Economy & Markets #41 - From Tokyo to Silicon Valley: How Politics and AI Are Reshaping the Markets

Japan saw its first female prime minister, Sanae Takaichi, who is committed to defense and AI. OpenAI and AMD closed a mega-deal for 6 GW of computing power, a symbol of the AI supercycle. Analysts are torn between growth and bubble, while the US labor market continues to cool.

This week's topics:

Japan opts for an "Iron Lady": Sanae Takaichi to become first female prime minister

On October 4, the Japanese ruling party LDP chose Sanae Takaichi as its new party leader, making her almost certain to become Japan's first female prime minister. The 63-year-old politician is seen as the heir to Shinzo Abe's economic policy and combines economic nationalism with classical conservatism.

Takaichi wants to continue the core of Abenomics, with an emphasis on government investment in strategic sectors such as semiconductors, defense, and artificial intelligence. She supports a loose monetary policy by the Bank of Japan and opposes rapid interest rate hikes. According to her, a weaker yen fits within Japan's competitive strategy. In foreign affairs, she advocates a more assertive stance towards China, closer cooperation with the United States, and a revision of Article 9 of the Japanese constitution to increase the country's defensive capabilities. Socially and culturally, she is known for her conservative views and her preference for restrictive immigration policies.

The financial markets reacted remarkably positively to her election. The Nikkei 225 rose by approximately 3%, led by technology and defense stocks that could benefit from Takaichi's investment agenda. At the same time, the yen weakened by more than 2% against the dollar due to expectations of continued loose monetary policy. Japanese long-term interest rates rose, especially on the far end of the curve, due to prospects of higher government spending.

The situation may put the Bank of Japan under renewed pressure to resume its buyback programs, as the central bank already owns more than 50% of the Japanese government bond market. The combination of rising stocks, a weaker currency, and rising interest rates is strongly reminiscent of the earlier Abenomics period (2012–2020), in which fiscal stimulus and monetary easing together drove the markets. Historically, that policy led to global liquidity growth and the so-called 'Mrs. Watanabe trades': Japanese investors who borrowed cheaply in yen to invest in higher-yielding assets worldwide. A repetition of that pattern does not seem inconceivable. In a context where Europe is already implementing interest rate cuts and the US is moving towards easing, a renewed Japanese stimulus could further strengthen global risk appetite, a scenario that particularly benefits equity and commodity markets.

OpenAI and AMD close megadeal of 6 gigawatts of computing power

Following the series of strategic collaborations in recent weeks, another major chapter was added to the AI industry. AMD and OpenAI announced a multi-year collaboration for the delivery of no less than 6 gigawatts of GPU computing power. From 2026, AMD will deploy its Instinct GPUs in OpenAI's data centers.

The deal includes a striking hybrid structure: OpenAI receives an option (warrant) to acquire up to 10% of AMD, approximately 160 million shares, depending on delivery and price milestones, including price targets up to $600 per share. According to market analysts, the contract could generate tens of billions in additional revenue for AMD.

For OpenAI, it marks a strategic shift: the company wants to be less dependent on Nvidia and is consciously opting for supplier diversification within its hardware strategy. Investors reacted euphorically. The AMD share rose by more than 25% on the day of the announcement, while analysts estimate that the agreement could generate more than $100 billion in additional revenue over the next four years. The rally in technology and data center funds continued, although critics point out that OpenAI is still a young and capital-intensive company. The scale of the announced investments exposes significant financing risks, a dynamic reminiscent of the speculative phase of the dot-com bubble more than twenty years ago.

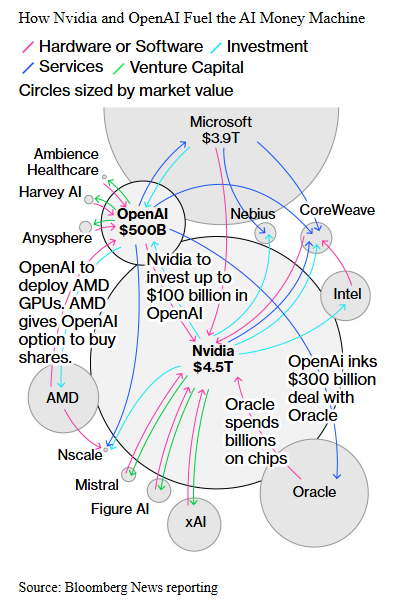

The mutual interconnectedness between the major players in the AI ecosystem is becoming increasingly complex. Not only is Nvidia investing directly up to $100 billion in OpenAI, but parties such as Microsoft, Oracle, and AMD are also simultaneously building strategic positions in the value chain, from chip production to cloud services and AI applications. The Bloomberg chart below visualizes this “AI-money machine”: how capital, hardware, cloud capacity, and equity interests intertwine rapidly between the largest players. Together, they form the engine behind the current AI boom and illustrate how the boundaries between cooperation and competition are becoming increasingly blurred.

Receive weekly insights in your inbox

Exclusive analyses and updates on family holdings and global market developments.

AI supercycle or Dotcom bubble 2.0?

According to investment banks such as Goldman Sachs, Citibank, and Morgan Stanley, the global economy is in the midst of a new AI supercycle, in which capital expenditures and infrastructure investments are increasing exponentially. The five major technology companies (Microsoft, Google, Meta, Amazon, and Oracle) will invest more than $1.7 trillion in computing power, data centers, and semiconductors between 2025 and 2027. This triples the AI-related capital outflow compared to the period 2022–2024. In particular, the recent megadeals, such as Oracle–OpenAI ($300 billion) and AMD–OpenAI (6 GW GPU capacity), underscore the unprecedented scale of these expenditures.

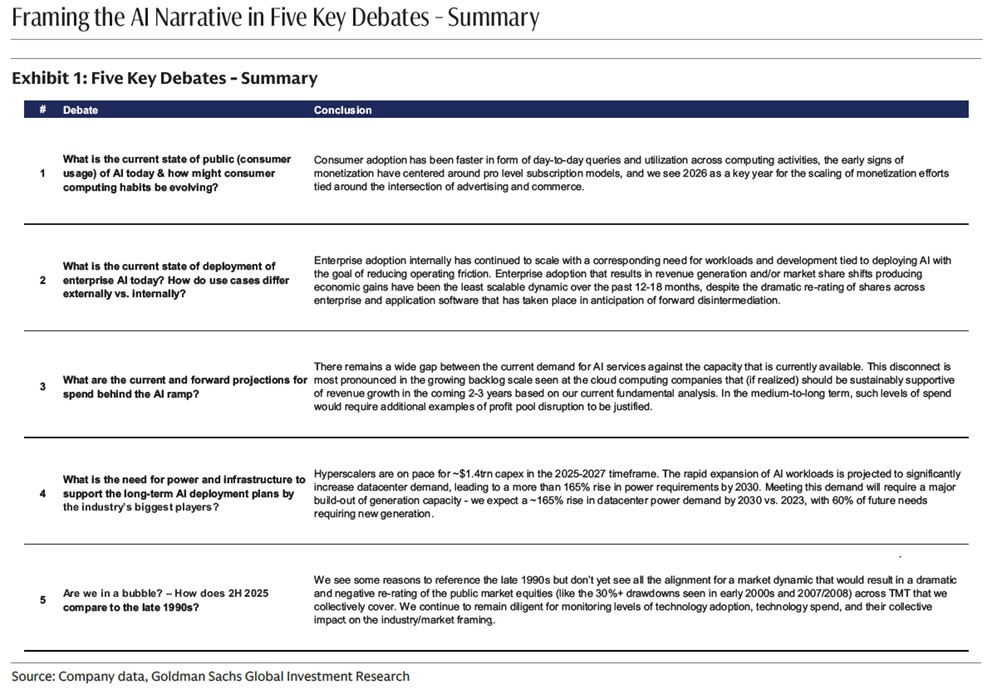

At the same time, doubts are growing as to whether this boom is still fundamentally substantiated. Goldman Sachs is trying to frame the discussion with five key debates about the current AI euphoria, from consumer adoption and business integration to the necessity of energy infrastructure.

Their analysis shows that the technology is spreading rapidly, but that monetization is still limited. Companies mainly use AI internally to improve processes, while only about 5 percent of companies already report measurable profit impact. The bank sees this as a sign of an early growth phase, in which enormous capital flows are ahead of actual returns.

A second finding is that the physical infrastructure, especially energy supply, network capacity, and chip production, is the new bottleneck. In the US alone, investments in the electricity grid would have to increase to $780 billion to support the growing AI demand. Goldman warns that this capital-intensive phase remains dependent on low interest rates and high liquidity: circumstances that are not self-evident in the coming years.

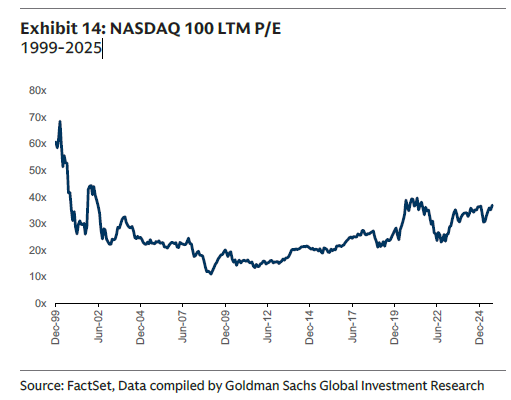

Yet there are important differences with the dot-com bubble of the late 1990s. The chart above from Goldman Sachs shows that valuations are much healthier today: around 37x earnings, compared to 68x at the peak in 1999. Moreover, companies like Microsoft, Nvidia, and Alphabet generate strong free cash flows, something that was exceptional at the time. The market for IPOs has also matured: fewer, but more profitable IPOs, and companies remain privately financed for longer. In macro terms, interest rates are approximately 4.3 percent lower than the 6 percent of that time, while the Fed is presumably moving towards easing.

Goldman Sachs summarizes these insights in its schema “Framing the AI Narrative in Five Key Debates”, in which the bank concludes that the current momentum is indeed extremely capital-intensive, but does not directly have the speculative character of the late 1990s. There is no “bubble” in the classic sense, but a growth phase in which expectations rise faster than profits.

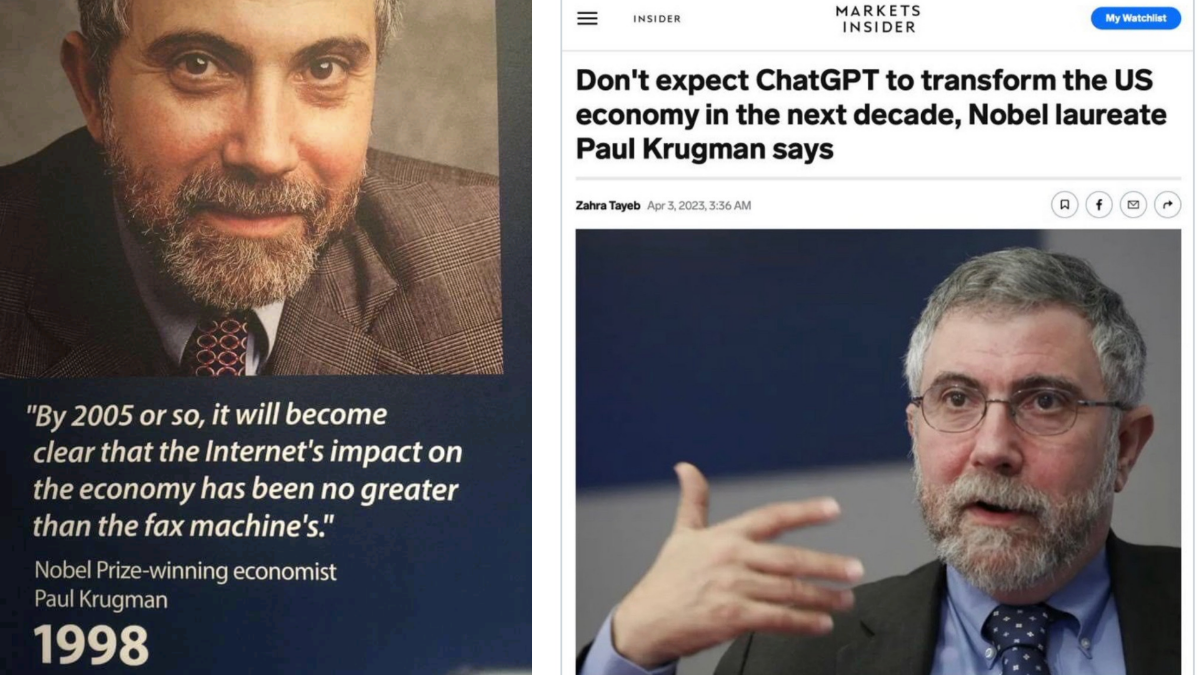

The comparison with the dot-com period is nevertheless compelling. At the time, the impact of the internet was massively underestimated, even by Nobel laureate Paul Krugman, who stated in 1998 that “the internet will have no more impact in 2005 than the fax machine.” A quarter of a century later, he repeats his skepticism, this time about ChatGPT and artificial intelligence. The now-viral collage of his statements symbolizes how technological revolutions are often initially dismissed, only to fundamentally change the economic reality.

The truth probably lies between both extremes. The current AI boom shows signs of overheating, but also of structural progress. Where some analysts warn of overinvestment and energy scarcity, others see a new industrial cycle in which data, computing power, and energy form the production factors of the future. Just as the dot-com crisis ultimately laid the foundation for winners like Amazon and Google, this phase will also produce new leaders, but not every player in the AI race will survive.

Caution therefore remains advisable for investors. Valuations are now mainly moving on expectations, not on realized profit growth. The coming years will have to show whether the AI supercycle is a sustainable transformation, or just a new chapter in the eternal pendulum movement between vision and euphoria.

US labor market: growth slowdown despite strong economy

The US labor market is beginning to show clear signs of cooling. According to chief economist Torsten Sløk of Apollo, in his recent analysis The Daily Spark, there are more unemployed people (7.4 million) than open vacancies (7.2 million) for the first time since 2021. Sectors that are sensitive to import tariffs and higher financing costs, such as industry, construction, and logistics, in particular, are showing a decline in employment. At the same time, various confidence indicators are falling among consumers, especially among lower incomes and the middle class, and among small businesses. This indicates a further slowdown in job growth and a gradual normalization of wage inflation.

Sløk emphasizes that this slowdown is not the result of a weak economy. GDP growth, consumer spending, and business investments remain robust. According to him, the cause lies on the supply side of the labor market. Three structural factors play a key role in this:

- Firstly, lower immigration leads to a smaller labor potential.

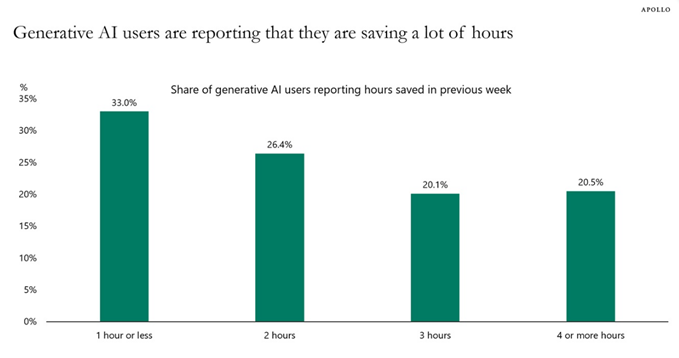

- Secondly, the rapid adoption of AI and automation leads to higher productivity, which means that companies need fewer staff.

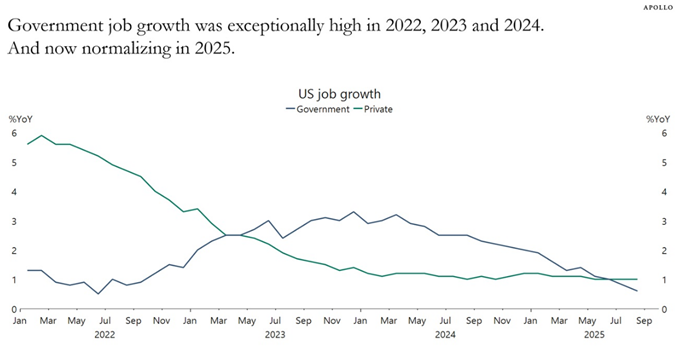

- Thirdly, the number of government jobs is decreasing after the substantial expansion under the previous administration.

This last movement is reinforced by cuts from the new Department of Government Efficiency (DOGE) under President Trump, which is implementing large-scale layoffs within the federal government. According to Sløk, the combination of restructuring and digitization, in which AI is increasingly being used in public services, indicates a structural reorganization of the American labor market.

For the financial markets, this means a milder policy direction from the Federal Reserve. A slowing labor market increases the chance that the central bank will pause or even reverse its tightening cycle, especially if inflation continues to weaken. Interest rates on US government bonds have fallen slightly in recent days, while stocks have found support in the expectation of a more flexible monetary policy.

Remarkably, the market remained relatively calm despite the federal shutdown at the beginning of October, in which more than 900,000 civil servants were temporarily suspended. Investors seem to assume that the political impasse is short-lived and will not cause lasting damage to the American economy. All in all, a shift is emerging: no longer overheating and wage inflation, but gradual normalization and higher productivity determine the new labor market picture in the United States.

Receive weekly insights in your inbox

Exclusive analyses and updates on family holdings and global market developments.

Would you like more information about our services? Please feel free to contact us.

Contact us

Disclaimer:

No rights can be derived from this publication. This is a publication of Tresor Capital. Reproduction of this document, or parts thereof, by third parties is only permitted after written permission and with reference to the source, Tresor Capital.

This publication has been prepared by Tresor Capital with the utmost care. The information is intended to be general in nature and does not focus on your individual situation. The information should therefore expressly not be regarded as advice, an offer or proposal to purchase or trade investment products and/or purchase investment services nor as investment advice. The authors, Tresor Capital and/or its employees may hold position in the securities discussed, for their own account or for their clients.

You should carefully consider the risks before you begin investing. The value of your investments may fluctuate. Past performance is no guarantee of future results. You may lose all or part of your investment. Tresor Capital disclaims any liability for any imperfections or inaccuracies. This information is solely indicative and subject to change.

Read the full disclaimer at tresorcapitalnieuws.nl/disclaimer .