Economy & Markets #44 - Opportunities for a New Investment Wave in the Gulf States

Researchers at KKR cite five factors why the Middle East is the place for investors in the coming decade.

This week's topics:

At the same time, artificial intelligence is rapidly changing the financial world. OpenAI's Project Mercury aims to automate the work of analysts and bankers, while McKinsey estimates that AI can influence up to 40% of the cost base in asset management. Yet human insight remains crucial: technology democratizes data, but not temperament, discipline and patience, the qualities that, according to Warren Buffett's principles, remain decisive for sustainable investment success.

From geopolitical risk to investment opportunity: the new roadmap for the Middle East

After years of tensions between Israel, Hamas and Iran, the Middle East seems to be slowly but surely recovering. The recent peace agreement between Israel and Gaza has reduced the immediate threat of a regional conflict and created space for economic reconstruction and cooperation. Despite new incidents in 2025, such as air strikes in Syria and confrontations between Iran, Israel and the US, large-scale disruption was avoided. Both stock markets and commodity prices reacted remarkably calmly, partly because the physical deliveries of oil and gas from the Gulf States remained largely unaffected.

According to the most recent report from KKR (Thoughts from the Road – Middle East, October 2025), the region is in a phase of structural reorientation. Reforms, investments and cooperation are once again the common thread, with the Gulf Cooperation Council (GCC) countries in particular developing from traditional capital exporters to destinations where international investors themselves want to actively deploy capital in the following themes:

1. Diversification

The Gulf States are investing massively in broadening their economic base. Where oil has been the main source of income for decades, the focus is now shifting to industry, tourism, technology and sustainable energy.

- Saudi Arabia, through the Public Investment Fund (PIF), is allocating approximately 80% of its more than $1 trillion in capital to domestic megaprojects, including NEOM, green hydrogen and production capacity. These projects offer plenty of opportunities for foreign partners.

- The United Arab Emirates (UAE) are strengthening their position as a regional hub for trade and capital flows. In 2024, approximately 6 billion dollars was raised through IPOs, and the pace of IPOs and private equity transactions remains high in 2025 as well. For investors, there are particular opportunities in export-oriented production, sustainable commodity chains and energy infrastructure.

2. Infrastructure and private lending

According to KKR, ongoing and planned projects in the Gulf States now represent more than $3 trillion, equivalent to one and a half times the combined GDP of the region. This creates an exceptionally attractive playing field for private infrastructure funds, asset-based finance and project financing. Real estate and logistics benefit from rapid urbanization and population growth, while private lending is playing an increasingly important role as an alternative to commercial banks, which have become more cautious due to stricter regulations. The Gulf region is thus developing into a new hotspot for private credit, a means of diversifying outside the saturated Western markets.

3. Policy stability and reforms

An important difference from previous decades is the greatly improved policy stability. Governments are now implementing long-term agendas with clear strategic goals. In this context, KKR speaks of a “new investment architecture” in the Gulf region.

Public debt ratios are low, according to GCC-Stat the average debt fell to approximately 29.8% of GDP in 2023, well below the peak of 40.3% in 2020, and the budgetary positions are solid. At the same time, free zones and tax benefits attract multinationals, while regulations regarding foreign ownership are being further relaxed. In Saudi Arabia, a law was passed in early 2025 that offers foreigners greater rights to real estate ownership. The UAE now has more than 40 free zones where 100% foreign ownership and full profit repatriation are possible.

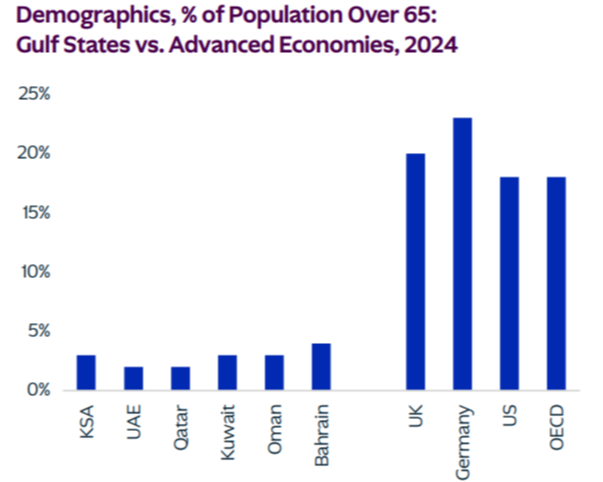

4. Demographics and digitization

The young population of the Gulf States is a powerful driver of domestic growth. With an average age of under 30 and a rapidly growing middle class, demand for education, healthcare, fintech, e-commerce and housing is increasing. The strong digital adoption, supported by 5G networks, artificial intelligence and data centers, also opens up new investment opportunities in technological infrastructure, cloud capacity and consumer services.

5. Capital inflows on a global scale

Capital flows to the Gulf region are increasing rapidly and are now reaching levels comparable to those of developed markets. Saudi Arabia has already awarded 440 billion dollars in projects and has another 1.5 trillion dollars in the pipeline. The UAE continues to attract international investors through a strong influx of IPOs, venture capital and collaborations with sovereign wealth funds.

AI and the future of the analyst

A recent edition of Barron’s Magazine featured an intriguing analysis of a question that is being asked more and more loudly in the financial world: can artificial intelligence eventually take over the role of buy- and sell-side analysts? This discussion gained new fuel in October after Sam Altman revealed that OpenAI has established a secret division called Project Mercury.

According to Barron’s, OpenAI has now attracted around a hundred former investment bankers from, among others, JPMorgan Chase, KKR, Goldman Sachs and Morgan Stanley. Their task: designing prompts and financial models with which AI systems can take over routine tasks from junior bankers. This includes building valuation models, analyzing financial data and preparing transaction documentation.

The ambition of Project Mercury is to train AI into a digital analyst that can model, analyze and report independently or semi-autonomously, a fundamental step towards large-scale automation within investment banking. This would also have consequences for valuation work, corporate actions and IPO preparations. In 2024, researchers Li, Tu and Zhou concluded in their paper 'The Promise and Peril of Generative AI: Evidence from GPT-4 as Sell-Side Analysts' that human analysts at that time still performed better than the AI models. Altman's goal is now to close that gap quickly.

The impact on banks and asset managers

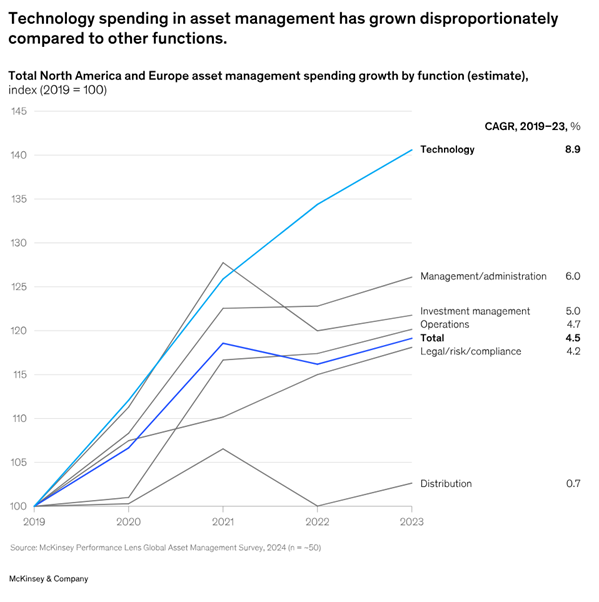

The question is not only when, but also how AI will change the banking and asset management model. According to research by McKinsey & Company (How AI could reshape the economics of the asset-management industry, July 2025), generative AI can influence between 25% and 40% of the cost base in asset management.

According to McKinsey, the sector is at a tipping point. For years, asset managers benefited from low interest rates and stable growth, but margins have been under pressure since 2022. Management costs are increasing, returns are becoming more volatile and competition from passive strategies is increasing. In North America, margins have fallen by around three percentage points in the past five years; in Europe even by five.

It is also becoming increasingly difficult to prove the added value of active management. Only about five percent of active American fund managers are beating their benchmark indices this year. As a result, the pressure is shifting to scaling up, automation and cost reduction, developments that further strengthen the role of AI.

McKinsey sees the greatest efficiency gains in distribution processes, support for investment teams and compliance automation. However, the researchers warn that many institutions are struggling to get a return on their technological investments. Despite sharply increasing IT spending, an average of 8.9% growth per year, there is hardly any connection with lower costs or higher productivity. This is because 60% to 80% of IT budgets are still spent on maintaining outdated systems, rather than on fundamental digital innovation.

Receive weekly insights in your inbox

Exclusive analyses and updates on family holdings and global market developments.

Value investing in the AI era

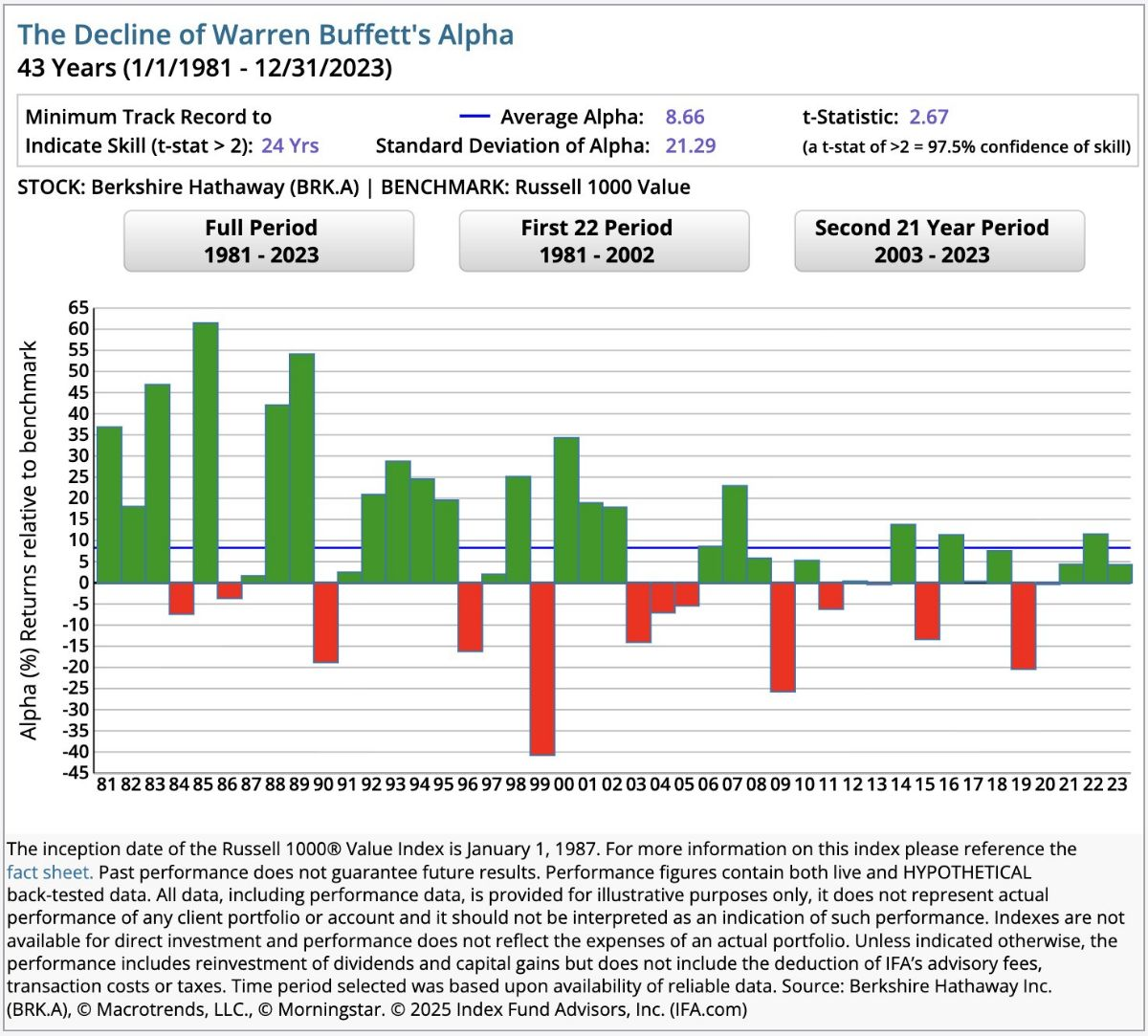

The rise of artificial intelligence bears striking similarities to the internet bubble of the late 1990s. In December 1999, Barron's mockingly asked: “What’s Wrong, Warren?” The internet revolution was at its peak, and Warren Buffett, who consciously ignored the hype, was dismissed as old-fashioned.

Twenty-five years later, history repeats itself in a new guise. AI is the new internet: a revolutionary technology that drives markets and tempts investors into impatience. Some, like investor Guy Spier, believe that AI heralds the end of value investing because it has flattened the information advantage of human analysts.

Spier describes how in the 1990s he spent days plowing through annual reports, calling companies, and attending shareholder meetings to find insights that others missed. Today, virtually all information is readily available via the internet and large language models like ChatGPT or Gemini. Access to data and the speed of analysis have been equalized, but this has not eliminated the essence of value investing.

The authors of the recent Barron's article, themselves experienced value managers, argue that this is precisely the moment when the value philosophy is being revived. In a market where index funds buy and sell blindly, inefficiency increases, the very oxygen on which value investors thrive. The power of value investing lies not in information advantage, but in two irreplaceable human qualities: time and temperament. Time, because true value only reveals itself after years. Temperament, because few have the composure and discipline to remain steadfast when markets panic.

AI can process billions of data points, but it does not possess courage, the characteristic that defines Buffett. He bought when others sold, such as during the credit crisis and the euro crisis. The op-ed below by Buffett in the New York Times, titled "Buy American. I Am." exactly one month after the fall of Lehman Brothers, speaks volumes in that regard.

Buffett's true strength lay not in technology, but in consistency and adaptability. Ironically, the man who once said he would never invest in technology later became a major shareholder of Apple and IBM. His principles remained unchanged, but their application evolved with time.

Similarly, the modern value investor will use AI as a tool, not as an oracle. Technology accelerates research and dissects patterns, but the assessment of (intrinsic) value and risk remains human. Buffett once succinctly summarized it:

“The stock market is a device to transfer money from the impatient to the patient.”

Research by Frazzini, Kabiller & Petersen (2011) shows that Buffett's returns can be partly explained by leverage (insurance float), quality, and valuation, but that his behavior and culture are decisive. His self-control and long-term vision are the true source of his alpha, qualities that, unlike technology, cannot be modeled.

The authors conclude with a reassurance that Buffett himself gave in 2023: new technologies do not take away opportunities, they create new ones. People remain susceptible to overconfidence and emotion, and as long as markets are driven by psychology, value investing will not disappear but will flourish.

Receive weekly insights in your inbox

Exclusive analyses and updates on family holdings and global market developments.

Would you like more information about our services? Please feel free to contact us.

Contact us

Disclaimer:

No rights can be derived from this publication. This is a publication of Tresor Capital. Reproduction of this document, or parts thereof, by third parties is only permitted after written permission and with reference to the source, Tresor Capital.

This publication has been prepared by Tresor Capital with the utmost care. The information is intended to be general in nature and does not focus on your individual situation. The information should therefore expressly not be regarded as advice, an offer or proposal to purchase or trade investment products and/or purchase investment services nor as investment advice. The authors, Tresor Capital and/or its employees may hold position in the securities discussed, for their own account or for their clients.

You should carefully consider the risks before you begin investing. The value of your investments may fluctuate. Past performance is no guarantee of future results. You may lose all or part of your investment. Tresor Capital disclaims any liability for any imperfections or inaccuracies. This information is solely indicative and subject to change.

Read the full disclaimer at tresorcapitalnieuws.nl/disclaimer .