Family Holdings #45 - While the World Invests, Berkshire's Cash Gathers Dust

Further: Acquisitions in Sweden; Alphabet gets approval for its largest acquisition ever and wants to ascend into space.

This week's topics:

Alphabet is strengthening its position as the backbone of the global AI economy. The approved $32 billion acquisition of Wiz strengthens Google Cloud with advanced security. At the same time, Apple is choosing Google's Gemini model as the engine behind the new Siri, a collaboration of approximately $1 billion per year that reaches billions of users. With the faster TPU Ironwood and the futuristic Project Suncatcher, which aims to bring AI computing power to space via satellites.

In Brief:

Constellation Software (Toronto: CSU) has executed three acquisitions through its subsidiaries for the second week in a row. Volaris Group acquired the software division of HeartCore Enterprises in Tokyo, the group's first acquisition in Japan. HeartCore provides CMS and digital transformation software to large enterprises and generated approximately USD 15.6 million in revenue in 2024. Jonas Group expanded its geographic footprint with its first acquisition in Mexico, through the acquisition of Apesa Software in Mexico City. The company develops banking software solutions, including the IKOS system, which manages approximately a quarter of the assets and liabilities of the Mexican central bank. In addition, Juniper Group acquired Inspiretec, a leading UK software platform for travel agencies and tour operators, operating in twelve countries and specializing in reservation and CRM systems.

Lifco (Stockholm: LIFCO-B) has acquired the German HEGUtechnik GmbH, a producer of electronic components for automation applications in industrial environments. HEGUtechnik, based in Oberasbach and with 83 employees, generated EUR 10.3 million in revenue in 2024 and is consolidated within the Contract Manufacturing division of Systems Solutions.

AddTech (Stockholm: ADDT-B) has acquired a majority stake of 80% in the German Axion AG, a developer of camera and sensor systems for vehicles with a focus on traffic safety. The company, based in Ulm, has 28 employees and generated approximately EUR 23 million in revenue in 2024. Axion will be integrated into the Vehicle Solutions business unit of Addtech Industry.

Prosus (Amsterdam: PRX) has expressed interest in Mobile.de, the largest German online car marketplace. According to Reuters, Prosus is exploring a potential bid through its subsidiary OLX, while current owners Permira and Blackstone are leaning towards an IPO with a valuation of up to EUR 10 billion. Prosus previously expanded its European activities in the automotive sector with the acquisition of the French La Centrale for EUR 1.1 billion.

Constellation Software, Lifco, Addtech, and Prosus are currently trading on the Toronto, Stockholm, and Amsterdam stock exchanges at prices of CAD 3,353.95, SEK 348, SEK 310.80, and EUR 58.95 per share, respectively.

A pile of cash but a lack of action at Berkshire Hathaway

The American investment holding company Berkshire Hathaway (New York: BRK.B) published its results for the third quarter of 2025 last week. It is the penultimate quarterly update under the direct leadership of Warren Buffett, who is stepping down as CEO at the end of this year.

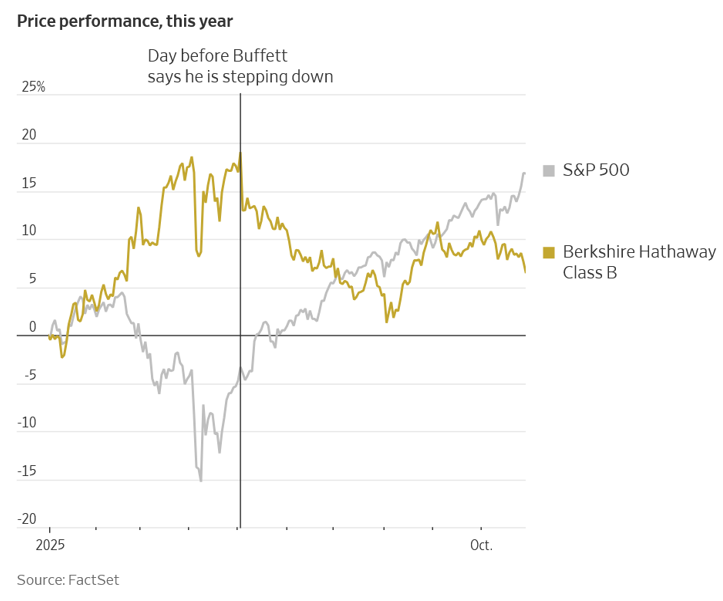

The insurance holding company is experiencing a rare weak stock market year. Since the announcement of Buffett's departure, the stock has lagged the broader market by more than 25%, an unusual situation for the world's most successful investor. Expectations were therefore low. Analysts pointed in advance to the substantial cash balance of $344 billion as of June 30, 2025, and wondered whether Berkshire would finally have repurchased its own shares in Q3 after six months without buybacks.

The somewhat somber sentiment led to a downgrade to 'Underperform' by KBW analyst Meyer Shields before the figures, who concluded that "many factors are moving in the wrong direction at the same time."

The figures themselves show a remarkably mixed picture. On the one hand, operating profit recovered strongly with a year-on-year increase of 34% to $13.5 billion, driven by a more than threefold increase in profit from insurance underwriting activities ($2.37 billion). On the other hand, it remains striking how little is happening with Berkshire's record cash position. This increased further to approximately $354 billion (adjusted for the purchase of short-term bonds worth $23 billion), a level that would make the value of the cash position alone one of the twenty largest companies in the world.

Despite this enormous financial firepower, no shares were repurchased this quarter either. The buyback program, which still amounted to billions per quarter between 2020 and 2023, has now been at a standstill for more than a year. Even during the weaker share price performance of recent months, Berkshire remained hesitant.

The fact that Buffett himself is hardly active paradoxically creates more movement in the market. Investors are wondering: what does Buffett see that we don't? Are the markets simply too expensive, or is he consciously building a position to be able to trade in the event of a future correction, a possible 'black swan' moment that others do not foresee or simply do not want to see?

For successor Greg Abel, this situation means one thing: an unprecedented amount of 'dry powder' to work with. In our view, even too much to leave in government bonds in the long term. A restart of the share buyback program or even the introduction of a dividend from 2026 onwards therefore seems inevitable. The latter would be ironic, as Buffett as an investor receives billions in dividends from companies such as Apple and Coca-Cola, but has never paid out a single one himself in all those decades.

Buffett's original idea, that Berkshire can better reinvest the capital in more attractive opportunities than its shareholders, no longer seems to be the case for a longer period of time. Buffett consistently passed up opportunities in the market in recent years, such as the sharp corona correction of 2020. Who knows, Greg Abel may have a different vision on the allocation of this capital.

The insurance activities, the core of Buffett's empire, showed excellent figures, perhaps against the expectations of some analysts. GEICO achieved a combined ratio of 84.3% and almost $1.8 billion in profit before taxes, while the reinsurance division benefited from a mild hurricane season and reported a profit of $884 million. Total float rose to $176 billion, still with a negative cost, a sign of structural profitability in underwriting.

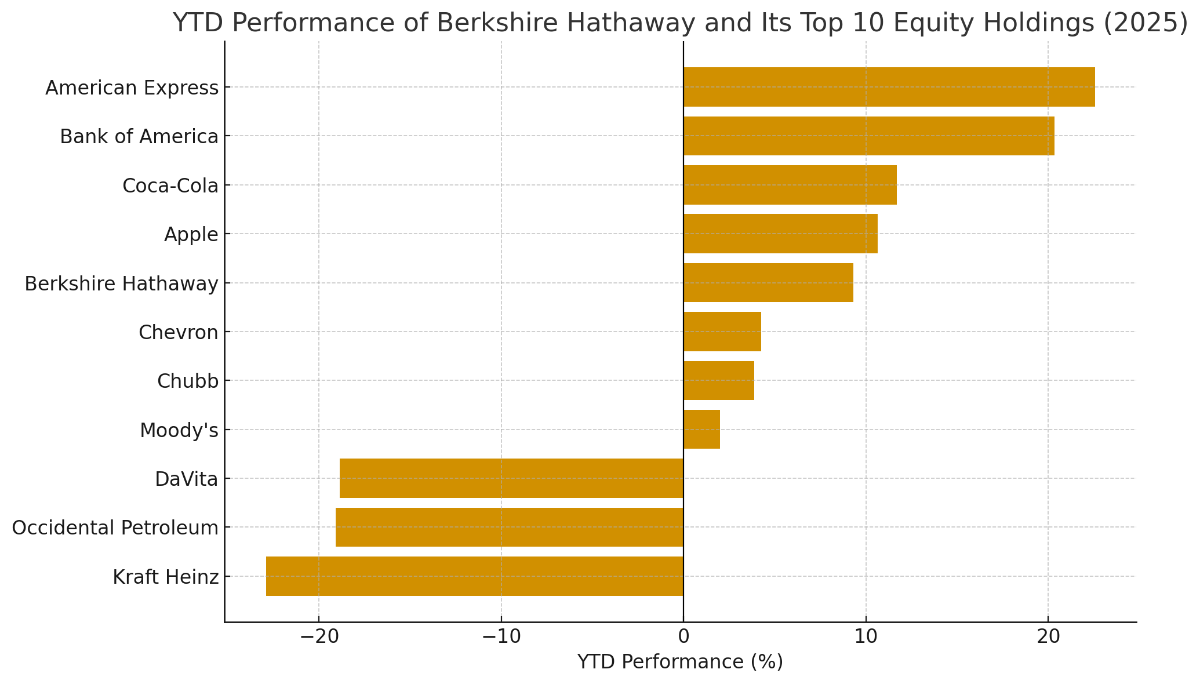

Berkshire's equity portfolio closed the quarter at a value of $283 billion. The financial positions did well, with strong price gains for American Express (+22.6%) and Bank of America (+20.3%), while Apple (+10.6%) and Coca-Cola (+11.7%) also performed solidly and reaffirmed their role as stable cash flow generators through dividends.

In contrast, Kraft Heinz and Occidental Petroleum, two investments closely linked to Buffett's name, were remarkably weak. The former continues to struggle with stagnating margins and weak volume growth, something Buffett openly criticized earlier this year. At the same time, Berkshire is expanding its involvement with Occidental, with a planned acquisition of the chemical division OxyChem worth $10 billion.

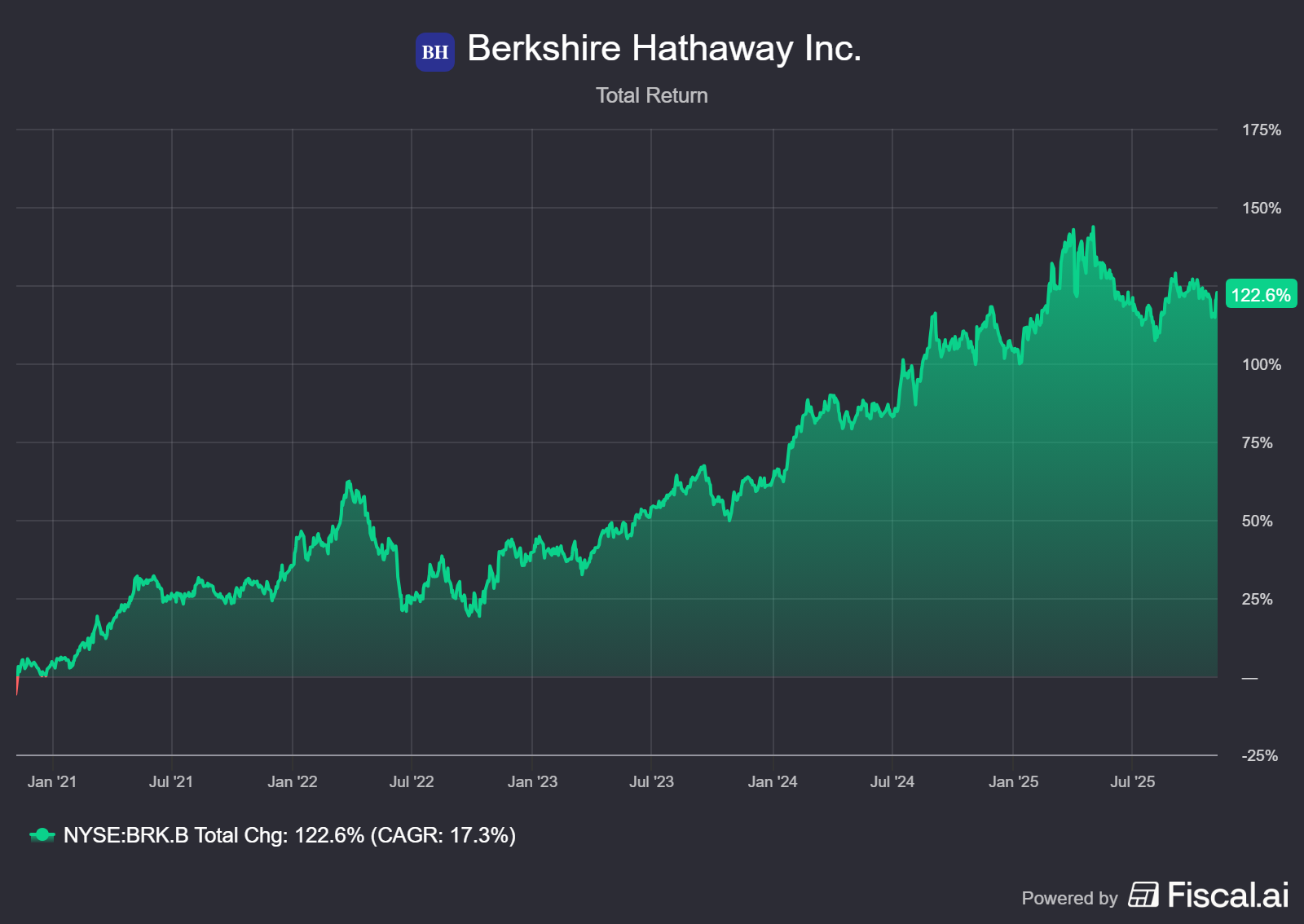

According to Whitney Tilson of Stansberry Research, Berkshire Hathaway is currently trading approximately 7% below its estimated intrinsic value, which he estimates at $535 per B-share. In his recent analysis, Tilson states that Berkshire's intrinsic value has grown by approximately 8-10% this year (previously stood at a premium). Tilson therefore sees the current valuation as attractive, especially given Berkshire's balance sheet strength and cash position of over $350 billion.

The Berkshire Hathaway B shares ended the trading week on the New York Stock Exchange at a price of USD 497.85 per share.

Receive weekly insights in your inbox

Exclusive analyses and updates on family holdings and global market developments.

Alphabet goes to space and takes along: TPUs

The American investment holding company Alphabet (New York: GOOGL) continues to rapidly reposition itself as the technological backbone of the global AI economy. While competitors focus on one part of the value chain, Google remains active in every stage from infrastructure to application. Recent events underscore this strategy.

Strengthening the cloud

This week, Alphabet finally received the green light from the U.S. Department of Justice (DOJ) for the acquisition of Wiz, valued at $32 billion. The company, founded in Tel Aviv and based in New York, is considered one of the fastest-growing software companies in the world. Wiz offers a cloud-native security platform that detects vulnerabilities and risks in real-time within corporate and government environments. More than 40% of the Fortune 100 now use Wiz's technology.

The acquisition was announced in March 2025, but remained under scrutiny for months by the antitrust division of the DOJ, which had to assess whether the transaction would strengthen Google's dominant position in the cloud market too much. A remarkable step, as competitors Amazon AWS and Microsoft Azure are still considerably larger than Google Cloud. Now that the approval is complete, Alphabet can complete its largest acquisition ever. Remarkably, the decision follows just two weeks after Alphabet announced a donation for the new ballroom of the White House.

For Alphabet, the integration of Wiz within Google Cloud means a strategic strengthening of significant proportions. With Wiz, the company is adding a leading player in cloud security to its ecosystem, and is further building an infrastructure in which AI, data and security fully converge.

Gemini as the new Siri

Alphabet also surprised again in the field of collaboration. After months of testing, Apple has decided to use Google's Gemini model as the core of the new generation of Siri. In doing so, the world's largest hardware producer explicitly chooses Google's AI technology over alternatives such as ChatGPT (OpenAI) and Claude (Anthropic).

According to Bloomberg, the collaboration is worth approximately $1 billion per year, which not only adds a new revenue stream for Alphabet, but also provides access to an unparalleled distribution scale. There are an estimated more than 2.2 billion active Apple devices worldwide, including more than 1.5 billion iPhones. This means that within a few years, billions of users will indirectly interact with Google's AI via Siri.

The choice for Gemini follows an extensive evaluation by Apple, in which various models were tested for accuracy, speed, contextual understanding and scalability. Ultimately, Google's model proved superior not only in terms of performance, but also because of the ability to run within Apple's strictly shielded Private Cloud Compute infrastructure. The latter was crucial, because Apple insisted that user data would never run through Google servers, unfortunately for Alphabet.

Data centers among the stars

In addition, Google is increasing its technological lead with the seventh generation of Tensor Processing Units, internally known as TPU Ironwood. The new chip delivers a fourfold speed improvement over its predecessor and can be linked in clusters of more than 9,000 chips to train the largest AI models in the world. This strengthens Alphabet's position as one of the few technology companies with its own AI hardware and reduces its dependence on Nvidia. Major customers, including Anthropic, have already indicated that they will use the new TPUs on a large scale.

At the same time, Alphabet is thinking further ahead with Project Suncatcher, a research initiative within Google Research that explores how AI capacity can literally be moved into space. The plan envisions constellations of satellites equipped with solar panels and Google TPUs, which are interconnected via optical connections and collectively function as one distributed data center.

The goal is ambitious and almost reminiscent of a science fiction film. In the right orbit around the earth, a solar panel can generate up to eight times more energy than on earth and almost continuously, without nightly interruptions. In theory, this creates a way to scale computing power to levels that are physically and energetically hardly feasible on earth. Although the project is still in an early research phase, the first test mission is already planned. In 2027, Google, together with Planet Labs, wants to launch two test satellites to test the technology in practice.

Alphabet ended the trading week on the New York Stock Exchange at a price of USD 277.07 per A-share.

Receive weekly insights in your inbox

Exclusive analyses and updates on family holdings and global market developments.

Would you like more information about our services? Please feel free to contact us.

Contact us

Disclaimer:

No rights can be derived from this publication. This is a publication of Tresor Capital. Reproduction of this document, or parts thereof, by third parties is only permitted after written permission and with reference to the source, Tresor Capital.

This publication has been prepared by Tresor Capital with the utmost care. The information is intended to be general in nature and does not focus on your individual situation. The information should therefore expressly not be regarded as advice, an offer or proposal to purchase or trade investment products and/or purchase investment services nor as investment advice. The authors, Tresor Capital and/or its employees may hold position in the securities discussed, for their own account or for their clients.

You should carefully consider the risks before you begin investing. The value of your investments may fluctuate. Past performance is no guarantee of future results. You may lose all or part of your investment. Tresor Capital disclaims any liability for any imperfections or inaccuracies. This information is solely indicative and subject to change.

Read the full disclaimer at tresorcapitalnieuws.nl/disclaimer .