Family Holdings #8 - The purchases and sales of the holdings

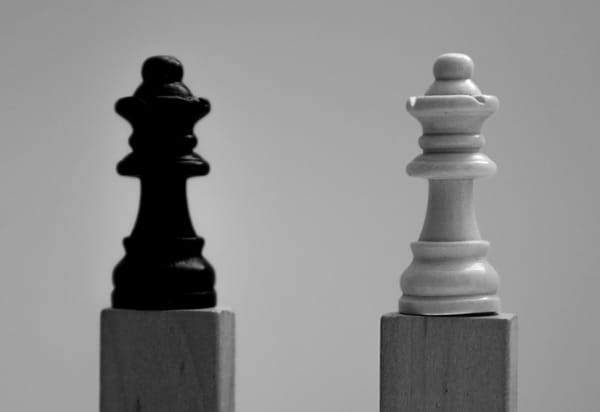

The narrative that AI will fundamentally disrupt existing business models has led to significant price movements in a short period of time. Whereas we could previously speak of healthy caution with regard to technological disruption, we have now entered a phase of total irrationality.

The market seems to have already passed its verdict, with artificial intelligence (AI) dealing the death blow to niche software. However, we believe that this fear is greatly exaggerated.

Together with host Quinten Hafkamp and Rowan Nijboer, Tresor Capital partner and co-owner Michael Gielkens recorded a deep dive podcast this week about serial acquirer Chapters Group. Below, we share both the link and the transcript of the deep dive podcast. The podcast is in Dutch, but thanks to the transcript, it can be understood by English speakers.

This week, we spoke at length with CEO, founder, and major shareholder Christof Nesemeier and CFO Torben Teichler of the German investment holding company MBB.

Family Holding Companies

Economy & Markets

Family Holding Companies

Deep Dives

Three experienced investors share their views on AI, quality, and valuation, and provide guidance on positioning for 2026.

Deep Dives

In a world where AI is becoming increasingly widely available, the structural qualities of vertical software companies are becoming more apparent. In this article, we explain why.

Family Holding Companies

Economy & Markets

Family Holding Companies

Economy & Markets

Family Holding Companies

Economy & Markets

Family Holding Companies