

For 2026, a rise in global CAPEX spending from $420 billion to $490 billion is now assumed. That amounts to an expected +24% year-on-year growth, after the market consensus in Q2 had already been increased by +20%. For the period 2023–2029, the total investment volume has now been adjusted from $2.3 trillion to $2.8 trillion. Citi also expects that large technology companies will announce further increases in their investment plans when presenting their Q3 2025 results.

At the same time, Citi outlines strong expectations for the demand for computing power and energy. The need for AI compute is growing exponentially and, according to the bank, will far exceed the available supply until 2030. Citi and other investment banks predict that the effective demand for computing power for AI training and inference will approximately double every 12–18 months, a much faster scaling path than previous IT transitions such as cloud and mobile.

The acceleration is mainly driven by the massive application of AI inference: think of AI services built into search engines, office software, e-commerce and gaming. Research by Epoch AI confirms this picture: since 2010, the demand for computing power for frontier model training has grown by a factor of 4.6 per year.

For comparison: according to Moore's Law, computing power normally only doubles once every two years. The growth of AI compute is therefore significantly above the pace at which supply can scale up. Despite improvements in model efficiency and software optimization, the structural trend of ever-increasing computing requirements and energy needs clearly continues.

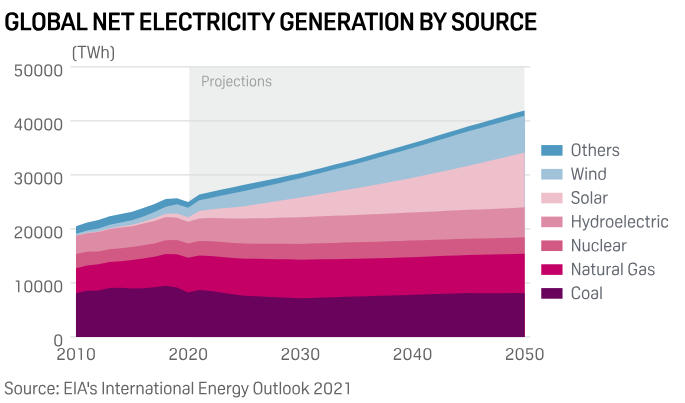

Rising energy demand

The demand for energy is also increasing sharply. It is estimated that an additional +55 GW of electricity capacity will be needed worldwide by 2030 to meet AI-related demand. In the United States alone, this could lead to $1.4 trillion in additional AI infrastructure spending for electricity. This growth is driven by the massive rollout of AI services, both in model training and in inference in companies and research institutions. The race around AI is therefore also a battle for who can supply electricity most efficiently and stably. For Europe, a threefold disadvantage arises here compared to the US and China:

- Regulation – Europe is already imposing rules before the market fully develops, which slows down testing, implementation and adaptation.

- Smaller technology companies and a shortage of specialized labor / venture capitalists – apart from players such as ASML, Siemens Energy and Mistral, Europe has few large listed technology companies that directly or indirectly benefit from this trend. The financial clout is also limited.

- Higher electricity prices – the energy transition in Europe leads to structurally higher energy prices than in the US and Asia.

New Forms of Financing: AI Race Requires Unprecedented Capital

As Sam Altman (OpenAI) recently emphasized: the scale of the AI infrastructure is so large that this requires “new forms of financing”. Where previous investment cycles (cloud, mobile, internet) were largely financed from operational cash flows, the emphasis is now shifting to debt-driven and contract-driven financing. This week, OpenAI reached a valuation of approximately $500 billion through a secondary sale of shares, making it one of the most valuable startups in the world.

In order to build the necessary infrastructure, the company entered into strategic collaborations with Samsung and SK Hynix for the supply of advanced memory chips. According to Reuters, there is talk of a possible delivery of up to 900,000 DRAM wafers per month for the production of memory chips needed for AI data centers. Note that this demand for wafers is equal to 30–40% of total world production at the moment. This is part of the large-scale “Stargate” initiative, which provides for the global expansion of AI data centers.

Earlier in September, OpenAi already reported the collaboration with Oracle and Nvdia. OpenAI is committed to purchasing approximately $300 billion in computing power and cloud services from Oracle. This creates certainty of long-term revenue streams for Oracle and justifies billions in investments in data centers, networks and energy supply. At the same time, OpenAI is investing in the massive purchase and deployment of Nvidia's GPU systems, with which Nvidia directly generates revenue and profit.

- OpenAI guarantees long-term capacity purchase.

- Oracle finances and builds the data centers.

- Nvidia supplies the crucial hardware and books direct revenue.

This construction makes it clear that AI is not just a technology project, but increasingly a capital-intensive infrastructure race. This also increases the investment risks: instead of financing from free cash flows, debt financing increases, dependence on a few suppliers grows and uncertainty remains about the return on long-term contracts. The scale of the projects is immense. Because the scale is increasingly difficult to express in computing power, the capacity is displayed in gigawatts. After all, it is no longer about the number of servers, but about the energy footprint of such mega clusters. 10 GW corresponds to the electricity consumption of approximately 10 million households or approximately 10 nuclear power plants.

Receive weekly insights in your inbox

Exclusive analyses and updates on family holdings and global market developments.

Would you like more information about our services? Please feel free to contact us.

Contact us

Disclaimer:

No rights can be derived from this publication. This is a publication of Tresor Capital. Reproduction of this document, or parts thereof, by third parties is only permitted after written permission and with reference to the source, Tresor Capital.

This publication has been prepared by Tresor Capital with the utmost care. The information is intended to be general in nature and does not focus on your individual situation. The information should therefore expressly not be regarded as advice, an offer or proposal to purchase or trade investment products and/or purchase investment services nor as investment advice. The authors, Tresor Capital and/or its employees may hold position in the securities discussed, for their own account or for their clients.

You should carefully consider the risks before you begin investing. The value of your investments may fluctuate. Past performance is no guarantee of future results. You may lose all or part of your investment. Tresor Capital disclaims any liability for any imperfections or inaccuracies. This information is solely indicative and subject to change.

Read the full disclaimer at tresorcapitalnieuws.nl/disclaimer .