Economy & Markets #46 - Markets Seek Direction Without Data

This week's topics:

End of shutdown in the US brings no hope for investors

The 43-day shutdown of the US federal government is over, but the impact is significant. Approximately 670,000 employees were placed on furlough (employed, unpaid leave), while more than 1 million civil servants had to continue working without pay. With a longer shutdown, this latter group could have grown to over 2 million. According to the Congressional Budget Office, the economic damage from the shutdown in the fourth quarter amounts to 1 to 2 percentage points of GDP, accounting for a loss of approximately USD 14 billion.

The impasse between Republicans and Democrats was broken when a small but crucial group of Democratic senators decided to agree to a temporary funding law (and to schedule a vote on the Affordable Care Act at a later date). Since the reopening, the government has been working on paying back wages: some employees will soon receive a so-called supercheck, while others will not be compensated until late November. Incidentally, the Trump administration suggests that not all civil servants are automatically entitled to back-pay unless Congress explicitly stipulates this.

Despite the economic damage, the White House remains remarkably optimistic that the economic damage will be recovered in Q1 2026. Economic advisor Kevin Hassett expects catch-up growth of 3-4% in Q1. It will prove difficult to determine the actual damage, as the quality of US macro data will remain limited for some time due to the disruption. Probably 2 months of government statistics will remain unprocessed.

There is also a high risk that the US central bank will have to navigate blindly due to the lack of macro and labor market data, and therefore remains indecisive. The costs of a possible policy error will be discussed later in the letter.

Agenda 'Fossil-Free' shifts to energy security and affordability

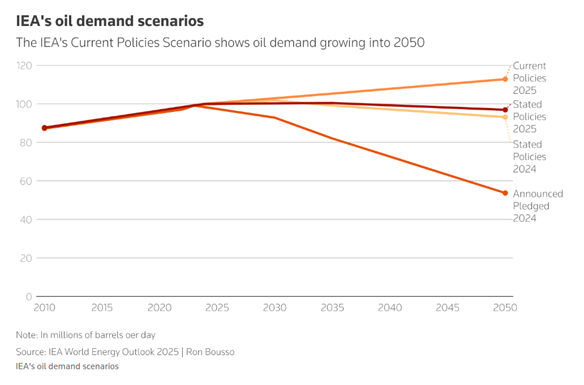

While politicians and NGOs are traveling en masse to the Amazon to talk about stricter CO₂ targets, the latest report from the International Energy Agency (IEA) points to a very different reality. As long as countries adhere to their current policies, the demand for oil and gas will continue to rise in the coming decades. This means: no peak in fossil energy this decade, hardly any emission reduction, and virtually no chance of staying below 1.5°C warming.

Despite 2024 being an exceptionally warm year, we see that governments and influential climate voices, including Bill Gates, are increasingly prioritizing energy security and affordability. This explains why the relative growth of renewable energy is flattening and the adoption of electric cars is also beginning to stagnate. The result: global oil demand continues to climb, from approximately 103 million barrels per day in 2024 to over 113 million barrels in 2050. Striking, because until recently, the IEA still assumed a peak of 106 million barrels in 2025.

This fundamentally shifts the picture of the energy transition. The optimistic "pledged policies" scenario, based on promised climate measures, is giving way to the much more realistic "stated policies" scenario, based on actually planned policies. In the even more conservative "current policies" scenario, in which virtually nothing changes, the peak in oil demand is not expected until around 2050. The picture is similar for gas: the previously predicted peak in 2030 is shifting to after 2035.

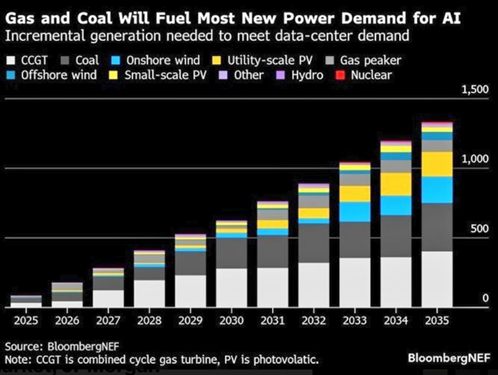

Electricity demand is exploding, especially due to data centers

Meanwhile, global demand for electricity is rising rapidly, driven by the massive construction of new data centers, the explosive growth of air conditioners, and an expanding chemical sector in Asian and African economies. China remains the largest CO₂ emitter for the time being, but if countries with comparable populations (such as India, Indonesia, Pakistan, and Nigeria) achieve the same economic growth, their emissions will inevitably increase sharply as well.

In the United States, many federal climate goals have now been abandoned. The decline in US CO₂ emissions in recent years is almost entirely due to the switch from coal to cheap shale gas. At the same time, Washington is heavily investing in reindustrialization, made possible by extremely low energy prices. This actively takes market share away from European industry.

Europe is therefore facing a double disadvantage. Due to CO₂ pricing, energy-intensive sectors are structurally less competitive, precisely now that global electricity demand is exploding due to the rise of AI data centers. Due to high national debts, there is also less and less budget available to compensate for the high electricity prices for consumers. The result: rising inflation and persistent job losses in Europe.

BloombergNEF expects that electricity demand from data centers could increase by a factor of 20 by 2035, a structural shift that further increases the pressure on the energy system.

Receive weekly insights in your inbox

Exclusive analyses and updates on family holdings and global market developments.

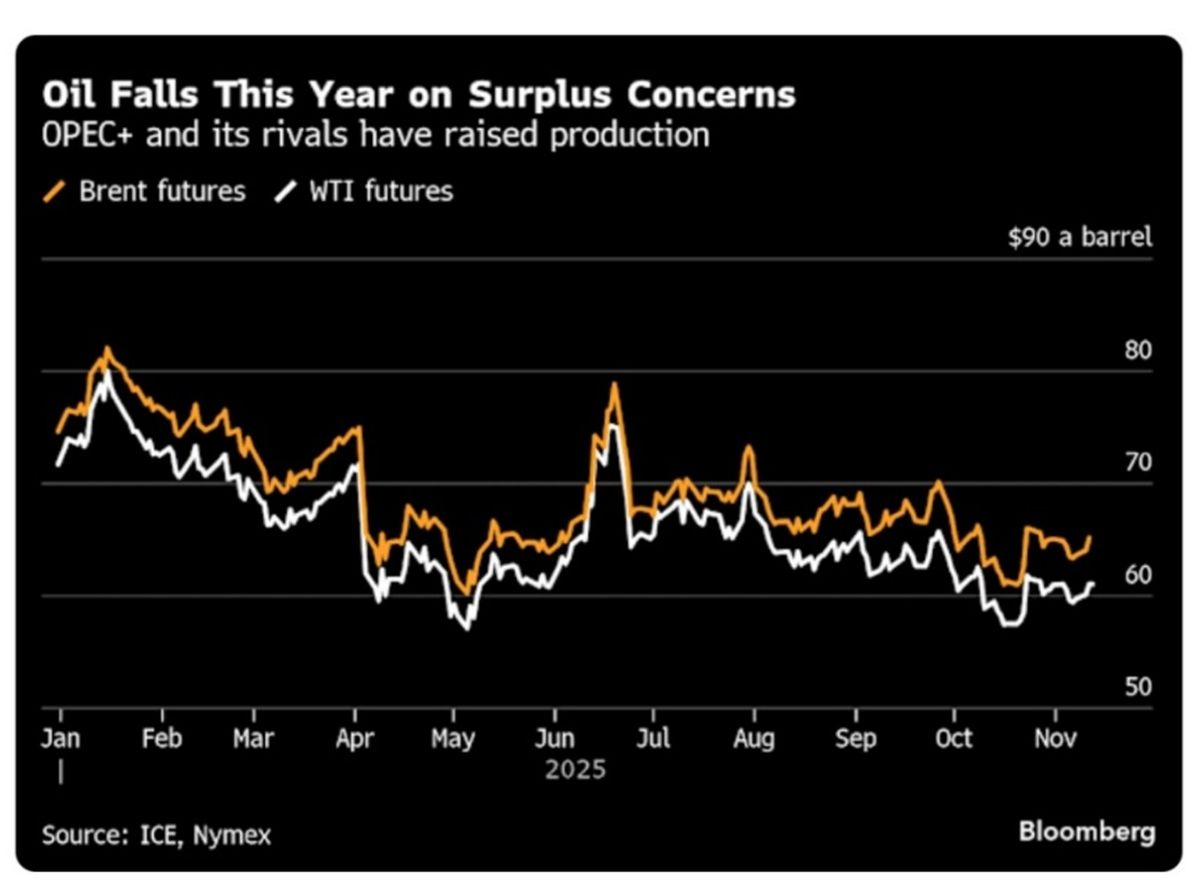

Oil supply is rising sharply due to Trump policy and OPEC

At the same time, the global oil supply is rising rapidly. Under President Trump's policies and through coordinated action by OPEC, production has increased even faster than global demand. Earlier this year, we already wrote that, as part of the so-called Mar-a-Lago agreement, an increase in oil production was initiated to reduce US inflation.

OPEC is now producing approximately 2 million barrels per day more than a year ago. Oil production in the US has also risen to 13.8 million barrels per day (compared to 12 million in 2022). This makes the US now the largest oil producer in the world, which pushed the US oil price (WTI) below USD 60 per barrel again this week (currently around USD 58–59, compared to ~USD 80 twelve months ago).

However, Brent oil remains considerably more expensive, recently around USD 64 per barrel. For European consumers, the lower WTI price therefore provides hardly any relief. Moreover, the euro has risen by about 14% against the dollar this year, further driving up the pump price due to currency effects.

The result: this week, the Netherlands recorded the highest gasoline price of 2025 to date, €2.195 per liter of Euro95. The crude purchase price is estimated to be around €0.95; the difference is entirely explained by higher VAT and excise duties, important drivers of inflation in the Netherlands.

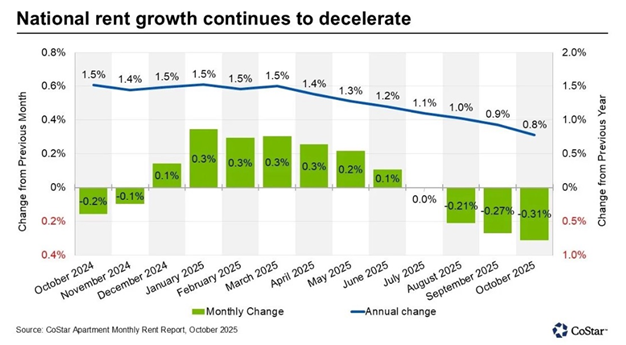

Rental prices are falling sharply in the US

In addition to the recently fallen oil prices, US rents are now also beginning to fall month-on-month. According to CoStar, one of the largest real estate data providers in the US via Apartments.com, the rental market in October showed the sharpest decline in more than fifteen years: a month-on-month decrease of -0.3% and only 0.8% growth year-on-year. Due to a combination of much new construction, weakening demand, and large regional differences, rents are under further pressure. Although these are "asking rents", historically they almost always move in line with the contract rents that are included in the official inflation measure.

This means that one of the heaviest components of US inflation is finally beginning to exert clear downward pressure. Rents account for 15.5% of core PCE inflation (excluding energy), the Federal Reserve's preferred measure. Energy does not directly count in this PCE calculation, but via second-order effects, a 10% drop in the oil price amounts to approximately 0.4 percentage points lower PCE inflation. With both energy prices and rents now falling, a broader deflationary pressure is emerging that should further temper US inflation in the coming months. Inflation is currently still around 2.9%, driven by rising costs in healthcare and insurance, categories that traditionally react slowly to economic cooling.

Last week, we already wrote that the exceptionally strong AI sector is obscuring the view of the broader cooling of the US economy: a pronounced K-shape recovery where the top of the K is supported by a historically unique investment wave in data centers (up to 7% of US GDP), while the bottom of the K is rapidly weakening. Consumers with credit, SMEs, the automotive industry, and other financing-sensitive sectors are cooling rapidly. The signals are piling up: demand fatigue, rising payment arrears, and tighter lending conditions confirm the picture of a cyclically slowing economy.

At the beginning of this month, it was still priced in with approximately 70% probability that the Federal Reserve would lower its policy rate by 0.25 percentage points to 3.75% in December. With the new rental data and an increasingly weaker bottom of the economy, that scenario is only becoming more convincing. The chance is increasing that the Fed will have to proceed to further easing this year, or at the latest at the beginning of next year.

Stock markets are taking a break

After the exceptionally strong stock market rally since April, the recent pullback seems mainly a healthy breather. The American technology exchange Nasdaq is now noting a correction of approximately 6% compared to the peak at the end of October. We see that many stocks are falling sharply, even when companies publish strong earnings figures. The euphoria surrounding AI has visibly cooled, although the underlying fundamentals remain solid: American technology companies are still realizing strong profit growth and the economy is showing resilience.

At the same time, concerns are growing about the financing of the enormous investment wave in AI infrastructure. More and more data center projects are no longer fully financed from operational cash flows, but are increasingly relying on debt financing. Credit spreads for major players such as Oracle and CoreWeave are rising rapidly, raising the question of whether all ambitious investment plans are sustainable at the current scale.

Despite these financing risks, AI remains a structural trend that is expected to contribute substantially to productivity growth and innovation in the coming years. Outside the technology sector, companies worldwide are also presenting strong earnings figures, and valuations in many sectors remain attractive. Emerging markets also benefit from their exposure to global technological trends and from the prospect of a looser monetary policy in the United States.

Now that stock markets are taking a step back, attention is shifting to the other building blocks in the portfolio and their role as stabilizing diversifiers. Gold and the Swiss franc remain strongly positioned in this regard. It is positive that gold is showing a clear comeback after the sharp correction in October. Hedge funds, high yield bonds, and catastrophe bonds are also performing well this year, making them valuable alternatives to government bonds.

Receive weekly insights in your inbox

Exclusive analyses and updates on family holdings and global market developments.

Would you like more information about our services? Please feel free to contact us.

Contact us

Disclaimer:

No rights can be derived from this publication. This is a publication of Tresor Capital. Reproduction of this document, or parts thereof, by third parties is only permitted after written permission and with reference to the source, Tresor Capital.

This publication has been prepared by Tresor Capital with the utmost care. The information is intended to be general in nature and does not focus on your individual situation. The information should therefore expressly not be regarded as advice, an offer or proposal to purchase or trade investment products and/or purchase investment services nor as investment advice. The authors, Tresor Capital and/or its employees may hold position in the securities discussed, for their own account or for their clients.

You should carefully consider the risks before you begin investing. The value of your investments may fluctuate. Past performance is no guarantee of future results. You may lose all or part of your investment. Tresor Capital disclaims any liability for any imperfections or inaccuracies. This information is solely indicative and subject to change.

Read the full disclaimer at tresorcapitalnieuws.nl/disclaimer .