Economy & Markets #42 - Xi Jinping Plays the King of Diamonds, But Is It a Bluff?

How China has become a major power in precious metals, and Europe is once again the loser.

This week's topics:

New geopolitical roadmap: from unipolar to polycentric

In 1405, the Chinese admiral Zheng He set sail with the largest fleet the world had ever seen: 317 ships, manned by 27,000 people. His "treasure ships" were five times larger than Columbus' Santa Maria. He reached East Africa, built trade networks across three continents, and created maps that connected the world for the first time. China was poised to become the first maritime superpower, technologically, economically, and geographically.

However, the officials in the court bureaucracy in Peking labeled trade, seafaring, and foreign enterprises as unworthy of an imperial and self-sufficient power and shifted the focus back inward. The large ships were banned, and the nautical charts were burned. Within half a century, Portuguese explorers sailed the same routes, using maps that were once Chinese. Europe became a global power, and China became impoverished: the rest is history, or is it?

Is Europe handing its route maps back to China?

Six hundred years after Zheng He's maritime expeditions, some European countries seem to want to hand back their nautical charts, this time to China (and the United States). For example, the city of Hamburg, for centuries one of Europe's major global ports, voted in favor of the Zukunftsentscheid in a referendum last weekend: legally stipulating that the city must be climate neutral by 2040, five years earlier than planned, and accepting the economic consequences.

What seems visionary and ambitious is, according to Die Welt, primarily symbolic politics: "No global impact, significant local side effects." The costs of home renovations, industrial greening, and mobility electrification are estimated at €40 billion, which will fall back on tenants and especially small businesses through local taxes.

The port authority and the logistics and transport sector are by definition very energy-intensive and now fear a rapid decline in tonnage. Although, if this trend continues, Germany will import even more goods from China. Energy-intensive companies such as copper producer and smelter Aurubis, which recently built one of the most modern copper smelters in the world in Hamburg, also call the future of its factory in Hamburg "uncertain." Airbus also assembles its aircraft in Hamburg and is now considering moving production to France if energy prices continue to rise and the number of permitted flights is limited.

Both concerns are clearly taking a pioneering role by focusing on hydrogen as a green energy carrier, but here too, the production of hydrogen is extremely expensive and is still being penalized, as hydrogen is currently produced via natural gas. Critics therefore note that the choice to accelerate sustainability only leads to higher local costs and the ambition turns into relocation of production.

Europe is rapidly losing its industrial heart

Hamburg, once the beating heart of European trade, symbolizes a deeper problem: Germany is deindustrializing at a rapid pace. This should raise questions about the generally very optimistic view of European equities. Since 2018, German industrial production has fallen by more than 19%. The economy is shrinking for 3 consecutive years: in 2023 (-0.3%) and 2024 (-0.2%), and slightly negative growth is expected again for 2025. This persistent recession is therefore taking place despite the extensive stimulus package of €600 billion that the new German government announced this year, spread over the next ten years.

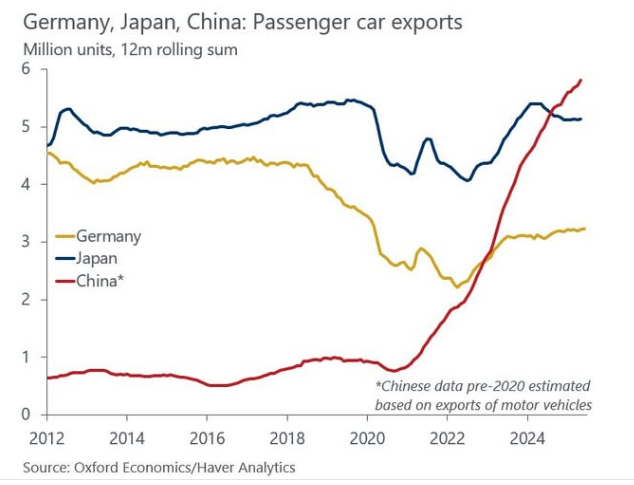

What Hamburg is for the port, the automotive sector is for Germany: for years a symbol of efficiency, now a source of vulnerability. The accelerated phasing out of the combustion engine has sharply exposed this weakness. While manufacturers are investing billions in electrification, they are struggling with high costs, a slow rollout of charging infrastructure, and consumers who are still hesitant to fully switch to electric driving.

During the recent Autogipfel in Berlin, Chancellor Friedrich Merz announced a change of course. According to Merz, there should be "no hard stop for the combustion engine" in 2035, when the European ban on new gasoline and diesel cars would take effect. He advocates a technology-neutral approach, in which hybrid drives and synthetic fuels can also play a role. To keep the transition socially acceptable, the German government is allocating an additional €3 billion for subsidies on electric vehicles for low- and middle-income earners. In addition, the tax exemption for EVs will be extended until 2035.

The business community supports this pragmatic course. Volkswagen CEO Oliver Blume called a complete ban "unrealistic" and received support from suppliers who warn of job losses and possible relocation of production abroad. At the same time, Germany is seeking allies, including Italy, Poland, and the Czech Republic, to advocate for a phased transition in Brussels and thus postpone the ban.

Europe divided over pensions: Germany tightens, France eases

The persistent recession and the process of de-industrialization threaten to impoverish Germany rapidly. In response, the German government has opened the discussion about a further increase in the retirement age, possibly up to 73 years. A measure that, despite the need for budgetary stability, will not do much to improve consumer and business confidence for the time being. At the same time, France is choosing an opposite course. The new Prime Minister Lecurnu has announced that he will lower the retirement age to 63, which will ease social pressure in his own country, but further increase the differences within the European Union.

Receive weekly insights in your inbox

Exclusive analyses and updates on family holdings and global market developments.

China plays export bans as a geopolitical trump card, Trump threatens new tariffs

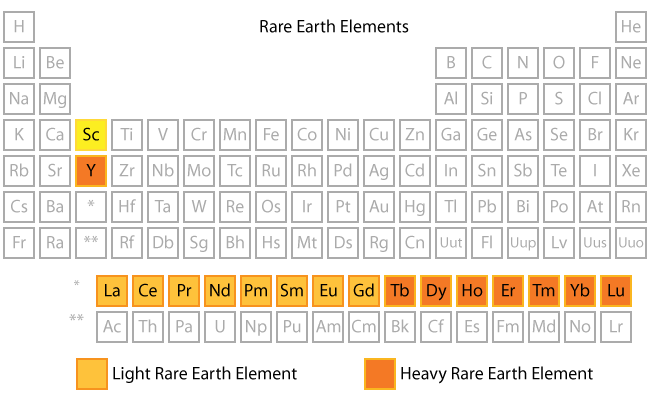

Last week, China further tightened export controls on rare earth metals. New regulations require companies to apply for a license to export certain raw materials and technologies related to mining and processing, including magnets and components of Chinese origin. Importantly, this measure applies not only to Chinese producers but also to foreign companies that use Chinese rare earth metals or technology in their products. The timing is not entirely surprising: the export rules will take effect just before planned summit meetings on October 30 between US President Donald Trump and Chinese President Xi Jinping, suggesting that China is using this step as a strategic instrument.

This poses a direct challenge to the United States, particularly in the defense and technology sectors, which are heavily dependent on rare earth metals. China's control over the chain gives it the power to restrict critical supplies, putting pressure on the American side to consider concessions or accelerate alternative supply chains. Trump announced that he would introduce an additional 100% tariff on Chinese goods from November 1, 2025.

Rare metals: rare, or just polluting?

Geologically speaking, rare earth metals are not so much scarce, but occur in low concentrations in the earth's crust. The bottlenecks therefore lie in concentration, separation, and refining, processes that are costly, chemically complex, and very energy- and water-intensive. Rare metals such as neodymium, lithium, cobalt, cerium, palladium, praseodymium, and dysprosium are each essential for modern technologies such as batteries and magnets for electric cars, defense materials, smartphones, and solar panels.

China's strategic "moat" in rare metals

China has masterfully positioned itself as a monopolist in the production and processing of rare metals over the past decades. While Western countries phased out their mining and chemical processing due to cost and environmental concerns, Beijing saw the strategic importance and built the possession of cheap energy (coal-fired power plants) and ample water supply into an economic moat in this sector.

In 2023, global production was approximately 350,000 tons of rare earth oxides (REO), the vast majority of which was mined in China. In terms of volume, this is an extremely small market: for comparison, approximately 22 million tons of copper and 70 million tons of aluminum are produced annually. The real leverage therefore lies not in the mine production itself, but in the processing. China can produce up to 40% cheaper than competitors and controls an estimated ninety percent of global refining capacity, thus dominating the production of permanent magnets, the actual bottleneck of the green industry.

That dominant position is no coincidence. China has deliberately chosen to keep the environmentally and energy-intensive parts of the chain within its own borders. The country has been willing to accept the pollution, high water consumption, and CO₂ emissions. Chinese data indicate approximately 75 m³ of heavily polluted wastewater and 40 to 80 tons of CO₂ emissions per ton of metal produced, approximately five times the water consumption and seven times the CO₂ emissions of copper production, respectively.

In the Bayan Obo mine, the largest in the world, this amounts to approximately 13 million m³ of water consumption per year with a production of 750,000 tons of concentrates. Behind China's refining power, therefore, lies a significant environmental price, largely driven by coal power and wastewater pollution.

With the recent export restrictions on rare earth metals and magnets, Beijing has once again demonstrated its geopolitical leverage. The G7 countries are now talking about coordinated countermeasures and an accelerated diversification of the supply chain. The United States is trying to build its own midstream industry through the Inflation Reduction Act and the Defense Production Act, together with partners such as Australia and Canada. An additional driver is defense. Under the guise of "strategic control," the construction of production capacity is being rapidly approved within the US. This is not surprising: an F-35 fighter jet or Leopard 2 tank contains approximately 400 to 450 kilograms of rare earth metals, while a submarine requires up to 6,000 kilograms. These metals are therefore not only crucial for the energy transition, but also form the invisible backbone of modern military power.

According to the Financial Times, Europe is lagging behind again: it does have a Critical Raw Materials Strategy, but attempts at large-scale mining and processing are encountering political and environmental resistance. The result is that Europe has become doubly dependent: on American digital technologies and on Chinese raw material processing. While China and the US are investing trillions in strategic industries such as AI, robotics, and batteries, European commitment remains "marginal." Without rapid mobilization of capital and industry, the EU, Glenny warns, will slide into a structural "supplicant," dependent on both Washington and Peking.

Cryptos lose their luster, gold shines

While crypto prices declined, gold prices continued to rise, a sign that confidence is shifting back towards precious metals in turbulent times. Last week, the trade war escalated precisely around the closing time of the US stock exchanges. Investors who wanted to reduce their risk looked for markets that allowed trading even after the stock market closed and automatically ended up in the 24-hour markets of crypto and altcoins. What followed was a real sell-off in the night from Friday to Saturday, which even led to liquidations of some heavily leveraged crypto funds.

On October 10, the crypto market was then hit by an abrupt flash crash. Altcoins in particular took heavy blows (declines of more than 30%), while Bitcoin held up reasonably well (-10%). According to Charlie Erith, founder of Wiston Capital, the total market value of crypto has fallen by more than 13% since October 6. During the low point, tokens (excluding Bitcoin, Ether, and stablecoins) fell by almost 33% in just 25 minutes, accounting for approximately $18.7 billion in liquidations and the closure of 1.6 million trading accounts.

The event made it painfully clear that crypto has not yet acquired the safe haven status that some attribute to it. In periods of geopolitical and monetary uncertainty, investors still seek the relative certainty of tangible assets. Moreover, in recent months, the possibilities to invest in cryptos with leverage have rapidly become popular, which has precisely triggered the accelerated reduction of positions.

Meanwhile, the gold price is trading at USD 4300 per ounce, making the highest weekly return (>8%) since 2008 (when Lehman bank went bankrupt).

Doing nothing is the biggest risk

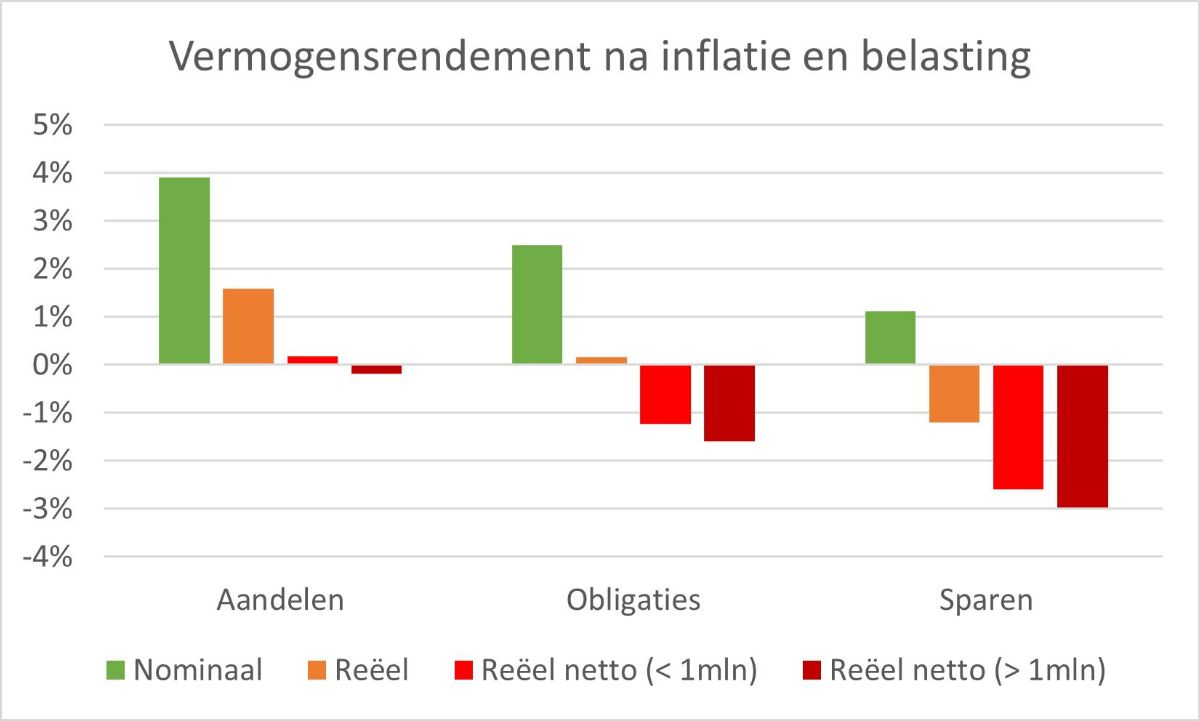

An interesting discussion arose on LinkedIn this week between Coen van de Laar (Achmea Asset Management) and several other financial experts about the influence of taxes on investing and the wrong incentives that result from this. In his message, Van de Laar shares recent calculations showing that, when inflation and taxes are taken into account, the actual return for many investors over the long term is practically zero or even negative.

With the elections approaching, virtually every party promises a "fairer" tax system. But what does fair actually mean when savings and investments have been structurally eroded by inflation and taxes for years?

In his contribution Coen van de Laar shows how heavily the wealth tax in the Netherlands now weighs, especially with the proposed increase to 49%. According to his calculations, hardly anything remains of the historical average return on stocks, bonds, and savings once inflation and box 3 tax are included. His message is sharp: the government does not tax the profits of investors, but their purchasing power. For most households, this means that wealth does not grow, but slowly evaporates.

The discussion ties in with an earlier analysis by David Blitz (Robeco), who already drew similar conclusions a year ago. Blitz pointed out that the real return since the start of the euro (1999) for bonds is practically zero, and clearly negative for savings. Even stocks, normally the best protection against inflation, hardly provide any added value after tax. His suggestion: do not tax the nominal return, but the profit after correction for inflation. That would distribute the tax burden more fairly and make saving and investing attractive again.

For investors, the conclusion is inevitable: those who want to maintain or grow their wealth cannot hide behind savings accounts or bonds. Not investing is investing, but against inflation.

Receive weekly insights in your inbox

Exclusive analyses and updates on family holdings and global market developments.

Would you like more information about our services? Please feel free to contact us.

Contact us

Disclaimer:

No rights can be derived from this publication. This is a publication of Tresor Capital. Reproduction of this document, or parts thereof, by third parties is only permitted after written permission and with reference to the source, Tresor Capital.

This publication has been prepared by Tresor Capital with the utmost care. The information is intended to be general in nature and does not focus on your individual situation. The information should therefore expressly not be regarded as advice, an offer or proposal to purchase or trade investment products and/or purchase investment services nor as investment advice. The authors, Tresor Capital and/or its employees may hold position in the securities discussed, for their own account or for their clients.

You should carefully consider the risks before you begin investing. The value of your investments may fluctuate. Past performance is no guarantee of future results. You may lose all or part of your investment. Tresor Capital disclaims any liability for any imperfections or inaccuracies. This information is solely indicative and subject to change.

Read the full disclaimer at tresorcapitalnieuws.nl/disclaimer .