Family Holdings #43 - MBB Breaks Records and Rises to New Heights

Also: Swedish serial acquirers show how it's done; Chapters CEO Jan Mohr on the 'Shotgun' and 'Rifle' AI approach.

This week's topics:

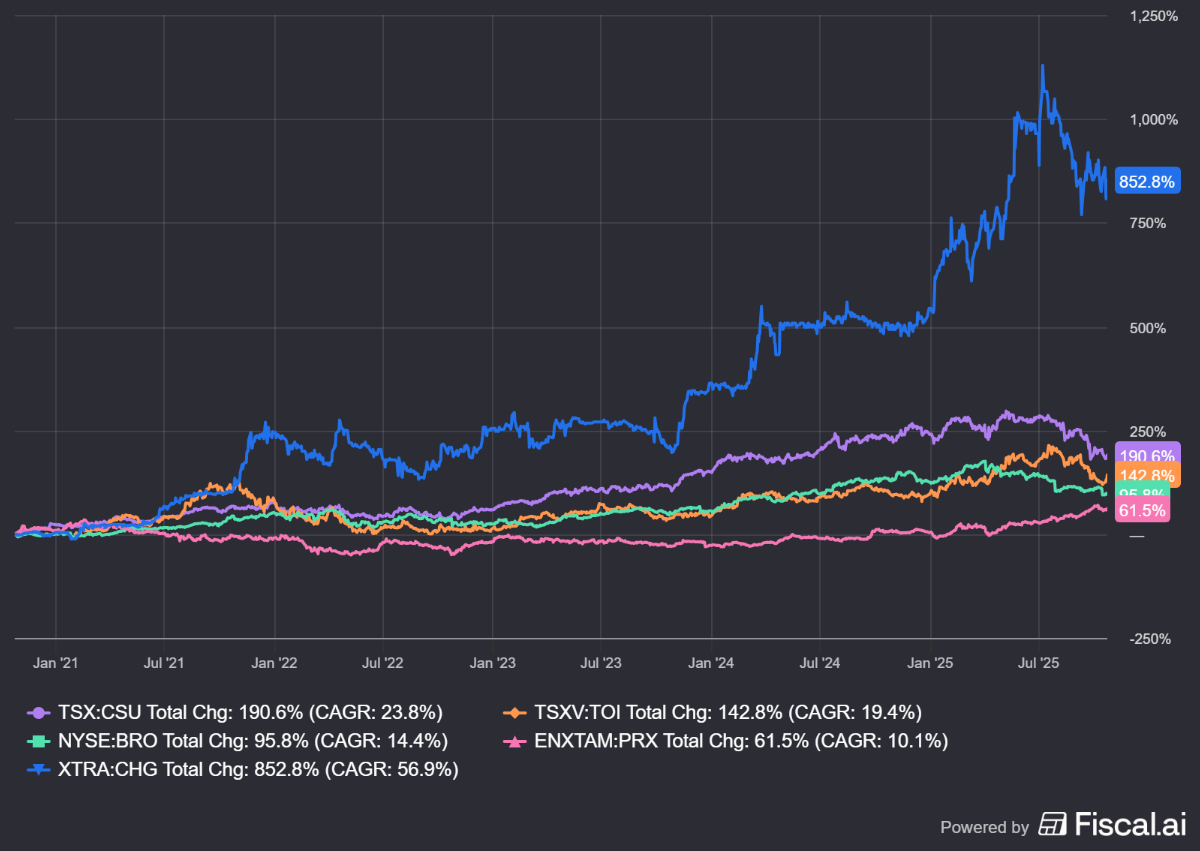

The Swedish serial acquirers Addtech and Lifco reported strong quarterly results with profit growth of around 10% and margins above 15–22%. Both companies demonstrate that the decentralized serial acquirer model remains resilient, even in fluctuating market conditions. Lifco added 13 new companies and maintains a rock-solid balance sheet. The >10% share price jumps reflect investor confidence in this robust growth model.

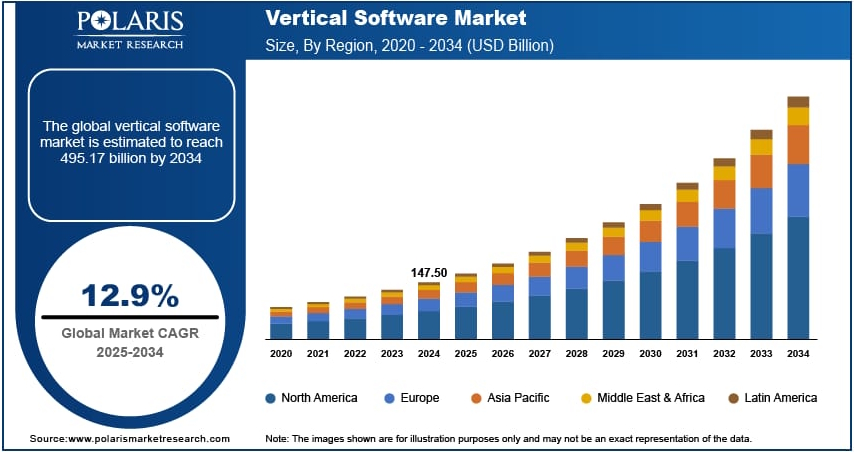

Chapters Group CEO Jan Mohr sees AI not as a threat but as a catalyst for the VMS sector. Chapters uses a 'shotgun' approach for broad adoption and targeted 'rifle' projects with rapid ROI. AI enhances efficiency, customer loyalty, and data infrastructure in mission-critical environments such as police services. This consolidates Chapters' strategic position, while the market for niche software grows towards USD 500 billion.

In Brief:

Brown & Brown (New York: BRO) has recently experienced some price pressure. Management clearly expressed its confidence in the long term by increasing the share buyback program by USD 1.25 billion to a new total of USD 1.5 billion. A serious signal from the management. They also decided to increase the quarterly dividend by 10% to USD 0.165 per share, the 32nd consecutive dividend increase. Finally, the acquisition of Pardus Underwriting was announced, a British MGA specializing in real estate and business insurance products.

Constellation Software (Toronto: CSU) continues to accelerate its expansion pace with three new acquisitions through subsidiaries. Volaris acquired British Fintilect Ltd., a provider of digital banking software for secure front-end solutions. In Singapore, Volaris also acquired Quantum Inventions from Continental AG, active in connected-car and mobility data. Harris expanded its portfolio with Canadian Constellio, specializing in content management and data security. These three acquisitions bring the total for 2025 to 73 acquisitions.

Topicus (Toronto: TOI) has acquired British Sendible, a social media management platform that helps businesses and agencies manage their online presence through one integrated system. Sendible offers tools for planning and publishing content, monitoring responses, and analyzing performance across multiple channels.

Prosus (Amsterdam: PRX) remains active in restructuring its e-commerce portfolio. The company has announced that it will not sell shares in the IPO of the Indian online retailer Meesho, in which it holds a 12.3% stake. The IPO, with an expected yield of ₹58–66 billion (≈$700–800 million), marks an important moment for the Indian tech market. While early investors such as Elevation Capital and Peak XV (Sequoia India) are partially exiting, Prosus is consciously opting for a long-term position in the rapidly growing platform, which has become one of the largest competitors of Flipkart and Amazon in India. In addition, Prosus continues to refine its portfolio by phasing out non-core activities. For example, subsidiary OLX Group sold its activities in Kazakhstan for $75 million. With this step, Prosus is further concentrating on core markets and more profitable digital ecosystems, while it can reinvest the proceeds in strategic growth pillars such as e-commerce, fintech, and education.

Chapters Group (Frankfurt: CHG) continues to actively reposition its capital structure. On October 16, the company further reduced its stake in Software Circle to 10%, a clear step away from the more expensively valued listed software market towards the more attractively priced private sector. Shortly thereafter, Chapters announced an expansion of its 7% bond 2025/2030 by €40 million, bringing the total outstanding volume to €72 million within a framework of a maximum of €100 million. The strong demand among investors confirms confidence in Chapters' model and provides additional financial space to accelerate the active M&A pipeline in vertical market software.

Brown & Brown, Constellation Software, Topicus, Prosus, and Chapters Group are currently traded on the stock exchanges of New York, Toronto, Amsterdam, and Frankfurt at prices of USD 88.08, CAD 3,784.48, CAD 148.77, EUR 59.48, and EUR 37.30 per share, respectively.

Vorwerk propels MBB to new record high

The German investment holding company MBB SE (Frankfurt: MBB) published a reverse profit warning this week. Where companies with such a warning normally warn before the official publication of figures that they will publish disappointing results, the opposite is the case with MBB.

MBB SE has presented impressive preliminary figures for the third quarter of 2025. Operating profit (EBITDA) saw an explosive increase of 80% compared to last year, reaching EUR 67.4 million. This growth is particularly significant because revenue increased by a more moderate 6.5% to EUR 316.8 million during the same period. The direct result is an extraordinary improvement in the operating profit margin. This increased by 8.7 percentage points to an estimated 21.2%.

The core of this excellent performance lies with the subsidiaries Friedrich Vorwerk and DTS. MBB did not disclose details about the unlisted cybersecurity specialist DTS IT, except for the remark that Vorwerk also contributed significantly to these strong figures. We will know more during the full quarterly report on November 13, but the earlier announcement of a large IT contract and the negotiation of several such deals provide reassurance.

Vorwerk, a leading supplier of energy infrastructure solutions for gas, electricity, and hydrogen, reported absolute record figures. Vorwerk saw its revenue increase by 39% to EUR 202 million in the third quarter. Vorwerk's operating profit more than doubled, from EUR 25.3 million last year to EUR 51.3 million this quarter. This resulted in a very strong operating profit margin of 25.4%. Vorwerk accounts for more than three-quarters of the operating profit in the quarter.

Vorwerk continues to benefit from a high-quality order book worth EUR 1.1 billion as of September 30, 2025. This offers tremendous visibility for the coming periods. Vorwerk is also benefiting from continued success in attracting personnel, with a 13% growth in the number of employees in the first nine months. Not so long ago, this was still the bottleneck for the company to monetize its order book.

Although order intake in the first nine months amounted to EUR 419 million, compared to EUR 516 million last year, this must be placed in the correct context. The total project volume, including the proportional ARGE (joint ventures) order volumes of projects acquired in the first nine months, actually increased by 45% to EUR 886 million.

Financial Fort

Looking back at the first nine months of 2025, MBB as a whole shows a strong trend. Consolidated revenue increased by 12.8% to EUR 862.3 million. Operating profit grew by 54% to EUR 143.7 million over this period. This yields a solid operating profit margin of 16.7%.

The capital position remains strong. The net liquidity of the total MBB group amounted to EUR 526.9 million at the end of Q3. However, what is even more important is the cash position at the level of the holding company itself. This increased to EUR 317.6 million, compared to EUR 280.8 million at the end of 2024. This shows that the holding company is building financial strength, which can be used for future allocation decisions.

Increased forecasts confirm momentum

Management, led by founder and major shareholder Christof Nesemeier, has clearly expressed its confidence in the future. As a result of the strong performance, both companies have significantly increased their forecasts for the full year 2025. Vorwerk now expects revenue between EUR 650 and EUR 680 million. This was previously EUR 610 to EUR 650 million. Even more impressive is the increase in the operating profit margin forecast for Vorwerk. This has been increased to 20.0% to 22.0%, where previously 17.5% to 18.5% was expected.

This strong momentum at the most important subsidiary enables MBB to also increase its own group forecast. MBB now expects consolidated revenue of EUR 1.1 to EUR 1.2 billion. The previous expectation was EUR 1.0 to EUR 1.1 billion. The expected operating profit margin for the group is being substantially increased to 15% to 17%. Previously, this was 11% to 14%.

Nevertheless, the holding discount remains quite high, as evidenced by the fact that the cash position and the listed subsidiaries Vorwerk, Aumann, and Delignit jointly represent a value of more than EUR 265 per MBB share. In addition, we get the fast-growing cybersecurity company for free. There is, therefore, no increase in valuation (ergo: a decrease in the holding discount), but a fundamentally driven price increase. We, therefore, remain convinced holders of this family holding.

MBB ended the trading week on the Frankfurt Stock Exchange at a price of EUR 201 per share.

Receive weekly insights in your inbox

Exclusive analyses and updates on family holdings and global market developments.

Swedish serial acquirers demonstrate robust business model

The Swedish investment holdings Addtech (Stockholm: ADDT-B) and Lifco (Stockholm: LIFCO-B) reported their quarterly results this week. The reaction from investors was exceptionally positive. Both shares recorded gains of more than 10 percent after the figures. These results confirm the strength of the decentralized acquisition model of these acquisition machines.

A third Swedish serial acquirer from our portfolio showed a similarly strong increase. However, the name of this company remains reserved for our clients.

Addtech exceeds expectations

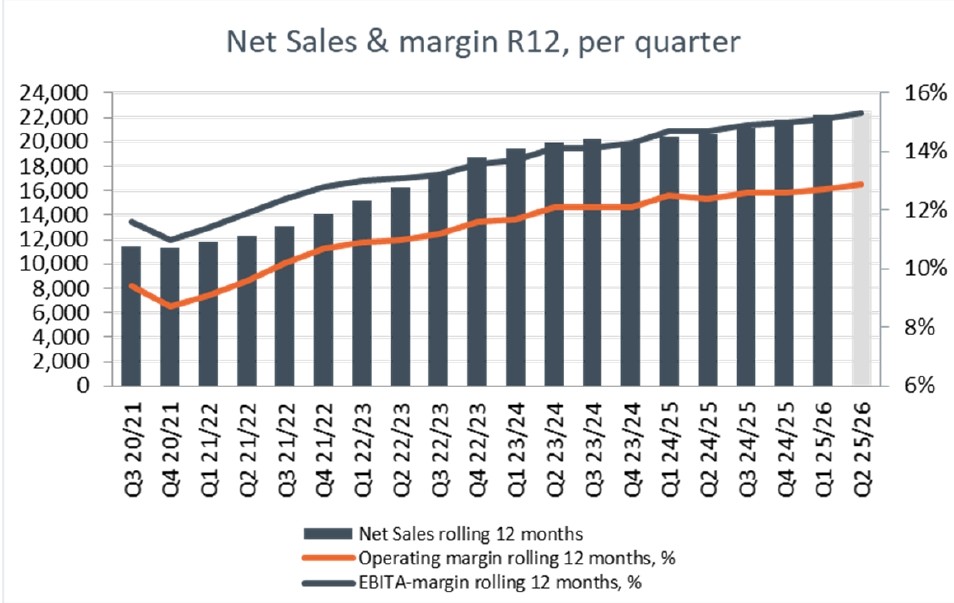

Addtech presented a very strong second quarter (2025/26). Net sales increased by 6 percent to SEK 5.5 billion. Operating profit (EBITA), the most relevant profit measure, grew by 11 percent to SEK 844 million. This was significantly better than the analyst consensus of SEK 808 million. The operating profit margin further strengthened to 15.5 percent, compared to 14.9 percent last year.

Organic growth was 4 percent. However, CEO Niklas Stenberg gave a crucial nuance during the conference call. Approximately half of this organic growth came from exceptionally strong project deliveries within the Industrial Solutions division, particularly in the sawmill industry. Stenberg emphasized that this specific project revenue should not be extrapolated to the coming quarters.

The strong performance was delivered despite headwinds in other segments. The Energy division experienced a temporary slowdown in demand for infrastructure for national networks. In addition, the Automation division reported a one-off restructuring cost of SEK 10 million. The operating cash flow was exceptionally strong at SEK 859 million, an increase of no less than 45% compared to last year.

Lifco continues to perform stably

Lifco also reported solid figures for its third quarter. Net sales increased by 8.9 percent to SEK 6.8 billion. Organic growth was robust at 4.9 percent. Operating profit increased by 10.4 percent to SEK 1.54 billion. This resulted in a strong operating profit margin of 22.6 percent. The Demolition & Tools division made a strong 'comeback' after a weak 2024, especially in the attachment segment. Systems Solutions saw its margin decline slightly due to weaker organic demand in the Transportation Products and Special Products divisions.

The solid performance was complemented by an undiminished high acquisition pace. During the first nine months of 2025, Lifco consolidated 13 new companies. These acquisitions, including various niche companies in the UK, Italy, and the Netherlands, account for approximately SEK 1.9 billion in additional revenue on an annual basis. Lifco's balance sheet remains a fortress. The interest-bearing net debt is only 1.3 times the operating profit. This gives the company sufficient ammunition for future acquisitions.

Conclusion

The strong share price increases of both Addtech and Lifco in the past week are a clear validation from investors. Both companies prove that the decentralized serial acquirer model is able to generate predictable profit growth and strong cash flows, even when individual divisions temporarily slow down or restructure.

The strength of this business model lies in the diversification and financial discipline at the holding level. With more than 150 (AddTech) and 250 (Lifco) subsidiaries, there is more than enough resilience to present impressive consolidated figures. It once again confirms our strategy to invest in these proven compounders within the family holding strategy.

AddTech and Lifco ended the trading week on the Stockholm Stock Exchange at a price of SEK 331.40 and SEK 381 per share, respectively.

AI as a flywheel for Vertical Market Software

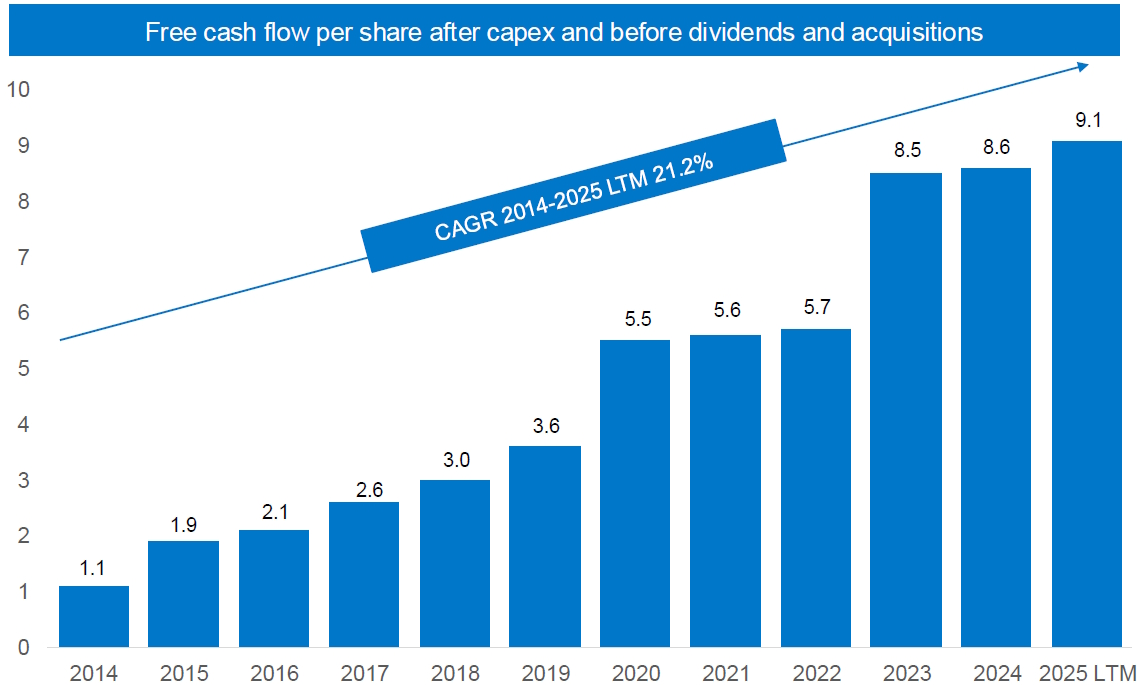

Is artificial intelligence an existential threat to established vertical market software (VMS) companies? Or is it an unprecedented commercial opportunity? That question is central to the technology sector. Many fear that 'legacy' software, often deeply entrenched but decades old, will be quickly replaced by new, AI-native startups. A recent podcast interview with Jan Mohr, the CEO of the German serial acquirer Chapters Group (Frankfurt: CHG), offers an illuminating perspective that directly contradicts this prevailing (investor) opinion. Mohr argues that AI is not a threat, but the biggest commercial opportunity the VMS sector has ever seen.

The 'Shotgun' and 'Rifle' Approach

Implementing new technology presents a unique challenge for a decentralized acquisition machine, a model exemplified by companies like Chapters Group or Constellation Software. Mohr elucidates their dual strategy. First, there's the 'shotgun' approach. This involves a cultural shift that demands all leaders and employees embrace AI in their daily work. It's a new way of thinking and working that must integrate into all existing processes, focusing on broad adoption and efficiency improvement. However, the 'rifle' approach is much more interesting. These are targeted, highly specific business cases with a clear and rapid return on investment (ROI). Ideally, these 'rifle shots' can even expand the total addressable market of a software company.

Jan Mohr identifies three concrete 'rifle' opportunities for AI in VMS. Firstly, AI offers direct efficiency gains, such as automating simple help desk tasks (which can account for 50-70% of calls) with voice bots. Secondly, and most importantly from a commercial perspective, is adding a new AI functionality layer on top of the customer's existing 'core system of record' without replacing it. Thirdly, there is an often underestimated opportunity to significantly accelerate (10-20% 'velocity' gain) the maintenance of 'legacy code' and the delivery of 'professional services', which shortens waiting times for customers, accelerates revenue recognition, and increases customer satisfaction.

The Myth of Disruption

Mohr dismisses the notion that AI startups will disrupt the established VMS order as a misconception. He argues that customers seek a reliable solution, not just technology. The real opportunity for AI lies not in replacing existing software, but in digitizing a still largely analog world. He emphasizes that enterprises do not simply replace 'mission-critical' software, such as Chapters' systems for Swiss police forces or the German weapons license administration.

Mohr calls it a "funny thought" that the Hamburg police would implement a cheap, unproven tool that was "coded two days ago." In procurement, cybersecurity, data protection, and reliability are decisive. The costs of failure in these sectors are dramatically higher than the software costs themselves, creating a virtually impenetrable barrier to entry.

This sentiment is echoed by acclaimed software investor Orlando Bravo. In a recent interview (see image above), Bravo states that AI is a "tailwind" for the software industry. AI does not make software redundant. It makes software better, more efficient, and more valuable. Established software companies already own the customers. They own the data. And they own the distribution channels. AI is simply a new, powerful feature set that they can add to their arsenal.

Recent research supports this view. Polaris Market Research expects the global market for niche software to grow to USD 495.17 billion in 2034. This represents a compound annual growth rate (CAGR) of 12.9%. The driving force behind this impressive growth is precisely the integration of AI and machine learning. Polaris' analysis emphasizes that AI models trained on domain-specific data (exactly what VMS companies possess) offer much better automation, higher accuracy, and more relevant insights than generic AI tools.

New Opportunities for VMS Companies

Mohr points to the new European data legislation (EU Data Act) as a new catalyst. This law gives companies access to their data, but they lack the infrastructure to utilize it. The VMS provider, who is the administrator of that data, owns the crucial data infrastructure to securely transform that data into business decisions. The magic is not in the AI model, but in the infrastructure to apply it effectively and safely in sensitive environments, such as with the data of the Hamburg police.

This approach strengthens customer retention (often above 97%) by increasing trust. Mohr identifies cybersecurity as the next big opportunity, similar to what payment systems were for Tyler Technologies. For Chapters, which manages systems for German weapons licenses and Swiss police services, this is a societal duty of the highest strategic importance. Mohr's conclusion is that AI is not a threat, but a powerful enabler that further strengthens the 'mission-critical' position of VMS companies, a view we fully endorse.

Chapters Group and Constellation Software are currently traded on the Frankfurt and Toronto stock exchanges at prices of EUR 37.10 and CAD 3,789.85 per share, respectively.

Receive weekly insights in your inbox

Exclusive analyses and updates on family holdings and global market developments.

Would you like more information about our services? Please feel free to contact us.

Contact us

Disclaimer:

No rights can be derived from this publication. This is a publication of Tresor Capital. Reproduction of this document, or parts thereof, by third parties is only permitted after written permission and with reference to the source, Tresor Capital.

This publication has been prepared by Tresor Capital with the utmost care. The information is intended to be general in nature and does not focus on your individual situation. The information should therefore expressly not be regarded as advice, an offer or proposal to purchase or trade investment products and/or purchase investment services nor as investment advice. The authors, Tresor Capital and/or its employees may hold position in the securities discussed, for their own account or for their clients.

You should carefully consider the risks before you begin investing. The value of your investments may fluctuate. Past performance is no guarantee of future results. You may lose all or part of your investment. Tresor Capital disclaims any liability for any imperfections or inaccuracies. This information is solely indicative and subject to change.

Read the full disclaimer at tresorcapitalnieuws.nl/disclaimer .