Family Holdings #44 - Alphabet's 'Small' Investments Become Large

Further: Brown & Brown and Markel with figures; Scottish Mortgage on AI and Brookfield focuses on the renaissance of nuclear energy.

This week's topics:

Brown & Brown reported a revenue growth of 35.4% in Q3, driven by acquisitions, but the share fell 8% due to a weak Q4 forecast. The disappointing outlook is caused by an expected organic contraction of 4-6% in the important Specialty Distribution division.

Scottish Mortgage Trust sees AI as the foundation for a new economic era and invests in the entire chain, including the new position Anthropic. The holding remains long-term focused and reinvests the proceeds from reduced positions such as NVIDIA and Tesla in the next generation of "inevitable" growth companies.

Markel Group shows renewed confidence after a successful restructuring, which CEO Gayner described as "We're back" and is proven by a strongly improved combined ratio of 93%. Management is now focusing on further efficiency, while the company has already bought back USD 344 million of its own shares in 2025 in accordance with its capital strategy.

Brookfield, as controlling shareholder of Westinghouse, is entering into a strategic partnership of USD 80 billion with the US government and Cameco. According to CEO Bruce Flatt, the deal, driven by the explosive energy demand from AI, is aimed at building scale to restore the American nuclear supply chain. The US government is facilitating the financing and in return receives a 20% profit share above USD 17.5 billion and a possible IPO warrant in Westinghouse.

In Brief:

Brown & Brown (New York: BRO) is strengthening its position as the largest provider of flood insurance in the US with the acquisition of Poulton Associates. The Salt Lake City-based company operates the CATcoverage.com platform and offers coverage through the National Catastrophe Insurance Program. The integration within subsidiary Wright Flood should further increase market share; financial details have not been disclosed.

KKR (New York: KKR) remains emphatically active in the deal market. Together with Apollo Global Management, the company is investing USD 7 billion in Keurig Dr Pepper, to finance the split into a global coffee division and a North American beverage division. The investment includes a USD 4 billion joint venture for pod production and USD 3 billion in preferred shares. At the same time, KKR is again in talks with Coca-Cola about the possible acquisition of Costa Coffee, with over 3,000 stores worldwide and an estimated value of GBP 1.5 billion.

Constellation Software (Toronto: CSU) has again carried out three acquisitions through its subsidiaries. Jonas Software acquired the British Fidelity EPoS (a supplier of POS software and loyalty and inventory management systems for the retail and hospitality sector), Volaris Nordic bought TimeSolutions A/S in Denmark (a specialist in time registration and personnel planning for accounting and administration office software), and Vela's Aquila division acquired Media Carrier Solutions in Germany (a digital library and content distribution service).

Lifco (Stockholm: LIFCO-B) saw after strong quarterly results that Martin Roland Linder, Senior Executive Vice President of the Dental division, bought additional shares for SEK 2.1 million (approximately EUR 180,000), a clear sign of confidence in the company's further growth path after the recent profit increase.

Chapters Group (Frankfurt: CHG) is further expanding its public software portfolio with the acquisition of UniSoft Gesellschaft für Software Engineering mbH through its platform Waterkant Software. Founded in 1993, the German company has been supplying specialist software to local health services for decades with the Äskulab product. The solution supports, among other things, infection control, youth health and medical administration.

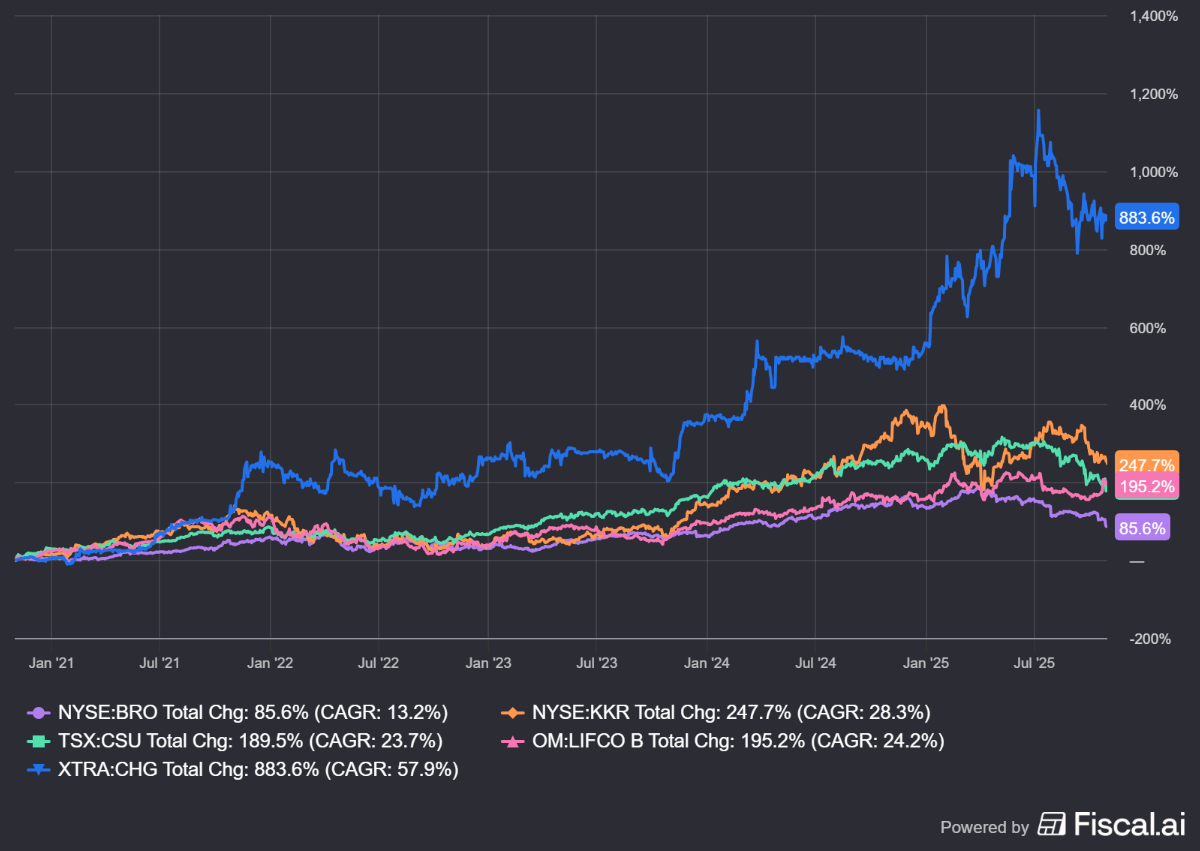

Brown & Brown, KKR, Constellation Software, Lifco and Chapters Group ended the trading week on the stock exchanges of New York, Toronto, Stockholm and Frankfurt at prices of USD 79.74, USD 118.33, CAD 3,691.08, SEK 368.20 and EUR 37.50 per share, respectively.

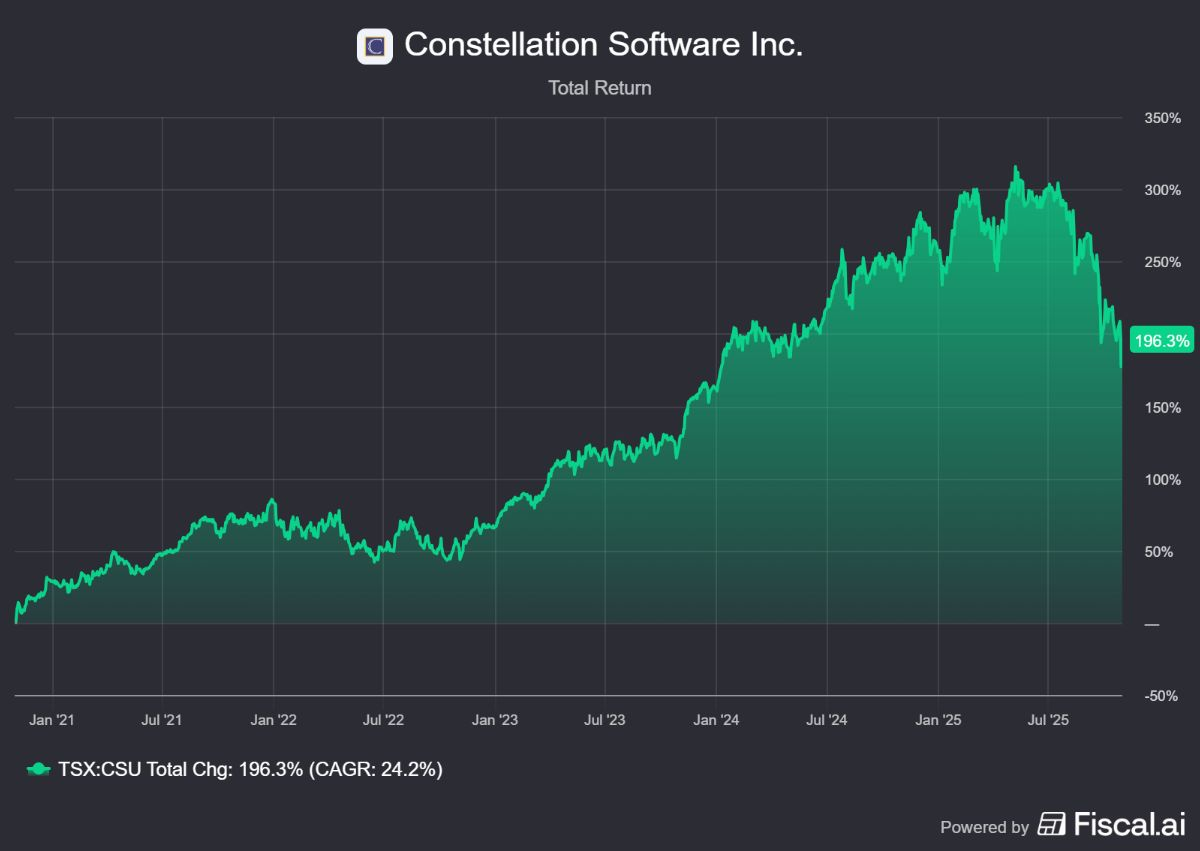

AI is not a death blow for Constellation Software

The rise of artificial intelligence (AI) dominates conversations in boardrooms and investor forums. The technological progress is undeniable and the potential impact on various sectors is immense. For investors in the software sector, and in particular in vertical market software (VMS), this raises a crucial question: does AI pose an existential threat to the sustainable, 'sticky' business models that characterize this sector, or is it a catalyst for a new growth phase?

The Canadian investment holding Constellation Software (Toronto: CSU) is a leading player in this sector, with an impressive portfolio of more than 1,000 companies. In an analyst meeting in January of this year, Constellation emphasized that their software is difficult to replace with AI, as it is deeply embedded in the daily, business-critical functions of end customers, is complex and involves high switching costs.

This deep integration creates a significant 'moat' or competitive advantage. An analysis by Royal Bank of Canada confirms this picture. The conclusion was that AI can shorten development timelines, but does not destroy the 'moat'. Factors such as customer trust, domain-specific knowledge and workflow integration remain crucial.

During Constellation's shareholder meeting in May 2025, Dexter Salna, CEO of the Perseus division, added an important economic perspective. He reasoned that a developer of a new AI product is more likely to focus on a market with a million customers than on the niche market for, say, the pulp and paper industry with only 40 to 50 companies. The investment and effort to understand a complex, vertical market simply do not outweigh the limited size of the potential customer base. This economic fact provides a natural protection for the deepest niches in which Constellation operates.

A nuanced view of threat and opportunity

Experienced software engineer and investor Brandon Wang emphasizes that AI does not replace the human factor. He states that AI is a tool that makes coding easier, but it does not replace the crucial, manual process of understanding the customer and their needs.

In an era of rapid technological changes such as the rise of AI, a crucial but often underexposed element may well become the most important line of defense: trust. The question for customers is no longer just 'which software is the best?', but increasingly 'which party do I trust with my most critical data and processes to guide the transition to AI?'. This is where the deeply rooted culture of VMS companies becomes a strategic advantage.

"I believe that in many cases we are the trusted IT partner of our customers and the most logical source for AI knowledge and learning," says founder Mark Leonard. Even if it's just about "90% solutions", customers are willing to take those first steps with their trusted partner. Constellation's organizational structure, with hundreds of independent business units, offers a unique advantage. "Who else can carry out hundreds of practical experiments, in more than 700 markets, with customer data and without regulatory friction?" The answer is: virtually no one.

Constellation Software ended the trading week on the Toronto Stock Exchange at a price of CAD 3,691.08 per share.

From experiments to the new and future growth pillars at Alphabet

In the third quarter of 2025, the American investment holding Alphabet (New York: GOOGL) reached a milestone: for the first time in its history, quarterly revenue passed the $100 billion mark. What was once a company that ran almost entirely on search ads is now a broadly diversified technology machine with four divisions that each generate more than $10 billion per quarter.

The illustration by @wintermoat on X nicely summarizes it: where Search in 2010 was still the 'father figure' of small experimental "Other Bets", those children have now grown into mature pillars. In Q3, $56.6 billion came from Search, $15.2 billion from Cloud, $12.9 billion from subscriptions and devices, and $10.3 billion from YouTube ads.

Yet Alphabet's innovative spirit is still very much alive. In addition to these four core segments, new "Other Bets" continue to emerge, experiments that can lay the foundation for the next technological wave. A recent example is the breakthrough in quantum computing. Google announced that its new Willow chip performed complex calculations 13,000 times faster than the world's most powerful supercomputer.

The research marks the first verifiable proof of quantum advantage: results that can be independently confirmed by other quantum computers. According to CEO Sundar Pichai, this development brings Google "one step closer to practical quantum applications", with potential for major breakthroughs in drug development, materials science and molecular modeling. While it is leading the AI race with Gemini and Cloud, Alphabet is also working on a technology that could lay the foundation for the next computing era.

Google Vs. OpenAI

At the end of October, the launch of ChatGPT Atlas, OpenAI's own AI browser, caused brief unrest on Wall Street. Alphabet lost a significant amount of stock market value that afternoon, fearing that the newcomer would undermine the dominant position of Google Chrome and Search. But the optimism surrounding Atlas proved short-lived. Within days, the sentiment turned and it became clear that the browser is primarily an early trial version of what OpenAI wants to achieve in the long term, not the direct threat that some feared.

Atlas is an experimental web browser in which the ChatGPT interface is directly integrated. Users can have web pages summarized, compare products or have texts rewritten in a sidebar. In the paid version, OpenAI introduced a new "agent mode", in which ChatGPT can independently browse websites, fill in forms and even prepare online purchases. The company calls this concept "agentic browsing", a next step towards a digital assistant that performs actions on the web for the user.

In theory, that sounds revolutionary. In practice, it is far from mature. The current agent mode is limited to simple interactions and does not have direct access to payment systems, shipping services or personal data. The much-discussed promise of an AI that autonomously orders your groceries or plans a trip is still a pipe dream for the time being.

In addition, Atlas, ironically, runs entirely on Google's own infrastructure. The browser uses the engine of Chrome and uses Google's search index to retrieve information. Without this backbone, the browser simply cannot function. Instead of competition, Atlas is more of an illustration of how deeply Google's technology is intertwined in the internet.

At the same time, Google itself is working on a similar vision. During the I/O event in May, the company already announced that it is developing such an AI agent in Chrome and Search, which should perform exactly the same functions: automatically make purchases, complete bookings and perform web tasks. The difference is that Google has the entire chain under its own management. It owns the browser, the search platform, the payment network (Google Pay), email and calendars, and also manages billions of devices via Android. Where OpenAI depends on partners and complex integrations, Google has the complete infrastructure to realize agentic browsing on a global scale.

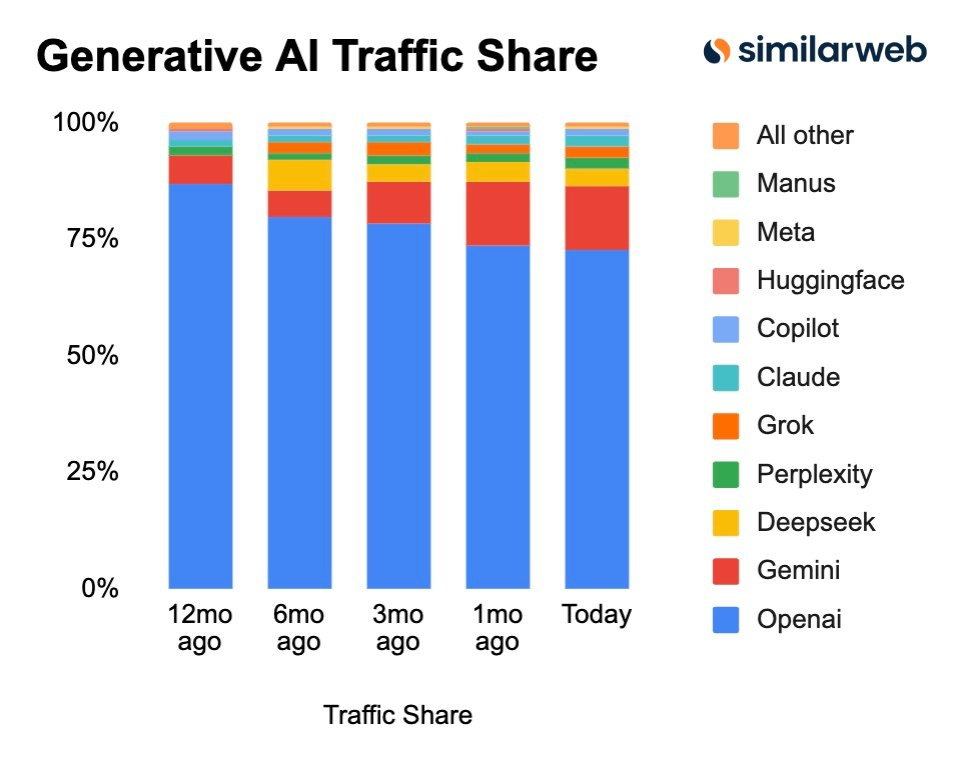

That infrastructure advantage also translates into figures. Google's Gemini, the AI assistant built into Android, Chrome, Pixel and Workspace, is growing rapidly. In one quarter, the number of monthly active users increased from 450 to 650 million. According to figures from SimilarWeb, Gemini doubled its global market share in the traffic of generative AI services in twelve months, from 6.5% to 13.7%, largely at the expense of ChatGPT.

OpenAI remains the largest player for the time being, with an impressive 800 million weekly active users. According to Bloomberg, the company would aim for a valuation of around $1 trillion in the event of an IPO, a figure that is largely based on that huge user base and the assumption that ChatGPT will further develop into an everyday digital platform.

If one were to apply the same valuation logic to Google's Gemini, then the current user base of approximately 650 million monthly active accounts would represent a value of around $800 billion. Of course, that comparison is mainly theoretical, but it does illustrate how large Google's model has become.

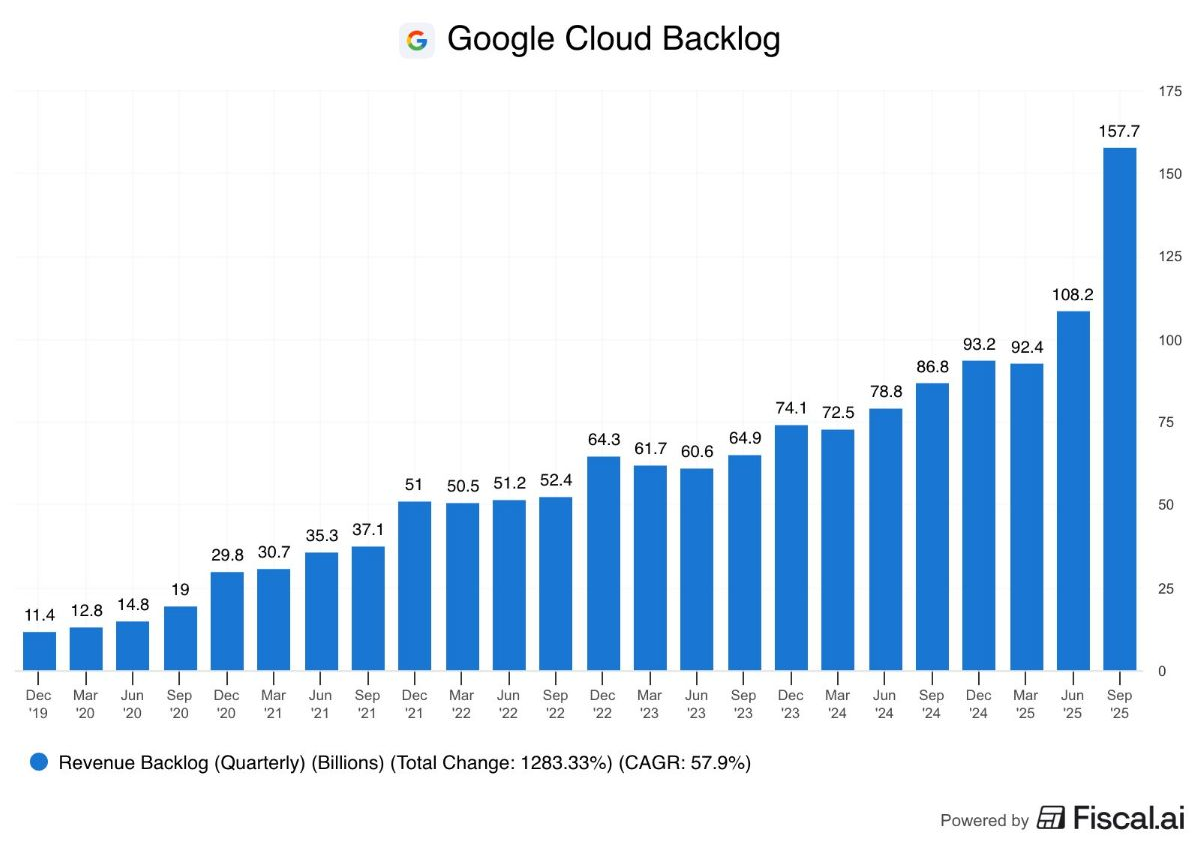

Google Cloud as a new growth pillar driven by AI

While Search still forms the financial foundation of Alphabet, Google Cloud has grown into the fastest-growing pillar within the group. In the third quarter, revenue increased by 34% to $15.2 billion, a clear acceleration compared to previous quarters. Even more impressive is the profit development. The operating profit almost doubled, from $1.9 to $3.6 billion, an increase of almost 90%. The operating margin thus increased from 16.7% to 23.7%, making the division not only larger but also considerably more efficient.

The growth of Google Cloud comes not only from attracting new customers, but especially from the increasing demand for AI-related infrastructure. According to CFO Anat Ashkenazi, the majority of revenue growth is due to "enterprise AI products", applications in which companies use Google's own Gemini models and Tensor Processing Units (TPUs) to train and run their own AI systems.

One of the most striking figures of the quarter is the explosive growth of the cloud backlog, the total of signed but not yet executed contracts. It increased in just three months from $108 to $157.7 billion, an increase of almost $50 billion or 46% quarter-on-quarter. It is the highest level ever and a clear indication that demand for Google's cloud capacity will remain robust in the coming years.

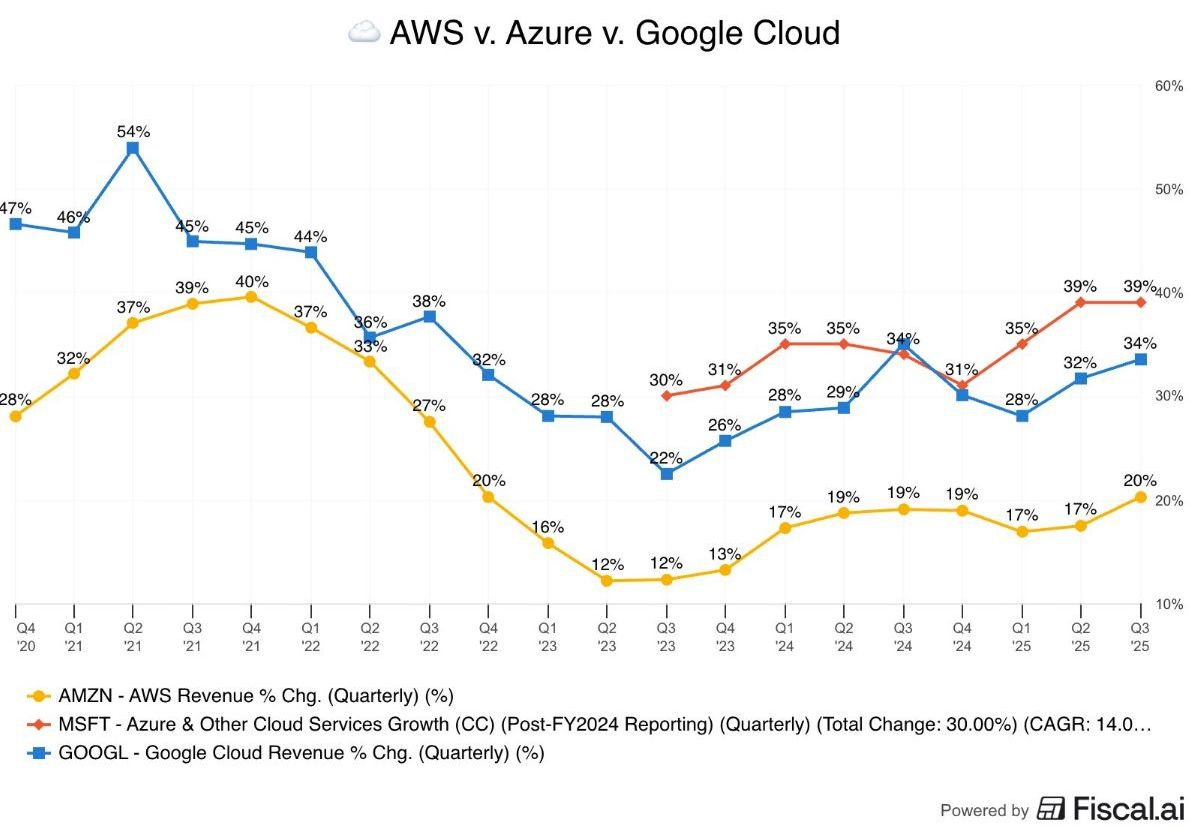

The competition also reported strong results. Both Microsoft Azure and Amazon Web Services (AWS) saw their cloud revenue continue to increase with 39% and 20% growth year-on-year, respectively. This means that Microsoft remains the market leader for the time being, with the largest revenue base and the highest growth rate within the sector.

The figures make it clear that the demand for cloud and AI capacity is not only supported by Google. The market is growing so fast that there is currently room for all three major players, each benefiting from the global shift to generative AI and the increasing need for computing power. Google's strong momentum especially shows that it has firmly established itself alongside Amazon and Microsoft, as the third full player in a market that does not yet seem saturated.

TPUs as a distinctive asset

Google also announced one of its largest AI deals ever. Anthropic, the developer of the Claude model and one of the fastest-growing AI companies in the world, will have access to one million of Google's Tensor Processing Units (TPUs). The agreement, estimated at tens of billions of dollars, provides more than a gigawatt of computing power, comparable to the capacity of a complete power plant. It is the largest TPU deal ever and a powerful signal that Google's self-designed chips are no longer just an internal engine, but an export product that is starting to conquer the global AI market.

While Nvidia remains the undisputed market leader in AI chips with its GPUs, Google's TPU offers an increasingly attractive alternative. This specially developed processor is designed to train and run AI models faster, more efficiently and cheaper. Where Nvidia has a strong lead thanks to its CUDA software ecosystem, which has become the industry standard for AI development, Google is now trying to build a similar integrated stack. In this setup, hardware, software and data center infrastructure work together completely. An important strategic consequence is that once a customer sets up their AI environment on TPUs, returning to Nvidia becomes difficult due to the specific optimizations and dependencies within Google's ecosystem.

A former Google employee who worked on the TPUs himself, found at @RihardJarc on X, shares some striking insights about the performance difference with Nvidia. According to him, Google's TPUs perform between 25% and 200% better than Nvidia's GPUs in many AI applications, depending on the use case. That difference mainly stems from the deep integration between hardware and software within Google's infrastructure. Where Nvidia's chips can be used universally, TPUs are fully optimized for Google's own algorithms and workloads and are therefore extremely efficient in energy consumption and speed.

According to the same source, TPUs are not only suitable for inference (running existing models), but also for training, the most capital-intensive part of AI development. In practice, several customers are now actively using the TPUs for both purposes, which illustrates the continued demand well. That picture is confirmed by recent statements from Google's VP and director of AI & Infrastructure, who indicated that even six- and seven-year-old TPUs are still running at 100% capacity utilization, a sign that the chips remain both technically robust and commercially highly sought after. Internally, Google's market share in AI training is currently around 2-4% compared to Nvidia's 80%, but that share is expected to grow slowly with the increasing demand for alternatives.

Conclusion:

The figures speak for themselves: more than $100 billion in quarterly revenue, a doubling of profit from Google Cloud, and an exploding order backlog that will ensure continued growth in the coming years. At the same time, Gemini is growing at a record pace and, via Android, Chrome and Workspace, is already deeply integrated into billions of devices worldwide. Applied to OpenAI's valuation logic, that user base alone would represent a value of around $800 billion. Where OpenAI is still loss-making, Google generates tens of billions in free cash flow every quarter, capital that is directly reinvested in data centers, AI capacity and chip development. The rise of OpenAI is therefore not a threat, but rather a catalyst. Artificial intelligence increases the demand for search capacity, cloud infrastructure and computing power, precisely the domains in which Google excels. In fact, many AI companies, including OpenAI itself, run (partly) on Google's infrastructure.

As Michael Fitzsimmons recently sharply concluded in his analysis on Seeking Alpha:

“OpenAI may have captured the headlines, but Google wrote the playbook and started executing it a decade ago.”

That observation hits the nail on the head. Google developed its first AI chips in 2014, then built the most efficient data centers in the world and today uses its own technology to keep the AI economy running. OpenAI may have the attention, but Google owns the backbone on which that attention rests.

Anyone who wants to explore this topic further can read the excellent article “OpenAI Won’t Catch Google” by Michael Fitzsimmons for free via our newsletter. We have made this piece, which goes deep into Google's technological lead, infrastructure and valuation, available free of charge to our readers via the link below.

Alphabet ended the trading week on the New York Stock Exchange at a price of USD 281.19 per A-share.

Receive weekly insights in your inbox

Exclusive analyses and updates on family holdings and global market developments.

Brown & Brown delivers a mixed picture; weak outlook puts pressure on the share

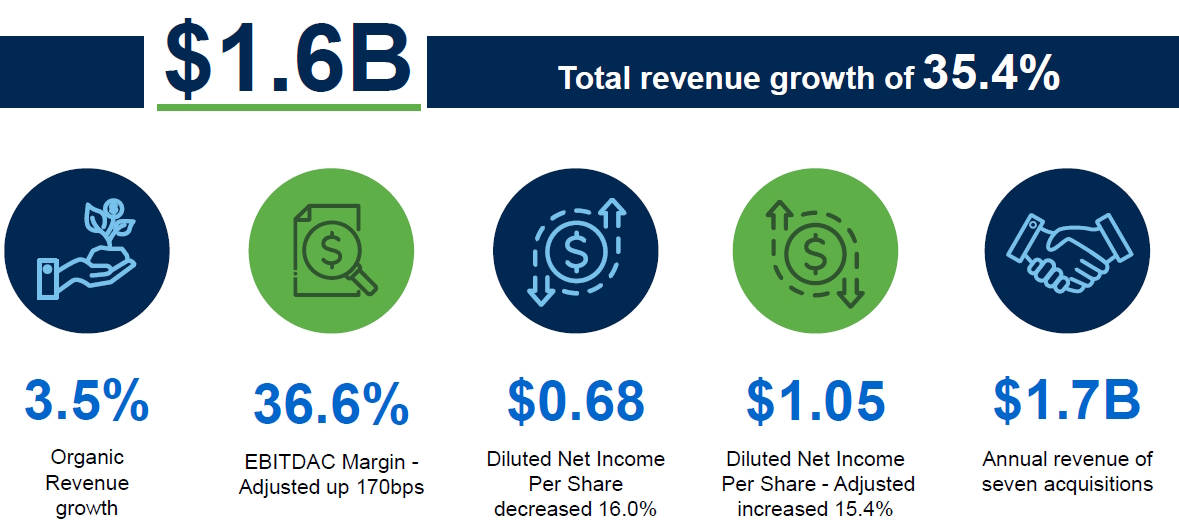

The American investment holding company Brown & Brown (New York: BRO), a serial acquirer of insurance brokers, presented its results for the third quarter of 2025 this week, leading to a sharp price reaction. The stock traded more than 8% lower in the two trading days following the publication. This sell-off appears to be primarily driven by the disappointing outlook provided by management for the fourth quarter. The weak forecast for organic growth overshadowed the seemingly strong figures from the past quarter, which were mainly driven by acquisitions.

On the surface, the results for the third quarter appeared robust. Total revenue jumped 35.4% to USD 1.6 billion. Earnings per share also increased by 15.4% to USD 1.05. Even more impressive was the operating profit margin, which expanded by 170 basis points to 36.6%. This significant revenue growth was largely the result of M&A activity, particularly the recent major acquisition of Accession. Underlying organic revenue growth remained at a modest 3.5%.

However, a deeper analysis of the segments provides a more nuanced picture that explains the market reaction. The Retail division reported organic growth of 2.7%. Management specified in the commentary that this figure had a negative impact of approximately 1 percentage point due to technical adjustments in incentive compensation. For the fourth quarter, CFO Andy Watts expects organic growth in this segment to remain at a similarly low level.

However, analysts' attention was primarily focused on the Specialty Distribution division. This new segment, which now combines the wholesale and program divisions, recorded organic growth of 4.6% in Q3. However, for the fourth quarter, management anticipates an organic contraction of 4-6%. CFO Watts pointed to an extremely strong comparison base in the previous year. Specifically, he mentioned USD 28 million in non-recurring income from the handling of flood claims in Q4 2024. This factor, combined with continued pressure on rates in the E&S market, results in a negative growth forecast.

Despite the weaker organic outlook for the last quarter, management raised its expectation for the operating profit margin for the full year. Brown & Brown now expects the margin to increase slightly compared to 2024, a testament to strong cost control and the positive impact of recent acquisitions on profitability.

CEO J. Powell Brown described the economic climate as "relatively stable." He emphasized that prices for casualty (liability) continue to rise, while the E&S (Excess & Surplus) property market is facing rate declines of 15 to 30 percent.

Brown & Brown's quarterly figures illustrate a dual picture. The company is succeeding in increasing total revenue and profitability through an active M&A strategy, with the recent acquisition of Accession as a spearhead. The seven closed transactions in the quarter represent an estimated annual revenue of USD 1.7 billion. The acquisition machine is therefore running at full speed, but investors are also focusing on autonomous growth.

There is also a desire for more certainty about the realization of synergy benefits from the large-scale acquisition of Accession, which at the time accounted for a third of the total market capitalization. Successfully completing this integration and re-igniting the autonomous growth engine will be the focus area in the coming quarters.

Brown & Brown ended the trading week on the New York Stock Exchange at a price of USD 79.74 per share.

Scottish Mortgage anticipates a new golden age of change

The British investment holding company Scottish Mortgage Investment Trust (London: SMT) recently provided an update on the portfolio and their vision during the reporting on the third quarter of 2025. The managers state that we are entering a period that will surpass the transformations of the past twenty years, such as the rise of e-commerce and mobile computing. Artificial intelligence (AI) is at the heart of this shift. Scottish Mortgage considers AI as a new foundation under the global economy. This technology also enhances progress in other sectors, such as digital commerce and transportation.

Despite AI currently being a "hot topic," the holding company's investment philosophy remains focused on the long term. The goal is to maximize total return by investing in the most exceptional listed and private growth companies. Success in growth investing stems from embracing asymmetry. A small number of companies are expected to create the majority of the value.

The AI economy is currently consolidating around a few large infrastructure giants. Scottish Mortgage has built positions throughout the AI chain. This includes computing power (NVIDIA, TSMC), data (Databricks, Snowflake) and the core AI models (the recently added Anthropic). The strategy is to identify winners early and hold on during volatility. As stated in the video: "It's about recognizing what is inevitable, not chasing a market hype."

In addition to AI, the holding company sees a profound revolution in transportation, driven by electrification (CL, BYD, Tesla) and autonomy (Aurora, Horizon Robotics).

Scottish Mortgage has recently reduced some positions and "recycled" the proceeds into the next generation of transformational growth. Positions in Wayfair and Shinik, among others, were sold. Investments were made in new platforms such as Figma and AppLovin, and in AI leader Anthropic. Positions in NVIDIA and Tesla were trimmed, citing high valuations.

Investment specialist Hamish Maxwell concludes that avoiding growth in a rapidly changing world is dangerous. True prudence lies in seeking meaningful exposure to what is inevitable. You can access the video of the Q3 update by clicking on the image above.

Scottish Mortgage Investment Trust ended the trading week on the London Stock Exchange at a price of GBP 11.72 per share.

Markel rediscovers its rhythm

The tone at Markel Group (New York: MKL) this quarter was clearly changed: more optimistic, more confident, and with a sense of regained momentum. CEO Thomas Gayner opened the call with the words “We’re back”, a statement that symbolizes the first tangible recovery after a period of pressure on insurance margins and far-reaching restructurings within the company in the past year. The emphasis is now on execution and further efficiency improvements, with a focus on cost control, digitization, and profitable niches within the insurance market.

The combined ratio, a crucial metric for insurers that reflects the ratio between claims paid and costs incurred relative to premiums received, improved by four percentage points to 93%, meaning that Markel paid out only 93 cents in costs and claims for each premium dollar collected. This means that the core insurance division is clearly profitable again, after a period in which higher claims costs and restructuring costs had squeezed margins.

According to Simon Wilson, CEO of Markel Insurance, the company is now fully focused on execution, with further focus on cost reduction, discipline in underwriting, and the development of “bottom-up, customer-focused business plans” for 2026 and beyond. CFO Brian Costanzo added that Markel expects to further reduce the expense ratio and improve the return on equity (ROE), with management stating that the current margin improvement marks the beginning of a structurally more profitable phase.

CEO Thomas Gayner emphasized that all business segments have contributed positively to value creation within the group and pointed to the tangible results of the interventions of recent years. For example, the loss-making reinsurance division was completely phased out, and under the leadership of the new division CEO Simon Wilson, Markel Insurance underwent a restructuring that places more focus on accountability, profit orientation, and more stable cash flows within each business unit. These measures, combined with a sharper focus on profitable niches and stricter underwriting discipline, are now translating into a clearly healthier profit contribution from insurance activities and more stable cash flows for the group.

At the same time, Markel remains true to its capital-efficient model, in which share buybacks play a central role in value creation for shareholders. In 2025, $344 million of its own shares have been repurchased to date, reducing the number of outstanding shares to 12.6 million. Gayner indicated that the next reduction target of 10% may be reached within three to five years, supported by continued strong operating cash flows. Since 2020, the total share base has already been reduced by almost 9%, a clear illustration of Markel's consistent and shareholder-focused capital strategy.

Markel Group ended the trading week on the New York Stock Exchange at a price of USD 1,974.53 per share.

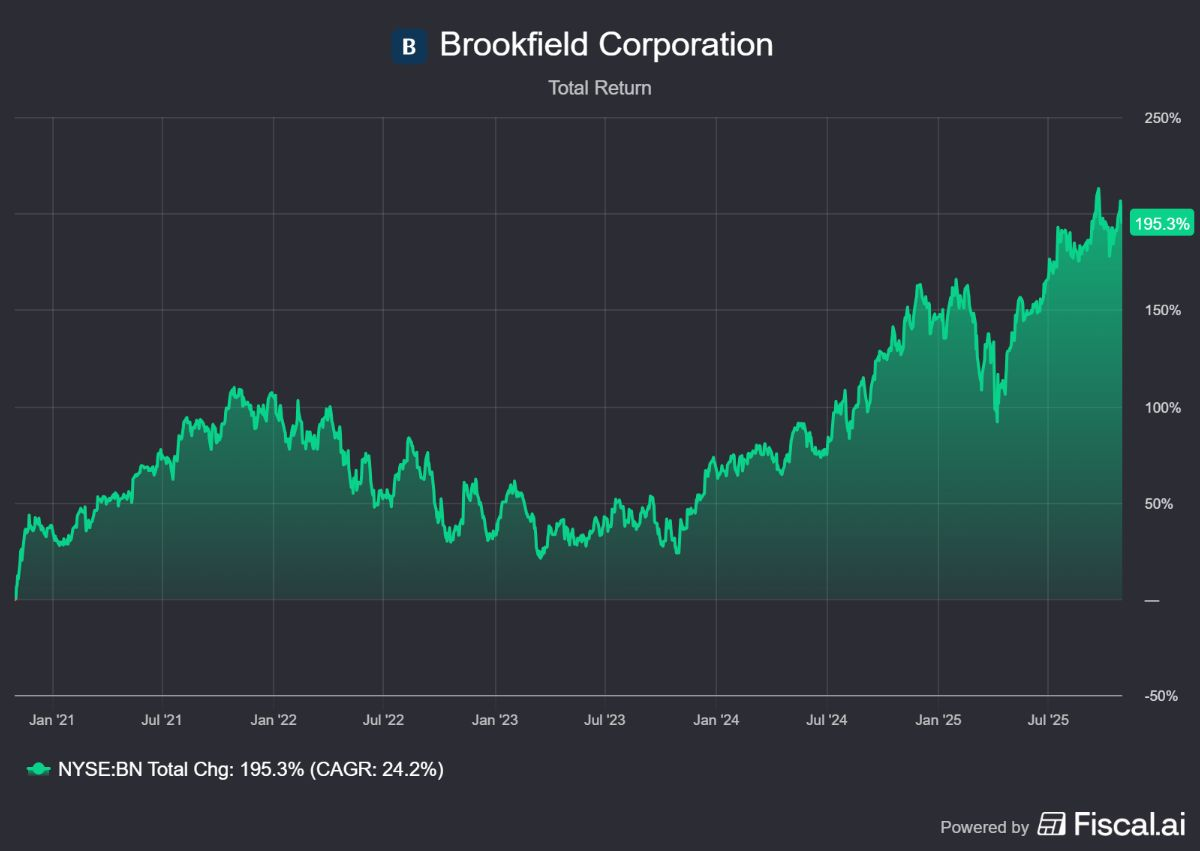

Brookfield pivotal in USD 80 billion American nuclear energy renaissance

The Canadian investment holding company Brookfield Corporation (New York: BN) is central to a transformative development within the American energy sector. The group, together with its partner Cameco, has entered into a strategic partnership with the government of the United States. This agreement includes the construction of new nuclear reactors with a total value of at least USD 80 billion.

The reactors will use Westinghouse technology. This nuclear technology company is 51% owned by Brookfield Renewable Partners and 49% by Cameco. Brookfield Corporation is the controlling shareholder of Brookfield Renewable Partners and of the asset manager Brookfield Asset Management. As a result, the holding company is the ultimate strategic and financial beneficiary of this long-term development. The shares of Brookfield Corporation and Cameco reacted significantly positively to the announcement.

The recent agreement is not an isolated event. It is the culmination of a strategic vision that was initiated years ago. CEO Bruce Flatt explained this this week. He indicated that Brookfield acquired the then-bankrupt Westinghouse in 2018. The investment case was based on the fundamental characteristics of nuclear energy. Flatt defined it as "continuously available power, clean, extremely efficient and very safe." He considered a return to nuclear energy as "inevitable."

The catalyst that forced the world to recognize this inevitability was the revolution in artificial intelligence. Energy demand is exploding. According to Flatt, the world is on the verge of doubling the electricity grid within the next fifteen years. To meet this demand, every form of energy generation is necessary. Solar energy, gas, hydropower and nuclear energy will have to coexist.

The new infrastructure

The driving force behind this energy demand is the construction of 'AI factories'. Bruce Flatt outlined the immense scale of these facilities. Where a data center consumed 50 to 100 megawatts ten years ago, customers today are asking for 1,000 megawatts, or one gigawatt, for a single location.

The capital intensity of such a project is extremely high. An AI factory of one gigawatt requires a total investment of USD 50 billion. This amount includes the buildings, the infrastructure, the servers and the chips. Flatt emphasized that this shields the market. It "cannot be done by everyone." He refuted the notion of a 'bubble' by arguing that these projects are "difficult to execute."

According to Flatt, AI infrastructure has become the new essential infrastructure. It is similar to the construction of roads and railways in previous generations. Countries that do not build sovereign AI capacity will see their companies leave. The United States was the first to recognize this.

Scale is the strategic goal

The CEO of Brookfield put the figure of USD 80 billion into perspective. The amount itself is not the most important element of the deal. The strategic goal is to achieve scale. This scale is necessary to rebuild the entire nuclear supply chain in the United States.

The American nuclear industry had been significantly reduced. To make the construction of the first reactor profitable, the supply chain must have confidence that a sustainable, long-term program will follow. That is exactly the goal of the partnership. It creates a "new industrial platform for nuclear energy" in the United States.

In this structure, the American government will buy and own the factories. Westinghouse will act as the builder. This distinguishes it from other projects, such as a recent transaction in South Carolina. There, Brookfield itself will own the plant.

The financial structure of the partnership

The details from the press release confirm the deep entanglement with the American government. The government not only facilitates the financing and permits, it also obtains a so-called 'Participation Interest'. This interest is activated as soon as the government makes a final investment decision for the construction of the USD 80 billion in reactors.

Once activated, this interest entitles the government to 20% of all future cash distributions from Westinghouse that exceed the amount of USD 17.5 billion. In addition, the government has the right to demand an IPO of Westinghouse before January 2029. This is only possible if the expected valuation at that time is USD 30 billion or more. In the event of such an IPO, the interest will be converted into a warrant to purchase 20% of the shares after deducting the first USD 17.5 billion in value.

The Brookfield blueprint

This nuclear strategy fits seamlessly into the broader model of Brookfield Corporation. Flatt confirmed that the organization is going "heavy up" on sectors where capital is flowing. Today, that is AI infrastructure and the energy supply to feed it.

Just as Brookfield created a very successful separate fund for the energy transition and renewable energy five years ago, it has now spun off AI infrastructure into its own fund. This prevents the enormous capital needs of AI from disrupting the diversification of the regular infrastructure funds.

The acquisition of Westinghouse, initially placed in a private equity subsidiary Brookfield Business Partners, was later transferred to subsidiary Brookfield Renewables with Cameco as a partner. This illustrates the flexibility of the holding company. The partnership with the American government, in which the government shares in the success above a certain threshold, is embraced by Flatt. It aligns with the core philosophy of Brookfield Corporation. This philosophy is "partnering with the best and owning the best assets."

Brookfield Corporation ended the trading week on the New York Stock Exchange at a price of USD 46.05 per share.

Receive weekly insights in your inbox

Exclusive analyses and updates on family holdings and global market developments.

Would you like more information about our services? Please feel free to contact us.

Contact us

Disclaimer:

No rights can be derived from this publication. This is a publication of Tresor Capital. Reproduction of this document, or parts thereof, by third parties is only permitted after written permission and with reference to the source, Tresor Capital.

This publication has been prepared by Tresor Capital with the utmost care. The information is intended to be general in nature and does not focus on your individual situation. The information should therefore expressly not be regarded as advice, an offer or proposal to purchase or trade investment products and/or purchase investment services nor as investment advice. The authors, Tresor Capital and/or its employees may hold position in the securities discussed, for their own account or for their clients.

You should carefully consider the risks before you begin investing. The value of your investments may fluctuate. Past performance is no guarantee of future results. You may lose all or part of your investment. Tresor Capital disclaims any liability for any imperfections or inaccuracies. This information is solely indicative and subject to change.

Read the full disclaimer at tresorcapitalnieuws.nl/disclaimer .