Economy & Markets #45 - Two Speeds in One Economy: Why the Fed Is Caught Between Growth and Inequality

Strong profit growth at the top masks the pressure on the middle class and SMEs, making monetary policy increasingly difficult to balance.

This week's topics:

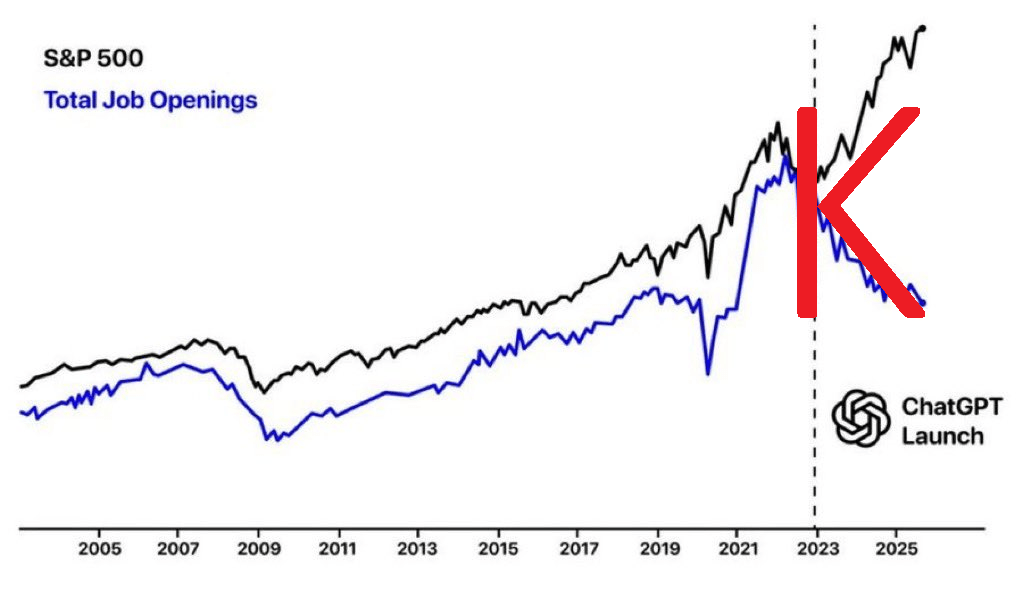

A K-Shaped Recovery: A divided recovery poses dilemmas for the FED

The American economy is at a crossroads. At first glance, the figures look solid: growth remains above expectations at around two percent, unemployment hovers around four percent, and inflation has fallen from almost nine percent in 2022 to around three percent now. Stock markets are also at record highs. Yet the picture behind these figures is less reassuring. Beneath the surface, a so-called K-shaped recovery is unfolding, a recovery that is moving in two directions. The upper leg of the K represents the winners of the new economic era, the lower leg the laggards.

The top of the K: capital yields returns

At the top are the sectors and groups that benefit from structural trends and abundant capital. The technology sector remains the growth engine of the United States: companies active in artificial intelligence, cloud computing and semiconductors are posting record profits, driven by productivity gains and large investments in data centers. The efficiency gains from AI offset rising labor costs and increase margins. Thanks to strong cash flows, these companies can largely finance their own growth and experience little hindrance from higher interest rates.

Large companies outside the technology sector also benefit. Their scale, cash reserves and access to credit make refinancing relatively cheap, an advantage that smaller players do not have. Wealthy households are benefiting from this recovery through stock markets that are reaching new highs and real estate in prime locations that remains stable in value. For this group, the higher interest rate even reinforces the sense of financial security.

These factors keep consumption up and make the macroeconomic picture seem robust. Companies with strong balance sheets, low debt ratios and pricing power remain attractive, while interest-sensitive sectors remain vulnerable. At the top of the K, capital-rich consumers continue to effortlessly buy premium products, from Ferrari sports cars to Hermès bags and Apple's iPhone 17 Pro.

The bottom of the K: labor and middle class under pressure

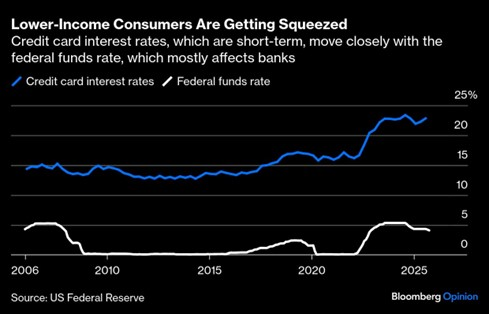

For a large part of American households, the reality is very different. Although inflation has been reduced to three percent on paper, the prices of rent, insurance, electricity, healthcare and daily groceries are rising faster than the official figures suggest. The real purchasing power of the middle class remains lower than before the pandemic. Small and medium-sized enterprises, the backbone of employment, are struggling with financing costs that have doubled since 2021. Where large companies have easy access to the capital market, small entrepreneurs often pay eight to ten percent interest on loans. This slows down investments, puts pressure on margins and forces many to reduce staff or postpone expansion plans.

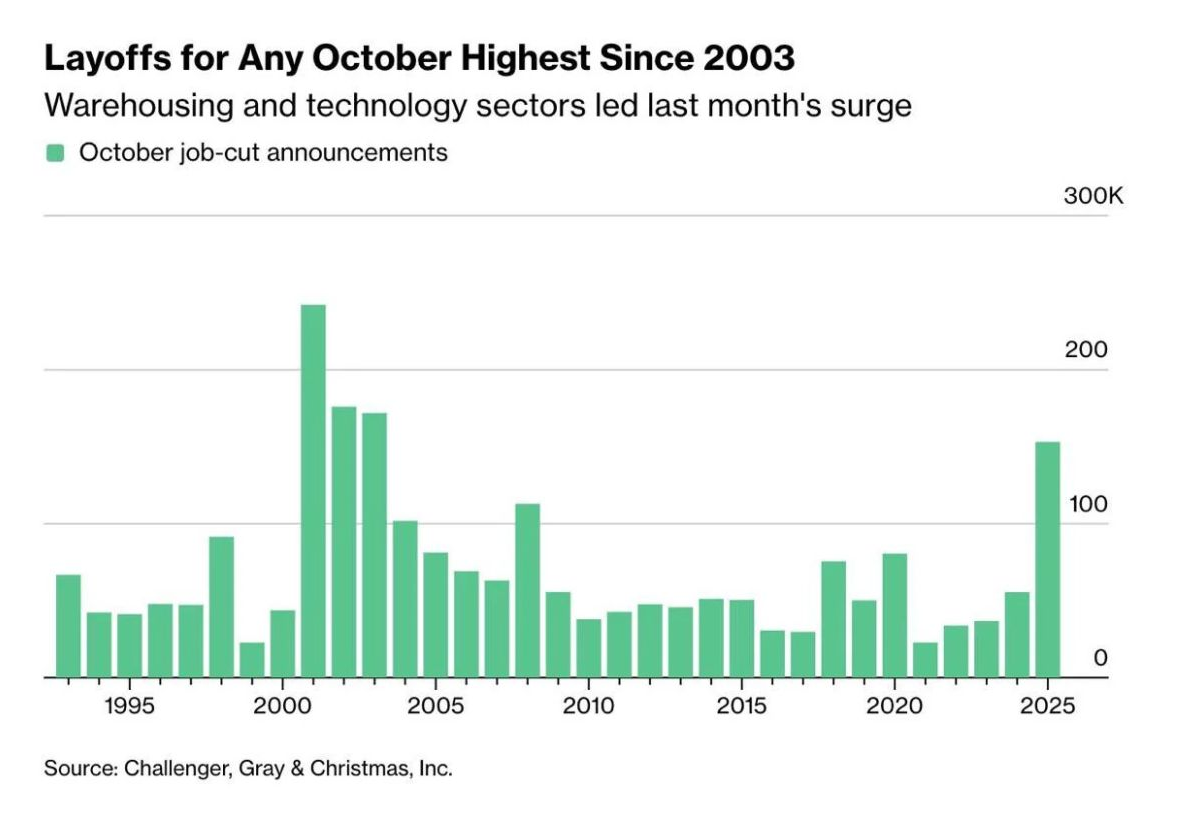

The labor market is also showing cracks. Behind the low national unemployment rate lies a growing gap between highly and low-skilled workers. In technology, consulting and engineering, the demand for personnel is greater than ever, while jobs in logistics, hospitality and retail are disappearing. The economy as a whole looks healthy, but the inequality between occupational groups is increasing further.

What we are seeing is not a temporary phenomenon but a structural shift. Technological progress increases productivity in capital-intensive sectors, but displaces labor in traditional industries. Capital is concentrated in a limited number of companies and households with access to financial markets, while the rest remain dependent on expensive credit and wage income.

Demographic and regional differences reinforce this trend. Older, wealthy households benefit from higher interest rates and have less need for credit, while younger families with mortgages and student debts are under pressure. Growth is concentrated in southern states that benefit from industrial policy and tax advantages, while the old industrial states continue to lag behind.

Even government policy contributes to the imbalance. Fiscal incentives and subsidies flow mainly to strategic sectors such as energy, defense and technology, not to labor-intensive services. According to the National Federation of Independent Business, small businesses' investment plans for the next six months remain below pre-pandemic levels. At the bottom of the K, we see that companies like Chipotle, Airbnb and hotels in Las Vegas are suffering from reluctant consumers.

The Fed in a balancing act

The American central bank is in a difficult position. Unlike the European Central Bank, the Federal Reserve has not one, but two legal objectives. On the one hand, it must bring inflation back towards the 2% target, in order to protect purchasing power and the credibility of monetary policy. On the other hand, it has the task of maintaining employment at the highest possible level, the so-called full employment goal.

In stable times, these two goals often go hand in hand. Low inflation stimulates consumption, high employment supports growth. But in today's divided economy, both missions are pulling away from each other. Curbing inflation requires a restrictive policy, while the weaker segments of the labor market need monetary easing. The Fed is therefore in a classic balancing act: every decision that helps one half of the economy seems to harm the other.

The K-shaped recovery is partly a result of this tension. Interest rate increases are a blunt instrument, much less targeted than the fiscal policy of taxes and redistribution. As former Fed economist Claudia Sahm once put it: “Interest rates are a blunt tool, far less targeted than the tax-and-transfer toolkit of fiscal policy.”

The paradox is that the Fed's policy, intended to restore balance, actually increases inequality. Higher interest rates limit lending and depress consumption at the bottom of the economy, while the top benefits from higher returns on savings and rising asset prices. Thus, every interest rate and inflation decision reinforces the division it is trying to correct.

The central bank knows that cutting interest rates too early carries the risk of inflation expectations rising again, which would undermine the credibility of the policy. But further tightening increases the pressure on lower incomes and SMEs, which are already struggling with high financing costs. The result is a stalemate in which no policy option is without side effects.

The market is currently pricing in that the policy rate will fall to around 3.75% around the end of this year, and further towards 3.25% by the end of 2026. Should that scenario materialize, it would result in a steeper yield curve, which is beneficial for credit creation: banks can borrow short at lower rates and lend longer at higher returns. Yet the dilemma remains fundamental: how do you keep inflation under control without further breaking the recovery of the bottom of the economy?

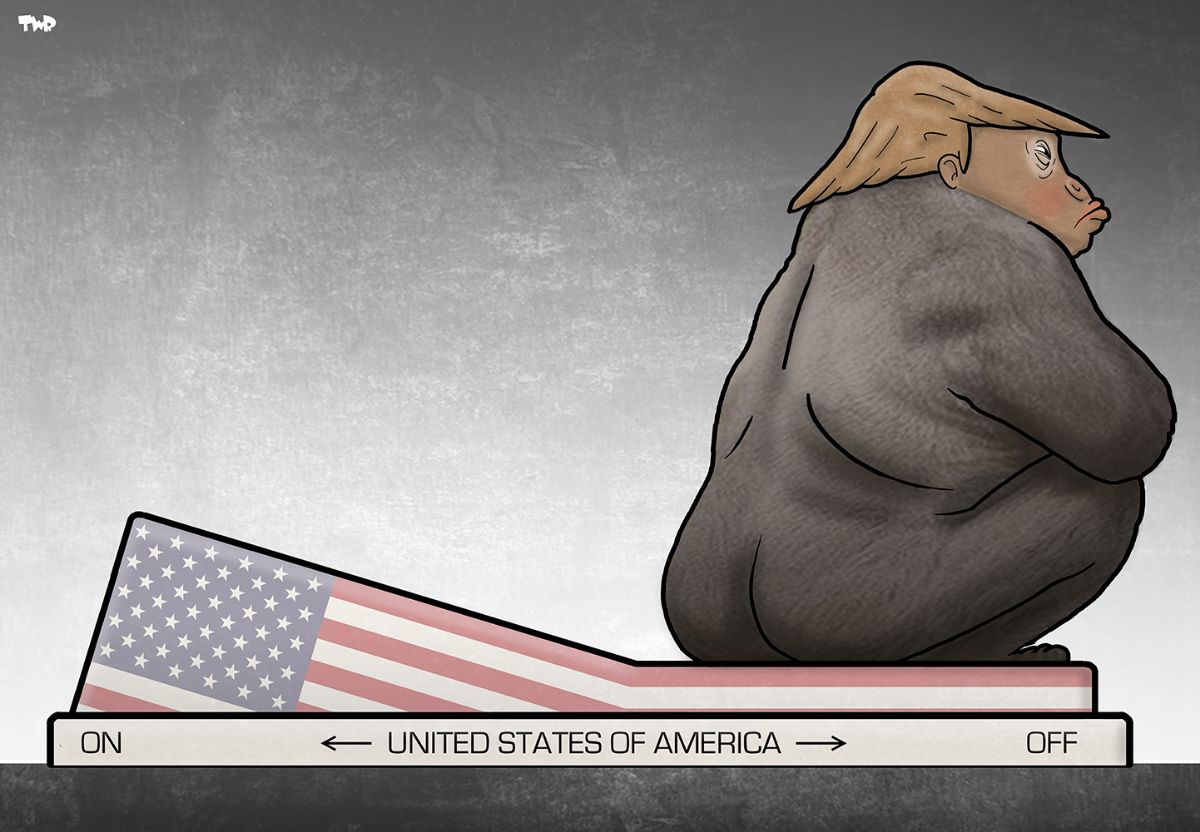

US political impasse deepens economic damage

The US federal government has now been partially shut down for more than five weeks due to a political stalemate in Washington. The Republican majority in the House of Representatives and the Democratic Senate cannot agree on the budget for the new fiscal year. The dispute is not only about spending ceilings, but also about policy areas such as healthcare subsidies under the Affordable Care Act and federal support programs.

The economic damage is becoming increasingly visible. According to Goldman Sachs, the shutdown costs about 1.15 percentage points of GDP growth in the fourth quarter of 2025, although some of this will be made up for in early 2026. The shutdown of federal services is preventing the release of crucial economic data, including employment figures, leaving policymakers and investors in the dark.

The Federal Aviation Administration (FAA) also warns of staff shortages, forcing 40 US airports to reduce their flight capacity by approximately ten percent. Construction and infrastructure projects are also at a standstill, further eroding confidence in the real economy.

Receive weekly insights in your inbox

Exclusive analyses and updates on family holdings and global market developments.

Democratic win increases pressure on Republicans

Political pressure on Republicans is increasing after clear Democratic victories in this week's regional elections. In New York, Virginia and New Jersey, the party made strong gains, and in California, voters approved a reform of the electoral district system, which is expected to give Democrats five extra seats after 2026. In New York City, 34-year-old Zohran Mamdani was convincingly elected mayor, leaving former Governor Andrew Cuomo and Republican Curtis Sliwa far behind.

Mamdani, an outspoken democratic socialist, is mockingly called the “little communist” by President Trump, a nickname that underscores both his popularity with progressive voters and his polarizing reputation. His victory shows that the Democrats, when they manage to position young and charismatic candidates, can regain momentum towards the 2026 midterm elections. Whether the party should continue that line in a more progressive, socialist direction, as previously advocated by Bernie Sanders, is still unclear.

The fact is that public dissatisfaction with the economy remains high: almost two-thirds of Americans rate it as “bad” or “very bad”, while 54% of the population disapproves of President Trump's policies. Analysts therefore see the recent results as an early warning for the Republicans. Historically, the opposition party wins an average of 25 seats during the midterms, a scenario that increases the chance that the Democrats will regain the House of Representatives.

Market impact and policy risks

The political impasse also has market effects. Mamdani's plans to borrow $70 billion for affordable housing clash with New York's constitutional debt ceiling and reliance on state aid. Proposals for higher taxes and free public transport seem politically unfeasible, although they show the direction of his policy.

According to S&P and J.P. Morgan, there is no direct threat to New York's creditworthiness, thanks to budget rules and state supervision. Yet real estate funds focused on New York, such as SL Green Realty Corp. and Vornado Realty Trust, already showed significant price losses. New York muni bonds are also performing weaker than the broader market. President Trump has again added New York to the list of “anarchist cities”, alongside Portland, Los Angeles and San Diego, threatening to limit federal support. The political scene in Washington therefore remains deadlocked: Democrats feel momentum, Republicans block the budget, and the American economy pays the price.

Political division slows down Europe's reform power

Netherlands: formation continues to search for reform coalition

The Dutch cabinet formation is proceeding with difficulty. A left-wing coalition seems unlikely, as the VVD excludes cooperation with GroenLinks–PvdA. Within the VVD, more conservative candidates have also received the most preferential votes, which shifts the party's course further to the right. The most likely option remains a center-right combination of D66, VVD, CDA and JA21, although the cooperation between D66 and JA21 in particular is meeting with considerable resistance within the D66 support base.

Belgium: impasse over multi-year budget slows down reforms

Political uncertainty also remains high in Belgium. On November 6, Prime Minister Bart De Wever reported to King Filip on the stalled negotiations surrounding the 2026–2029 multi-year budget. Because the De Wever government did not meet the deadline, Belgium is temporarily working with so-called “provisional twelfths”: monthly expenses based on the previous budget year. As a result, new fiscal measures, including the capital gains tax, cannot be submitted or voted on. This causes a budget gap of approximately one billion euros in 2026. The Prime Minister has set a new deadline of fifty days to reach an agreement, but important dossiers such as pensions, wage standards, tax reform and night work remain unresolved.

Political fatigue puts pressure on the reform agenda in Europe

The developments in the Netherlands and Belgium fit into a broader European trend. In more and more countries, including Germany and France, the reform agenda is stalling due to fragmentation and coalition fatigue. Center parties are losing ground, populist parties are gaining influence and consensus politics is giving way to short-term thinking.

Recent analyses, such as 'Navigating a Fractured Horizon' (European Central Bank) and 'Unity or Fragmentation?' by Collignon & Orsitto, show that political fragmentation is directly related to lower growth, rising debt levels and declining market confidence. Their conclusion is clear: without renewed administrative stability and consensus, Europe risks entering a phase of policy stagnation, in which populism and debt accumulation reinforce each other. This poses a structural risk to the economic resilience of the continent and a factor that investors are closely monitoring.

Stock market momentum decreases

After a strong summer, the stock market is clearly losing strength. The major US indices closed lower this week, with technology and AI-related stocks in particular coming under pressure. Concerns about high valuations, a more cautious tone from the Federal Reserve and political uncertainty surrounding the government shutdown are leading to caution among investors.

The technology sector, which has been the engine behind the stock market rally for years, was in the spotlight this week, but this time on the weaker side. Investors are beginning to question the high valuations of leading tech and AI stocks. The Nasdaq, with a forward P/E of approximately 29, is well above the ten-year average of 25, which limits the room for setbacks in profit growth or inflation. In addition, the high concentration of investors in popular momentum positions creates extra volatility. Where technology companies previously led the rise, we are now seeing profit-taking and a shift towards more defensive sectors.

Market sentiment has become noticeably more risk-averse. Investors prefer defensive positions and more often resort to safe havens such as government bonds and the US dollar. The recent fall in oil prices reinforces the market's wait-and-see attitude. After months of strong price increases, many parties are opting for profit-taking. Analysts point out that a temporary correction of approximately 10% is common and healthy within a longer bull market, especially after periods of excessive optimism.

Profit growth within the S&P 500 is now being driven by an increasingly smaller number of companies. Where large AI names dominated sentiment in recent months, we are now seeing a rotation towards more defensive sectors such as healthcare and utilities. The market therefore seems to be shifting from euphoria to consolidation.

Doubt about financing OpenAI plans

The discussion surrounding OpenAI's investment ambitions flared up again this week after an explanation from CEO Sam Altman. Where earlier there was talk of several hundred billion, Altman confirmed that the company is committed to approximately USD 1.4 trillion in investments until 2030 to build a global AI infrastructure. That scale raises questions about financing. OpenAI is expected to achieve annual revenue of more than USD 20 billion by the end of 2025, but is counting on explosive growth towards hundreds of billions per year towards 2030. Altman denied that OpenAI is asking for government support or guarantees, and emphasized that “the government should not choose winners or losers.” However, he sees room for cooperation in building national AI infrastructure and strengthening the American chip chain. According to Altman, the global demand for computing power is growing faster than the supply. He considers the risk of too little capacity to be greater than that of too much, a “necessary gamble to build the infrastructure of the future.”

Conclusion – a new wall of worry

Investors face a familiar challenge: navigating an environment of high valuations, mixed economic signals and increasing political uncertainty. The American stock market is once again climbing against a wall of worry: a classic characteristic of a mature bull market, in which confidence and caution constantly balance each other.

Receive weekly insights in your inbox

Exclusive analyses and updates on family holdings and global market developments.

Would you like more information about our services? Please feel free to contact us.

Contact us

Disclaimer:

No rights can be derived from this publication. This is a publication of Tresor Capital. Reproduction of this document, or parts thereof, by third parties is only permitted after written permission and with reference to the source, Tresor Capital.

This publication has been prepared by Tresor Capital with the utmost care. The information is intended to be general in nature and does not focus on your individual situation. The information should therefore expressly not be regarded as advice, an offer or proposal to purchase or trade investment products and/or purchase investment services nor as investment advice. The authors, Tresor Capital and/or its employees may hold position in the securities discussed, for their own account or for their clients.

You should carefully consider the risks before you begin investing. The value of your investments may fluctuate. Past performance is no guarantee of future results. You may lose all or part of your investment. Tresor Capital disclaims any liability for any imperfections or inaccuracies. This information is solely indicative and subject to change.

Read the full disclaimer at tresorcapitalnieuws.nl/disclaimer .