Family Holdings #46 - Insider Purchases Indicate Undervaluation of Family Holdings

This week's topics:

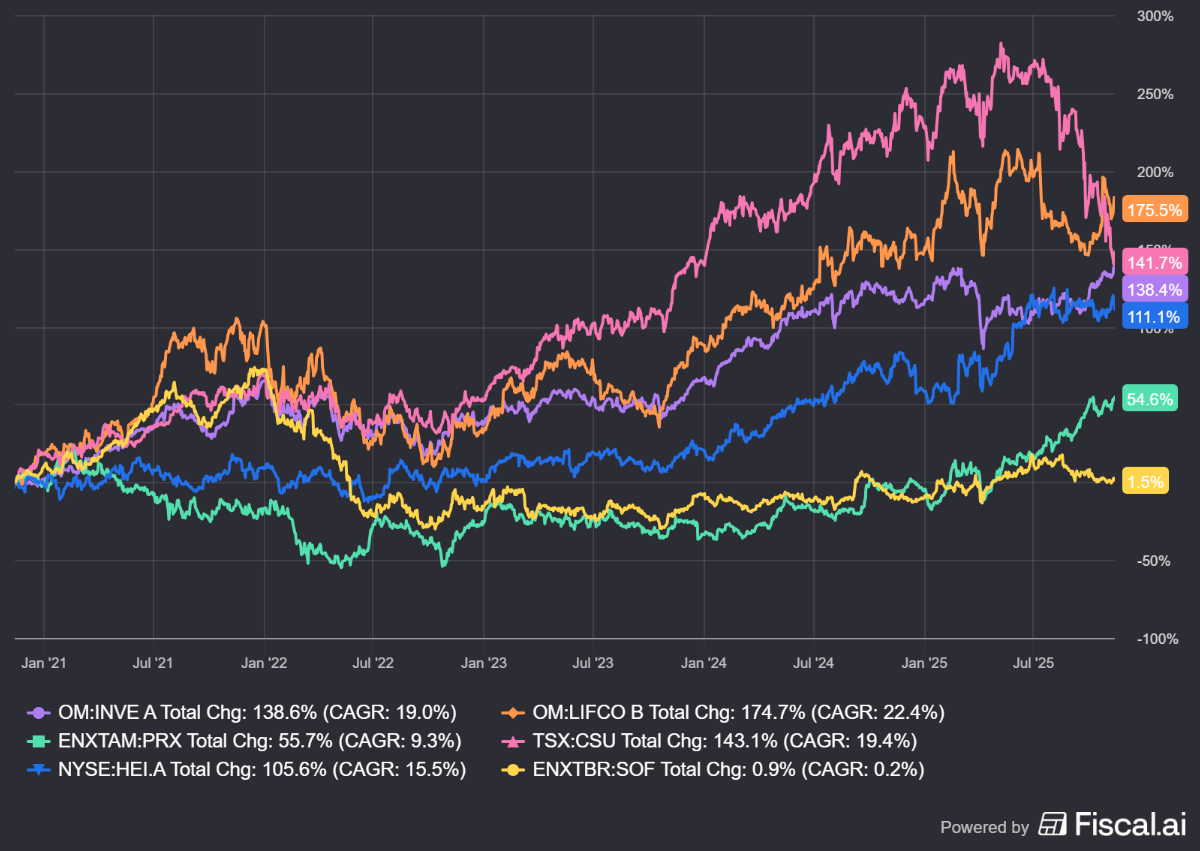

Constellation Software and Topicus reported strong quarterly figures with significant revenue and cash flow growth, and continue to acquire aggressively. Despite these operational successes, investors remain hesitant due to fears about the impact of AI on niche software companies. However, insider purchases at Constellation, including those by the new CEO, signal internal confidence in the low valuation and the future.

KKR reported a record quarter with $1.0 billion in fee-related earnings and $43 billion in inflows, largely thanks to the synergy between insurance subsidiary Global Atlantic and private credit. Although a rare 'clawback' of $350 million from an old Asia fund briefly dampened sentiment, the focus is on the structural growth of the insurance division.

In Brief:

Investor AB (Stockholm: INVE.B) reports that Patricia Industries' subsidiary Laborie is acquiring the American JADA System for USD 440 million. With a total potential value of USD 465 million, this is one of the largest add-on acquisitions within Patricia Industries in recent years. JADA generates USD 60–67 million in annual revenue, making it a significant expansion for Laborie. The deal is being financed with additional debt and is expected to close in Q1 2026.

Lifco (Stockholm: LIFCO-B) reports that CEO Per Waldemarson has purchased 15,000 shares worth SEK 5.2 million. The purchase follows two weeks after Dental division EVP Martin Roland Linder also bought SEK 2.1 million worth of Lifco shares. A strong signal from the top of the company.

Prosus (Amsterdam: PRX) reports that iFood is acquiring the Brazilian Advolve, a company specializing in AI technology for real-time creation and optimization of advertising content. Advolve’s technology will be integrated into iFood’s Ads division, which has been active since 2021 and is now used by more than 230 companies. Prosus Ventures has been a shareholder since early 2025. Financial details of the transaction have not been disclosed.

Constellation Software’s (Toronto: CSU) Harris division is acquiring the French Eloquant, a SaaS provider of AI-driven customer contact and CX solutions. Eloquant, based in Grenoble and Paris, serves more than 260 customers in sectors such as insurance, banking, energy, and telecom, and processes over 450 million customer interactions annually.

HEICO (New York: HEI.A) is acquiring Axillon Fuel Containment, a manufacturer of fuel cells for military and commercial aviation, as well as for various military vehicles. Axillon is known for its long history in crash- and safety-focused fuel systems. The company, with approximately 530 employees and a large production and engineering facility in Georgia, will be integrated into HEICO’s Electronic Technologies Group. HEICO expects the acquisition to be accretive to earnings within a year.

Sofina (Brussels: SOF) saw two of its Indian holdings go public this week. Pine Labs made a strong debut: the fintech company opened above the issue price and closed 14% higher, resulting in a valuation of approximately EUR 2.75 billion. The IPO was 2.5× oversubscribed, mainly due to institutional demand. Sofina owns 1.70% of the shares according to the half-year report. Lenskart, a fast-growing eyewear and lens retailer with over 2,000 stores in Asia, also listed in Mumbai this week. The IPO raised INR 72.8 billion (approx. EUR 707 million) and was 28× oversubscribed. Sofina has been a minority shareholder since 2019, although the stake has been gradually reduced since then.

Investor AB, Lifco, Prosus, Constellation Software, HEICO, and Sofina are currently traded on the stock exchanges of Stockholm, Amsterdam, Toronto, New York, and Brussels at prices of SEK 319.10, SEK 353.40, EUR 60.74, CAD 3,341.65, USD 246.72, and EUR 241 per share, respectively.

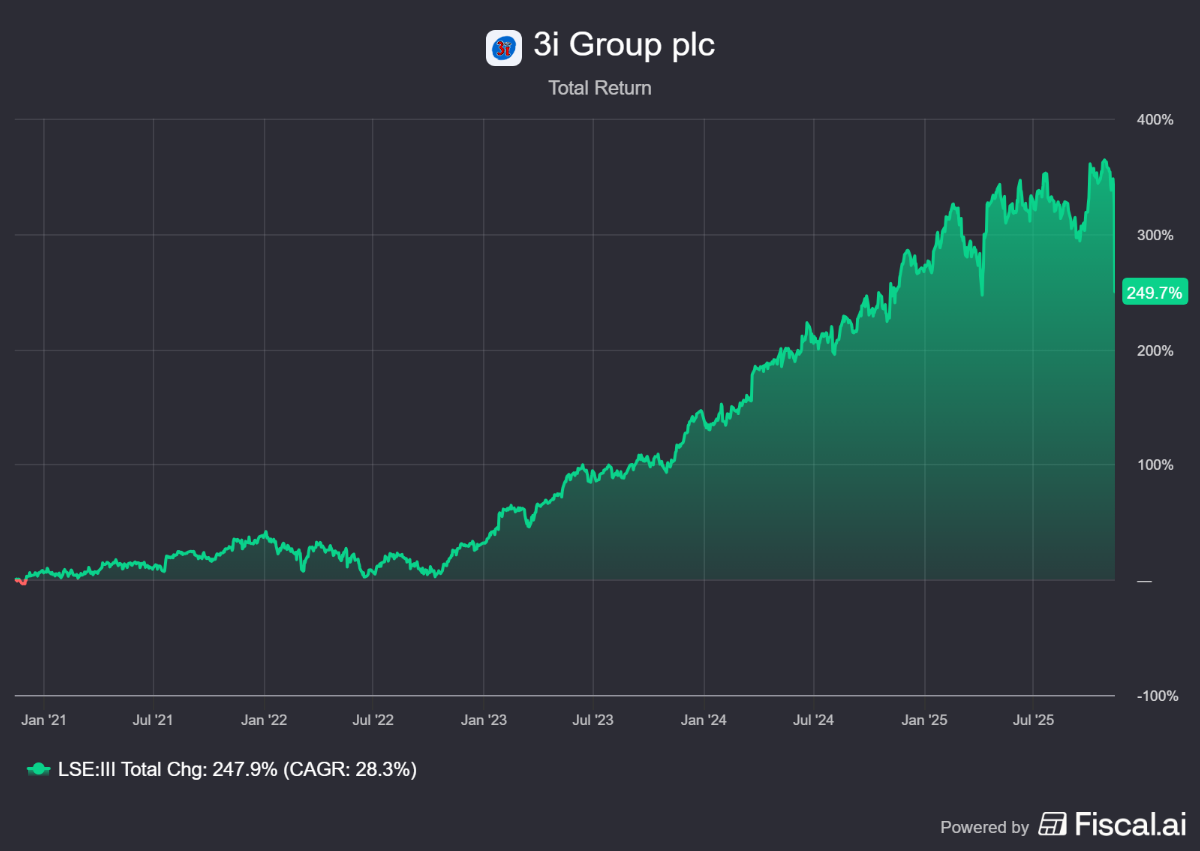

Strong 3i Group Under Pressure Due to Weakness in France

3i Group (London: III) published its half-year results for the period ending in September this week. The British investment holding company had already prepared investors for weakening consumer spending in Germany and France during the Capital Markets Seminar in September. That message is echoed in the half-year report. In terms of content, the results were fully in line with our expectations, but the outlook outlined by management put significant downward pressure on the stock. In our opinion, this is a clear overreaction, a pattern we see more often in the current fragile stock market climate.

Broad profit growth of the group

3i reports the net asset value (NAV) calculated by the company every quarter. Since the end of June, it has increased by 5%, since the end of March by 12%, and on an annual basis even by 26%. This is an exceptionally strong development, especially in the current macroeconomic climate. The main driver behind this value creation remains the private equity portfolio, which realized a gross investment return of 14% in the first half of the financial year.

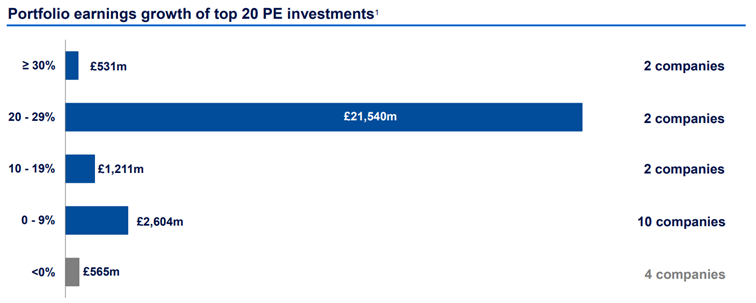

In particular, the long-term holdings Action and Royal Sanders contributed significantly to this, but there was also broad profit growth elsewhere in the portfolio: no less than 98% of the twenty largest investments recorded an increase in profit over the past twelve months. Approximately 30% of these companies recorded profit growth of 10% or more, once again highlighting the quality and diversification of the portfolio.

On the realization side, 3i again provided evidence of successful value creation. The previously announced sale of the IT services platform MAIT was completed at an IRR of 28%, while the previously realized exit of MPM even yielded a multiple of 3.2x. Both deals were well above the internal target of at least 2x, which underlines that 3i not only builds value in the portfolio, but also actually manages to cash it in, even in a challenging transaction environment.

Action as the heart of the portfolio

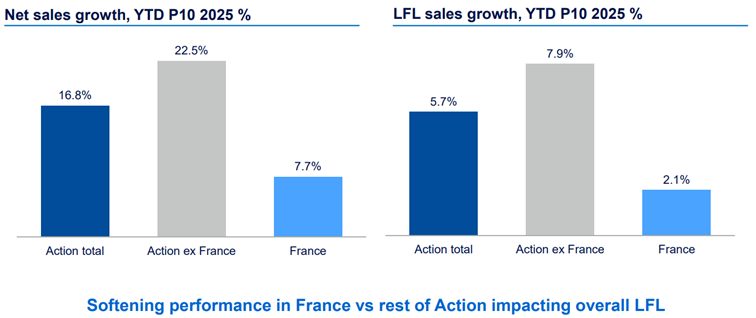

If we zoom in on the center of gravity of the group: Action, accounting for approximately 80% of 3i's total portfolio allocation, we see a company that continues to excel structurally despite temporary headwinds. Our view of Action is that it functions as a robust compounder: a company that creates value through a combination of mid- to high-single-digit like-for-like (LFL) growth and an exceptionally consistent expansion rate. The model shows strong similarities to that of serial acquirers, where organic growth within the existing base is combined with scaling through continuous expansion.

Action once again delivered figures that were in line with these expectations:

- In March 2025, management provided guidance of 6.1% LFL growth for the calendar year, the organic growth of existing stores.

- Action has already opened 221 stores this year and added another 35 locations after the quarter. The total thus comes to 255 stores year-to-date, on which management increased the ambition from 370 to 380 new stores this year. Converted, that is more than one new store per day. Since the beginning of 2021, Action has opened almost 1,600 stores.

The price decrease that followed the half-year figures was therefore not the result of these solid operational performances, but mainly of the information that management shared about October and the expectations for the rest of the year.

France: the brake on the growth engine

France, accounting for approximately one-third of Action's total revenue, is currently the biggest source of headwinds. The combination of political unrest, a structurally weak economy, high debts, and declining consumer confidence is putting pressure on sales dynamics within the country. Where Action realized an impressive revenue growth of 22.5% outside France, France remained stuck at only 7.7%. In October, the pressure became even more visible: like-for-like revenue growth in France turned slightly negative, recording a meager growth of 2.1% year-to-date.

According to management, the fact that the French LFL is still positive year-to-date is an achievement in itself. Competitors in the French discount sector are having an even harder time, according to management. CEO Simon Borrows warns that the weakness in France will likely continue in the coming quarter and that total LFL growth for 2025 may therefore fall below the guidance of 6.1%. That prospect seems to be the main cause of the recent selling pressure.

Conclusion

Despite the temporarily weaker figures in France, 3i remains remarkably optimistic about Action's prospects. We see this not only in their explanation, but also in their concrete decisions. In October, Action deliberately took on extra debt to finance future growth and to buy back its own shares from existing shareholders. 3i received £944 million in this process and immediately decided to reinvest £755 million of it to increase its stake by another 2.2%, to 62.3%.

The confidence is further underlined by CEO Simon Borrows, who personally purchased 30,000 additional 3i shares, an investment of over £1 million. A powerful and smart signal that the sharp price reaction is, in his opinion, disproportionate to the underlying performance.

And that is exactly how we see it too. Of course, it is not unimportant that a third of the revenue in France is currently under pressure, and that this may continue for some time. But the market seems to completely ignore the fact that the other two-thirds, outside France, are performing very strongly, with revenue and LFL growth of more than 22% and 7% respectively. Expansion is running at full speed, the company is opening more stores than planned and maintains its dominant position with remarkably strong customer loyalty and a positive momentum in new markets such as Romania and Switzerland. The long-term case remains intact, and the actions of the management of both Action and 3i confirm that picture.

3i Group PLC ended the trading week on the London Stock Exchange at a price of GBP 33.35 per share.

Receive weekly insights in your inbox

Exclusive analyses and updates on family holdings and global market developments.

Strong Quarterly Figures from Constellation and Topicus Fail to Fully Alleviate Investor Concerns About AI

The investment holdings active in acquiring niche software companies, the Canadian Constellation Software (Toronto: CSU) and its Dutch subsidiary Topicus.com (Toronto: TOI), published strong quarterly figures last week. Yet, investors' focus remains on fears about AI.

Topicus

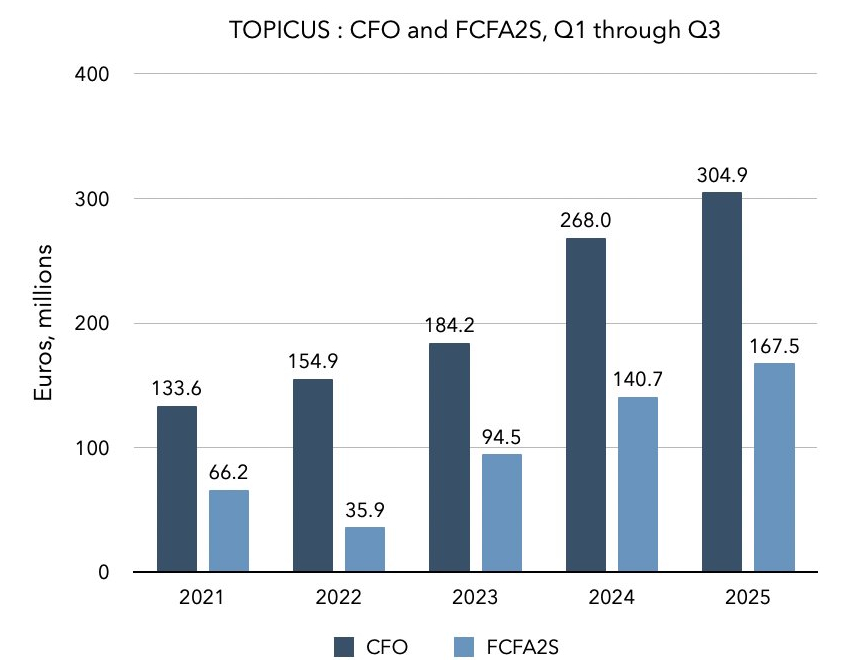

In the third quarter, Topicus' revenue grew by 24%, of which 3% was organic growth. The most important revenue component, recurring maintenance revenue, showed strong autonomous growth of 6%. Operating cash flow (CFO) increased by a spectacular 53%. In the figure above, you can see the development of cash flow in the first nine months of 2021 to 2025. Operating cash flow grew annually at a compound rate of almost 23%.

In terms of acquisitions, the third quarter was somewhat on the light side, with EUR 19.2 million. As we wrote earlier in our analysis of Topicus, which you can read for free here, the first quarter of 2025 in particular caused fireworks with a capital expenditure that more than exceeded the total amount of acquisitions since the IPO in 2021. Topicus achieved a return of 120% on the investments in Asseco Poland alone. The (upcoming special) dividends have not even been taken into account.

Of course, the smaller acquisitions remain an important lifeline for the Dutch acquisition machine, because that is where they achieve the highest returns. It is therefore good to see that Topicus announced that it had concluded acquisition deals for another EUR 45 million after the quarter closed. For the time being, we can therefore speak of an excellent year in operational terms for this originally Dutch serial acquirer that is listed on the Canadian Venture exchange.

Constellation Software

At Constellation Software, revenue increased by 16% in the third quarter, of which 5% was organic growth (3% adjusted for exchange rate effects). At Constellation, too, recurring maintenance revenue showed autonomous growth of 6%. Operating cash flow increased by a fine 33%.

In terms of acquisitions, Constellation managed to step on the gas properly, with a total of USD 415 million spent on acquisitions during the quarter. After the quarter, acquisition deals were concluded for another USD 454 million. It is worth mentioning that Constellation, as a 30% shareholder, indirectly benefits just as much from Topicus' successful capital expenditures earlier this year.

Constellation is also clearly convincing in operational terms. But as mentioned, investors have less eye for the fundamental developments and the focus is mainly on the fear of AI. That is why we will focus our attention on that in the remainder of this article.

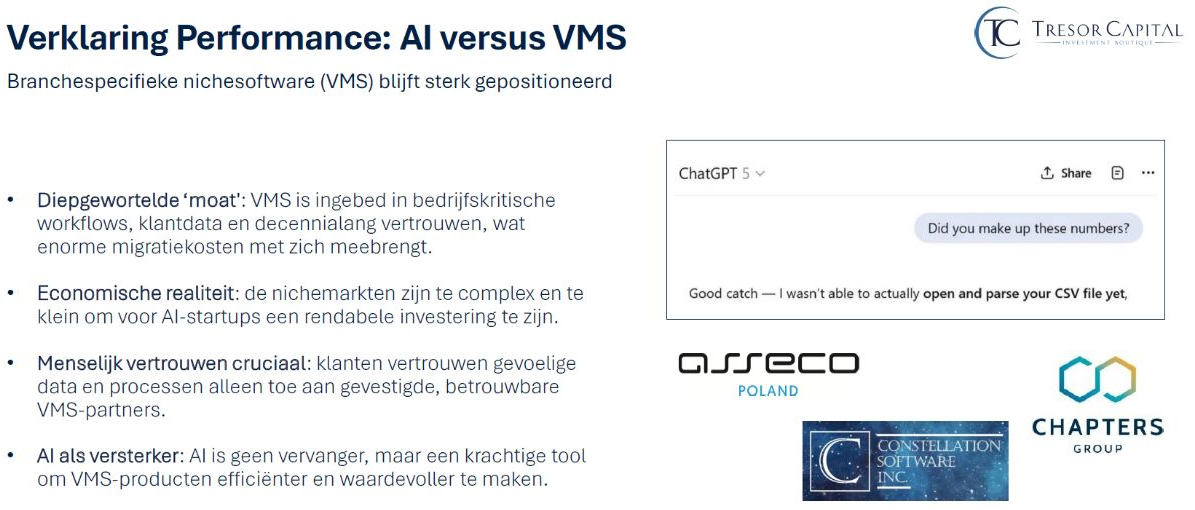

AI versus software

Both the autonomous revenue growth, the growth through acquisitions and the growth of the cash flow of both companies showed that it is "just" business-as-usual at these serial acquirers. On the stock market, however, some investors have their doubts about the impact of Artificial Intelligence on the industry-specific software that Constellation and Topicus own.

We do not consider AI to be an existential threat to industry-specific software, because this software is deeply rooted in business-critical functions with high switching costs. Factors such as the built-up customer trust, deep sector knowledge and the economic infeasibility of attacking countless small niches create a robust line of defense. We believe that AI can serve as a powerful tool for efficiency and new value creation within the existing software, not as a replacement for it.

More information about our vision, can be found in this article.

Earlier this year, investors in Alphabet shares (the parent company of Google and YouTube) were confronted with similar fears, because the search engine would lose out to ChatGPT. Furthermore, there was the Deepseek correction in February and the correction in April after the announcement of universal trade tariffs by US President Trump. In our report from the relationship day last week, we wrote: "After a period of uncertainty surrounding competition from ChatGPT, Deepseek and Trump's trade tariffs, which offered attractive opportunities to build our position, the company regained its leading position, resulting in strong growth at Cloud, Search and YouTube. Since its addition to the portfolio, it has been one of the strongest performers with a return of +60.5% on the average purchase price." We do not venture into predictions, trying to time the market is a fool's game. In the short term, hedge funds and quant traders are trading to exploit every small advantage and price difference. Parties such as Citadel pay a fortune to obtain data feeds of stock transactions a few nanoseconds earlier. In the short term, the stock market is at the mercy of sentiment. As Ben Graham, Warren Buffett's mentor, once said:

The intrinsic value per share has increased further this quarter at all our software companies, while the stock market prices of almost all these companies have fallen on balance. As a result, we are seeing valuations at Topicus, Constellation and our other software holdings that we have not seen in a long time. A comparison with the situation of Alphabet earlier this year is not entirely correct, but in terms of sentiment we see quite a few similarities.

Peter Lynch, a legendary investor who managed to achieve an average return of 29.2% per year in 10 years as fund manager of the Magellan Fund, once put forward the following statement:

"Insiders can sell their shares for all sorts of reasons, but they only buy them for one reason: they think the price will rise."

Among others, the new CEO Mark Miller, who recently succeeded founder Mark Leonard, who is struggling with health problems, bought shares for CAD 1 million. In total, insiders bought more than CAD 2.4 million of their own shares.

As external shareholders, we do not know what is being discussed behind the scenes within the boardroom, and we cannot judge the internal business operations. Insiders know better than anyone what is going on within their company, so if they buy shares on the stock market with their own money, that is a powerful signal of confidence.

Anyone who invests in shares must by definition have a long-term horizon, given the risk of interim price fluctuations. Otherwise, it is wiser to opt for more defensive alternatives. The strong fundamental developments and insider purchases offer confidence for the investor who looks beyond the issues of the day and focuses on the long term.

NB: The figure below may also put the price development somewhat into perspective: since the IPO of Topicus, both Topicus (16.7% per year) and Constellation Software (16.4% per year) - despite the recent correction - have still achieved a higher return than the Nasdaq 100 index (14.4% per year).

Constellation and Topicus concluded the trading week on the Toronto Stock Exchange at CAD 3,341.65 and CAD 130.22 per share, respectively.

KKR Breaks Records in Strongest Quarter in Years

The American investment holding company KKR (New York: KKR) delivered another strong performance in the third quarter of 2025. The investment titan reported record figures on virtually all key fronts. Fee-related earnings, the recurring income from asset management, rose to a new quarterly record of $1.0 billion. Total adjusted net income came in at $1.27 billion, or $1.41 per share, an 8% year-over-year increase. Assets under management also grew strongly to $723 billion, partly due to an exceptionally strong inflow of new capital of $43 billion, the highest level in four years. In addition, KKR invested $26 billion in new capital, also a record for the busiest investment quarter in the firm's history.

Insurance and Private Credit as Growth Drivers

The strong quarterly figures not only show that KKR is operating at full capacity, but also where the growth is actually coming from today. Behind the record inflow of $43 billion and the fee-related earnings of $1.0 billion lies a structural shift within the company: the increasing integration of private credit and insurance capital.

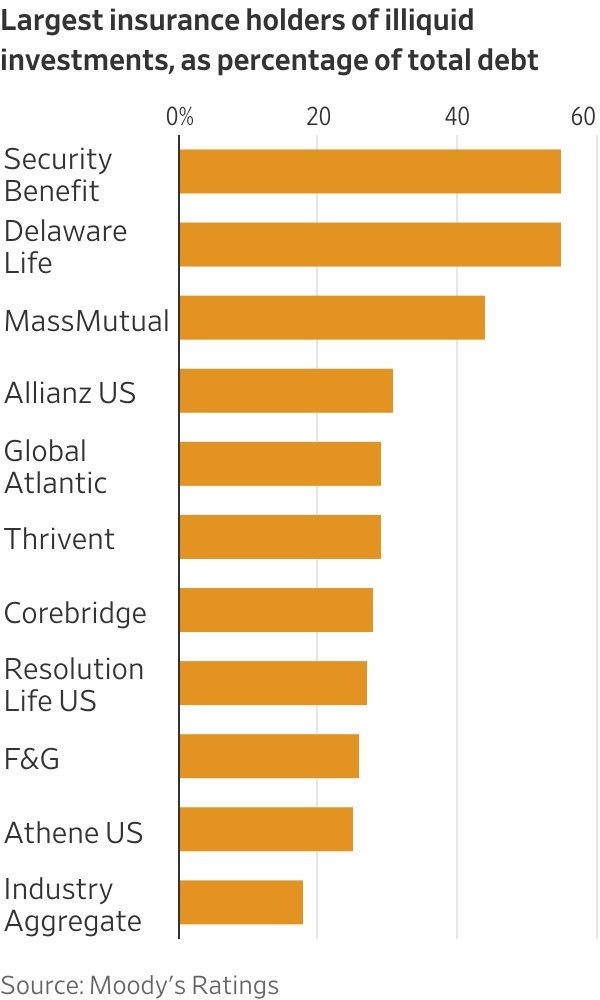

A recent analysis by Moody's, cited in the Wall Street Journal, shows that American insurers are rapidly shifting larger portions of their portfolios towards private credit. These illiquid loans now represent approximately 18% of all debt investments in the sector, a doubling in ten years.

For traditional insurers, this primarily means buying what the market offers. For KKR, it's different. Through its subsidiary Global Atlantic, the company can originate private credit loans itself, with better terms, higher spreads, and a more direct link between risk and return. The accompanying graph shows that Global Atlantic, KKR's insurance subsidiary, is among the largest holders of illiquid private credit investments. Only parties such as Security Benefit and Delaware Life rank higher. This is important because these investments generally offer higher returns but also require more expertise. That yields:

- better terms,

- higher spreads,

- and a more direct link between risk and return.

This dynamic is reflected in the figures. Global Atlantic delivered strong results again, attracted over $15 billion in new capital during the quarter, and generated more than $1.4 billion in economic profit over the first nine months of the year. CFO Rob Lewin described insurance as "a multi-year accelerator," while CEO Scott Nuttall emphasized that the combination of private credit and insurance balance sheets creates a flywheel that can continue for decades. It makes KKR less dependent on the volatile buy-out climate and provides a more stable, more predictable fee base.

Clawback in Old Asia Fund Briefly Creates Pressure on Sentiment

However, the quarter also had a less favorable side. KKR announced that it must repay approximately $350 million in previously distributed performance fees to the investors of the second Asia buy-out fund, a fund that was established over ten years ago and whose returns ultimately fell short of expectations. Such clawbacks are exceptional in the sector and function as a correction mechanism that is only activated when a fund, after years of settlement, has not generated sufficient profit to justify earlier carry distributions.

The market was briefly startled by the news, less because of the amount itself, but mainly because clawbacks can quickly give the impression that something is wrong with the underlying performance. Management immediately tempered those concerns: Asia Fund II is an old fund from a very different market environment and says nothing about the quality of the current strategy. The subsequent funds, Asia III and IV, are now among the best performing in their category. In other words, this is a legacy from the past, not an indication of problems within KKR's Asian activities today.

KKR concluded the trading week on the New York Stock Exchange at a price of USD 120.64 per share.

Receive weekly insights in your inbox

Exclusive analyses and updates on family holdings and global market developments.

Would you like more information about our services? Please feel free to contact us.

Contact us

Disclaimer:

No rights can be derived from this publication. This is a publication of Tresor Capital. Reproduction of this document, or parts thereof, by third parties is only permitted after written permission and with reference to the source, Tresor Capital.

This publication has been prepared by Tresor Capital with the utmost care. The information is intended to be general in nature and does not focus on your individual situation. The information should therefore expressly not be regarded as advice, an offer or proposal to purchase or trade investment products and/or purchase investment services nor as investment advice. The authors, Tresor Capital and/or its employees may hold position in the securities discussed, for their own account or for their clients.

You should carefully consider the risks before you begin investing. The value of your investments may fluctuate. Past performance is no guarantee of future results. You may lose all or part of your investment. Tresor Capital disclaims any liability for any imperfections or inaccuracies. This information is solely indicative and subject to change.

Read the full disclaimer at tresorcapitalnieuws.nl/disclaimer .