Family Holdings #41 - Family Holding Companies Go All-In on Artificial Intelligence

The week was marked by acquisitions and AI growth. Major holdings and tech companies expanded their operations through strategic acquisitions, while Alphabet and others invested heavily in AI innovation and data center expansion.

This week's topics:

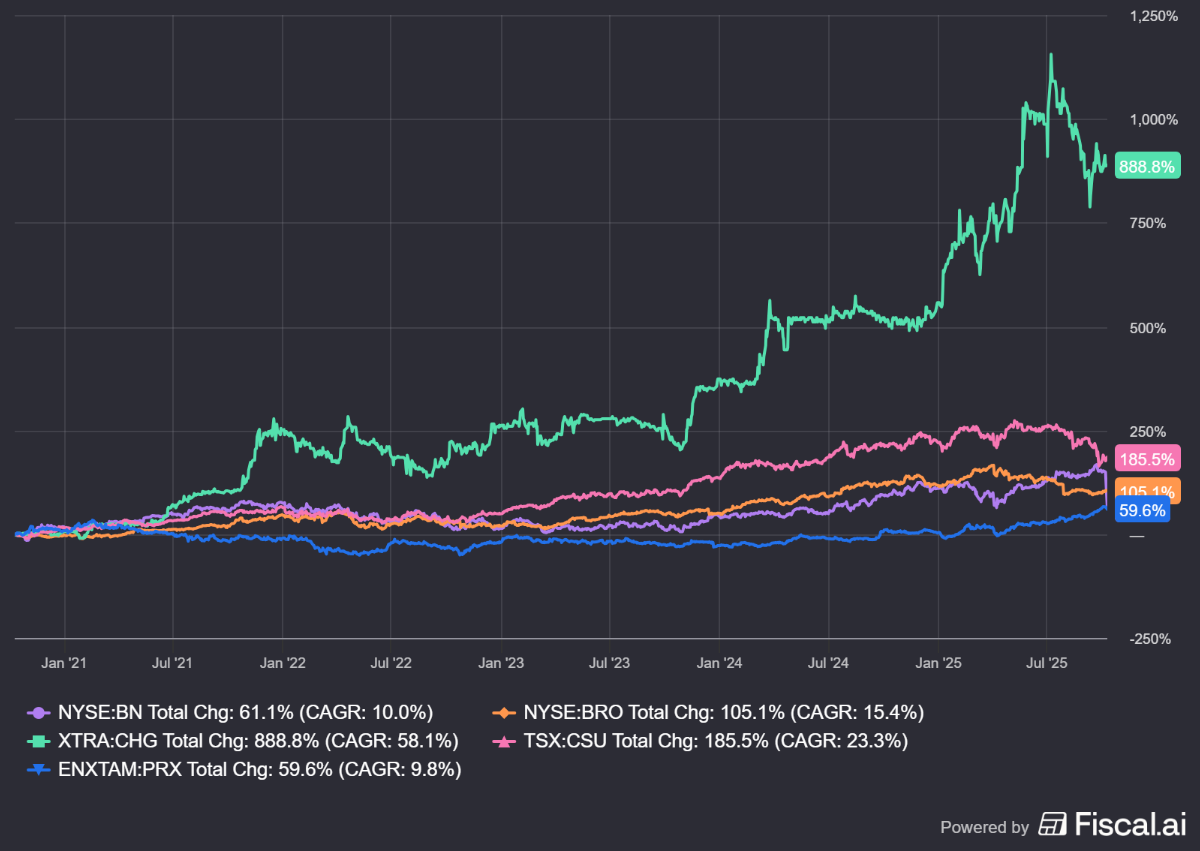

Investor AB core holding ABB sells its robotics division for USD 5.4 billion to Japan's SoftBank. Earlier this year, the holding discount at Investor AB had increased, which prompted Tresor Capital to increase its position in the Swedish holding company.

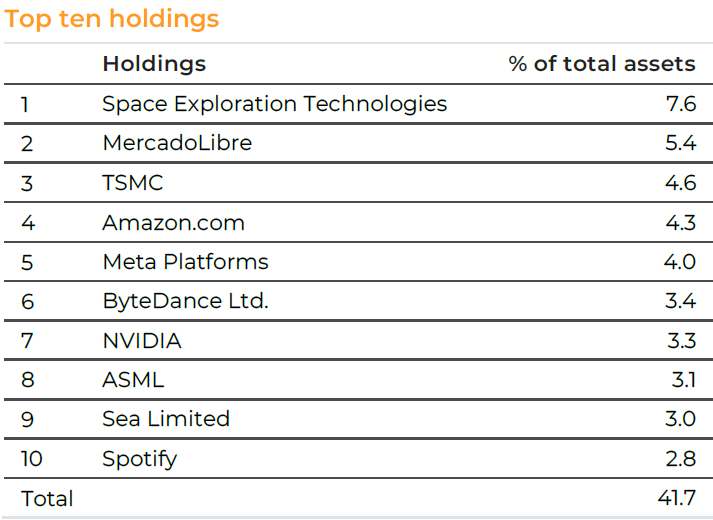

Scottish Mortgage is sharpening its strategy with a focus on the resilience of its portfolio companies. The portfolio is dominated by core holding SpaceX, whose USD 400 billion valuation is justified by the Starlink division alone, while the investment holding remains heavily invested in the AI sector through both infrastructure companies and companies that successfully apply AI in their business operations.

In Brief:

Brookfield Corporation (New York: BN) completed a three-for-two stock split on October 9, 2025. Shareholders received one additional share for every two existing shares via a stock dividend. Fractional shares are paid out in cash based on the closing price on October 3. The shares have been trading on a post-split basis since October 10.

Example: Someone who owned 200 shares at $60 apiece (total value $12,000) before the split, owns 300 shares at $40 after the split, still worth $12,000.

Brown & Brown (New York: BRO) has acquired All Medical Professionals Limited (AMP) through its European division. AMP is a digital insurance broker from Swindon (UK) active in the dental, hospital, and life sciences sectors. Founded in 2011 by Tom Chaston and Adam O'Keeffe, the company is known for its technological solutions for medical professionals. The company will continue to operate under the name All Med Pro and will be integrated within Brown & Brown's Digital Division.

Chapters Group (Frankfurt: CHG) is further expanding its software portfolio with the acquisition of Haiberg, a German provider of logistics software for publishing houses. Haiberg will be integrated into HUP GmbH, part of Chapters' media division, strengthening expertise in publishing and distribution processes. Founder Simon Heinrich remains active as COO and authorized signatory of HUP.

Constellation Software (Toronto: CSU) has acquired the Australian Vitalcare, a specialist in nurse call and medical alarm systems, through its Vela APX division. Vitalcare, founded in 1979, supplies communication and emergency call systems to hospitals and care institutions in Australia and New Zealand, with approximately 1,000 installations and 50,000 connected beds. The company has an estimated 50 employees and will continue to operate under its existing name.

Prosus (Amsterdam: PRX) is acquiring a 10.1% stake in the Indian travel technology company Ixigo (Le Travenues Technology) for approximately ₹1,295 crore (±$155 million). Ixigo will use the proceeds for organic growth, acquisitions, marketing, and the development of new AI platforms. The investment strengthens Prosus' position in the Indian digital economy, where it has now invested more than $6.5 billion through stakes in companies including Swiggy (delivery) and PayU (fintech). India is one of the most important growth markets for Prosus, and with this transaction, it is adding another fast-growing technology company to its regional portfolio.

Brookfield, Brown & Brown, Chapters Group, Constellation Software, and Prosus ended the trading week on the New York, Frankfurt, Toronto, and Amsterdam stock exchanges at prices of USD 43.66, USD 96.05, EUR 38.20, CAD 3,962.60, and EUR 59.26 per share, respectively.

Alphabet Continues AI Acceleration

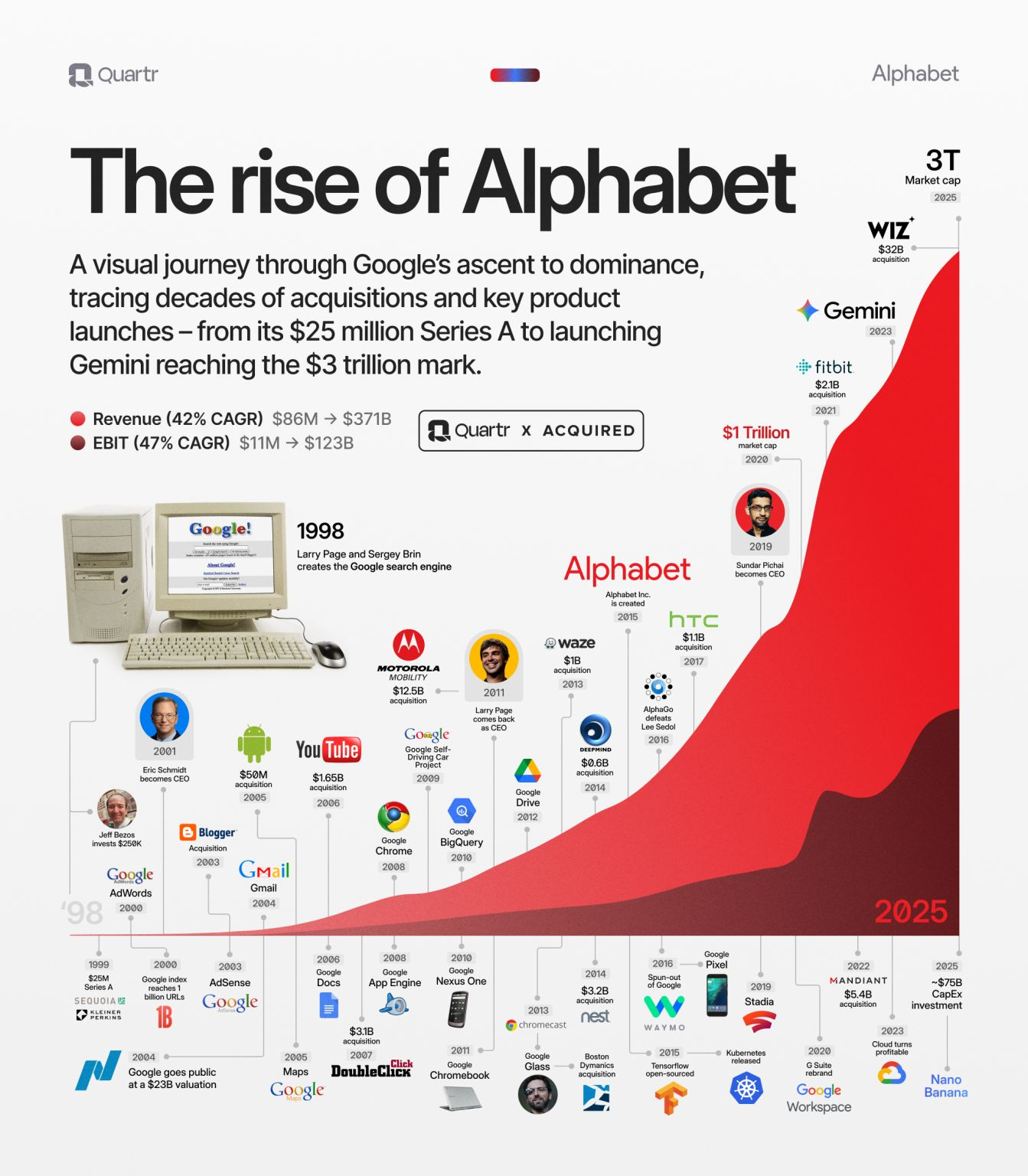

The chart below, "The Rise of Alphabet", shows at a glance how the growth path of the American investment holding company Alphabet (New York: GOOGL) has developed since its founding in 1998 into one of the most impressive trajectories in the technology sector of all time. From its early days as a search engine to the launch of Gemini and a market capitalization of over $3 trillion, it illustrates a timeline of nearly three decades of product launches, acquisitions, and continuous scaling.

With an average revenue growth of ~25% per year, Google systematically built on its core competence: organizing information and translating it into scalable digital platforms. Where earlier growth phases were driven by advertising revenue, YouTube, and Android, the current period clearly marks a new chapter: the AI phase of Alphabet.

New in the AI Arsenal: Gemini Enterprise and AI-Mode

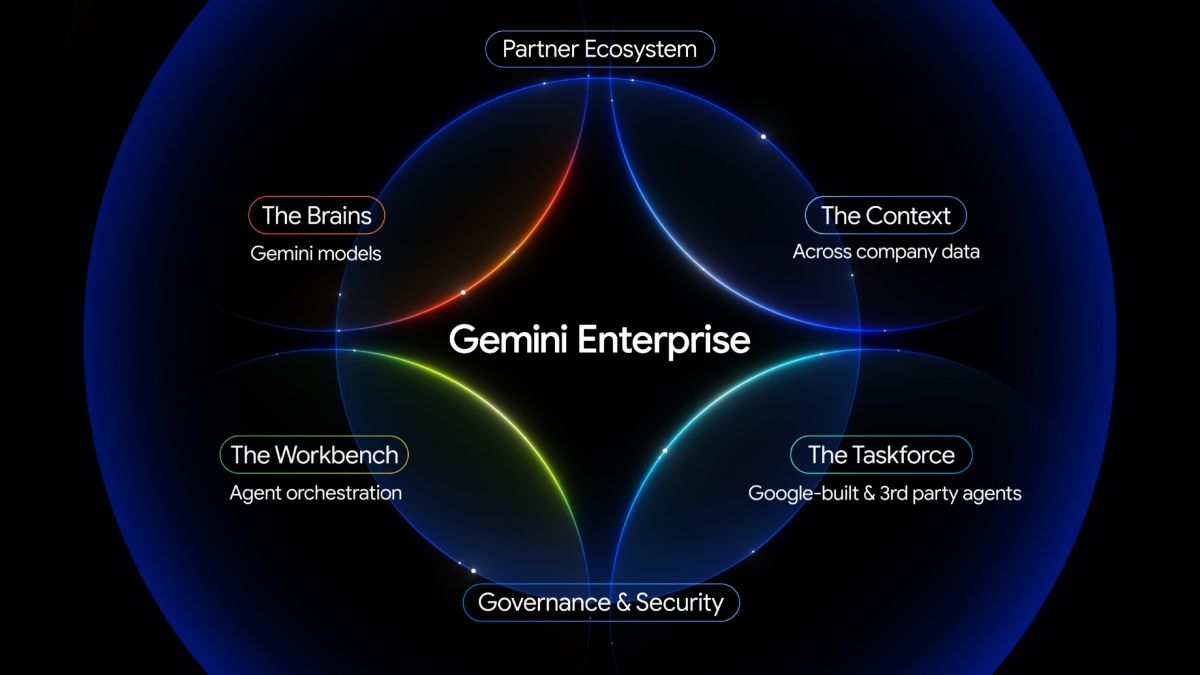

With the launch of Gemini Enterprise this week, Google Cloud is emphatically positioning itself as a direct challenger to Microsoft Copilot. Both companies distinguish themselves from Amazon Web Services, which is the only major cloud player that does not yet offer an integrated AI assistant for the workplace. Gemini Enterprise brings all of Google's AI capabilities together in one integrated environment. Employees can use AI agents via a chat interface for a wide range of applications, ranging from data analysis to workflow automation. The platform seamlessly integrates with Google Workspace and with external systems such as Salesforce and SAP. In doing so, Google combines infrastructure, its own TPU chips, language models, and software into one complete AI solution. The main challenge remains increasing market share, as Microsoft has a strong starting position thanks to its Office dominance. Technologically, however, Google appears to be fully able to keep up with its biggest competitor.

Development is also accelerating within the consumer market. Google has provided its core product, Search, with a fundamental AI upgrade. The new AI mode, now available in more than 200 countries and 35 languages, is changing the way users interact with information. Instead of simply displaying a list of search results, the AI mode generates summary answers in which relevant sources are directly incorporated. Users can ask more complex questions, formulate follow-up questions, and click through to the most relevant websites without additional actions. This preserves the traditional search function but enriches it with an intelligent layer that makes the process faster and more intuitive.

The strategic significance of this expansion lies primarily in its accessibility. Billions of people already use Google every day, but a large proportion of them have never actively opened a separate AI platform. By integrating generative AI directly into the familiar search environment, Google is now reaching precisely that broad group that has so far been outside the AI ecosystem. Users no longer have to go to separate websites or apps such as ChatGPT or Perplexity but are given the option to see it easily within their existing search page. This eliminates the barrier to using AI. Anyone can benefit from AI-driven answers and recommendations without logging in or using a new interface. The AI mode thus constitutes a massive introduction to generative AI, not for a small group of pioneers, but for the internet users who have so far barely come into contact with it.

In the background, Google is also making subtle adjustments to its search structure. In September, the parameter "num=100" disappeared, which previously allowed users and external parties to view up to one hundred results per page. Since then, the maximum has been ten. At first glance, this seems like a small technical change, but the consequences are far-reaching. Many AI systems, including OpenAI and Perplexity, partially use Google's search index. This restriction has reduced their access to the so-called long tail of the internet by an estimated 90%. These models are thus faced with higher costs and more limited data access, while Google's own AI mode naturally retains full access.

The initial results underscore that advantage. The Gemini models now process more than 1.3 quadrillion tokens, an increase of 30% since July. In addition, approximately 65% of all Google Cloud customers now use at least one AI product from the company. This shows how quickly generative AI is being scaled up in practice and how it directly contributes to the growth of its cloud activities.

Accommodating Growing AI Usage Through Data Center Expansion

To accommodate this explosive growth in AI applications and cloud usage, Alphabet is investing aggressively in its infrastructure. New data centers and cloud regions are being opened or planned worldwide, often with a focus on AI workloads and sustainable energy supply:

- India: Google announces its first major data center cluster in India, an investment reportedly worth $6 to $10 billion in the coastal city of Visakhapatnam. The project includes three campuses with a total of 1 GW of data center capacity and an additional $2 billion for renewable energy to power the site. This will be the largest data center in Asia in terms of power and underscores the importance of the Indian market.

- United States: In the US, Google is expanding into new regions outside the traditional tech hubs. A $4 billion investment in West Memphis, Arkansas, was recently announced. Here, Google is building its first data center in that state, on a 4.45 million square foot campus. This project is being called an "AI data center," with a focus on running AI models and cloud services, and is accompanied by a 600 MW solar park to partially cover the enormous power needs. In addition to infrastructure, Google is supporting the community through a $25 million energy innovation fund and free AI training for residents and students.

- Belgium: Google has announced an additional €5 billion investment in its Belgian data center campus near Saint-Ghislain in 2026-2027. The expansion includes new data centers (there are already five on that campus) and the creation of 300 additional full-time jobs. Google is also working with Belgian energy companies to develop new wind farms so that the additional capacity can largely run on green energy. The Belgian Prime Minister speaks of a "strategically important" investment.

- United Kingdom: Also in October 2025, a new Google data center was opened in Waltham Cross, Hertfordshire (UK), as part of a £5 billion investment package over two years. This investment includes not only the data center itself but also R&D. The new data center is intended to support the increasing demand for AI services in the UK, from Google Cloud to Search and Maps. At the opening, the government emphasized that this project supports ~8,250 jobs annually and should boost the British AI economy. Google also reached an agreement with Shell in the UK for innovative battery storage, so that surplus sustainable energy on the campus can be returned to the grid.

Expansions Through Collaborations

Alphabet is also strengthening its position in AI and cloud through a series of strategic collaborations with leading companies from various sectors.

- Klarna, the Swedish fintech, now uses Google's full AI stack to create personalized shopping experiences. Generative tools within Google Cloud, including Gemini 2.5 Flash, are used for dynamic product catalogs and marketing images. Pilot projects show promising results with up to 50% more orders and 15% longer session duration. In addition, Klarna uses Google's AI hardware for fraud and money laundering detection, adding value to the collaboration on the back-end as well.

- Affirm, also active in the payment market, is working with Google on the Agent Payments Protocol (AP2). This protocol allows AI assistants to make payments on behalf of users, with Affirm's "buy now, pay later" option being directly integrated into AI-driven shopping experiences. The partnership supports Google's long-term vision of seamless, AI-managed transactions.

- Figma, the popular design platform, uses Google's Gemini Flash 2.5 model to allow designers to generate images via text prompts and automatically optimize existing designs. This deeply integrates Google's AI into creative workflows and proves its value outside of traditional text or development applications.

Conclusion

Alphabet is proving to be one of the most balanced players in the AI race. The company combines technological innovation with strategic capital deployment and an impressive pace of infrastructure development. While competitors are still focusing on the product phase, Google is building both the ecosystem and the backbone on which AI and cloud will run in the coming years.

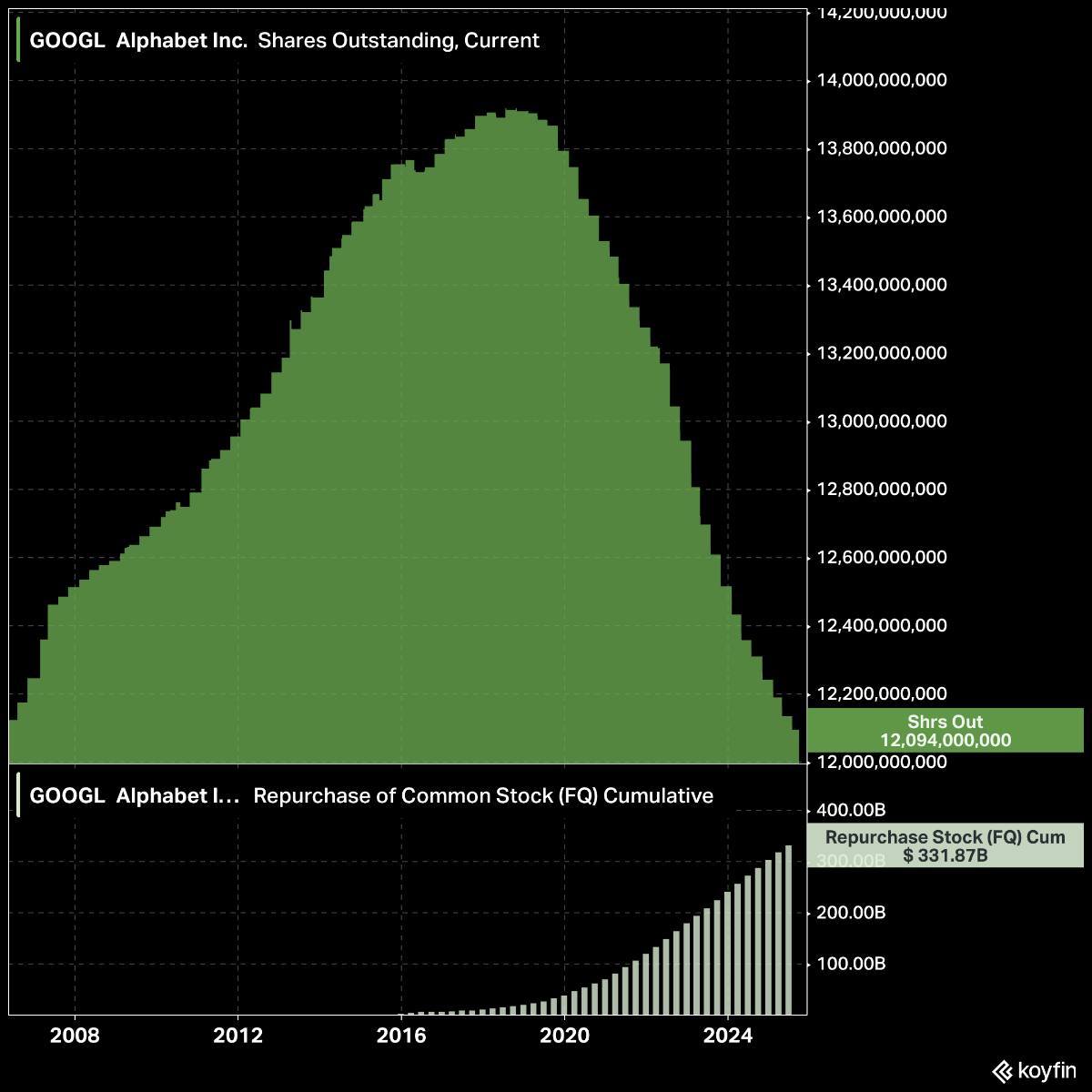

Management is showing remarkable discipline in this process. While billions are being invested in data centers and AI infrastructure, Alphabet is simultaneously returning significant amounts to shareholders. Since 2018, the company has bought back more than $330 billion in shares, reducing the number of outstanding shares to the lowest level since 2006, as shown in the figure above. During that same period, net profit has more than tripled, which strengthens the impact of the buyback policy on earnings per share. At the same time, management is purposefully implementing reforms to make the organization leaner and more AI-driven. In early October, more than 100 employees from design and UX teams within the Cloud division were laid off, with management layers being streamlined and resources being shifted to AI priorities. These restructurings demonstrate that the company is not only focused on growth but also on profitability and scalability. Analysts underscore this confidence.

The recent reratings by MoffettNathanson, BMO Capital, TD Cowen, and HSBC, among others, are based on tangible improvements in the core activities: an acceleration of Google Cloud, a rising profit contribution from YouTube, and a recovering advertising market in which AI functionality is further driving growth. The decreasing regulatory risk surrounding Search and the increasing operational efficiency also contribute to a more stable profit profile. Analyst Michael Nathanson of MoffettNathanson even goes further, arguing that not Nvidia, but Alphabet deserves the title of the world's most valuable company, pointing to the unique combination of market leadership, diversification, and scale that positions Alphabet to optimally monetize the opportunities in AI. In our opinion, the combination of growing adoption of Gemini, robust data center investments, profitable buybacks, and strong management makes Alphabet well-positioned for sustainable value creation. We, therefore, remain positive about this holding.

Alphabet ended the trading week on the New York Stock Exchange at a price of USD 239.38 per A-share.

Receive weekly insights in your inbox

Exclusive analyses and updates on family holdings and global market developments.

Investor AB portfolio company ABB sells robotics division

ABB, the main holding of the Swedish investment holding company Investor AB (Stockholm: INVE-B), announced this week the sale of its robotics division to Japan's SoftBank. The transaction is valued at $5.4 billion (approximately €4.6 billion), which cancels the previously planned IPO of this division in 2026. With a 14.3% stake, Investor AB is the largest shareholder in ABB.

The division, accounting for $2.3 billion in revenue and approximately 7,000 employees, is one of the world's largest producers of industrial and autonomous robots, with customers such as BMW. SoftBank founder Masayoshi Son sees the acquisition as a strategic step within his long-term vision of "Physical AI," the merging of artificial intelligence and robotics to allow machines to perceive, reason, and act autonomously.

The purchase fits within the so-called Stargate project, SoftBank's internal master plan to accelerate the next phase of artificial intelligence. This project focuses on developing so-called Artificial Super Intelligence (ASI), systems that Son believes should become 10,000 times smarter than humans. Within that strategy, robotics plays a key role: according to Son, the coupling of advanced AI to physical applications should lead to the next industrial revolution.

In that context, ABB Robotics will be integrated with existing SoftBank investments such as AutoStore, Agile Robots, and Skild AI, with which the group is building a complete ecosystem of hardware, software, and sensor technology. By combining ABB's global production capacity and industrial expertise with SoftBank's AI portfolio, Son wants to take a lead in what he sees as the "era shift from digital to physical AI."

For ABB, the sale represents a clear reorientation under CEO Morten Wierod, who since 2024 has been focusing on the more profitable segments of electrification and automation. The proceeds from the transaction will be used in line with ABB's capital allocation policy, presumably for debt reduction, dividend increases, and targeted acquisitions (including the French Legrand, which is said to be under consideration).

The news about ABB comes at a time when the valuation gap within Investor AB is once again in the spotlight. As the chart shows, the underlying participations, especially Saab and ABB itself, have increased significantly in value this year, while Investor AB's stock price has clearly lagged behind.

This means that the holding discount of Investor AB, the difference between the intrinsic value of the portfolio and the market value of the holding, has increased sharply in recent months. According to our models, the discount even reached a level that had not been seen since the beginning of 2024.

For Tresor Capital, this was reason to further increase the already existing high conviction in the position of Investor AB. We have temporarily overallocated the weighting, with a view to the expected normalization of the discount. In the meantime, that valuation gap has partially closed again, but Investor AB remains an attractively valued company.

Investor AB ended the trading week on the Stockholm Stock Exchange at a price of SEK 303.60 per B-share.

Scottish Mortgage Bets on AI and SpaceX as Driving Forces Behind the Next Growth Phase

The British investment holding company Scottish Mortgage Investment Trust (London: SMT) seeks out the most exceptional companies worldwide, both listed and private, with the intention of holding them for five, ten, or even more years to fully capitalize on their potential growth.

The managers acknowledge that investing in the future inevitably involves uncertainty and volatility. Therefore, a long-term perspective is not a wish but an absolute necessity. Nevertheless, the harsh lessons of recent years have significantly raised the bar for what truly makes a company exceptional. Today's world is characterized by deep unpredictability. This demands more from companies than just a visionary concept.

Managers Tom Slater and Lawrence Burns have taken the hard lessons of recent years to heart. As Slater himself wrote in a recent publication for Scottish Mortgage, the sharp interest rate hikes and the painful bankruptcy of the Swedish battery manufacturer Northvolt have yielded a clear conclusion. Without a foundation of operational and financial resilience, even the most brilliant idea is doomed to fail.

The Anatomy of a Sustainable Winner

The theme of resilience translates in practice to stringent requirements. Scottish Mortgage is now focusing with renewed emphasis on companies that possess a rock-solid balance sheet with minimal debt. In addition, robust profit margins that can absorb economic headwinds and a positive cash flow that enables them to invest are absolutely crucial.

Manager Lawrence Burns emphasizes that true 'outlier companies' are able to deliver exceptional returns, even against the most challenging macroeconomic and geopolitical backdrop. He repeatedly points to Mercado Libre in this regard. Burns emphasizes that from a macroeconomic perspective, Latin America has not been an attractive place to invest over the past ten to fifteen years. Nevertheless, Mercado Libre has succeeded in creating enormous shareholder value.

This focus on operational excellence is also evident in other core positions. Shopify, the e-commerce platform, had been swept away by the euphoria surrounding accelerated digitization during the pandemic. The company massively hired staff, anticipating uninterrupted growth. When growth normalized, the inefficiency of the organization was painfully exposed. However, management intervened decisively, cut costs, and refocused on core activities. The result is a spectacular transformation into a profitable enterprise.

Meta (the parent company of Facebook, Instagram, and WhatsApp) underwent a similar trajectory. After a period in which the company invested billions in the metaverse and even renamed the company, a vision that was penalized by the market, Mark Zuckerberg announced a 'year of efficiency.' The organization was streamlined, and profitability was vigorously restored. Both Shopify and Meta have proven that they can not only grow but also adapt. They emerged stronger and more resilient from their crises.

The downfall of Northvolt serves as the ultimate contra-indicator here. The vision of a European battery champion was strategically correct, but the reality was that the company struggled with operational delays. The recent investment by Scottish Mortgage in the company CATL, the undisputed Chinese global leader in batteries, is the logical consequence of this lesson. This is not a gamble on a start-up. It is an investment in a proven winner with a global market share of approximately 40% and superior operational execution.

The Hidden Value of SpaceX Dissected

The most impressive contribution to the return of the past 12 months came from the unlisted position in SpaceX. In an interview with Trustnet manager Lawrence Burns described Elon Musk's company as "one of the most important geopolitical assets in the world." That claim is not an exaggeration. With approximately 78% of all active satellites in orbit, SpaceX has a de facto monopoly on access to space. The crucial role that the Starlink network played in the conflict in Ukraine has made the strategic irreplaceability of the company to the West painfully clear.

Manager Tom Slater offered an analysis of the most recent valuation of approximately USD 400 billion in another conversation with Trustnet. According to Slater, this valuation is fully justifiable by simply looking at the Starlink division. His calculation is based on the explosive growth in the number of subscribers. Starlink closed last year with 4.5 million users and, according to recent statements by Elon Musk himself, has already grown to 7 million. Slater extrapolates that trend and expects the company to close the year with approximately 9 million subscribers, which equates to a growth of 100% year-on-year. Assuming a monthly price of USD 75, this leads to annual revenue of approximately USD 8 billion.

According to Slater, this revenue, combined with the extreme growth and potentially high profit margins, is sufficient to support the entire valuation of SpaceX. As an investor, you essentially get the entire launch division, which has eliminated global competition, for free. The perspective becomes even more compelling when one considers that Starlink currently holds less than 0.5% of the global broadband market of USD 1 trillion, while the technology is becoming increasingly better and cheaper. Given the high margins and the subscription model, it is plausible according to his analysis that Starlink alone justifies the entire enterprise value.

Investing in the Foundations of AI

The managers are convinced of the transformative power of artificial intelligence (AI). The portfolio is carefully positioned to benefit from this development by investing in the entire value chain.

The investments in AI start with the foundation, the hardware. A position in Nvidia is an investment in the 'shovels' of the AI gold rush. A stake in the Dutch ASML is an investment in the only party in the world that can build the machines for the most advanced chips. TSMC is the Taiwanese giant that can actually manufacture the designs on a large scale. These three companies form an almost irreplaceable ecosystem.

Further down the chain, the holding company invests in companies that directly apply AI to gain a competitive advantage. Burns cited the Brazilian digital bank Nubank as an excellent example. By integrating AI into its credit assessment processes, Nubank can profitably serve millions of customers who are ignored by traditional banks.

However, confidence in Elon Musk via SpaceX does not mean that every Musk venture is a blind investment. The position in Tesla was significantly reduced at the end of last year. The original investment case, based on dominance in the transition to electric vehicles, has largely materialized. However, the valuation of the share seems increasingly based on a speculative future of self-driving taxis and humanoid robots. Scottish Mortgage concluded at the end of last year that the market had run too far ahead of the facts and was paying too high a price for a future that is far from proven.

Scottish Mortgage Investment Trust ended the trading week on the London Stock Exchange at a price of GBP 11.22 per share.

Receive weekly insights in your inbox

Exclusive analyses and updates on family holdings and global market developments.

Would you like more information about our services? Please feel free to contact us.

Contact us

Disclaimer:

No rights can be derived from this publication. This is a publication of Tresor Capital. Reproduction of this document, or parts thereof, by third parties is only permitted after written permission and with reference to the source, Tresor Capital.

This publication has been prepared by Tresor Capital with the utmost care. The information is intended to be general in nature and does not focus on your individual situation. The information should therefore expressly not be regarded as advice, an offer or proposal to purchase or trade investment products and/or purchase investment services nor as investment advice. The authors, Tresor Capital and/or its employees may hold position in the securities discussed, for their own account or for their clients.

You should carefully consider the risks before you begin investing. The value of your investments may fluctuate. Past performance is no guarantee of future results. You may lose all or part of your investment. Tresor Capital disclaims any liability for any imperfections or inaccuracies. This information is solely indicative and subject to change.

Read the full disclaimer at tresorcapitalnieuws.nl/disclaimer .