Family Holdings #40 - Asseco and Topicus create fireworks in Poland

This week's topics:

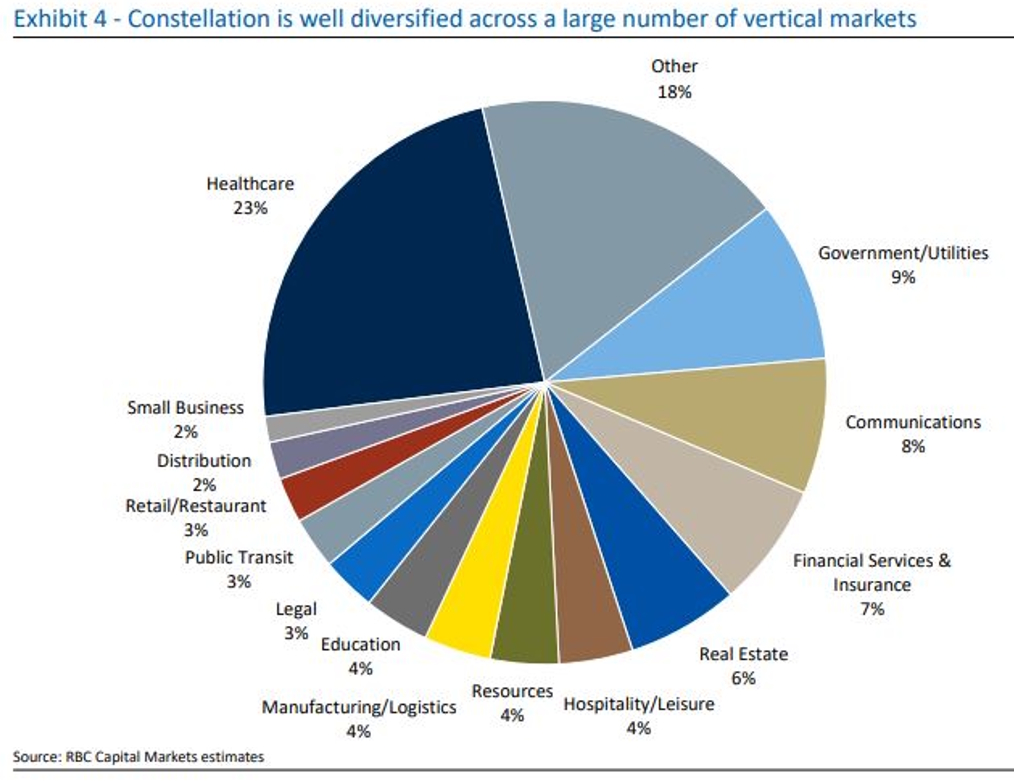

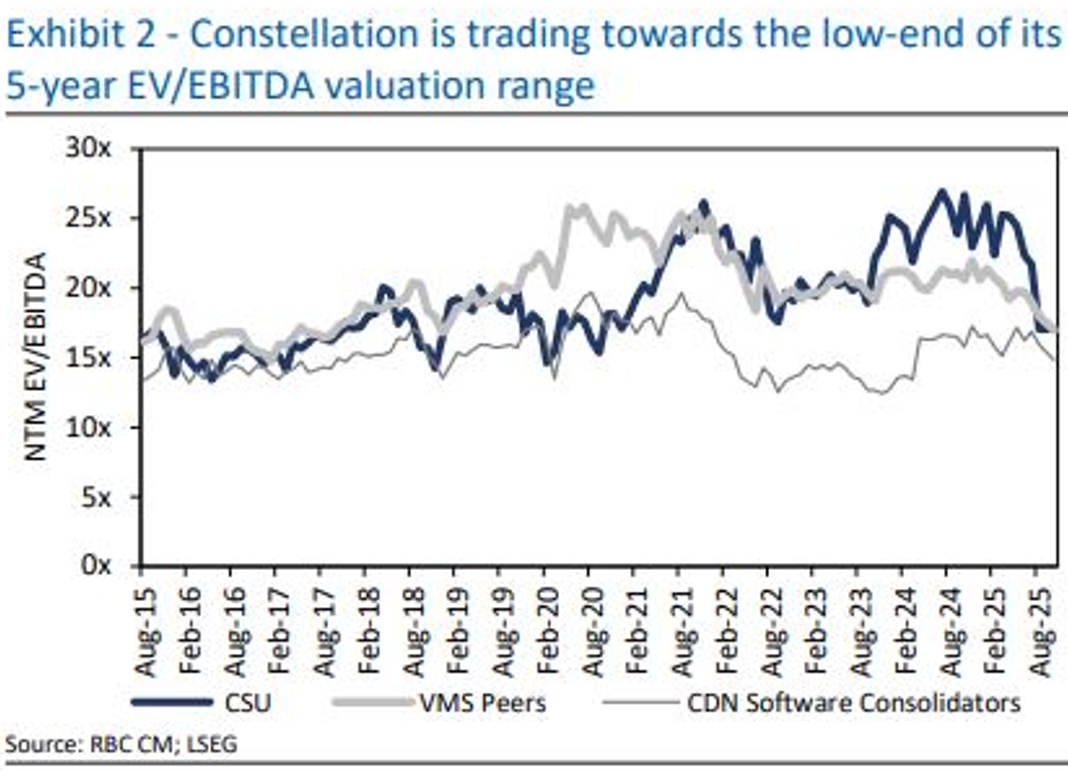

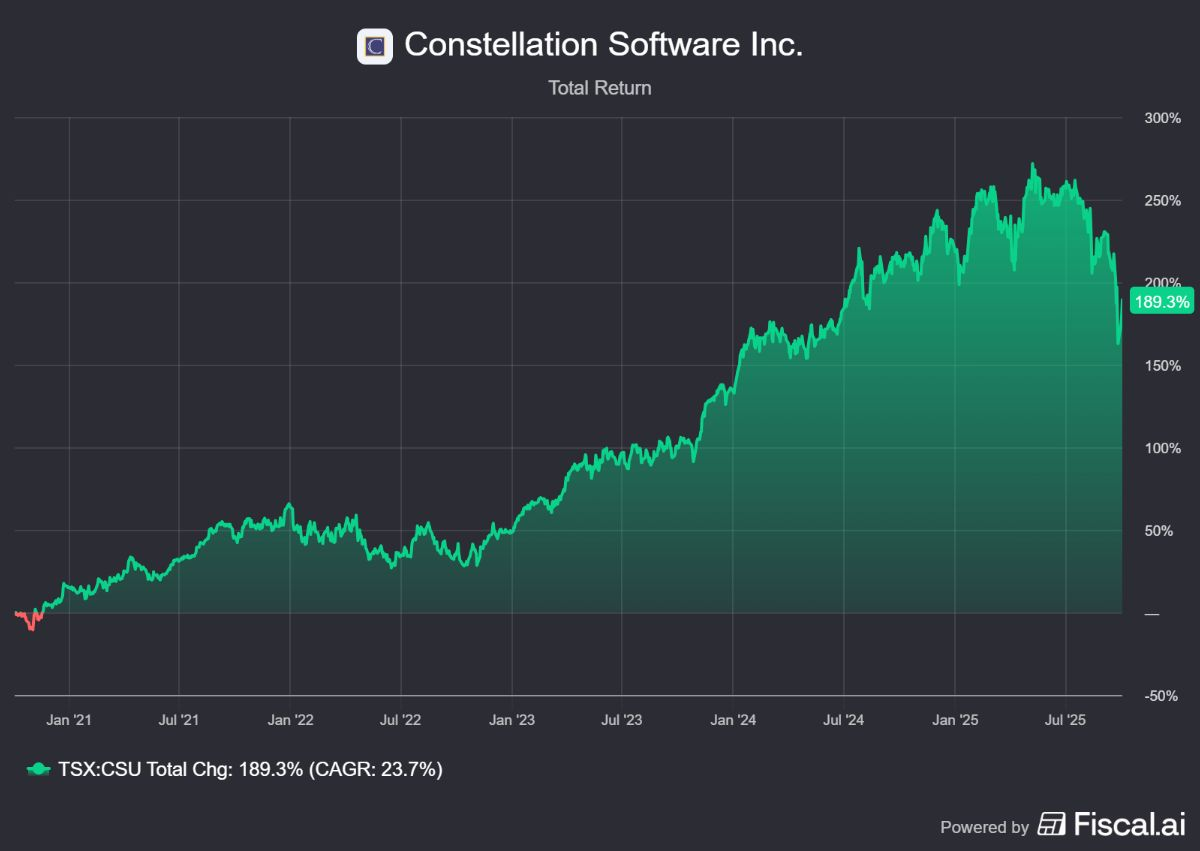

Despite the departure of founder Mark Leonard, Constellation Software, under the new president Mark Miller, continues its proven, decentralized acquisition strategy unchanged, focusing on operational strengthening and efficiency. Confidence in this continuity is strongly underscored by significant share purchases by insiders and a positive analysis from RBC Capital Markets, which confirms the strength of the business model.

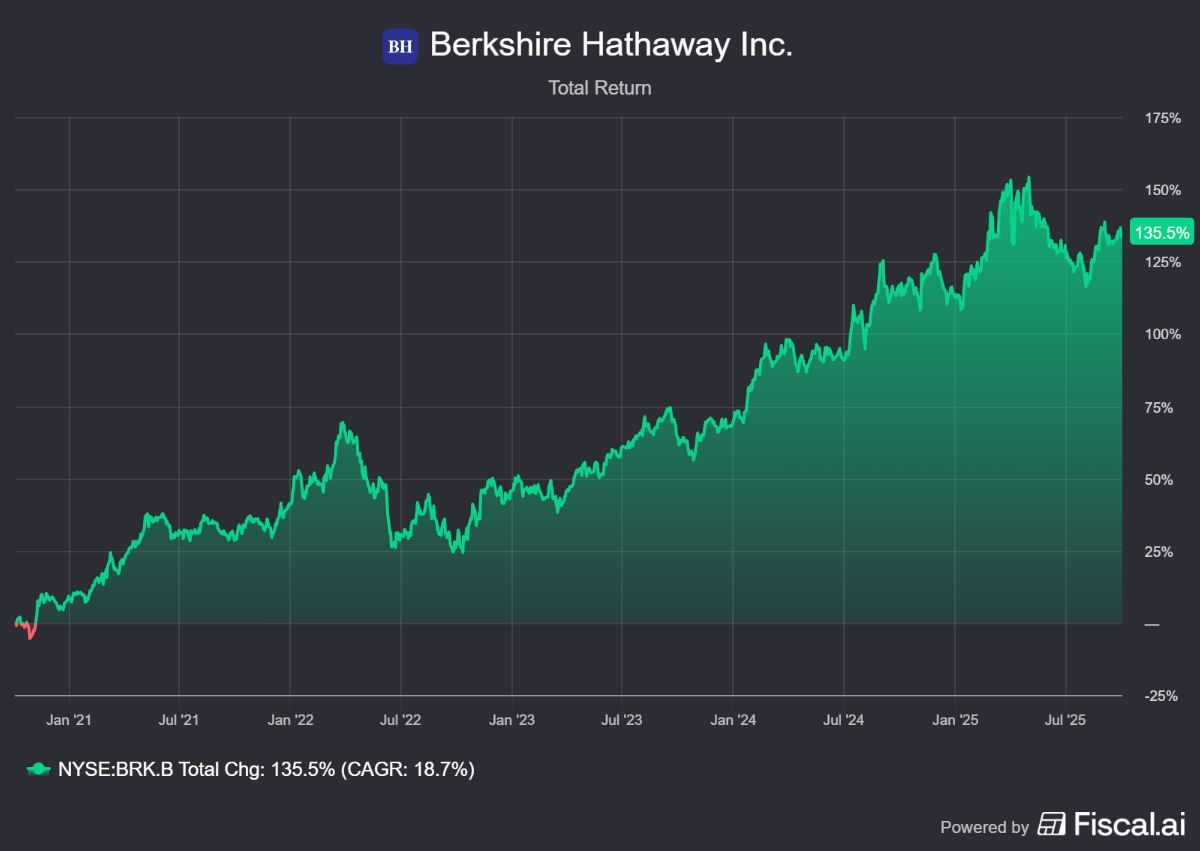

Berkshire Hathaway is acquiring OxyChem from Occidental Petroleum for nearly USD 10 billion, its largest acquisition since 2022, significantly expanding its non-insurance activities. The transaction, led by incoming CEO Greg Abel, allows Occidental to significantly reduce its debt, while Berkshire acquires a high-quality chemical company at a very favorable price, further solidifying its position as a major shareholder of Occidental.

With a record amount of over USD 20 billion, KKR is heavily investing in the European market, strategically focusing on the fundamental building blocks of the economy: energy and digital infrastructure. In addition to large-scale investments in LNG and solar energy, KKR is focusing on making the capital-intensive data center market more efficient, with the goal of building the most profitable, not necessarily the largest, platform.

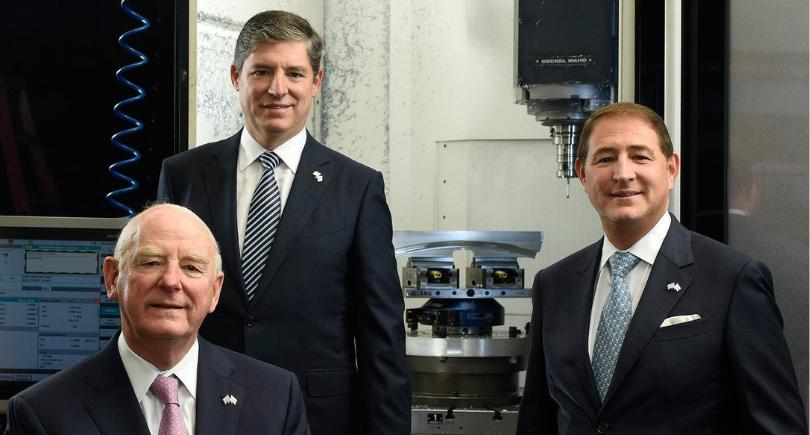

Following the death of Laurans Mendelson, the architect who transformed Heico into an aviation giant of USD 40 billion+, his successful, decentralized family model-based strategy is being continued unchanged by his sons and Co-CEOs Eric and Victor Mendelson.

In Brief:

Brookfield Corporation (New York: BN) announced a merger of Brookfield Business Partners LP and Brookfield Business Corporation into one Canadian company, BBU Inc. This is a step towards a simpler and more accessible corporate structure. This should lead to a broader investor base, higher liquidity, inclusion in international indices, and greater transparency for shareholders. The shares will be listed in both New York and Toronto. The reorganization is expected to be completed in the first quarter of 2026 and may foreshadow similar simplifications at other Brookfield divisions, such as the Renewables and Infrastructure branches.

Lifco (Stockholm: LIFCO-B) has acquired a majority stake in the Italian Nobil Bio Ricerche S.r.l., a specialist in customizing implant surfaces for global dental manufacturers. The company, based in Portacomaro with 21 employees, achieved a turnover of approximately EUR 4.1 million in 2024 and will be included in Lifco’s Dental division.

Constellation Software (Toronto: CSU) remains relentlessly active on the acquisition front despite recent changes in management. Via subsidiary Volaris, two new acquisitions were announced this week, bringing the total to 67 deals this year. These include the Danish AskCody, a developer of meeting management software integrated with Microsoft Outlook and 365, and the American Alpine Testing Solutions, specializing in psychometric testing software, data management, and consultancy. An interesting detail is that Volaris is the division where Mark Miller, the new head of Constellation, was in charge until recently.

Topicus (Toronto: TOI), through its subsidiary Sygnity S.A., has entered into a conditional agreement to acquire the hospital information system division (Comarch HIS) of Comarch. These activities will first be spun off into a separate entity and then fully acquired by Sygnity. The completion of the transaction is expected at the end of 2025, subject to the usual approvals.

Prosus (Amsterdam: PRX) has further expanded its position in the Indian transport market by acquiring approximately 9% of Rapido from Swiggy for an amount of USD 222 million. This increases Prosus's exposure in the Indian mobility sector, in which it is already active through a 25% stake in Swiggy itself. In addition, it was confirmed this week that the acquisition of Just Eat Takeaway (JET) will be formally completed: more than 90% of the shares have now been registered, meaning that completion will take place on October 6 and the company will disappear from the Amsterdam stock exchange. CEO Fabricio Bloisi called the completion "the starting point of hard work to transform JET into a European tech champion," while JET CEO Jitse Groen emphasized looking forward to working with the new owner to accelerate growth.

Brookfield, Lifco, Constellation Software, Topicus, and Prosus have ended the trading week on the stock exchanges of New York, Stockholm, Toronto, and Amsterdam at prices of USD 68.71, SEK 328.60, CAD 4,029.53, CAD 147.46, and EUR 61.80 per share, respectively.

Topicus Receives Green Light for Investment in Asseco, New Era Begins for Polish Acquisition Machine

In our newsletter of August 16, 2025, we described our investment in the Polish serial acquirer Asseco Poland (Warsaw: ACP) as a prime example of a 'bet-on-the-jockey' case. The core of the investment case, we argued, does not necessarily revolve around current financial performance, but around the enormous, latent potential that can be unlocked through the active involvement of a new, strategic partner: the investment holding Topicus.com (Toronto: TOI). With the formal approval of the second share transaction this week, this potential has now become a concrete reality.

The strategic alliance between Asseco and Topicus marks the beginning of a new chapter, in which the operational expertise and disciplined capital allocation of one of the world's most successful serial acquirers (Constellation Software, the parent company of Topicus) is integrated into the Polish IT giant.

After Topicus already acquired a stake of 9.99% earlier this year, it has now acquired another 12,318,863 own shares of Asseco Poland. This corresponds to 14.84% of the share capital. This brings Topicus's total stake to 24.84% of the total share capital of Asseco Poland, which amounts to 20,618,892 shares.

A New Strategic Vision

In an open letter to the shareholders of Asseco Poland, Topicus outlines a vision that is fully in line with the philosophy we highlighted in our earlier analysis. Topicus positions itself not as an activist, but as a long-term partner.

"Our mandate is simple: to be a patient, rational owner, supporting managers who create sustainable value for customers and shareholders, in continuity with Asseco's long-established culture and values," the letter states.

The focus shifts radically from short-term indicators to the statistics that really matter in the long term. The new guideline for all decisions is a prime example of that long-term focus: "We care most about customer outcomes, product vitality, return on invested capital, and cash flow generation, not short-term revenue or profit figures."

Implementation of the 'Constellation Playbook'

In practice, this new focus means a commitment to margin expansion, the growth of annual recurring revenue (ARR), and extremely disciplined capital allocation. As the letter states: "Every zloty has alternatives: product investments, carefully selected acquisitions that meet strict return requirements, dividends, share buybacks, or alignment programs. We will favor the option that we believe increases long-term value per share."

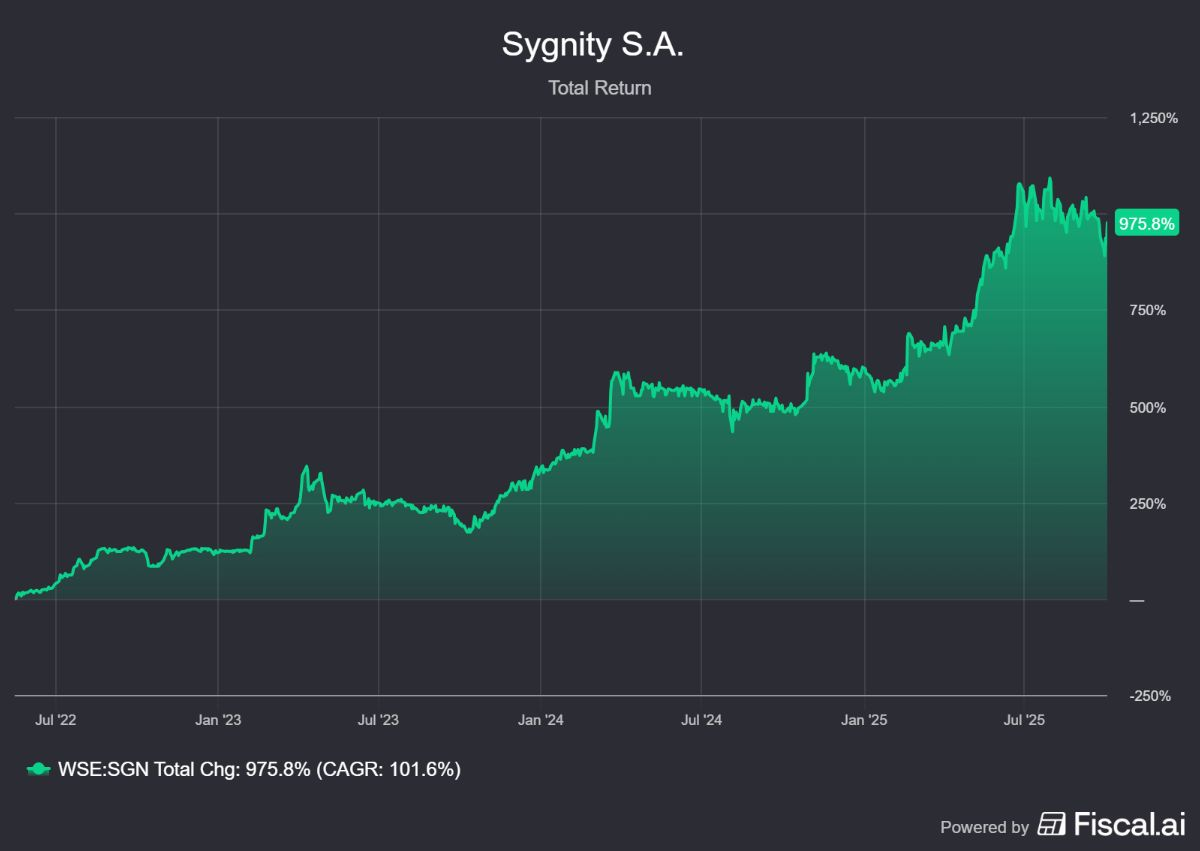

As we already indicated in our newsletter, the successful intervention at the Polish Sygnity is a promising harbinger. After the acquisition of a controlling interest by Topicus in 2022, the focus there was on proprietary product solutions, a strict cost control policy was implemented, and the acquisition machine was turned on. The result was a share price explosion of the Sygnity share, as can be seen in the figure below. The expectation is that a similar trajectory at the much larger Asseco can lead to enormous value creation.

Alignment of Interests

A crucial first step in the new strategy is to properly align the interests of management with those of external shareholders. Topicus writes about this: "We like to see management benefit when shareholders prosper and suffer in difficult times. The mechanisms used are crucial in this regard. Our preference is for managers who acquire shares at the prevailing market price, usually financed with a portion of the annual cash bonus and subject to multi-year vesting and holding periods."

To support the succession of founder Adam Góral, Topicus proposes a one-time 'management alignment program'. "Normally this is not our approach, but the situation is unique: there is a new phase in leadership, the company is of considerable size, and the management team (outside the founder) owns hardly any shares. Therefore, we believe a one-time, transparent allocation of shares is a justified and appropriate step," Topicus's letter explains.

Crucially, no new shares are issued, thus preventing dilution for existing shareholders. The sources for this program are 3.0% of the shares that Asseco itself has in treasury and 1.5% of the shares that will be acquired on the stock exchange. Of this total, 3.0% is allocated to Adam Góral, and the remaining 1.5% is reserved for a select group of senior key employees.

Operational Excellence and Financial Strength

While the strategic repositioning is taking shape, Asseco Poland continues to perform operationally strong. The results for the second quarter of 2025 were excellent, with a 39% growth in operating profit, a 14% increase in turnover, and thirteen acquisitions since the beginning of the year. This growth is broadly supported by all segments, with strong demand from both the public sector (+17%) and financial institutions (+5%). The order book also remains rock solid with a value of PLN 13.65 billion (+10% compared to a year ago).

The combination of strong cash flows and the proceeds from recent divestments enables Asseco to significantly reward its shareholders. Management has already indicated that the proceeds from the sale of shares to Topicus (approximately PLN 1.05 billion) will be distributed as a "large" and possibly "record-breaking" dividend. What is special about this is that Topicus will immediately earn back part of the cash expenditure for the acquisition.

In addition, as we described in our earlier analysis, the sale of a majority stake in Sapiens by subsidiary Formula Systems will result in an additional, significant cash inflow. To efficiently channel capital back, consideration is even being given to introducing a mechanism for interim dividends.

The arrival of Topicus and Constellation has triggered a wave of interest from foreign investors. This has also put the company on Tresor Capital's radar. Where previously only a handful of international investors attended the conference calls, the latest one had as many as 30. This increased attention from long-term investors may further benefit the visibility and valuation of the stock.

In any case, investors have greeted the formal approval of the second tranche of Topicus shares with cheers, as evidenced by the price jump of more than 20% since the formal announcement of the deal earlier this week. However, if we take a look at both the fundamental performance and the price development of Sygnity, the game has only just begun.

Asseco Poland ended the trading week on the Warsaw Stock Exchange at a price of PLN 245.40 per share.

Receive weekly insights in your inbox

Exclusive analyses and updates on family holdings and global market developments.

Constellation Software Continues Proven Strategy Under Mark Miller

Last week, we wrote extensively about the departure of Mark Leonard, the founder and president of the Canadian investment holding Constellation Software (Toronto: CSU). Due to health reasons, Leonard will no longer be in day-to-day management, but from the supervisory board, he will still oversee the company's strategy and philosophy.

The sudden departure has naturally caused some movement in the market. For us, however, this is not a cause for concern, but rather demonstrates the strength of the foundation that Leonard has laid. The succession by Mark Miller is a logical step that ensures the continuity of the company.

As we wrote last week, the core of Constellation's success is the decentralized structure that has been functioning for thirty years. Mark Miller's experience as an operator and dealmaker guarantees that the strategy will be implemented unchanged. Miller, who for years led the Volaris group and guided more than two hundred acquisitions there in the same cultural style, is the perfect person for this role. For us as investors, it is crucial that Miller himself has invested more than USD 700 million in private capital in Constellation and its spin-offs. Skin in the game is one of our most important selection criteria, and Miller more than meets this.

CFO Jamal Baksh confirmed in a recent interview that Leonard has mainly focused on the overarching strategy in recent years, such as the potential for investments outside of vertical market software (VMS). The daily operational management was already largely in the hands of the broader and very experienced management team. Leonard's vision remains accessible to the company through his role on the supervisory board.

Miller's Vision: Focus on Mini-Holdings and Efficiency

Under Miller, Constellation's proven approach will be continued: creating value by strengthening companies operationally and investing capital smartly. A clear example of his strategic preference is the recent merger of TUNE and CAKE, two companies active in affiliate marketing software within the Perseus subsidiary of Constellation.

Such a merger is precisely the framework that Miller has rolled out more broadly at Volaris. By bringing these entities under joint leadership, a more focused mini-holding is created within a specific niche. The concrete benefit for the customer is that the best elements of both companies are combined, resulting in a stronger product offering and more efficient service.

This strategy aligns with an analysis by RBC Capital Markets, which was written following the conference call with Mark Miller. They indicate that Miller wants to improve M&A coverage by refining the purchasing processes, rather than lowering the strict return requirements. It is an approach that clearly prioritizes quality over quantity. Furthermore, Miller, like Leonard, sees opportunities for future spin-outs, similar to the success of Topicus and Lumine Group. According to management, such a step is only possible if there is a manager ready to lead their own entity, there is a complex acquisition target in sight, and the business unit itself already has sufficient scale.

Insiders Buy: The Ultimate Signal of Confidence

Confidence in the continuation of the strategy under the new president is strongly underscored by the behavior of the insiders themselves. The purchase of 275 shares by Mark Miller last week was followed by other insiders. For example, insider Brian Beattie bought 130 shares this week at a price of CAD 3,798.96. This brings the total of recent insider purchases to over CAD 2.3 million, an unambiguous signal of confidence.

Peter Lynch, one of the most successful investors of all time, put it aptly: "Insiders sell their shares for all sorts of reasons, but they buy them for only one reason: they think the price will go up." After all, there can be countless reasons to sell, but purchases are only made with a conviction that the share is undervalued.

Analysis by RBC Confirms the Strategy

The analysts at RBC Capital Markets share our optimism. They maintain their Outperform rating and have a target price of CAD 6,000. Their analysis emphasizes the strength of the scalable business model and the deep "culture of capitalists" that Miller will further develop. RBC believes that the decentralized M&A strategy, in which the business units themselves initiate acquisitions, is a proven success. They also see AI not as a threat, but as a factor that can actually increase the market for Constellation's software companies.

The fundamentals of Constellation Software are unchanged and strong. The transition to a new president has been carefully prepared and the strategy is being continued by an extremely capable leader. The significant purchases by insiders underscore the confidence from management in the future of the company.

Constellation Software has ended the trading week on the Toronto Stock Exchange at a price of CAD 4,029.53 per share.

Big Deal for Berkshire Hathaway

The American investment holding Berkshire Hathaway (New York: BRK-B) of stock market guru Warren Buffett made the largest acquisition this week since 2022. For just under USD 10 billion, Berkshire is buying OxyChem, the chemical division of oil company Occidental Petroleum (New York: OXY).

A Strategic Transaction for Both Parties

The acquisition adds a substantial non-insurance activity to Berkshire Hathaway's extensive portfolio. Greg Abel, who will formally take over from Buffett in two months, stated: "Berkshire is acquiring a robust portfolio of operational assets, supported by a highly skilled team. We look forward to welcoming OxyChem as an operational subsidiary within Berkshire."

For Occidental Petroleum, the sale is a strategic move to significantly strengthen its financial position. "This transaction strengthens our financial position and catalyzes a significant opportunity that we have built over the past decade in our oil and gas operations," said Vicki Hollub, CEO of Occidental. "OxyChem has grown into a well-managed, safely operating business under Occidental, and we are confident that the business and its employees will continue to thrive under the ownership of Berkshire Hathaway."

OxyChem is a global producer of basic chemicals that are used in, among other things, water purification, pharmaceuticals, and the production of paper. In the twelve months prior to June 30, 2025, these activities generated a turnover of USD 5 billion.

The impact on Occidental's balance sheet

Occidental plans to use the proceeds from the transaction to strengthen its balance sheet, an objective formulated after the acquisition of CrownRock in December 2023. Of the transaction proceeds, USD 6.5 billion will be directly used to pay down debt, with the goal of bringing total debt below USD 15 billion. This is expected to result in annual interest savings of more than USD 350 million.

A subsidiary of Occidental will retain the historical environmental liabilities of OxyChem. These will continue to be managed by Glenn Springs Holdings Inc. Thus, Berkshire remains indemnified from all liabilities relating to the historical operation of the chemical company.

A new chemical company for Berkshire

The acquisition of OxyChem is Berkshire's second major investment in the chemical sector, following the acquisition of specialty chemical company Lubrizol in 2011 for nearly USD 10 billion, including debt. Although the transaction, valued at USD 9.7 billion, is significant, it only makes a small dent in the enormous cash position of Buffett's investment holding, which amounted to more than USD 340 billion at the end of June.

The price Berkshire is paying is also very interesting. After Buffett previously came to the company's aid in finalizing the Anadarko acquisition, where Berkshire managed to acquire the preferred shares, characteristic of Buffett, with free stock options at very attractive conditions, the investment holding company now seems to be offering a helping hand again.

The fact that Occidental needs to reduce its debt position offers Berkshire a great opportunity, as we see in the acquisition multiple. Competitors of Oxychem are traded at 8-10x the operating profit, Berkshire pays about 8x the operating profit. A financially healthier Occidental is also in Berkshire's own interest, which owns about 27% of the oil company's shares, worth about USD 11 billion.

The fact that this deal is being financed with cash, instead of the exchange of the preferred shares, is also an important indication that Berkshire has made a very good deal here. Berkshire thus retains the USD 10 billion in preferred shares, which yield an 8% return.

Our conclusion is that this is a good deal for both parties. Although Occidental is out of the danger zone in terms of debts and interest payments with this deal, it is mainly Berkshire that manages to get its hands on the silverware at a very reasonable price. Despite the changing of the guard, this is a typical Berkshire Hathaway deal. In other words: business as usual.

The Berkshire Hathaway B shares ended the trading week on the New York Stock Exchange at a price of USD 500.17 per share.

KKR invests billions in the backbone of the economy

The American investment holding KKR (New York: KKR), whose founders and name givers George Roberts and Henry Kratis are the largest shareholders, is investing heavily in Europe this year.

According to a report by The Financial Times the company has already deployed a record amount of more than USD 20 billion on the continent, spread across private equity, infrastructure, credit and real estate. These figures include only the capital of KKR and its investment funds, excluding the external financing used for acquisitions. More than USD 10 billion of this amount comes from the company's buyout division.

Philipp Freise, head of KKR's European private equity division, emphasized during the IPEM private capital conference in Paris that Europe is at a "crucial moment." He sees the current challenges, such as low productivity growth and an aging society, as a "wake-up call" that leads to progress and new investment opportunities. The fact that there has been structurally too little investment in digital infrastructure, the energy transition and defense, according to Freise, creates an environment in which private capital, in collaboration with governments and entrepreneurs, can play a key role.

Strategic focus on energy and data

KKR's investment strategy is not limited to a geographic focus; the investment holding directs its capital to the fundamental building blocks of the modern economy: energy and data. This is evident from a series of recent, large-scale transactions.

For example, KKR reached an agreement with Sempra to acquire a 45% stake in Sempra Infrastructure Partners for USD 10 billion. Through this transaction, a KKR-led consortium becomes the majority shareholder with a 65% stake. The deal is directly linked to the further development of the Port Arthur LNG Phase 2 project, an initiative with an estimated capital expenditure of USD 12 billion for the construction of two new Liquefied Natural Gas (LNG) liquefaction plants.

At the same time, KKR is stepping to the forefront in the energy transition. An insurance fund managed by KKR has acquired a 50% stake in TotalEnergies' North American solar energy portfolio. This portfolio, with a total value of USD 1.25 billion and a capacity of 1.4 gigawatts, will be jointly managed after the transaction, with TotalEnergies retaining operational control.

Efficiency in the data center market

In addition to energy, digital infrastructure is a core pillar in KKR's strategy. According to the company, the current AI-driven rush for data centers leads to significant inefficiency and capital wastage. In an interview with The Infrastructure Investor, Waldemar Szlezak, partner and global head of digital infrastructure at KKR, stated that there are many "stranded, inefficient dollars" in the data center market.

KKR's approach is to optimize the entire chain. The company wants to "re-evaluate the entire ecosystem, from molecule to the rack and beyond." The recent appointment of Adam Selipsky, former CEO of Amazon Web Services, as a strategic advisor underscores this ambition.

The investment holding points to the enormous cost differences for the construction of comparable AI data centers. Szlezak pointed to differences per megawatt that can range from USD 12 million to USD 18 million, a difference that can amount to 50%. "Nobody knows whether USD 12 million is the right number or USD 18 million, but through efficiency you can get closer to the USD 12 million," said Szlezak.

While the market is now focused on speed, KKR is focused on reducing these costs. They do this by integrating the power supply more intelligently and by adapting their construction strategy to local market conditions, such as building vertically in Europe where land is expensive. With investments in platforms such as CyrusOne in the United States, GTR in the United Kingdom and Nxera in Singapore, KKR is positioning itself to lead this efficiency drive worldwide.

CyrusOne is a good example of KKR's philosophy. This is the investment holding's most prominent data center platform, which it took private in 2021 for USD 15 billion. The investment is extremely successful. Raj Agrawal, KKR's head of real assets, stated that CyrusOne's growth has even exceeded the most optimistic scenarios.

Despite the fact that the platform's growth is exceeding expectations, KKR does not aim to build the largest, but the most profitable company. Through its focus on value creation, KKR is positioning itself to sell its investments in the long term with maximum profit and thus realize a high return for its investors. Due to the high quality of the company, its customers and locations, the options for an eventual sale or IPO will be "abundant" according to KKR.

KKR ended the trading week on the New York Stock Exchange at a price of USD 127.50 per share.

In memoriam: Laurans Mendelson, the architect of Heico

Laurans A. Mendelson, the Executive Chairman and the man who shaped the American investment holding Heico (New York: HEI.A) into what it is today, passed away this week at the age of 87. He was the visionary leader who transformed Heico from a small, struggling company into the aviation giant of today.

The succession had been prepared for years. His sons, Eric and Victor Mendelson, have been appointed Co-Chairmen of the board of directors and remain as Co-CEOs. The company has confirmed that the strategy and day-to-day operations remain unchanged, further emphasizing the stability and long-term vision of the family.

The legacy that Mendelson leaves behind is unprecedented. In 1990, he and his sons took over a company with a turnover and stock market value of only USD 26 million. Under his leadership, Heico grew into a giant with a market capitalization of more than USD 40 billion and a turnover of almost USD 4.5 billion. The value creation is phenomenal: an investment of USD 100,000 in 1990 was recently worth more than USD 130 million. That is a compound annual return of almost 23% over 35 years.

As we wrote in our recent deep dive on Heico, it is precisely the combination of the decentralized model, the rock-solid culture and the long-term perspective of the family that makes Heico so unique. Laurans Mendelson was the architect of this success formula. He built a company for the long term, focused on technical perfection and sustainable customer relationships.

For us at Tresor Capital, Laurans Mendelson was the prime example of an entrepreneur we are looking for: a company builder who puts capital to work patiently and disciplined. His sons are imbued with the same philosophy. The culture and strategy that have made Heico such a unique compounder thus remain firmly anchored for the future.

Heico ended the trading week on the New York Stock Exchange at a price of USD 252.50 per A-share.

Receive weekly insights in your inbox

Exclusive analyses and updates on family holdings and global market developments.

Would you like more information about our services? Please feel free to contact us.

Contact us

Disclaimer:

No rights can be derived from this publication. This is a publication of Tresor Capital. Reproduction of this document, or parts thereof, by third parties is only permitted after written permission and with reference to the source, Tresor Capital.

This publication has been prepared by Tresor Capital with the utmost care. The information is intended to be general in nature and does not focus on your individual situation. The information should therefore expressly not be regarded as advice, an offer or proposal to purchase or trade investment products and/or purchase investment services nor as investment advice. The authors, Tresor Capital and/or its employees may hold position in the securities discussed, for their own account or for their clients.

You should carefully consider the risks before you begin investing. The value of your investments may fluctuate. Past performance is no guarantee of future results. You may lose all or part of your investment. Tresor Capital disclaims any liability for any imperfections or inaccuracies. This information is solely indicative and subject to change.

Read the full disclaimer at tresorcapitalnieuws.nl/disclaimer .