Economy & Markets #43 - Private Credit: The Wild West of Wall Street

According to JPMorgan CEO Jamie Dimon, private credit is the new frontier of financial risk. The losses at Tricolor and Jefferies illustrate the vulnerability of this rapidly growing market, even as system banks show strong quarterly figures.

This week's topics:

“When you see one cockroach, there are probably more.”

During the presentation of the third-quarter results, Jamie Dimon, the influential CEO of JPMorgan Chase and one of the most authoritative voices on Wall Street, warned of hidden risks in the rapidly growing market for private credit, lending outside the traditional banking system. According to Dimon, the loss of approximately $170 million on a loan to subprime auto lender Tricolor Holdings is an early signal of broader vulnerabilities.

He also pointed to the bankruptcy of First Brands Group, an auto parts supplier with more than $10 billion in debt, as an example of how quickly the risks can materialize. Dimon emphasized that when the economy weakens, similar problems can arise in sectors that are heavily dependent on consumer credit, such as autos, home improvement, credit cards, travel, and recreation.

A concrete case is the significant exposure of Jefferies Financial Group. Through its subsidiary Point Bonita, a hedge fund within the asset management division, Jefferies had approximately $715 million in claims on First Brands, payments of which were abruptly halted. The direct loss for Jefferies is estimated at approximately $173 million, including potential legal and reputational damage, but the impact may prove to be broader.

The private credit market has grown explosively over the past decade and is now estimated at over $3 trillion. According to the IMF report The Risk and Rise of Private Credit (April 2024), this segment is not only large but also highly diverse in quality and transparency. The loans are provided outside the traditional banking sector, mainly by specialized funds and so-called non-bank lenders.

In contrast to commercial banks, these lenders are not subject to strict supervision, do not maintain capital buffers, and are not required to report their risks in a comparable manner. This gives the sector a great deal of flexibility but also makes it less transparent and more vulnerable in times of stress. Dimon warns that the risks in this market are therefore "less visible" and can thus escalate more quickly.

For investors, private credit is attractive because of the higher interest rate compensation: the illiquid and riskier nature of these loans is compensated with a significant risk premium. In the past, this premium proved to be more than sufficient to compensate for the higher default risk. According to the IMF report, private credit funds have historically even achieved higher returns than the S&P 500, venture capital, and broad global equity indices. The explanation lies in the exceptionally favorable market conditions of the past decade. Private lenders were often able to lend at interest rates of around 15%, while no real default cycle occurred during that period that structurally affected returns.

| Category | Description | Transparency | Liquidity | Risk / Return |

|---|---|---|---|---|

| Private Credit | Loans outside of banks, often to SMEs and PE portfolios. | Low – limited insight and supervision. | Low – illiquid, buy-and-hold. | High risk, high potential return. |

| Leveraged Loans | Loans to companies with high debt levels (CLO structures). | Average – banks report in part. | Average – limited trading. | Medium to high risk, variable interest rate. |

| High Yield Bonds | Publicly traded bonds with a low rating (BB or lower). | High – listed and regulated. | High – liquid, daily pricing. | High risk, fixed interest rate, more transparent. |

The private credit sector has not yet benefited from the recent interest rate cuts initiated by the Federal Reserve. Despite historically strong returns and attractive yields, analysts warn that the rapid growth of this market increases the chance of "weak links" in the system. Competition between banks and private lenders has also increased: private parties have now taken over parts of the leveraged loan market, while banks often remain involved in these structures as financiers or guarantors.

Jamie Dimon noted that he "doesn't know what everyone's underwriting standards are," a concern he believes poses a significant risk to the stability of the broader financial system. Data from Lipper shows that syndicated loans, often packaged in collateralized loan obligations (CLOs), experienced an outflow of approximately $1.5 billion in October, the first monthly withdrawal in half a year. This suggests that investors are becoming more cautious in this complex and rapidly growing form of lending.

At the same time, opinions in the market diverge. Blackstone warned this week that the "golden decade" for private debt is coming to an end, while Henry Kravis of KKR calls that concern unfounded. According to Kravis, "not a single dollar of private credit has been lost" in the bankruptcies of Tricolor Holdings and First Brands, and KKR does not finance its private credit funds with deposits, which, according to him, means there is no systemic risk. Only inexperienced investors in these funds, according to Kravis, are now experiencing the downside of their risk-seeking behavior.

Receive weekly insights in your inbox

Exclusive analyses and updates on family holdings and global market developments.

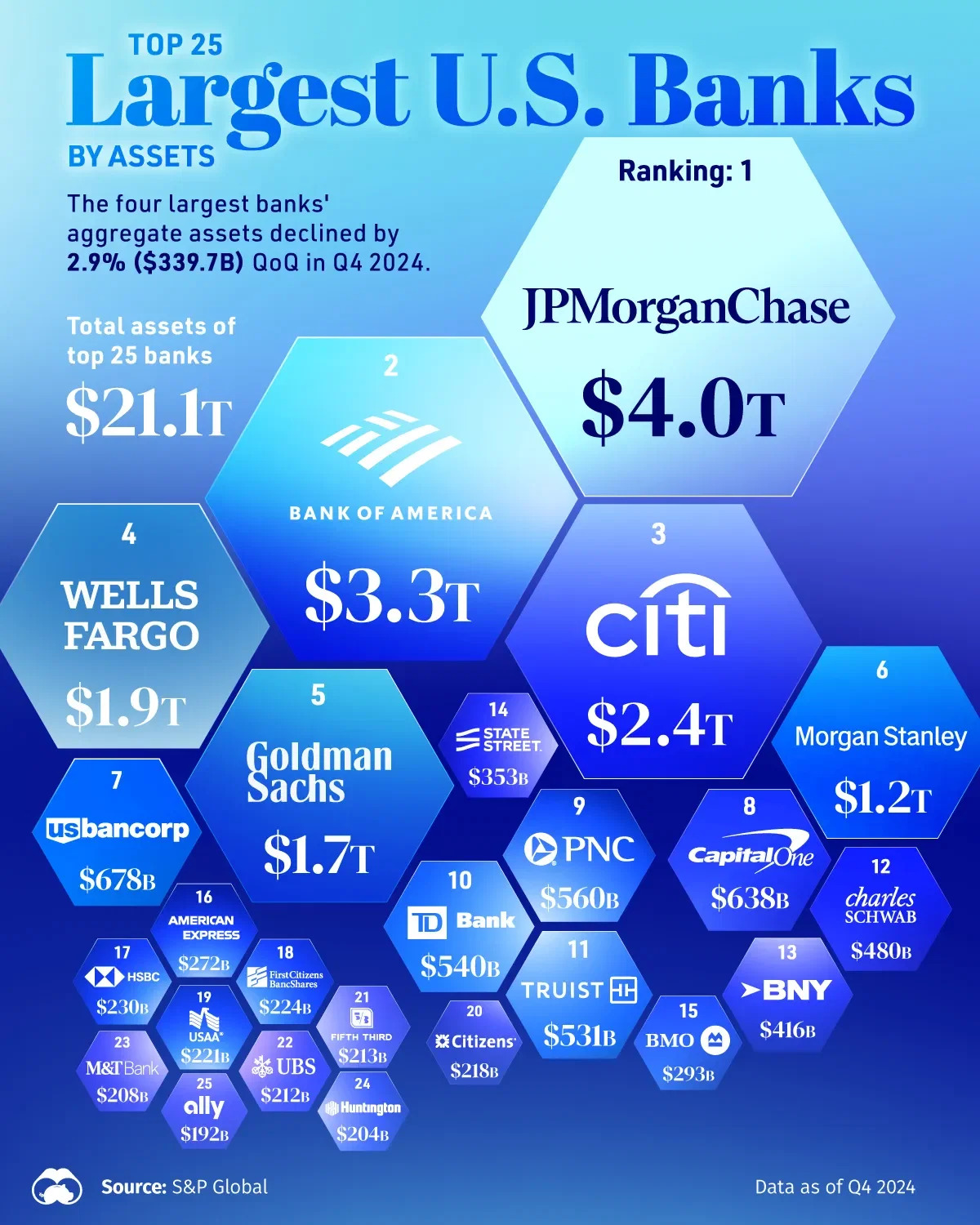

U.S. Big Banks Report Solid Figures

The major U.S. systemically important banks remain financially robust and well-capitalized. They reported strong results again for the third quarter: JPMorgan Chase posted a profit of $13.2 billion, Bank of America came in at $6.9 billion, Wells Fargo saw profits increase due to lower credit provisions, and Citigroup kept results stable thanks to cost control and a strong trading division.

The stability of these institutions is supported by the strict supervision of the Federal Reserve, which imposes high requirements on capital buffers, liquidity, and stress tests. The resilient U.S. economy also contributes to the profitability and soundness of the balance sheets. According to the Federal Reserve stress test of July 2025, the CET1 capital ratios are well above the required minimum: JPMorgan 14.4%, Bank of America 13.2%, and Citigroup 13.7%.

Provisions for credit losses also remain stable, with an average net charge-off rate of just 0.4%, well below the levels seen during previous recessions. This means that the greatest risk currently lies not with the systemically important banks, but with the less transparent parts of the credit market, such as private credit. For the time being, systemic risk appears to be well-managed.

Swiss Franc Retains Strength Despite Low Interest Rates

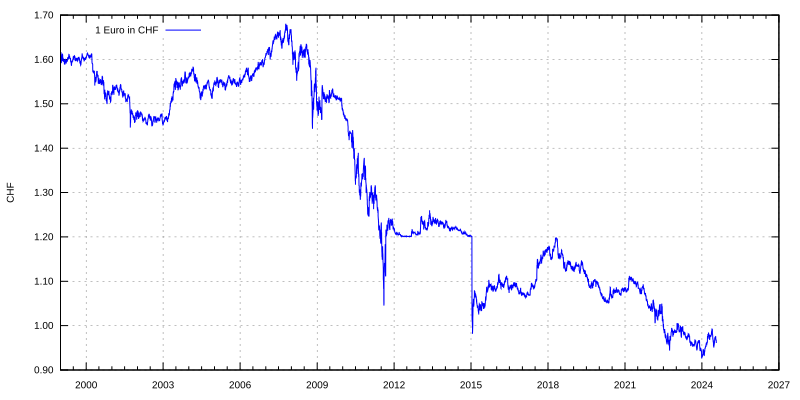

The Swiss franc (CHF) remains one of the strongest currencies in the world, confirming its status as a safe haven in times of uncertainty. The currency is trading close to a ten-year peak against the euro and remains remarkably stable against the U.S. dollar. Increasing concerns about debt, budget deficits, and political instability in the U.S., Japan, and the Eurozone are leading to a renewed preference for currencies with solid fundamentals.

Switzerland distinguishes itself as one of the few developed economies with structural stability: low inflation, a prudent fiscal policy, and a strong external balance. Remarkably, the franc retains its strength despite years of negative and later extremely low interest rates. Where other currencies depend on interest rate differentials to attract capital, demand for the franc is mainly driven by confidence in Swiss policy and the soundness of the financial system. Foreign capital, including that of wealthy private investors, continues to flow in and is reinvested in francs.

According to Bloomberg Intelligence, the franc benefits not only from the credible monetary policy of the Swiss National Bank (SNB), but also from the weak outlook for the euro. However, the strong currency poses a challenge for the domestic economy. The SNB has lowered its policy rate by 175 basis points to 0% since the beginning of 2024, but further easing seems unlikely. The appreciation of the franc has led to falling consumer prices: in June, inflation was -0.1% year-on-year, partly due to a 2.4% price decrease in imported goods. Because imports make up about 23% of the CPI basket, this directly impacts domestic price developments.

As long as the macroeconomic outlook in the Eurozone remains weak, the franc is expected to fluctuate around CHF 0.92–0.93 per euro. This makes the currency a natural hedge against market uncertainty and an anchor of monetary stability in Europe. Where the German mark once fulfilled that role, the euro has lost more than 46% of its value against the franc since its introduction in 1999, a powerful reminder that confidence in monetary discipline has become rare.

Gold Makes Rare Correction, But Confidence Remains Unaffected

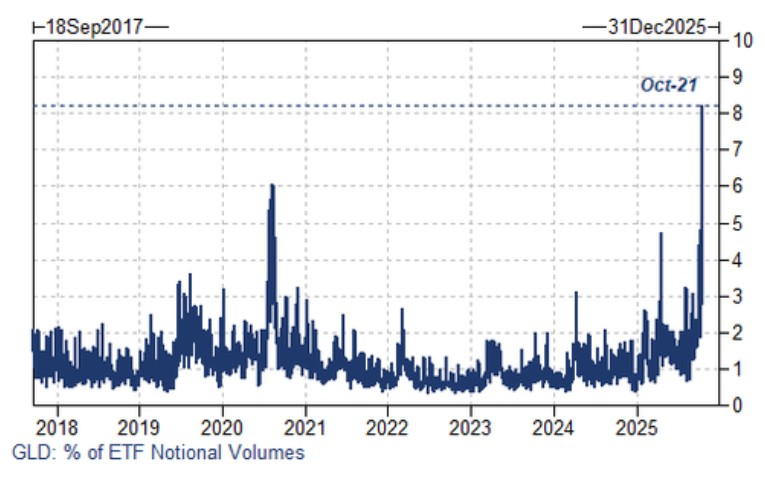

After months of strong price increases, the gold market experienced an abrupt correction this week. Within a few days, the precious metal lost more than seven percent, after profit-taking, a stronger dollar, and rising real interest rates led to a rotation out of so-called momentum assets. Gold mining stocks, which typically react more strongly than the underlying metal price, also declined sharply. According to Goldman Sachs, there was no clear fundamental reason; the decline mainly reflects a technical cooling after an exceptionally strong rally. After nine consecutive weeks of increases, the market was overcrowded with long positions, which ultimately resulted in a sudden "panic outbreak" among investors.

On October 21, the gold price on the spot market at one point fell by 6.3%, to just below the $4,000 per ounce mark, the largest one-day decline in more than twelve years. Analysts described the volatility as a rare "5-sigma event," which statistically amounts to a probability of only one in 3.5 million. Silver took an even harder hit, temporarily falling by 8.7%. The correction abruptly ended the strong momentum of the previous week, in which gold and silver repeatedly reached new record highs. Shares of leading gold producers such as Barrick Gold, Newmont Mining, and Agnico Eagle Mines all lost more than eight percent that day. At the same time, the gold ETF GLD registered a record trading volume, accounting for eight percent of all ETF transactions in the U.S., the highest share ever measured.

Despite the sharp decline, the underlying fundamentals for gold remain strong. The expectation of financial repression, where central banks keep real interest rates artificially low to alleviate high government debt, and the continued demand from central banks provide lasting support. Even the most fervent gold bugs see the correction primarily as a healthy breather within a broader upward trend. In a world of high debt, geopolitical tensions, and monetary uncertainty, gold continues to fulfill its role as strategic diversification and insurance against systemic risks, even if the road to it is full of volatility.

Receive weekly insights in your inbox

Exclusive analyses and updates on family holdings and global market developments.

Would you like more information about our services? Please feel free to contact us.

Contact us

Disclaimer:

No rights can be derived from this publication. This is a publication of Tresor Capital. Reproduction of this document, or parts thereof, by third parties is only permitted after written permission and with reference to the source, Tresor Capital.

This publication has been prepared by Tresor Capital with the utmost care. The information is intended to be general in nature and does not focus on your individual situation. The information should therefore expressly not be regarded as advice, an offer or proposal to purchase or trade investment products and/or purchase investment services nor as investment advice. The authors, Tresor Capital and/or its employees may hold position in the securities discussed, for their own account or for their clients.

You should carefully consider the risks before you begin investing. The value of your investments may fluctuate. Past performance is no guarantee of future results. You may lose all or part of your investment. Tresor Capital disclaims any liability for any imperfections or inaccuracies. This information is solely indicative and subject to change.

Read the full disclaimer at tresorcapitalnieuws.nl/disclaimer .