Family Holdings #42 - Investor AB Capitalizes on Megatrends AI and Defense

Further: Scottish Mortgage on simple investing; Brookfield increases exposure to private credit and energy.

This week's topics:

Scottish Mortgage emphasizes that its success stems from patience, resilience, and a long-term vision: true value only arises when one dares to persevere through volatility. MercadoLibre, their second largest holding, embodies this principle. The company has grown into the digital backbone of Latin America, with leading positions in e-commerce, fintech, and logistics, strong profitability, and a sustainable competitive advantage. It perfectly illustrates the type of "outlier company" that Scottish Mortgage believes in: companies that do not react to change, but shape it themselves.

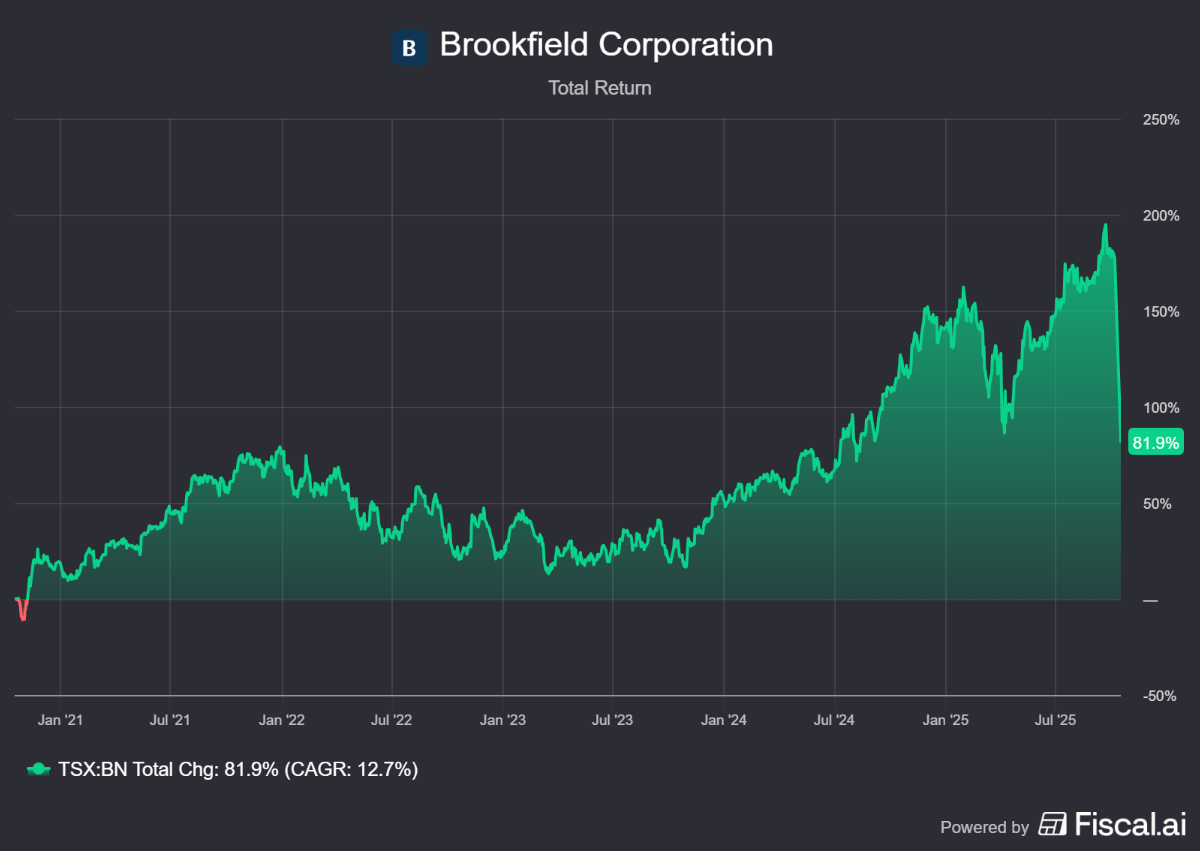

Brookfield Corporation has powerfully positioned itself this week as the linchpin of the next capital cycle, where energy, infrastructure, and credit converge. With the launch of the $20 billion Global Transition Fund and the full acquisition of Oaktree Capital, the group is strengthening its grip on both sustainable energy and credit markets. At the same time, Howard Marks is more moderate about valuations in the current market: unlike during the dot-com bubble, the AI revolution today rests on strong cash flows, proven profitability, and mature business models. Brookfield is therefore not investing in hype, but in the infrastructure that makes the technological future possible.

In Brief:

Constellation Software (Toronto: CSU) has acquired the German TECVIA GmbH through its subsidiary Harris for an estimated USD 150-200 million. TECVIA develops software for driving training, simulation and digital education systems, used by training centers, governments and companies in the mobility and automotive sector. The solutions help train drivers, simulate traffic situations and manage learning paths. The company achieved a turnover of approximately USD 110 million in 2024 and has approximately 450 employees. The deal underscores Constellation's impressive acquisition growth and the increasingly powerful capital allocation towards larger transactions, following the earlier USD 100 million plus acquisition of Cipal Schaubroeck (via Topicus) earlier this year. In addition, Vela Software Group (also part of Constellation) made its first acquisition in Thailand with CAN Innovation Co., Ltd., a supplier of CRM and distribution software for customers in Southeast Asia.

Topicus (Toronto: TOI) has also been active and has acquired the German MeData EDV-Systeme GmbH, a software company active since 1990 specializing in transport management systems (TMS) for the distribution of fuels, industrial gases and oxygen. MeData serves customers in Germany and other European markets and offers, among other things, the cloud solution Margo and the mobile app MTMx for drivers. In addition, Topicus also acquired the British Cindercone Solutions Limited, a developer of an integration platform that automates data flows between ERP systems, e-commerce and logistics platforms. Cindercone connects to the existing British activities within Topicus and is now the tenth acquisition in the UK and Ireland. These acquisitions bring the total to 21 acquisitions for 2025.

Brown & Brown (New York: BRO) has acquired Sunderland-based 1st UK Broking through its European branch. The company, founded in 2014, specializes in fleet and business insurance, including employer and liability insurance, as well as building and contents cover. It is the second acquisition in Europe for Brown & Brown in a short time.

Sofina (Brussels: SOF) is once again facing unrest at an Indian participation. The Belgian holding company, which previously had to write down heavily on its investment in edtech company Byju's, is now seeing problems at brewer B9 Beverages, producer of the popular beer brand Bira 91. The company is struggling with heavy losses, liquidity problems and internal tensions: hundreds of employees called on shareholders to replace CEO Ankur Jain. The problems arose after a legal name change that led to months of sales stops in several states. Sofina is estimated to own 6.4% of the outstanding shares and it accounts for only a small part of the intrinsic value. At the same time, there is better news at another Indian investment: fintech company Pine Labs is preparing an IPO for mid-November with a target valuation of USD 6 billion. Pine Labs is active in payment and credit solutions, became profitable in FY25 and sees the IPO as a means to accelerate its “credit-at-checkout” services and regional expansion. Sofina is estimated to own 2.45% of the outstanding shares.

D’Ieteren (Brussels: DIE) is bundling the luxury brands of its subsidiary D'Ieteren Automotive under one flag. The Belgian car group is bringing together the dealers of Porsche, Bentley, Lamborghini, Maserati, Bugatti and Rimac within the new Luxury Performance label. In doing so, it wants to create synergy between the exclusive brands and offer customers additional services, such as storage, maintenance and logistical support for circuit use.

Constellation Software, Topicus, Brown & Brown, Sofina, and D'Ieteren concluded the trading week on the Toronto, New York, and Brussels stock exchanges at prices of CAD 3,814.13, CAD 137.41, USD 87.91, EUR 239.40, and EUR 156.90 per share, respectively.

Investor AB navigates megatrends AI and defense

The Swedish investment holding company Investor AB (Stockholm: INVE-B) announced robust figures for the third quarter of 2025 this week. This quarter, it was the listed companies that led the way, while Investor reinvested in all three divisions.

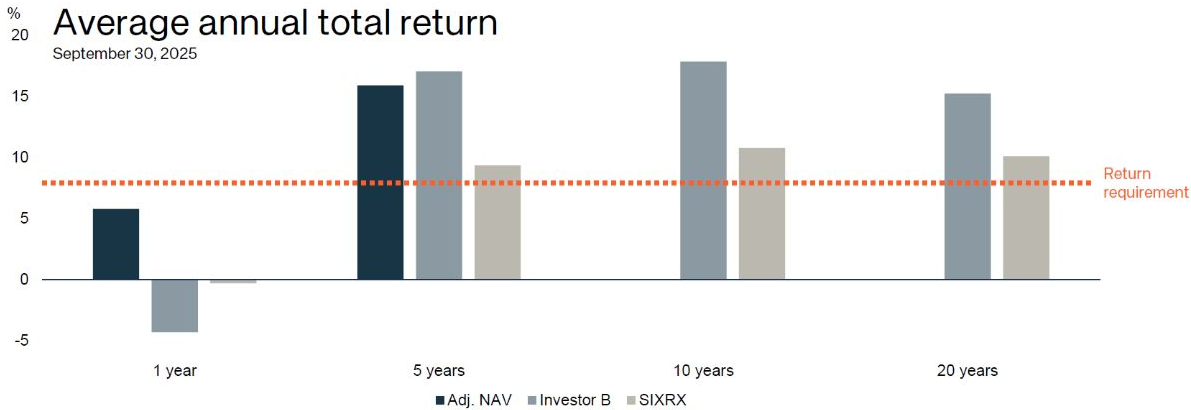

Investor AB saw its net asset value increase by an impressive 7 percent in the third quarter. The shareholder return (share price return plus dividend) was 5 percent, which was significantly better than the 3 percent of the Swedish stock exchange index SIXRX. Since the beginning of the year, the net asset value has increased by 8 percent. The shareholder return over the same period was 2 percent, while the Swedish stock exchange rose 6 percent.

Looking at the past twelve months (see figure below), a special phenomenon occurs: Investor AB's share price performance is less strong than the Swedish SIXRX stock exchange index. The net asset value is doing clearly better, which means that the undervaluation has increased in this period. However, Investor's long-term performance remains far better than that of the benchmark index.

CEO Christian Cederholm wrote in his letter to shareholders about the challenging global climate and the resilience of the portfolio companies:

- "As an avid proponent of free trade as a catalyst for innovation and global economic growth, it is concerning to see trade friction continue to increase due to tariffs and significant geopolitical tensions. In this environment, it is gratifying to see that our portfolio companies are doing a good job by focusing on what they can control, such as cost efficiency. Our companies also continue to invest in future-proofing their businesses, positioning themselves for stronger long-term performance.

The current environment offers opportunities to further strengthen the positions of our companies and Investor itself, which supports our ability to continue to generate an attractive total return for you, our fellow shareholders."

Listed companies

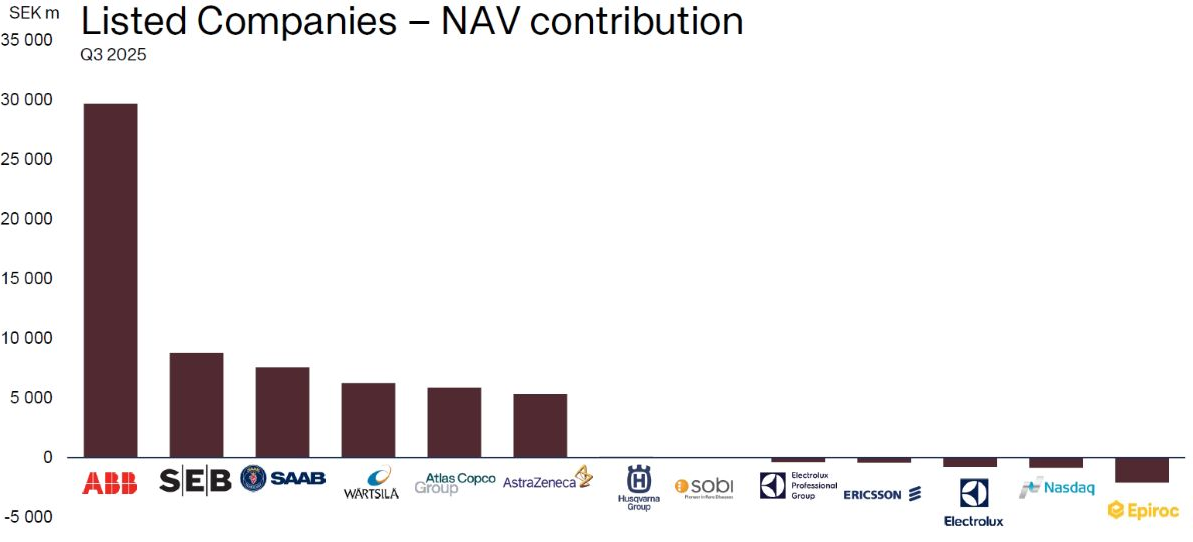

The listed portfolio delivered a total return of 8 percent in the third quarter, which was significantly better than the 3 percent of the Swedish stock exchange index. This excellent performance was led by Wärtsilä and ABB, which showed significant returns. The figure above shows the contribution to the growth of the net asset value per company. Investor is clearly reaping the benefits of the fact that AI enabler ABB is the largest position.

Investor continued to invest in its core positions in a disciplined manner. In the quarter, SEK 0.6 billion was invested in Atlas Copco and SEK 0.5 billion in Ericsson at levels that the family holding company considers attractive. In addition, an agreement was reached to sell 5 million shares in SEB to maintain the current ownership interest as SEB continues to buy back its own shares (to remain below the regulatory limit).

Meanwhile, the listed companies continue to work on future-proofing their activities. For example, Atlas Copco has acquired more than 30 companies in the past twelve months. AstraZeneca announced plans to invest USD 50 billion in the US by 2030, while Wärtsilä further streamlined its portfolio with the sale of the Marine Electrical Systems activities.

An important event after the end of the quarter was ABB's agreement to sell its Robotics division to Softbank, which we already wrote about last week. When asked by Tresor Capital whether ABB was offered a price that they thought was too good to ignore, CEO Cederholm confirmed during the conference call that Investor shares the view of ABB's board that this transaction is financially attractive for ABB and offers a good new home for ABB Robotics.

Unlisted companies: Patricia Industries

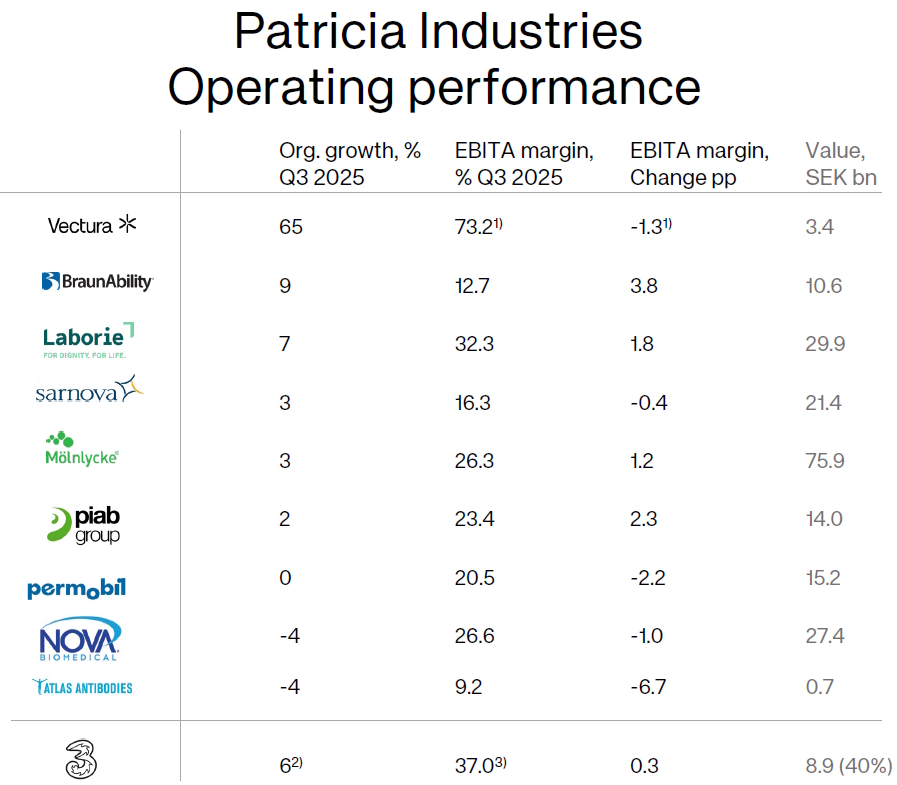

The unlisted companies, consolidated within Patricia Industries, achieved a total return of 4 percent in the third quarter. This increase was primarily driven by higher valuation multiples in the market and cash flow generation, but was partially offset by a negative currency effect.

Operationally, the picture was mixed. The major subsidiaries reported organic sales growth of 4 percent (excluding exchange rate effects), with BraunAbility and Laborie growing significantly faster. However, operating profit (EBITA) decreased by 2 percent, largely due to negative currency effects from a weakening US dollar.

The quarter was dominated by the completion of the strategic acquisition of Nova Biomedical by Advanced Instruments, a transaction valued at USD 2.2 billion. Patricia Industries contributed USD 1.6 billion in equity to finance this acquisition. The integration of the two companies, now operating under the name Nova Biomedical, has commenced and is on schedule. Organic growth in the first quarter after the acquisition was negative at 4 percent, which, according to Investor AB CEO Cederholm, was due to a very strong comparison period and a cyber incident that disrupted business operations. He emphasized that the underlying qualities of the company are in line with the investment case and that the focus is now on rapid integration to realize its full potential.

Mölnlycke, the largest subsidiary, reported solid organic growth of 3 percent, driven by Wound Care and Gloves, both growing at 5 percent. Investor CFO Jenny Haquinius noted during the conference call that Mölnlycke continues to gain market share in a market with low, single-digit underlying growth, but also acknowledged weakness in parts of Europe, such as Germany and France, due to pressure on healthcare budgets.

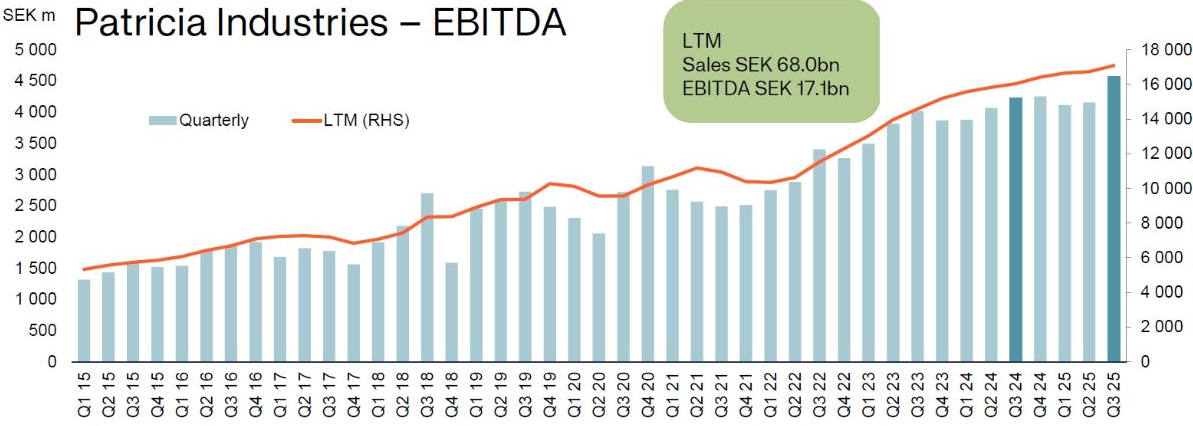

In the long term, Patricia Industries demonstrates impressive and steady profit growth, as shown in the figure below.

EQT AB and private equity funds

The value of the EQT segment grew by 1 percent in the third quarter. Investor AB includes both its stake in the shares of this private equity fund manager and the direct investments in EQT's investment funds. The stock price of EQT AB increased by 2%, while the return of the private equity funds was 1% negative. This is reported with a one-quarter delay and therefore concerns Q2; the result in Q3 was positive according to the EQT call, which will therefore be reflected in Investor's figures in the fourth quarter.

Investor continued to strengthen its collaboration with EQT by investing an additional SEK 1.8 billion in the co-investment in Fortnox, bringing the total investment close to the communicated SEK 4.5 billion. This investment is part of a strategic transaction in which a consortium, led by EQT X and the largest shareholder of Fortnox, has taken the company off the stock exchange to realize the next growth phase in a private environment. Fortnox is a Swedish software company that provides a cloud-based platform for financial administration to more than 600,000 small businesses. Investor AB is participating as a major co-investor in this deal to support the necessary investments in product development and potential acquisitions, which should lay the foundation for future scaling and growth.

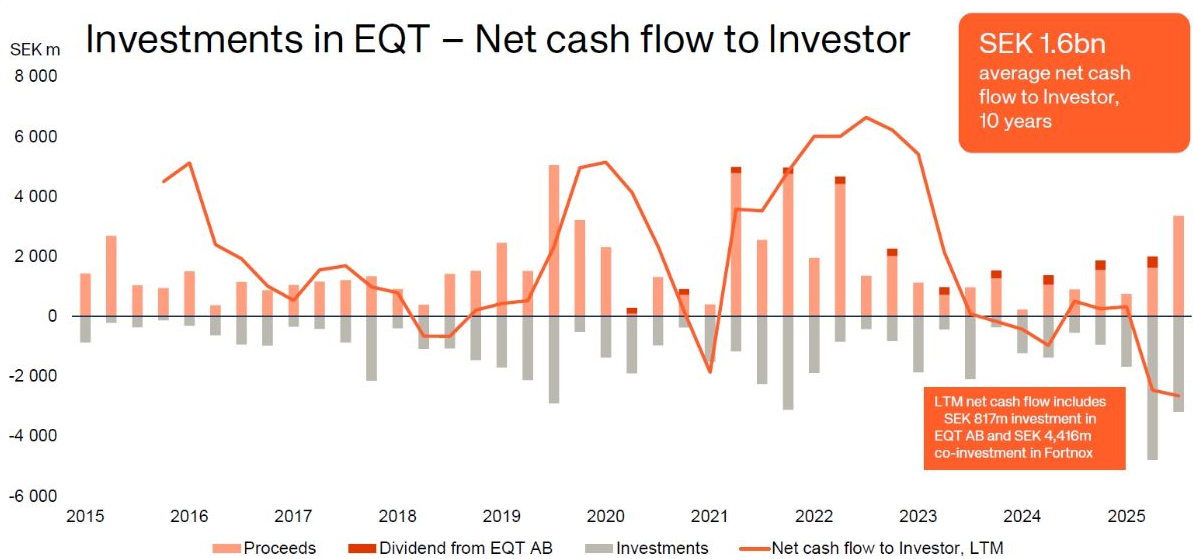

Cash flows from EQT were positive this quarter. A net SEK 165 million flowed to Investor. Although this amount is modest, a look at the longer term shows a very healthy picture. The net cash flow to Investor has averaged SEK 1.6 billion per year over a ten-year period. This demonstrates that the investments and returns from the EQT funds are well balanced. CFO Jenny Haquinius explained that the negative cash flow over the last twelve months (-SEK 2.7 billion) is distorted by the large investments in EQT AB shares and the co-investment in Fortnox. Adjusted for these items, the underlying net cash flow was actually SEK 2.5 billion positive.

Outlook and future-proofing

Investor AB is strongly focused on future-proofing its portfolio companies. Digitalization and artificial intelligence (AI) are high on the agenda. During the presentation of the figures, Tresor Capital asked for concrete examples of how Investor is addressing this theme through their position on the boards of directors. CEO Cederholm indicated that the opportunities in this area extend across the entire value chain, from research and development to more efficient production, administration, and marketing. Ultimately, AI should also improve the products and services for the end customer. He emphasized that this topic is high on the agenda and that Investor is actively promoting it through its role on the boards of the companies. In addition, knowledge sharing between the companies is encouraged to learn from each other's successes and failures and to create healthy internal competition.

Regarding the establishment of Sferical AI, an initiative of Wallenberg Investments AB and various portfolio companies, it was clarified in response to questions from Tresor Capital that Investor AB itself is not an investor. It concerns a collaboration between a separate entity of the Wallenberg family and the companies that will use the AI infrastructure for, for example, training models for research and development. Investor AB will benefit from this collaboration through its subsidiaries.

The private portfolio also remains a focus area, with additional capital for EQT and the completion of the substantial acquisition of Nova Biomedical. Investor AB is clearly not a passive investment holding company that sits back. With EQT co-investments such as Fortnox, the capital allocation spectrum is further broadened.

We consider the private portfolio to be the jewel of the family holding company. Patricia Industries is an attractive serial acquirer with a good position in the less cyclical healthcare sector. Supplemented by the investments in the private equity funds of EQT under favorable conditions (Investor AB does not pay performance fees), shareholders can gain liquid exposure to this investment category.

The liquid portfolio also offers very attractive exposure. For example, ABB and Atlas Copco are crucial players for the infrastructure surrounding Artificial Intelligence. Atlas Copco provides essential vacuum and compressor technology for the production of semiconductors (chips) and the cooling of data centers, while ABB supports the AI infrastructure with its automation, electrical systems, and energy management solutions. With Saab, shareholders also have exposure to the booming defense industry.

Thus, Investor AB proves not to be a boring, solid Swedish family business, but an attractive and dynamic investment holding company that offers exposure to megatrends and that constantly adds value through active management. Since its founding in 1916, the Wallenbergs have been optimizing and future-proofing the portfolio, in which they are succeeding again today. This provides a strong foundation for continued strong returns towards the future. As one of the larger positions in the Tresor Capital Family Holding Portfolio, we are riding along on the success of this Swedish stock market gem.

Investor AB ended the trading week on the Stockholm Stock Exchange at a price of SEK 306.70 per B-share.

Receive weekly insights in your inbox

Exclusive analyses and updates on family holdings and global market developments.

Patience as a weapon: how Scottish Mortgage wins with companies like MercadoLibre

Last week, we wrote about how Scottish Mortgage Investment Trust (London: SMT) is focusing on structural themes such as artificial intelligence and space travel. This week, new sessions with fund managers Tom Slater and Lawrence Burns were released, in which they spoke about something more fundamental: how to learn as an investor to use time, imagination, and patience as your greatest advantage. An important theme in the current market, where euphoria and fear alternate rapidly.

The long term as a competitive advantage

Slater kicked off the conversation with a simple but powerful message: “Rome wasn’t built in a day.” According to him, days or weeks on the stock market sometimes feel like an eternity, but they rarely say anything about the actual progress of a company. The success of Scottish Mortgage Investment Trust is not built on quick decisions, but on the discipline to look five to ten years ahead, not five to ten days.

Patience alone, however, is not enough, the management notes. Time is only valuable if it is supported by resilience. This attitude requires calmness and confidence, qualities that are becoming increasingly rare in a world full of headlines, volatility, and social media. Lawrence Burns put it aptly: “The price you pay for chasing exceptional companies is volatility.” Big winners never grow in a straight line; they are formed in periods of uncertainty. Even the most successful companies experienced deep valleys along the way: Apple once lost more than 70% twice, Amazon even more than 90%.

Only companies with real profitability, healthy margins, and strong teams are able to grow through such shocks. It was precisely in those moments that the foundation was laid for their later exponential growth. Slater summarizes this in one principle: “You can only lose one hundred percent once, but you can earn back your stake many times over if you are right.”

Therefore, positions within the Scottish Mortgage fund, and also at Tresor Capital, are only reduced when the original investment case fundamentally changes.

The managers' thoughts align seamlessly with our own philosophy. We also believe that patience is the rarest but most powerful investment factor. After all, it is the only factor that cannot be copied. Whoever masters it has a permanent advantage.

In essence, the principle is simple: those who want to trade little must understand their investment case in detail. Only then can you muster the discipline to stay put when the market screams for action. It is reminiscent of Johan Cruijff's statement: “Football is simple, but playing simple football often turns out to be the most difficult thing there is.” The same applies to investing: it is seemingly simple, buy great companies and hold them for a long time, but truly understanding those companies requires patience, dedication, and perseverance.

MercadoLibre as an example of these core values

In addition to the two videos with the fund managers, an interview with the second largest holding of Scottish Mortgage was also released this week. Where we wrote last week about the largest position, SpaceX, MercadoLibre is now in the spotlight. The company has long been the most important listed holding within the fund and embodies many of the principles that Tom Slater and Lawrence Burns spoke about in their conference: long term, resilience, innovation, and independence.

In the conversation with the upcoming CEO Ariel Szarfsztejn, it quickly becomes clear why Scottish Mortgage remains so convinced of this company. MercadoLibre is not just an e-commerce platform, but the digital backbone of Latin America. The company now serves more than 100 million active buyers in a region with 650 million inhabitants and combines e-commerce, payments, lending, logistics, and digital media in one integrated ecosystem. This interconnectedness makes it both the dominant player in online commerce and the largest fintech company on the continent.

MercadoLibre's position within its markets is remarkable. In Brazil, the largest economy in the region, the company's market share has grown from approximately 20% to 42% in recent years, while Amazon has only increased from 8% to 11% in the same period. In digital payments, Mercado Pago is the clear number one, with a reach that traditional banks and international fintechs cannot match. And in other domains, such as digital advertising, MercadoLibre has also firmly positioned itself, now the number 3 in Latin America, directly behind Google and Meta. This spread shows that the company is not dominating one market, but is redefining multiple sectors simultaneously.

What appeals to Scottish Mortgage in this company goes beyond growth. MercadoLibre meets almost all the characteristics that Slater and Burns previously mentioned as conditions for sustainable exceptional returns: a strong cash flow, structural profitability, and a defensible competitive advantage.

In eight years, it built its logistics network to more than 70,000 employees and hundreds of fulfillment centers, making it faster and more reliable than Amazon in the same region today. At the same time, the company remains profitable, a rarity in emerging markets that are often characterized by inflation, volatility, and political noise.

For Scottish Mortgage, MercadoLibre is therefore a prime example of what they call “outlier companies”: companies that not only go along with change, but shape it themselves.

The scale of Latin America makes that potential even more impressive. With a combined economy of approximately USD 7 trillion, the continent, if it were one country, would be the third largest economy in the world. Yet e-commerce penetration is still below 15% of total retail sales, and more than half of all transactions are still conducted with cash. For a company that is a market leader in both sectors, that means a long growth path ahead.

That also explains why Scottish Mortgage is drawing attention to it again. Not to promote the share, but because MercadoLibre is illustrative of their way of thinking: investing in companies that use time to their advantage, become stronger through scale and data, and have a culture that can withstand crises. The conversation with Szarfsztejn shows that this company is not dependent on short-term trends, but is built to grow with the economic modernization of an entire continent.

For investors, the story of MercadoLibre mainly offers insight into the quality and direction of Scottish Mortgage's portfolio. It shows what the fund is looking for, companies that not only make a profit, but also stimulate structural progress, economically, technologically, and socially.

Scottish Mortgage Investment Trust ended the trading week on the London Stock Exchange at a price of GBP 11.07 per share.

Brookfield’s billion-dollar offensive towards the future

The Canadian investment giant Brookfield (New York: BN) has had a remarkable week. Within a few days, it announced three strategic steps that together paint one clear picture: the group is positioning itself as the linchpin of the next capital cycle where energy, infrastructure, and credit intersect.

Launch of the largest sustainable energy fund ever

First, Brookfield Asset Management announced that it has closed its second Global Transition Fund, with an impressive size of $20 billion. The fund, focused on sustainable energy and infrastructure, is one of the largest private capital injections ever in the global energy transition. Major contributions came from Alterra (the investment arm of the UAE, $2 billion) and Norges Bank Investment Management ($1.5 billion), while Brookfield Corporation itself contributes approximately 25% of the total capital, an unusually large share for a fund manager, and a clear signal of conviction.

The fund invests broadly: from solar and wind farms to nuclear technology and CO₂ storage, but also in infrastructure that enables the growth of artificial intelligence. The latter is no coincidence. According to President Connor Teskey, the AI explosion is driving global energy demand faster than expected: “The world needs not less, but more energy – clean, abundant, and cheap. The AI industry is becoming a new major consumer, and that is accelerating our investment cycle.”

More than $5 billion of the fund has already been allocated, including to the French Neoen (battery storage and solar parks) and to the Indian Everen, a joint venture for wind and storage. The same logic that it also applies with its investment in Bloom Energy, where it previously invested up to $5 billion in fuel cell technology to satisfy the power hunger of AI data centers.

By investing in both the production and consumption side of energy, Brookfield is gradually building an integrated ecosystem that powers the technological revolution. The group therefore seems not to be speculating on the future, but literally energizing it.

Purchase of remaining Oaktree shares

As if that were not enough, Brookfield Corporation also announced this week that it is taking over the remaining 26% of Oaktree Capital Management for approximately $3 billion. Brookfield and Brookfield Asset Management are each financing approximately half of the transaction, completing the merger from 2019, at the time for $5 billion.

With this step, Oaktree, the legendary manager of distressed debt led by Howard Marks, is fully integrated into Brookfield's structure. Together they manage more than $1 trillion in assets, firmly positioning Brookfield alongside Blackstone and Apollo as one of the largest alternative asset managers in the world. Oaktree is known as the temple of value investing and credit discipline, a counterweight to the exuberance of the stock markets.

Mark Howards changes direction

Marks, for years a sharp critic of overvaluation and market euphoria, was still seen a month ago in an interview where he thought that shares were expensive compared to the fundamentals and investors were “too optimistic out of habit”. He even spoke of “the early days of a bubble” then.

However, in a more recent interview this week, he sounded remarkably more moderate. Although he acknowledges that valuations are high, he sees no signs of “psychological excesses”, the characteristic that he believes defines every real bubble:

“There is enthusiasm, yes, but no mania. Today's companies are better, more dominant, and more profitable. Optimism is justified as long as it is not blind.”

Marks’ statement touches on a point that is often overlooked in the current market. As soon as there is euphoria around technology or AI, the comparison with the dot-com bubble of the early 2000s is quickly made. But those who look deeper see that the situation is fundamentally different.

The companies that set the tone at the time, such as Yahoo, Pets.com, or Netscape, had hardly any free cash flow. The value of the market was built on promise. The average earnings per share of the then technology index was less than a tenth of current levels at the beginning of 2000, and the combined free cash flow of the ten largest tech companies was less than $20 billion per year. Today, those same top companies, Apple, Microsoft, Alphabet, Meta, Amazon, Nvidia, and TSMC, collectively generate more than $400 billion in free cash flow per year. That is twenty times as much. In other words: where valuations were completely detached from reality then, the current valuation rests on an extraordinarily profitable and capital-strong basis.

In addition, the investment size of today, however large, is manageable in relative terms. When Mark Zuckerberg says he would rather misspend $100 billion than lag behind in the AI trend, it sounds excessive, but it is only a fraction of the cash flow that Meta expects to generate in the coming years. Other companies also invest from abundance, not from debt.

The difference with the dot-com era is therefore not only financial, but also structural. The current generation of technology companies has proven business models, monopolistic market shares, and the scale to absorb billions in R&D without undermining their profitability. Where the internet revolution of the time revolved around hope, the AI revolution of now revolves around cash flows, infrastructure, and mature markets.

Brookfield Corporation is currently trading on the New York Stock Exchange at a price of USD 44.18 per share.

Receive weekly insights in your inbox

Exclusive analyses and updates on family holdings and global market developments.

Would you like more information about our services? Please feel free to contact us.

Contact us

Disclaimer:

No rights can be derived from this publication. This is a publication of Tresor Capital. Reproduction of this document, or parts thereof, by third parties is only permitted after written permission and with reference to the source, Tresor Capital.

This publication has been prepared by Tresor Capital with the utmost care. The information is intended to be general in nature and does not focus on your individual situation. The information should therefore expressly not be regarded as advice, an offer or proposal to purchase or trade investment products and/or purchase investment services nor as investment advice. The authors, Tresor Capital and/or its employees may hold position in the securities discussed, for their own account or for their clients.

You should carefully consider the risks before you begin investing. The value of your investments may fluctuate. Past performance is no guarantee of future results. You may lose all or part of your investment. Tresor Capital disclaims any liability for any imperfections or inaccuracies. This information is solely indicative and subject to change.

Read the full disclaimer at tresorcapitalnieuws.nl/disclaimer .